And transactions in the apartment sector plunge.

After seven dizzying boom years, commercial real estate prices peaked in December 2016 and have since turned south. These values are collateral for nearly $4 trillion in loans, a good chunk from smaller banks. When the last bubble imploded after September 2007, prices plunged nearly 40%. The Fed has been pointing at the risks the new CRE price bubble poses for the banks. Among the sub-sectors, prices of apartment buildings, according to Green Street’s Property Price Index, were down 3% in May year-over-year.

And transaction volume of apartment buildings has plunged. Real Capital Analytics put the “story for the apartment sector” this way:

Activity in this sector, which was the largest and most liquid investment market for most of 2015 and 2016, declined in May and was lower than activity in the office sector. For the year to date, transaction volume for apartments is down 25% year-over-year.

There is another side to this equation – the most important: rents. Because they pay for the whole construct, including the loans.

According to Zumper’s National Rent Report for June, rents in multifamily apartment buildings (single-family houses for rent are not included) spiraled into a surprising counter-seasonal drop in June.

“Summer is peak rental season, meaning it’s usually a difficult and expensive time to look for a new apartment,” said Zumper co-founder Taylor Glass-Moore. “However, renters this year are in luck, as median rents are dropping for both one and two bedrooms nationally.”

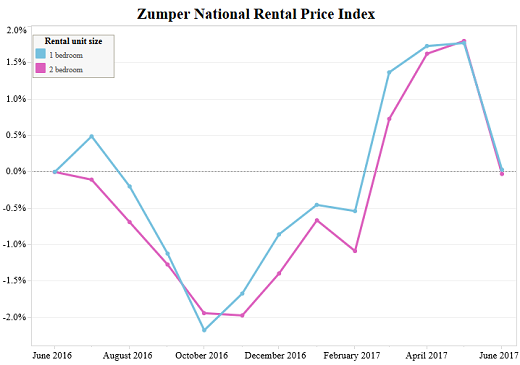

The chart below shows the monthly percentage change in median asking rents since June 2016. Note the seasonal surge in early spring – and then the sudden drop in June. That’s when the median asking rent, instead of rising, dropped 1.7% for one-bedroom apartments (blue line, $1,149) and 1.8% for two-bedroom apartments (red line, $1,367) — both where they’d been in June 2016.

Rents fall in the most expensive markets

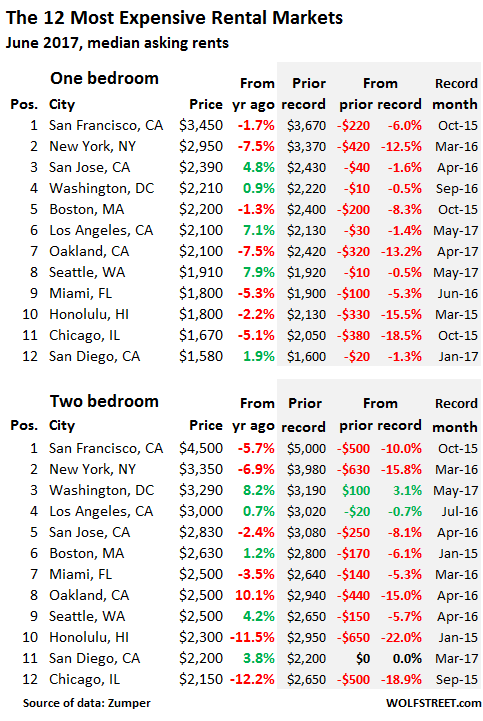

In San Francisco, the median asking rent for a one-bedroom apartment dropped 1.7% in June from a year ago to $3,450 and is down 6.0% from the peak in October 2015. For a two-bedroom, the median asking rent dropped 5.7% year-over-year to $4,500 and is down 10% from the peak in October 2015.

The last period of year-over-year declines in San Francisco ended in April 2010. This time, there is no Financial Crisis. There is however a “Housing Crisis,” where the middle class can no longer afford to move into a modest apartment. This has consequences. And the exodus has started.

In New York City, the median asking rent for a one-bedroom dropped 7.5% year-over-year to $2,950 and is down 12.5% from the peak in March 2016. For two-bedrooms, it dropped 6.9% and is down 15.8% from the peak.

In San Jose, median asking rent for a one-bedroom rose 4.8% year-over-year to $2,390 but is down 1.6% from the peak in April 2016. For a two-bedroom, it fell 2.4% year-over-year to $2,830 and is down 8.1% from the peak.

This table of the 12 most expensive large rental markets in the US shows median asking rents, their year-over-year changes, and (in the shaded areas) the prior record and the change since then:

Note the double-digit plunges from the peak in New York City, Oakland, Honolulu, and Chicago.

Asking rents do not include incentives, such as “1-month-free.” In San Francisco, a historic construction boom is flooding the rental market with high-end apartments and condos. But employment in May dropped to where it had been in July 2016, and the labor force dropped to where it had been in March 2016. Landlords are trying to fill their units, and incentives – a trick to keep asking rents high and make the market look better – have become common.

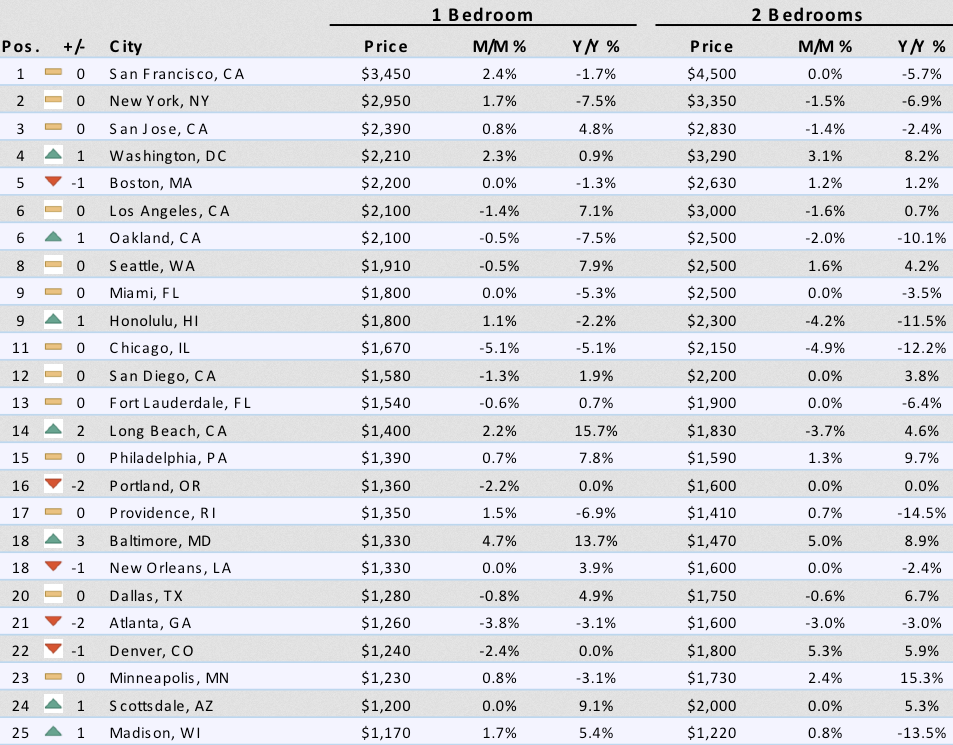

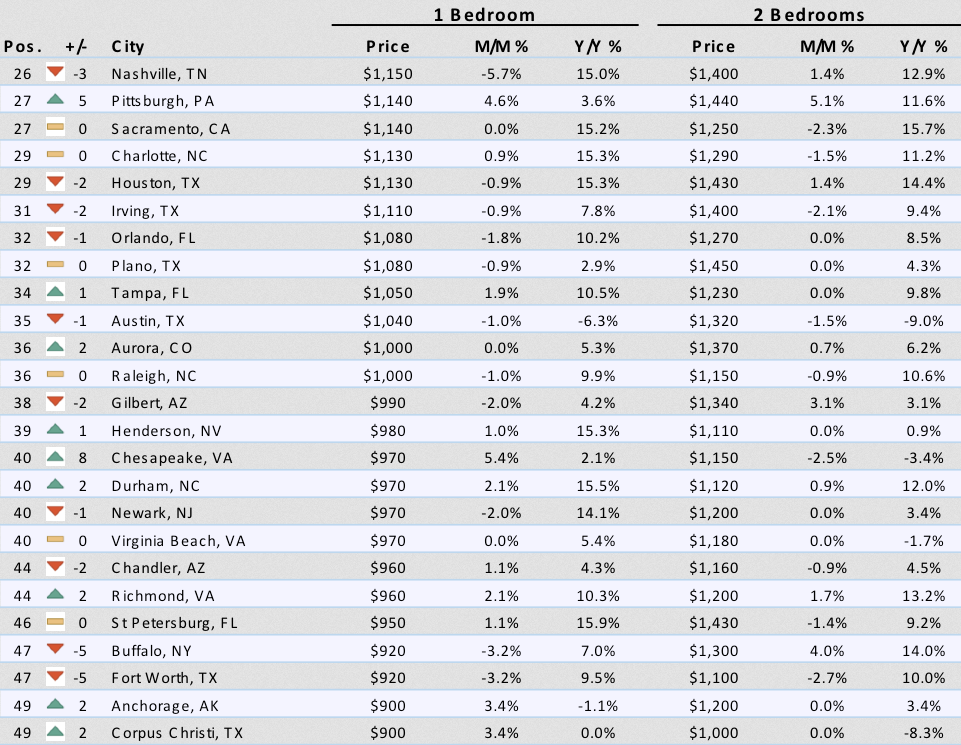

What gives? In some “mid-tier” rental markets, asking rents are soaring in the double digits, and in most other areas they’re rising by smaller amounts, though there are now some other markets where rents are heading down sharply, including Chattanooga, TN, where the median asking rent for a 1-BR dropped 12.0% and for a 2-BR 15.6%.

Here are some of the mid-tier markets with the large year-over-year rent increases:

- Nashville, TN (+15.0% and +12.9%);

- Sacramento, CA (+15.2% and +15.7%)

- Charlotte, NC (+15.3% and +11.2%)

- Houston, TX (+15.3% and +14.4%)

- Durham, NC (+15.5% and +12.0%)

Few workers receive those kind of pay increases. So these surging asking rents pressure consumers and cause them to cut back in other areas. And for the national numbers, the plunging rents in Honolulu and the soaring rents in Sacramento, and all the ups and downs everywhere else get neatly averaged out to 0% rent growth year-over-year. And that hasn’t happened since rents started soaring in the Fed-inspired asset-bubble euphoria that followed the Financial Crisis.

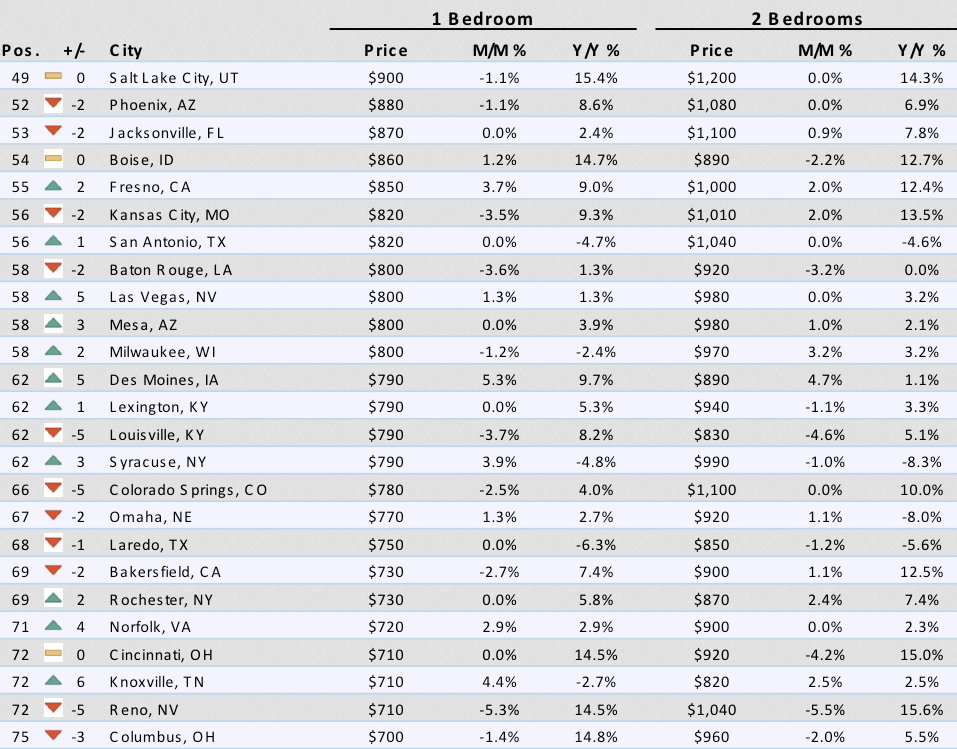

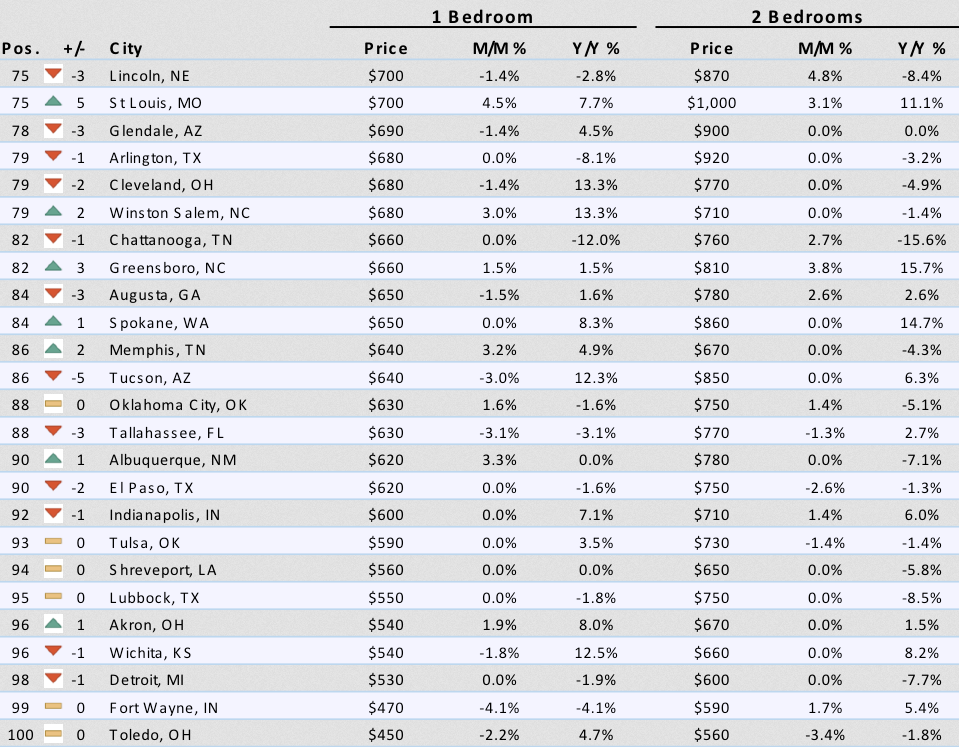

Below is Zumper’s complete list of the top 100 most expensive rental markets and price movements. Check out your city (click on image to enlarge).

Commercial and residential real estate price bubbles can choke the economy, the consequences of which are now visible in San Francisco. Read… San Francisco Bay Area Sheds Jobs and Workers

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Rents and prices are falling nearly everywhere now.

Not where I live: Tampa. REIT’s are buying up all of the rental properties here and aggressively raising rates. Like, 20-30% aggressively.

The poor saps that bought into those REIT’s will be crying when the economy corrects.

I am not sure how many times I need to repeat this, but rents are FALLING, not RISING, in Houston. I had to rent in 2015 when my house was destroyed in a flood. There were no deals in Houston at all. The price was the price. 12 months later (July 2016), my apartment complex (inside the Loop, high end) gave, without asking, a 20% REDUCTION in rent. This year, I went shopping. Again, inside the loop, high end. All of them, not SOME, not MOST, but ALL offered 2 months free and waived app fees. More apartments are coming on line that were in the process of being planned in 2014 / 15 / 16. I chose an apartment last month. I still get calls, emails, every other day from the some these apartments ( yes 20 – I really shopped ) complexes asking if I have made a decision. Despite telling them I have, I guess the next person did not get my answer and they call again. A bit of desperation here. Again, inside the Loop of Houston, but I really expect the same of the energy corridor (west Houston / Katy), Woodlands (where Exxon moved its campus) area, and Medical Center (M.D. Anderson laid off 1000 last year, Memorial Hermann announced 150 being let go a few days ago) given the over-building and continued completion of complexes in these high end areas.

Very informative. Incredible that they are calling you back, kind of like a realtor.

As a veteran of the 80 ‘s bust and working as a realtor, I had the experience of owners calling me back to know if the offer they’d snubbed 2 months ago was still around.

Like…no.

Agreed Todd, most Apts inside the loop are offering multi-month incentives, this data appears flawed to me, perhaps it doesn’t take incentives into consideration? Most people I know are moving to take advantage of the falling market, my experience is that Apts refuse to negotiate rates downward. Incredible that yours offered a 20% reduction.

I can confirm that here in Winnipeg, just yesterday I saw an advertisement for an apartment that said “first month free”. The last time I remember seeing an ad like that was in the late Nineties.

I moved to the SF Bay Area in 2003, to Sunnyvale. The apartment complex I moved into had the 2nd month free, because, they told me, people were just staying the first month then leaving in the middle of the night. The 2nd year there, they lowered my rent w/o my asking. Nice! Then they jacked the rent the next year from $800 a month to $1200 and I left for another complex nearby, bigger apartment for $1000. Then it was 2007 and the crash and I lost everything.

San Francisco and San Jose may be getting cheaper but not all of bay area.

Fremont, which is the mini-India of bay area is actually getting more expensive. Yes, it is still cheaper than SF by a mile but y-o-y rents are increasing.

And cost of buying houses is going up too.

I just don’t know how people can justify paying 1 million USD for crap shacks; unless they are ill-gotten gains in a totalitarian regime like China. Even at this price, the freedom and quality of life in SF bay area beats anything in China. But for folks on W-2; i just cannot imagine the stress it entails to buy something like this.

Compromises:

1. Both husband/wife need to work

2. Need to work 30 years

3. Have no more than 1 child

4. Live in house built 50 years ago to blue collar standards

I heard a netflix software guy’s compensation is 380K/year half salary, half stock.

1 million, so what?

That’s probably a very senior engineer who has been there quite a while and has shares vesting from when Netflix was $10-$15. I think more typically it would be about ~200k.

Personally I know a lot of Bay Area people in their mid 30’s to mid-40’s who are doing quite well. However the “well” part comes from stock, bonuses, etc. Without that they are very much middle class and at times are cutting it pretty close budget-wise on a monthly basis.

Saw this shit show from 98/99 … work tech … I got a good gig now, but no illusions.

Very. Very. Very. Few people really have a skill set that is special.

If the Trump cracks down on H1Bs, things might change salary wise – but most people in tech are commoners – just a new set of blue collars. IMHO they think too highly of themselves.

I am not sure this has been stated elsewhere, but if Trump cracks down on H1Bs, it will be like the minimum wage labor hike in cities like Seattle.

Let that soak in.

Why am I brassy? I was laid off before and had a few hard spots along the way – couple decades now – nothing like a 2×4 upside the head to clue a person in.

Same thing the oil patch deals with all the time. Old man pissed me off good when I was young, but oddly enough, just like me, he is right most of the time.

Regards,

Cooter

I have an American nephew living and working in San Francisco. He owns a small rancher, and has had enough of the commuting required for his job…(1.5 hours Each Way!!) He is a well-paid professional with a decent degree and lots of experience with the same large company. (I am withholding specifics for reason, and all of us know why :-) Many many have been ‘let go’ from companies on simple suspicion of looking to move on.)

Anyway, he just told his mom last week that he is Gone by November. He has had enough of everything!

Good time to sell was all I said in reply.

380K half salary half stock is a market price (recently) NFLX paid to hire that Engineer with 5 year experience. Basically one who knows how to code and have seen one major product cycle that can tell what code is good and what code is bad. New graduate do not have this compensation but all they have to do is to code for 5 years.

Crazy Cooter – truer words were never spoken about the tech scene here. The average tech worker is lucky to get $15 an hour.

My Great-Aunt Mary told me to not go to college and stick with working at the animal hospital because “people will always have their pets” and she was right, dammit. College has been a total loss for me as it is for the majority who fall for that scam.

I hated working at the animal hospital, but the idea of being in a trade that will always be needed/desired is a good one. It could be anything; being a tattoo artist or any cockamamie thing, but being one electronics technician in a sea of electronics technicians with hordes of electronics technicians overseas itching to get over here, while electronics (soldering, etc) is being handed over to robots, is not a good life.

While there are not actually degrees in basket weaving (art, maybe?) I feel even one of those would have been better for me. I was interested in music, and that would have served me well – there will always be whore houses who need a piano player.

This bright glittering tech world of good jobs and good pay …. I wonder how high George Jetson was in the scheme of things …. probably layers and layers of proles in misery below him ….

Saratoga, where Netflix is HQ, is a long commute from Fremont. At that end of pay, these ‘workers’ live in Saratoga, Cupertino, Sunnyvale, Mountain View which are in the heart of silicon valley.

Fremont is at the edges of Silicon Valley.

Most people who I know that have 800k houses make 130 to 140 k. And they paid 5% down. Of course, houses have gone up so they have about 100k equity. But a large figure of them are single income households so the risk of loss is substantial, in case of a job loss.

By the way I am one of those 200k plus cash engineers and trust me there are very few jobs that pay 200k plus even in Silicon Valley.

And I didn’t like 800k houses and I’ll be damned if I pay the million plus for the houses that I liked… Maybe move auto Silicon Valley in a year or so is on the cards.

Got a sorta 100k-ish gig (given overly friendly rounding) in Juneau, AK doing tech.

For small pop towns in the US, they are #1 for millionaires per capita (1:13). Spendy here – not cheap.

http://www.alaskapublic.org/2017/06/22/juneau-tops-national-list-of-smallest-cities-with-most-millionaire-households/

Ironically, I am a huge fan of Fredericksburg, TX and they made the list too. You might recall some guy named Nimitz.

Germans!

To be completely fair I do a volunteer radio show up here – Friday nights on public radio – and I feature TX music. KRNN.org, 7-9PM AK time. South Central TX is a huge music hub, truly wonderful local folks, that I play from, but still love LA, OK, etc.

Playlists are at:

http://RedStuartAK.blogspot.com

Do a super special awesome XMas special for two weeks before Christmas. And Memorial Day and Veterans Days specials. And Willies birthday. And … ok, I’ll shut up …

Anyway, live a mile from work … wrecks my MPG in the winter when I have to warm my rig for 10 minutes before I drive to work.

If I really tried, I could hit six stop lights going across town – and I mean from one end to the other.

There are no roads in our out – you come on a boat or a plane.

God bless.

Work for a 99.9% renewable energy power company – all hydro, all the time, diesel back up.

Veteran.

Like guns.

Have great fun prospecting. Gold!

This place was the gold production capital of the world for many years.

Gold!

Way more (lifestyle) green than any douche bag that brags about being green. I tried to count for quite a while.

NOTE: still looking for the paper that tells me fish are a carbon problem … and crab … and prawn … and god BLESS when those TUNA boats show up …

Was New Zealand or Alaska before I moved here. I did extensive homework after a divorce in TX.

NZ is on my bucket list – and I want a month minimum.

What is my point? Be an outlier. Do some research and figure out where you and yours fit best. Life isn’t easy – do what everyone else does – and you get the herds outcome.

You are dead in old age – do something.

Regards,

Cooter

P.S. Shameless request for assistance.

My favorite Far Side cartoon – which I have failed to successfully search – FOR YEARS – is the cow (bessie?) that has a fat skull and pokes up above the herd and looks around … caption goes like “something isn’t right”

Go go go gadget WS readers … gimme a google image … I need that on a shirt or coffee cup or bumper sticker (and happy to buy officially).

I was under the impression that you needed 20% down to even get considered for a jumbo loan in the bay area. Hevy buying in the irban areas by all cash deals.

Jas, a lot of the “cash” offers are actually just pre-borrowed. Up here in Portland, I haven’t seen much in the way of 5% Jumbo loans, but 10% is pretty easy with good financials.

Just tonight I heard an ad for some apartment in Manhattan offering $3500 or thereabouts with signing, as well as 1 year free wifi, and 1 year free something else. I only partially listened for Wolf’s sake (ha ha)—I normally MUTE ALL ADVERTISEMENTS.

Thank you Wolf for a wonderful blog.

Regards,

Cooter

Cooter,

Only one Merle song?

What about Iris Dement?

Allison Krause?

Nice job. I wish our little coast valley had a radio station. I wouldn’t mind starting a short range jobby myself. There is an awesome one on one of our Gulf Islands. Anyway, good job with the volunteer and sharing!!

regards

I am doing my 59th show right now. I play tons of Merle. :-)

Go back through the 59 posts with playlists.

I volunteer at public radio – make a promo cd and pitch it to the program manager. It’s a fun hobby.

If you want to contact me, wolf has my email. Happy to provide constructive advise.

Regards,

Cooter

Seattle keeps on rising though. Hopefully it starts to trend down next year when the large capacity finally starts to come online and I’m looking for a place again.

last count, a few weeks ago, we had 61 cranes in Seattle with many sites waiting for new cranes to arrive.. I’ve been on a voter drive and have gotten to see how many renters live.. These aren’t one bedroom but one room rents with a tiny side room that passes for a kitchen in a 1920 building; $1700 and going up.. All of the $4500 one bedroom places on Broadway (Capitol Hill) are rented. Paul Allen’s, Vulcan, is still buying and still plans on ripping up whole blocks in the Central Dist. evicting many.. Plywood signs on lots all over the city are proclaiming some new high-rise catering to those with big paychecks.. If there is an end in sight in Seattle, none of us on the ground here can see it..

The question you have to ask is Are these people who stay there insane or just enjoy being reamed? There are a lot of options in the world after all

I’d agree with this assessment, having lived in the Capitol Hill neighborhood of Seattle going on 6 years now. Rent has just exploded with no end in sight.

My first rental was a new top floor unit 700 sq ft one bedroom with floor to ceiling south facing windows. Very nice, new appliances. Rent was $1295/month in 2011. They wanted $1495/month in 2012, and $1695/month in 2013 when I fled. Moved into a total dump 600 sq ft basement unit with no natural light for $1300/month – this was realistically the limit of what I could afford as a medical resident who needed to live close to the hospitals. Looking back at my first apartment, a comparable unit in the same building rents today for $2346/month, parking extra – almost $1000/month more than in 2011.

What’s really interesting is despite the high demand for apartments and condos and explosive population growth, a big fraction restaurants and shops in the neighborhood are boarded up with “for rent” signs in the windows (some for years now). I think despite the high incomes, locals are spending so much on rent, there just isn’t much left over for eating out or shopping.

Won’t someone think of the robots? They too need a place to stay. Paul Allen is thinking of the future where Bill’s newly minted minions will need places to “live”.

Mark – your last paragraph described down town San Jose to a T. Lots of boarded-up empty places. Lots of high rises going up. They’re building like crazy, everywhere. I just don’t know how they’re going to fill them because as mentioned, the average person here is making $12 or $15 an hour. Put 4 people in a studio apartment I guess.

I survey apartments as a “virtual gig” for one of the big companies nationwide. You would be surprised at the number of apartment complexes that are low income or tax credit apartments that are in the US.

They all have restricted income requirements.

I don’t have any actual numbers to support this but I’d guess that 20% of the apartments in the US are subsidized in some manner.

Section 8 is a way to transfer public housing to private development which is a win for the govt. The tax credits to developers is a short term win for them. Those who suffer are the suckers who buy condos or rent luxury apts. and have no idea about the amount of Section 8 which has to be filled for the developer to get the tax credits.

You know it is bad when the “beautiful rooftop pool with vista views” looks like a hip hop video. Full price payers move out. Panicked developers/owners allow more Section 8 to fill the long term vacancies. Presto Chango it now becomes Public Housing.

Luxury public housing and the city didn’t have to build it.

There was a good documentary recently on Frontline about how much fraud is in the Section 8 program. Developers are getting rich off of public housing programs while taxpayers and voucher recipients alike are getting screwed.

A while back we saw listing for a condo in Oakland. Lost all interest when we realized some nearby units were designated low income housing. Do these forced “affordable housing” projects ever work? I haven’t seen any evidence in support of them considering how much more taxpayer money we throw behind them each year.

The president’s son in law owns a real estate “empire” and section 8 housing is a growing part of it. All the excess housing is going to land up as section 8 housing.

In Miami the condos, especially older ones, are already full of renters and the section 8 number is probably growing. This is because once a unit is captured by section 8, you must keep it available for another section 8 tenant. At least that was the case 10 years ago, when someone I knew rented a basement apt to a section 8 tenant.

Orlando area is booming, and rent is reasonable. Central Florida is flat as a pancake and builders rule the local governments. Green space is frowned upon. So apartments are going up everywhere. Population is too though so I don’t expect to see much change price wise.

Most incomes are dependent on retail, tourism and construction. Lots of latinos from Puerto Rico escaping and willing to work cheap. So prices have to stay muted.

Traffic is a horror story. Toll roads everywhere. Roads constantly under construction. And just as they open, the population has increased enough to make them already over-capacity. And it is unbelievably hot outside.

‘green space frowned upon…toll roads everywhere…apartments going up everywhere and….most incomes dependent on retail, tourism and construction.’ Imagine what fresh hell this will be like in the next resulting recession?

Rising rents in Sacramento and falling rents in SF may be two sides of the same coin. I have young friends: she’s a tech worker in SF and he’s a professor at Stanford. They pay $3,000 for a tiny apartment in San Mateo, but next month they are moving 70 miles inland to Davis, a pleasant university town where they have rented a spacious house with yard, backing to a park, in a good neighborhood, for $2,000 per month. She can work remotely 4 days and commute (by train) one. He can work remotely 3 days, and commute to Stanford, (by car) two days. Not only is rent cheaper, but child care is about 30% cheaper.

Train service from Sacramento to SF is fast and efficient and has WiFi, and at least some SF workers are willing to make that commute for the sake of a more affordable life inland.

Probably part of the future of people working in parts of the bay. Maybe they should work on improving extended commutes. Sounds reminicent of how new york keeps a labor force. People live sometimes across state lines and commute in.

How about this for arbitrage? My husband and I sold our house in San Francisco (which we owned for 30 years) and bought a house in Joshua Tree for under $100,000. He still works for a research firm in San Francisco (making the same pay) and goes up there a couple days a month (many nonstops daily PSP-SFO). I decided to retire. Neither of us had family ties to the area.

So I think both companies and people are doing whatever works best for them. San Francisco just got too expensive for those of us with options. I am not surprised about the recent exodus that Wolf has so rigorously documented.

Why is any of this a surprise to anyone My beautiful modern apartment on the best street in Warsaw rents for under a thousand Dollars a month and includes heat and hot water These rents will balance out over time It’s called globalization People will not be able to afford these rents and it will end I’m amazed that it’s gone on for so long to be honest

Are wages rising while housing costs fall? Too good to be true for the working class.

@CrazyCooter

“Very. Very. Very. Few people really have a skill set that is special.”

That is an important truth for all to grasp. Especially the ones that think, and are made to think, that they are special. When in reality they are just the latest sucker “employed” to keep the ponzi scheme rolling. The real special ones are the ones that figure it out. Red/blue pill thing.

Herr Vulfy, please consider some comment system that makes it easier to follow along/participate. p.s. any relation to Gerhard the painter?

No relations to German painter Gerhard Richter (MoMA in NY); nor to Charles Richter, the seismologist from Ohio who became Californian and invented the Richter Scale to measure earthquakes; nor to Russian pianist Sviatoslav Teofilovich Richter, one of the greatest pianists of the 20th century; nor to any of the other famous Richters….

:-[

Darn. Gerhard Richter is my family’s favorite painter. :)

A Nashville local here, I noticed this was the third or fourth post in which you’ve mentioned Nashville’s rising rent prices, so I thought I should comment. First, they are definitely rising! But the reported numbers seem kind of low to me, at least for Nashville-Davidson county (it’s a unified city-county government) proper. Do these numbers include the suburbs and income restricted rents? I’m living in the suburb of Hendersonville, it’s about 15 miles from downtown and 2bd goes for about 1100-1400. I know in the SoBro, Gulch, Downtown, Germantown, 12 South, Belmont, and Vanderbilt neighborhoods of Nashville proper you can’t even touch a 1 bd for 1,200. Those prices are more like East Nashville prices, which used to be the low income area but is now moderately gentrified. One final observation, the summer price bump is strong here! The rental rate for a 3bd at my complex went up by $200+ between May and June (I routinely check the apartment’s website to see what they are asking from new tenants). All that to say, I’m curious to know what kind of units (rent controlled, sec. 8, etc.) are included in Zumper’s numbers, and does it calculate rent averages for the MSA or just the cities proper?

Zumper only includes multifamily units that are advertised as being currently for rent (“asking rents”).

You mention rent controlled units. Yes, they’re included. But rent control is peculiar to each market where it exists. For example, in San Francisco, certain units qualify for rent control, but when the unit goes back on the market, it is rented out at whatever rent the market bears. So rent control has no impact on asking rents in San Francisco. This may be different in other cities.

Hi, I live in Bergen County NJ, 8 miles from Manhattan and rents are not falling here! I am a landlord and I follow the market. 7 years ago average 2 bedroom would rent for $1,200. Now it is close to $2,000. I am talking about 2 family houses. If you look at big rental apartment buildings 2 bedroom is at least $2,500 and can go up to $4,000. Don’t ask me who are those people paying these rents. Just fast example. Two bedroom apartment , no parking went on market for $2,000 and had hundreds of views in a couple of days and was rented out on a spot.

As someone who values apartments for a living, two important points are missing from the article. The first is any reference to multi-family inventory growth. For many markets, delivery of apartment units over the last 5 years have been at all time historic highs. Until the last couple quarters, metros with solid pop and employment growth have overall been able to absorb this supply with negligible impact to occupancy rates and thus rental rates have been able to remain positive (albeit not at the crazy 5% to 7% rent growth seen in some markets from 2012-2016). Now we are starting to see supply being to materially outpace demand as the surplus of potential renters has all but dried up in most markets. Once occupancy begins to materially decrease, rates follow. For newly delivered properties that have been delivered in supply heavy markets, 1 up to 3 months of upfront free rent has been the norm the last couple years. The second point I want to make is that I feel we are off the historic peak; construction pipelines are tapering somewhat, partially because of of the major banks becoming more cautious about construction lending – this isn’t to say that construction lending is completely dried up. Although the major banks have applied the brakes, this has opened the door for others – insurance companies, regional banks, etc have been on a lot more term sheets that have come across my desk over the last year for proposed construction. As long as money is cheap enough to support the cost feasibility of a new project, developers are going to continue to build. I don’t see this stopping until rates increase to parity with the financially feasible to build. Assuming rates remain static, my WAG is that “stabilized” apartment occupancy would have to get down into the low 90%s/high 80%s before the faucet gets completely closed. Last point, one should also take into consideration the effect that “value-add” inventory has had on rental rate increases. If I’m an investor and buy a 1980s asset, sink $4000 to $10,000/unit in capital updates/renovations to reposition the asset to a higher class, I’m capturing $50 to $250/month increase in rent within 18 months on 100% of the units. This phenomenon is hidden in the data.