But where did the money go? Fume and gnash your teeth.

The US gross national debt – after having been successfully disappeared from public discussion – has jumped by $1.38 trillion in fiscal 2016, which ended Friday. Ironically, this is not one of my infamous typos.

So OK, there were some timing issues with the debt ceiling and so forth a year ago, after which the debt jumped $340 billion in one day.

To smoothen out those factors, we look at fiscal 2016 and 2015 combined: the gross national debt ballooned by $1.71 trillion over those two years, $850 billion on average each year. There were only four years in the history of the US, when deficits exceeded this average: 2009-2012.

Not too shabby, for a booming economy. But follow me. This is just to lay down some basic numbers, as we’re drilling into the mystery of how the government borrowed $4 trillion more than it said it spent since 2003. Those $4 trillion in borrowed money – the bonds are still out there – went up in smoke, according to government numbers. But money doesn’t go up in smoke. It flows somewhere. So follow me.

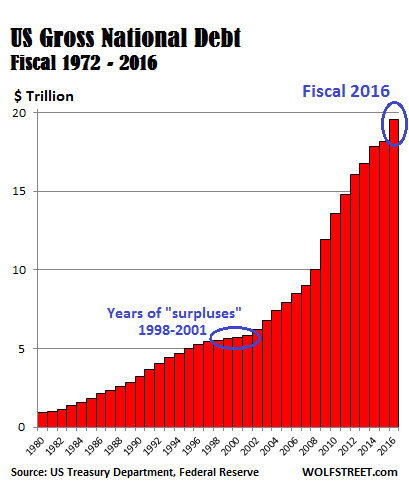

This is how the US gross national debt has ballooned since 1980, from less than $1 trillion to nearly $20 trillion ($19.53 trillion).

This scary chart says two things:

- Deficit spending has become a huge stimulus package that does not stimulate the bogged-down economy.

- Inflation, oh boy, it does exist! It chewed up the value of the dollar over those years. The government had to borrow many more, increasingly worthless dollars to accomplish the same thing, plus some to grow real spending. Adjusted for inflation, this chart would look less scary but would still give you the willies – particularly about inflation.

In government accounting, outlays for infrastructure projects or a fighter jet are not set up as assets and depreciated over time. They’re recognized as an expense and thus show up in the budget as an outlay. Under this system, debt rises because government spending exceeds revenues. Over time, the amount by which debt rises and the amount of the cumulative deficits should be roughly the same. If you run $5 trillion in deficits over 10 years, you have to borrow those $5 trillion, which are added to existing debts, which should therefore rise by $5 trillion.

But not with the US government.

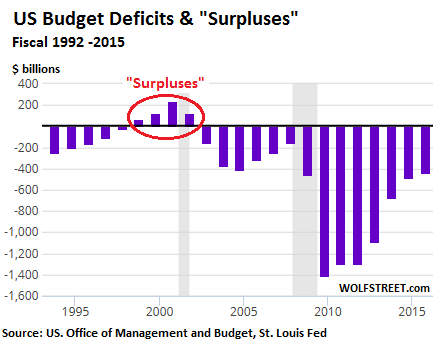

Remember when the US government had “surpluses” in the years 1998-2001? Well, yes, according to the Office of Management and Budget, those four years produced a combined $559 billion in “surpluses”:

So did the debt fall by that amount? Nope. The debt continued to rise each year, as the government continued to borrow more and more money though it had a “surplus”: over the four years of “surpluses,” the government added $394 billion to its debt, as the scary chart above shows.

But that was then and this is now. Now, the hole through which money disappears has gotten a lot bigger.

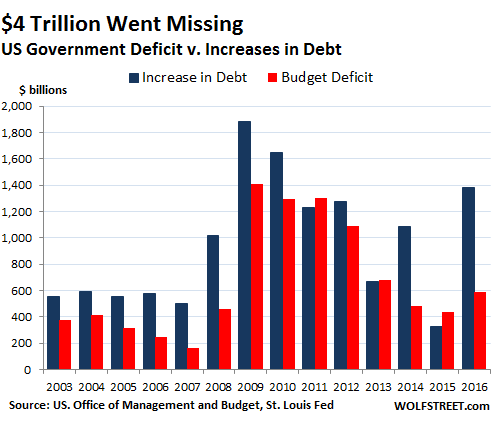

In Fiscal 2016, the government ran a deficit of $590 billion, per the latest estimate of the Office of Management and Budget. Last year, the deficit was $438 billion. So combined over $1.0 trillion. But it borrowed an additional $1.7 trillion to pay for 1.0 trillion in deficit spending. What happened to the $700 billion that it borrowed and that were not officially spent?

It disappeared.

Is it just a timing difference that averages out over the years? Nope.

Since 2003, the government deficits published by the Office of Management and Budget amounted to $9.26 trillion. So the Treasury should have had to borrow that much to make up the difference. But over the same period, the national debt rose by $13.3 trillion. Meaning, $4.04 trillion had gone up in smoke.

This chart shows the official deficits (red columns) and the increase in outstanding debt (blue columns) each year:

The $4 trillion was borrowed and the bonds were issued and the amounts are still outstanding, but the proceeds from the bond sales went out the door, off the books!

Might it be due to the Social Security surplus, which does count as an asset and so lowers the deficit? Nope. In fiscal 2015, the surplus was only $23 billion, and it was likely less than that or even a small deficit in fiscal 2016. So that doesn’t explain the $700 billion difference between debt and cumulative deficits over those two years.

We’ve all heard the stories of how the Pentagon’s books are sordid fiction, how the Army’s financial statements for 2015 were “materially misstated,” how it made $6.5 trillion in wrongful adjustments to its books and manipulated the numbers, etc. etc. But that’s a different – and additional – matter.

The money the Pentagon received was part of its budget; they just messed with the numbers after they received the money, and now the money they received cannot be accounted for.

But the money the Pentagon received was part of the federal outlays, and thus in the federal budget, and thus reflected in the federal deficit and US national debt, even if subsequently the money disappeared in the endless hallway maze at the Pentagon.

With the missing $4 trillion, I’m talking about money that the government borrowed but never spent officially, that it never acknowledged even existed. This $4 trillion is on top of all the internal shenanigans at various departments, including the Department of Defense.

In my articles, I’m like a lawyer: I rarely ask a question to which I don’t already know the answer. But this is one of those times.

What happened to the $700 billion in real money that the government borrowed over the past two fiscal years but never officially spent? What happened to the $4 trillion that the government borrowed but never officially spent since 2013? Where did this money go?

It doesn’t matter who sits in the White House: it happened under Clinton (the “surpluses” of 1998-2001), under Bush, and under Obama. It’s standard operating procedure, but hidden from view. And it’s getting bigger.

I do know, however, that the money went somewhere – and that US taxpayers owe it and have to struggle with the debt and the interest on it for all eternity. And there’s another thing I know: our government’s accounting of what it spends and therefore the deficit numbers are BIG lies: since 2003, it admitted to an accumulated deficit of $9.26 trillion, but the national debt during that time rose by $13.3 trillion. That’s not a rounding error, but a liar margin of 43%!!

And the fate of this deficit-stimulated, consumer-based US economy? Read… “Negative Growth” of Real Wages is Normal for Much of the Workforce, and Getting Worse: New York Fed

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Where did this money go?”

=============

I understand that wars are amazingly expensive, so maybe the same place this money went.

https://www.theguardian.com/world/2007/feb/08/usa.iraq1

Generally speaking, since Ike’s days, that money should have never existed. By “never existed” I mean it should have never existed on paper anywhere.

Everybody has heard sordid stories about “black funds” used to finance shady activities around the world.

It’s useless to hide behind a finger: those funds existed and exist. The piles of freshly minted dollars Federal investigators found in Hughes’ casino safes surely didn’t come from gambling profits. The fact you could not tell where Hughes’ financial empire ended and the CIA began probably had something to do with that money.

It well possible that, given government officials have become far more brazen and the public far more disillusioned with politics over the years, caution has flown out of the window.

The pallets of freshly minted dollars sent to Iraq and Afghanistan to bribe local warlords into compliance are just the tip of the iceberg. The recent story about those same pallets (albeit loaded with euro and Swiss francs) making a comeback to ransom those US Navy sailors captured by the Iranian Revolutionary Guard hint the practice has not merely become far more widespread than in the past, but the numbers have spiralled out of control.

As much as these stories are truly fascinating, the big problem here is complete unaccountability, which in turn is leading to a rapidly accelerating loss of faith in the whole political system, which in turn leads to more unaccountability, which in turn leads to… Hillary Clinton’s now infamous “What difference does it make?” sums it all up nicely.

According to the Fed the estimate “is that between half and 2 thirds of the value of US currency in circulation is held abroad”.

The total of all US currency (Federal Reserve Notes) in circulation is around $1.3 trillion based on the H.3 report from the Federal Reserve.

The total M1 money supply in the US is only $3 trillion and only $1.3 trillion of that is printed currency. This is confirmed by the Federal Reserve H.3 report:

http://www.federalreserve.gov/releases/h3/current/

Studies show that since 9/11 the United States spent

Five Trillion on wars – all of which we lost or are losing.

And….here comes Climate Change barreling down on us.

Reality is hard to face!

wars

Especially when you add in the fact that “climate change” is a hoax of the highest dimensions.

Of course the climate does change … it’s called weather.

But “climate change” is nothing but the NWO looking to grab

more and more of your money.

Don’t be so fooled. Do research and learn … while there is still time for it.

There is also the thorny issue of solving an equation with two unknowns.

Unknown 1 is the re-emittance of IR into space – i.e. the famous IPCC ‘radiative forcing’.

Unknown 2 is the well hidden, never spoken of, other side of the equations: the incoming solar radiation’s modulation by the earth’s albedo – i.e. mainly clouds.

Because of this second unknown the Global Warming equation becomes:

Unknown outgoing radiation = Unknown incoming radiation

At the end of the day, the scam is uncovered by simple algebra. All good scams have simple bases – like renting currency ;)

There’s another aspect of “where did it go?” people don’t understand.

No government employee ACTUALLY pays taxes…though it appears they did, on paper.

Like this…you have 5 private sector employees and one public sector (government employee), each paid $50K a year, each “taxed” $10K a year.

As you can see, there will SHOW $60K as “taken in in taxes”…the government shows a $60K “income”…but the public sector employee is paid his $50K OUT OF THE TAXES OF THE PRIVATE SECTOR EMPLOYEES.

So the TOTAL $50K collected from the private sector is now paid to the government employee…net income–zero.

NOW, they CLAIM the government employee paid $10K in taxes…so they take that BACK out of the $50K already collected from the private sector.

So they show, on paper, that they collected $60K in tax income…yet the actual monies they collected only amount to $10K.

Now add to that the fact that the average American family, at the average household income, will get back more than was withheld for taxes, come April…if you’re actually an “average” family in all aspects, you don’t pay a cent in taxes “for real” until you reach a household income slightly under $80K/yr…between deductions, tax credits, and the discrepancy between withholdings and gross taxable income…well, you’ve had about 28.7% withheld under FICA ($22,960)…

Work this out…deduct your childcare for 2 kids…an average of $300/mo (many private childcare setups, where a neighbor is paid to watch kids after school, yet it’s claimed as a deduction–brings average down from commercial daycares)…so that’s $3600/yr to deduct. Average mortgage carried is about $300K, at slightly over 3%, average mortgage term now is 25 years, average homeowner has been in their house less than 7 years. This means the average American family can deduct in the neighborhood of $24K/yr on interest on their home loans. Home repairs? Deductible. Home improvements? Deductible. If you itemize, business/work clothes and most your kids’ clothes are deductible…dunno about you, but I had to replace a couple suits a year, and at least one pair of shoes, so that was an easy $3000 deduction, yearly on ME, alone. Kids, I averaged about $6K a year on clothes and deductible supplies (school and such) between the three of them (they didn’t need more than jeans and sneakers, for the most part…what got expensive was shirts, jackets, and accessories…lol).

That right there is an automatic $36,600 off your gross taxable income…so your taxable income is now $43,400–or taxable at a base 15%–this is according to the IRS income tax calculator–with a federal tax liability of $5,468–final result, out of your $80K income, you keep $74,532. Now add in the actual credits for kids and the CREDIT for childcare (on top of the itemized deduction), you keep $79,732.

That’s right, folks, at nearly DOUBLE the average American household income, the average American household pays less than $300 in taxes…without considering credits for investing in retirement instruments, any gains or losses from investments, any major medical expenses, any credits for medical coverage, or a dozen other available credits or deductions!

I know this SOUNDS wrong, if you’re the working stiff, because you sure as HELL don’t have that in spending money, at that income…but that’s because you don’t get your contributions to SSI/SSDI/MEDICAID/MEDICARE back, your contributions to L&I/disability back, or anything similar…but those are ALSO struck off your taxable income…they’re part of the deductions that brought you down from $80K taxable to $43K.

Now…add the two situations I just described together…take a look at how many employees the federal government has, and their income levels.

On average, for every 6.25 private sector workers in this country, there is a government-paid direct employee (this doesn’t count private sector employees being paid through tax dollars because they’re working on a government contract). Average income of a federal employee is $82,575.92 (fed budget tracking, Congress’s website).

As I just showed, TWICE, those government employees pay no actual taxes, it’s a shall game on paper…and it takes TWO of those private sector employees, on average, to match the gross income of ONE government employee…who then, as shown, pay about $300 a year towards that government employee’s salary, who then, themselves, are given an almost total tax “return” on taxes they never paid!

Now…if the average in this nation is that it takes two average working families to pay $300 in actual income tax, and those taxes have to pay the salary of a government worker at $82K+/yr…547 average private sector workers to pay for ONE average government employee…who then gets a “return” on taxes he never actually paid (it was the money of the other taxpayers’, already collected and redirected), and end up with less than $1000 cash in hand at the end of handling those 547 private sector employees and one public sector…

Wait! Say that again!? FIVE HUNDRED AND FORTY SEVEN PEOPLE to pay one government employee, and leave $1000 cash to pay for overhead for whatever that employee’s job may be!

Worse, currently, according to the bureau of employment, there are 116m working people (private and public sector) supporting 93m people who collect some subsidy or another, ON TOP OF this unsupportable balance of public sector/private sector employment.

And you wonder why it gets worse and worse? The math isn’t hard, folks, just takes a bit of research to come up with legitimate numbers.

That’s roughly 4 trillion or 4000 billions, too much for the wars in Middle East. Financial markets “disappearances” are more plausible:

http://seekingalpha.com/article/3985133-stock-market-crash-3-trillion-really-just-disappear

https://en.wikipedia.org/wiki/2010_Flash_Crash

So, here we are, 35 years later, $20 trillion in debt later (yeah,Reagan started it with a 200% increase in the national debt during his administration), with $6 trillion of delayed infrastructure rotting in the sun (yeah, I know, that’s a recipe for another government boondoggle and a great campaign talking point), a missing $6.5 trillion rat holed into the Pentagrammaton (with the Middle East in a state of devastation as a direct result of MICDOD FIAT carpet bombing the locals with airdrops of shrink wrapped Benjamins by our Prince Of Nobel Peace Prizes), a deficit of $1 trillion this year ( yeah, I like rounding at $1 trillion a year for the last 8 years because a trillion here, a trillion there and we’re talking unreal money), local and state PUBLIC pension deficits that are well beyond $1 trillion (CALPERS $300 billion and always needing MOAR bail ins), 95 million unemployed with labor participation rate of 63% (yeah, while the 5 dozen or so people with day jobs, the BLSBS says this constitutes a 4.9% full employment) and the homies want $15 trillion in reparation (and us Social Security/Medicare recipients are destined to bankrupt the system long before the inner cities get a dime)

Let’s just say I am not particularly worried about DBank, the WMD derivatives and all the other global economic and financial system FUBARs and TACFUs

Actually, I’m forming a new political party and call

it.

The ProtoMongolian Anarcholibertarian Genghis Keynesian Khan Khlan. It might not work that well because the initials are PAGKKK.

Or maybe I’ll just settle on the Fukitawl Party and be done with it.

Cheers and have a great weekend

Reagan almost tripled the debt. When i want to watch my pre-rich republican friends heads explode i tell them that on a % basis Reagan spent more than Obingo.

rage ensues. too funny

He certainy did spend a load of money, but also implemented polices of growth.

But let’s be honest, these massive welfare and entitlement programs are the lions share. Regan’s spending pales in comparison to Bush, and Bush spending pales in comparison to Obama.

All I hear from you libs, is military, military, military. Meanwhile entitlement and welfare programs alone will bankrupt the country. The CBO charts interest on the debt, and I want to underline INTEREST, as reaching what we spend in defense in as little as five years. We spend 7% of the budget on interest. We are projected to be in the 15% range in the not-so-distant future.

Yet many loons want to support new massive college entitlement programs.

57% of U.S. revenue is spent on “defense,” which, includes the FBI, the CIA, the NSA, and the rest, along with all branches of the armed forces, weather manipulation, clandestine operations, nation-building all over the world, and goodness knows what else.

So the fact that we spend more on the military than everything else COMBINED is meaningless to you? IT’S THE POORS FAULT!!! The powerless are dragging me down! Fool yourself much?

Raymond: Funny thing is, if we eliminated SNAP, popularly known as food stamps, most grocery chains would go out of business. The term “food desert” would be understood by the majority of Americans, as opposed to the less well off citizens.

BTW Raymond, while there are many differences in personal experience and differing opinions here at wolfstreet.com, most of those commenting try to avoid denigrating those with whom we disagree with name calling. When I see that in a comment, it undermines the argument.

Gee whilikers! You don’t suppose the massive Bush tax giveaways to the rich had anything to do with the deficit? Note how carefully Obama continued and expanded upon this. I just love it when guys like you claim that we are spending way too much on the American people. Does that mean we should give more to the billionaires? However much we give them I rather doubt it will ever be enough. The best way to reduce these shameful “entitlement” programs is to reduce the surplus population. Any suggestions on how we ought to begin the culling?

“57% of U.S. revenue is spent on ‘defense'”

NO, that’s the approximate percent of DISCRETIONARY spending. Here’s the pie chart for discretionary AND non-discretionary spending.

https://upload.wikimedia.org/wikipedia/commons/5/57/U.S._Federal_Spending.png

DOD is 16% of all federal spending while Social Security and Health Care combined are 49%. If health care costs were reduced to what they would be without federally granted exemptions from non-competitive behavior and competitive bidding on ALL federally funded treatments and medications, the DOD budget could be paid for just from those savings.

So spending money on warring (killing innocent civilians and bombing hospitals) is OK. Spending money helping the sick and the hungry and the homeless (our citizens) is BAD. That is some value system.

@Gerald, Healthcare costs are rapidly rising? How does that help the middle class?

Only 20% of the US government annual spending is for total military spending with 16% for actual military spending and 4% for Veterans Benefits.

The biggest part of the spending is SOCIAL PROGRAMS including the Social Security and Medicare insurance programs which are NOT ACTUARILY SOUND and which are paying out vastly more than they have taken in with payroll taxes.

A summary of the fiscal 2015 US federal government expenditures totaling nearly $4 trillion is as follows:

WELFARE & MEDICAL (63%)

33% Social Security, Unemployment, Labor

27% Medicare & Health

..3% Housing & Community

MILITARY (20%)

16% Military

..4% Veterans Benefits

INTEREST ON DEBT (6%)

..6% Interest on Debt

FOOD & TRANSPORTATION (6%)

..3% Food & Agriculture

..3% Transportation

EDUCATION & SCIENCE (3%)

..2% Education

..1% Science

ENERGY, ENVIRONMENT, & INTERNATIONAL (2%)

..1% International Affair

..1% Energy & Environment

OTHER EXPENSES (1%)

..1% Government Expenses (general)

The complete breakdown of Fiscal 2015 expenditures is extensively detailed including actual numbers as well as pie-charts with various percentage breakdowns as to discretionary and non-discretionary expenditures at:

https://www.nationalpriorities.org/budget-basics/federal-budget-101/spending/

damianl, it certainly does.

Know why? It’s BARELY enough, in terms of actual manpower and combat ability.

Who are the “biggest kids on the block”, globally?

China, Russia, and the US.

Next, we also have a population of nearly a third of the planet that honestly believes they should run EVERYTHING, with an iron fist, instead of trying to manipulate things so that the majority balance of governments are willing to at least interact productively with us, over 10% of whom have already declared war on anyone not one OF them, and most of the other 90% won’t even condemn them publicly, much less DO anything to help us defend ourselves and THEM from those elements.

And we’ve got a couple million people actively able to respond within 48 hours as a defensive force….

Compared to China’s half billion, between reserves and active military, Russia’s 8 million soldiers, or the 160 million Islamic fundamentalists who’ve basically declared holy war against the world…

The problem isn’t how MUCH is spent, it’s HOW it’s spent….

We’ve been hearing complaints from the US Army and USMC about how they’re being FORCED to retire perfectly serviceable tanks, and replace them with “brand new refurbished” ones at 2.83 mil a pop, or 5 mil, new…forced because the US gov’t is locked into a production contract with the manufacturers.

We’ve known about $400 toilet seats, and $80 for a nut and bolt set that can be picked up for $1.25 at Home Depot, for the Navy for a long time.

The F-35 boondoggle, while our current fighting craft are still a cut or two above almost every other military plane in existence, and our pilots tend to be among the best in the world, making a billion dollar per replacement jet a pretty big waste, even if it DID work, which it doesn’t…but is going to be built, anyhow.

Know why China pays less, yet has a military orders of magnitude larger than ours? They pay for only the hardware they’re going to use, and use it until it’s too outdated to consider using (hell, they have the manpower to soak up casualties…they can afford to lose 4 tanks to our one, if it comes to it). Same with Russia.

But their militaries could certainly give us a run for the money, if it came down to it.

See my point? How MUCH is spent is needful just because, as the biggest and richest “kid on the block”, we BETTER be capable of playing REALLY rough, even if we don’t WANT to, because otherwise, *eventually* someone else will decide that we’re undefended enough they can take what we have (what all war except religious war boils down to–resource control).

It hasn’t happened YET for one reason and one reason only…we have the best trained and most effectively equipped military in the world, and, for right or wrong, they’re kept in fighting trim and in practice through the politicians and profitmongers using us for their own gain…not a good thing, but definitely advantageous to have a military that’s been regularly in live fire conditions, in the event they ARE needed for what a military is intended for…to have about 2/3 bar the doors, while about 1/3 starts hurriedly training all volunteers into being soldiers, and, if it gets bad enough, training reluctant draftees…because if you DON’T have that…well, it’s like living in a million dollar mansion in Watts, loaded with portable luxury items, but having ZERO security in place…no alarm, no bars on windows, no window or door locks, not even a damned broomstick in the frame of the sliding glass door to the back porch…as soon as someone else realizes you’re THAT lacking in security, all those portable luxury items will disappear, and shortly thereafter, the mansion itself will be pretty much destroyed…if you’re lucky, it won’t end up with you, the owner, killed in the process.

Serious question if you own your house out right with no mortgage can you qualify for welfare? I was at a local tavern today and the question came up. There were five or six small business owners there who employ 20 to 30 people at 15 to 25 dollars per hour and they said if Hillary wins they will close up shop and go on the public dole because they can and owning a house outright doesn’t count. Is that true?

In Florida I think it is true if you have children in the household.

They are most likely not going to close up shop due to Hillary. That would just be a stupid business decision. If they had half a brain, they would at least try to sell the business. Being on the public dole isn’t fun or prosperous. They are all talk and bickering while their depressed and miserable friends are willing to lend an ear on a Tuesday afternoon. It is like the same people saying “if Trump is president I am leaving the country!” Most likely they won’t be leaving the country either.

Politics, it seems, brings out the worst in people.

If Trump is elected, we will all be applying for welfare.

Really? How so? Last I checked, Obamacare wasn’t bringing down healthcare costs.

Neither Obama nor any member of Congress dares take on the insanely out of control health care industry. It won’t happen until the American people DEMAND that this happen and back it up by voting the sycophants out of office. We pay a lot more for our health care and get less than any other advanced nation. The American people have ,let this happen. Until they stop voting so stupidly, there is no hope.

Nope. Donald Trump will be very good for the US economy once he is elected and will work to reduce government regulations and costs on businesses.

How can you be so utterly blind? Not only has that failed to produce any results it has lead to the disaster we are facing now. American will fall if Trump gets elected for precisely the reasons you mention. Democracy will fall to be replaced by a grim corporate plutocracy.

Jerry, I really can’t imagine under any scenario as to how you could possibly come to the conclusion that you have drawn. Donald Trump would be very good for the ACTUAL FUNCTIONING AMERICAN ECONOMY from everything I can see and from all of the statements that Donald Trump has made including his tax plan, handling of immigration, and handling of trade issues.

Yes. My neighbors house is paid for and she is self-employed making between 2 to 3 thousand a year as a pet sitter. In addition, she is collecting Social Security, $330 per month. She qualities for two programs, SSI and food stamps. Due to her pride, she refuses to sign up for SSI, but she does collect food stamps. Her food stamps are 190 per month.

“But where did the money go?”

Well, the poor didn’t get it. They’re still getting poorer, and their ranks are increasing.

The middle class didn’t get it. They’re circling the drain.

Maybe college professors got it. Nope, they’re turning into adjuncts.

Maybe union workers got it. Nope, they’re getting pay cuts and their jobs are going offshore.

Money, like water, seeks its own level, and unless it’s diverted it all runs uphill. And there hasn’t been much of anything to divert it for the last several years.

BTW, the “temporary” Bush tax cuts have cost the country at least $6 trillion and counting, and tax evasion can be expected to have cost at least twice that.

Where did all the money go? Since it’s not invested in the U.S., one must surmise it’s all gone offshore and is sitting around doing nothing, neither spent nor invested. Not that the crooks who run the global economy are ever going to admit that.

I’ve never liked the formulation that the such and such tax cut cost the government XXX billion dollars! The problem is that it ends up sounding a bit like the government (not the country but the government) was somehow entitled to that money and that citizens are cheating the government by keeping the money that they earned. How dare they?!

The people who really benefited from those tax cuts didn’t, I think, so much earn that money as steal it. How dare they be asked to pay their fair share! Too many types in our modern society are earning their loot by indulging in the sort of activities that Jesus referred to as “grinding the faces of the poor into the dust”. How dare we ask them to give some back?

“How dare they be asked to pay their fair share!”

True to form, the rentier class repudiates any legal, ethical, or economic obligation to maintain the systems which enable their wealth.

As usual, those costs are externalized so as to maximize their extraction: the most profitable way to cover the bills is always to have somebody else pay for them. Since those profits are neither spent nor invested the product of human toil is increasingly being reduced to useless collections of ones and zeros.

Michael Hudson and Agent Smith have observed that they have adopted the role of parasites and are killing the host. And as Hervé Kempf has shown, the rich are on course to destroy the planet. The process is genocidal and suicidal, but they control it, and nothing prevents their success.

It is always a mistake to feed the rich because it only makes them hungrier, until at last in their uttermost famine they will devour themselves. And that, as they say, will be that.

Right wing Republicans and Trump want to take us back to when America was great. Back then when we had a thriving middle class and opportunities to advance. Back then we had 80-90% tax on the rich – strong labor unions – and a big effective government.

they all say that!

Effective government is an oxymoron. If course, the glory days you speak of have little to do with the factors you mentioned. Try the fact that we emerged fromn WWII with things intact and didn’t have any competition.

no competition and no infrastructure damage after WW II. speaking truths like that will get you into trouble.

So why are cities like Baltmore, Detroit, Philly, and Chicago in such poor shape? Which political party has run them over the last 50+ years?

Look at the sinkhole states run by Republican governors, including Illinois. This fiasco is bipartisan.

Illinois is a poor example. But I agree that the pension crisis is bad no what matter what state.

The republican governor of Illinois does not “run the state”. He has been almost completely ineffective trying to butt heads with the democrat majority that actually runs the state. However, in general the national fiasco is bipartisan.

Back when had a Liberal/Progressive dominated government? All the Conservative, Right Wing, Free Market types have brought us is ever increasing poverty and an increasingly pathological economy.

$2.4 Trillion of QE money is sitting in the Fed, in those bonds misnamed; “Government Debt” I can’t recall where I saw that figure, but I don’t doubt it.

All those idle bank reserves are liabilities of the Fed, which paid banks and others for its assets (like Treasury bonds). The Fed or the Treasury doesn’t issue bonds to fund any of that: the Fed creates the money, and the bonds it buys have already been issued, with the proceeds remitted to the Treasury. So this doesn’t explain anything.

Please try to understand GENERAL LEDGER BALANCE SHEETS. You are correct that $2.4 trillion is sitting inside the Federal Reserve on BOTH SIDE OF THE BALANCE SHEET with $2.4 trillion on the LIABILITIES SIDE OF THE FEDERAL RESERVE IN CASH IN EXCESS RESERVES ACCOUNTS of the member banks from the proceeds the Federal Reserve paid out to those banks to purchases the ACTUAL US TREASURIES ON THE ASSETS SIDE OF THE FEDERAL RESERVE BALANCE SHEET which it holds as assets to offset those liabilities. Part of those funds were used to purchase MBS INSTRUMENTS and were not used exclusively to purchase US Treasuries (bond, bills, notes, and TIPS) and the total amount of QE funds was $3.6 trillion, and much of the other part of that is in the NORMAL RESERVES ACCOUNTS of those banks as reserve requirements were raised from 3% to 10% in January 2014 and required on both DEMAND and TIME deposits.

The Democrats generally follow the same big business, ultra rich, austerity, free market tactics as the Republicans and with about the same results….. Heads I win, Tails you lose!

Huh, Jerry? Did you not comprehend a single word that I very clearly stated with the present situation of the composition of the Federal Reserve balance sheet? The Federal Reserve DOES NOT CREATE ANY US GOVERNMENT DEBT and is an OWNER OF AROUND $2.5 TRILLION OF THE $19.5 TRILLION IN OUTSTANDING US TREASURIES which then become ESSENTIALLY INTEREST FREE TO THE US TREASURY because the Federal Reserve rebates more than 94% of its entire profits each year to the US Treasury as it has done for the past 103 years. The Federal Reserve presently is the LARGEST SINGLE ENTITY SOURCE OF US TREASURY (GOVERNMENT) REVENUES and rebates around $100 billion a year to the US Treasury.

Worse. The Dems betray their base which the GOP doesn’t need to. The dems have a fig leaf of concern for the poor, but nothing substantial. It doesn’t matter who you vote for a venal politician always wins!

It’s going into yachts ……. lots of big yachts !

Wolf, first look at the Treasury statements. Cash will increase by a little bit, but I think to understand where it goes you must look at investments made by the government. Think Student Loans. You might find it there.

This brings up an entirely new line of questioning as it relates to what is sustainable.

According to my understanding, the government is on cash accounting as far as the budget is concerned. If it buys something (a building, a jet, whatever) the total cost enters the budget as an outlay that has to be budgeted for. So some of these outlays are investments, such as a bridge, but they’re still treated on a cash basis as part of the outlays and are not set up as an asset.

That’s why infrastructure projects, for example, are treated as outlays as they’re being built, rather than investments that are depreciated over time.

Also, to your question about student loans: total student loan balances on the government’s books right now are about $1 trillion. Since 2003, they’ve grown by about $900 billion. So that’s a lot, but it’s not nearly enough to explain the $4 trillion. TOTAL financial assets on the government books are only about $2.2 trillion. So any growth in assets since 2003 doesn’t come close to the $4 trillion.

(attempting to reply again since my last attempt seems to have been lost; apologies if two went through…)

Wolf,

Yes, you are correct — the government is on cash accounting. It allows for the most irresponsibility, so of course.

I can answer where about $750 billion of the debt growth comes from: the Pentagon’s war budget (formally, the “Overseas Contingency Operations Account”, or OCO). This “budget”, is of course, off-budget. At one time, Obama said he would fix this. See this article for more (including a helpful chart: http://www.govexec.com/defense/2016/02/obama-punts-controversial-war-account-successor/125854/ )

With that, and the growth in student loans, we’ve found about $1.5T of the total “missing” $4T, leaving $2T. That is cold comfort for a lot of reasons, the first being that it’s highly disingenuous (and dangerous) to leave discussion of these items out of the debt debate, focusing on the fiscal deficit entirely. Secondly, these expenses/liabilities are their own (large) problem. And third, $2.5T is still a huge amount to be falling through the cracks.

What might be going on here, as far as I can tell, is that there’s nothing that prevents the Treasury from making payment on any cheque drafted through it, as long as the check is nominally-correlated with a budget item on the books. But it isn’t clear that there’s any real limit to the *amount* of checks that will be cleared in this way, i.e., there’s no function to constrain them to the actual budgeted amount. Why should there be, when the government’s “operating account” simply consists of however many Treasurys it can sell immediately into the market (or to the Fed)?

In other words, our government may simply be allowing itself to be endlessly overdrafted, enabling rampant waste and corruption — really, outright looting. This actually explains quite a bit about how DC appears to function.

This is also why I’ve argued that it is exceedingly dangerous (and in the long run, suicidal) for any government to establish a system of open-ended, cash-flow-demand bond issuance, rather than issuing bonds only correlated to a specific budget item or fiscal operation (and optimally, only in emergencies, or in order to finance development that will yield its own repayment cash flow). It is, in effect, a backdoor means of endless money-printing (in the US’s case, famously, constrained only by the thin veneer of incipient fiscal deficit reduction and debt ceilings).

Finally: we shouldn’t forget that Fannie and Freddie’s $5 trillion is still not being included in the public debt — even though they have become de facto government bureaus.

To put these amounts into perspective I usually divide it by the number of people or households on the hook.

So in the US the number of households is around 125e6, for an amount of 4e12 that gives us a cost-per-household of $32,000.

For every single household in the US, rich or poor.

That’s a free luxury car _each_.

It’s a lot of money.

The missing $6.5Tn spent by the Pentagon is $52,000.

The death of the taxed class (the middle class) is no longer a mystery – they have been, are and will be paying for this for quite some time. The ruling class is an expensive habit for the average citizen.

Correct, Wolf. By the way, this is an EXCELLENT ARTICLE and you’re starting to dig down through the entire matter of the discrepancies between the reported deficit by the CBO and the actual deficit which is the increase in debt each year as reported by the US Treasury itself. You’re going where nobody has gone before! Thanks!

By the way, that is NOT me speaking above.

Thanks for pointing it out. The other “Just Me” used a different log-in email.

Maybe one of you could rename yourself “Just Lil’ Ole Me” or something like that?

Why do you think both parties are united against Trump? They don’t want any outsiders poking around, looking in dark corners where pallets of cash may have disappeared, into prominent pockets.

That is what Henry Ross Perot was all about. His snooping around and Poppy’s unpopularity was extremely worrisome.

Petunia…. What are you talking about? Trump will loot the Treasury for himself and his friends and then finish off the middle class. The suffering will be beyond anything you can imagine. Turning over the country to a narrsassistic two year old is insanity!

I voted for Bill Clinton the first time and I’m still sorry. Next.

P. S.

I call myself a Clinton Republican. The Clintons made me a Republican.

Here’s a list of the most narcissistic presidents:

http://www.pewresearch.org/fact-tank/2013/11/14/the-most-narcissistic-u-s-presidents/

“These researchers also found that, on average, presidents are more narcissistic than the average American. Moreover, the level of grandiose narcissism in presidents has increased in recent decades.

But there’s also a dark side to grandiose narcissism—the painful cutting edge of Watts’ double-edged sword. Leaders ranking higher on this narcissism measure also were more likely to be the targets of impeachment resolutions (Richard Nixon stood sixth on the list, just behind Kennedy) and engage in unethical behavior (Bill Clinton ranked seventh).”

The way it’s set up, the more big money and big media you have on your side, the greater chance you have of succeeding in becoming President, as you control the narrative. The downside is that you have to pay all of these people back with favors.

Of course people running for President would be more narcissistic. You or I would fold under the criticism, we couldn’t spin falsehoods like they do, we couldn’t sit in front of congressmen and be grilled and still lie.

My above comment was directed at Gerald Stehura who seems to think that only Trump is narcissistic. How about them “what difference does it make” Clinton’s? The Clinton’s are the epitome of narcissism.

Of course we need to help the poor, but, remember, in so doing, we keep them dumbed down. They end up voting not for the person who will make the country great, but for the person who will continue to look after them. And, of course, the politician loves that because they have a solid block who don’t ask questions, who don’t care if they loot, just as long as they continue to get their checks.

If the poor did not get helped (which I am not advocating), were left to twist, they might wake up too, start looking around and begin demanding that things change as well. They don’t because they are not desperate enough.

Narcissism up to a point can cause a person to set high goals and standards for themselves. Under the right circumstances it can lead to greatness. But the great downfall of narcissists is when they start lying to themselves about their real qualifications and start trying to fake it. This is the problem with Trump. He has become pathological and toxic.

@Gerald, Have you thought about donating to the Clinton Foundation?

Shudder! No! Absolutely not!

Only Insanity, Nay it is suicidal insanity.

Trump will bring war and financial disaster.

Just as assuredly, as baby bush was always going to engage in a war with Saddam, and bring great financial pain to America. As after hiding from the shooting in Vietnam, he had to prove he was better than daddy. Who at least knew what it was like to be shot at, and chased, by people who hated you, and wanted to to kill.

The only question was, how that war would be started. An islamic madman, made it easy for him.

Nope. Donald Trump will not do that at all. And cash isn’t the issue as there is only about $1.3 trillion in actual US currency (Federal Reserve Notes) even in existence with a total US money supply measured by M1 of only about $3 trillion. The M2 money supply including savings accounts is nearly $13 trillion, while the MZM is around $13.5 trillion, all of which are very SMALL NUMBERS in our $18 trillion a year economy.

The big issue is the HUGE SHADOW BANKING SYSTEM IN THE US where there is around $25 TRILLION of funds and those entities include pension funds, hedge funds, money market funds, and insurance companies among a number of other entities and is OUTSIDE THE REGULATED BANKING SYSTEM IN THE US.

Trump hasn’t (yet) cost the US any money, in fact he is arguably a contributor.

Google: Dr. Kilari Anand Paul Libya Clinton

to see Hillary’s record, she has arguably cost the US $trillions, on top of the human cost she has inflicted on the middle east. That’s even without Bill’s repeal of Glass Steagall that led directly to the 2008 credit crisis that cost the world trillions too.

State managed healthcare is a pre-requisite of the civilised world in most of europe, but apart from making token (big pharma approved) moves toward that the cost of the Clinton’s for the US could have funded a private hospital per street in the US and still saved money.

A trillion here, a trillion there, very soon you end up with a big debt.

Note also that Bush is voting Clinton, because for all Trump’s press vilification and media attacks – he’s an independent businessman under chronic attack from the establishment that has created all these problems and debt for us.

Voting against the failed establishment is the obvious thing to do – unless you can explain exactly why we need more of the same?

Is that the money for “black budgets”, NSA and such? The amount of money they budget is secret and they don’t want anyone to figure out how much it is.

“Black budgets” should still show up in the outlays and deficits. Just not detailed.

The ‘Black, Black’ budget comes from the CIA’s worldwide drug and other nefarious operations and will never show up on any set of books. The ‘Black’ budget is for small stuff and other incidentals and is meant to keep us off balance, focused on the small change while the big elephant in the room never gets discussed. That’s how polite society maintains the status quo.

If I were to guess, it would be that the money went to fund U.S. intelligence operations. The money was indeed spent, but the act of spending it and what it was spent on is classified.

Nope, sorry, that’s not the way it works.

Funds are allocated to XYZ and then re-allocated to fund any ‘black’ ops or other operations that come up on an as needed basis. Once the pot of money is gone, it is gone.

If the FBI (Federal Bureau of Incompetents), the CIA (Complete Idiots and As**holes), the NSA (I’ll pass on that one), the DIA (Dummies, Idiots, and A**holes), and etc set up some entity such as travel agencies as fronts, the funds are supposed to be used to fund the operation and then any ‘surplus’ returned to the government (yeah, like that will ever happen in real life…………..)

And remember as the end of the fiscal year approaches every entity scrambles around to spend whatever is left of their pot of money.

Like spending x hundreds of dollars on Xerox paper even though it won’t be used by the end of the month…………..

Exactly, Lee.

It takes enormous amounts of cash for the various PPT teams to run their internationally coordinated operations. It takes a big chunk of change to squeeze the shorts real good, a common ploy — wait for the shorts to accumulate and then drive the market up, reaping the shorts — it practically pays for itself!

And psy-op propaganda generated non-stop to keep the masses ignorant and appeased is likewise not a cheap operation — think of all the paid advertisements, paid shills, bought-and-paid for key men all throughout mass media.

Then, toss in the ongoing costs of keeping NSA, CIA, US Military, Homeland Security and militarized police forces operational with plenty of backup to spare.

Suddenly $4 trillion begins to look like a very reasonable sum.

It is all for our benefit, of course, they just don’t want to come out and say it.

In the US, the PPT (Plunge Protection Team) was entirely ENDED IN EARLY 2003 and the Federal Reserve owns absolutely no equities (stocks) whatsoever and is prohibited from purchasing or owning stocks.

Yesterday Rush Limbaugh was saying how when he was a kid his father went on about the national debt, same when I was a kid – my father very often bemoaned their irresponsibility.

The lack of concern boggles the mind! Like Cheney saying, “Deficits don’t matter, Reagan taught us that.” Just because the day of reckoning has not yet arrived hardly means it’s not coming. Come it will and we should not deceive ourselves with the notion that irretrievable national ruin is not a distinct possibility. Fiscal insanity eventually leads to catastrophic consequences, even the fall of civilizations. Deficits most certainly do matter!

Like the Good Book says, “The curse causeless shall not come.”

“The lack of concern boggles the mind! Like Cheney saying, “Deficits don’t matter, Reagan taught us that.” Just because the day of reckoning has not yet arrived hardly means it’s not coming.”

================

As long as the MSIC can force US citizens to use only USD in all their transactions, and force other nations to continue to accept printed-out-of-thin-air USD as payment for REAL goods and services, the one and only way that I can see the US’s Ponzi / mafia / perpetual-printing-borrowing scheme stopping is if an external force intervenes to defeat the US’s ongoing wars of hegemony.

The US is reliving 1930s German history and the vast majority of citizens are simply incapable of realizing it and acknowledging what their government has been doing for a very long time.

If you need further evidence that what I’m saying is true, listen to Ralph Nader describe what Smedley Butler had to say about his long career in the Marines.

https://www.youtube.com/watch?v=7NiQ38DW7gA

Missing a few trillion USD? SO WHAT?! Janet will just print some more!

NOW do we understand why a gold-standard USD might be a good thing instead of a drone-standard USD?

” a gold-standard USD might be a good thing instead of a drone-standard USD?”

That implies a zero interest debt currency, or a credit, treasury owned currency (as mandated in the US Constitution).

Because interest creates an exponential function – and gold is not mined in that way, it’s a constant, linear supply, linear and exponential graphs can cross each other, but never track for more than a short time.

This is why all ‘gold standard’ interest bearing currencies leave the gold standard at some point – it’s simple maths.

Could it be from rolling over debt that comes due? Paul Craig Roberts talks about this occasionally.

When debt is rolled over, it’s a scheduled event. The Treasury issues new bonds, and with the proceeds redeems maturing bonds. So I don’t think it impacts the overall debt over time.

Well heck I hear the Stargate program costs billions and billions a year.

Thank you for taking up this subject. I have been following this phenomenon for several years and am still clueless as to what happens to the money. An out in the weeds guess is that it goes into financing ‘color revolutions’ and other attempts at overthrowing governments that the establishment doesn’t like. I also think that we supply opposition groups with weapons and training. Remember Col Oliver North’s operation that he was running out of the basement of Reagan’s White House? Reagan also ran the “School of the Americas”. We have Special Forces that operate in an estimated 147 countries, they and their operations don’t come cheap. There are also outfits like Blackwater who are wildly expensive. My guess is that these expenses and others are all carried off the books but still have to be paid for by the taxpayer.

If America is actually USA LLC or something close to that, a privately held corporation owned by various unknowns, a few things occur to me

The national debt rest on the people’s shoulders

The USA LLC is more than just insolvent. It’s illiquid for the most part.

The LLC operated on cash accounting so the real debt is not recognized

If the LLC was operating on GAAP accrual accounting our debt would be $200 trillion with an asset base maybe 30% of that, a GDP 8% and a tax revenue maybe, at best 1.5% of that.

The federal government spends 25-35% more than in takes in annually, accrues 1.5 as much new debt per year as the total Federal tax revenue.

And I’m pretty much at a loss for words how describe the situation we are in. Most of the G 20 is in the same predicament and yet we’re the biggest economy in the world. You’d think we’d have been able to do it better than we have.

If this is the best we and the other countries can do God help us all

What I really think is happening is money is losing all real meaning and becoming something abstract and arbitrary. When the time comes, they will simply declare all debts and all currency invalid and null and void and replace it by some sort of computerized credits system that they can finely control. We seem to be well on our way to that even now.

Yes, and when that day arrives those like us who read and comment on sites like this will all of a sudden find themselves on the outside looking in. Our digital accounts will go to zero and we won’t be able to pay the rent, travel or eat. Best thing is to understand what’s at stake and work really hard to see that this dystopian nightmare doesn’t come to pass.

i look at numbers and realize that they are only numbers that other people accept, or don’t accept, with gradations between.

either they reflect reality, something between, or fantasy. or, there is no “price.”

if the debt issuer is the only one buying the debt with the proceeds of the debt, then, ah, never mind.

that being said, i’m optimistic.

You cant stop draggi and co They are mobsters and they rule. Untill they crash or get replaced. Even Germany can not Stop the Mafiosi at the ECB only slow him down.

Brussels and the ECB have to much power and no accountability. It is to hard for the people to remove Draggi, Junker, and co, this is a flaw that must be resolved. It has lead us among other disasters, to Brexit.

What you can and should do is ensure that you can and do survive the negative events when they occur.

The war on cash and the grossly manipulated unrealistic price of gold along with the states ability to take land tell you what not to have to much or nearly any off.

Which leaves silver, other usable semi precious metals and other stores of Hard Wealth.

I think it’s the Supplementary budgets or Emergency ones that get tacked on every year, to fund the war efforts that didn’t get covered under the current Pentagon budget. I recall it starting soon after the Iraq invasion… where $200-300 billion was tacked on. By some govt accounting conventions, such a budget is not counted as official outlays, since it’s supposed to be a one-off. But like corporate accounting with all the ‘one-off’ huge expenses that keep recurring, the supplementary budgets have become a way of life to add on significant govt spending – without officially acknowledging it.

The depression began in 2008! No end in site!

2009, i think. took a minute.

there are a lot of people in this country to whom $100 is a lot of money to be in “surplus” at one time.

let’s say you make 600 a week. after taxes etc, gas food lodging and a couple of essentials, if you have much left over, it ain’t $100.

let’s say it is. save 5200 a year for what? let’s say there is a what. can you count on that what for ten years? maybe 1/4 can.

but then we get back to it ain’t $100.

I asked my 2 senators about the difference between deficits abd debt.

It took 6 months and several follow ups, but a clerk when I was finnaly called by one senators office told me that the difference is “investments”.

When I asked if that was like Solyndra I was told yes.

The government is on the modified bullshit method of accounting. The GAO says in its annual 29 page internal control deficiency letter addressed to the President, speaker of the House and Senate majority letter, that the books of the US are unauditable.

Ya have to read it to believe its that bad and that letter has been written for at least 15 years.

This Wolfster gathers together a few fundamental numbers that add up to the emperors new clothes. Not a pretty sight. Then Hal passes along this nugget: oh by the way, our government “investments” are “unauditable.” As I adjust my tinfoil hat, I wonder: do these two points of reference explain the mystery of the ever rising financial markets, with always a game save at the last cliff hanging moment like, well, this Friday. Does this mean our elites financial economy is just one big hide the sausage party with huge sums going around, like offshore to prop up Japan and what used to be Europe with more bank and market supports? Hank Paulsen are you still down there, good god, man?

What if there is no there there, friends of W Street? What happens when the 555 quadrillion bazillion derivatives snowplow Herr Deutsche bought doesn’t happen to start this winter and the street ices up?

I have wondered for years if virtually everything in the ever expanding financial markets, and tethered to nothing, has not been simply a Punch and Judy show for the mainstream media viewer. The puppeteers hide up in the Obama treasury department (strings courtesy of Congress) and have done so since 2009 (at least). Which would explain a great deal about our very weird and disconnected federal government, especially Congress. At some level where no one talks about pay grade, I believe there is a room full of very queasy, utterly corrupt nitwits who now see the lowinfos out there with a real Punch for Judy presidential race. What these smarter than everyone else boys didn’t figure on though, when they went long on bulls**t, was just what happens when suddenly it goes way short. Like, now. Keep drinking.

thank you for your comment, now i get it.

we are investing for the future, which is one damn thing after another.

Different cash amounts can explain some of the changes you see in deficits vs. total debt. However, that doesn’t explain the constant gap we see year after year. I think what can explain the gap in debts versus deficits are government lending facilities. Off the top of my head, these loans include the FHA, students, DOE, SBA, agriculture, and energy.

Lending money is not spending money, and as long as the government gets its money back it shouldn’t be a problem. Of course, we all know the government won’t be getting back all of its money borrowed to help fund the education bubble, but that is another matter for another day. Solyndra is another example of this lending, but that 535 million dollar crony loan didn’t work out too well. That turned out to be spending and not lending in the end…oops. Overall, though, so far the government has benefited from giving out these loans and so have the borrowers.

Giving loans to college students and issuing FHA loans are the two elephants in the room when it comes to government lending programs. Total government-backed home loan issuance is about 1.7 trillion dollars. Student loans are about another 1.3 trillion dollars. There is about 600 billion in total loans outstanding for the Small Business Administration. This explains the 3.6 trillion in the debt vs. deficits. Add in all of our other lending programs and I could see how it explains the 4 trillion dollar gap. I hope this helps, but I would recommend researching this further and writing a follow-up article on it :)

Those loans are and asset ?? and the loan amount is an expenditure. The way the American system work’s. (I dont view a loan as an asset. I view them as a potentially recoverable bad debt’s. And express them as such).

They should,both be on teh books as such Somewhere wolf has an issue that the 4t is not on book’s (That he can see) first thing to check is where do those loan’s and the expenditure’s show in the federal accounting system??

agreed.

“we” fund these investments, and then banks fund them with deposits.

a virtuous circle, so long as virtue holds out.

Is US now in negative equity with this 19 T debt? I mean if this is the case then all folks including the unborn are broke already. Sorry if that seemed a stupid question. Great article Wolf.

Chaplin is the man

I wonder about that too The Federal debt is $20 trillion Accrual base is $200 trillion. What is the debt to net worth of this country?

In a business if your debt is 2 times your net worth that’s a sign the company’s getting top heavy in debt. Four to one is very dangerous. The company is essentially insolvent. Liquidation of assets usually garners 50 cents on the dollar, leaving virtually all creditors unpaid. Bankruptcy, foreclosure and liquidation ensues. Some say that happened twice in the history of America and USA LLC is basically a debtor in possession even at this time, still accruing debt payable to its owners and another foreclosure looms.

What is the true value of the US?

The supposed gold holdings of 8,000 tons are only valued at $42 an ounce. Ridiculous accounting!!

If an asset is valued at cost and yet its true value is many times due to its intrinsic value then basic accounting fails to make a case of real worth.

Goodwill can be calculated yet if we have any left in this country it’s probably dropped dramatically. The natural resources are vast but not generally shown at more than $1 on the Fed balance sheet.

Supposedly the only assets owned by the Federal government are the confines of of Washington D.C. The Fed Gov ‘owns’ or ‘controls’ huge sections of land in the states and foreign territories but what is the value of those holdings on the Fed Balance sheet?

If the US was a business it’s accounting system is a fraud perpetrated by fraudsters.

If the true net worth of USA LLC, included their supposed land, buildings and other holdings shown at real market value, then the net worth of the USA LLC would be almost beyond accurate tally. It would probably dwarf the debt. But the debt increases at an exponential rate and cannot be paid by more printing.

The only way to repay the debt is by foreclosing on USA LLC, selling off the assets to liquidate the debt, like the Greek government sells its state controlled companies and national monuments to relay the ECB and its crony banks.

This is a frequent means of repayment when a central bank, regular bank, country or corporation wants repayment of a debt owed by a bankrupt country. Most smaller countries, PIIGS, emerging market countries and the like have falling into great debt via the predations noted in the book Confessions of an Economic Hit Man. Their debts are being called and countries like Greece and Cyprus have felt the lash of the collector’s whip.

My concern is what happens when we get the margin call and foreclosure levied against the USA LLC by its creditors. We’ll find out whether our assets are sufficient to pay the due bills. It seems that the budget crises coming up nearly every year tells me we are close to the tipping point of being able to pay our bills. The entities that buy the debt are growing fewer as the dollar begins to lose its preeminence as the world reserve currency.

On another note, if cash is essentially banned we will become little more than wetware in the vast DIGIFIAT MATRIX HIVE. Cash, gold and silver are the touchstone to reality in a debt ridden world where counterparty risk is always close at hand.

” Cash, gold and silver are the touchstone to reality in a debt ridden world where counterparty risk is always close at hand.”

===========

Exactly right and well said.

When far-too-dangersously-political “fiat money” INEVITABLY proves its fundamental toxicity to a society, NON-political (i.e. governments can NEVER, under absolutely ANY circumstance, create out of thin air) gold, silver and more-political-but-precious-metal-backed paper currencies will be the one and only “sound money” that painfully-educated citizens will have confidence in.

you make the case that our assets are far far greater than our debts.

i’m optimistic.

Interesting topic, my guess would be that some kind of (deliberate) ‘funny accounting’ is causing the difference.

Maybe others know if this gap only occurs in the US budget, or also in the budgets of other Western nations? That could provide some pointers for what is really causing it.

It strikes me as coincidental that the Fed’s balance sheet has risen by about that amount. Perhaps that is where you start to look.

I have watched with interest the rise of the economy post 2009 low following the financial crisis. Isn’t it funny how we are told the Great Recession ended in 2010? That the economy was growing again after so many millions lost homes (I was one of them) and most of those who managed to hang on to their houses still lost most or all of their equity and then some. Yet we are told that the inexorable rise in the equity markets from a low of 6900 to now well over 18,000 is legitimate profit ‘invested” in stocks.

That 265% increase in the stock market is not just a feel good indicator, it takes real $$$ to move the market a point higher, in this case the market capitalizations at 6900 back at the post crash low was about 15 trillion dollars. It is hard to say what the market cap is now because of NYSE and Euro bourse mergers, and the buy backs that have taken a lot of companies off the exchanges, the market cap is not actually published anymore as it once was. But, the market cap is at least 38-40 trillion now and could be as high as 48 trillion.

That is a lot of money to flow into just one financial sector, remember money has also flowed into bonds, so much that it dwarfs equities. It has flowed into government spending, into consumer debt, into corporate debt, and the amounts to keep the banking system solvent are too ghastly to imagine.

All this money has not come from the profits of all the growth post collapse. I can tell you that I have lost a significant amount of my purchasing power since 2009, about half in fact, mostly since 2013 in the form of unreported inflation. I am a 100% disabled vet who gets compensated monthly so I watch expenses like a hawk, I have to because I have not had a decent raise since 2008. The Great recession ended in 2010 for the wealthy investor class certainly, the top 10% have done very well and the top 1% have made more than at any point in human history. The rest of us not so much.

As an aside to the missing funds, I do hate to become entangled in partisan political debate with the right since it is clear to me they do not understand what is being debated or even why they hold the positions they do, it is like arguing with a religious person about god, you are never going to win because they are never going to be rational.

But, I would like to respond to the claim entitlements are the cause of all our problems, particularly the comments above about SNAP. Food stamps help feed 52 million people who would otherwise go hungry, and I agree that people SHOULD be able to feed themselves, the fact that they cannot is a testament to the damage done to our economy by a rigged tax code that essentially allows the wealthiest not to pay a fair share, that is in essence welfare for the rich.

For, four years in a row now the wealthiest 10 individuals in America made more untaxed money off their financial “investments” alone than the entire SNAP program costs. Twice in the last year Jeff Bezos alone made more than 8 billion in a single trading day off his Amazon shares.

So, I do not want to hear any crap about entitlements which all are spent back into the economy and thus act as stimulus while feeding kids. When the right can come up with how the top 1% are aiding the nation and Americans by absorbing 98% of all new wealth, and by founding dynastic wealth the tax authorities can never claw back into the economy then we can talk. But their claim that these billionaire parasites are somehow creating wealth and jobs it so totally specious it is beyond words.

Herk,

Not all Republicans are conservatives. I was a moderate Democrat pushed out of the party by Clinton’s extreme liberal politics. I am now a moderate Republican. I have always supported a single payer medicare for all system. I am also pro-choice in the first trimester and support “entitlement” spending. I consider entitlements an investment in the people. Notice that I hold positions in the middle of the political spectrum. That’s where the votes come from.

You are right about the parasites, but wrong that they are all Republicans. Wall Street is full of entitled Democrats, so is the media. Both parties are squeezing us to keep us unfocused and dependent. Whether it is war, mortgage interest deductions, social security, or gay issues, if we keep voting for them, we all lose. Vote them all out, vote third party, ignore them, and scare the hell out of them. Take back your government.

I became an independent many years ago. I could see it coming.

I live about halfway between Charlotte and Atlanta. I use the Chapwood Index as a true indicator of inflation. I think that it comes close to correctly modeling the price increases I experience in my area.

http://www.chapwoodindex.com/

All good points and opinions. The closest truth is since 1913 with the then Congress illegally giving away control of US money ( Federal Reserve Act ). Trillions have filled Rothschild’s Khazarian Mafia vaults. Parasites have been in a feeding frenzy!

Yes, I noticed that Israel is experiencing a renaissance in infrastructure, business, and tech, while everything around it is being vaporized. I keep wondering who’s paying for all that, and they have universal healthcare too, and gun rights.

And horrible taxes, and child poverty issues, and housing shortages, and small disposable incomes.

They also still just have a sense of nationalism as there is still the, WE CANT GO ANYWHERE ELSE AND ALL THE NEIGHBORS WANT TO KILL US. So we have to make it here.

Jews have been growing their economy’s with nothing for over 2000 years and having the fruits repeatedly stolen from them.

They have become rather good at it.

among other things they buy a lot less “Unneeded stuff” and many gifts are still personally made.

You and me Petunia (US taxpayers)

If there is in fact a US deep state as well as a US government, the deep state would want its own budget.

i am gonna say something, against the grain here. what does it really matter. i realize everyone wants to know and have a say, but the debt owed are already so significant, does it really matter?? tax payers can’t give blood after they are turned to stone. whats another 4 trillion?no one will ever pay back what they owe. i say they give everyone a license to issue bonds, sell them to the government at zero interest to replace debts and mortgages clean every one off everyone debt free, including every company large and small. i mean isnt that what companies are doing now? expecting bailouts. or they are building their reserves and have cash available when things do slow down to stay in business. when it happens u can have all the inflation you can ask for, and increase interest rates to as high as you like. but the good news is people then can afford to pay what they need to pay. buy more crap if need be. world economy starts spinning again and growth can once again continue. the rich can stay rich and people can live out their lives not eating cat food. the way i look at it, the other way will end in a bad way. no growth means the rich will lose their wealth and they dont want that either. i was reading something and it looks like they are already losing money on all the art and cars they bought. the expensive mansions are getting a little more affordable. now i hate to see anyone lose their shirts even the rich folk. do you really want all the investments bankers asking you how you like your coffee?? not a good situation. keep them rich keep me out of the unemployment line and we are good.

Great idea! We like it even better than the ‘Basic Income’ approach. We’ve used Publisher to create our first $3 trillion perpetual, NIRP bonds. Where do we turn them in to get new, crisp 100 dollar Federal Reserve Notes? And, if it’s not asking too much, can we have them on pallets just like we did for Iran?

and zero to show for it,borrow trillions year in year for what!snap,ebt,war,moar,moar ever increasing gov’t and waste

If the market continues to accept that the Fed and other Central banks can print money out of thin air and and buy such large amounts of government debt that they have moved to purchase corporate debt and ETF’s ,does government debt have any meaning..And if debt has no true meaning,then it follows that deficits and taxes do not matter either.

Try not paying the demanded taxes and you will see how much they matter.

Today, the only difference between and extortionist and the state.

Is that the extortionist, is a lot more honest and open, about their activity’s, than the state.

Irwin Schiff sure found out the hard way “d”

Yes, and from there it’s only one short step to ‘I better get to the store before you or anyone else’, and from then on it’s Zimbabwe style Hyperinflation!

It would be hard to fathom the US government doesn’t know where the money is going in this digital age of tracking everything. Obviously it is being hidden, similar to other hiding games where nobody has seen or audited the total US gold reserves since the 1950’s.

maybe that this is why they want to go cashless.

all i was trying to say is that when all is said and done unless we all pay off our debts the economy is going no where. we will be joining japan. im canadian and we are in the thick as much as anyone. things are slowing, debt is high and unsustainable. by the sounds of it getting worse. what do we do? cant save, cant spend. put all your money in the stock market and pray that rates stay low or go lower and let the market reach new highs? options anyone??? raise rates?? lower rates? QE 2016? anyone?

Dave,

If it’s any consolation, I agree with you about the debt. I think they knew back in 2008 that none of the debt, new or old, could ever be paid back. I expect it won’t be. Cheney’s comment about debt limits not mattering was a clue as well. Congress has never voted down a debt limit and I bet they won’t ever do it either. The debt limit is just a ploy to make it look like they are capable of exercising any kind of restraint. Just enjoy the show.

it is. im sure there has been knowledge of all this for years. im not the smartest person but i have been talking about some of these things for over a decade. interest rates and japans issues of lack there of. but for me in my blue collar situation i recognize my place and the only thing for me to do is invest fairly aggressively so i can retire and not have to work till im 70. so thats why how i found wolfstreet. lots of research and homework. looking to invest by the economics. so far so good. making the best decisions i can.

Lots of data here….but consider the source!

https://www.fiscal.treasury.gov/fsreports/rpt/mthTreasStmt/backissues.htm

How much of ‘underground’ infrastructure is accounted for in official spending reports ? Perhaps bunkers and the like is where it’s going.

Usually all of the secret spending is accounted for in the official budget. They just don’t say how the money is being spent. As long as the spending is legal, it is in the budget, usually called the black budget.

I understand that, in addition to keeping cash, the government also makes loans which are not considered as spending because much of what is loaned is expected to be paid back?

See my comment above on student loans. The government’s total financial assets (which includes the loans the government makes) are about $2.2 trillion, 45% of which are student loans, now about $1 trillion. Since 2003 – the time frame of the $4 trillion that is not accounted for – student loans have risen by $900 billion. The rest of the financial assets haven’t gone up all that much. So this doesn’t explain the $4 trillion.

Cash levels are relatively small compared to the size of the government, and they go up and down.

Wolf

To loan to a student is very imprudent

A loan on an auto is a debt obligato

To loan to a government makes for a troublement

Later, I was thinking, like Petunia said, that Black Budgets are still accounted for somewhere, (but the Shadow CIA’s drug profits don’t show up in those Black Budgets !, they are completely off the books ?)

The Treasury issues Bonds, but what is bought with bonds and not with government cash?

I’m now thinking it would be the ‘troubled assets’ from banks etc during the aftermath of the 2008 financial crisis, in which The Fed bought back the fraudulent mortgages the Mafia sliced and diced and put into those $100 million ‘triple A rated packages’ and sold world-wide, and which Russia, China, Germany, etc bought and were hopping mad when they found out they were packed (maybe up to 30%) with ‘fake paper’ ! and demanded their money back, and this is why The Fed gave Freddie Mac and Fannie Mae a $5 Trillion line of credit to repurchase back the ‘fake paper’ and save US ‘face’ and the financial system. This ‘fake paper’ also led to the Foreclosure crisis in which banks were caught trying to foreclose without being able to prove they actually had a genuine mortgage on the property.

[see; Catherine Austin Fitts 9 part article (which isn’t saved on this computer) for the details of why Andrew Cuomo owes us $3 Trillion, and ‘Where did all the money go’. She gives an excellent analysis of the mortgage crisis and how it happened.]

Toyota fleet sells to Isis didn’t net out enough petrol dollars!