Inventory glut, lousy consumer demand, the global economy…

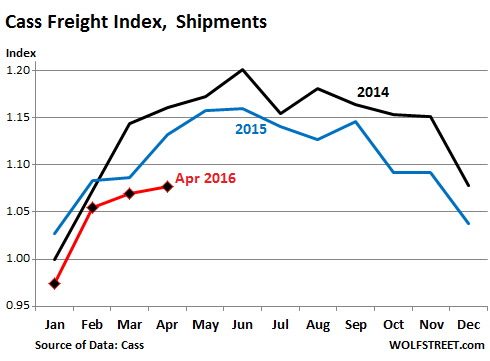

Freight shipments by truck and rail in the US fell 4.9% in April from the beaten-down levels of April 2015, according to the Cass Transportation Index, released on Friday. It was the worst April since 2010, which followed the worst March since 2010. In fact, shipment volume over the four months this year was the worst since 2010.

This is no longer statistical “noise” that can easily be brushed off.

The Cass Freight Index is based on “more than $26 billion” in annual freight transactions by “hundreds of large shippers,” regardless of mode of transportation, including by truck and rail. It does not cover bulk commodities, such as oil and coal and thus is not impacted by the collapsing oil and coal shipments. The index is focused on consumer packaged goods, food, automotive, chemical, OEM, heavy equipment, and retail.

In a similar vein, the Association of American Railroads reported last week that loads of containers and trailers fell 7.5% in April year-over-year. “Intermodal” is a direct competitor to trucking. Combined, they’re a measure of the goods-based economy.

The Cass Freight Index is not seasonally adjusted. Hence the strong seasonal patterns in the chart. Note the beaten-down first four months of 2016 (red line):

And May is not going to look much better. The report:

May is usually a relatively strong month for freight shipments, but given the high inventories with ever slower turnover rates and the decline in new production orders, May could be another soft month.

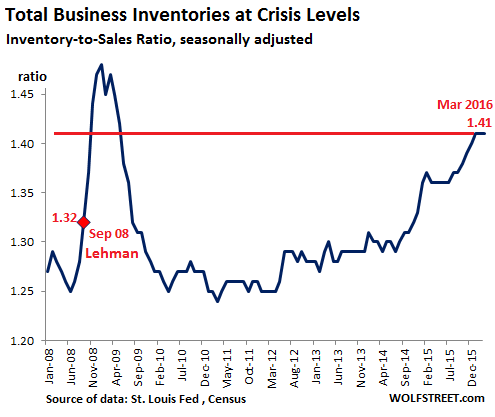

These inventories are a doozie. Total business inventories have ballooned since late 2014, even as business sales have declined. On Friday, the Commerce Department reported the March installment of that story: total business sales (adjusted for seasonal and trading-day differences but not for price changes) fell once again, this time by 1.7% from a year ago; and business inventories rose by 1.5% from a year ago.

As a result, the crucial inventory-to-sales ratio, which tracks how long unsold inventories sit around and gather dust, has blown out to the same crisis level it had spiked to following the Lehman bankruptcy:

With sales down and inventories very high, businesses are trimming their orders to bring inventories back in line, and this is impacting the transportation industry.

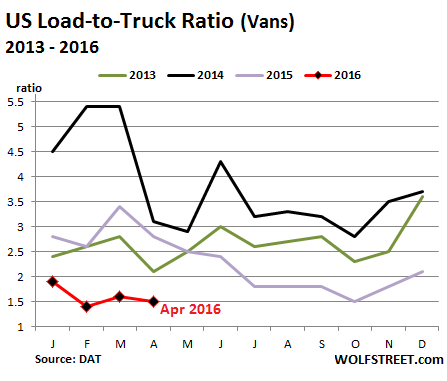

Due to falling volume and “very soft rates,” as the report puts it, shippers have spent 8.3% less in April than a year ago, the lowest April spend since 2011. “With ample capacity available across the modes, competition for loads is holding rates down,” the report explains.

Transportation data provider DAT looks at this from the truckers’ point of view. It tracks national spot-market demand for trucks and availability of trucks via its load-to-truck ratio – “a sensitive real-time indicator” of the balance between the two. And the spot market for the largest category, van-type trailers has become ugly: Last month, the load-to-truck ratio for vans plunged 46% from April 2015, and 52% from April 2014. It has been terrible all year (red line):

Cass notes that the economy “decelerated in the first four months of 2016.” And this “slowdown,” the report said, was caused by:

- the continued decline of the global economy;

- the reticence of the consumer sector to increase its buying;

- the loss of jobs and income from the plunging oil costs (which shut down the fracking business and cut back on coal shipments);

- very high inventory levels across the entire supply chain;

- and poor export figures due to both the strength of the U.S. dollar and a decline in worldwide demand.

Which aptly summarizes much of what troubles the US economy. And the current data doesn’t leave much room for any excess optimism:

Eyes are on the Chinese economy, which has been extremely unstable and can have a big effect on world economies if it continues to falter. Based on the trends of many economic indicators, it appears the economy may get worse before it gets better.

This type of transportation data shines some light on the goods-based economy in the US, and by extension, in the world: the goods-based economy is hurting – and there are no signs it’s getting any better anytime soon.

The downturn’s impact on railroads has become very visible beyond their income statements: the majestic sight of 292 Union Pacific engines idled in Arizona Desert! Read… Freight Rail Traffic Plunges: Haunting Pictures of Transportation Recession

Special note: We would love to hear from truckers and employees or owners of trucking companies, and from railroad employees, to get some first-hand observations on what is going on. We suspect that business is uneven, that some pockets are doing well while others are hurting. Please use the comment section below to share your observations. Thanks!

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

I found this article on http://dailyjobcuts.com/ regarding layoffs at a Vertex rail car manufacturer who make sand hopper cars for the oil industry. You have probably read this, but I thought it may interest you just in case you missed it.

http://www.starnewsonline.com/article/20160513/NEWS/160519817

I haven’t got the data at hand right now, but I seem to recall fracking brought with it an explosion, not merely a boom, in sand hopper manufacturing. No sand, and fracking becomes a whole lot more difficult and expensive.

However the most recent technical advances are reducing the quantity of sand needed per barrel of oil, very much like multi-pad and other drilling advances decimated rig count without affecting production that much.

It seems quite a few of those fracking outfits didn’t merely use the money raised courtesy of financial repression to increase production, but to make it a whole lot more efficient as well. Another confirmation of the ancient saying “all technology is inherently deflationary”… in short the opposite of our central planners’ wishes.

I suspect railway companies will be sitting on a whole lot more rolling stock as fracking becomes more and more efficient, except perhaps for oil cars which are often used to stockpile production (like VLCC’s) in hope to artificially repress supply without cutting production, a mid-term financial impossibility. The cost of loaning oil cars and VLCC’s alone will make sure of that.

Wolf, thank you for your blog. I read it everyday! I enjoy the articles and that you stick to the data and facts and don’t try to predict the future.

Regards.

A few months ago I was arranging a move out of Florida and dealt with more than a few commercial movers. The spread of the estimates was 250% from the lowest to the highest. The mover we used was able to move us within one week of giving us the lowest estimate. After a full day of loading a truck, they followed us to our new place. If not for the fact that they are not allowed to drive more than a certain number of hours, they might have beaten us to the new place. They showed up the day after we arrived. It was obvious they needed the business and especially the final payment.

I commented to the driver that I hadn’t expected them that soon. He told me the company made him leave the same night after loading up the truck.

The cost of living in Florida is low and you can’t beat the lack of state taxes. Isn’t the local economy taking off due to the real estate booming ?

Why are you moving? And to what paradise are you heading?

I left Florida because our big corporate landlord priced us out of the market when they jacked up the rent 6%. We were already paying too much. We are still in the south and I don’t miss Florida one bit.

Just out of curiosity, I checked the rental listing for our old Florida rental. They had decreased the rent to $5 below what we were originally paying. I guess I was right when I thought Florida rentals had peaked.

The job market, in Florida, doesn’t support the rental rates and increases, unless you double or triple up.

If you live in FLorida (as I do) you can not get a job with any National chain (7-11, Hertz, Home Depot, etc) unless you speak Spanish.

They will hire the person who speaks great Spanish (but lousy English) overr one who only speaks English.

When I go into my local Target, Wal-Mart, Sears, etc. I have to actually look and FIND somebody who speaks English. Once, in Wal-Mart, I spoke to 3 “stockers” and had to ask them “Do you speak English”. One of them had no idea what I was saying. The other two responded in broken English. I kept searching.

So let’s face it- the recession is here. Normally like in say the 60’s- so what, but NOW? After the largest stimulus in history, which just ended as far as bond purchases go and is still in effect with ZIRP.

I don’t have a lot to say personally – I live in Canada and receive two pensions that won’t go bust in my life time. It is also a very law abiding place. Where I live personal safety is barely an issue- apart from the self inflicted kind via autos.

All I will add is that as far as I can judge, June is off the table ( Fed increase) and unless there is some miracle so is the rest of the year.

As to what is on the table- who knows?

I will just repeat something I said on WS about six months ago and which seems to have echoed- you don’t need or want helicopters for helicopter money- you just deposit it in bank accounts.

What about people who don’t have bank accounts?

I don’t know- maybe they’ll get more ‘spare change’.

Nick, don’t forget the service sector. It’s big in the US. It’s still doing so-so, but hasn’t fallen into a recession. Health care – with price increases and all – is doing well.

But the goods-based sector is heading south, it seems. If the goods sector is shrinking enough and the service sector shows very little or zero growth, than the overall economy is shrinking. So this is what we’re going to watch.

I guess I see the goods sector, the production of which is measured by freight, as more the bedrock of the economy which supports the service sector.

It’s worse than that, it’s a stagnation Jim!

Recessions tend to be sudden, brutal affairs where much (financial) blood is spilled but they are inevitably short-lived. Look at the business inventory chart above, especially at the 2008-2009 period. That’s how a recession looks like.

The following data on the same chart tells the reality: “extraordinary” monetary and fiscal policies worldwide bought us a massive two years of respite before stagnation started setting in.

Stagnations are insidious: there are no big order cancellations, no front line bankruptcies, no devastating defaults. They build up slowly and then explode, like it happened in 2014 when, in my personal experience, the present stagnation set in.

It’s a variation of how Hemingway described bankruptcy in The Sun Also Rises.

Differently from recessions/depressions (see Harry Truman’s definition of), stagnations can drag on and on for years. We are already in the second year and with no end in sight.

Now, ending a stagnation always requires a big shock, and not of the pleasant kind. Paul Volcker ended the 70’s stagnation by massively hiking rates in 1981. It brought on a recession, but like all recessions it was over soon. Continuing on the present course of fiscal deficits and monetary easing is the wrong course of action: sending rates into negative right now it’s not a shock. It’s expected if not demanded.

Phoning in interest rate hikes and then reneging on them, like the Fed is doing, is appeasement, not a shock.

You know what the shock I am talking about is: hike rates overnight by 400 or 500bps with little or no warning. Yes, it will be a bloodbath because debt levels worldwide are exponentially higher than they were in 1981 but there’s no other cure. Bankruptcy lawyers and debt restructuring experts would make a killing.

Bad? You can bet on it. But the alternative is far worse.

By destroying the mechanism of price discovery day after day we are stepping in a minefield that makes the 38th Parallel looks like a kindergarden playground. The Soviet Union, with all its secret polices, firing squads, labor camps and nuclear weapons, was pulled apart precisely by refusing the principle of price discovery. Khrushchev bought the USSR a couple extra decades by aping the mechanism but setting prices by committee and by copying what Western Germany and Japan were doing was no substitute for price discovery.

For the past four years I have been following the exploits of a long haul trucker who drives a refrigerated van.

This past Spring has ushered in much tougher times.

Loads used to be plentiful with single point destinations that were pin-to-pin – dropping a fully loaded van and picking up a fully loaded van for a very quick turn around. Not much dead heading with an empty unit to a loading point. Your load log could be booked 3 to 4 days in advance.

Now its not unheard of to dead head hundreds of miles for your next load. Which is quickly turning out to be a partial load. Most of these loads now are made up of three and sometimes four pick up points. Being delivered to just as many locations in most cases. Load logs are now running on empty. Drivers sit around truck stops playing the waiting game for a load from their dispatch. Sometimes for days.

OutLookingIn

Any chance you could share the name of this blog? I’m in the refrigerated trucking market and would be curious to read that blog. I am seeing more and more of this on my end and the ease and cost of brokering loads out took a fall for us late summer/early fall 2014 with a real nose dive after the holiday season. People are coming up out of the wood work looking for shipments these days.

Wolf,

Keep up the great work as always, yourself and Mish are my two favorite economics and finance bloggers and I read you guys every day! Happy Sunday!

Ty from GR

Its a you tube channel – Allie Knight

Along with many other “trucking” channels covering;

Flat bed, heavy haul, dry/bulk van, tankers, hoppers. etc.

Most are beginning to feel the “pinch” starting to really hurt.

Good luck.

Wolf,

Thank u for ur team web man. I ve been reading it on a daily basis for the last month. I think what u r doing is damn important so we understand that politics shapes missallocation of capital deeply & strongly. Regular joe cant afford the time and energy just to gather the data for the required analysis. So thanks again. Please Keep up the howling.

re: Goods decline

I am 60, retired, and smack dab in the middle of the boomer designation. We have had years of almost 0% interest rates, so low even 3% mortgages seem to be high. This demographic group is aging, and already have their ‘stuff’. My wife and I just don’t buy much, anymore.

With this demographic shift taking place after years of easy credit, isn’t it inevitable that purchasing will begin a drop off? Add in to this people having less money to play with, how on earth is more transport needed?

It seems to be a natural and inevitable decline.

Japan! Millennials have plenty of wants and needs and there are many of them. Because they can’t be paid they must be extended credit. There is probably no limit to how far the Fed can go with credit. This is the repeating pattern year after year after year. Why are people so certain that it must end?

This is exactly what is driving governments to ease immigration policy and move to a more “open door” direction.

The governmental bureaucrats and think tankers that advise politicians, know that there is a looming demographic bomb slowly exploding and that to maintain present tax loads, the population must not only maintain but to increase in size.

Except with a sick economy not only nationally but globally, there are not enough jobs to go around. The immigration open door policy has been around for years. Starting with the 1956 Hungarian influx from their failed revolution, to the so-called “boat people” of the early-mid seventies from the US failed Vietnam conflict.

The latest influx of conflict refugees from the mid-east, will prove to be a total game changer in the long run.

Cultures are not interchangeable.

Here in western Montana 500 tank cars are setting on the siding south of Whitehall

also hundreds of container cars are sitting on a line north of Helena

I hear stories of thousands of cars sitting on rail lines across Montana

What do you think

While speaking with someone I know, they mentioned that the Port of New Orleans is finishing up a major renovation. The renovation was done to coincide with the expansion of the Panama Canal which will now accommodate the largest ships. The expanded canal is due to open in the next few weeks.

The New Orleans port was also upgraded to accommodate the bigger ships. They connected the port to rail lines to transport the containers directly from ship to rail. The expectation seems to be that they will now be able to undercut the west coast ports and the railroads that support it.

Petunia,

This is interesting indeed, I read a pretty interesting book on the history and effects of container shipping “The Box” by Marc Levinson. One of the natural conclusions in the book and from being on the ground in the industry is that the west coast ports will become less and less needed until they fix their union/worker problems. The insanely high relative to skill pay isn’t necessarily the issue but more so the delays caused by the strikes.

No one in their right mind would put anything that could be time sensitive through those ports as they could close for months without any warning. That being said, I wouldn’t mind one of those positions haha.

It should be easy for New Orleans to compete with CA because the labor in CA is so expensive due to the cost of living. NOLA is not cheap but it is more affordable than CA.

I’ve read about Mexico building a huge port on their Pacific Coast and tying it in with the Trans America highway.

Containers come off the China Trade, loaded onto Mexican freight haulers and driven right into America for drop-off.

Think of this. Products made in China at “The China Price”, shipped on Liberian registered ships, and unloaded by non-Union Mexican long-shoremen and then hauled away in “Mexican” registered (and maintained ancient trucks, burning cheap subsidized Mexican Diesel) border-free, tariff-free, inspection-free, right to you local Wal-Mart…………..unloaded at Wal-Mart by legalized undocumented recent immigrant “Americans” and sold to you by a cashier who can’t speak English.

I’ll be able to by a VIZEO 4K, 3-D, 75 inch, flat screen for $395!!! My neighbor will really be envious since he won’t be able to afford one. He won’t have a job.

Come to think of it, neither will I.

We most certainly are living in ‘interesting times’.

Within the western world the demographics are wreaking havoc.

I’m part of the ‘boomers’. I have little to spend money on at this point other than living expenses. The subsequent generations do not appear to have the same purchasing power as my generation.

I lost my income and house in 2009. I don’t really feel like buying another one now that I have income again as prices are so high and I’ll never pay it off in my lifetime. Plus…I’m a little uneasy with the whole climate change thing as I live in a drought situation.

The ‘influx’ of immigration is not bringing any help (generally unskilled labor with even less purchasing power)

Technology (robots, new materials/less production steps, etc.) will exacerbate the above issues.

All of the above points to ongoing stagflation (except for regional spots).

My husband has had four jobs and we have lived in four houses since 2008. We wouldn’t buy again even if we could afford it. Mobility is the only asset we have now.

Smart move petunia and when the market collapses house prices will tank again worse than in 2009

It is an interesting thing we have morphed into.

You have to have mobility because of work. I worked in the silicon valley for many years. The typical person worked and lived in the same place for up to 5 years.

The history of war shows that as time has gone on, mobility has replaced ‘stand your ground’ fortress/city states. Indeed, even the Maginot Line reinforced this concept.

Yes…mobility would appear to be the asset to have at this time.

When Nations have no borders, it means there are no more Nations.

That means we are all Gypsies and migrants.

The Multi-National companies love that since we will all “owe our souls to the company store”. A docile, sick, uneducated, hungry people are easy to rule.

Saylor you shouldnt buy again İ agree with you im a boomer and sold my house and expatiated in 2014 and have never been happier Low taxes low cost of living and much less stressful life which is very welcome at this pğint in my life. İ am in the process of buying land for a small bnb and organic farm for most of my food İm on the Med coast in western turkey

AND, Saylor, the new immigrants have absolutely no obligation, in their hearts and minds, to fund your Social Security. Just “who are you”? Why do they owe you anything? You are not of their culture, their community, their past.

When they are the “majority” (in about 20 years) their representatives in Congress will keep their jobs by reducing your “benefits”, which by the way, are NOT guaranteed by the Social Security Act.

I might add I do have one ‘thing’ I’d like to spend money on….a sailboat!

My sort of ‘mobility’.

I too am a retired boomer with a comfortable lifestyle and adequate assets yet I don’t even spend what income I have. I bought a small handgun and a iPhone 6 last year but this year other than a new kitchen faucet and some pants I don’t need to buy anything, I could travel but most of the places I would still like to see are too dangerous for 60 something tourists. Egypt? No thank you. The Olympics in Brazil, I don’t think so. A Europe being overrun with African and Muslim migrants is not the Europe I want to visit. If I want to see vagrants and Third World hustlers there are more than enough of them in the U.S. No the world’s factories just aren’t making anything else I want other than a $300,000 plus cars and million dollar yachts I can’t afford. I don’t need software, video games or giant TVs. A real flight simulator with 3 axis motion might be a must have even if it cost $10,000 or holographic TV but until technology offers something really new I am satiated.

Hello, little by little we approach the moment of truth and without haste but without pause graphics and technical indicators coincide in the same reality.

‘WE ARE ONE STEP AWAY FROM CLIFF !!!

The NASDAQ goes first, and almost half inexorably breaking about his great crash.

Everything is ready, we need only one thing …

This will be the next ‘black swan’ for the world economy

My cousin is moving back to Alaska from PHX. He’s 67 and will be looking for a job. He was making good money hauling nitrogen for the fracking industry, then moved to hauling hydrogen after the oil crash, but is soon to be unemployed as that ends. He’s worried, as he should be, as AK is crashing and burning also. He says there are trucking jobs out there but they don’t pay anything, thus he’s going home. His elderly parents just bought a condo next to theirs for him and his wife, so he’ll be OK. He’s never been unemployed and is proud of that fact, but things are changing.

On another note, I live near La-La Land (Aspen). I discovered an internet swap for the local valley. It has 25,000 members and is going great guns. One can buy high-quality stuff for a mere pittance, I mean $100 for a nice high-end couch in excellent shape. A lot of it comes from hotels and houses in Aspen. Stuff is on there for mere minutes before selling.

This is the wave of the future or even the present, if you will. Swap meets where stuff is recycled over and over. Lots of baby stuff, also. People no longer can afford to buy anything new and the stigma of buying used has changed into bragging rights for finding bargains. There’s less need to ship things as what’s already in place gets circulated over and over. The real market around here is for someone with a small truck to help you move it.

I might add that my cousin’s first real job at 18 was trucking on the Haul Road (Dalton Hiway) out of FB. He then moved into the IT industry and when it crashed, went back to trucking.

He owns his own truck and is trying to sell it. He says his broker told him he has a gazillion just like it that he can’t sell. My cousin also got behind on his taxes and when settling with the IRS said the agent told him that every trucker out there is behind on his taxes. All anecdotal, I realize, but it’s one real-world story, and I suspect there are more like it.

Thanks for sharing!

We are inching closer to self driving trucks. I believe it will be a decade before they integrate in a big way. I know testing is going on with various companies. Information anybody? Might we eventually see a human revolt against all the automation?

There are correlations between the soft truck sales market & ag equipment sales. Neither appear to be doing well currently & no signs of a turn around that I have encountered. Problems are cropping up worldwide in agriculture & much of it seems tied to debt like everything else. Anybody know where to find stats regarding interstate bulk commodities shipping? (not export)

Florida-still rolling along on the financial front pretty well in the major metropolitan areas. Like Petunia mentioned, the rents have gone up consistently, many are struggling & being priced out of the market while simultaneously new multifamily is being built. Won’t end well. Residential sales are still good with a bit of softening in the condo market which looks to me like it’s starting to roll over & we have most likely have seen the top. I’ve been here all my life & have no intention of leaving. There’s a lot of beautiful places, they aren’t in the city & I don’t live in one. There is some industrial growth here (bio tech). Tourism, agriculture, & the service industry are the main economic drivers. There were 66 million visitors to Orlando last year & marketing is still working There is no shortage of government(debt) projects going on either.

My hobo buddies aren’t happy. With the rail traffic down, it’s putting a real crimp on their travel style :-)

Bigfoot, I’ve often wondered how many still ride the rails. Any thoughts on that?

I have no way of knowing so I’ll wager a WAG. There has been a general increase in rail security from what I understand, though I’m not privy to any first hand data. Containerized train freight is used more often than open cars these days & trains run faster. There is no way to get an accurate count & most estimates believe train hoppers are less than a thousand these days nationwide. There was an estimated half million riders around the great depression era & the trains were heavily utilized by migrant labor. There have been some loose knit organizations & gangs affiliated with rail riders. Train hopping seems to be slowly fading into oblivion but hasn’t completely died yet.

Maybe the Japanese watched too many old Hollywood hobo train hopping movies & said, “try to hop this hobo” after the maiden launch of their high speed rails.

Thanks. I’ve also heard that it’s very dangerous to ride these days because of the gangs.

IMO self driving anything on public roads (as distinct from mines, where the operator owns the property) is grossly hyped.

We hear Google is testing. So what?

Note we don’t hear much about the obvious customer: a bus company.

Doing the same route, where you could have beacons on the road?

Why not? because it’s too ‘what’s the hold-up?’

It can’t be bluffed. Why can’t you provide it NOW?

The vast majority of legal work in a typical non-corporate shop is real estate, divorce and MVA’s

You will know self-drivers have arrived when one can be in an accident and the occupant is automatically exonerated because, hey, he wasn’t driving.

I agree with you 100% regarding the hype. Just the liabilities alone make it a head scratcher for me. That’s why I think it will be at least a decade before it’s a real consideration.

I don’t have a link, but I had read about a company working on the bus market for this technology, so it’s in the works. I agree this is the obvious market via repetitive pre-planned routes. The themes I’ve read about regarding trucking mostly involved running tandem or more for cost reductions.

“They” would have to drag me away from the controls kicking & screaming. I’d rather have something built in the 60’s.

If you have a self driving car & you were discovered drunk in your vehicle, will you be charged with the new PUI law? (passenger under the influence)

I wonder what will happen when a large bug/bird smacks into one of the sensors. Or it ices over and then smacks into someone. Seems like a liability waiting to happen.

If rdeal world fundamentals applied to any markets these days

I wonder what will happen when a large trucker smacks one(hundred) of the sensors. Satellite, GPS, grid malfunctions ?

I, too, live in Florida. So, I am going to open a can of worms:

My area has Apartment rentals, 2 or 3 bedroom, 2 baths, with prices ranging from $450 a months to $1,100 a month. I am purposely leaving out fancy condo/rentals with boat docks, etc. These are just your normal apartments that families can live in without the golf course or fancy club house & Gym.

So, why are people COMPLAINING. You can get a 3 bedroom-2 Bath apartment, with appliances, all within normal quick drive time around the town/city and they say prices are too high? Explain.

Even with houses. My county lists many houses in the affordable range of $100,000 to $125,000 yet people complain about prices. For some reason they all want to live on the Gulf or gulf-access canal.

What is wrong with these affordable houses and apartments that people don’t grab them up??? Huh, anybody want to touch this 3rd rail?

Rents & the general cost of living expenses have been increasing at a pace much faster than incomes for a number of years. People are being squeezed financially from all angles. While a mortgage in the 100K to 125K range may be affordable to you, it’s not even remotely an option for many people, so they must rent.

There is also going to be deviations in various locations so situations will vary from city to city in every state as well as urban versus rural. I don’t live in the city. There are cities nearby me that have rents lower than the baseline averages. There a lot of those places that I wouldn’t consider living in if I was a renter & many of them are located in city centers.

Millions of jobs have gone away. Mandated health insurance is putting a squeeze on many. Wage disparity is at an all time high. Many have become or already are angry at a system that is so inherently corrupt. There will be a lot more complaining coming down the pike IMO.

AH, what exactly do you mean by:

“There a lot of those places that I wouldn’t consider living in if I was a renter”

These are affordable and these places have many residents who DO live there and don’t seem to have your attitude? I drive by them and see families, cars and people having a great time. Yards full of kids, maybe 2 or 5 to a family, playing. Why won’t you live there? These places are affordable and all I hear is how “expensive” housing is.

Housing in America is NOT expensive.

“Housing in America” doesn’t exit. Housing markets are local. Rural Oklahoma has one housing market, and San Francisco has quite another. And it goes by neighborhood. Want a 2-hour commute? Or live close to work? Do you work in a big urban center or in a small town?

How about the simple hypothesis that everyone by now is saturated with goods and as the double whammy of global birth rate and aging crisis intensifies, the demand will get even worse. This is not something that can be fixed with monetary policy madness.

I’m barely out of my twenties and there is nothing I want to buy outside of necessities. Besides I got no more space to store stuff in my house.

Buy a bigger house.

YOU WANT TO KNOW THE “KICKER” LOOK AT FLAT BED FREIGHT. ALL NEW MACHINERY , CONSTRUCTION MATERIALS, AND STEEL COILS, MOVES ON FLATBEDS.(that includes oilfield pipe and equipment, cellphone towers, ect).

I own a small fleet on on-the-road tractor trailers and we just pick up general dry freight from brokers and load boards. I can say my business did very well in 2013-2014. Since March of 2015 I felt the downturn in freight plus the price of diesel was dropping which caused even lower rates for truckloads. I’m glad we got through 2015 but 2016 is looking very slow and I’m sure it will stay like this until next year. When the economy was doing good, everyone and their mother bought a truck and put it to work which helped to cause this over capacity issue we are having now. With OOs and trucking companies selling their trucks now since they can’t survive with the low rates and no freight, it might help to bring some demand a bit higher. Also next year when the FMCSA requires eLogs for all truckers, more will be pushed out or just leave the industry. We’ve already parked 2 of the trucks (paid off, why pay for insurance?) until work picks up. It’s too much risk with drivers, minor accidents, DOT tickets and insurance polices getting stricter and increasing every year. If I can survive this rest of this year I’ll be happy.

BTW – Found this blog when searching for what’s going on with freight industry since no one was covering it last year and we felt it first hand. Knew there was bad news ahead. Keep up the good work! Read your articles everyday. Thanks.

Doing some mathematics on the percentages, one can estimate the impact on US oil demand of this freight slowdown. If for sake of argument, the Cass sample is the whole trucking market present size of USD 26bn and it shrank by 4.9% yoy, then the market size a year ago was USD 27.34bn, or a difference of USD 1.34bn. The average WTI crude oil price was USD 45/bbl over the past 12 months. So this USD 1.35bn loss of demand for petrol/gas is equivalent to 30m barrels of oil. 30m barrels over a year is 2.5m barrels a month and 0.58m barrels a week. If the trend Cass tells us is happening continues month-by-month then this will be added to potentially “already-saturated” inventories in gasoline and knock back up the chain to crude inventories. A downside demand shock may well occur in the US oil markets. The above rough and ready analysis is just thinking about trucking. Idling railway engines would also hit oil demand, I would guess.

SIGNS OF THE TIMES

As many of you know I am an over the road trucker with a large firm in the Midwest. I see many of the same signs of the downturns around me as I travel the country. My company got blindsided by the 2008 recession and 2009 was a rough year. The company made a shift in the types of freight we haul, and focus on quality service and dependability. While March was slow the changes put in place in ’09 are reducing the impact this time.

Already strained parking availability at night have led me to starting my day a little earlier. There seems to be a shift toward paid parking going on, the majors all are putting “reserved parking” areas in, and these spaces are taking up more and more space. This used to be a phenomenon of states like Massachusetts and certain areas like L.A. But is now spreading universally. The ultimate goal seems to be to get us to rent our nightly parking space like in an RV park. It is not enough any more to just be a customer.

The truckstops are filling up earlier particularly in the Northeast. There seems to be a schism at Walmart between the ones who allow us to park (a few even put in dedicated spaces) and those that go to great lengths to keep us out.

Yesterday the Trexler Truck Stop which I’ve been patronizing for years tried to charge me a dollar to send in my Transflo. I didn’t pay the dollar and I won’t be back.

The company is forcing us to upgrade our sleep apnea machines again due to tech upgrades. I hate the bloody thing, and if I can ever retire it will be the first thing I chuck out the window.

The other day I saw a class 8 truck used lot that put up a sign that says “BUY HERE, PAY HERE”. An appropriate way to wrap up my theme.

Yeah, what he said… Sorry Wolf, I’m so busy doing nasty, brutal and short that there’s not time to type out much. This punkinhead made a little over 60k last year. Down a bit, this year’s going down a bit more, seems like. But doing the back roads is like a shopping trip. There are so many for sale signs on good stuff in people’s yards, poor folks trying to raise cash, but I cannot break the seal and put stuff into my trailer. Awesome site, this and Asher Edelman are my favorites. Ttyl, loaded