Default Rate Highest since 2009, US Distress Ratio Soars.

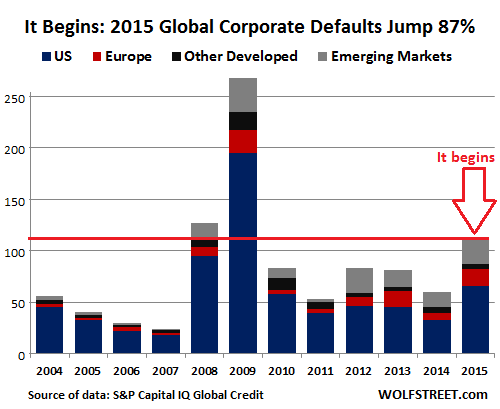

Standard & Poor’s slashed the credit ratings of 112 corporations around the globe to default (D) or selective default (SD) in 2015, according to S&P Capital IQ Global Credit. The highest number of global defaults since nightmare-year 2009, when a previously unthinkable 268 companies defaulted, and not far behind the second highest default tally of 125, in 2008.

The oil & gas sector led with 29 defaulters (26% of the total). Metals, mining, and steel followed with 17 defaulters (15% of the total). The consumer products sector and the bank sectors tied for the third place, each with 13 defaulters (12% of the total).

So where are the defaulters? In Russia and Brazil? The economies of both countries have been ravaged by deep recessions and other problems. They rank high on the list but the country with most of the defaulters is… the US.

In total, 66 defaulters were US issuers, up 100% from 33 in 2014, and the highest since 2009. US defaulters accounted for 59% of the global total. Some of this dominant share of defaulters can be attributed to the size of the US economy and the enormous size of its credit market. But the US is also the epicenter of oil & gas defaults, with contagion now spreading to other sectors.

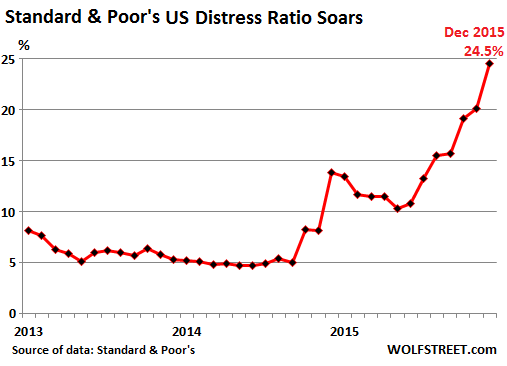

An indication of what’s coming in 2016 is the Standard & Poor’s Distress Ratio. It’s the proportion of junk-rated bonds with yields that exceed Treasury yields by at least 10 percentage points (option-adjusted spread). And this Distress Ratio soared in December to 24.5%, up from around 5% in 2014. There are now 437 bond issues tangled up in the ratio:

Of those 437 bond issues in the Distress Ratio, 127 have been issued by oil & gas companies. The metals, mining, and steel sector has 71 bond issues in the ratio. The remaining 239 issues are spread over other sectors. And a number of these distressed issuers will default down the line. So defaults in the US are likely to get even uglier in 2016.

Emerging Markets were in second place with 25 defaulters, up from 15 in 2014 and the highest since 2009, according to S&P Capital IQ Global Credit, “owing largely to a credit spillover effect of the increasingly unfavorable geopolitical climate in Brazil and Russia.” Brazil sported eight defaulters, and Russia seven, thus occupying the second and third country-rank behind the US.

In Europe, where QE and negative yields are raging, S&P downgraded 16 issuers to default, up 167% from 2014, despite the current monetary policies that should make defaults virtually impossible. The remaining 5 defaulters were spread over other developed nations (Australia, Canada, Japan, and New Zealand):

There are different reasons companies can be downgraded to D or SD. Of the 112 defaulters, 36 (or 32% of the total) undertook “distressed debt exchanges,” a favorite extortion method in the US oil & gas sector, whereby the company tells investors to swap existing bonds for new bonds with a huge haircut, or risk an even worse fate in bankruptcy court. This tool is becoming increasingly popular: in 2015, 32% of defaults were distressed debt exchanges, up from 23% in 2014.

Another 32 defaulters failed to make interest or principal payments, while 22 filed for bankruptcy. Among the remaining defaulters, 11 were the result of regulatory interventions.

Standard & Poor’s global “weakest links” – companies on the lower end of the junk-bond spectrum most in danger of defaulting – reached 195 in December, the highest since March 2010 (when there were 203), representing $234 billion in rated debt, with oil & gas in first place and financial institutions (!) in second place:

Drops in oil prices affected the profitability of oil and gas companies, where spreads have widened considerably. This spread expansion has had a spillover effect upon the broader range of speculative-grade rated firms, where spreads have widened considerably leading to increased default risk.

What’s next in the US? Standard & Poor’s upgraded 18 companies with total debt of $49 billion, but downgraded 60 companies with a breath-taking total debt of $1.3 trillion (with a T).

So 2015 ended on an ugly note. But there is still no crisis of any kind. Yes, the price of commodities has collapsed, but money is still nearly free for high-grade borrowers. Numerous governments and corporations can borrow at negative yields, thus getting paid to borrow, a central-bank engineered absurdity. And many more can borrow below the rate of inflation – i.e. for free. And yet, defaults are surging.

And it’s just the beginning.

The non-dollar world has piled on nearly $10 trillion in dollar-denominated debt, betting that the dollar would never rise, and that US interest rates would stay low. But the dollar has soared and US interest rates are rising. The last time this happened was 1997. It triggered massive currency outflows from those countries and all kinds of crises, including the big one at the time, the Asian Financial Crisis, according to the economists at National Bank of Canada, who added, “It would be foolish to rule out a similar if not a more devastating outcome.” Read… What Will Knock the Dollar off its Perch?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I have patiently been trying to educate myself on Fed monetary policy mechanics and at the same time true that up with the market place.

The Fed can shove free money to their closest friends, and swap cash for trash or trash for cash (repo and reverse repo), also with their closest friends, but they can’t compel those same closest friends to engage in lending suicide with dead beat borrowers. In the good times, credit was available to all. As we are more prominently faced with a real down turn, credit is going to dry up. This is in the face of record debt all over the place.

To be clear, this is a contraction of the monetary supply and without expansion of the monetary supply (i.e. new credit) things are going to get VERY deflationary. Do get out of debt and do hold physical cash some place safe (e.g. safe deposit box or safe) or a COI/very short term bills in your TreasuryDirect account.

And … the Fed may well hold rates where they want them, but only for their closest friends. Everyone else downstream is going to pay – and dearly if they have the option at all. So, I am still curious how the fed will hold the yield curve to the shape they see fit – as things slide away into the oblivion.

This is how I currently think the Fed loses control. Their only option in this point is to extend their relationship to new parties, or let their close parties middle-man the trash for cash – and the unwind becomes about as legendary as Maiden Lane. How did that turn out? Oh, that is right, they blew another bubble and turned a profit. Think that is going to work out for them again, on an even bigger scale, on the back of an even more broken market/economy – starting at ZIRP?

Again, to be clear, it is going to be very interesting when sectors of the real economy, where people work and produce and provide services, go tits up for lack of credit (e.g. to float payroll), while at the same time, free money is available to all those close friends of the fed, who push paper and claim commissions and spreads. Insiders are going to loot all the real assets and everything else is going to burn.

This is an old game, but blogs, such as ZeroHedge, WolfStreet, Market Ticker, and others continue to shed such light that this may very well be a different theatrical production entirely as the masses may finally see the light of what is really going on and perhaps, just perhaps, justice may prevail in the end, however messy it may be.

But, I still over estimate humanity, even in my older age. Yet now, everyone is watching, and more importantly, following along.

Thanks Wolf and the community here. Best comment section around these days. I am pretty sure Wolf puts in time keeping the comments section amenable to his readership and I do want to say thanks. Hopefully my “still-a-few-million-short-of-eccentric” ramblings aren’t too annoying. :-)

Regards,

Cooter

They still have the last resort option to combat deflation -injecting money directly into the bloodstream i.e. our bank accounts. Finland is supposedly doing it this year. It will come to the US eventually, and when it does, you will have your inflation.

Aaron, As far as I understand the process, the FED doesn’t have the right to put money in my account but Congress, thru the US Treasury does.

The FED may supply the money via new debt issues but that would take our dysfunctional Congress along with our out of touch President signing such a bill into law.

I really do not see this happening soon as between the three entities, a lot of mistrust has enter the system since the last crisis.. And due to campaign contributions and other indirect additions to the Congress and Presidential accounts, those with the biggest voices will be the same as the last time. And other than Elizabeth Warren and Bernie, the voice of what is better or good for the people will not even be in the conversations. They believe in their own koolaid colored vision of the future.. although as most on this site know, it is really cognitive dissonance.

I enjoy Cooters replies as much as the articles. There was no rambling, only cold hard facts and good analysis. Keep up the good work.

Thanks, Cooter.

We always enjoy your comments and learn from them. And, just in case you have any doubts: they’re never “annoying.”

The only way to keep the monopoly game going is to add several more “pass go – collect $200” places on the board – otherwise I think you are correct and we will see the same bankruptcies and deflation that always occurs at the end of the game. But I don’t expect this Fed or Congress to have enough insight into economics to change the game – they all drank the free-market koolaid.

CrazyCooter –

I once had a primary care physician I worked with tell me “about 35% of what we do is shamanism”. What he meant is his ministrations worked best if his patients believed they work.

I think this same thing is true of the Fed. The Fed has strongest effect when we all believe it actually has control of the economy. And that is unraveling. The Fed’s tools, interest rate changes, have been spent. The most recent increase was solely to protect the Fed’s reputation – after all they promised an increase in 2015. In a world where no one believes in the Fed the results, as they say, “are unpredictable”.

If you try to educate yourself on FED, you should read the formerly great Asia Times, for example this article “‘Bent’ Fed now blind”: http://www.atimes.com/atimes/Global_Economy/GECON-01-290914.html.

You might also find some archived articles from Henry C.K. Liu and Julian Delasantellis.

Just my few cents.

There are not as many articles on WS as ZH however the ones that are published are generally of very high quality (ZH has a lot of good stuff but also a lot of rubbish)

Let’s just hope the Zero Hedge rabble of riff raff doesn’t show up here commenting. Of if they do those not contributing anything of value should be run off.

ZHer’s invading Wolfstreet? Lets hope not!

ZH has great content and I reload their main page many times a day, but the comments forums have gone to hell for the most part.

I still skim the comments for stuff that is more than two sentences long and/or by folks whose previous opinions I respect. There are still some gems there, but I don’t always have the time to sift through them and usually I don’t find anything worth considering.

I once asked ZH via their tips email to add a feature so I could “hide” or “collapse” comments by user and have that stored in my profile. That would bring me back to the comments there as my time would be more respected and I would have to listen to the same jew hating idiots spouting off nutty conspiracy garbage – they would be hidden by default and I would only be looking at what was left.

Regards,

Cooter

Seems to me that the provisions of chapter 12, grace periods and ‘restructuring of debt’ are designed to avoid defaults (credit events) which would activate default swaps. Is this the case ? I can see the benefit to the borrowers and exposed lenders, But why would an entity that has hedged the risk with a CDS accept loss of interest/principal by agreeing to a restructure? Perhaps Wolf or poster could tell what mechanics I am missing – seems an important aspect.

Again, I recommend you all go and see “The Big Short” movie. It clearly shows that when the mortgages were defaulting and the CDS investors were expecting to cash in their holdings, the brokers colluded in deliberately mispricing the CDOs. The brokers were trying to make the CDS investors sell out to them first. Are you getting the picture, now.

I would recommend people to read the book by Michael Lewis on which it is based – it was much, much better.

Default swaps are a rigged game. A default has to be declared/acknowledged by ISDA to trigger a default. Look at who runs that organization and then tell me when there is a default, and it is going to cost charter/member banks of ISDA billions, if they are going to declare the default a real default.

Of course they won’t even if the language of that decision is more tortured than Robert’s opinion of Obamacare. I can see it now, “This default isn’t a real default, it is a TAX on the creditors, so therefore there is no default.”

Regards,

Cooter

Cooter, don’t get your Jockey’s all crack-snagged trying to figure out the Fed. There isn’t much to figure out: their only concerns are THE BANKS. Their only reasons to exist are THE BANKS. The only things they care about are THE BANKS. To that end they are a conduit for picking the pockets of the citizenry by inflating the currency, Three-Card Monte shifting and exporting of debt, and the elimination price discovery.

As a result, most sectors of the economy ARE tits up, not for lack of credit, but for lack of any true connection to their market because prices, including the cost of money, have no true connection to reality. In short, ‘the crash’ has already taken place (I’ve been saying this a while now) and what we see now is the Potemkin Village that has taken its place: based on nothing, running on nothing, and going nowhere.

I don’t disagree – I think the crash really started in 99 and has been bumping along since. They screwed up the price of money, everyone is invested in overcapacity, and it is impossible to make sound business decisions in this environment.

I also stated that their cash for trash/trash for cash was only for those closest to the Fed and everyone else is/was SOL.

I periodically go on these rolls (1) to summarize everything neatly, at least as best I can figure, and (2) elicit potential corrections/refinements of points which benefits all readers.

Case in point; not too long ago in a discussion on SDRs someone finally pulled back the curtain for me such that I think I finally understand how they work now. This is important because many folks will cite SDRs in some argument/prediction/opion, but the mechanics of how they actually work don’t fit the argument/prediction/opinion made. This helps sort the s**t from the shinola so to speak.

Ultimately what I learn along the way helps me make personal life decisions to produce the best outcomes. :-)

Regards,

Cooter

I believe that he dollar is backed by something far more sophisticated that gold. I believe that the dollar is backed by science, technology and patents. The dollar is of course then also backed by culture and brands, the entire American economy. The Fed has exclusive right to print the dollar and the banks that own the Fed, in a way own the dollar.

American and European International banks are intertwined by ownership (they are too connected to fail) and the banks own the Transnational Corporations that in their turn own the science , technology, patents, culture and the brands of the modern global economy. This “entity” controls 80% of the global trade today.

I don’t know what their are up to, but I’m sure it will be very interesting to follow the events that are about to come. I’m sure the dollar will survive and that the “Bank” will survive too. Because if they don’t survive…

Yoshua, and it use to be backed by the rule of law.. which was probably the most important principle. The legal system in the US, backed by our strong military was the underlying support of the dollar overseas. People could write a contract in US$ that was enforceable.. I believe that this support is being undermined by our US Department of Justice, not putting the fraudsters and financial criminals in prison. Also by a US military that seems arbitrary in its actions.. Both a consequence of our captured government.

It appears to me that is the biggest drawback to the Yuan. You have no pretense of justice in China, not even for the Chinese. Certainly not for any other country. The Euro has different problems. It has no real central government.

Agree with all your points.

The lack of personal freedoms in China will limit that government’s ability to promote their currency internationally, although that may change if backed by gold.

The domestic legitimacy of the Chinese government rests on their management of the economy. It will be interesting to see how this pans out politically.

I’m sitting here on a pile of cash where it isn’t enough to pay for a house, but yet I got nothing to spend it on because everything I have is more than good enough. I’m pretty sure it’s plenty of people like me all over the world.

Renting is cheap and sitting on a nice pile of cash helps one sleep soundly. ;)

Debt default in USD is making it more valuable. Global slow down is becoming obvious. Keeping the powder dry is a pretty good strategy right now, IMO. The cycle is about right for a real correction. I’m seeing assets that I follow, and purchase, starting to show pretty consistent price weakness over the last 6 months.

Is this the point in the conversation where it’s appropriate to ask about a “Minsky Momemt”?

Just as side note i’d like to share in regards to Credit Cards and anyone who holds debit with them. I’ve received a lot of ” new policy forms ” from the CC companies for merchants. Even my PayPal account has them and they are all going into effect in April. From what I have read all the rates for merchants are going up this Spring and they are making merchants responsible for everything basically. Now I’m just guessing here but I think there will be an interest rate increase coming this year on Credit Cards. But idk, I’m just guessing at what I’m reading on these new forms that I have to sign for my store. I will probably cancel my AMEX one seeing how that seems to be the worst in regards to me signing over my first born child, my arms, legs and nuts.

Something to look into Wolf I may be wrong, basing it on what I read with these new forms.

The new chip cards require the merchant to use the physical card to be protected for the charge backs. If they do online or phone sales without the physical card they are on the hook for all the loses. That is basically the biggest change for merchants. As far as credit card interest rates, mine are obscene already.

That was also my understanding. The readers have to read the chip now, not the stripe or manually inputted numbers. If a non-chip method is used, they are dumping responsibility on the merchant.

That said, I have no idea how this goes for vendors that supply the POS and card readers – all of which have to be upgraded now. I suspect there is some fat licensing fees in there somewhere just because they can stick someone else with the bill.

Check into avoiding the liability with the new chip reading machines. Not sure what this means for customers who don’t have the chipped card – extra fees by the merchant to cover losses?

Regards,

Cooter

Interesting, I would have thought in the US chip cards would be prevalent all over the US , certainly they’ve been around a long time here in NZ.

Just wait until they bring you the contact-less payment terminal for low value transactions! Under $80NZ and just wave the card at the terminal and… it’s gone! (your $$$ anyway)

I think the idea behind this change is so the bank captures more of a percentage of all sale transaction value, over here eftpos cards can be used everywhere but there’s no sale% fee collected by the bank on the transaction. They want more of that so encourage the use of the credit card as the ‘normal’ way to pay. My bank even offers a phone app that accepts credit card payments now… the phone trying ever harder to replace the wallet.

Personally I’m old fashion and like banknotes…

What to do when SHTF? Your plan should fit each individual. My plan? My house, and cars are paid off. I have a years supply of cash plus Gold and Silver stashed. I do have credit card debt It will be paid off when extra cash is available. Everything I own is protected by Trusts. I realize card interest is high but if SHTF all they can take away is the cards. In making your plan, take into account the laws in your state. Here in Texas the laws protect the individual which makes the planning much easier.

Recourse HELOCs with the home as collateral are also not enforceable – if it is the home stead. Check with your RE attorney, but that is what mine says. I am going to tell the bank to stick it one of these days, just need to get some other things cleaned up first.

If you didn’t know. ;-)

Regards,

Cooter

! How are you going to eat gold and silver ? The coming collapse is going to affect us all! Be prepared . Get to know your neighbors, because the feds are not going to help you.

I just love the term “Free Market.” I’ve yet to see one that is “FREE” meaning, I need not risk any capital, or credit to play, and if you like a trade Bazaar, yup we got it our stock market. To say they’re fairly priced one would have to ask, “according to whom, or what?”

Credit is the big question. Frankly, a good strangling of credit either by availability, or sharply increased rates would be a great thing!

You already have weak demand, let us make it weaker to non-exiostant, strangle the yet alive Zombie companies, and begin to start over.

This should have been the “colon blow” that was needed in 2008, but for government interference by the always puking secretary of the Treasury, and his trusty Fed Chairman, along with many of questionable character, here we yet stand.

My grandfather was famous for saying, when someone asked him how much something was worth (car, house, land, etc):

Well, that depends on whether you are buying, selling, or paying taxes.

Regards,

Cooter