Toronto single-family prices -15% from peak, condos at multiyear lows. Calgary & Quebec City reach new highs.

By Wolf Richter for WOLF STREET.

Home sales across Canada dipped 0.7% in July from June, seasonally adjusted, and remain about 10% below the 10-year average for this time of the year, as the housing market “hits pause,” according to the Canadian Real Estate Association (CREA) today, despite the Bank of Canada’s two rate cuts in a row. Sales declines in Calgary and the Greater Toronto Area were mostly offset by gains in Edmonton and Hamilton-Burlington, CREA said. Compared to the beaten-down levels of July last year, sales were up by 4.8%.

New listings ticked up by 0.9% in July from June, the sixth month of increases over the past seven months. The number of properties listed for sale was up 22.7% from a year ago, but still about 10% below the historical averages for this time of the year. So both supply and demand are about 10% below 10-year averages. Supply remained 4.2 months in July, up from 3.3 months in July last year.

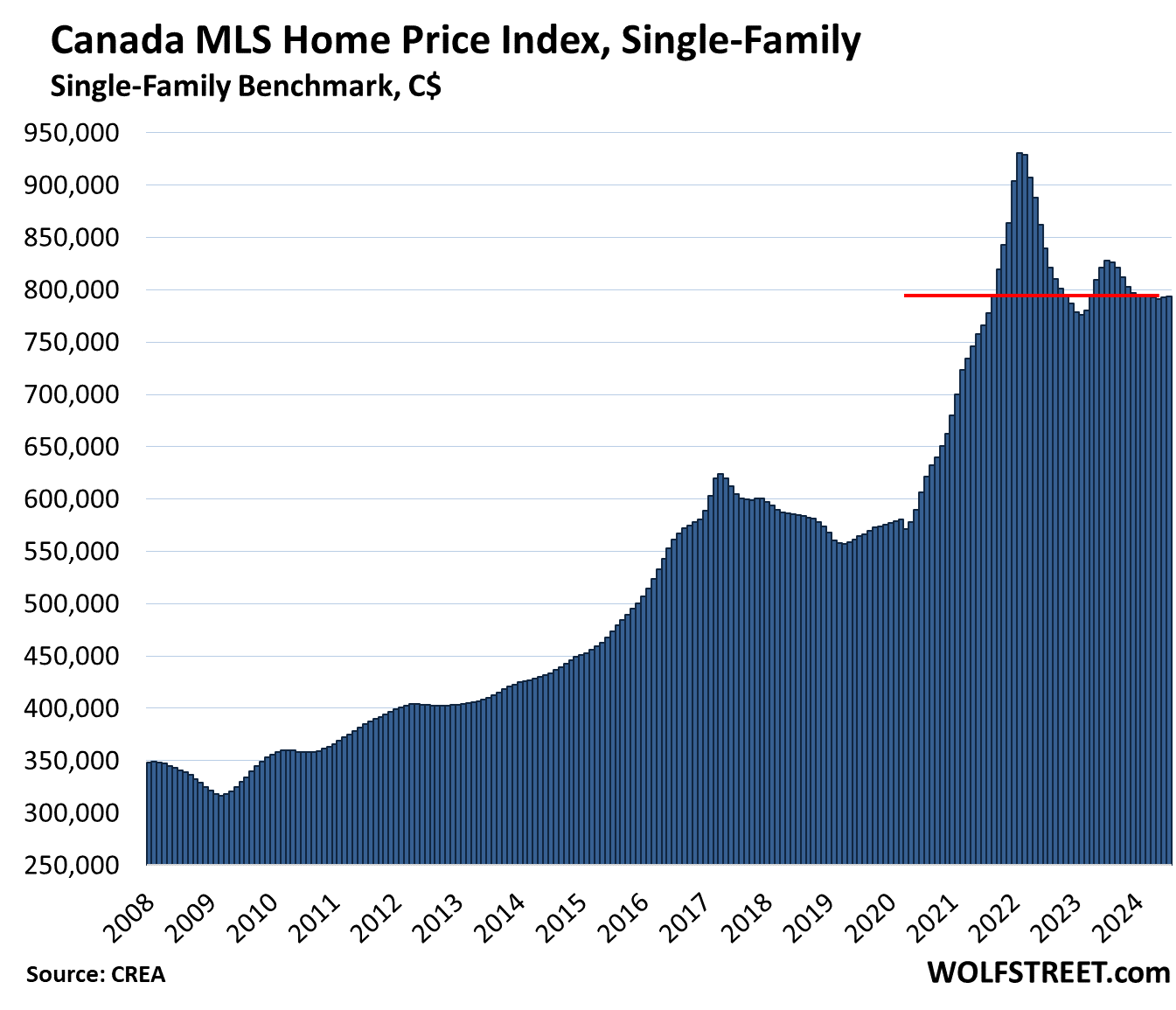

The Canada MLS Home Price Index for single-family benchmark properties edged up 0.1% in July from June, seasonally adjusted, but was down by 4.1% year-over-year, and down by 14.7% from the peak in February 2022 (all prices in Canadian dollars):

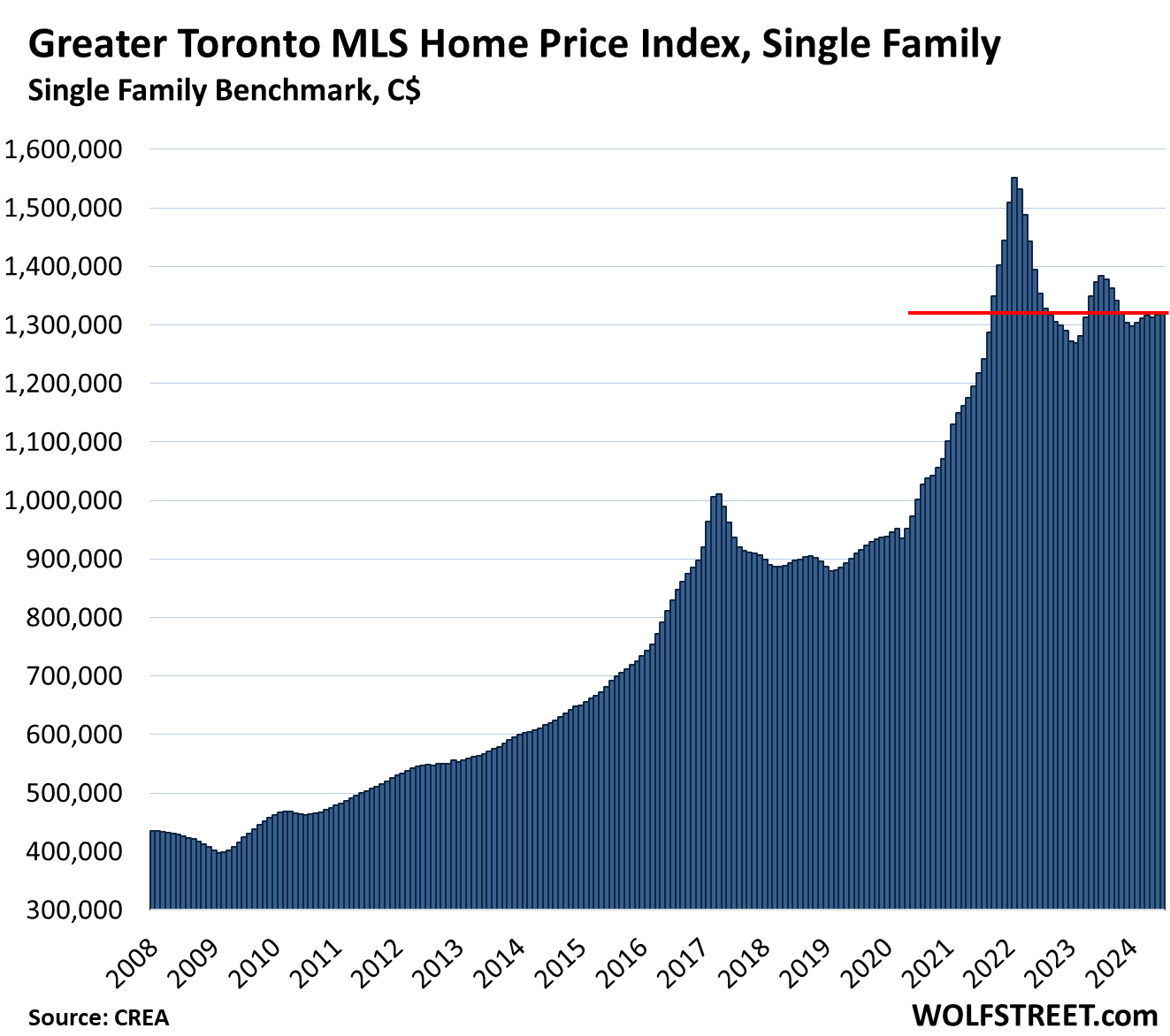

Greater Toronto Area, single-family MLS Home Price Benchmark Index:

- Month-to-month: +0.1% to $1,318,600; essentially unchanged for four months in a row, and below October 2021

- From peak in February 2022: -15.0%

- Year-over-year: -4.7%, the third month in a row of year-over-year declines (-4.1% in June, -2.6% in May)

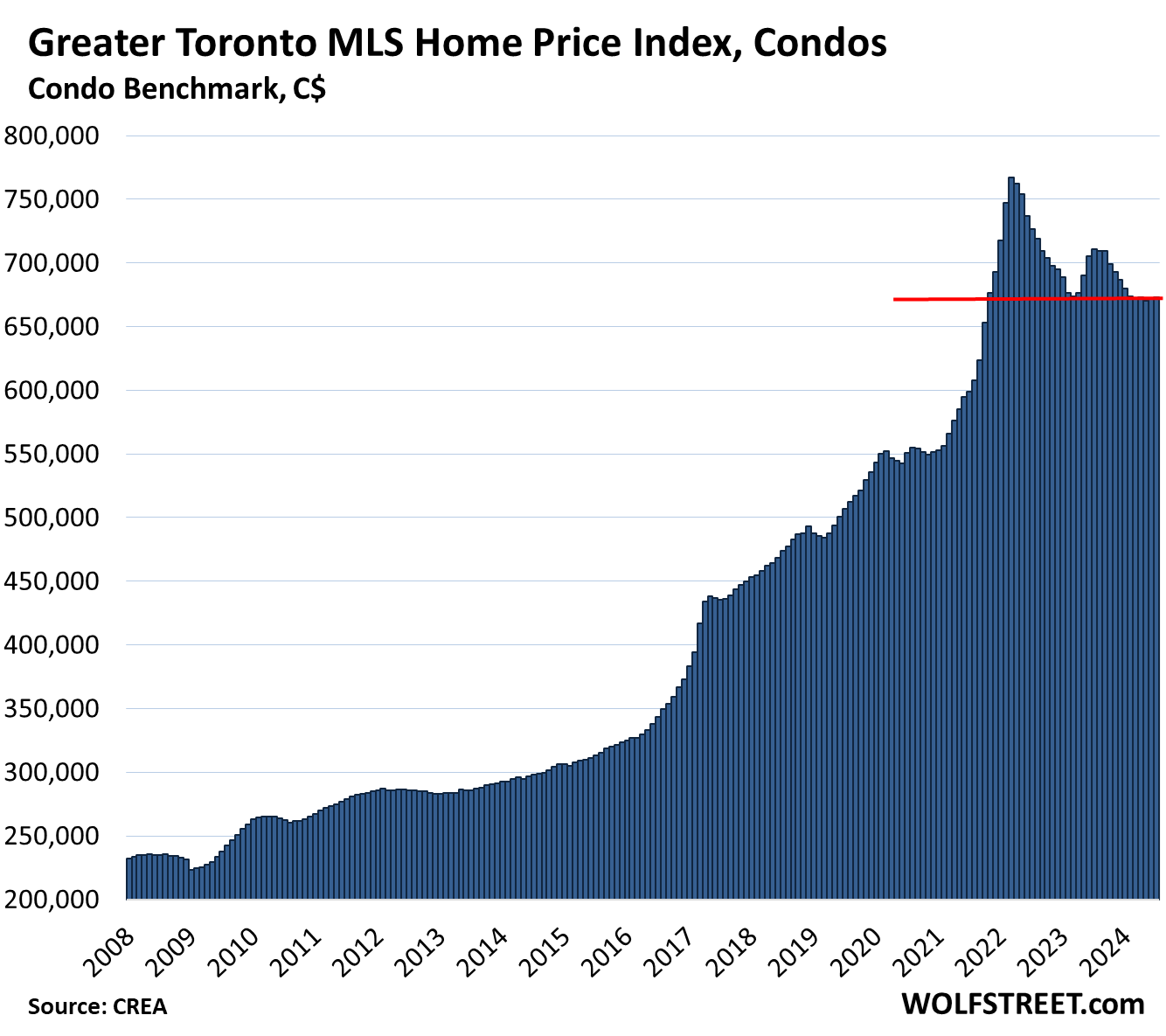

Greater Toronto Area, condo benchmark price:

- Month-to-month: +0.1% to $672,700, just below where it had been in November 2021; and essentially unchanged for the sixth month in a row at this multiyear low.

- From peak in February 2022: -12.3%

- Year-over-year: -5.4%, the 18th month of year-over-year declines out of the past 19 months, and the biggest since May 2023.

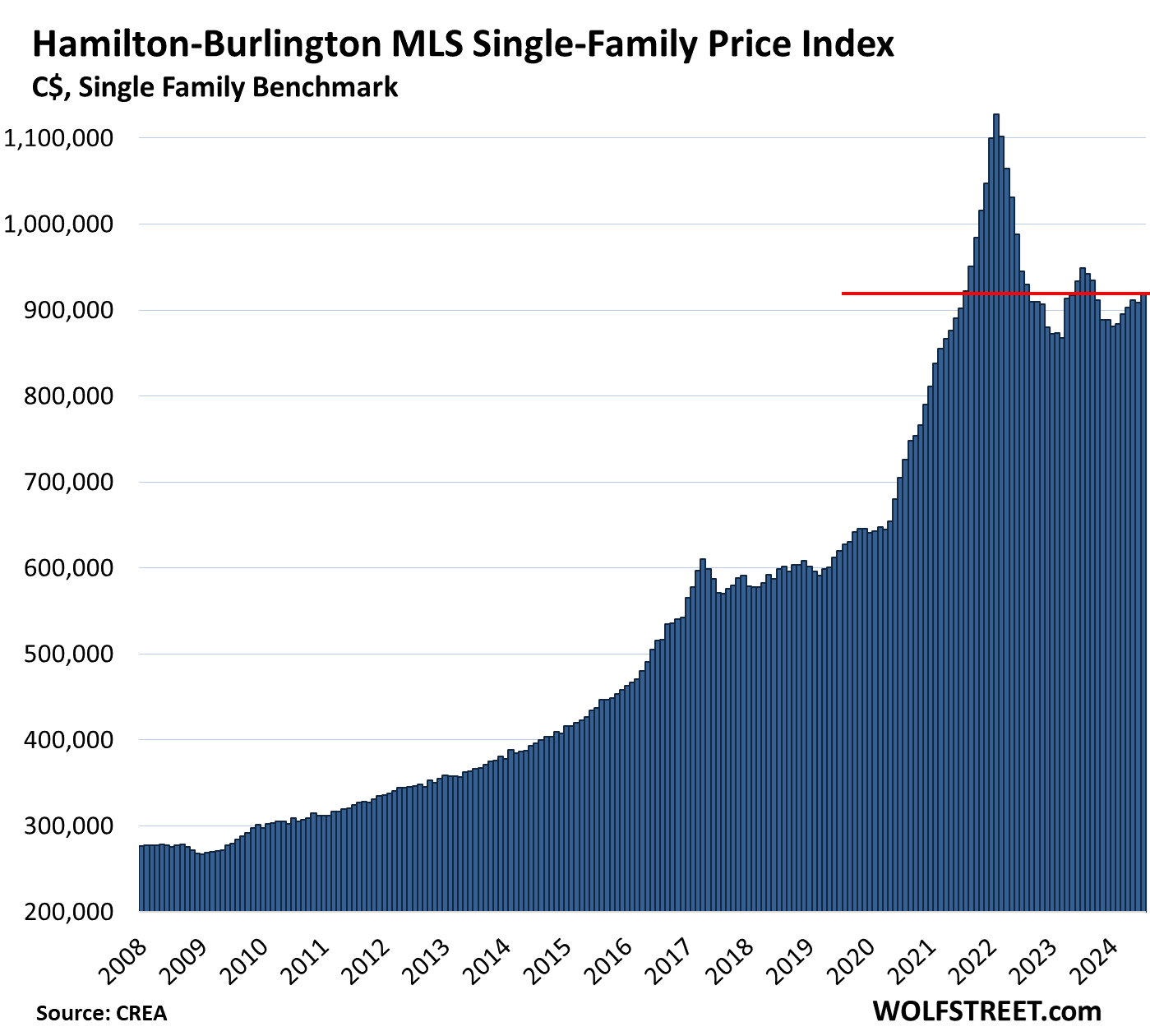

Hamilton-Burlington metro single family benchmark price (in the “Greater Toronto and Hamilton Area”):

- Month-to-month: +1.0% to $918,200, below August 2021

- From peak in February 2022: -18.6%

- Year-over-year: -3.2%, the fourth month in a row of declines, and the biggest.

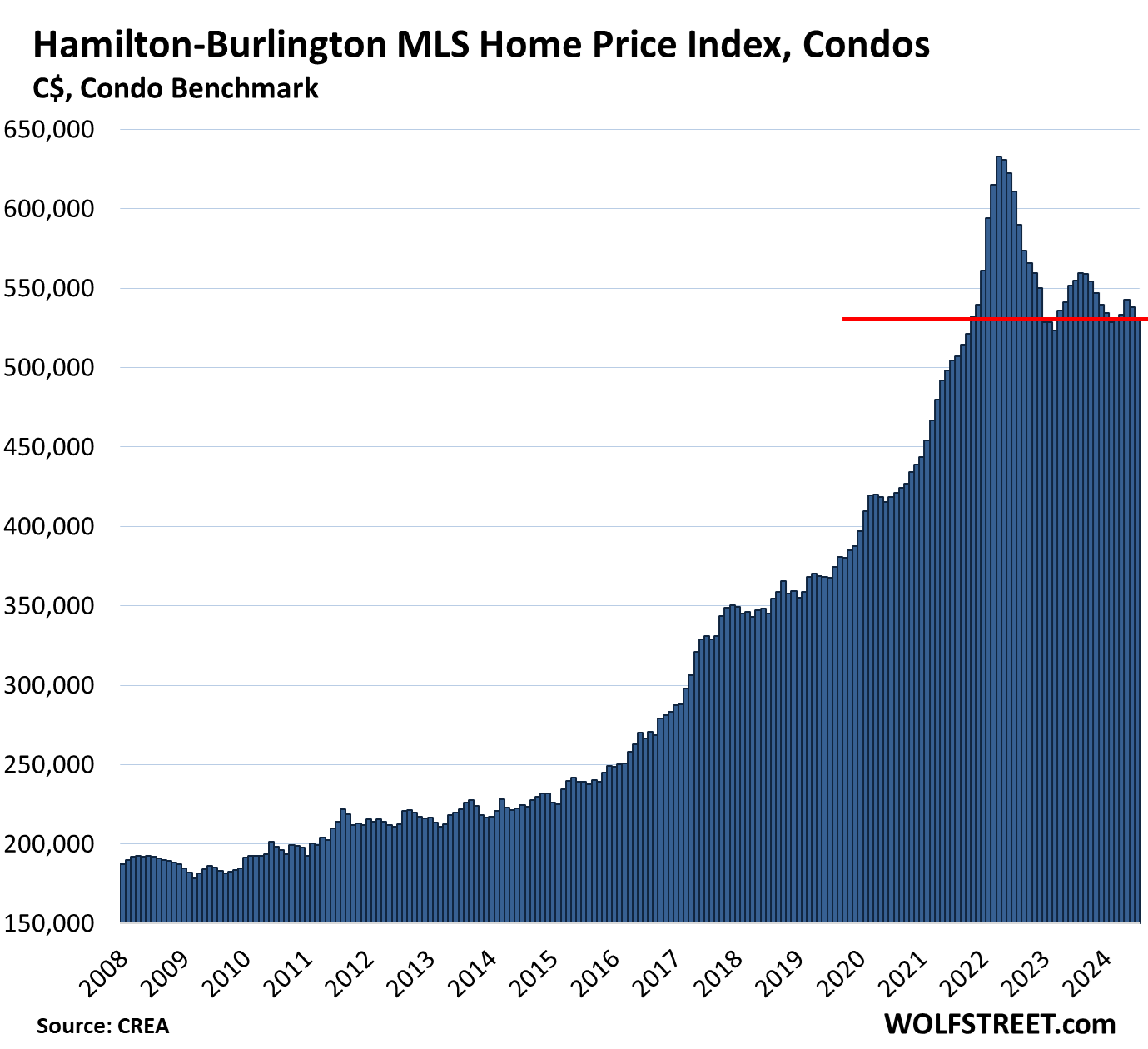

Hamilton-Burlington metro condo benchmark price:

- Month-to-month: -1.5% to $529,800, back to November 2021.

- From peak in February 2022: -16.3%

- Year-over-year: -4.5%.

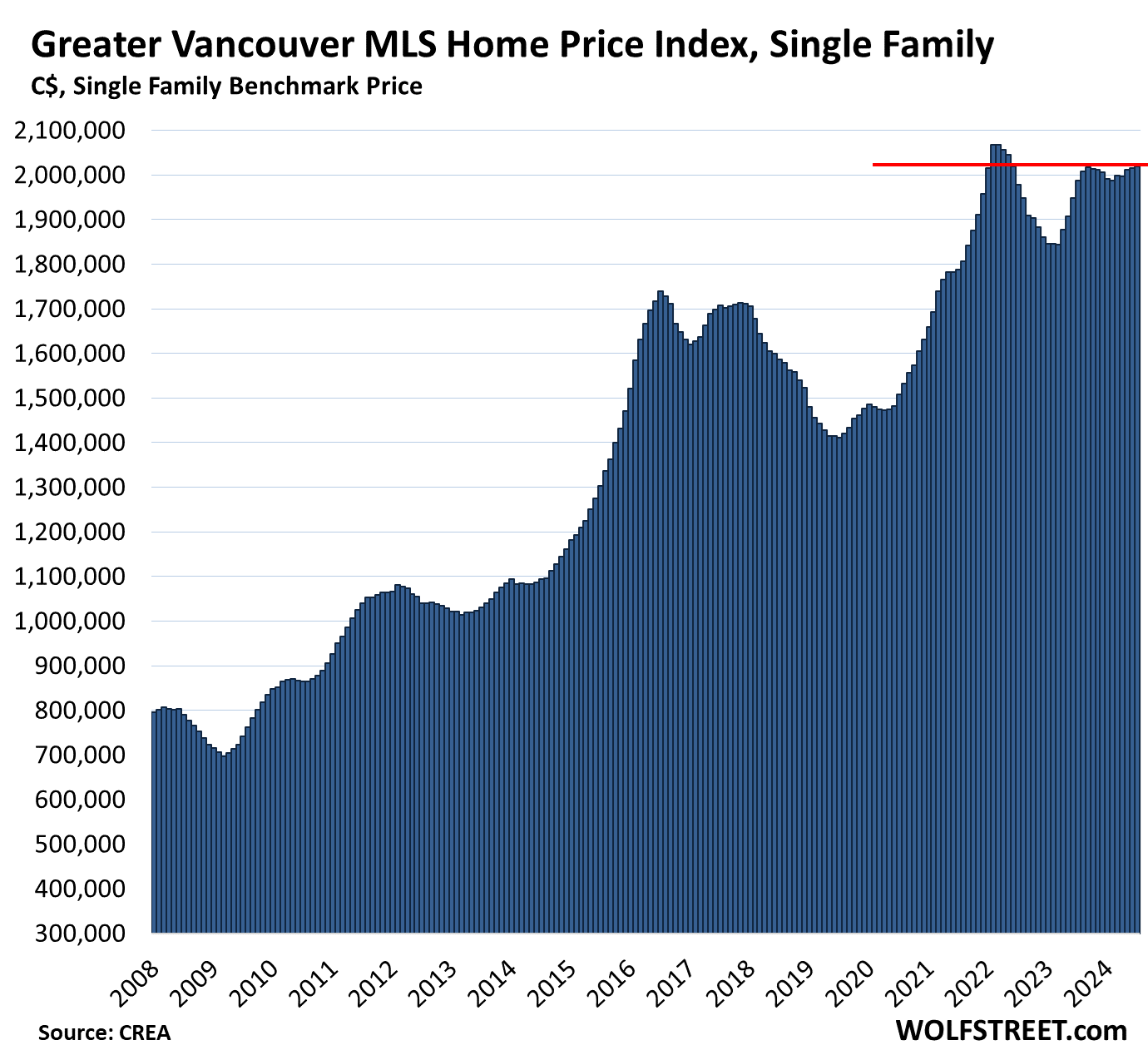

Greater Vancouver single-family benchmark price:

- Month-to-month: +0.2% to $2,019,500, about where it had been in January 2022, and roughly flat for 10 months

- From peak in April 2022: -2.4%

- Year-over-year: +1.6%, smallest gain since July 2023.

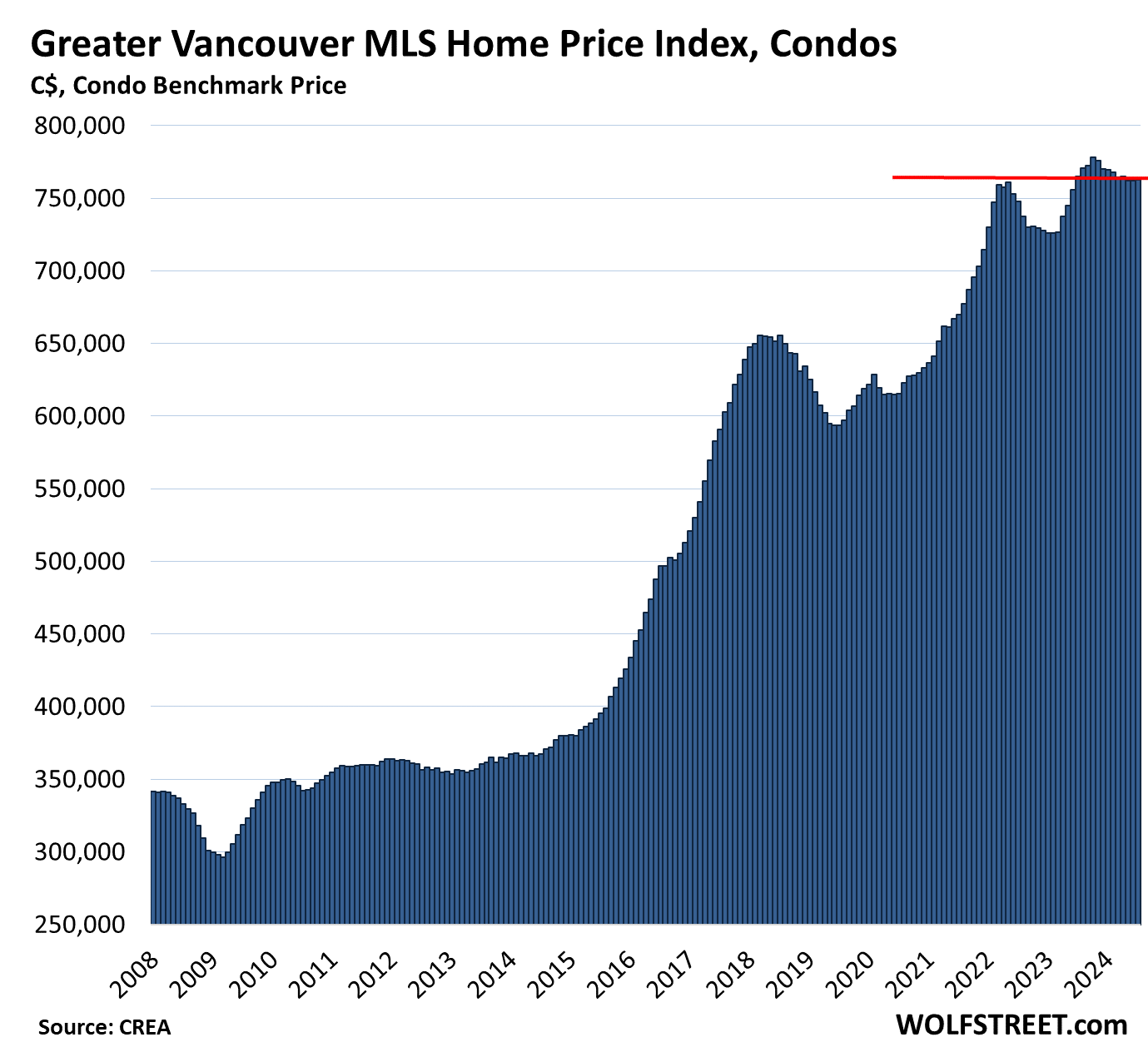

Greater Vancouver condo benchmark price:

- Month-to-month: unchanged, at $762,500, a hair above May 2022.

- From peak in October 2023: -2.0%

- Year-over-year: -0.3%.

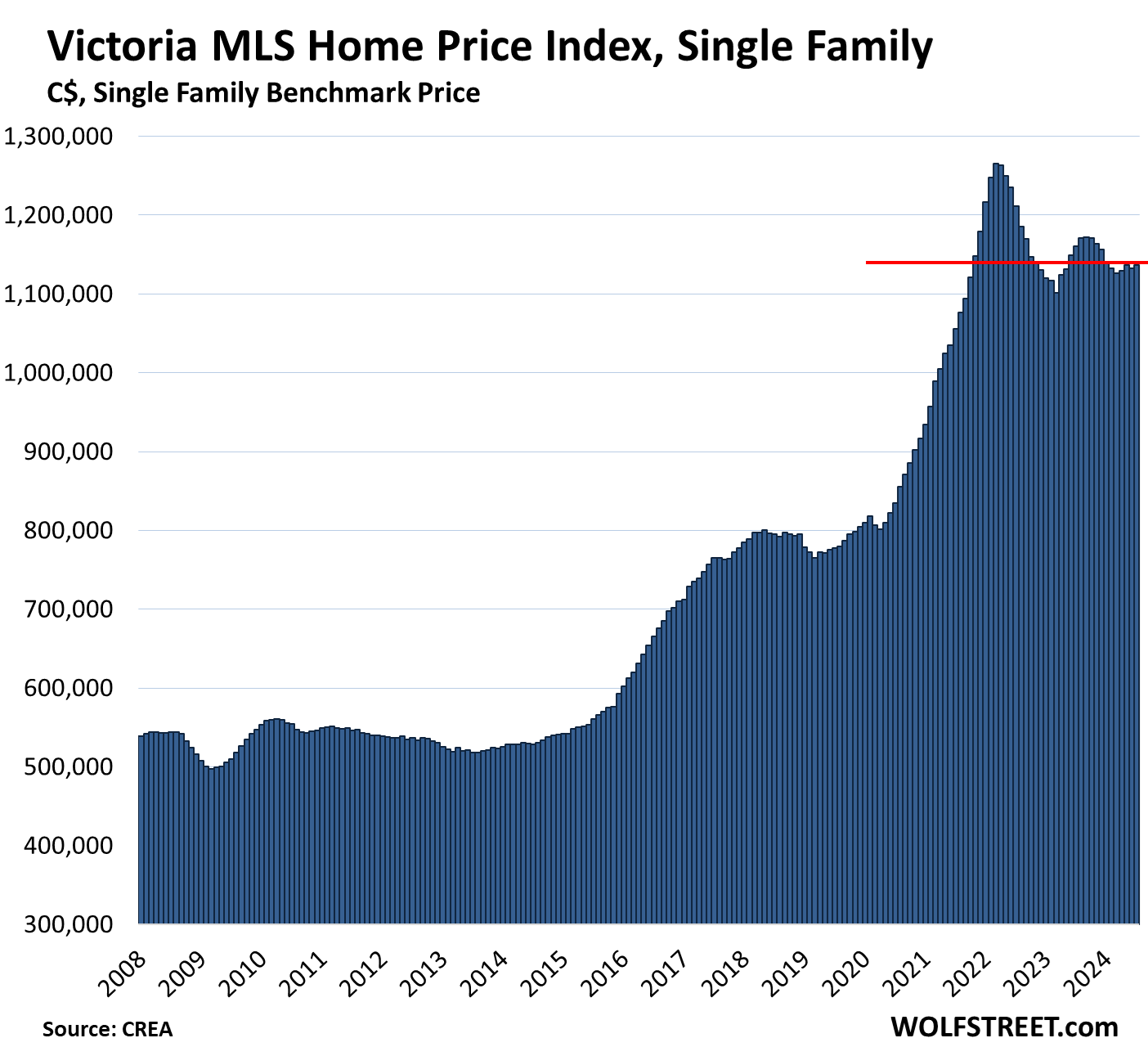

Victoria, single-family benchmark price:

- Month-to-month: +0.4%, to $1,136,600, below November 2021

- From peak in April 2022: -10.2%

- Year-over-year: -2.1%, second year-over-year decline in a row.

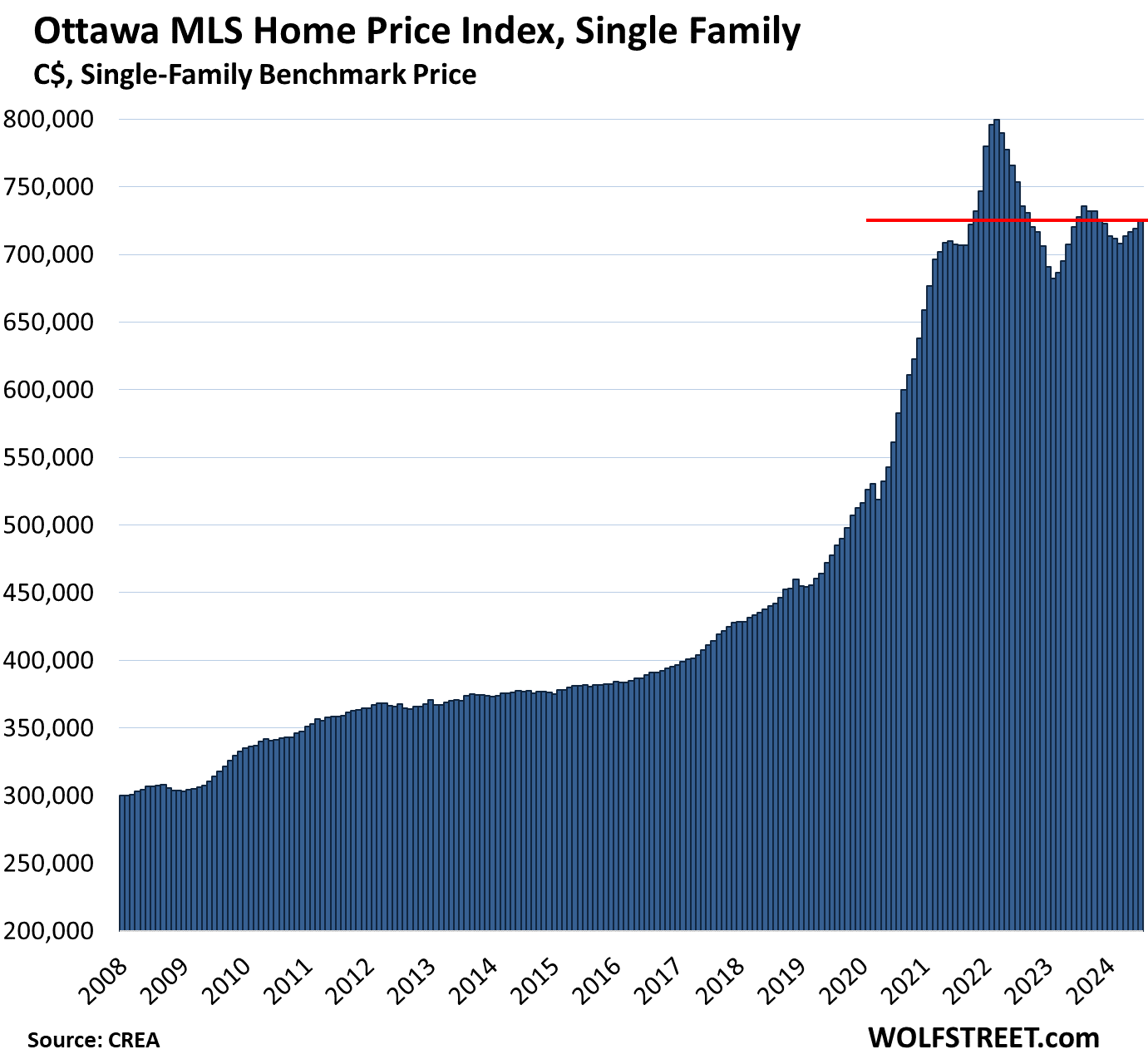

Ottawa, single family benchmark price:

- Month-to-month: +0.8% to $725,200, roughly back to October 2021

- From peak in March 2022: -9.3%

- Year-over-year: -0.3%, second year-over-year decline in a row.

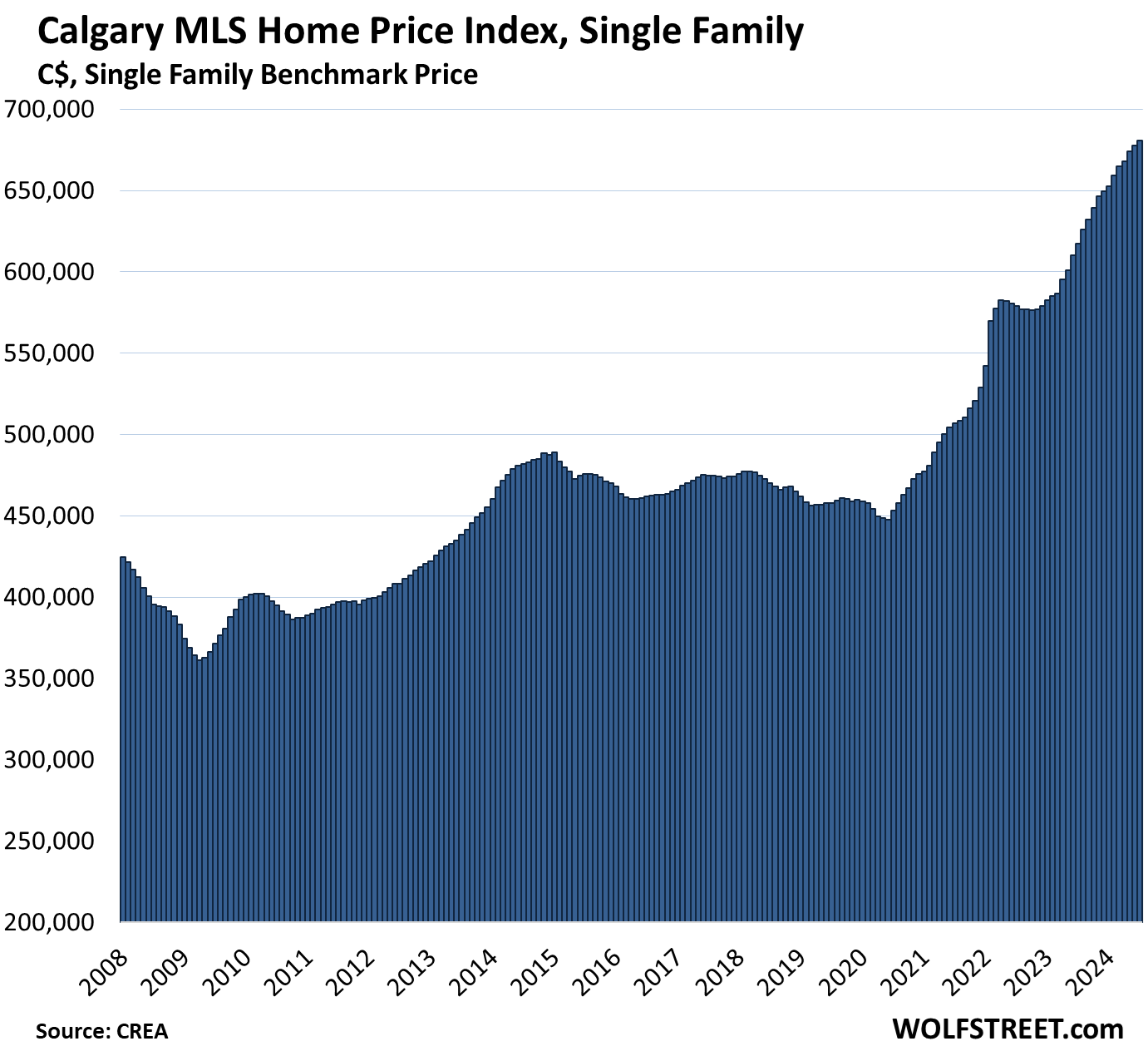

Calgary, single family benchmark price:

- Month-to-month: +0.5% to new high of $680,700

- Year-over-year: +10.3%.

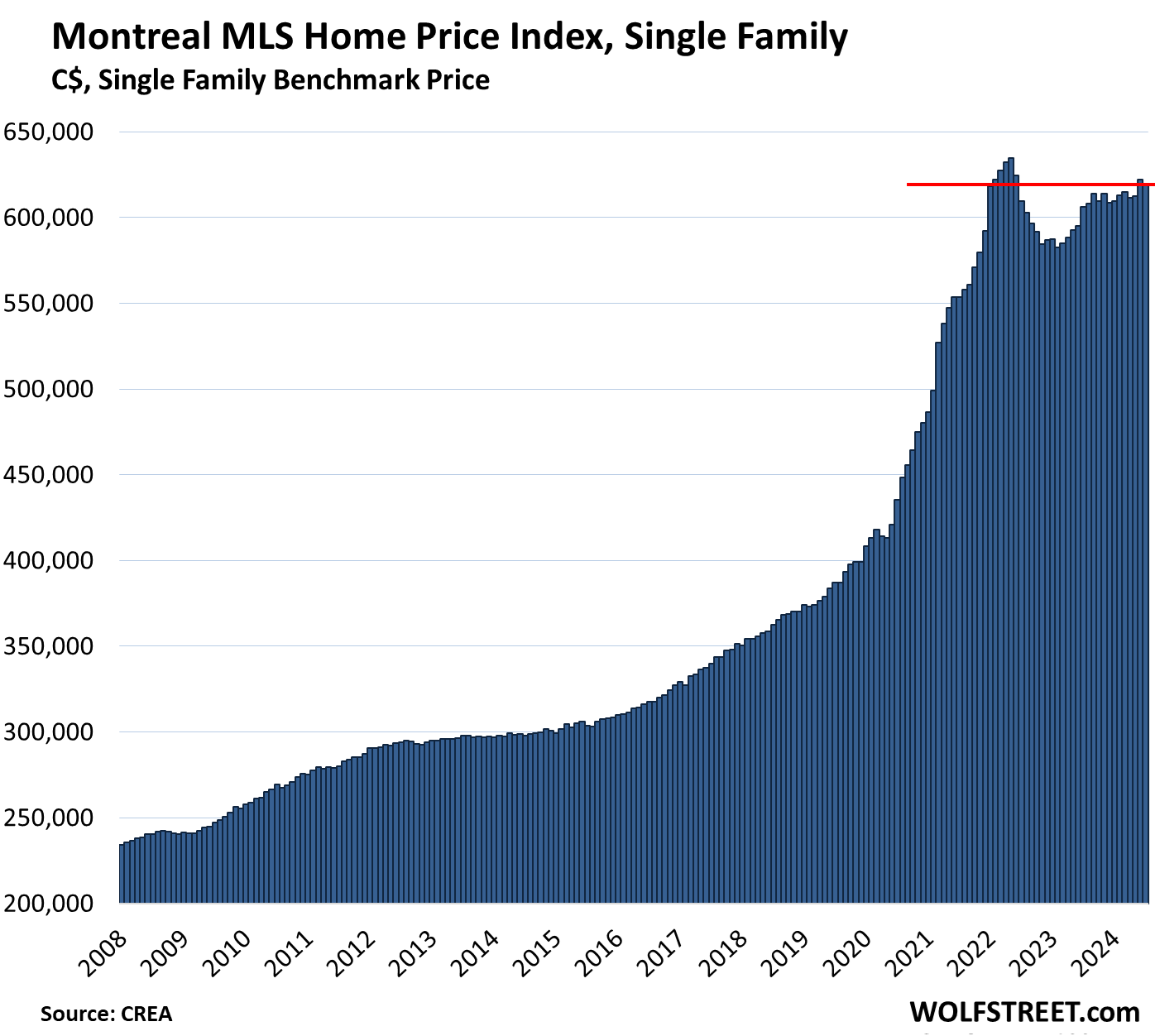

Montreal, single family benchmark price:

- Month-to-month: -0.4%, to $619,600, below February 2022.

- From peak in May 2022: -2.4%

- Year-over-year: +2.2%.

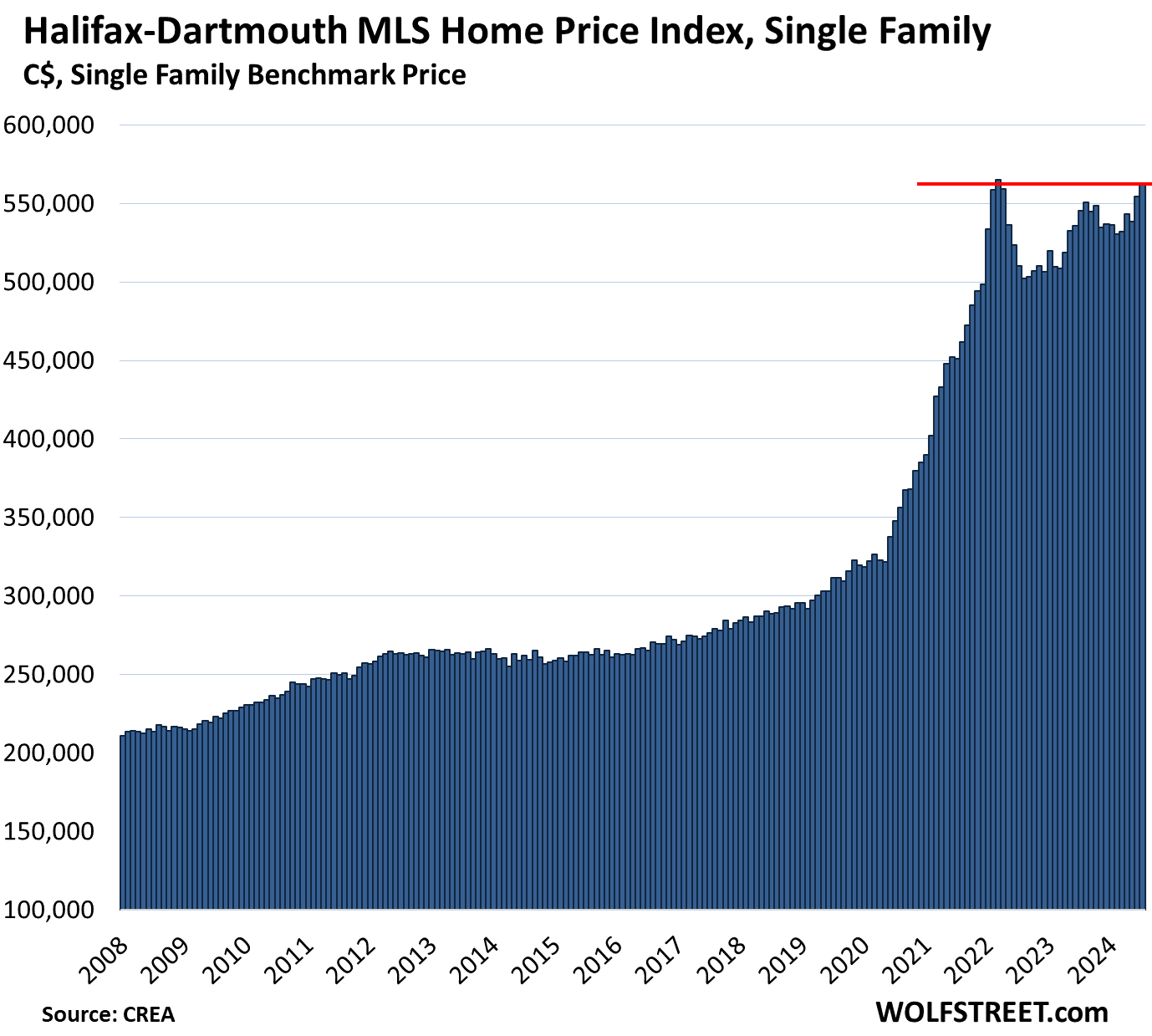

Halifax-Dartmouth, single family benchmark price:

- Month-to-month: +1.6% to $563,200

- From peak in February 2022: -0.3%

- Year-over-year: +3.3%.

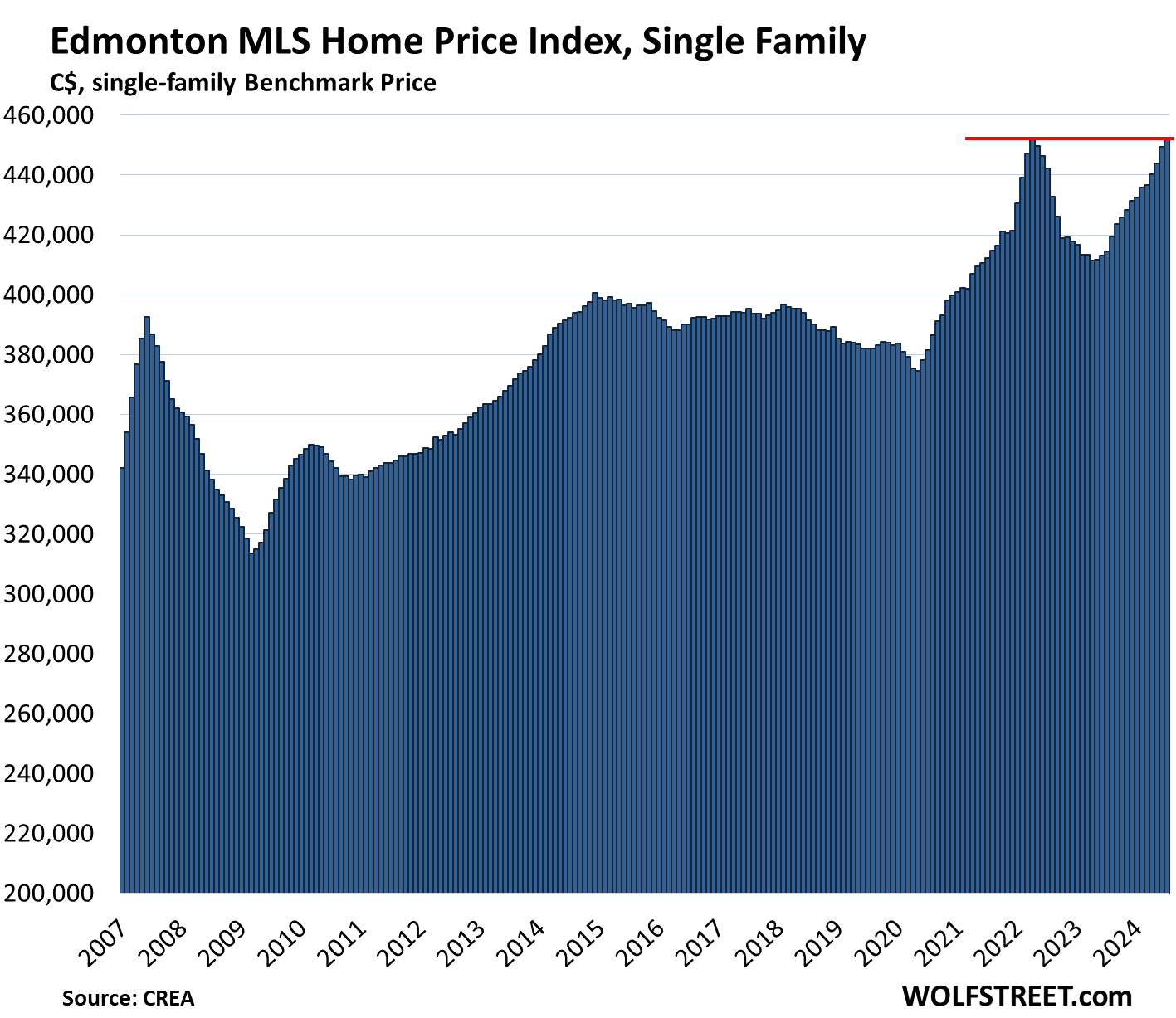

Edmonton, single-family benchmark price:

- Month-to-month: +0.7% to $452,400

- Matched the prior peak in April 2022

- Year-over-year: +9.1%

- In the 17 years since the peak of the 2007 bubble, the index is up 15%.

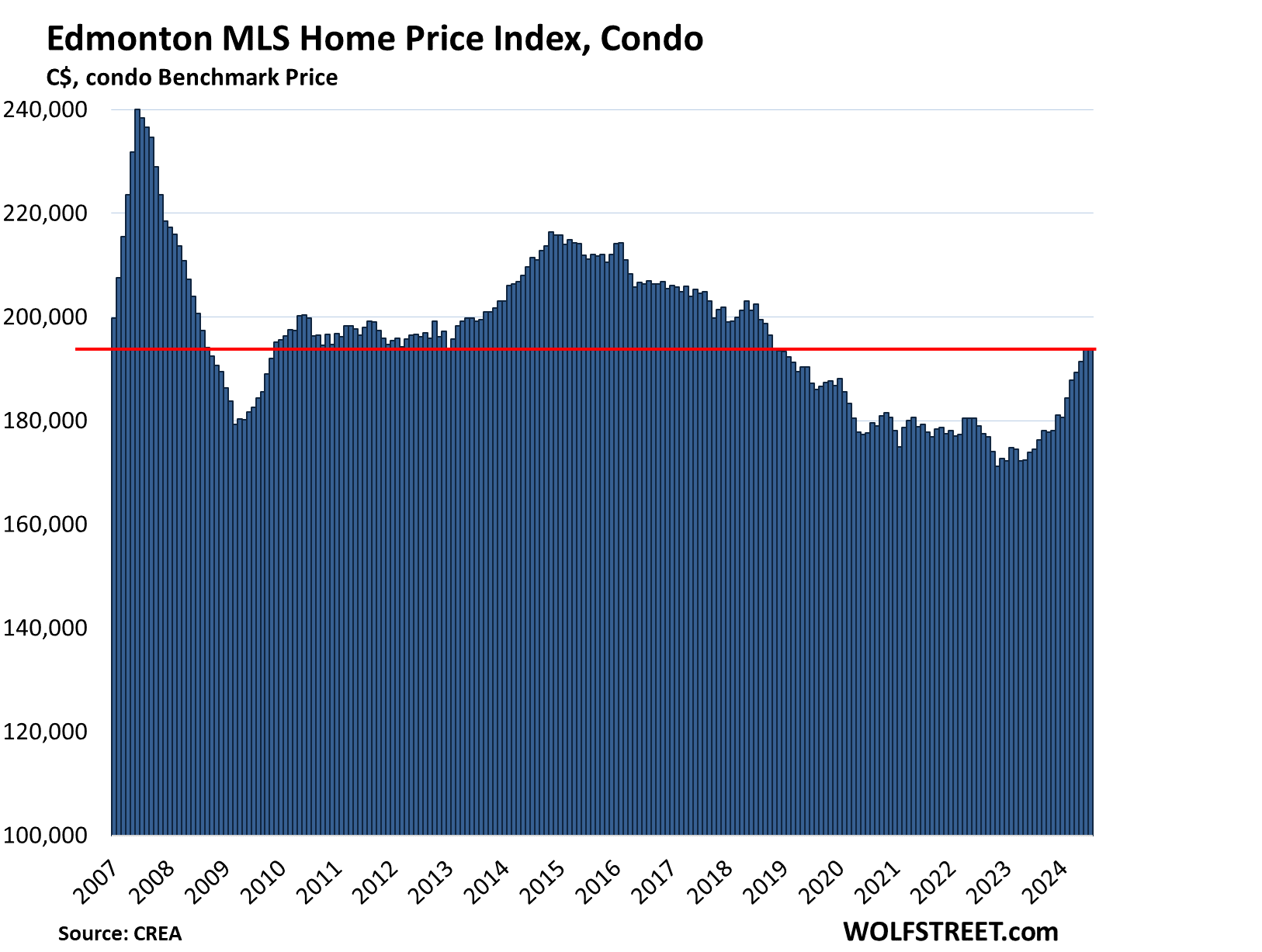

Edmonton’s epic condo bubble and subsequent bust 15 years ago, and what it looks like afterwards: Despite the price surge since May 2023, the index is still down 19% from the peak in June 2007.

- Month-to-month: +0.1% to $193,900, first seen in December 2006.

- From peak in June 2007: -19%

- Year-over-year: +11.1%

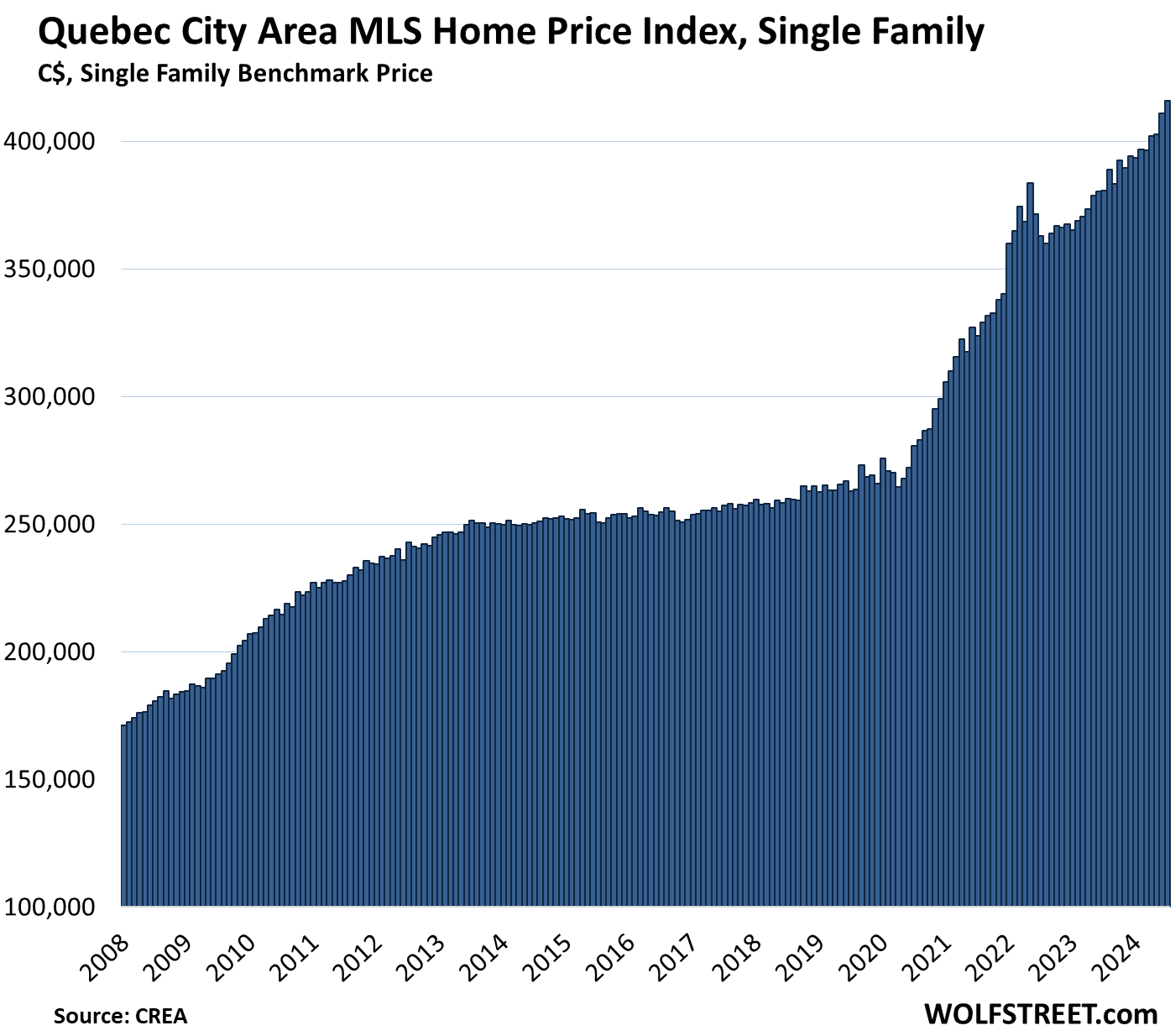

Quebec City Area, single-family benchmark price:

- Month-to-month: +1.2% to $416,000, a new high

- Year-over-year: +9.2%

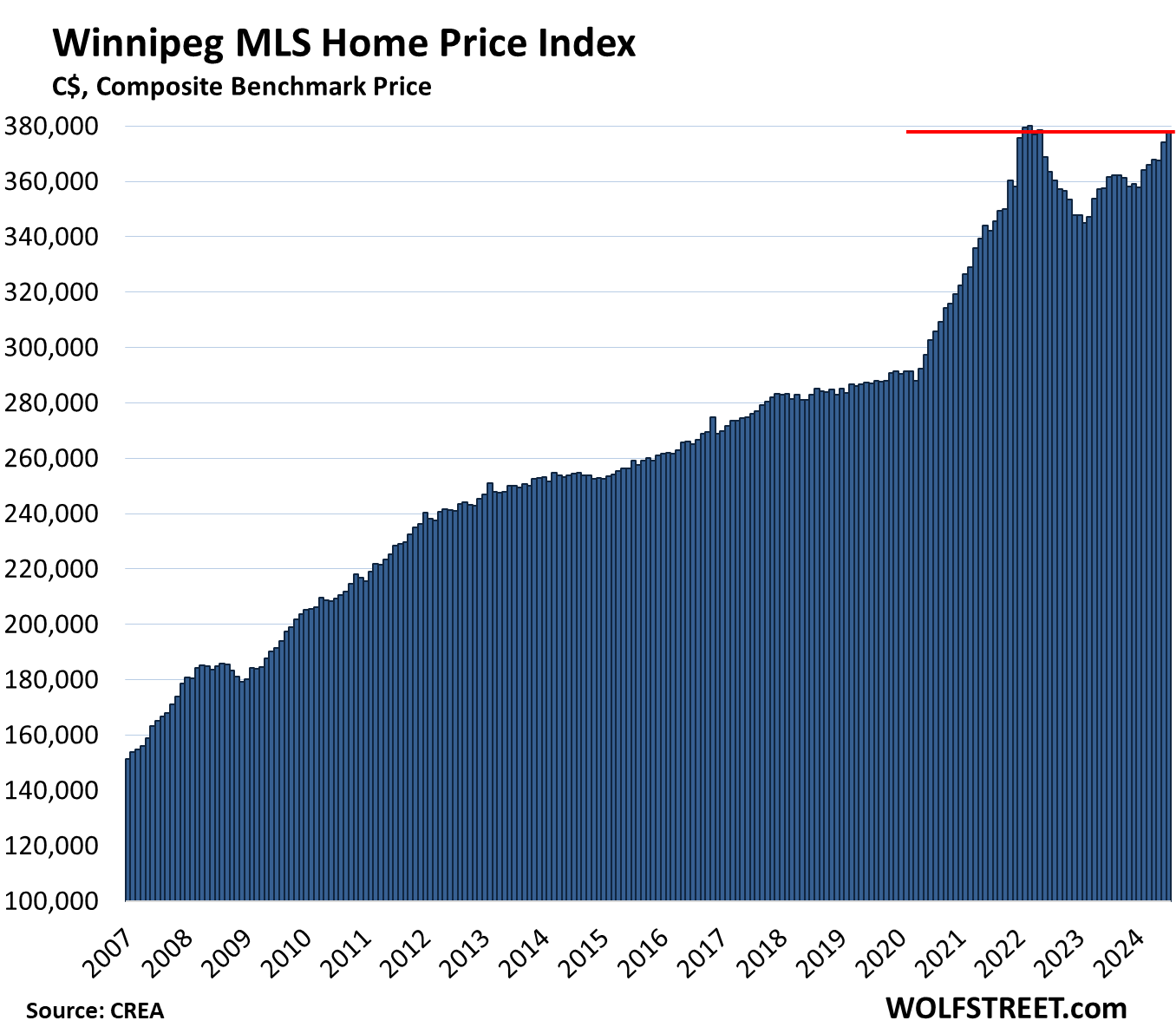

Winnipeg, single-family benchmark price:

- Month-to-month: +1.0% to $377,900

- From peak in March 2022: -0.6%

- Year-over-year: +4.5%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Canadian mortgages are reset/renegotiated every few years, while American mortgages generally aren’t (most home buyers get fixed-rate loans, not ARMs.)

For this reason, I think even modest Federal Reserve easing will unleash a massive wave of speculative home buying. Look at mortgage application volumes in recent weeks, both new & refinancing. I think the Federal Reserve is potentially making a policy error with premature easing.

“I think even modest Federal Reserve easing will unleash a massive wave of speculative home buying. Look at mortgage application volumes in recent weeks, both new & refinancing.”

This is RE promo BS. For at least 3 reasons:

1. Refi mortgage applications spiked which does nothing for the housing market, but it will increase the pace of the Fed’s QT by increasing the roll-off of MBS, and we have already seen some of it.

2. Purchase mortgage applications remain near record lows:

3. Mortgage rates have already fallen to the lowest in a year, in anticipation of rate cuts, and sales volume collapsed, LOL

Since the article is about Canada and not about the United States, here is information about mortgages in Canada.

“(BoC) data shows annual household credit growth decelerated in May. Just off multi-decade lows, despite cheaper credit on the way, households are pulling back on borrowing. The low growth for borrowing is even more concerning when the rapid population growth is also considered.

Canadian Household Borrowing Is Unusually Slow

Canadian households have suddenly stopped borrowing, and to say it’s unusual downplays how concerning it is. Household credit advanced just 3.4% (+$96.2 billion) to $2.95 trillion in May. Annual growth is returning to deceleration, potentially having hit its peak growth for the year. The rate of change is now just 0.2 points above the rate reported in October, which was the lowest rate in well over 30 years.”

Well, I hope this slowed borrowing “concern” incentivises one of the banks or CC issuers to offer us another “deal” to transfer existing debt at ultra low fees with a year of 0% interest so I can keep buying T-bills

So glad I didn’t buy a home in Canada a few years ago like I wanted to do!

Depends where! Vancouver has held up so far. I do not know how it can stay so high, but i also do know what catalyst could make it drop if interest rate spike couldn’t

My Vancouver friends have been crying the past 2.5 years because their mortgage rose so much.

This is great to see, it will be even better if the pricing is back to long term trend line. Perhaps it’s a matter of time or maybe it will never happen as this time is different as many have said before..

My second wish is for this to also happen in the SoCal market but to a greater degree. Many new listings I am seeing are still delusional in asking price and some are still getting them, wonder if any mortgage rate drops in the future will have the same effect as the canadian market..

So while prices have declined in most Canadian cities there is still similar delusion for “investors” and “flippers” trying to sell at outrageous prices, they then find out that it’s hard to make a sale, I know someone that turned down a good offer now wishing he accepted it because he can’t sell at a new lower price anymore. Still the best pricing seems to be with brand new units, very similar to what Wolf describes in US market, I see new development condos offering bonuses in 10k-30k range sometimes, parking spaces thrown in where before those would be extra and some promotional interest rates if you go with the developers preferred lender, this on top of lower pricing from the peak.

It’s kinda wild to see how much investment activity affects the pricing in Toronto though, if you look at a condo with closing within a year it will be quite a lot less than longer dated projects expected to finish 3-5 yrs from now, people are betting on lower interest in the future, like the “good old days” 🙄

The days of selling homes here in British Columbia in 1 or 2 days is over for now. Plenty of listings and many (small) price drops. It’s common to see 3-6 months to sell. Prices are still high. Building costs are $400-$500 per square foot. Starter homes that need major work for $500k. 930k for a 3 bedroom condo. With just about every new mortgage the bank hands out a HELOC because after your mortgage payment you need credit for everything from furniture too your new roof.

Pay down your mortgage and rack up your HELOC the Canadian way

Wolf – when’s the update on the FED balance sheet coming? I see the Topline data published on Thursdays and I go straight to wolf street to get the dirty details.

Thanks

My Fed balance sheet (assets) discussion gets published on the Thursday when the Fed releases its balance sheet with the month-end Treasury roll-off.

Thursday August 1 was the first one I missed in like two-plus years. I had a huge amount of other topics to deal with, so the Fed and a couple of others got triaged out. I published 5 articles in two days, which is all I can do if I work from 5 am till midnight (along with all the other stuff I do, such as read all the comments and write a gazillion myself)

Good thing there are weirdos that read this blog and keep you accountable.

Looking forward to that next FED balance sheet update.

Gold up 2.09%.

1:04 PM 8/15/2024

Dow 40,563.06 554.67 1.39%

S&P 500 5,543.22 88.01 1.61%

Nasdaq 17,594.50 401.89 2.34%

VIX 15.23 -0.96 -5.93%

Gold 2,493.10 13.40 0.54%

Oil 77.99 1.01 1.31%

Gold closed at $2507.70. That passes a momentum trigger number, indicating acceleration in its next leg up. Watch silver more than catch up. Gold should move fairly quickly to $2700-2800.

Gold up 2.09%.

NZ will another interesting data point, to see if the recent start of a rate cutting cycle will be enough to arrest the slide of house prices

Does Canada have a”work from home” policy, remnant of Covid?? Most NYC businesses allow it. We live about 100 miles N of NYC. Our existing housing market is overpriced, made up of primarily older homes – 40 to 100+ years. 99% of new builds are apartment complexes – leased prior to completion. Tenants – NYC work from home, single or a couple. Rates $2200-$2500/mo one year. Some seniors downsizing but not many as these are all 2 story w/ 1 or 2 upstairs BR. More in the planning stage.

No work from home policy.

No policy of that sort, but hybrid work arrangements are the new normal for just about any job where remote work is feasible. 2019 is never coming back, no matter how much the CRE crowd howl for it.

While looking to buy a lot of land and home in US,not Canada,still on buyers strike.

I honestly wonder if I will ever buy another place,interesting times.

Bloomberg is saying today that stocks and other asset prices are inflated to unprecedented record levels because the markets are so awash in cash with no places to put it in huge quantities other than risk assets. How can this be, and if so, why is the Federal Reserve even remotely considering adding any more liquidity to the system in the form of lower rates?

Canada’s money supply is managed by the Bank of Canada, not by the Federal Reserve.

The Bank of Canada probably does not use Bloomberg opinion pieces as its source of data.

Q: What’s the saddest Country song you ever heard?

A: O Canada.

Canada could still join the US!

Just give King Charles the 🖕

Haha just kidding around

We just need to get rid of Trudeau.

Walmart announced it is cutting prices on 7200 items as they said inflation is dropping

What they actually said in their earnings call was: general merchandise has come down (as evidinced by what Wolf posts here) but food and grocery has not come down and it has been stubborn. They’re taking rollbacks on items to put competitive pressure on their rivals; and it’s working too as they’re taking marketshare.

Depends. I set foot in a Wal-Mart once a year on Easter Sunday when H‑E‑B is closed. They can take their Chinese merchandise and go to hell.

I guess the white house has noticed food prices have not come down yet corn, wheat, etc have all dropped 50% in price over the past year.

I guess the white house thinks price gouging is happening. I would not be surprised. I never did understand why grocery food was cheaper in Europe than the US even though the US is a big exporter of corn and wheat.

By what amount? A penny each?

Consumers are tapped out.

I am in Western Canada, the next door flipper listed newly renovated house for 20% over the market price. Viewings less then one a day. Recent RE data from my hood indicates decent sales in the lower end of the housing market and noticeably slower sales in the higher end of the market. Detached houses up to 800K selling well, up to 1.35M selling slow, over 1.35M not selling at all. My take, the lower end is still the seller market but the upper end is a buyer market for now.

Twitter is awash with examples of serious losses on (mainly) condos and SFH from VC & TO. It will be interesting how long this takes to show up in the data

Our condo in Calgary is rising in value around $3000 a month. We have to increase the rent.

Anyway, there is an Indian Billionaire who apparently owns 20,000 rentals across Canada….that is an issue. But don’t hate the player, hate the game.

We live in Nova Scotia. We are aging out of our Ocean front home on 3.5 acres so are selling and moving closer to town, I was suprised when the realtor said we should list at 880 CAD (635 USD) but when we started looking at available homes the price made sense. There is not much out there to buy and the price of a slab home on a tiny lot or a manufactured home on tiny lot is over 500. With global warming Nova Scotia is no longer Canada’s best kept secret. So we also started looking in the States and even there the prices are about the same and suprisingly when we left the states 16 years agoe we were shocked by the prices in Canada. After doing some research I think Canadian prices are cheaper.

Meanwhile in America, Kamala is promising $25,000 for all first time buyers…

…in a market where the average price is still close to 10x the average wage.

Idiots. The prices are still TOO HIGH, adding more liquidity to that “market” will make it worse. The housing market needs to DEFLATE. Someone tell Kamala. Also curious as to where the 25K is coming from…

And guess what….that is inflationary. So is forgiving student loans (giving out billions of loans that do not have to be paid back).

People want free stuff and then complain about inflation. You cannot have one without the other.

It’s coming out of your pocket, and mine.

3 DAVID GOHN CIRCLE

Markham, Ontario, Canada

Listed at $2,378,000 still hasn’t sold and has been listed for 63 days. The Chinese aren’t presently buying everything listed.

We own our own home In Nova Scotia, Canada, $565,000 3 bedroom current price but we paid $155,000 28 years ago. We never liked the hassles of dealing with being a landlord and with the whole taxes situation with annual class specific depreciation etc.The lower interest has been a boom to higher bond prices since the mid 90’s.

I am very skilled, self taught with many decades of experience in bond trading and bond investing since the mid mid 90’s. I have traded mostly Canadian bonds but not federal but provincial ones. There are so many good bonds to buy and sell as I have done with this bonanza of lower interest rates over the years. It has provided us with alot of capital gains. I can give you so many examples but just 7.5 months ago some provincial bonds at broad numbers $92 to $93 each and sold them just today at $105 to $106.

The interest portion was 2.2% to 2.3% and the capital gains portion was roughly 11%. In less than 8 months, 13%+ returns. Actually, about 40% of our provincial bonds are kept to maturity, bond investing, not bond trading because we bought them at $83 to $84 each bond and they mature at $100 so the capital gain is guaranteed as we will get $100 each bond on maturity. Lower interest rates are making bond returns look like gold and stock market returns.