So now, there’s another aspect of Housing Bubble 2, this time in new single-family homes: dropping sales, swooning prices, and ballooning inventories.

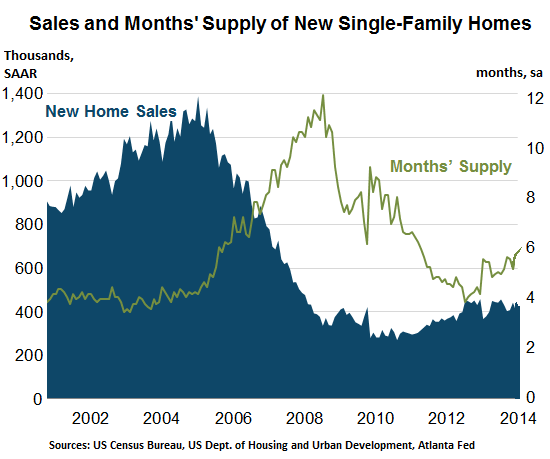

Sales of new single-family homes fell 2.4% in July, to a seasonally adjusted annual rate (SAAR) of 412,000, the worst in four months, and those four months had been nothing to brag about. While up 12.6% from a year ago, sales have been languishing, as the chart below shows, near the bottom of the range. By comparison, during the housing construction bubble, new single-family homes were selling at a seasonally adjusted annual rate of well over 1,000,000.

The inveterate optimists that economists have become were disappointed. They’d expected a rate of 430,000 sales.

The median price dropped 3.9% from June and almost 6% from May, to $269,000, and was up only 2.9% from a year ago. But hey, at least year over year, it wasn’t a downdraft. Not yet….

So, on a monthly basis, sales and prices are heading south. These numbers from the Census Bureau are volatile and subject to big revisions; hence, by a miracle, sales and prices might reverse course. But over the longer term, and after revisions, one trend is now becoming glaring: the supply of new homes on the market (green line, right scale) rose to 6 months, from 5.6 months in June. It was the highest – and for builders the worst – level since October 2011:

Rising supply of unsold homes is the bane of the industry. During the last housing bubble, inventory in terms of months’ supply shot up: as sales declined, new homes were still being planned, built, finished, and put on the market. The process takes time, and the supply faucet can’t be shut off overnight. Oversupply is a powerful force in the market.

Unperturbed, home-builder optimism about the future has been sizzling, perhaps fired up by prices that until recently had been soaring. At the same time, they’re complaining in the most recent home-builder survey about very crummy foot traffic, possibly a result of these prices that have soared beyond the reach of most households. And now the dark clouds forming over the industry have led government-sponsored and bailed-out mortgage giant, Fannie Mae to sledgehammer its formerly rosy forecasts for home construction and sales for the rest of the year.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This epitomizes what is wrong with the housing market: an oversupply of houses while, simultaneously, many people can’t afford to buy.

The impact remains to be seen. Will this oversupply eventually result in improved affordability for people who actually want a place to live, or will the drop in prices be trivial and serve to further the current shell-game (if not outright Ponzi scheme) that the is the current housing market?

Affordable houses? Never! A serf that owns a house is too unproductive.

People have no credit and little or no income. The housing market cannot come back until employment increases and credit is loosened so people can borrow. All the homeowners who have lost homes can’t buy, all the college kids with no jobs and student loans can’t buy, foreigners pay cash and don’t occupy properties, who’s left.

Declining labor force participation rate for the 25-54 yr olds as well as stagnanting wages and declining wealth, are killing the ability of first time home buyers. Boomers retiring early will find their last house…usually someplace warm, and be done. September may be a very ugly month for homes.

Finances are issue for the demographic you describe; however, they are not the only problem. Another issue is the increase in all-cash offers; if you’re a first-time buyer who qualifies for a mortgage, you’re still going to find it very hard to compete against all-cash offers.

As long as speculators and investors continue to crowd out those who actually want a place to live in, the dysfunctional housing market won’t get better.

So much about capitalism’s invisible hand and demand/supply rule. Invisible hand failed to correct things and there is oversupply of many things, but prices don’t fall.

I will forever be grateful that the market crashed in 2007 and that mortgage lending effectively stopped. Instead of mortgaging my unfinished home in the desert, I defaulted on my credit cards (which I had planned on paying off with the mortgage.) My business, FICO scoring consultation, vanished and never came back.

My house is still unfinished with only 640 sqft of living area, but I got big garage, an acre with gardens and greenhouses and I get to eat great organic food. All things considered, I’m doing great.

And I much rather spend my time propagating trees and berries and teaching my friends and neighbors how to avoid GMOs, HFCS and the resulting ailments than helping people buy houses they can’t afford.