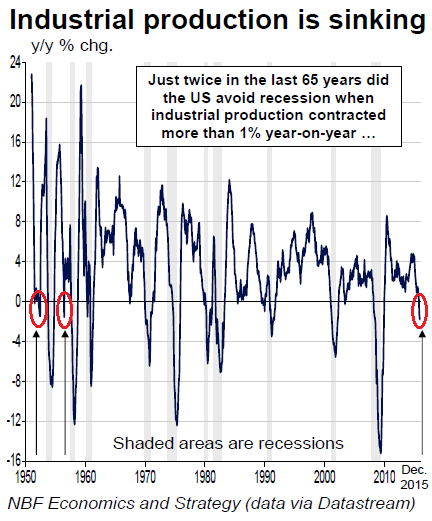

The only exceptions were in the early 1950s

Painful – that’s how you can describe the slew of recent US economic data. And today’s data dump was even worse.

On a regional level, there was the Empire State Manufacturing Survey. The Current Activity Index plunged to the lowest level since March 2009. The last time it had squeaked into positive territory was in July 2015. The Expectations Index plummeted by an unprecedented 29 points, also to the worst level since March 2009.

Thank God it’s only regional. But wait…. California’s Inland Empire Purchasing Managers Index, which tracks manufacturing in the Inland Empire, started losing its grip in August and in December plunged to the lowest level since the dark days of February 2009.

The report pointed to the link between the index and the overall economy in the region: Historically, when the PMI drops below a certain level, as it did in December, and stays there for three months, it coincides with a recession in the region’s overall economy [“The Sky is Falling” on California Manufacturing, Worst since February 2009, Might Kick Regional Economy into Recession].

Then retail sales for December dropped. Turns out, holiday sales brought no respite to the beleaguered brick-and-mortar retailers [read… Wal-Mart Rubs Salt on Deepening Retail Wounds].

And the final shoe to drop today, in a gratuitous sort of way, was the Federal Reserve’s index for industrial production. It fell 0.4% in December, after having already fallen 0.9% in November and 0.2% in September, while August had been flat. Year-over-year, December was down 1.8%.

A year-over-year drop of this magnitude (-1% or more) has been linked to a recession every time it occurred over the past six decades. You have to dig into the early 1950s before you find the last two occurrences where this kind of drop in industrial production was not associated with a recession.

I circled those two exceptions in this chart by the Economics and Strategy team at NBF. I also circled December’s drop. The recessions are the gray columns. This is starting to look ugly:

Worse: contagion is spreading from beaten-down oil & gas and metals & mining to consumer goods, where production dropped 0.8% for the month, the fourth month in a row of declines, though they still eked out a gain of 0.3% year-over-year. And it’s hitting production of Business Equipment, down 0.8% year-over-year.

Some sectors are still strong: the sub-index for Construction output was up 1.6% year-over-year, given the apartment building boom in major cities; and the stalwart of growth in America, defense and space equipment, rose 0.6%.

But the utilities index fell 2.0% for the month and 6.9% for the year. This drop “contributed substantially to declines in the indexes for consumer goods, business supplies, and materials,” the Federal Reserve pointed out. So that explains part of the problem in consumer goods. But output of consumer durables fell 0.3% and output of “consumer non-energy nondurables” also fell 0.3%. It finally all circles back to the consumer.

Everyone was quick to blame the weather, which this time had been too warm rather than too cold. When it gets warm in the winter, utilities produce less. We get that. But production of consumer durables and consumer non-energy nondurables?

Weakening exports also get blamed. Exports excluding petroleum products are falling off the chart. This is a problem of weak global demand combined with the swooning currencies of some trade partners.

Yet it is still possible that the US economy won’t skid into a recession. The service sector – which is about five times as big as oil & gas, other mining, and manufacturing combined – is still growing. It includes healthcare, which is booming.

Auto sales (and auto manufacturing) have been setting records. Housing hasn’t visibly rolled over yet. While job-cut announcements are now disconcertingly gracing our headlines on a daily basis, weekly unemployment claims have only been edging up recently from very low levels. We expect them to jump when things get dicey. But they haven’t jumped yet.

That said, numerous jobs that were cut in the oil & gas sector and elsewhere were contractor jobs. Other contractors had their hours reduced. And those folks won’t show up in the weekly unemployment claims because they don’t qualify for unemployment compensation.

One thing we know: If ugly data like this keeps piling up over the next few months, or if auto sales, services, or housing take a hit, something big is going to give. Then there’s the growing possibility of a financial crisis or a debt crisis in the Emerging Markets, which would rattle our nerves even more. And the current “market turbulence,” as the global swoon in stocks is called, might just be the market’s reflection of those possibilities.

Consumers are curtailing their purchases and shifting to online stores. So, brick-and-mortar retailers are being taken out the back and shot. Read… Wal-Mart Rubs Salt on Deepening Retail Wounds

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

nice work, Wolf. Cool roundtrip view of economic numbers. Its kind of exciting and scary to be sitting on the edge of a precipice like this. They say crises are the only real opportunities for change that human beings have, because of our tendency to resist change…

Gee I wonder if Janet and her gang look at mfg/industrial output instead of focused on BLS manipulated unemployment data boosted by lower paying service jobs not to mention not include so many folks “stop” looking for work (guess they don’t exist with some say 9 million folks in that boat).

Anyway the graph not only indicate the Great Recession II may be around the corner and that it has more to fall…

Alas – the Fed is out of the bullets with interest rate at 0.25% (vs. 5.25 back in late 2008) and with each round of QE loosing oomph with last round III that lasted too long (to make Benny’s exit look grand followed by Janet afraid to upset the apple cart till her credibility was shot down for not raising way too late in Sept 2015).

I fear that the FED does indeed look at all the data not just the numbers presented to the public. Nefarious actions would be worse than incompetence. The fed are far drom out of bullets. When the next crisis hits it will be the banning of cash and deeply negative rates.

“Anyway the graph not only indicate the Great Recession II ”

Try the second leg of the double dip that QE II and III simply staved off.

You cant stop a big double dip depression/recession, with financial engineering only stave it off, QE II and III, or cushion it QE I.

20/20

QE II and III should have gone into infrastructure, not the markets, where QE I went, and did its job. Then maybe America would be in a lot healthier position, to weather a mild corrective recession. Now, due to the misdirection of QE II and III, the future probability, is a lot worse. than “a mild corrective recession”

++

The lesson for the financial academics in the QE II III event, is that contrary to their wisdom. Stocks, Bond’s, and Banks are not the drivers of the total economy.

That in fact, with out, a, LARGE, EMPLOYED, PROSPEROUS, middle class, with well paying jobs, advanced economies, die.

IN 08, the FED did better than they did in 29, ther emay need to be some adjustments to its mandates, so it can apply the lessons from 08 – 17. If the Academics can see beyond their, wall-street dogma, to those lessons.

O bummer was out to, and has, GUTTED the existing American middle class. So he could have an upper lower class, of new immigrants and existing takers. Ensuring continuous democratic presidents, for the next century’s. Add that deliberate Racist policy, to the 08 disasters. Made by Barny Frank and his Keynesian clan, and behold. Here we are. Heading into the inevitable second leg of the double dip with no FED weapons to fight it.

GIC sales are on fire in Canada.

Yes very much, some pay over 3% for 60 months deposit.

Remember time when in was paying 7.75% annually and you could lock for indefinite period of time. Those days are gone.

Today you are more about preserving capital instead of making capital.

Cheers.

I sold my house in late 2014 and the Royal asked me if I wanted a US$ account. Passing has cost me 20 %

You don’t want your assets in C$ anything.

And not just because of oil. We’ve got a kid in charge who’s never had a job because he’s the kid of PM who never had a real job. When Dad got through with the $C it was 62 cents and serious people were saying we might have to go to the IMF.

The kid is already saying he’s going to run deficits,

Look out below

This time we might go even lower; lets say 59/60 cents by the time oil charade is over. If auto sector and real estate go bust we as a country are in DEEP trouble.

Poster boy will make things just worse.

The FED will finally receive it’s well deserved credit.

The FED was quite late in raising interest rates, in my opinion. The commodity recession is now upon us, for how long is unknown. We drivers benefit, but oil producers, metal producers, mining, are all hurt. China’s production slowdown, and the slow demand for goods hurts.

It is world of hurt just now. until inventories correct, demand picks up expect more job loss, market loss, and confidence loss. WELCOME to 2016.

I have a limit order to buy the total market ETF should it hit my price -about 26% below current levels. I’m confident – NOT!!!

good chart. interesting that ge decided industrial was the way to go.

so haier buys their appliance division for 60% more than the failed electrolux deal……job creation.

America is no longer the “America” you’ve grown up if you’re at that age.

I’m feeling the millenial’s will elect Sanders and the US will become a socialist unionized utopia. Millenials have no desire to work 40 hours nore to own a business. They looking for the “quick” fix of growing pot, become a softwrare designer or create apps to make millions.

They live off of social media a burger and a beer.

The current economic and financial situation is perfect for Sanders to grab hold if these “lost” generation.

And imagine this some day they’ll be parents!

LG: Back in my day we were said to be the “Turn on, Tune in and Drop out” Generation. Most sold out with the first good offer. I expect the Millenials to do the same. It’s the American way.

Oh there will be no quick fix for the destruction the Baby Boomers hath wrought. We’ll be cleaning up your mess long after you’re dead. But you got to live high on the hog before pulling the ladder up behind you, so bully for you, right?

Just shuffle off this mortal coil so we can get to work fixing all your mistakes which are rooted in selfishness.

They called FDR a socialist too.

Go easy nigel. Your wrath is pointed in the wrong direction. We boomers are just as much a victim of all this as the later gens. Look up Veblen and “the slaughter of the innocents”.

PS This millennial owns a business and works a hell of a lot more than 40 hrs. I have to in order to compete with the Oligarchy that has allowed 4-5 companies in every industry to squeeze out everyone else.

We’ll vote Bernie, raise your Social Security, and send you off in a Viking funeral with dignity (though it is more than you deserve).

lol borrow a trillion large to buy a car,that’s as out there as it gets.borrow 2 tril to go school (lol),tril plus in cc dept,point is if u simply borrow cash to drive consumption then u really don’t need to produce anything other than more cash (qe-infinity),until u can’t

Hi from Oz. Wolf said ‘It includes healthcare, which is booming’. If this is due to Obamacare, then maybe its just price inflation, not real growth?

Or maybe it’s just oligopolism with pricing via a politically engineered demand function (aka, gun to the head). Shush, the insurance, pharmaceutical and medical sectors don’t want to believe it’s not real growth. There’s something about their cognitive dissonance that drives them manic if you push that button.

Well, one thing’s for sure. When government begins spending money there’s no limit to the methods companies will go to in an effort to mop it up.

You’re right about healthcare inflation. But it’s unrelated to Obamacare.

Healthcare and healthcare inflation have been booming for decades to where healthcare is now close to 20% of GDP, by far the highest in the world. Obamacare tried to put some limits on it, and that’s helping some people, and it has screwed up other things. Healthcare in the US has been a government protected and sponsored oligopoly and multiple monopolies (pharma for example). There is neither a free market nor effective regulation. Obamacare law was written by insurance companies.

Congress loves it that way – and has for decades. Big Pharma and big hospital groups have deep pockets, and we have the best Congress money can buy.

As a result, healthcare prices have soared. A couple of weeks ago, I posted an article on inflation, which included a chart on healthcare inflation. It’s outrageous, and has been for decades. The chart is about halfway down in the article:

http://wolfstreet.com/2015/12/27/i-was-asked-whatever-happened-to-inflation-after-all-this-money-printing/

Hi Wolf,

I seem to be in a rare mood this evening. Have you ever wondered if there might be a financial connection between the food industry, given the increasing numbers of additives in processed foods, and the pharmaceutical/medical industry? They’re definitely having an impact on health and if there’s a way to make money on it….

Good questions. Would certainly love to find out, now that we have trace elements of pharmaceutical products in our drinking water that got there because people flushed the toilet and that stuff was treated and released into the river system from where it evaporated and landed as rain on agricultural land and watersheds….

Here in British Columbia, Canada, health care has been rising way over inflation for 20 years, and now consumes 50 % of the budget. Without Obama!

The fundamental reasons are common to all developed economies- medical science is always advancing and people will always want the latest thing. Plus the fact that in Canada at least, health care unions and doctors are always getting salary increases above inflation.

I got to tell you one thing though- the system works.

My ex felt chest pains, ambulance picks her up, takes her to Victoria’s Royal Jubilee, she has stent put in, back to work five days later. No death panel ( she was 55)

When I burnt my hands, I was seen by a specialist within the hour.

High cost system ( not as high as US) but high performance in my experience.

I am starting to wonder if healthcare (along with finance and education) have become “bubble” sectors.

Yes, interesting chart. But if we view it closely and take the details seriously, it seems to say that those recessions (almost?) always start <> that curve crosses over into negative territory. So the cross-over doesn’t seem to be predictive. As the article points out, some important sectors are still strong, so although there are some signs of a recession threat, it’s definitely not here yet.

A reason why “this time it’s different” could be that the present dip in the curve may be largely due to loss of industrial activity supporting the fossil energy industry caused by the unusual collapse in oil prices, in turn caused by an industrial <> in the U.S. (fracking) combined with serious structural problems in the world’s second largest economy. Most of that damage has already occurred, oil will find its bottom as it can’t go negative(!), and we will realize that cheap oil is good for most of the economy.

Wolf,

Keep producing written material like this and POTUS just might call and suggest you are “peddling fiction”

I think the declines in industrial production in the early 1950s were the result of labor strikes, most likely the steel strike of 1952 which wound up lasting about 53 days.

So the recession exception from the early 50s was probably due to labor strikes.

Since we no longer have powerful private sector unions in this country, declines in industrial production are most likely a leading indicator of recession.

Add the end of the Korean War. It brought about a recession in Japan (which had been supplying UN forces with a lot of non-military material) and as soon as the Armistice was signed at Panmunjom large contracts were instantly cancelled by the new Eisenhower Administration, which had made the end of the war and deep cuts in military spending two of its paramount objectives.

The strong industrial production through all the 60’s was partly brought about by a renewed arms race with the USSR and the Vietnam War. As it can be seen as soon as the Tet Offensive was repelled and Nixon won the elections on the promise of withdrawing US troops from the conflict, industrial production tanked again.

Another military contract-related contraction was the one happening around 1990: with the Red Army starting to withdraw from Europe, contracts were cut again, albeit not at a level one may have expected. The First Gulf War, albeit largely fought with stockpiled material, brought about a rapid rebound, together with following large orders for military hardware from Gulf States such as Kuwait and Saudi Arabia.

The Tet offensive was repelled? It was a suicide offensive to begin with- launched in the heart of the US zone. Of course it would ‘fail’ eventually,

The take away was that it happened- and demonstrated for anyone with eyes and a brain that the war could not be won.

The Tet offensive was repelled? It was a suicide offensive to begin with- launched in the heart of the US zone. Of course it would ‘fail’ eventually.

Before Tet 68 Hanoi was not calling all the shots in the NVA VC entity, after, it was. Stalin and Mao Taught them well.

It did not prove the war could not be Won. As the Americans and Hanoi Both won their wars in Vietnam. As they were, in fact, fighting about different thing’s. Which is why the whole Vietnam event lasted so long.

If the fincial zone blows up it will impact on real activity. And the financial does look like its going to blow.

Trying to read a recession in industrial production tea leaves is rather pointless when the manufacturing sector is so much smaller part of the US than it once was.

Reading these tea leaves like industrial production and jobs is the sort of thing Fed governors and their acolytes do. They are Dr Pangloss to a man.

Peak oil is here.

The Fed got oil wrong. As long as oil is a producers market with high oil prices, the shale oil production is profitable, but as soon as the oil production rises and turns into a buyers market with falling prices, the shale oil production goes bankrupt.

Good summary of Friday’s action. Oil prices going into the 20’s is scary. My concern is that, at some point in the not too distant future energy companies, miners, and others are going to start going bankrupt. If they can’t get cheap financing to continue their operations and they are extracting resources at a loss, how long is this really sustainable? And it’s not just oil but iron, copper, and other resources & minerals.

If bigger corporations start to go bankrupt over the commodities crush then it will likely trigger derivative losses in the billions/trillions again, much like in 2008 with the credit default swaps. How long can the federal government and federal reserve continue to bail these guys out while keeping “faith” in the system.

Exploration and drilling have come to a halt. But existing wells are still pumping as the debt levels need to be sustained. So it may last a while.

Commodities always cycle like this…high prices bring in more production which in turn adds too much production and prices come down. Then they wind down to a point where production is too low.rince and repeat.

It may have started already. I have several family members who work for Arch Coal and they entered Chapter 11 on Monday. Arch is the 2nd largest coal producer by volume in the US. Miners are going to have to weather the storm and see what happens.

Nothing personal but how coal is not banned with nat gas dirt cheap is a puzzle.

How can the US can bitch at China and Canada while a cleaner fuel is in over supply is pure politics.

There are votes in coal country but none in Alberta.

Simple Coal owns to much of congress, STILL.

Bad numbers and more lay off announcements. It is starting to sound like a rcsssion again. Unemployment claims should be jumping up soon…what will the fed do when their rosy employment numbers start going south?

Nothing. They can only increase or decrease liquidity. They don’t have the fiscal tools to deal with it. Congress retained the tool of fiscal stimulus.

I think it will be the junk bonds that start this rock and roll party going. To much money has been lent without worrying about risk to marginal enterprises, including oil and mining but to many others. Already the first of these junk bonds are being defaulted on and the interest rate in refinancing has climbed dramatically.

We are already seeing the slack in consumer spending. Some due to slack wages but also the diversion to health care costs and other insurances plus rising rents and taxes, services and well, most of what the consumer needs and can not control has been going up, except the income.. This is finally affecting retail and will eventually affect their loan servicing. This trend is going to continue causing lowering demand and lowering sales and lowering revenues to many enterprises.

As the winter turns to Spring, more and more corporations with declining revenues are going to come to that point where they are forced to do something.. Get more money, lay off personnel, pray….

By that time, no matter what the FED does, interest rates on marginal loans will be significantly higher and the dominoes will be falling…

The markets may already be much lower by then as they are suppose to be seeing the economy 6 months or more out..

Doesn’t mean we won’t have decent rallies on the way down.. just to suck in more of the private money as possible..

By the time we reach the end of this, people will be depressed.. funny time for this to happen in an election year.

There are all kinds of things that occur in economic downturns. You can point to any one of them as indicative of further decline or improvement, some being more or less effective in their predictive power. Some will be better at identifying a particular point in the cycle, but that’s all. But that doesn’t give you any insight as to the primary movers of improvements or declines. These things are just the effects of the primary movers. Lets say you focus on QE. The major thing you’ll notice is misallocation and maldistribution of capital, but that’s all you’ll see if you just stay focused on that. The essential question is what is the prime mover. It’s the only thing that’ll give accurate framing to the other effects.

I guess the prime mover is the downward slope in the Velocity of Money chart https://research.stlouisfed.org/fred2/series/M2V which shows that consumers have had less money for some years now and that less money causes less consumption and less consumption causes less demand for imports which has caused China to contract which has caused the demand for resources to contract all the while borrowing accelerated. Leading to defaults of the weaker loans, i.e. junk bonds.. and …… not rocket science.

“MASSIVE overcapacity has caused china to contract, as manufactures in china. Try to be the last mans standing, by undercutting every other manufacture, with state subsidys.

You can buy new Chinese stuff, all over the world, for less than what it cost, to produce and ship.

The retailer isnt taking the hit, as he got the stuff for free, on a sale or return consignment. ( which is how the Chinese get around the dumping regulations.)

China stole our industry’s, and our jobs. What they didnt do, was steal the knowledge to protect themselves, from the money printing required to do that. With their Global vampire corporation buddies, they have sucked to much out of the golden goose “AKA the hated western middle class”.

This mess has now got to the stage where china, has to take the big hit, and CCP are not willing to allow it.

With the kind of overcapacity and undisclosed debt they have, stripping every foreign investor, and new non Xi clan chinese billionaire, of their assets will not come close,to starting, to resolve, the issue.

The US is going to have issues, think of some of the EM nations. China demand will never be as it was again.

When china realizes it will be a very long time, before they even possibly become ready, to become and advanced economy, watch out for them to start getting, very nasty.

And if you want to know why the Velocity of Money is in decline, it is about the system that has allowed the accumulation of most of the resources and income in the hands of fewer and fewer people. Thus the distribution of income to the less fortunate has finally rippled thru the revenue system which is going to lead to a collapse. When an economy is based on 70+% consumer spending and the consumer’s income is increasingly strangled by those at the top… it is just the inevitable consequence. It is just the timing that has always been the question. And still is.. we won’t know if this is the big heart attack until we see it in the rear view mirror.

In response to both the above-

Velocity of money is just a metric possibly reflecting some of the effects of the prime mover. In your other arguments you’re walking all around it. This is economics 101, it doesn’t get any simpler.

QE and ZIRP/NIRP means lots of extremely cheap dictated funding to those closest to the Central Banks. This invariably has led to a colossal waste of capital. As these loans no longer get serviced and the spent capital goes to zero value, deflation sets in.

That is why interest rates should be set by the market mechanism, not the dictates of self-appointed economic gods like the Fed.

Define market mechanism.

AsYouLikeIt, I know you have a serious point but your vague statements leave me wondering a lot.

Prime mover… the US economy is not just the US economy but a part of the world economy. What are the prime movers in the world economy? Energy is probably the main prime mover as our modern economic system will not operate without it. Then the internal combustion engine came next and the list of technical advances is long.

Then fiat money and *modern* banking which allows the control of resources to be manipulated by a few are prime movers.

There is the US military that directs, controls and protects the flow of energy and resources.

These are the main prime movers but what has been discussed in this blog is the current economic situation and where we are heading..

As for econ 101, supply and demand.. which we have more supply and less demand in a highly leveraged world where sales are mandatory to service the debts incurred and where sales are declining because to much of the profits go to either the few or to service the debts already incurred. Thus leaving less money for demand of goods.

Yes, but the answer is so simple that pitching it out early on is just asking for incredulous responses because of it’s simplicity. Demand is always the prime mover, everywhere and at all times.The whole edifice of commerce is erected towards it’s satisfaction. Any other activity in variance to this leads to misallocation and maldistribution of capital and resources. You’re correct in the description of the strangulation of demand by withholding monetary function (maldistribution of capital). The demand is still there, it’s just not being met due to privation. The monetary function is being maldistributed towards areas where demand doesn’t exist leading to non-productive ends, the feeding of a golden calf.

See the film The Wolf of Wallstreet. There’s one scene in it that makes the point quite well.

A demand for energy and matter to live and thrive. Since matter is energy and the sun is our source of energy, it’s all Sun Worship.

The real profits, go to the few, in or from china, as they Make things.

And these days there are very few, real profits.

I am only a simple person but the 1950’s are a lot different than today.

The USA and most of the west has outsourced most of its manufacturing to China in the last 20 years.

Inflation was driven by wage inflation; i.e. there were more jobs available than workers to do those jobs in the 60’s meaning employees could demand more wages.

Increase in GDP was really caused by increase in debt; especially consumer debt over the last 30 years.

How the western economies could believe that we could just keep selling services to each other on credit defeats me.

Now the credit has dried up, there is less money to spend on services and therefore less service jobs required and more demand for those few available jobs that companies only need to pay minimum wage for.

A good overview and your qualifiers re. services sector are very apropos. I am glad you and most of your readers are sceptical of the FED generated wealth effect; it is the incomes effect coupled with much higher taxes on incomes above 200K and a fully linear Social Security tax on all incomes that will bring about an evenly ordered capitalist society. I don’t understand why Sanders does not talk about 3+3 =6 individual and employer joint payments for a Medicare for all. Hospitals and Physicians will remain happy; it is the insuarnce companies that will let loose their lobbyists.

TAX TAX TAX TAX TAX the rich.

Is NOT the answer to Americas problems.

Flat or NO personal income tax ( Personal income tax did not arrive until after WW I), national consumption tax, and an increase in real corporate tax paid, by closing loop holes is the answer.

Which means first campaign funding reform has too take place. As needed tax changes, that work ,will never happen, until campaign funding, is radically reformed, so reducing corporate influence.