By Lee Adler, The Wall Street Examiner:

American consumers in the aggregate are far better forecasters of markets and the economy than are the professional economic and financial pundits who are so focused on the meaningless short term headline numbers. The verdict of consumers has been consistent for the past 16 years: Thumbs down.

That matches the decline in real median household income and living standards that most Americans have experienced over that period. It represents the long term decay of the US economy, an economy that is increasingly structured to benefit only the few at the top while leaving more and more Americans behind.

These trends have been promoted thanks to the Fed’s policies of ZIRP and QE which accrue entirely to bankers, leveraged speculators, and corporate executives who get their companies to buy back their own stocks to pay off their self granted stock options. They shrink their companies, lay off workers, increase the pool of unemployed and underemployed workers, and pressure labor market rates lower in the process. These parasitic policies will, if allowed to play out indefinitely, eventually kill the host – the US economy. The long term consumer sentiment trend clearly reflects the results of current policy.

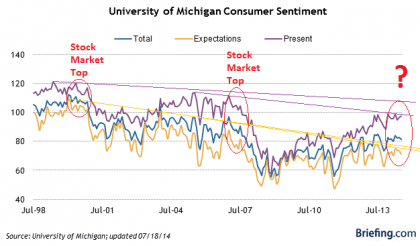

Consumer sentiment has also had a pattern of more pronounced shorter term declines as the US stock market topped out in 2000 and 2007. This chart from Briefing.com illustrates both the long term decline and the negative divergences that have developed at the last two major stock market tops.

Both the Michigan/Reuters measure and the Conference Board’s measure consist of a couple of useful component indicators which reflect consumer attitudes about current conditions and their feelings about the future, which are then amalgamated into a meaningless composite for headline consumption. I like to focus particularly on the present conditions component because consumers are quite capable of evaluating how things are going right now. While their predictions about the future are suspect, the expectations index has nevertheless had a knack of foreshadowing major stock market declines. Pessimism about the future has persisted for 16 years, a clear reflection of the reality of life for most Americans.

While the long term trends clearly depict the steady deterioration in the “American way” of life, I’m more interested in those year long negative divergences that have marked the last two major tops.

Both the present conditions and expectations indexes reached the long term downtrend lines in late 2012. In spite of stock prices going on a massive run since then, consumer sentiment has not broken out in similar fashion. It has remained below the long term trendlines. This shows that the stock market bubble is benefiting only the privileged few. Economic gains are not accruing to the majority.

I see the inability of these indexes to break out to the upside as a sign that the next big move to the downside in the markets and the economy is merely a matter of time.

The longer perspective in this case is deeply troubling. The shorter term negative divergences from economic data and stock prices are also a red flag. If these negative trends do not reverse within a few months, and especially if they deepen, they would suggest that the stock market is likely to be forming the same kind of top that it formed in 2000 and 2007. Worse, any downturn today would start from a weaker economic position than either of the two previous bear markets. The financial and economic impacts of a downturn from such a weak position are likely to be devastating. By Lee Adler, The Wall Street Examiner

In terms of inflation, since rents aren’t fully reflected in the Consumer Price Index, we’re behind the curve. And the Fed, which relies on the PCE index, “won’t even see the curve,” says Lee Adler in this must-see video (and chart). Read…. How The US Government Deliberately Understates Inflation

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The average consumer doesn’t own stocks but does have to buy groceries and other stuff every week. So what goes on in the rigged markets are unreal while reality for us peasants is trying to pay ever-increasing bills. Government statistics, claiming 1% inflation, are also rigged. (It’s more like 10%.) In addition, big business doesn’t give a rat’s ass that all those thousands of soon-to-be-unemployed workers won’t be able to buy any of their products. I’m just waiting for the whole thing to blow up yet again.