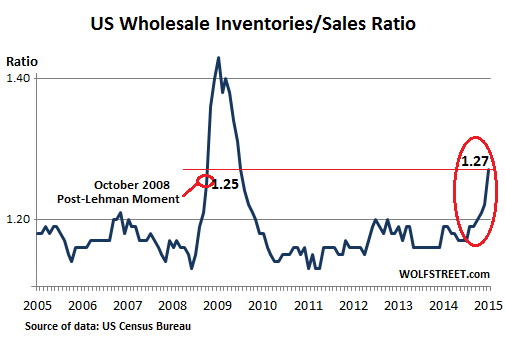

Wholesale inventories-sales ratio spikes worse than in Oct. 2008

A month ago, when I last wrote about it, I half-figured, half-hoped that the lousy wholesale inventories and sales for December had been a fluke, that some numbers had gotten lost in the shuffle, that the trend would reverse in January. Now the January data is out. And it’s terrible.

This time, there weren’t any redeeming qualities left.

Inventories tie up cash. So inventory management has become a sophisticated obsession, tightly connected to sales forecasting. Merchants who are optimistic about sales prospects stock up for it. When these hopes turn into crummy sales, inventories begin to balloon, and the crucial inventories-sales ratio rises to ugly levels.

And for January, that ratio has spiked to a level worse than October 2008, after Lehman had collapsed. That ratio is not some kind of semi-irrelevant financial indicator; it’s a red flag for the real, main-street economy.

The problem: hopes turned into terrible sales. January sales by merchant wholesalers (except manufacturers), adjusted seasonally but not for price changes, fell 3.1% from December to $433.7 billion, the Census Bureau reported today. Even year-over-year, wholesales fell 1.0%!

On a monthly basis, there were only four categories with sales gains: automotive +2.5%, professional equipment +0.6%, computer equipment +1.3%, and paper +1.2%. That was it. For the rest, sales were relentlessly negative. The biggest losers: petroleum products -13.5%, electrical -4.4%, metals -4.1% miscellaneous nondurables -4.2%. Even drug sales – the second largest non-durable category behind groceries but ahead of petroleum – dropped 3.6%!

But wholesale inventories rose to $548.7 billion at the end of January, up 0.3% from December, and up 6.2% from January a year ago. Year-over-year, durable goods inventories jumped 7.7%; nondurable goods inventories 3.7%.

Only three categories showed year-over-year declines in inventories: petroleum products, such as gasoline held by wholesalers, plunged 20.8%, and farm products fell 5.9%, after sharp declines in commodity prices; misc. durable goods inventories fell 3.0%.

All remaining inventory categories rose year-over-year. Among the standouts: automotive inventories jumped 8.7%, furniture 7.0%, lumber 4.1%, professional equipment 9.7%, computers 12.2%, metals 13.1%, electrical equipment 10.2%, hardware 13.5%, drugs 18.4%. You get the idea.

Given lousy sales and rising inventories, the inventories-sales ratio has been ticking up since July last year, when it was 1.17. It hit 1.22 in December, above the level of September 2008, the Lehman Moment. In January, it popped to 1.27. Now we’re looking at a spike:

Sure, the ratio had been higher back in the day. In the 1970s and 1980s, computerized inventory management and ordering systems were driving the trusty index-card systems into extinction. Each innovation along the way improved inventory management and allowed businesses to keep lower stocks while improving sales. Hence, over the decades, the wholesale inventories-sales ratio steadily declined to reach 1.14 in October 2005, which it revisited in 2010. In early 2011, it dropped to 1.13.

So what we should see is a continued slow and halting decline of the inventories-sales ratio. But since 2013, and particularly since July 2014, we’ve been seeing the opposite. And wholesale merchants aren’t seeing that rosy scenario of rising sales and declining inventories either.

Businesses across the US, each struggling to run a lean operation, will try to get their inventories in line. If a miracle happens and sales suddenly take off, halleluiah, problem fixed. If that strategy doesn’t work, they’ll trim their orders. And those orders are the sales of their suppliers.

When businesses across the country cut orders enough, they contribute to a chain of events that may trigger a business cycle recession. After Lehman collapsed, businesses cut orders so drastically that the supply chain seized. Sales throughout the economy were spiraling down. Inventories were soaring. The inventories-sales ratio went ballistic. And stocks crashed.

So the sudden Lehman-Moment-like spike in the ratio is disconcerting.

Businesses will eventually react. Maybe they’re still blaming the weather, and they’ve got big plans for promos, and optimism for the next few months is swapping over the brim. But if that miracle on the sales side doesn’t happen soon, the scenario might take on ugly hues. And it would happen just when stocks and bonds are at ludicrously inflated levels, precariously teetering, waiting for just such an event.

The financial scenario that corporations have been feverishly preparing for over the past few years took another step forward. Read… A “Crush” of Bond Sales Before the Market Goes to Heck

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, everything you say is correct, but unlike the previous occasions when this happened, the market today pays no attention to the underlying businesses. Mr. Market is only concerned by what the Fed does. Eventually, the businesses will begin to jettison workers and there will be an uproar, but that is some distance off yet and when it does occur, the Fed’s response will simply be to give more money to the banks.

It will take around two months ,,

First a one month wait to see if sales pick up and if not, then second month liquidations, discounts, whatever it takes to get rid of stock, and remember most companies have a several month long pipeline, You cant just cancel that next shipment coming in from China, especially when its on board and left port in Shanghai or GZ.

Everyone will looking fearfully and hope its not their competitor that jumps the gun and gets a headstart.

Equally they will be fearful on being the first because it is very costly to start liquidating, bit another month and they know its coming one way or another.

Head count is next on the agenda, except this won’t be just in oil jobs, this will start to get very briad based indeed and this is where the trickle down of the Feds, printing binges really starts to settle,.

You guessed it, the 0.1 of 0.1 will be away already, as management stock sales in their own companies are already hitting, funnily enough, the same levels just before the Lehman moment

Thanks for the data Wolf as it appears that rise in inventory is across the board to various industries. Sadly businesses often resort to headcount reduction to get by when the margins are squeezed like we saw in 2008/2009.

In the mean time the WH and the Feds are trumpeting low unemployment thanks to not counting workers who got tired of looking, forced into low pay part time serivce jobs and BLS creating jobs out of thin air. At least weak economy will give the Feds not to raise interest rate further strengthening the USD which will be the lifeline for the stock market for few months until it becomes very evident earnings suck back to back qtr or year over.

My local discount liquidator store, a big chain, has been selling higher priced items lately. There’s lots of furniture and house hold items and less electronic items but more expensive brands. The merchandise seems to be moving nicely. The more expensive retailers and/or wholesalers must be dumping merchandise.

The stock “market” hasn’t gone into orbital trajectory yet. The males haven’t got that uber-confidence-mojo on display. They are weary, edgy… They are all ready to flee the unseen predator.

There are signs tho. The restaurant that was built at the height of the last bubble is about to open. It’s been sitting their for 5+ years now, in pristine condition, just waiting for a restauranteur who happened to want a restaurant built in a Mexican, Moroccan, southern-plantation, corporate-chain motif.

This explains the 80% off sales at Holt Renfrew, one of Vancouver’s highest of the high end fashion stores. Never thought I’d see the day, and not only that, but they did the unthinkable(for Holt), they put the 80% off racks front and centre when you walk in…..have they no shame?!?!

While I would agree that inventories going up in general and sales dropping arent a good sign, I wonder what exactly is the impact from the fact that compared to 7-8 years ago sales of services in general were lower than today

I would imagine the billions that are being spent on providing internet related services – ad space, broadband, software arent exactly correctly factored into this inventory/sales ratio, though i could be wrong.

Would love to hear to views on this…

I just downgraded my internet/cable package, the last one became too expensive. The cable company wasn’t even surprised when I told them I needed to go cheaper. They gave me a promotional price on a downgraded package for one year. Next year when the price goes up I will downgrade some more. Incomes are stretched as far as they will go.

The discounts haven’t started in the Midwest yet. We’re usually the last to see them. Freight has been moving steadily though Kelloggs is down and Lowes seems to be slowing down. I’ve quit eating at Denny’s (they’re in a lot of the Flying J truck stops) as they’ve returned to their bait and switch ways.

Had to replace my 27 year old furnace last month ($2400) with the usual sticker shock.

As someone else said, the stock market isn’t frothy enough yet. People are still expecting a crash, which means there won’t be a really big crash.

I’m expecting another round of froth in the stock market before the big crash. Extreme froth.

We might have a smaller crash before then — or we might have that rarity, a long-term bear market.

So there should be a nice confirmation mirror peak for retail inventory/retail sales, preceding the wholesale Inventory/wholesale sales?

Assuming retail gets hit first which backs up into wholesale then manufacturing.

It would seem retail inventories would be hit first.

Wolf,

I just recently found your website. I’m in your camp.

I live in Huntington Beach, Ca. Looking out my window I’ve been seeing the slew of large Chinese cargo ships sitting along our shore trying to get into the San Pedro/Long Beach ports for over 4 months now. The labor strike is piling everything up. A buddy just told me that if you look at Google maps there are probably close to 200 ships out there? I haven’t looked.

So exactly when does the ships’ cargo technically count toward inventory on company’s books? Because if it hasn’t yet it seems like it was a great time to strike since there looks to be a truckload more inventory waiting to unload? Either way it seems like a convenient time to strike and slow the product down then?

Chris, wholesalers normally account for something as “inventory” after it arrives on their premises, though there are exceptions. So the goods in these containers is not yet accounted for as “inventory” at US wholesalers that will receive the goods days or weeks later.