But there’s still no panic.

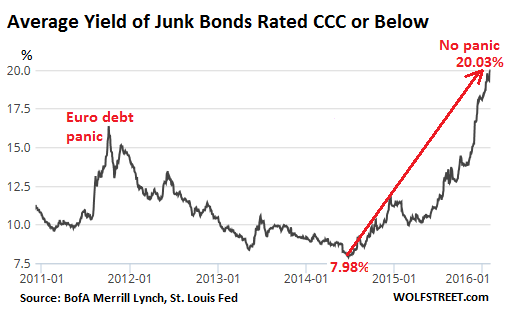

Late yesterday was a propitious moment. And today, when the index was updated, it became official: The average yield of junk bonds rated CCC or below, the bottom tier of the rating scale, hit 20%.

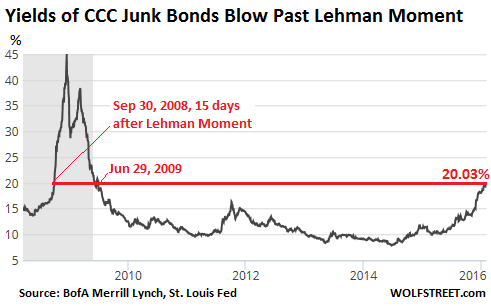

Yields soar when bonds get crushed. The last time the average yield of those bonds jumped to 20%, on September 30, 2008, all heck had already broken loose. Lehman Brothers had gone bankrupt 15 days earlier. Liquidity had dried up. Banks were lining up to be toppled. Panic was breaking out.

Today, there’s no panic.

Back during the remaining QE-glory days of early summer of 2014, during four days at the end of June, the average yield of these bonds dropped below 8%. That was the precise peak of the most incredible junk bond bubble the world has ever seen. The Fed’s “wealth-effect” strategy gets much of the credit.

The BofA Merrill Lynch US High Yield CCC or Below Index shows just how much the average yield has soared since June 2014:

At the time, oil was still selling for over $100 a barrel, though the price of natural gas had been demolished years ago. Even over-indebted, junk-rated, cash-flow negative oil & gas drillers were able to borrow, no questions asked, at super low interest rates. Investors gobbled up fancy charts and diagrams of a perfect and ultimately illusory future. It never occurred to them that there were major risks, such as that the price destruction that had already hit US natural gas as a result of the fracking boom might also hit oil. The risk was there for all to see, along with numerous other risks that come with over-indebted, junk-rated, cash-flow negative companies.

It wasn’t just in oil and gas. Other companies did the same. There was a reason why these bonds were rated CCC or below, the riskiest category on the scale, before D for default. These bonds have a significant risk of default, and if there’s a default, recovery can be low or nil. They weren’t high-grade corporate bonds. But investors didn’t feel like looking at it. They played along, closing their eyes, hoping for the best, and going for the 8% yield. These folks willingly did what the Fed had wanted them to do.

“Consensual Hallucination” we’ve come to call it – consensual because everyone eagerly smoked the same stuff. But this hallucination is waning. Investors are coming to. And now they’re vomiting up these bonds.

The last time CCC or below junk bonds had an average yield of 20% was June 29, 2009, as the Fed was dousing the market with QE, corporate bailout programs, and emergency loan facilities. Now the Fed has raised rates one notch and is flip-flopping about raising rates further.

And the day the average CCC yield hit 20% on the way up during the Financial Crisis was September 30, 2008. Lehman Brothers had filed for bankruptcy 15 days earlier. It was the largest bankruptcy in US history. Panic was cascading through Wall Street. Credit markets dried up. CEOs were begging for bailouts and emergency loans. Those times captured by the BofA Merrill Lynch US High Yield CCC or Below Index going back to 2008:

But these days, there is no panic. There’s “no largest bankruptcy in US history.” Bankruptcies, now a daily drumbeat, are of digestible size. The S&P 500, the Dow, and the Nasdaq are down but haven’t crashed, though many individual stocks have gotten crushed, the IPO window has just about closed, and stocks in some other markets have crashed spectacularly. But here, on the surface, calm reigns.

Moody’s warned late Monday that its “Liquidity Stress Index,” which tracks the number of companies downgraded to the lowest liquidity rating (SGL-4), had jumped from 6.8% in December to 7.9% in January, the largest one-month jump since March 2009, and the highest level since December 2009.

Moody’s wasn’t kidding. Beneath that calm surface, over-indebted, junk-rated companies are running out of oxygen.

The index for oil & gas companies rose to 21.4% in January from 19.6% in December, but still below the 24.5% of its peak in March 2009.

It wasn’t just oil & gas. That meme no longer holds. Oil & gas is just way ahead. Without oil & gas, the index rose to 4.5%, up from 3.6% in December, and the highest since November 2010. Six of the ten downgrades to SGL-4 in January were for non-energy companies.

The companies in the index, which also often have a CCC or below credit rating, are facing one heck of a time borrowing new money, or even rolling over existing debt, given that for them, the cost of borrowing may approach or even exceed 20%.

These companies are essentially locked out from the capital markets. Their bonds trade at a fraction of face value. Their banks are getting nervous. They will have difficulties refinancing their maturing debts. Some of them – as is currently happening – might not even be able to make their interest payments. The increasing difficulties and costs in raising new cash will lead to many more defaults.

In short, these over-indebted, junk-rated, cash-flow negative companies are in their own Financial Crisis that is now metastasizing by the day. Only this time, no one is talking about bailouts. And this is what happens when risk, long repressed by the Fed, reappears in its unpleasant manner.

And then hope came unglued all over again. Read… The Transportation Recession Spreads

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

To play Devil’s advocate with the second graph, it looks like there was a longer period of distress before the Lehman moment than we have now. The baseline in 2008 looks to be a 15 pc yield. The recent rise to 20 pc came quicker from a lower level. Thus not sure a Lehman event is imminent.

As of now we might be facing something between that of the Euro crisis and 2008 in terms of severity, though it looks like we will find out where we stand only in next few mknths.

No need to play the devil’s advocate. The problem is 2008 never truly ended. We had two spells of complacency (2010-2011 and 2013-2014) when assurances from government and central banks drove yields lower but the unsolved problems stayed there. Now these problems are coming back with a vengeance. Officially the cause is havoc on energy and commodity markets but the reality is the monetary and financial tools which allowed for yields to be artificially repressed are running out of steam.

Yields on investment grade bonds are still being ferociously repressed, especially on sovereign, and that’s where the next conundrum lays: for how long will central banks and the largest institutional investors will be able/willing to repress those yields? I am hold enough to remember when AAA rated bonds yielded 3%, which is probably their true value. Right now most AAA rated paper worldwide has negative yields, a complete anomaly.

The big problem is these investment grade bonds are being literally sucked out of a market that needs them: loan collaterals, insurance companies, retirement plans… these sectors have been literally starved of investment grade paper yielding what they have been yielding for decades. And if insurance companies and retirement plans can be made to work by taking far too many risks on stocks, ETFs and junk bonds, loan collaterals are another matter completely. We all remember what happened the last time loans were extended on low quality/existant only on paper collaterals…

I haven’t a clue to what could be down the road for Main Street America. I do know that questions are now being ask if you make too many trips to the bank, Bank of America that is, to withdraw large sums of cash. Every other day now for a couple of months I’ve handed the teller a check made out to cash for either a $1,000 or $2,000 because I know that there is now a $5,000 limit for non-business accounts. Yesterday, I had to produce two picture ID’s and sign the check again even through I had signed it front and back. Not to mention every two weeks I go to my safety deposit box for assorted reasons. It’s a small branch and they know me. Some Monday morning people are going to go to these banks and find a notice that the bank is temporarily closed. There will be notices on ATM machines of new daily limits. And on that day all the Howler Monkeys will scream out, “Someone should do something.” No Sir, it’s someone, you being that someone, who should have done something long ago. You made the bed, now sleep in it.

Safety deposit box in a bank = suicide.

tell us why you are accumulating cash. Are you long in years and scared of running out of money? DO you think the banking system will fail? If you have $500k in Fidelity funds you think that would somehow go away? Please explain what you are thinking……

Were you paying attention when they closed the banks in Greece? It was weeks before people could get to a safe deposit box. I think the ATM limit was 60 euros a day if they had the cash, and many didn’t.

The bail-in in Cyprus where they actually confiscated money was worse.

Or when MF global bit the dust, screwing even people with so called allocated gold accounts. (ask Gerald Celente). The very idea that a customer is now only a creditor in bankruptcy, standing behind hedge funds or derivative holders in line is a concoction straight from Hell, and furthermore, it is no longer sure that even safe-deposit box holders are immune: they were traditionally considered private, not bank assets, but that does no good if they won’t let you in the bank without an examiner at hand, as in Greece

Robert is right. Safety deposit boxes are not safe. Little more than a vanity tape, as far as the powers that be are concerned.

No politician would attempt a Greece in the USA, not in a country where most citizens are armed.

No police force or military would be capable of controlling social unrest involving 100m people and their guns.

They’re cooking some other thing. No idea what, but it’s not gonna be Greece.

I agree Petunia, those are 2 reasons enough for me not to keep much in a bank. Eurogroup chairman called Cyprus bail-in a template:

http://www.economist.com/news/europe/21575762-some-worrying-signals-cyprus-and-eurogroups-new-chairman-banking-disunion

http://truthingold.blogspot.com/2013/04/the-frightening-truth-about-cyprus-bail.html

See what is covered/not covered by FDIC. Lots of bank issued instrument not covered (and safety deposit box is not covered):

https://www.fdic.gov/deposit/deposits/brochures/your_insured_deposits-english.html

Also, I had no idea the FDIC insurance limit was set to drop to 100K by 2014, but the Dodd-Frank act prevented that from happening.

Let’s face it….If the Government wants our money they are going to find a way to get it by some emergency mandate. All the wealthy have theirs stashed off shore so no skin off of their back.

Sure, It’s simple really, I don’t trust the Fed or the administration. Do you ? I stopped being cynical because it was so hard to keep up. Now I worship at the Church of Realism and do my finances at the First Bank of Beauty Rest.

Yes, BM, at my bank the buggers are now asking you to call ahead. Oh, you want 7500, did you call ahead? No. Well I can only give you 5k. LCS accepts this crap for new shiny. These banks are on the edge! These are not normal times and call for drastic action. They may ban all this cash, but screw them, I will take out what I can on a regular basis.

I recommend a book called Depression Diary by Benjamin Roth. Back then, an account in a failed back could be used to pay off debt or mortgage with same failed back. Might it be prudent to keep your checking account with same institution you have mortgage with?

Yet, there is now $6 trillion worth of sovereign bonds that have negative yields. I wonder what the total amount of junk bonds are, that is in danger blowing up?

Over $1.8 trillion in US issued junk bonds (and growing as more companies are downgraded to junk). But CCC-rated junk bonds only make up a portion of that.

I’d have thought a reduction in demand for bonds, thereby causing yields to go up, is symptomatic of a flight to quality. It is not necessary surely for investors to buy into companies that other investors don’t rate.

“Bankruptcies, now a daily drumbeat, are of digestible size.”

Best argument of all to bust up the self-proclaimed “Too Big to Fail” banks into much smaller pieces.

Perhaps we won’t need cash in hell? Although, some will no doubt attempt to take theirs (and yours) with them.

” “Consensual Hallucination” we’ve come to call it – consensual because everyone eagerly smoked the same stuff….”

Well, just guessing, but I doubt that Wolf was.

And I most certainly wasn’t. Never reach for yield. Wait til assets are transferred to creditors. Fire sale prices always come back. Always wait for the panic.

Are you to suggest the “cleansing” of 2008 might finally be at hand? The weak then that should have been liquidated, save the intrusive hand of the FED and cheap money, might be here to finally render what is due?

I say carry on, let the carnage begin anew, with fervor! We could use some fresh popcorn, now.

Yes, let it begin!

Only 20% ? IMHO, these bonds should be trading at zero cents on the dollar. Who are the geniuses putting fresh money down these rabbit holes?

There are so many companies today that could replace Lehman and take down this market. My bet would be on Glencore with all of its counter-party risk, huge leverage and illiquid asset base. And they really aren’t a bank so it would be a stretch for the Fed or UK equivalent to bail them out. Maybe a consortium of banks will rescue it but it will be a market jarring moment. As for the man who is withdrawing cash from his bank who thinks we will have a Greek style run on the bank – the US can print more money to satisfy any run like nothing but what that money can buy is another issue. But withdrawing money from the bank won’t solve your problems.

Gee, Wolf. What’s the panic? It’s business as usual in the New Normal!