Central banks have lost their aura of omnipotence.

In Saudi Arabia, the Tadawul All Share Index plunged 5.4% on Sunday and dropped further on Monday before ticking up a smidgen. It’s at the lowest level since March 2011. Soothsayers blamed oil, and what Iran will do to the already oversupplied oil market now that the nuclear sanctions have been lifted. But Saudi stocks started losing it in September 2014 and have since collapsed 50%.

Russia’s MICEX stock market index is down only 13% from its high in November, 2015. But the RTSI dollar-calculated index of Russian shares plunged over 7% on Monday as I’m writing this, is down 40% since May 2015 and 70% since August 2011. Every big rally in between was followed by an even bigger slide. The major difference between the dollar-calculated RTSI and the ruble-calculated MICEX is the value of the ruble, which has plunged 2% today to 79.3 rubles to the dollar, a new all-time low. It’s down 57% against the dollar since mid-2014 and 64% since mid-2011. The Central Bank isn’t even trying anymore to prop it up.

China’s Shanghai Composite is down 44% from its high in June 2015. During that time, the yuan has dropped about 6% against the dollar. So dollar-based investors took an additional loss, with the total loss amounting to over 52% (not including transaction costs and fees).

Dollar-based investors, when they buy foreign stocks, make two bets: that those stocks rise; and that the currency of those stocks at least remains stable against the dollar. When they catch it right, with both stocks and currency going up, the returns can be breath-taking. But the opposite happens when both go down, as they’ve been doing recently. And dollar-based investors are getting totally crushed.

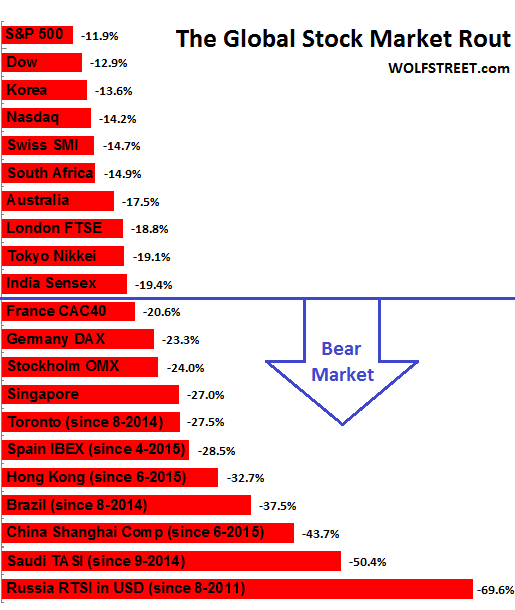

There has been a lot of moaning and groaning about the decline in US stocks, with the S&P 500 down 12% from its all-time high in May last year, the Dow down 13%, and the Nasdaq down 14%. After seven years of bull market, those declines have a bone-chilling effect. No one is used to losing money in stocks anymore. A whole new generation of traders and investors never experienced a big loss.

But those declines are still puny compared to what happened in past downdrafts in the US markets, and they’re puny compared what is already happening among the major indexes around the world. In fact, the beaten-down US indexes are the world’s best performers!

This chart shows the plunges or crashes of the major indexes since their respective recent highs in 2014 or 2015. The one exception is the dollar-calculated index of Russian stocks, the RTSI$, which has been a dreary affair all the way back to 2011; hence the decline calculated since that date.

Note the ever longer list of markets that have now dropped 20% or more from their recent highs (below the blue line) and are in what a lot of people call a bear market. India’s Sensex and the Nikkei are a hair away from sinking below the blue line (US as of Friday close, Toronto as of Monday morning, Asia as of Monday close, Europe as of Monday afternoon):

So, add those equities-based losses to the currency-based losses for dollar-based investors, and suddenly some of these indexes are starting to look like the dollar-calculated RTSI. For dollar-based investors, it has been brutal out there.

So why can’t central banks step in and stem the bleeding and restart the good times?

The answer lies in the Eurozone: France is down 21% from the highs in April; Germany 23%; Italy 23%, and Spain 29%.

These are the big four economies of the Eurozone. In early 2015, the ECB has unleashed a massive wave of QE and inflicted negative deposit rates on the Eurozone in an effort to flog savers until their mood improves and to drive asset prices up into the sky to create that special wealth effect. That worked wonderfully during the run-up before the well-telegraphed QE and NIRP became reality. But since April, the wealth effect has reversed. The ECB has since enhanced QE, but stock market losses have only increased.

Turns out, our delicious central-bank alphabet soup of QE, ZIRP, and NIRP is losing its effectiveness in inflating stock prices. In fact, it may have the opposite effect. Also look at Japan and Sweden. Despite massive QE programs by their central banks, their stock markets have dropped 19% and 24% respectively.

There’s no longer any guarantee that QE, even a much hoped-for QE4 in the US, will re-inflate stock markets. That era has passed. Central banks have lost their aura of omnipotence. And thus, they’ve lost their omnipotence.

However, when it comes to government bonds, central banks still rule; QE, ZIRP, and NIRP still pump up bond prices and repress yields. Hence the low yields prevailing in fiscally challenged countries such as Japan and Italy. But at the low end of corporate bonds in the US — the lower end of junk bonds — the bottom has already fallen out, and rot is creeping up the rating scale.

A special mention is due Canadian stocks. The TSX has been beaten down 28% since August 2014. Canada is in part a resource economy. Oil & gas, metals & mining, agricultural commodities, lumber, etc. have gotten caught up in a vicious commodities rout. But other stocks have gotten hammered too, including Canada’s formerly must-own hedge-fund darling and stock-market giant Valeant.

During the time that the TSX swooned from its high in August 2014, the Canadian dollar also dropped 25% against the US dollar. A nightmare for USD-based investors.

For instance, if USD-based investors in mid-August 2014 bought US$100 worth of Canadian dollars (C$109.50) and invested them in a Canadian index fund that parallels the TSX, they would have lost C$29.67 on those stocks by Friday. If they sold on Friday, they would have obtained C$79.83. They’d then convert that fortune into USD by paying C$1.45 per greenback and end up with US$55.05. A 45% loss. More realistically, including transaction costs and fees at every step, the loss would have been over 50%.

So how well has the highly touted, strongly urged, even must-do diversification into global equities worked out recently? It has been a massive fee-generating Wall-Street bonanza for one side, and a slickly-engineered form of capital destruction for the other.

Because in the markets, something big has changed. Read… Consensual Hallucination Fades, Global Stocks Crushed

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Gentlemen, start your engines! The race to sell stocks and bonds is about to begin. The losers will wind up in a long line for Wall Street that’s been cleaned out of cash like an empty Communist grocery store. Does Black Tuesday 29Oct1929 mean anything to you? Every time they close the doors, they will reopen to a crowd of people demanding their money back. It’s like Musical Chairs except that in the end, only the House Wins.

The insiders (corporate execs and directors) have already sold out at the highest stock prices. As companies like IBM were borrowing to buy back shares, in order to boost stock prices, the insiders were engaging in the dump phase of this pump and dump scam. The bag holders are small investors and the pensioners.

No rest for Wolf.

Ouch! Oh, Canada?

…”Canadians are sick of seeing their money spent on blatant pork-barreling — such as the $100,000 gazebo built in former industry minister Tony Clement’s riding for an international summit in Huntsville. We don’t need more “infrastructure” like that.”…

http://www.msn.com/en-ca/money/topstories/canada%E2%80%99s-economy-needs-a-jump-start-editorial/ar-BBoljuk?li=AAggFp5

Drunken pond scum on a river cruise. Jump start, right!

It is starting to look like a full-on bull market for the USD.

The USD buys more of everything in the world except those things supported by US govt monopolies. Recession should be upon us soon, if not already.

Global CB kabuki acts AKA Keyneisian wetdreams are coming to close as money and associated debt created out of thin air cannot solve the mother of all debts – that is more debt is not going to solve the debt prob.

It was like giving a drunk more alcohol to keep him in a state of drunken stupor rather than nasty hangover – just merely delayed the hangover.

Debt is either paid off or defaulted, and kicking it down made it more like snow ball down slope – got bigger and once it hit the bottom flattened few folks or exploded.

First rule of economics:

ALL DEBT WILL BE PAID.

Either with pennies worth dollars, or dollars worth pennies.

The Canadian penny does not even exist anymore in it’s physical form!

A debt jubilee is a total forgiveness on repayment of said debt, requiring the lender to take a 100% loss. This the creditors are unwilling to do. Instead will hang on until forced to settle for pennies on the dollar and in the process taking down the financial system.

One way or the other, the system MUST go through a reset and be reformed, for ANY equitable common basis to emerge.

A debt Jubilee need only target the fiat, credit created loan sums. As you know, all loans today are credit created with not one cent of real money involved. No FRL any more.

The banks got that money for nothing so they can write them off just as simply. They will miss getting interest but all the other non fiat parts will keep the banks solvent.

The property owners will get to keep their properties unencumbered.

All this will cause property values to crash, but without all the bleeding that would result if the mortgages were still in force.

>>>”The banks got that money for nothing so they can write them off just as simply.”

John, what world do you live in?

The insiders are thw only winners, shareholders get the shaft.

Australia, South Africa should be in TSE range as of now.

London, Tokyo should be in Singapore, Hong Kong range as of now.

India should be somewhere between China and Russia stock market as of now.

There is more to come.

BTW nice work Wolf.

I wonder what the CNBC brass thinks of Cramer’s sudden sell everything call. How does this fit in with this Trading Nation ethos, where ‘traders trade better together’ ?

I mean it sounds like his message is ‘stop trading’ and if so why tune in to CNBC, unless you do it like I do to see my super bearish predictions come true.

Speaking of trading- when I go to my supermarket the debit machine asks me if I want a lottery ticket, When I go to the RBC cash machine it tells me I can have x free trades (or something)

I think sucking the average guy (you can bet they are mostly guys) into thinking he should be a trader will go down in the history of this period as an equivalent of the great Casino era.

Cramer is more like an actor/drama king and buffoon to boot. He is there to entertain yet lemmings/sheeple/muppets take his crazed advice which worked somewhat during the bull market. Besides with so many recommendations some are bound to be winners in raging bull market. As for CNBC – for me it’s more or less entertainment with talking heads exhorting buy buy buy not to mention falling viewership.

I remember when Cramer had a column in Smart Money mag back in 1995. I took his advice on a software (Hogan something in TX) and tape back-up companies and lost $$$ on the tape company. Emailed the joker and his response was rather comical.

Back in 2010, I think it was, someone made a very funny video of a series of clips where Cramer Basically flip flopped on many recommendations. It may still be on YouTube. This showed how Cramer is utterly full of BS.

I watched Jeb on CNBC this morning. From my point of view he was threatening them. Talk up my plans or else no more advertising money for you.

this oil thing has really looped currencies.

am starting window shopping in canada, closer to home, don’t you know.

Next up may be the all mighty USD devaluation as strong USD is causing too much havoc and carnages in the EM and even our NAFTA neighbors not to mention the US manufacturing exporters.

And expect a loud chorus of Q4 earnings filled with moans of earnings hit due to strong USD.

Currency wars lead to trade wars which in turn led to real wars – history does repeat…

I came across a copy of my resume a few days ago and it reads like a history of Wall St. downturns. None of the original three financial institutions I worked for exist any more. One bank was bought out once since I first worked there, another has been bought out twice. The brokerage firm was sold for scrape. The future after a bad downturn looks like that.

I would also like to point out that all three institutions were weak before the downturns, lots of bad loans, all done to increase income. Mergers are a great way to hide really ugly business practices. Sometimes it works, sometimes it doesn’t, and sometimes the taxpayers take the hit.

“Saudi stocks started losing it in September 2014”

Brent broke down in August 2014, so it’s difficult comprehending this point of view. My guess is someone knew the oil crash was coming and once that became clear to everyone Saudi stocks began selling.

Of course now we hear about the past of nearly two years.

Funny thing is, I recall several (5?) years back Saudi Arabia promised to increase production once their new field came on line, I guess once oil is $10 we hear about this point. I’m not aware of current status of Saudi production vs the past several years.

The problem with the economy is global warming which has demolished the demand for warm coats. And unfortunately for stockholders, with the backs stop erected by the the central bank now rescinded by recent policy shifts, bad news is bad news which is truly bad news.