Retail sales are held up by only two sectors. The rest are sinking.

There are two components of “retail and food services sales” that have been booming over the past few years through the fourth quarter 2016. And then there’s all the rest combined – 71% of total retail sales – that has been in decline since the third quarter of 2008. That’s the tough reality of retail sales in the US.

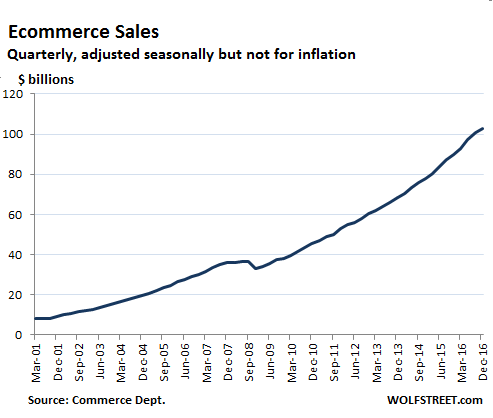

First the good news: e-commerce sales

In the fourth quarter, e-commerce sales soared 14.3% from a year earlier, to $123.6 billion, not adjusted for seasonality and price changes, according to the Commerce Department today. E-commerce sales for the entire year 2016 jumped 15.1% year-over-year to $394.9 billion, accounting for 8.1% of total retail and food services sales, up from 7.3% in 2015. You see where this is going.

E-commerce sales include online sales by retailers with brick-and-mortar stores, such as Walmart and Macy’s that are all trying to carve out a presence on the internet, with varying success.

This chart uses seasonally adjusted e-commerce sales to eliminate the very large seasonal fluctuations, including the spike every Q4 and plunge every Q1, but it’s not adjusted for inflation:

While e-commerce soared 14.3% year-over-year in Q4, total retail and food services sales, including e-commerce, rose only 3.9%. In all of 2016, total retail sales edged up only 2.9% from 2015. So what is left over once e-commerce is removed from the equation?

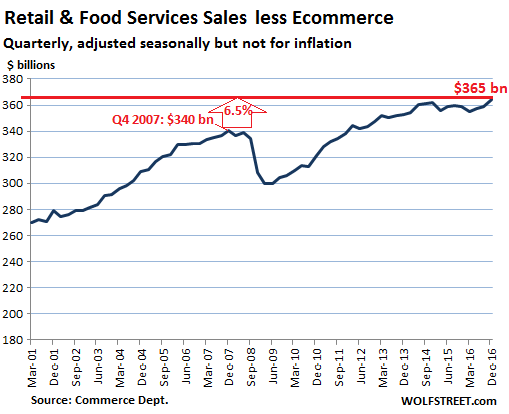

Retail and food services sales without e-commerce

Total retail and food services sales without e-commerce in Q4 2016 edged up to $364 billion, only 6.8% above the peak before the financial crisis in Q4 2007 ($340 billion):

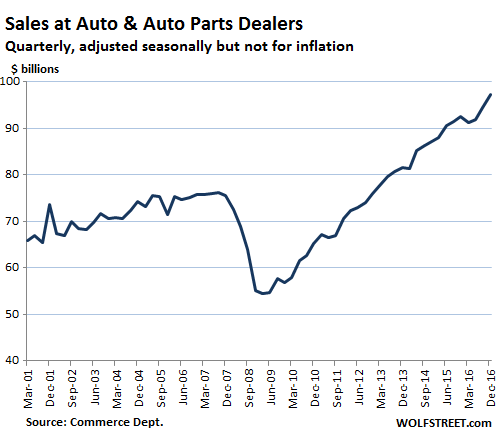

And the second booming sector: auto sales

Auto sales have been booming since the end of the Financial Crisis. The number of new vehicles sold set a new all-time record in 2015 and squeaked past it in 2016 with a record of 17.9 million vehicles. The record prior to 2015 and 2016 had been set at 17.8 million vehicles in the year 2000! So it was a recovery from the Financial Crisis, but in terms of new-vehicle unit sales it’s nothing to write home about.

Then this: new vehicles in dollar terms have gotten more expensive, and prices of used vehicles have also risen over the years, so total sales in dollars at auto and parts dealers have seen a red-hot boom – due to price increases!

Back in Q3 2007, sales at auto and parts dealers reached a record of $76.2 billion. By Q4 2016, this had jumped 28% to $97.4 billion. This chart shows the dollar-sales boom by dealers of new vehicles, used vehicles, and auto parts:

So the increase in dollar sales since 2000 is a function of price increases, not of volume increases, which anyone who bought vehicles at regular intervals can attest to. The same type car is nicer and might have a 9-speed automatic transmission instead of the 5-speed automatic of yore, and might have more safety features, cup-holders, gadgets, and internet-connected devices. But it’s still the same brand, and same size car. You just have to pay a lot more to get it. Your reaction as you grapple with that reality is called “sticker shock.”

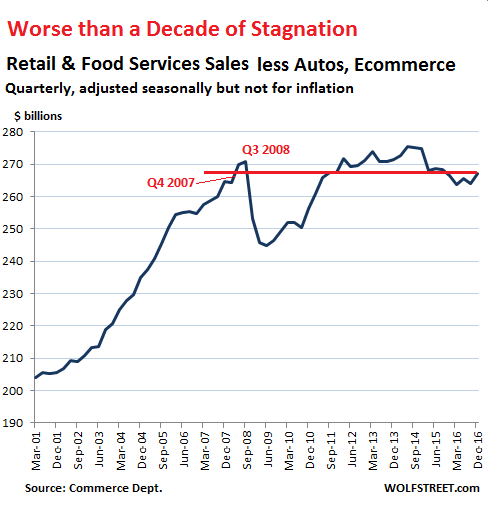

Sales by auto and parts dealers account for about 21% of total retail and food services sales. So what happens when booming e-commerce and booming auto sales are removed? Combined they account for about 29% of total retail sales. What happens to the remaining 71%, the sales at millions of shops and big-box chain stores and grocery stores and jewelry stores, and at all the department stores, taco trucks, farmers’ markets, discount stores, fast-food joints, high-end eateries… all combined?

This is what happens in the brick-and-mortar world

Retail and food services sales less e-commerce sales and less auto sales in Q4 2016 were $267 billion, about flat with Q4 2015 ($266 billion), down 2.6% from Q4 2014 ($275 billion), down 1.5% from Q4 2013…. In fact, they’re down 1.5% from Q3 2008 ($271 billion), and about flat with Q4 2007! That was a long time ago. And note the steep ascent during the prior years:

Adjusted for inflation over the years (the Consumer Price Index has risen 16% since 2007, including 2.7% in 2016 alone), these sales figures in Q4 2016 would look even sadder compared to Q4 2007! So for those 71% of US retail sales, it has been worse than a decade of stagnation.

And that’s why companies love consumer price inflation: enough of it can hide a very tough reality.

So what happens next?

E-commerce sales will continue to boom by taking share away from brick-and-mortar retailers. This process is far from over.

But can auto sales continue to boom? These auto sales were funded by debt, and this debt has ballooned to over $1.1 trillion. The risks lenders have been taking have surged. Bank regulators have been warning for months, and now it’s happening. Read… “Seriously Delinquent” Auto Loans Surge

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Excellent piece, Wolf. Are there any reliable, demonstrable metrics available vis employment loss in brick&mortar retail/supply sector vs. employment gains in the online sector for this period?

The problem with tracking employment of brick-and-mortar v. online is that much of online retail is considered “tech” employment, except those people moving the physical merchandise (workers in fulfillment centers, driers, etc.). There may be sources out there that sort this out, but I haven’t run into them.

Other readers who know about this may want to chime in.

Amazon!

The rest wasted billions!

My two cents about Amazon is, I have returned more than anything I have bought at a real store. Inferior quality on so many things that appear to be first quality, not to mention they are actually higher priced. Went thru FOUR sink faucets that were 160 to 190 and all were crap…throwing water over the sink edge, crooked pipes, near full on with the slightest handle movement. A $400 convection oven and 30 days later the fan sounds like a car with a slipping belt.

Screw Amazon, I don’t buy from HIM now.

If everybody came to the same conclusions about Amazon as I did , the company would be finished in a year.

Wolf,

Any thoughts about how things go if E-Comm sales roll over? Seems to me that if that happens we’re in a worse-case scenario. Regress to local economies? Is a global economy actually sustainable?

Who will buy goods online when there are no local jobs to pay for those purchases? When the local economy is killed off by the ecommerce economy we better be able to employ retail workers elsewhere. With over $19+ trillion of national debt we can’t afford to replace millions of household incomes with welfare.

This is where “universal income” comes in. Remember the talks before the election when QE would run its course, what would the fed do?

Well, what does Uber look like?

An Uber driver out here in LA gets payed $1.2k/week= $5k/month at full time.

A “universal” job with a “universal driving skill” for everyone with a drivers license in this new economy.

Helicopter money is already here.

Charles Murray is proposing a universal income in some book he is now promoting. His idea is to give every adult 10K a year and not tax a portion of income over that(I don’t remember how much). I didn’t pay much attention because I don’t trust the guy or his ideas.

My fear with any universal income proposed in America is that they will give it with one and and take it away with the other. I can see Wall St. buying up the right to take your money or just taking it away when you can’t pay your bills on 10K.

End the fed transfer the assets over to social security and everyone would have time to read?

The value of currency is related directly to it’s scarcity and the labor required to produce value (short version). Universal Income is the final death knell of a fiat currency issues within a Welfare State. Bottom of the Barrell.

Does this take into account fuel costs, repair and maintenance on our poorly maintained roads and 15% payroll tax

Learn to scam Nigerians from home?

Hack the Russian hackers?

Counterfeit cheap Chinese goods?

It seems to me that some sort of tipping point is on its way.

Ecommence may result in more delivery jobs, but if cars and trucks are autonomous then those jobs go away. Likewise the trend in auto manufacturing will continue to be more automation, just as it will be in other industries

Fewer entry level jobs + an aging citizenry doesn’t seem to be a recipe for economic health.

And the problems we have now would only seem to get worse – if we think we have pension issues now in certain blue collar pensions – like the Central States Pension Fund – imagine what the health of those funds will look like when the have a constant decline in membership.

Rest assured that the Government or the FED will bail out the businesses. As for the little people, there is always the underpass with a phone charger on each column. The point IS…the government and business do not care about you, pensions, children, flowers, nothing.

75 years of repeat rinse, repeat has taught us nothing.

Remarkable post Wolfman. Fascinating to watch the change in the core economy in just the last decade. And incredibly Amazon still isn’t making money.

I’ve got about 10 years to retirement. By then I expect to have everything produced by robots, do my shopping online and have it delivered by drone. With the gubmint crediting my bank account every month. Easy street.

Good luck Kent, and I AM NOT BEING SARCASTIC AND CYNICAL. I really mean it, GOOD LUCK.

Much can change, but if there are no large changes, your plan is OK.

You said, “I’ve got about 10 years to retirement. By then I expect to have everything produced by robots, do my shopping online and have it delivered by drone. With the gubmint crediting my bank account every month. Easy street.”

Which was my plan as well. But due to a rather large post-divorce mortgage ( compared to retirement income ) and a nasty drop in IRA value, I changed my plan for about two years.

I returned to work to (1) pay off ALL C.C. debt [check] and (2) pay off the CAR LOAN [check] and (3) rebuild the IRA [another year to go] .

If this works for you as I hope it does — and if my rework plan succeeds also — then you and I will have achieved the American Dream, that our parents had in many cases — and that our millennial kids will have to work awfully hard — just to achieve only a bit of that dream.

Decade of stagnation ( this Wolfman post ) will become a generation of stagnation, I am afraid .

Maybe I can leave my kid a financial legacy ( not at all certain ) to boost the chance of the American dream for the poor kid.

I’ll repeat what you said : ” . . .I expect to have everything produced by robots, do my shopping online and have it delivered by drone. With the gubmint crediting my bank account every month. Easy street.”

http://www.oftwominds.com/blogfeb17/pie-shrinks2-17.html

Just for the last of the boomers . . . . . . but maybe not for the millennials ?

Generation of Stagnation caused by excessive debt and spending ?

Great post Wolf, well researched with excellent factual support !

SnowieGeorgie

“…incredibly Amazon still isn’t making money.”

Only because Bezos chooses not to.

Surplus cash flow from Amazon which could be labelled “profit” is plowed back into expansion of his businesses.

Recovery? Grass roots CAPEX.

Starts with some type of earth moving.

Which involves heavy machinery.

Caterpillar (CAT) has gone 50 months straight now, with a negative retail global sales number. If anything this says STAGNATION, or worse yet the tip of a new Greater Depression.

“new vehicles in dollar terms have gotten more expensive, and prices of used vehicles have also risen over the years, so total sales in dollars at auto and parts dealers have seen a red-hot boom”

Didn’t I read in one of Wolfstreet’s posts that off lease vehicles are saturating the market and tanking used car prices? Or is that just the last year?

Not sure how the below indicies of used car prices are.

They show a modest decline yo/y.

https://www.cargurus.com/Cars/price-trends/

Used car prices haven’t started “tanking” yet. They “slipped” in January, and were “stable” before, according to the Manheim index.

Here’s Manheim’s take:

“The theme that played throughout 2016 continued into the start of 2017 as wholesale pricing remained stable despite sharply rising supplies. Give credit to a retail used vehicle market that enabled dealers to quickly and profitably sell their auction purchases.”

Remember, NEW vehicle sales plunged in January as people are switching to used. Which has kept the used retail market in good condition so far, despite the flood of lease-returns.

Used prices never move rationally.

The trend is generally towards keeping them as high as possible for as long as possible. This is done to increase trade-in value and hence entice people to buy the new, more expesive model and especially to make brand new vehicles/machines more tempting by reducing the price difference with second hand units.

I am not an expert on cars, but I can tell you in the agri and earth moving equipment thing tend to move very quick and by sectors.

For example prices for used 1.2 ton backhoes have been pretty high for a few years now, while those for 1.6 ton backhoes started to drop in late 2015 and are still dropping.

Another absurd example is forestry equipment: right now used chainsaw prices are through the roof. But the market is clinically dead, nobody’s buying used right now, and for good reasons. You have to be clinically insane to pay that money for used chainsaws of any kind,. Sellers are still holding to their fantasy valuations and will keep hold unto them until reality will start hitting them over the head with a big stick.

I’ve seen this show before and it may take years for reality to set in. The idea you are holding onto some rare and precious treasure while there are millions of what you are selling around is a powerful drug.

I ended up buying a new truck last year as my 16 year old car was finally worn out. The used vehicle prices were brutal, looked for a minute but the prices weren’t a good deal. Was aware of what was going to happen in autos and even let the dealers know. I hope I get 15 years out of the truck! (Don’t expect it, but you never know.)

One thing which vehicles is tech is accelerating on them. Self driving and hybrid/electric isn’t a normal joe retrofit. That might generate more churn.

As I have mentioned before, starting in the Xmas season the pickings were slim, and I haven’t seen any improvements in inventories.

We only go out on special occasions, which is a shame, because our town is opening 18 new restaurants by April. It really is two Americas out here.

I confess that right before I read this article I just made an online purchase. I needed some specialized furniture clamps. I also live 75 km from the nearest town which probably won’t have what I need, anyway. However, even if I could source these parts in town it would cost me approx $20 in fuel and 2.5 hours of my time. This product will be delivered to my door some time next week for the price of Canada Post home delivery.

I have always tried to buy local for tools and fasteners, but this past year I have spent thousands of dollars online due to bricks and mortar suppliers apparently not interested in my business. I requested some quotes and the stores could not be bothered to reply. I’m not going to chase these people to take my money.

Service is service, and there is no better service than a mouse click.

I tried to buy a battery charger local last Sunday eve, it was $109 everywhere online, I found it at advance auto for $89 Plus they offered a 20% coupon if I payed online and picked up local. The coupon wouldn’t work so after work on Monday I went to the store, still the coupon wouldn’t work, one of the guys there said I could buy it through his account and the coupon worked so I did. Then he told me I needed to wait for the confirmation that the sale went through. I waited for 40 minutes, it never came through finally the guy told me you can take it and go. So I left my name and number, 2 hrs after I got home with my treasure he called me and said the payment was reversing so I had to go back the next day and pay cash. What a hassle and a time waster but I did manage to get the charger for $43 off. I think the online coupon was a scam they really didn’t want the coupon used or their system is messed up bigtime. I doubt if I will shop there again.

This xmas retailers didn’t do so well.

Looking @ FRED, the ratio of e-commerce retail sales as

percentage of total sales, it’s flat. Q3, Q4 are the same @8.3%

y/y. That’s not a good sign. It happened before in a recession,

or in a difficult period like Q4 2011 & Q1 2012.

E-commerce is growing very aggressively, but the rate of

change in the 90’s, though on smaller volume, were much more

impressive. In the year 1996 it was 17%, in 2000 was 20%.

The increase, in the early days came from pure e-commerce,

now, it is a hybrid of e-commerce & brick and mortar.

The question is if they don’t cannibalized themselves with the

dual system, an increase of overhead.

A lot of sustain effort for so average results

E-commerce also has their backs covered by the stock market, and indirectly by Central Banks around the world, and with commonwealth funds and such, all having little sense of value investing. Traditional brick and mortar do not that luxury. Investors do not seem to care if an E-commerce company ever makes one cent, the store on the corner does.

Unless you are a darling company, you are SOL Amazon…never made one penny and trades at , what, 750 a share. WE MAKE our own demise.

Account P&L Facts do not matter now, the trend does and so does perception of success. The’ convenience’ of E-Commerce is one thing, but the fashion to buy from them carries a lot of weight in this new world of couch and fancy-phone living.

When your town looks like what many towns looked like the 1950s to 1970s era, with boarded up stores as venders moved to the suburbs, so goes the quality of the town you live in. If you think your ten cents doesn’t matter to the local economy, then you best rent so you can move on to the next soon-to-be boarded up town.

If I could get commercial space dirt cheap I’d have a flat-rate arcade and a local music venue set up to capture video/audio for youtube publication in addition to live audience.

If the rents drop hugely on commercial then all sorts of vibrant things might come out of the woodwork to fill in holes.

I see sales numbers, but no profit numbers. Yes, I could dig for them, but if they were good news, the companies would shouting it from the rooftops. Having retired from 10 years at JC Penney, I track their numbers. Sales are increasing and things look good on the surface. However, they lose money (on average) every time they make a sale. They are burning through their last billion dollars in cash. What then?

Amazon has zillions in sales but loses money. Tesla is supposed to be the future in cars, but they haven’t made one penny (GAAP) in profit since they opened in 2003. Is this the new paradigm?

How many companies are only staying afloat from stock buybacks, new debt, etc?

Profits ?

Online has siphoned billions out of the capital accounts as companies strive to maintain a retail foothold at the expense of blowing up margins?

My box retailer has destroyed its bottom line trying to destroy its brick and mortar footprint by undercutting its prices online!

New word for all y’all: “Amazonable”. Here is Hedgeye’s take on this QuarterHorseman robber baron preying on retail peasants:

https://www.youtube.com/watch?v=lQMd1hDDo5o

And more fun to watch (and quite frankly, IMHO, addictive) Galloway on Amazon continuing to conquer:

https://www.youtube.com/watch?v=avIehXHk1Xo

Best quote: Walton exploited minimum wage workers to serve America’s retail needs, and … [amazon] exploits robots. Silicon Valley isn’t alone – Chaos Monkeys live in Seattle too.

“… [amazon] exploits robots.”

http://www.businessinsider.com/amazons-robot-army-has-grown-by-50-2017-1

I looked at retail sales in the year 2000 from US Census historical records. Here is the link.

http://www2.census.gov/retail/releases/historical/marts/adv0010.pdf

I found it interesting that auto sales in Q4 2000 averaged $68.0 billion. Today it is at $97.4b.

The 16 year C.A.G.R is a whopping 2.27%…

There are two problems with online retail world and some related problems in the online world that limit the whole “tech” situation. The online world depends upon commoditized products and on cheap capital, cheaper than its “non tech” and less hyped competitors. There recently was an interesting bar chart showing that Jeff bezos personal net worth is much higher than Amazon’s total retained earnings since inception. Many tech companies including Amazon need to grow sales because earnings and profits are not growing, and it’s the only thing they can point to. This is why Amazon is going into transport (both trucking and now supposedly ocean shipping–this after they have.done nothing on drone.delivery–pllleeeaaasssseeeee) and web hosting. Bezos talked up drones and now essentially has his own trucking company.

Walmart never got into trucking because they squeezed the truckers so much there was no profit left. I used to sell IT systems to Less than truckload (LTL) and the joke was that companies made the excuse of using Walmart for backhaul, but they always lost money.

So why does Amazon go into trucking? Two reasons:. Grow their revenues even though they hardly grow profitability in this business (they do it on the back of independent drivers I think and don’t pay healthcare like Uber who lost $800 million). And #two they increase Prime business. I just bought some books and a few other things from Amazon this week. They still give free shipping, but make that shipping delivery so far out–three weeks to month–that the buyer is forced to pay for more rapid shipping. For example, even though the site says, say 3 to 5 days, they hold the product (i.e. send it out late) that you up wanting to go to Prime. Try it and see. I’ve done this three times. (If u buy used books try ABEBOOKS).

The key for Amazon is continue the hype and keep growing revenues, but this gets increasingly difficult, as they are running out of commodity products. Remember in the 90’s companies like Ariba and Commerce One were going to make market exchanges to sell and trade everything. It was a complete failure after the crash, and each company used their remaining capital to get into new businesses. The issue for them and for Amazon is that the products need selling. I just bought some door locks and handles and called an online company that could provide voice sales help. Amazon won’t do that. Buying clothes online is hard to make sure u like fit, fabric, feel, and look. In web tools and hosting Amazon is competing with the cream of the tech world. We are at the top of the S-curve. We have Amazon competing with Google, Oracle, Microsoft, IBM and a host others including CRM, SAP, and other. They are all squeezing into the last growth area. Ya think margins will stay when technical difficulty is nominal?

Now Amazon wants to get into groceries. It’s the only thing peoplemust have. This may work for commodity canned soup, but don’t expect people to buy meats, vegetables and fruits that way. And look at how high tech groceries are. Wow!

Amazon is certainly running out of profits and squeezing their employees, and I think growing sales is getting tougher too unless, of course Amazon can do everything cheaper by squeezing independent contractors.

This is using cheap capital and squeezing everyone else out. Buy Amazon.

A big shot market head was in the area last week and everyone was impressed because he had a personal airplane. I just thought overhead as in overheadmart!

Good write up…..

“Now Amazon wants to get into groceries. It’s the only thing people must have. This may work for commodity canned soup, but don’t expect people to buy meats, vegetables and fruits that way. And look at how high tech groceries are. Wow!”

Well, Jeff and Warren can trade pennies with each other over lunch at Duncan Donuts or Pizza Hut.

MI,

The bulk of our spending money goes to groceries and is local. But out here in flyover country you can’t buy ethnic products that are worth a damn. They actually sell something called Vinnie’s Spaghetti Gravy. You would get whacked in NY for that. Anyway, we have tired of all the local delicacies and are going to start importing some real spaghetti sauce and real Spanish chorizos. So there is a market for e-commerce grocery shopping.

>>”This is using cheap capital and squeezing everyone else out.”

Agree. I’ve said this for years, and it still holds true.

But there’s another factor: some companies, like Amazon, get away with producing lousy earnings while at the same time enjoying sky-high stock prices. One of the best examples of that is Tesla. At least Amazon is (mildly) profitable. Tesla has been a financial sinkhole for a decade. It has burned through billions of investor money, and will continue to do so. It constantly raises new money and burns it. A year or two ago, I did a tally but I haven’t kept it up to date. Investors just don’t care. They prefer hype.

” Investors just don’t care. They prefer hype.”

I think the stock buyers care, but they are speculators, not investors.

They continue to place their bets on their appraisal of the chances for the bet paying off in a higher stock price.

The latest “hype” is just part of the sum total of the stuff they appraise.

“Tesla has been a financial sinkhole for a decades.”

you should loose the plural

“The company was initially founded in 2003 by Martin Eberhard and Marc Tarpenning”

“a decades” is not a plural but a typo. Should be “a decade” :-)

And so I fixed it.

You are right Wolf.

This is the tulipbulb of the moment. They can’t produce earnings but they can produce sales growth. In the case of tesla that growth in sales will slow. If there is a recession and money tightens at all, then tesla is dead and Amazon stock falls incredibly.

I wonder if the gov’t will continue Tesla’s subsidies, and I wonder if they wouldn’t question Amazon as part of WaPo’s support, indirect.

I completely agree on Tesla, but we are in the crackup boom phase.

Great writeup! Galloway keeps insisting that Amazon will open up stores – well they have – to some extent. I think they are still experimenting with their last mile problem on delivery. It wouldn’t surprise me at all to see them roll out some sort of delivery depot with app-linked storage boxes on every other street, and free delivery as a teaser to get buy-in. That, coupled with their in-house logistics fleet, could really grease delivery and customer satisfaction. This air-based delivery won’t fly, IMHO (LOL), until all houses and apartment complexes have secure drone landing platforms with delivery compartments. But the work gets them lots of attention and free press.

Why would retail sales moving to e-commerce really be growing anything though, isn’t it just a shift?

I guess if I bothered to look at all the numbers I could tell.

It’s just a shift. And my suspicion is that it reduces net sales somewhat because buying behavior online is different and perhaps less influenced by impulse buying that retailers have spent so much effort on monetizing in their brick-and-mortar stores. I have no prove for this, but the numbers seem to bear that out.

I think that’s right.

I buy a great deal from Amazon and alot of it is to supplement existing stuff, which remains useful with supplementation.

I would have to buy the whole lot anew, if I were dependent on local merchants.

Amazon supermarket might use RF bar code. The sku no#

will be received near the exit door and the shopper will be

charged.

Shoplifters will use ECM.

The observation that workers will fail to reproduce if their wages are insufficient for survival is as old as Adam Smith.

It is also the case that wages for workers in market based economies will almost always fall to the minimum required for basic survival.

Wolf’s physician like observations accurately describe the health of the economic patient, but there’s no mention of the demographic forces at work here.

In 1900 the US population was about 76 million. In 2000 it was 282 million, about a four-fold demographic wind that was at the back of the economy for the 20th century.

Since 2007 the US birthrate has been declining (see link below), and I wonder what percentage of GDP and consumer salers can be linked to this noteworthy decline.

The general acceptance of extreme neoliberal market based policies and the resulting inequality is pushing the population into the ‘non-reproductive’ category.

It’s obvious the retail sector is suffering from overcapacity created prior to 2007. They ‘built it’ and the people never came.

The presence of too much cheap money was the enabling factor.

https://en.wikipedia.org/wiki/Demographics_of_the_United_States

Latest estimate from the Census Bureau: the US population is 323.13 million (as of June 2016), up from 308.8 million in 2010. So the population is still growing, but more slowly than before.

Which is another point: on a per-capita basis, the retail numbers look even worse.

that includes immigration Wolf. take out immigration and the birth rate of immigrants and we don’t replace ourselves. not as bad as russia, but not good.

Read Will Durant on this.

Actually, the bigger issue is overpopulation, not lack of economic growth. The world has finite resources.