Look at the Fed’s dashed hopes!

By Larry Kummer, Editor of the Fabius Maximus website

After a year of waffling and flip-flopping, the Fed finally decided to raise rates, a decision that had the surprise of a sunrise. Yet there is a behind-the-curtain drama of clashing hopes and fears by the Fed’s governors and staff.

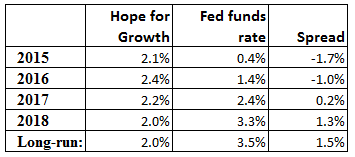

This conflict does not appear in their statements or press conferences, but in their economic projections. Let’s start with their hope for continued economic growth: the predictions released today for GDP and the fed funds rate…

This paints a mildly optimistic picture. They have abandoned hope of a “take-off” – of growth accelerating above the 2.2% average of this expansion – but still have faith that no recession ends this already old expansion during the next 3 years, or actually ever.

But look at the Fed’s dashed hopes!

In June 2011, the Fed predicted that real GDP growth would peak in 2013 at a booming now unimaginable 3.5% to 4.2%, overheating vs. their hoped-for long-run rate of 2.5% to 2.8%.

After years of slowly lowering expectations, now they hope GDP growth for this cycle will peak in 2016 at half that. Worse, they believe that the US economy’s long-term growth rate is one-quarter slower than they believed four years ago (2.0% vs. 2.6%). That creates a sad symmetry, with 2% both their inflation target and their expectation for US growth.

We see the Fed’s growing desperation in their decision to raise rates now, despite forecasts that have been darkening during the past four years:

They did not raise rates because the economy has improved; they did so because it has not improved.

They act now, fearing that the recession will arrive before they can raise rates enough to give them the monetary ammo to fight it. So the Fed governors have begun the gradual process of raising the fed funds rate in tiny increments to 3.3%, which would restore a more normal relationship between the fed funds rate and GDP.

Good luck with that.

Jacking up rates will slow both domestic consumption and exports; raising rates while other central banks are lowering might send the US dollar into orbit. Worse, large parts of the US economy are already slowing (e.g., exporters and manufacturers), as are the economies of key trading partners, such as the oil exporters (including Canada) and many emerging nations, especially the big ones: China and Brazil.

As the economies of commodities producing countries around the world weaken due to the commodities rout, they also import less from the US, and in this way, falling commodity prices will further damage the US economy.

Some key sectors of the US economy have grown rapidly, such as the auto sector, but only because it was funded by excessive, loosely underwritten debt, including a large portion of subprime debt. This boom in auto loans is one of the symptoms of the imbalances and weaknesses typical of an old cheap-credit-based expansion shortly before the end.

Why don’t they tell us all this?

The US economy is in a peculiar situation. To use a pilot metaphor, it has flown into the “coffin corner“: it cannot grow faster, and slowing down probably starts a recession.

Politicians and government leaders have a long history of managing the expectations of the public. They consider it the most powerful tool they have. However, once leaders start on that path, they will find themselves routinely lying before they reach its end [see the Big List of Government Lies and add your favorites in the comments].

Fed leaders too have figured this out. They believe that managing the expectations of the public, and particularly the expectations of big business and Wall Street, to be one of their most powerful tools. So they “talk up the economy,” regardless of how mediocre it is, and regardless of what economic misjudgment that will produce, as Governor Lockhart did last week, to accomplish whatever their goals may be. By Larry Kummer, Editor of the Fabius Maximus website.

Even as they’re raising rates, Yellen once again put negative interest rates on the table. In Europe, negative interest rates have already morphed from sheer impossibility to solid reality. But there are some unintended consequences. Read… “Perverse, Unpredictable Effects” of Negative Interest Rates: Mortgage Rates Soar in Switzerland

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Perhaps a rate roller-coaster is the future? Up then down, then flat, then up,….

What I find bizarre about this is that raising rates is, as I understand it, be definition contractionary. Who looks at the economy right now and thinks “OK . . . time to slow things down . . .”? Of course, I live in Edmonton, so my perspective is a little skewed.

Personally, I think that the only justification for this rate hike is that the Fed wants to be able to cut rates in the future if the economy worsens, and has somehow prioritized this over supporting the economy today. It makes about as much sense as my boss coming and telling me “OK, I’m giving you a pay cut for 2016 — this will let me give you a raise in the future, though!”

How’s this for bizarre- I’m also named Nick and I live on Vancouver Island and I was just going to write what you wrote!

Raising rates so they can cut them if things slow down- when they ARE slowing down, fast.

I would have agreed with a rate cut a few months ago- but after the ongoing carnage especially in the last two weeks…

I feel for Yellen though. Ben had way better times to raise

Most Canadian men skeptical of the current state of the economy tend to be named ‘Nick’. It’s a bit of a mystery, top scientists are working on why.

I wish the Fed took its inflation targets seriously, as in tried to reach them when they were undercut, not just when they’re exceeded.

I wonder if part of their haste to raise has to do with the fact that when at ZIRP, the rate can only go up — and that this unidirectional probability affects all the people who bet money on things that are affected by this. It would be sort of like having a horse race with just two horses, Wins and Stays The Same, where in the past you had three. That dynamic might change markets in ways that the Fed doesn’t like. Just a guess, though.

I agree. I’m a Nicholas, but will call myself Nicko (after childhood nickname), too many Canuck Nicks as it is! :D

but did they actually raise them? I read that they only agreed to pay their member banks who have reserves stored at the FED a 25bp increase. This is giving more free money to the member banks.. Has nothing to do with you and me, except that it will make the US deficit worse because they are giving the rate hike with money that would have gone to the US Treasury.

So from what I read, this is really stealth QE. Not a rate hike in my savings rate…

But, but , but Janet Yellon said the rate hike would benefit the Savers also known as depositors class.

So I checked with banks to see what they were paying savers. The same old story, we raised interest rates on credit cards but we didn’t raise interest on savings as we have too much excess cash deposited with the FED drawing interest.

The whole thing is a dog and pony show. They had to raise because the market already started increasing rates.

Most pension fund models were based on 6 to 8% and they have not been able to achieve yields like that in a long time. You can bet that some pension funds have been pushed into risky trades, also here in Europe it is compulsory for pension funds to hold a % of government bonds so if these funds were put under pressure and they lost\ or and to liquefy their position government bonds could come under pressure in a fire sale.

With the differentials between the USA & Europe & Asia becoming more profound this will cause large capital inflows into the USA which will inflate equities and assets which will force Yellen to push interests rates higher. This is when you will see great pressure on other countries and you may see 1932 Mk2. There is about 200 trillion in the bond market and we see everyone jumping into the short end of the market.

The Fed has painted themselves into a corner with no nice way out.

I don’t pretend to understand this issue, and I can’t comment on what you’ve said, beyond pointing out that I always thought the role of the Fed was to balance inflation and unemployment. To my knowledge, they don’t take this balance seriously, as exemplified by them not caring if they fail to hit an inflation target that is higher than what was achieved — but caring about pension funds isn’t pat of their mandate. At least formally. I think.

Nick, the Fed may say that their role is to balance inflation and unemployment, but that is not the truth. The Fed is a PRIVATELY held banking cartel that has been given the power to issue currency. The Treasury should be the Government instrument to issue currency.

On 4 June 1963, JFK signed Executive Order 11110 which returned to the U S government the power to issue currency without going through the Fed. This was a fatal mistake.

Wolf Street readers may enjoy reading:

http://www.wallstreetonparade.com

The only option left is total default and reboot of International Banking System. And this is the way things will unfold, because there is not even one major currency to be trusted and used as a reference for value.

The fed is irrelevant to the average person. Zero interest rates were never the option for any normal borrower. Credit cards, mortgage rates, student loans, were all at hundreds or thousands of basis points above the federal funds rate. The public thinks of the fed as the protector of the fraudster class, and they are right.

The Fed may be irrelevant to the average person on the borrowing side, but on the savings/capital formation side, the Fed is killing everyone but the 1%

Very troubling the inflation conundrum. how can inflation hold low with massive & stupendous monetary ease?

Maybe it’s the ‘new’ economy – we’ve become so efficient with no variable costs and little fixed costs that supply can & will rise with no demand pull – and naturally this confuses the models and the brilliant people who study them & prognosticate from them.

Season’s Best & Here’s to An Inflation-less ’16…PJS

My belief is that a disproportionately large part of the extra ZIRP and QE money has been sucked up by people and entities least needing it for everyday living/spending and it has not flowed back into the economy in any balanced way. How much food, clothing, household goods and other necessities does a very rich person need to buy for their personal use? Yes, they may buy expensive luxury items but do those few luxury items counterbalance reduced spending by a much bigger proportion of the population that can not afford to spend?

I suppose I do not have data, but just anecdotal evidence. I see some parts of the country with very a very poor recovery and other parts such as San Francisco that are extremely overheated with doubled housing prices (over not cheap ones 4 years ago), hugely increased salaries for some job types and rampant real estate and other speculation. The wealthy money wants a return and is bringing larger and larger dumptrucks of money to the party happening in selected industries and locales in any attempt to secure the money or get more growth from it.

It’s too bad the Fed can not effectively help cool overheating in some areas and and heat up others that need it. All their intervention seems to just make existing trends worse whether it’s an overheated or a depressed market.

It doesn’t really surprise me that socializing the risk while privatizing the rewards from the last crisis hasn’t helped most people. If they’re able to play their cards right, the top people might be able repeat the trick during the next crisis and absorb even more freshly printed money than everyone else, yet again.

i’m of the opinion that what they are doing makes perfect sense. it will attract funding. it will instill a little discipline.

it will bring us out of sinai.

There are I think 2 agenda(s) in increasing the interest rate.

1) to flex muscle – to try to prevent China’s currency from overtaking the dollar. (Excuse my ignorance of terminology, but the informed shoyod get the drift.)

2) admission that almost zero rates isn’t working as envisaged so better perhaps to discourage debt and focus on saving. Money on deposit earning interest is an investment method that has been hard hit over the years. Perhaos if interest rates had been hiked up in the aftermath of the sub- prime crisis, the short term pain for many would have been a small price to pay for long- term stability. All that low interest rates have done is oave the way for long term instability.

I suspect they realized that after 7 years they have done all they can.

They just threw the towel in.

No mas…….

This is the END of tightening, not the beginning. Tightening began with the end of asset purchases a year ago in October. The entire world is in a deflationary spiral and central bankers hate it when prices go down. Expect the Mother Of All QEs very soon.

When that happens will also be when oil prices start to go up – a weaker dollar mean higher oil prices – and then: back come the fracking wells!

Yellen missed the first several busses, and now finally -at the least opportune moment filled her “promise” to raise rates in 2015.

Was it the best time to raise rates? Hell no, it was well PAST prime time from the indicators I’ve seen. As an alleged “Data Driven” enterprise the FED must have had access to some grandly unique data to raise even .25% in December. Not earth shattering is the .25% goose, and we should have done this a year ago. Maybe we would have contemplated a 2nd rise since then, and perhaps passed on any action by Data alone in December 2015.

The bull market is aged, we are within 10% of recent market highs, oil is in the dumper with most commodities, and further growth seems, well not on the horizon.

I am no FED banker however, and they have no working crystal ball. They did as promised “begin to raise rates by the end of 2015.”

The question is, ‘now what?’

After reading the OECD economic growth forecasts/misses, I concluded that the crystal ball is a more accurate tool than a panel of economists.

@dCynic

Economists are obviously lost in books and theories. The real economy is wrecked. Whether by intention or accident, the private banking cartel has killed its goose. Now, we real economy people are working on how to live our lives. Think of all the Boomers now collecting SSI. The unwind is happening. Eventually we don’t listen to liars and walk away.

The truth is they are protecting US currency – fearing people might lose faith in them if they continue with zirp policy