Besides that, rents are in free-fall in Chicago, decline in Seattle, plunge here, soar there, city by city.

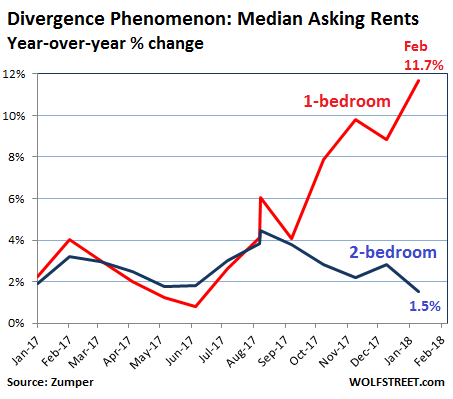

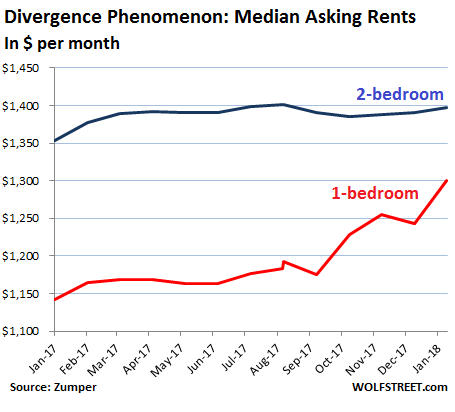

The peculiar phenomenon that had started last November is getting more and more peculiar. The momentum of median asking rents across the US has split in two: On a national average, one-bedroom rents are soaring in the double-digits while two-bedroom rents are barely ticking up. And this was exacerbated in February:

- Median 1-BR asking rent soared 11.7% from a year ago to $1,300.

- Median 2-BR asking rent rose only 1.5% from a year ago to $1,398.

This divergence between the growth of 1-BR rents and 2-BR rents is occurring as 1-BR rents are rising faster or are declining more slowly, depending on the market, than 2-BR rents. In other words, starting in November, on average, the one-bedroom rental market has become a lot hotter or at least “less cold,” depending on the city, than the two-bedroom market, which is beginning to freeze over in many cities.

The reasons for this phenomenon remain unclear, but the guessing game has started. A top contender is simply the price level: Rents are too high, 2-BR rents have moved out of reach, and people are substituting and downsizing.

But rents are local, so to speak.

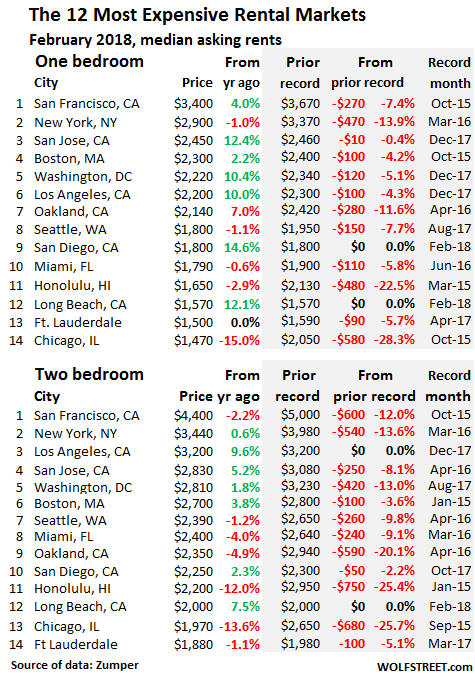

In San Francisco, the most expensive major rental market in the US, the median asking rent for 1-BR apartments rose 4% year-over-year to $3,400 in February, but is down 7.4% from the peak in October 2015. Median asking rent for 2-BR apartments fell 2.2% year-over-year to $4,400 and is down 12% from the peak in October 2015.

In New York City, the second most expensive major rental market, the median asking rent for 1-BR apartments fell 1% from a year ago to $2,900 and is down 13.9% from the peak in March 2016. For 2-BR apartments, it rose 0.6% to $3,440 but is down 13.6% from the peak in March 2016.

These asking rents do not include incentives or “concessions,” such as “1 month free” or “2 months free,” which reduce the effective rent for the first year by 8% or 17%. In New York City, concessions have reached record levels, according to Jonathan Miller, of Miller Samuel real estate appraisers, in his Housing Notes:

The key storyline across all three New York City was the record use of concessions. The market share of landlord concessions – inclusive of paid brokerage commissions, free rent, and other costs – was 49.3% in Manhattan, 47.5% in Brooklyn and 50.8% in the northwest region of Queens.

A special word about Chicago:

Back in September 2016, Chicago was the 8th most expensive rental market in the US. But its rents have plunged, and Chicago moved down the list (below). In recent months, it fell to 12th position. In February, it fell to 14th position with 1-BR rents and to 13th position with 2-BR rents, overtaken by Long Beach and Ft. Lauderdale. Chicago rents are in free-fall, if that can be said about a market that moves in months not minutes: 1-BR rents plunged 15% year-over-year to $1,470 and are down 28.3% from the peak in October 2015. 2-BR rents plunged 13.6% year-over-year to $1,970 and are down 25.7% from their peak in September 2015.

The data is based on asking rents in multifamily apartment buildings. Single-family houses and condos for rent are not included. Zumper gleans this data from active listings in cities across the country and aggregates it into its National Rent Report. Unlike some other types of rent reports, Zumper’s data includes asking rents from new construction.

In this table of the 14 most expensive rental markets, the shaded area indicates peak rents and the movements since then. Note the number of double-digit declines from their respective peaks. And look at the rents in formerly red-hot Seattle that is now drowning in high-end supply that the construction boom is dumping on the market, with 2-BR rents now down 9.4% from their peak:

Other trouble spots among the most expensive markets.

In Honolulu, the 11th most expensive rental market, 1-BR asking rents, now at $1,650, have plunged 22.5% from their peak in March 2015. 2-BR rents, at $2,200, have plunged 25.4% from their peak in January 2015. This market has not yet found a bottom.

In Oakland, the 7th most expensive rental market and one of the destinations for San Francisco’s rent refugees, 1-BR rents, at $2,140, are down 11.6% from their peak in April 2016. And 2-BR rents, at $2,350, have plunged 20.1% from the peak in April 2016.

But asking rents are soaring by the double digits in many less-expensive metros, while they’re plunging in others to produce the national averages that hide most of the drama on the ground. Use the search function in your browser to look for a specific city in Zumper’s list of the 100 most expensive rental markets:

| City | 1 BR Rent | Y/Y % | 2 BR Rent | Y/Y % | |

| 1 | San Francisco, CA | $3,400 | 4.0% | $4,400 | -2.2% |

| 2 | New York, NY | $2,900 | -1.0% | $3,440 | 0.6% |

| 3 | San Jose, CA | $2,450 | 12.4% | $2,830 | 5.2% |

| 4 | Boston, MA | $2,300 | 2.2% | $2,700 | 3.8% |

| 5 | Washington, DC | $2,220 | 10.4% | $2,810 | 1.8% |

| 6 | Los Angeles, CA | $2,200 | 10.0% | $3,200 | 9.6% |

| 7 | Oakland, CA | $2,140 | 7.0% | $2,350 | -4.9% |

| 8 | San Diego, CA | $1,800 | 14.6% | $2,250 | 2.3% |

| 8 | Seattle, WA | $1,800 | -1.1% | $2,390 | -1.2% |

| 10 | Miami, FL | $1,790 | -0.6% | $2,400 | -4.0% |

| 11 | Honolulu, HI | $1,650 | -2.9% | $2,200 | -12.0% |

| 12 | Long Beach, CA | $1,570 | 12.1% | $2,000 | 7.5% |

| 13 | Fort Lauderdale, FL | $1,500 | 0.0% | $1,880 | -1.1% |

| 14 | Chicago, IL | $1,470 | -15.0% | $1,970 | -13.6% |

| 15 | Atlanta, GA | $1,460 | 8.1% | $1,870 | 10.0% |

| 16 | Denver, CO | $1,430 | 14.4% | $1,890 | 14.5% |

| 17 | Philadelphia, PA | $1,400 | 3.7% | $1,560 | 1.3% |

| 18 | Scottsdale, AZ | $1,360 | 13.3% | $2,120 | -7.8% |

| 19 | Portland, OR | $1,330 | -2.2% | $1,560 | -1.9% |

| 19 | Providence, RI | $1,330 | -7.0% | $1,370 | -8.1% |

| 21 | Minneapolis, MN | $1,320 | -2.2% | $1,760 | 1.7% |

| 22 | New Orleans, LA | $1,300 | -9.1% | $1,340 | -15.7% |

| 23 | Dallas, TX | $1,280 | -1.5% | $1,700 | -2.9% |

| 24 | Baltimore, MD | $1,260 | 14.5% | $1,490 | 15.5% |

| 24 | Houston, TX | $1,260 | 4.1% | $1,550 | 3.3% |

| 26 | Nashville, TN | $1,250 | 7.8% | $1,370 | 5.4% |

| 27 | Sacramento, CA | $1,210 | 15.2% | $1,360 | 13.3% |

| 28 | Charlotte, NC | $1,200 | 7.1% | $1,250 | 1.6% |

| 28 | Irving, TX | $1,200 | 12.1% | $1,480 | 8.8% |

| 30 | Orlando, FL | $1,190 | 15.5% | $1,320 | 10.0% |

| 31 | Austin, TX | $1,180 | 9.3% | $1,470 | 5.8% |

| 32 | Tampa, FL | $1,150 | 13.9% | $1,280 | 5.8% |

| 33 | Madison, WI | $1,140 | -0.9% | $1,300 | 1.6% |

| 34 | Gilbert, AZ | $1,130 | 14.1% | $1,350 | 6.3% |

| 34 | Plano, TX | $1,130 | 7.6% | $1,510 | 7.1% |

| 36 | Chandler, AZ | $1,110 | 14.4% | $1,240 | 6.9% |

| 37 | Aurora, CO | $1,080 | 5.9% | $1,340 | 3.1% |

| 37 | Henderson, NV | $1,080 | 13.7% | $1,150 | 4.5% |

| 39 | Newark, NJ | $1,050 | 10.5% | $1,250 | 5.0% |

| 39 | Virginia Beach, VA | $1,050 | 6.1% | $1,150 | 0.9% |

| 41 | Fort Worth, TX | $1,010 | 8.6% | $1,240 | 12.7% |

| 41 | Richmond, VA | $1,010 | 3.1% | $1,150 | 9.5% |

| 43 | Pittsburgh, PA | $1,000 | -8.3% | $1,220 | -4.7% |

| 44 | Chesapeake, VA | $990 | 3.1% | $1,200 | 5.3% |

| 45 | Durham, NC | $980 | 10.1% | $1,110 | 9.9% |

| 46 | Raleigh, NC | $970 | -3.0% | $1,150 | 1.8% |

| 46 | Salt Lake City, UT | $970 | 15.5% | $1,200 | 7.1% |

| 46 | St Petersburg, FL | $970 | 14.1% | $1,540 | 14.1% |

| 49 | Phoenix, AZ | $960 | 14.3% | $1,100 | 7.8% |

| 50 | Buffalo, NY | $940 | 4.4% | $1,100 | -11.3% |

| 50 | Jacksonville, FL | $940 | 14.6% | $1,050 | 1.9% |

| 52 | Fresno, CA | $930 | 9.4% | $1,000 | 5.3% |

| 52 | Kansas City, MO | $930 | 2.2% | $990 | 3.1% |

| 54 | Mesa, AZ | $910 | 13.8% | $960 | 1.1% |

| 55 | Las Vegas, NV | $900 | 15.4% | $1,000 | 7.5% |

| 56 | Syracuse, NY | $890 | 12.7% | $940 | -6.0% |

| 57 | Louisville, KY | $880 | 15.8% | $930 | 14.8% |

| 58 | Anchorage, AK | $870 | -6.5% | $1,110 | 0.9% |

| 58 | San Antonio, TX | $870 | 1.2% | $1,100 | 0.9% |

| 60 | Baton Rouge, LA | $860 | -1.1% | $900 | -10.0% |

| 61 | Boise, ID | $850 | 4.9% | $950 | -3.1% |

| 61 | Corpus Christi, TX | $850 | 4.9% | $1,060 | 14.0% |

| 63 | Milwaukee, WI | $840 | 6.3% | $940 | 4.4% |

| 64 | Colorado Springs, CO | $830 | 3.8% | $1,000 | 0.0% |

| 65 | Omaha, NE | $810 | 15.7% | $920 | 2.2% |

| 66 | Bakersfield, CA | $800 | 9.6% | $860 | 7.5% |

| 66 | Reno, NV | $800 | 15.9% | $1,180 | 12.4% |

| 68 | Cincinnati, OH | $790 | 8.2% | $1,020 | 7.4% |

| 68 | Glendale, AZ | $790 | 14.5% | $860 | -1.1% |

| 68 | Lexington, KY | $790 | 1.3% | $930 | 0.0% |

| 71 | Chattanooga, TN | $780 | 11.4% | $820 | 9.3% |

| 71 | Rochester, NY | $780 | 14.7% | $980 | 15.3% |

| 73 | Knoxville, TN | $760 | 13.4% | $830 | 3.8% |

| 76 | Des Moines, IA | $720 | -8.9% | $760 | -10.6% |

| 74 | Laredo, TX | $750 | -2.6% | $900 | -1.1% |

| 75 | Arlington, TX | $730 | 7.4% | $970 | 7.8% |

| 77 | Augusta, GA | $710 | 12.7% | $750 | -5.1% |

| 77 | Cleveland, OH | $710 | 10.9% | $760 | 7.0% |

| 77 | Oklahoma City, OK | $710 | 14.5% | $780 | 4.0% |

| 77 | St Louis, MO | $710 | 2.9% | $1,010 | 5.2% |

| 77 | Tallahassee, FL | $710 | 9.2% | $790 | 3.9% |

| 77 | Tucson, AZ | $710 | 14.5% | $800 | 1.3% |

| 83 | Norfolk, VA | $700 | 7.7% | $900 | 2.3% |

| 84 | Greensboro, NC | $690 | 15.0% | $800 | 3.9% |

| 84 | Spokane, WA | $690 | 6.2% | $910 | 12.3% |

| 86 | Winston Salem, NC | $670 | -4.3% | $720 | -2.7% |

| 87 | Indianapolis, IN | $660 | 15.8% | $720 | 5.9% |

| 88 | Columbus, OH | $640 | 0.0% | $950 | 4.4% |

| 89 | El Paso, TX | $630 | 0.0% | $740 | -1.3% |

| 89 | Memphis, TN | $630 | 14.5% | $690 | 11.3% |

| 89 | Tulsa, OK | $630 | 12.5% | $730 | -1.4% |

| 92 | Albuquerque, NM | $620 | 3.3% | $800 | 3.9% |

| 93 | Shreveport, LA | $580 | 1.8% | $620 | -7.5% |

| 93 | Lincoln, NE | $580 | -14.7% | $770 | -6.1% |

| 93 | Lubbock, TX | $580 | 5.5% | $730 | 7.4% |

| 96 | Wichita, KS | $570 | 14.0% | $660 | 0.0% |

| 97 | Akron, OH | $560 | 5.7% | $670 | 3.1% |

| 97 | Toledo, OH | $560 | 14.3% | $640 | 14.3% |

| 99 | Detroit, MI | $530 | 0.0% | $600 | -3.2% |

| 100 | Fort Wayne, IN | $510 | 6.3% | $580 | 5.5% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“A top contender is simply the price level: Rents are too high, 2-BR rents have moved out of reach, and people are substituting and downsizing.”

That has to be part of it. I don’t know how those statistics are calculated, but could it be that the newer more expensive construction has a higher percentage of one bedrooms which would skew the numbers?

Whatever the reason, indeed, rents and housing costs are too high. Part of the inflationary wave precipitated by current monetary policy.

Vancouver BC peaked fall of 2016…now with thousands of new condos completing prices are on the down …same for real estate sales sinking ship hopefully everyone has a life jacket

In this area, Buffalo, there are a couple things in play. First, they really overbuilt suburban two bedroom rentals. Second, there are lot of single renters, divorced empty nesters and single people.

That said, developers have seriously overbuilt in rentals. In my neighborhood we have thousand os units coming online and many more in development. The nest city suburban housing market (1200 sq ft, 3 bedroom brick houses bulit in the 50s) are becoming ghettoized.

A number of factors at play across the country. One big one is emigration from less desirable and immigration to more desirable. Certain parts of the northeast and midwest are losing people daily. The southeast and Florida gaining. Those changes affect the demand side.

Continued apartement building in some areas (supply) is being filled; others will see vacancies grow.

I don’t think there is any question that a major apartement boom has occurred across the country. And it still continues, even in areas that are seeing declining demand. You have to ask yourself the question as to why this goes on. Who is financing these apartments? I think you will find the Federal Government deeply invovled through Fannie/Freddie.

I think we will see these unprofitable ones going back to the government in the future….that’s been the hidden plan all along. In the meantime, the apartment building has generated lots of jobs to stimulate the economy.

If we dug deep enough we would find a lot of Teacher’s pension funds financed a lot of this overbuilding.

The decline in chinese funny money is the biggest driver in all this IMO, both on the way up and now on the way down. Drove all the tertiary effects – person sells to Chinese, moves to 2nd tier location which drives up prices there, etc.

And this country needs to stop passing laws to fix the flaws in human nature. Let people live in their vehicles; give people a place to crash in tents. This constant predation by the busy bodies in control is going to provoke a backlash that wont be pretty.

Very interesting article. I concur that the cost of a two bedroom is a major factor in choosing to live smaller. I would imagine a re-purpose of the kitchen table, or a desk in the corner negates the need for the bedroom/office, and a fold-out couch for the occasional visitor is another option.

But talk about depressing. This article paints a very clear picture of modern serfdom. Work, barely getting by. Rent, until the day you die.

I really admire ‘Van by the River’ solution to his high-cost situation. He will get by working in high cost Seattle, then will get the hell out when he decides to move on. SF = a hundred bucks+ a night to grab some zzzs, shower up, and store some stuff. People are so busy running on the wheel they don’t have time to evaluate and correct in many cases.

My question about these high priced areas. Where do the silent people live? The city workers, police, gas station attendents, ticket takers, cleaners, etc? Obviously, they aren’t raising kids in a $3400/month apartment. How do these cities even function anymore. (I include Vancouver and Victoria BC in this question).

regards

They are called “super commuters”.

https://www.youtube.com/watch?v=e3_jC_Oe8hQ

Some of the silent people live with their parents. Such is the case with my stepson, his wife, and their child. They just weren’t going to make it any other way, so we decided to live on as a three-generation household, with the demand that they take over an increasing share of household expenses as my retirement funds are eroded by inflation.

Paolo,

yes. it’s bad. it’s bad even for people who’ve got homes. their kids can’t stay nearby and they don’t celebrate holidays like they used to. it happened so fast it’s shocking. the ones with houses go crazy being alone in their own way. that’s why i know no one’s truly “winning” here.

but what’s really sad is i’m seeing families routinely breaking up when they lose their homes from all the casual evictions (stress leads to divorce, sending elders to old folks homes, and kids may stay behind in SF on a neighbor’s sofa to finish school), and people are living in shelters, cars and vans for real. no one really cares about housing for regular folks anymore.

even Santa Rosa is going to decimate a trailer park that actually survived their big fires, so they can build condos now. and YES, Santa Rosa, the suburbs, sound worse than the city ever did with crime and homelessness and blatant crime.

living in cars and vans is losing its stigma as most of us are an eviction away from considering the same. many of us don’t even have cars in the city so that’s a step UP to living under the highway overpass.

our building is currently getting painted and one of the few white guys you EVER see doing actual labor, he said he crashes sometimes in Bernal (i think it’s his main squeeze) but he admitted looking for a new vehicle he can live in. the look on his face… i’m seeing that disgusted rage more and more like never before from all walks of life now.

as Alex in the Digital Detroit says, the escalator has stopped for regular people and they know it. there is a level of disgust that i’ve never seen en masse before. i used to feel it as an undercurrent. but now… it’s alarming. because no one believes in this country much anymore. it’s like a free for all now and the fact that people feel like suckers for not being axxholes isn’t a good direction.

the rage and disgust is palpable. but people in power don’t fear poor folks anymore. they think they’re safely toothless. but no one cares anymore. about anything. their work.

the paint job here is so bad, i asked the kid who took away the ladders if we tenants were supposed to pay extra to have them clean the splattered paint off the windows. but that’s what you get more and more now when our management company gets bids from the lowest bidder online (we’ve had bicycles and our gas grill stolen because we have NO IDEA who they send over to do half-assed fixes that are shockingly horrible like building stairs that crack because there’s 50% overhang).

no one cares about their work or being honorable anymore. it’s actually depressing because i know what i’m like when i feel like i’ve got nothing left to lose.

I care about my work :-]

And so do you!

you make me laugh for calling me out on my lack of specificity. James does that, too.

yes. we do honor our work, and that’s why i feel bad when others are forced or encouraged not to care because it poisons you to spend most of one’s working hours checking out.

as artists back in the 80s, we were taught to draw well before we went abstract and to paint and finish even and especially the UNDERSIDE of sculptures.

what makes me swoon about tailoring is the importance of even minute interior details like how seams are finished so they can be forever and not ravel or be generous enough to be let out.

i cannot imagine life where you don’t CARE about what you’re doing or your affect on others and life in america seems all about that now.

your site is all about showing the slipshod lack of inspiration, detail, structural integrity and architectural underpinnings under this huge massive tilting sculpture.

i come here for the OPTIMISM. that others here DO care and get broken hearts. this is a romantic site to me, even with all your distracting graphs charts and talks of fed reserves getting interest. some stuff i’ll NEVER get no matter how many times i re-read your explanations on how things work.

p.s. your site makes me optimistic because there ARE some adults left in the room who understand all these woo woo “look over HERE!” distractions.

your site makes me optimistic because i see more tiny green shoots of re-birth here more than anywhere else.

there is more cutting edge “art” here in watching people who’re learning to live honest lives, daring to live generously, and care about the well being of their fellow humans, in spite of the constant siren calls to do otherwise.

thanks, Wolf. i love what you do and feel the honor of your craft and it inspires me. i’m crying again. jeez. i actually love crying over sweet stuff. i’m desperate for it.

yes. you DO care about your work.

x

You live in a bubble Wolf, surrounded by gentrified areas and the tech forests, which yield their fruits to only a select few.

I suggest you take a road trip across America.

I spent half my life in Texas and Oklahoma. Does that count?

I’ve crossed large parts of the US a number of times, including via Greyhound Bus (70s), hitchhiking (late 70s and early 80s), and driving. Does that count?

Lopez – Wolf lives in SF, he can literally walk a block or three in any generation and find a homeless village or an out-and-out slum. He’s not insulated.

That’s like saying I’m insulated because I live in the land of Google and Adobe etc. Yeah, those things are here but my Silicon Valley is not that one at all. It’s poor people, homeless encampments, playing street music paying better than a real job which is fine because real jobs are incredibly hard to get, knowing you’re about as likely to afford a moon rocket as ever afford a car, and if you’re really doing well, you get to live in a warehouse like I do.

Those are median rents, so there is cheaper supply out there.

The median 1br in Boston is $2200, but there are 1brs available for $1000. And 1brs available for $4000.

Police in SF start at $83k a year. I don’t know the housing situation at all there, but if you’re a 30 year old police officer making let’s say $90k a year and live with another roommate or two, renting doesn’t seem that bad. Minimum wage workers? I imagine it’s impossible to live in the city unless you live in a large apartment with a lot of roommates and spend all of your income on basic necessities.

“but if you’re a 30 year old police officer making let’s say $90k a year and live with another roommate or two”

Sounds like living in Hell. That kind of money should allow anyone to live extremely well without room mates.

In Vancouver, many singles share apartments and houses. My son shares a house with 3 other young men. He is only tolerating this until he has finished his studies after which he will move to a more affordable city.

Sweet about Chicago rents. I’ve always wanted to rent a place for a year or so in Downtown Chicago as a 2nd home to get away to from time to time. See the sights. Go to events. Hide out. Whatever. With interest rates rising and rents falling, this might be possible in a couple of years.

Why not use AirBnB and only pay for the nights you actually stay there rather than being locked into a lease?

More fun to come and go whenever. I could get a better deal at a hotel that includes breakfast and a kitchen in the room. Not the same thing. AirBnB, never. Too weird. Lots of good room prices available if you know how to shop. Transportation is the big expense when vacationing. Rooms are a commodity.

when I travel with my family, I stay in good hotels with provides gourmet custom order made breakfast as complimentary.

For a family of 4/5, it makes perfect sense.

In SD (up14%, tops) the rise in vacation rentals has grown, the story goes thusly, City of X in snow belt gives homeless person a bus ticket to SD. Homeless person arrives and shows up at public shelter, public officials build new temporary shelters, (one tent shelter for seven months cost 65M), in response the Mayor and council raises the hotel tax on visitors (some from X who come here for winter vacations) Visitors from X see that $100 room costs $150 and go for the “vacation rental”. Vacation rental Landlords raise their rates. The city lost its football team because they couldn’t agree on a hotel tax to fund the project. Note to X, quit sending us your homeless.

Do you get puzzled why the stray cat comes for the bowl of milk placed outside your door?

The situation is much more similar to the dog that waits, for years, at the bus stop where his now-deceased master used to get off the bus and walk with the dog, home.

A huge number of homeless people here lived here, grew up here, had families here, etc. Very few turn out to have specifically come here to be homeless.

2-Bedroom rents are too high yet in many of those cities you can’t even buy at 2 and rent it out for a profit at current prices. Relative to cost to own prices aren’t high enough. The only thing left to chase is asset appreciation which leads to speculation and bubbles. At least not with 20% down…

A friend manages a 20 unit complex in San Francisco. All 2 bedroom units. He concurs that the price peak was a couple of years ago.

I wonder if Chicago is a case study in how you don’t need rent control as long as you allow enough construction. The downtown area is booming right now, but so is apartment construction. I think they are second only to Seattle in number of construction cranes active, with multiple super tall skyscrapers going up.

If this is the case, I actually think Chicago is a positive example: you can have growth without massive price increases as long as you allow enough construction.

OTOH, Chicago is a bifurcated market: the central core is doing really well, the south and west sides are emptying out. So maybe the “average” rent doesn’t capture an accurate picture.

Either way, I don’t see how declining rents are a bad thing for anyone besides the owners of the rentals.

Are the SD one bedroom numbers accurate? February 2018 seems equal to the peak in February 2017 but the chart says rents are up 14%.

The year was wrong. SD 1BRs set a new record in February, so the date for the record should have been Feb 2018, and not Feb 2017. Fixed. Thanks.

a. yes, it counts

b. one bedrooms might be a sign people want their own place and can afford to do so

c. lowest rent is in fort wayne indiana. an example to all

d. overbuilding is real, but low rates allow the projection into the future and the carry for the now; at some point money and people might be more scarce

yeah, i know, obvious.

I wonder if this 2 bedroom pricing phenomenon is forcing people to ‘roommate up’ involuntarily?

So now, some astronomical rents are finally coming down a bit to a level that is still unaffordable for vast swathes of the workforce. It’s ok, maybe Bay Area residents can all move to Reno and commute over the Sierra Nevada by helicopter; of course Reno rents are skyrocketing at +15% annually for a one bedroom, as Silicon Valley decamps to more welcoming terrain, where housing is still cheap and Tesla is building that huge battery plant.

It is very sad that so many people work very hard all over the US to pay 1/2 or more of their take home pay for rent, or to live in their cars, or on the streets. I am a native (former) Californian and when I hear friends from my current state of Florida talk about SF as a horrifying place with lots of homeless and human waste on streets, even in tourist areas, I am utterly ashamed of my country. No one notices the shiny new condos (unoccupied by the homeless or anyone?) all over town.

This says massive housing crises; massive income crises; massive apathy by our government to the plight of the many.