Schäuble tries to soothe nerves, but the plunge gets worse.

Shares of Deutsche Bank have plunged 57% since July 31, to a new 30-year low today of €13.71. Since the beginning of the year, they lost 38%. Credit Suisse plunged 8.3% today to CHF 13.01, down 53% since July 31. Other European banks got mauled too.

The Stoxx 600 Europe Banks index dropped to the lowest level since the gloomy days of the Eurozone debt crisis in 2012. At the time, Draghi’s whatever-it-takes pledge kicked off a bank rally. When it petered out, Draghi came up with negative deposit rates and QE, which in early 2015 kicked off another bank rally. But it all came unglued around July 31. Since that propitious date, the index has plunged 40%.

Yet among the big banks, Deutsche Bank is the trailblazer. And they’re all trying to prop it up in a concerted effort that is eerily reminiscent of the efforts during the early stages of the Financial Crisis. The reassurances have now ascended to Finance Minister Wolfgang Schäuble. When Deutsche Bank is under attack, everyone’s got to stick together.

“No, I have no concerns about Deutsche Bank,” he told Bloomberg TV on Tuesday without further elaborating, after a meeting in Paris of French and German finance gurus, where they’d probably discussed how to deal with the sprouting banking crisis.

Bundesbank President Jens Weidmann, also at the meeting, said that the “financial-market volatility we are seeing is an expression of the uncertainty, of these risks to growth.” But he refused to comment on Deutsche Bank.

Co-CEO John Cryan has been out there for weeks, reassuring investors. To no avail. This morning, in his desperation, he sent a message, ostensibly to employees, which was posted in German and English on Deutsche Bank’s website for all the world to read. And it included this morsel:

You can tell them that Deutsche Bank remains absolutely rock-solid, given our strong capital and risk position.

With banks, semantics matter. Every single word was weighed by a team of experts. Nothing is random in these types of communications. He said, “You can tell them that Deutsche Bank is absolutely rock solid.” Go ahead and tell them. Tell them anything. He did not make the simple declarative statement, “Deutsche Bank is absolutely rock solid.”

He fooled much of the media that picked up the “absolutely rock solid” part and failed to see the “tell them” part. But he apparently didn’t fool investors.

He then added:

On Monday, we took advantage of this strength to reassure the market of our capacity and commitment to pay coupons to investors who hold our Additional Tier 1 capital. This type of instrument has been the subject of recent market concern.

It’s precisely this “Additional Tier 1” capital, or “AT1,” that has collapsed. His repeated reassurances with their escape clauses and the help from Schäuble only accelerated the collapse.

To prop up Tier 1 capital, Deutsche Bank was arm-twisted into raising nearly €20 billion in 2010 and 2014, most of it by selling shares, which diluted existing shareholders. It also issued the equivalent of €4.6 billion in “contingent convertible bonds,” spread over four issues in dollars, euros, and pounds.

CoCo bonds are designed to be “bailed in” first when the bank gets in trouble so that taxpayers don’t have to be shanghaied to do the job. They’re perpetual bonds, so they have no maturity date, and investors are not promised they’ll ever get their money back, though the bank can redeem them, usually after five years. Annual coupon payments are contingent on the bank’s ability to keep its capital above certain thresholds. If the bank doesn’t make that coupon payment, investors cannot call a default; they just have to get used to it. And if the bank’s capital drops below certain thresholds, these bonds are going to get “bailed in,” that is they convert automatically to the banks’ increasingly worthless shares.

In return for these risks, these bonds pay a seductive coupon of 6% or higher, which is why investors, stuck in the ZIRP or NIRP quagmire, jumped on them. Now they’re ruing the day!

As Deutsche Bank is inching closer to breaching the thresholds, it came out on Monday to say that it would likely be able to make the coupon payment for 2016, after having told investors last month that it would be able to make the coupon payments for 2015.

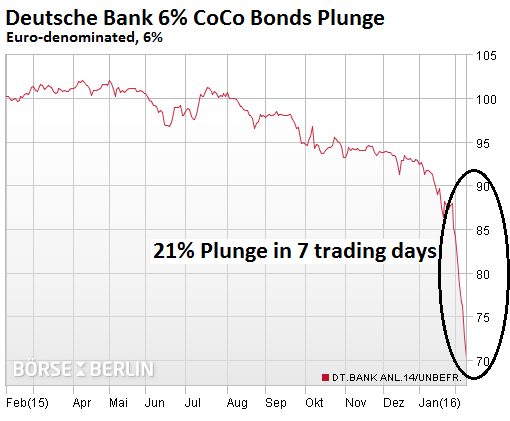

For investors, those CoCo bonds have been a fiasco. For example, the 6% euro CoCo bonds, which traded at 104 cents on the euro in early 2014 shortly after they’d been issued, and that still traded at 102 in April 2015, have collapsed. When I last wrote about them on February 1, they’d already plunged to 84.11 cents on the euro. After today’s reassurances, they dropped another 3.2% to 70.27, down a dizzying 32.4% from their peak. Over the past seven trading days, they’ve plunged 21%:

One thing is clear from the chart: The more the bank and the German government talk about “rock solid” and “no concerns,” the shakier the bank gets.

The crashing shares and CoCo bonds have a gloomy significance. Deutsche Bank is expected to have to raise more capital to rebuild its buffer, fund more losses on its loan book, fill the holes left behind by asset values that have gone up in smoke, and pay more legal settlements for things for which it keeps getting caught – as Cryan said in his message today, “We will almost certainly have to add to our legal provisions this year….”

This capital will have to come from selling shares or CoCo bonds. With both crashing, selling shares is going to be highly dilutive to existing shareholders and pressure shares further; and selling CoCo bonds, when the existing 6% issue trades for about 70 cents on the euro, if it doesn’t crash further, will be nearly impossible.

And this is one of the reasons banks in Europe – and even elsewhere – are getting mauled: there is no longer any appetite in bailing out shareholders and bondholders with taxpayer or central-bank money, as it was done during the Financial Crisis.

Deutsche Bank investors are now feeling the consequences of regulations that specify for the first time that investors in megabanks are explicitly at risk, that taxpayers won’t automatically backstop every crime and misbehavior and every bad bet and all the ludicrous risk-taking by banks, that a bank crisis will involve stockholders and some bondholders first. And that is, for these investors that have been bailed out so many times before, a very unsettling idea. And they’re bailing out, so to speak, before they get bailed in.

Is the banking crisis radiating out from Europe? Read… Contagion Hits Japanese Banks, Nikkei Plunges, 10-Year Yield Negative for First Time Ever

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Stalwart of EU bank no more DB as slew of TBTF banks in EU, PIIGS and even Swiss banks (UBS and Credit Suisse) lost billions resulting in collapsing share prices. Who knows about their CDS and counterparty risks are which may be many times over their capital requirements.

Add the woes of BoJ and Chinese banks with tons of NPLs and soon outright defaults from mother of all lending. So much for the easy money yen carry trade.

Guess it’s different this time as US banks may be better position, for now, with Lehman/Bear Stearns moments outside US as no doubt many EM banks are also sitting on USD denominated loans.

And the global CB cabals are out of QE and ZIRP ammo and tip toeing into the NIRP experiment to the unchartered territory with BoJ’s nasty unintended consequences and capital flight.

We indeed live in interesting times as I fear that 2016 banking contagion and all kinds of asset bubbles bursting globally may make 2008 crisis child’s play…

Deutsche Bank. insiders say that before 2017 German Government will have to take the bank over get your money out now before it is to late

“Every banker knows that if he has to prove that he is worthy of credit, however good may be his arguments, in fact his credit is gone … ”

— Walter Bagehot

Another Ponzi bites the dust …

who thought up these dopey instruments? the idea was they were a foundation, not the roof of the coal mine.

maybe trump is the answer, being we need a real estate/casino/golf course/resort speculator running the show.

With an official denial from Wolfgang Schäuble we now have confirmation that DB is in deep doodoo.

“Deutsche Bank investors are now feeling the consequences of regulations that specify for the first time that investors in megabanks are explicitly at risk” . . .

Don’t forget the depositors. No wonder the “kill cash” drums are beating ever more furiously.

I checked DB’s profile on Nasdaq and found that Vanguard has a significant risk. Vanguard is DB’s third largest shareholder with stocks valued at over $455 billion on Dec. 31st (obviously, the value has dropped precipitously). Four US banks, led by Goldman, own shares collectively valued at $885 billion as of Sept. 30th. Goldman holds shares valued at $320 billion; JP Morgan’s stock was valued at 222 billion; Bank of America had holdings worth $205 billion; and Bank of MY Mellon had stock valued at 138 billion.

The real threat to US banks comes from derivatives, but the plummeting stock price at DB will do some damage.

The impact on Vanguard from a collapse of DB is interesting to consider. The asset management firms — Vanguard, Black Rock, State Street, Fidelity (FMR) — attract scant attention in the press. They not only are the leading shareholders in all the major US banks, but they also are prime stockholders in virtually every major corporation: Apple, Google, Disney, Wal-Mart, every major media company, all the airlines, all the health care companies. They’re also the major stockholders in Exxon and other oil majors, as well as many smaller firms that specialized in fracking. They hold hundreds of billions in stocks in the FANGS, which are now plunging in value and may plummet even more sharply if Apple has poor sales in China for the lunar New year. Add to that, the Saudis were heavily invested in Black Rock and State Street and have pulled billions of dollars out. They’ll have to continue to withdraw capital as long as the price of oil is depressed. The first derivatives crisis involved an asset management company, Longterm Capital Management. The collapse of Deutsche Bank is viewed as the nightmare scenario, but just consider the effects if these firms start hemorrhaging.

http://www.nasdaq.com/symbol/db/institutional-holdings

Nice post and a good find, but I think your numbers are wrong when it comes to the value of the DB shares. They are listed in Millions not Billions…. Total value of holdings is 4.71 Billion with a “B”. Institutional Ownership is 21.98%. Market cap is 21.20 Billion.

Thank you Jeff and Oliver. I appreciate the correction.

I just wanted to add that Black Rock and other asset management firms face a significant threat of loss of foreign investment. China and Russia are now engaged in an intensive effort to attract investment from Saudi Arabia and the Gulf states. Xi and Putin have both had a series of meetings with the Gulf royals to discuss investment. (China has signed strategic partnership agreements in the past year with Iraq, Iran, Saudi Arabia, and Egypt. American dominance in the Middle East — and the financial benefits that dominance has brought to the US — are coming to an end). China is offering investment in its highly ambitious Silk Road project. This offers the opportunity to invest in projects such as the construction of a canal in Thailand or expansion in the Suez Canal, which will produce lucrative returns through shipping fees. Russia is offering investment in agriculture, and may open up their energy sector to some private investment. Russia has enormous potential in agriculture: they’ve just surpassed the US as the world’s leading grain exporter.

The asset management firms are now facing a very daunting challenge in persuading the Saudis and the Gulf royals to keep their money invested the US.

A summary of President Xi’s recent trip the Middle East:

http://www.thechinamoneyreport.com/2016/01/25/china-lays-out-vision-for-the-middle-east-with-massive-investment-and-trade-deals/

China’s investments to Africa are actually decreasing, and Russian ‘investments’ are mostly an illusion, they offer cheap weapons, that’s about it. Meanwhile, the silk road faces many roadblocks throughout central Asia, not least the threat of terrorism from militants throughout. Not so cut and dry.

Frankly, I’d put my money on India, which still has healthy internal growth, and on increasingly friendly terms with US investment.

Liz … I think your numbers are off by 3 digits: total institutional ownership of DB is “only” $4.7 billion. Which makes sense given that their total market cap is around $14-15 billion.

Great post, thanks.

“Deutsche Bank investors are now feeling the consequences of regulations that specify for the first time that investors in megabanks are explicitly at risk”

Investors: “Quick, call in the socialist bailout whambulance! The free market is ruining us and its not suppose to happen!”

Wolf, you left the best for last:

“And they’re bailing out, so to speak, before they get bailed in.”

The bail in provisions I think make bank runs much more likely: with a pure bailout model most depositors and bond holders can afford to be wary, but reassured that they would be made whole.

With a bail-in model why, as a wealthy depositor or a small/medium business with most of your operating capital in a current account, WHY WOULD YOU WAIT TO TAKE YOUR MONEY OUT ?

20/20 It would have been much cheaper to Buy out Lehman before it became and obvious implosion that destabilized, market confidence.

So who of the big shareholders buy’s out DB.

Or will they decide to let it fall so they can pick over the other fallen dominoes?

They should have let Bear Stearns go bankrupt and the others might have survived. But they saved the worst for nothing.

Deutsche Bank will not default or fail because this would spell end of Euro and EU. They will be bailed out no matter what is the price.

No. It will not be tax payer bailed out.

To forcibly roll up many Club med/greek Zombie banks, there must first be a Northern European “Sacrifice” to “Roll” the “Crisis”.

DB may have drawn this short straw, if the ECB decides this is how it wants to resolve the greek/Club Med Zombie Bank Crisis.

DB like scores of Greek, Spanish and Italian banks will become a quasi zombie bank on life support – enough capital infusion to operate while the hide the CDS and NPLs weenies or better yet super Mario buys the bad debts for the sake of DB’s balance sheet – all part of TBTF financial engineering and propaganda machine.

Interestingly Euro Bank socialist are already clamoring for bank losses to be quietly Socialized, with tax payer funds.

“To promote positive sentiment, Williams said the ECB may need to take more radical action than simply cutting rates, suggesting that it could start to buy some of the toxic assets that have weighed on bank balance sheets.”

http://uk.reuters.com/article/us-europe-banks-stocks-idUKKCN0VI1WL

Mutti and Wolfgang will not permit this. Nichts, Nien, Verboten, ist VERBOTEN.

The bail in rules, were written, to be used.

They are going to clean Bank Hausen, in greece, and Club Med, the hard way.

There’s a tiny problem here.

Deutsche Bank is presently sitting on €54.7 trillion of derivatives, significantly larger than what ultimately blew up Lehman.

The German GDP, which includes estimates for illegal activities such as drug trafficking and money laundering, stood at an estimated €2.74 trillion for 2015.

The numbers just don’t add up.

To this it must be added Germany has quietly bailed out scores of medium and small banks, mostly owned or controlled by Lander and municipalities, over the bast six years, sometimes twice. The silent bailout of the German banking system, which started before the Greek debt crisis blew up, has been underreported to say the least by financial media. None of these bailouts attracted the attention of regulators in Frankfurt and legislators in Brussels.

And throw Volkswagen (VAG) into the toxic mix. The EU has been helping the German car manufacturer big time, for example by suspending NOx testing until 2017 and waiving all sorts of exceptions, but the US and the Swiss governments have not proven amenable so far. A big fine is coming, as well as major recall costs: EPA not only want VAG to delete the offending firmware, they also want VAG to “lock” the ECU’s so in the future no other “tricks” can be uploaded on cars to undo what the recall will do. Last Fall costs for VAG were estimated at around €20 billion but since then the number of cars affected has grown a lot. When all is said and done this will cost VAG and its major shareholders (which include several Lander and North European SOE’s) north of €25 billion.

As the icing on the cake, costs for the present refugee crisis for Germany alone have been estimated at over €30 billion for 2016 alone.

At the height of the European debt crisis, Angela Merkel famously lamented “Our strength is not infinite”. As China is delivering a crippling blow to exports, the lifeblood of German economy, that phrase sounds more true than ever.

By the way, this morning DB bounced back a massive 11% on rumors (just rumors) of an ECB intervention in form of monetization aimed precisely at the ever frailer European banking system.

Problem is even the usually talkative Draghi has stayed silent so far, possibly because not even him knows exactly what to do right now. The problems affecting European banks are manyfolds and run far deeper than Italy’s NPL fiasco or DB’s exposure to “financial weapons of mass destruction”, as Warren Buffet rightly called them.

Great info!

And there is no ex-AIG which was nationalized (bailed out) by the Fed to pay off the CDS/CDO to US and other international banks like DBs and yeah the losses were borne by the US taxpayers.

From Wiki:

AIG had sold credit protection through its London unit in the form of credit default swaps (CDSs) on collateralized debt obligations (CDOs) but they had declined in value.[45][46] The AIG Financial Products division, headed by Joseph Cassano, in London, had entered into credit default swaps to insure $441 billion worth of securities originally rated AAA. Of those securities, $57.8 billion were structured debt securities backed by subprime loans.[45][47]

As a result, AIG’s credit rating was downgraded and it was required to post additional collateral with its trading counter-parties, leading to a liquidity crisis that began on September 16, 2008 and essentially bankrupted all of AIG.

The United States Federal Reserve Bank stepped in, announcing the creation of a secured credit facility of up to US$85 billion to prevent the company’s collapse, enabling AIG to deliver additional collateral to its credit default swap trading partners. The credit facility was secured by the stock in AIG-owned subsidiaries in the form of warrants for a 79.9% equity stake in the company and the right to suspend dividends to previously issued common and preferred stock.[48][49][50] The AIG board accepted the terms of the Federal Reserve rescue package that same day, making it the largest government bailout of a private company in U.S. history.[51][52]

And it gets better on DB’s dirty hand repeating the CDO debacle of last bubble. Didn’t DB learn?

From Wiki:

As portrayed in The Big Short, Lipmann in the mid of the CDO and MBS frenzy was orchestrating presentations to investors, demonstrating his bearish view of the market, offering them the idea to start buying CDS, especially to AIG in order to profit from the forthcoming collapse.

Deutsche Bank was one of the major drivers of the collateralized debt obligation (CDO) market during the housing credit bubble from 2004 to 2008, creating ~$32,000,000,000 worth. The 2011 US Senate Permanent Select Committee on Investigations report on Wall Street and the Financial Crisis analyzed Deutsche Bank as a ‘case study’ of investment banking involvement in the mortgage bubble, CDO market, credit crunch, and recession. It concluded that even as the market was collapsing in 2007, and its top global CDO trader was deriding the CDO market and betting against some of the mortgage bonds in its CDOs, Deutsche bank continued to churn out bad CDO products to investors.[36]

The report focused on one CDO, Gemstone VII, made largely of mortgages from Long Beach, Fremont, and New Century, all notorious subprime lenders. Deutsche Bank put risky assets into the CDO, like ACE 2006-HE1 M10, which its own traders thought was a bad bond. It also put in some mortgage bonds that its own mortgage department had created but couldn’t sell, from the DBALT 2006 series. The CDO was then aggressively marketed as a good product, with most of it being described as having A level ratings. By 2009 the entire CDO was almost worthless and the investors (including Deutsche Bank itself) had lost most of their money.[36]

For those brave souls out there – SKF is double short ETF for banksters.

I lost my shirt on it by not cashing in back in 2009 so be sure to use stop loss order.

Well, at least now you have a nice tan ;)

The time to take action is precisely when they tell you not to worry

They reported on the news yesterday, that the Fed wants a negative interest rate scenario to be included in the stress tests, to be conducted in the next round of tests.

Banks traditionally made their profits on the yield spread by lending long term for high rates and paying low interest rates to depositors. But the yield curve is so flat that the old business model doesn’t produce profits any longer.

The big banks have been relying on trading profits. But since the public is much more aware of their deceptions those profits are much harder to come by.

Since the big banks nonetheless need money that can no longer safely or easily be provided by bailouts, the US Federal Reserve has been raising interest rates, which is the money it pays on the deposits that the banks have with the Fed. Less than .50% is obviously not sufficient for the big US banks, so they need more rate hikes. It looks like the Fed wants to give it to them.

But Deutsche Bank is not a big US bank and it also needs money. Since there is no EU Federal Reserve to give Deutsche Bank money, its best option was to dupe bond investors. That worked for as long as the bond holders did not realize they were dupes. Now they know.

So, what could be the next gambit in European banking?

Very interesting points. But when you say, “the big banks need money that can no longer safely or easily be provided by bailouts, the US Federal Reserve has been raising interest rates, which is the money it pays on the deposits that the banks have with the Fed. Less than .50% is obviously not sufficient for the big US banks, so they need more rate hikes. It looks like the Fed wants to give it to them.” you overlook the fact that these banks own the Fed, and tell it when to hike rates, rather than the other way around.

I guess the music stopped and DB couldn’t find a chair…

Look at the bright side. Not only can you survive on potatoes, but you can also make vodka with them.

Much ado about nothing… It’s all good. Deutsche Bank is rock solid. Well, maybe not.

But there’s booze in the blender…

How does it go? “Never believe anything until it has been officially denied”. Something like that.

Will Deutsche bank fail and what its after effects on the financial markets, in particular in relation to “too big to fail”?

Should government bail out Deutsche bank to avoid the Lehman case happens again?

Please give me some ideas.