Peak Rent. Traces of relief for renters. Landlords scramble. But in cheaper cities, rents soar.

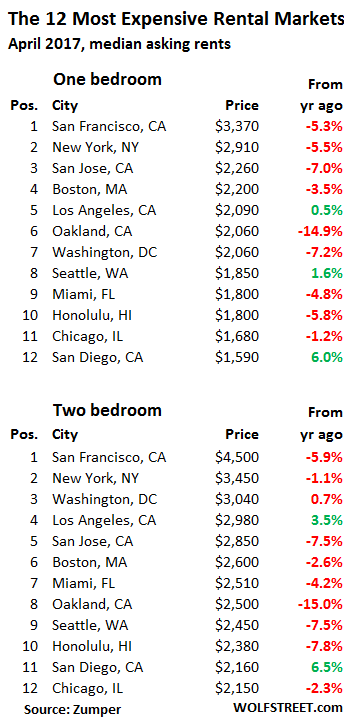

In April, asking rents for two-bedroom apartments declined from their respective peaks in all of the 12 most expensive rental markets in the US, ranging from a tentative 1.3% down-tick in Los Angeles to an 18.9% plunge in Chicago.

For one-bedroom apartments, asking rents declined in nine of the 12 most expensive markets from the respective peaks, with Chicago’s median rent down 18%.

It seems the 12 most expensive rental markets in the US have had a date with reality, and that can be tough. But in some “mid-tier” markets (in terms of how expensive rents are), rents are soaring by the double digits.

The gap between plunging and soaring rents gets neatly averaged away in the national numbers to create a rental la-la land where the median asking rent for a one-bedroom apartment rose 3% year-over-year to $1,169, and for a two-bedroom 2.9% to $1,390. No sign of the drama playing out in local markets.

Zumper’s National Rent Report, on whose data this is based, tracks asking rents in multifamily apartment buildings. Single-family houses for rent are not included though they’re ultimately impacted by multifamily dynamics.

In ludicrously expensive San Francisco, the median asking rent for a one-bedroom apartment dropped 5.3% from a year ago to $3,370 and is down 8.2% from the peak in October 2015. For a two-bedroom, it dropped 5.9% to $4,500 and is down 10% from the peak.

This doesn’t happen often: The last episode of year-over-year rent declines in San Francisco ended in April 2010.

These asking rents do not include incentives, such as “1 month free” or “2 months free.” Incentives were rare during the years of breath-taking rent surges in San Francisco. Now, with new apartments and condos flooding the market due to a historic construction boom that coincides with a slowdown in job creation, incentives have become common. And they have a big impact. For example, with “2 months free,” the first-year median rent of a two-bedroom would be down 25% from its peak. That’s $15,000 a year!

Incentives are a way of lowering the rent without showing the declines to the public, on the fear that lower rents beget lower rents and encourage renters to negotiate. By hiding the actual declines, the industry hopes that next year, rents might rise again.

And signs of desperation are cropping up – desperation both, among investors that sit on new but vacant luxury condos with very high carrying costs; and among folks looking for an “affordable” nice place to stay, even if space and privacy are a bit compromised.

So a startup has sprung up to bring these two desperate parties together. The SFGate:

These arrangements, which come complete with subdivided bedrooms featuring upholstered partitions between roommates’ beds, come courtesy of HomeShare, a startup that carves up rooms inside of unoccupied luxury apartments and then vets and links up strangers to occupy them.

Each of HomeShare’s hundreds of tenants gets about 55 square feet along with half a closet, half a bathroom, and a compact common area shared with a roommate and usually two other flatmates, slumbering in the unit’s other divided bedroom. Each micro-bedroom fits a queen-size bed and little else. Some of the walls don’t quite reach the ceiling. It’s a fit for the kind of person who needs to scrounge cash and will tolerate roommates, but craves panoramic views and glistening new plumbing fixtures.

In New York City, the second most expensive rental market in the US, the median asking rent for a one-bedroom dropped 5.5% from a year ago, and has now plunged 12.9% from the peak in March 2016. Rents for two-bedroom apartments fell 1.1% year-over-year and 10.4% from the peak. And there too, many landlords are luring buyers with large incentives.

This table of median asking rents and their year-over-year changes in the most expensive large rental markets in the US is awash in red ink where for the past half-dozen years there used to be thicket of lush green:

Rents in the Bay Area cities of San Francisco, San Jose, and Oakland are all in the red. Note the free-fall of rents in Oakland, down 15% year-over-year.

In terms of the longest plunge from the peak, Chicago is it: from peak rent in September and October 2015, median asking rents have plunged 18% and 19%!

Even in Seattle, where annual rent growth was in the high-single digits through the fall of 2016, red is making an appearance. While the median rent for a one-bedroom eked out another record, the median rent for a two-bedroom has dropped 7.5% from a year ago.

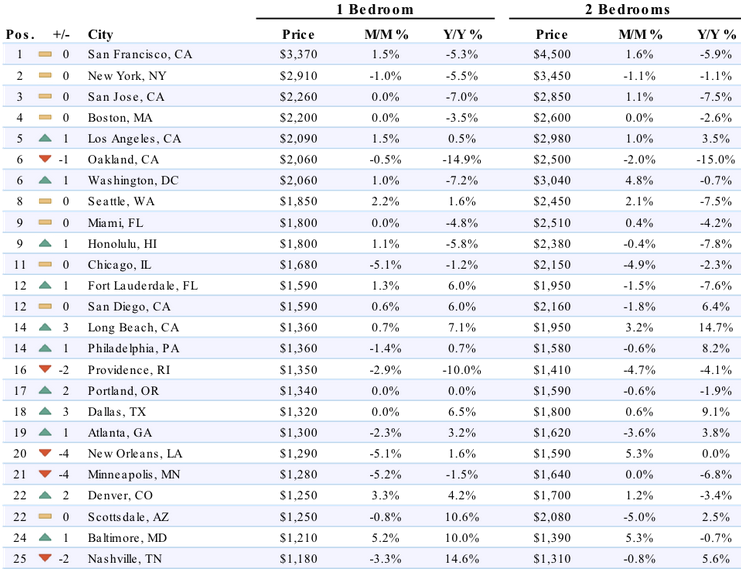

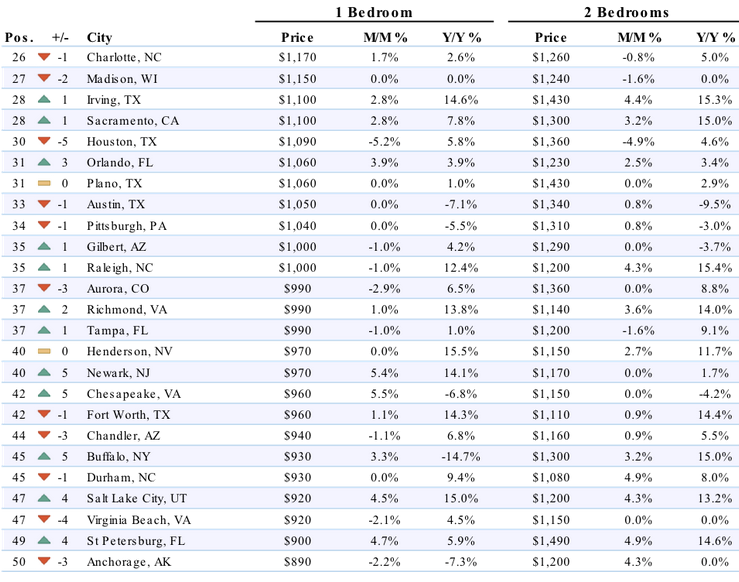

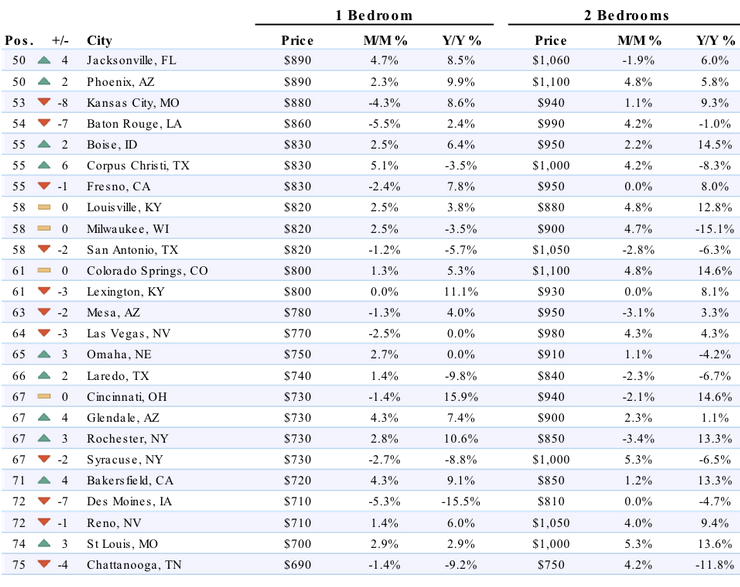

But huge rent increases, some well into the double digits, are migrating to mid-tier markets, with two-bedroom apartments experiencing often the largest increases, for example: Nashville, TN (+14.6%); Irving, TX, (+15.3%); Sacramento, CA (+15.0%), Raleigh, NC (+15.4%), or Richmond, VA (+14.0%).

For renters living in any of those markets, their cost of living surged far beyond what the national averages of the Consumer Price Index might suggest. And few of them received a corresponding double-digit pay increase. This might be part of the problem with the overall economy. It depends on consumers taking on debt to buy things they cannot afford, but these consumers, perhaps strung out by rising rents, are now cracking. Read… Are American Debt Slaves Getting in Trouble Again?

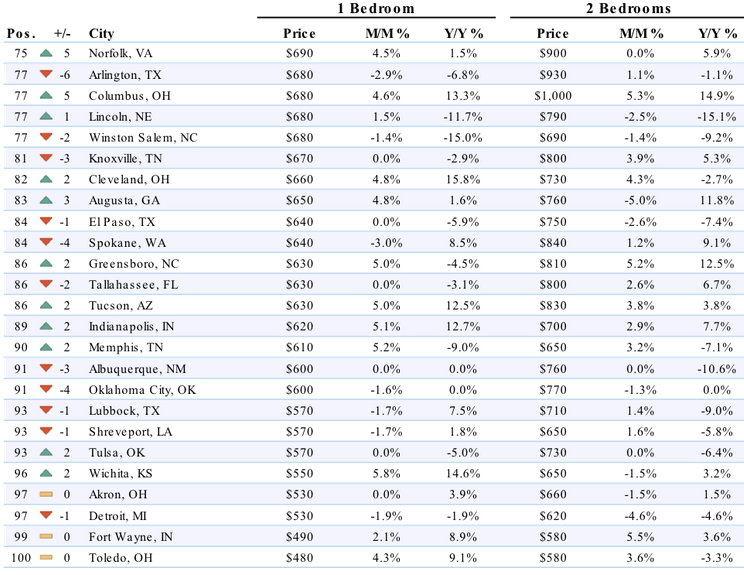

Below are the top 100 rental markets in April, in order of the amount of rent for one-bedroom apartments (tables by Zumper, click to enlarge):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Great read! Rents are finally coming down and home prices are following the trend also. Deflation rears is ugly head as the housing/rental bubble finally is pricked. The FEDS plan of reflating bubbles is backfiring. How many more schemes do they have left to support the FAILING AMERICAN economy while consumers are credit-tapped to the limit?

Amazing how there are significant bubbles in some cities whiles depressing RE values in others. My company has a dispersed workforce with Denver-area employees enjoying $300-$500k valuation increases in their homes, yet DC-are employees get peanuts. Texas price increases are minimal by military bases and over 100% in some metro downtowns since 2000.

The economy definitely needs this wealth effect, even if disperses. Homeowners feel smart, then entitled to start spending.

The economy needs this? Are you kidding me? The wealth effect doesn’t do anything for the long-term health of the economy. How do people not understand this this given the last couple decades of economic history… Pls

Mike, You write better than Wolf. I should read the posts more often.

Nothing accelerates the economy, creates jobs and raises the standard of living like falling prices to dramatically lower and more affordable levels. Nothing.

Let her rip…

That’s true, but the asset price deflation causes a painful recession before the recovery can begin. That’s why the Fed won’t let asset prices drop. The Fed would rather sit back and watch the cancer grow, while hoping it simply goes away.

The Fed can’t do jack. If they could, housing prices wouldn’t have fallen 30% from 2007-2009.

They do NOT care about economy, jobs or standard of living.

Wealth transfer is what they care.

Creating complexity, dependence and control is what they care.

They may allow some minor episodes of price drop, those would be minor and it is part of the transfer as well.

Over all inflation trend stays until currency is trashed or revolution.

To deliver economy, jobs and standard of living is “failure” of .gov.

Stagnation, dependent citizens and debt slavery is “success” of .gov

As long as .gov is functional, one should expect inflation.

US of A was founded by the principke of disfunctional government, that’s why it was a great country and economy, jobs, standard of living was good.

Now the .gov is strong and functional.

“US of A was founded by the principke of disfunctional government, that’s why it was a great country and economy, jobs, standard of living was good.”

JZ… beware of your ASSUMPTIONS for they will hobble you. USA was not a great country, economy, standard of living for ALL people. and that is now part of the problem… the system is doing what it was designed to do consume and ravage, which was okay as long as “others” took it on the chin…

but there are no “others” … there is no smoking section/you pee in the water we’re drinking…

That does not hold water. Asset price inflation is mainly caused by private money creation, that is, comercial banks issuing new debt.

Somehow, people asume that only gov can cause inflation, and this assumption is just false.

On top of that, the USA really was the thriving when government ess strong enough to tame the financial sector along with monopolies: New Deal.

The relationship among private banks, .gov and inflation (asset or cpi) is complicated.

If you want to go to the core, it is the .gov because they issue “money”.

On the surface, inflation is caused by private debt/credit which are promises to pay “money” issued by .gov.

When those “credit” go bad, you face either deflation or “bailout” of all forms that ends up on the shoulders of the public.

In the past 30 years, it has been bailout, which is wealth transfer. Encourages more credit/debt creation and inflation.

Inflation was caused by private credit, but .gov is the ultimate drive that encourages private credit and therefore inflation.

The key thing is “how much government violence power should be used in economics”.

If you give .gov lots of power, it could do good things or bad things. There were cases they did good, there were cases they did bad.

Just remember, given long enough time, power corrupts human like cocain.

I would prefer .gov stay out of economics and money should be sound backed by real stuff as opposed to corruptible promises.

There were days when a hard working person can raise a family of 3 kids and retire.

Nowadays, if you read wolf street long enough, it is all about debt slavery, people on pay check to pay check, 50% population has no savings, kids live in parent’s place and. body can retire.

Free market dynamics.

What’s not mentioned, yet increasingly popular, is flexible lease terms. Renters can choose from 6 to 14 months of rent (adjusted according to commitment). This didn’t happen 15 or 20 years ago.

Fluid prices. Fluid lease terms. Mobile workforce. Sharing economy (HomeShare). Great indicators of economic health within cities. But also, great advantages for the U.S. economy. If you haven’t already, jump aboard one of the new economy trends. I have a condo on airbnb myself.

Really …your condo on Airbnb. Well, what shall you do when all the condos in your building, in your development, in your neighborhood are all on airbnb? By the night, no less. Market Dynamics, you are going to really love market dynamics then.

That only considers the supply end of things! What about demand When the unemployment rate goes to 15-20% and there are half the people vying for those over-supplied apartments? Oh well, guess we’ll put the rent to $500 a month to provide incentives…wait, my mortgage is $800 a month…

The unemployment rate isn’t far from 15% now, and getting $500 a month to pay most of your $800 a month mortgage is better than saying “Hmph! I won’t play!” and paying all of your $800 a month mortgage.

This is what people did before things got crazy. They’d take in renters, and feel good that they were essentially getting a 50% discount buying their house.

fed would do whatever they can to not pop the asset bubble…. They can do massive QE as well as implement ZIRP….

Dow 50K for sure. The stock market just loves these bad stats. If the data is not so bad, it rockets, if the data is REALLY bad, it goes to the moon.

The People’s Bank of China has been “price managing” assets for years now and their policy has not exactly been a success.

To stay on target, the PBOC has tried time and time again to “manage” (read: deflate) the absurd Chinese housing bubble but ended up flip-flopping on the matter after the 2015 stock market crash and possibly after seeing the real data (not those created for the consumption of us gullible Westerners) about overcapacity in the usual culprit industries: cement, glass pane, rebar etc.

On square meter basis (note that this applies to “investment grade” residential real estate), the China housing bubble has now entered ludicrous speed, with Shenzhen well over the $7000/m3 mark and on its way to $8000. By contrast San Francisco is at around $4800.

Of course whose who bought early are happy because their equity has shot in the stratosphere, but many other aren’t. Both the Shanghai and Shenzhen stock markets have entered a prolonged period of “managed” decline and officially the government is hell-bent on stomping capital flight.

So the PBOC is intervening again, pumping liquidity into a system which is awash in it already, and that’s without counting the shadow banking sector. This creates monumental inefficiency and waste: according to official data, China now needs to spend 100 yuan to get 7 yuan of GDP growth. The rest? It gets wasted or pumped into hare-brained schemes such as buying apartments which were never meant for people to live in, only flipped around.

Provided you find somebody willing to do the flipping.

To paraphrase Bill, it’s about JOBS, stupid. And add to that: middle class, bulk-of-the-bell-curve affordability.

CHRIS FROM DALLAS!

damn, it’s like CHRISTMAS now!

(we’re still missing some regulars but i think they’re taking time off to watch the birds and avoid the news for a bit like i must)

x

Chris From Dallas

The good jobs have sailed away and are probably never coming back in the next to 10-15 years at a minimum. Everything is made in China and techies in San Francisco may luck out on cheaper rentals but as the middle classes have been eviscerated across the entire US who will Tim Cook sell his $1000 iPhones to?

Cook will sell his iPhones to ATT/VZ/et al who will lease them to their customers for an extra $20/month with a 24~36 month contract calling it the “Get A New Phone Every X Years” plan. Oh wait…. Cook’s already doing that too.

When an item gets too expensive to sell, lease it. Depreciation? Meh… Look at my shiny new phone!

Thanks Wolf,

I enjoy when these reports come out. It would be a nice bonus to compare current rents to peak rents. I know you had a peak rent column in months past. No biggie.

Also, it’s interesting to see that the San Diego rental prices seem to still have legs. A little surprising.

I found some inconsistency in the data I had received from Zumper a while back about the max rents – some things weren’t adding up with the new data I was getting from Zumper. So I didn’t post the part of the table that shows the declines from the peak.

I have meanwhile sorted this out with Zumper. They’ve been great. Turns out they’d made some revisions to their old data, based more complete information, etc. So now I have the revised Max Rent data. And it adds up!!

So next time, you’ll see the table with the declines from max rent.

“Each of HomeShare’s hundreds of tenants gets about 55 square feet along with half a closet, half a bathroom, and a compact common area shared with a roommate and usually two other flatmates, slumbering in the unit’s other divided bedroom.”

Weren’t these called tenements in previous centuries?

But the economy is fine. Just fine.

I suggest you check the HomeShare webpage to see prices for yourself. Let’s just say it can only work in markets where a one bedroom apartment is over $2000/month.

These guys are after the startup cannon fodder who flocks to San Francisco and Silicon Valley, not your ordinary low wage worker.

Tenements may not far from the truth. We’ve returned to the era of debt-slaves with un-dismissable student loan debts.

While admiring HomeShare, I’m disappointed this generation can’t simply meet people through regular means to find roommates. There seems to be a social website to replace every in-person social behavior normally required in life.

oh, technology has ravaged social codes and bypassed biology.. it’s astounding to see what it’s done to SF. there’s a lot of melt downs and stress and mental stuff that’s breaking apart because of it.

my friend in england who says london’s turning into a theme park, she said the netherlands are thinking of putting lights in the curbs because people don’t look UP anymore.

it’s EVERYWHERE. it’s incredible. we’re in SF, the most gorgeous city in the world and all these new young people are here taking apartments from people who LOVED it here, and the new folks don’t look UP ever.

it’s all about the STORY. what you can put in your profile. people are taking photos of their FOOD for pete’s sake.

and there was a local story about a couple of cute party girls going and sitting in a bar waiting to see if ANYONE would hit on them. no one did. they were all on their PHONES… swiping…

capitalism and the commodification of everyone and everything is here NOW. you swipe photos of people you wanna fuck and women write LISTS of things they want in men…

it all seems inevitable. but then so does SOME kind of human backlash that screams out for LIFE again…

Kitten – No kidding!!

When I’m out playing my trumpet for tips it’s amazing how many people are walking by like zombies, staring at their phones. And yes, I’ve seen people taking pictures of their food, it’s just weird.

Walking around downtown, you have to have a very good spatial awareness because so many people don’t, and I’ve seen people almost walk into a post etc.

i know it’s so CREEPY and openly bottom feeding like Warren Buffet’s the pied piper of pulling the rings off the half-dead.

i’m watching the matrix again. i have a short attention span for screens and tv now, so it might take us a week to finish it, but sci fi is like the terminator to me now–all that stuff seems so quaint and old fashioned now like the WALTONS.

the future’s here and it’s still got birds tweeting and beautiful sunsets and i’m having the time of my life now that it’s all out in the open. the world is finally catching up to wolfstreet because the lies are threadbare and you can actually SEE people still trying to talk over the rampant b.s. like wallpapered dreams atop rotting plaster.

because what else IS THERE???

wolfstreet… you might go take a nap or shoot up to take it at first; but you’ll BE BACK.

even the archdruid quit his racket as it is online. i see renaissance and change everywhere….

i have NO idea what anything underground or cool will look like or where it’ll be now that everyone bad ass is dispersed… but people are still in shock…

i’m watching PETUNIA. i know a lot of the best things are gonna happen offline again soon. and Petunia will end up doing more in life and be here LESS… so that’s why i wanna know her here while i CAN. read all i can.

long distance relationships seem less likely to work because it’s hard enough staying in touch with someone down the STREET. and that’s the future to me.

thanks for existing, Wolf. and doing THIS.

i still think one day you’ll have a crazy little bar that old astronauts and adventurers drink at together. i rode my motorcycle through the desert here and happened on a place like that. met a guy doing the pacific coast trail with a donkey and a horse and i was young and he was older enough to say, “come with me. you don’t know it yet, but you don’t meet people like us in the world anymore. this is special.”

i had goals. things to get home to. or so i thought. i had no idea how right he was and i wished i’d gone with him. but he’d talked about holding onto the horse while going poo and for a young woman, that was just too much man reality for me at that time. (that was when i didn’t think men even pooed)

(sorry i went on. i’ve been having crazy good creative jags and focusing in on my new epic goals which i’ll share here later. because now i wanna help start an ART SCENE in real life now that it’s all dying as it was in sf and elsewhere. something without PHONES internet and documentation. something SECRET. sweet… more later)

have a good day you all. but i love this site because it saves me TIME in getting to the bottom line of all this b.s. so that as an entrepreneur and artist trying to get AHEAD of the crowd, i can plot my own comeback in all this mess.

and i had a very wealthy friend of mine from england come to me about helping them save stores and events in person and i laughed because i said EVERYONE’S trying to save their store. she didn’t even KNOW or GET how bad it is.

wolfstreet makes this news old hat. but i’m always surprised at how oblivious wealthy people are about the conditions they helped cause.

Petunia’s right about po’ folks being the only ones who really know how to do math or handle cash. their survival depends on constant math.

x

Those ‘share a bedroom/rentals in San Francisco are pretty close to a prison cell. In fact, you could commit a few felonies and a judge might offer you similar accommodations across the Golden Gate in San Quentin. You’d live rent free and the weather is nicer.

The vetting on the roommates is a bit different though.

“The vetting on the roommates is a bit different though.”

i LAUGHED when i saw that because you’re implying prisoners would be dangerous roommates, but the wild west of the new sub-rentier class and how they become WORSE than their own landlords… it’s causing a lot of crazy stories that don’t make it into the ratings systems so both will keep reality quiet.

i had to put the kabosh on everyone in our building airbnb’ing their places out because they were such greedy new sub-landlords, i thought the sub-tenants they were casually ripping off (keeping $2k deposits and kicking ’em out early simply because the management company spied the subtenant???)… i felt like we were gonna get this building torched by some pissed off sub-tenant and there are ENOUGH fires in the mission lately to clear out rent controlled buildings built before 1979.

so even though i’m a female, i’d RATHER share a cell with a big scary prisoner than share a condo with 10 people just for shiny plumbing. cheap stuff looks worse in a hurry than these beautifully old, grungy places.

indeed!

Unit 472 – I was on the light rail a couple of years ago and got talking with a guy; he’d lost everything, divorce, job loss, the usual. He’d been sleeping on lawns etc., the usual homeless routine, and did some minor thing that got him tossed in jail. Well, he got out of jail and now he was eligible for all kinds of training and support, and the long and short of it was, being put in jail was the best thing to ever happen to him. He got help he’d never have gotten otherwise, to get back among the housed and working.

Rent free, the weather is nicer and I hear the sex is great, and plenty of it….

And here in Melbourne, Victoria:

“In the past year to March, Melbourne’s median weekly house rents rose $20 to $420 and the median unit rent increased $15 to $395. Vacancy rates have also remained tight at 1.2 per cent for houses and 1.5 per cent for units over April, according to Domain Group chief economist Andrew Wilson.”

(That median for units works out to about US$1300 per month or around number 20 on the American list. That house median of A$420 a week seems to be quite low as where I live you wouldn’t even be able to rent a unit for that amount. There must be a lot of cheap houses for rent and not many middle to higher quality houses in those figures. A house would cost you a minimum of A$500 a week and that wouldn’t get you much………….. )

And people are going on bidding wars in order to get a place to rent with rent aps coming:

https://www.domain.com.au/news/more-rent-bidding-apps-to-launch-in-australia-as-rental-revolution-looms-20170427-gvslpc/

Wolf…all of the top cities have an out flow of residents. SF and Chicago have the highest then NY and even DC. May be that has something to do with rents lowering, may be not, but these numbers can not be sustained and have America great again.

Wages are going to either drop or the job won’t be there. Automation and ‘app software’ will make sure of that. Even if ‘some’ manufacturing came back to America from China, no way can you have jobs that pay $400 a month. Everyone knows these things and yet we keep pretending it ain’t so.

Again…it all goes back to the FED. THE FED with the insane ‘mandate’ to create inflation.

About these “outflow” numbers. I’ve seen them too. I don’t know how reliable they are (from U-haul, RE brokers, etc.). And there could be other factors involved.

For example, SF is supposed to have this outflow, as you mentioned. But jobs and labor force are still up year-over-year (though they’re down since July 2016). My suspicion is that people without regular jobs (retired, artists, etc.) might be leaving because it’s getting too expensive, but new people with job offers in their pockets are still coming in. Yet, from the numbers I see, the inflow of these new people with jobs must also have sharply dropped from prior years.

I can’t speak for SF proper, but Silicon Valley had a “domestic” outflow of about 21,000, and a “foreign” inflow of about 22,500 in 2016. While still a positive inflow, it was the lowest net inflow since 2010.

The domestic outflow was the highest since 2006.

Source: http://siliconvalleyindicators.org/data/people/talent-flows-diversity/net-migration-flows/

WOW. this is chilling. (re: outflow/inflow)

as a colored girl i feel all sorts of ways about this that are confusing and uncomfortable.

We escaped San Francisco, the Bay Area, and Prop.13 California! Yea! We made it out!

No more filthy junkies dirty needles to worry about stepping on.

No more human feces to avoid stepping on.

No more coddled thugs to avoid.

No more of the “rentiers” and other parasites taking everything.

No more “unexpected events” ruining a perfect day.

No more Bay Area: traffic, broken infrastrucure, derelict services but high taxes, unsafe environment, total rip-off prices on everything, hell-hole schools, fuedal tax structure, ect. ect……

Our moving specialist said that she has never been this busy moving people out of SF.

She knows why but she asked me anyway.

San Francisco’s population will undoubtedly continue to grow with those magnificent methodone clinics and free housing for the annointed ones and crammed living spaces for the “two suckers” who followed the first sucker.

We are people with regular jobs and many of us are fed up.

I finished my tour being a sucker and I pity the two that follow.

I am very grateful to have departed from that place and I have no intention of ever going back.

The trick is to leave your politics behind too. I live in a city outside of California that is being populated by fleeing Californians. Unfortunately the political landscape is changing just as quick. Our not so little anymore, once conservative, town is starting to enact all the same crazy rules and regulations that we all once laughed about Californians having to put up with, thanks to the crackpots that now get voted in to office with promises of free this and free that, who just 10 or 15 years ago would have never had a chance of getting elected. This isn’t a democrat or republican thing, it’s a personal responsibility thing.

– Why ALWAYS blame the FED for everything ? Is the FED responsible for:

1) Rising health care Insurance premiuns ?

2) Rising property taxes ?

3) Wages remaining flat ?

– In 2015 I heard an interesting story from Vancouver, Canada. A software company from Vancouver wanted to hire/employ a bunch of guys. These people were willing to work for that company and move to that city until they became aware of how expensive it was to live in Vancouver (think: rents, RE prices). Those high living expenses in Vancouver was the main reason by far why these (wo-)men refused to work in Vancouver.

– Wolf Richter told a story about teachers in San Francisco. They couldn’t afford to live over there and found work elsewhere. And left SF.

http://wolfstreet.com/2016/10/18/the-economy-is-cracking-under-too-much-debt/

And the tech companies in Silicon Valley also have pushed up RE prices and rents.

http://wolfstreet.com/2015/10/27/million-dollar-shack-in-silicon-valley-video/

And you’re blaming the FED ?

OK, here’s a thought…. Have the Fed raise its target for the fed funds rate to 2 percentage points above 12-month CPI – so about 4.5% – and have it slash its balance sheet at the same rate that it grew it during “QE Infinity” – so by about $75 billion a month, including MBS – and have all other major central banks do the same, thus undoing the scorched-earth monetary policies of the past 8 years, and then watch how asset prices, including home prices, will adjust to this new reality. Assets will deflate with a giant sucking sound.

Suddenly rents will get cheaper, buying a home will get cheaper, the money sloshing through Silicon Valley will evaporate, and regular people with wages have to spend less money on housing, and thus have a lot more money to save for retirement or spend on other things. Just a thought experiment about how central banks have screwed up the economy.

That would mean admitting all those Socialist/Communist Kenysian theories, and, asset inflation creates economic expansion theories, the majority of central bankers have doctorates in, are seriously flawed. Along with the Extortion models, and culture, at GS Etal.

They are not going to do that.

Rates will probaly stop rising, or continue to rise at 25 BP every 6 to 9 months, until FED unloads all the crap and short treasuries on its balance sheet. Which is a clandestine rate rise any way.

FED would be happy with FED funds at 2-3 and banks changing 7 minimum, keeping State borrowing cost low and retail borrowing high. Nobody is screaming about bank interest rate margins, and they are creeping up. Credit card never really ever came down.

Nobody is still sure which way things will go under the great Orange. Confidence on the street is much Greater than under Obama but there is still a great deal of uncertainty.

– Agree. I am very well aware that falling interest rates since 1980/1981 have enabled the giant build up of debt. In that regard I am appalled that interest rates kept falling after the year 2008. Enabling an even more larger build-up of debt. In that regard (slightly) rising interest rates is (indeed) very healthy. But I don’t blame the FED, I blame a person called “Mr. Market”. Because the FED follows the 3 month T-bill rate.

– I also “don’t like” the fact that central banks have executed “Quantitive Easing”. But I am NOT convinced that the FED is able to meaningful determine (both long & short term) interest rates.

– Mr. Michael Pettis has an interesting theory why Mr. Market is pushing interest rates lower. He blames increasing “income inequality” since say 1980.

(But I think that one Wolf Richter and I won’t agree any time soon)

– I would vote for anything that would make buying or renting a home cheaper. E.g. get rid of the taxdeduction for interest payments on mortgages Because it’s a subsidy for the lender and the borrower is forced to take on more debt.

– But I fear that there’s no painless (financial) solution anymore to get home prices lower.

Wolf

You’ve nailed with this comment. The mal-investments and distortions created by the Fed are going to come to the fore soon enough..

Yes, the fed is indeed responsible for all of that. There needs to be an ever-increasing amount of debt in the system to service the interest on the existing debt. It’s a cycle that never ends, which is why they have jammed down interest rates. Good luck with that strategy long term. Result: Asset prices increase making the wealthy richer — while the cost of living rises making everyone else poorer. the system is corrupt at its core.

Assuming a combined US,FICA and Ca state tax rate of %35 , a single resident of San Francisco has ~$75,000 after tax on an income of $ 115,000.Paying a rent of $40,000 means that even he/she is paying ~ %53 of his/her after tax income just to rent a one bedroom apartment

How in the world does SF attract and keep young college grads?

It doesn’t. They move to Seattle in droves when they get sick of living with 6 roommates in a 1 bedroom apartment, subsisting on a diet of ramen and Soylent.

It’s still insane here and I haven’t seen any sign of slowdown yet. Have an open house to rent your condo, there’ll be 30 people in the first hour clamoring to the first to sign a lease application. Want to buy a home in the city? A ~$100k offer over asking, preferably all cash, while waving contingencies is what it takes to make a winning bid nowadays.

…. the same thing albeit not quite as dramatic/drastic is going on here in Denver as well . The logic of illogic still pervading a few metropolitan areas like Seattle and Denver while the majority begin their decline . Then again though .. Denver always seems to be a bit late to the party and just behind what ever curve is looming on the horizon .

No kidding. We moved to Portland 2.5 years ago, and we scoffed at what the landlord paid for the house we’re renting. Now the value of this house we’re renting has gone up so much that it would cost us nearly a grand more per month to buy it (not to mention the down payment.)

We could technically buy this summer, and our son’s age and health issues make jumping into certain school districts really tempting, but we’re trying to remain steadfast.

A strange dichotomy considering rental rates are slipping in Seattle.

Yes, I think the Seattle RE market is starting to cool a bit (mostly from lots of new construction soaking up demand), but it’s still plenty hot.

I’m still sitting on my rental condo, mostly because I’m afraid of having to find a decent new place if I don’t renew. Changed apartments twice in the last few years – it was a nightmare I remember well and would rather not go through again. Despite an 800 FICO score, great income and minimal debt, I’d lose out to “more qualified” renters until I figured out you need to fill out the first application and offer a bit over the rent asked. The alternative is to significantly overpay to live in one of the crappy corporate apartment buildings with paper thin walls and no ventilation during the summer. They also will raise rent by 10%+/year, every year, while my experience renting condos is owners are happy just to keep a stable tenant in place.

I’d say it’s been crazy, but shopping for an SFH and listening to realtors’ advice how to make a winning bid…now that’s really crazy.

With all that new inventory and slipping demand and prices, time is on your side.

It’s a great REIC narrative but not very truthful. As we’ve already established, rental rates are falling and demand is getting whacked for months now.

The most egregious myth? The cash buyer narrative. It’s all dumb borrowed money.

“How in the world does SF attract and keep young college grads?”

exactly what Mark said: it DOESN’T. that’s part of why it’s a dying city in terms of LIFE. art/warehouse space is getting demolished for condos and the type of people who move into them complaining to cops about music noise and even construction noise.

people FROM here can’t even stay. their kids leave, too.

so you have a less friendly more transient disconnected town.

it’s all easy sounding via words, but it’s hell to LIVE in a town where people and places disappear and the stress of keeping your place is so high.

i’m actually doing better. am in the mind set like Wolf gets– where you know reality and how bad it is, but reality is still AMAZINGLY GOOD.

it’s hard to hold both (seemingly) dissonant views, but they’re accurate.

it’s like singing louder BECAUSE the titanic’s going down. not singing louder to drown out the screams because you’re trying to pretend it isn’t.

Kitten – http://hoodline.com/2017/05/wrecking-ball-blues-lucky-13-to-be-replaced-with-5-story-apartment-building

Yeah, it’s great and all that they’re putting in more housing, but as the Reddit discussion about this does, “In the future a night out will be walking around looking at everyone’s condos”.

SF is becoming a place you go to to make money, then get out as soon as you’ve made your “wad” to somewhere with some character.

but alex in san jose…

i agree about this being a town for people to make a killing and leave.

but regarding leaving for somewhere ELSE with “character”– WHERE TO??

if you can so easily kill san francisco’s character in just a few YEARS of this stuff, then WHERE will there be “character” that is safe from THIS??? it really is like this great big NOTHING that is killing everywhere, making barcelona, iceland, new york, london… all transient/tourist theme parks.

so funny about the line you repeated about taking walks at night to look at others’ condos. yup.

i’m gonna look at your link. i’m fascinated by all this.. that it’s even POSSIBLE…

The Fed has inflated everything with their monetary policies. A pickup truck was 30k a few years ago now 50k gets you a stripped model. In rural Wyoming 300k buys you a trailer house. Keep buying up the mortgages Fannie.

I think investors have abandon the bubble cities like San Francisco to lower housing cost areas like Stockton because they are still able to get positive cash flow there on rentals. This is driving the rents in these areas up which explains the difference in the markets. It will not be too long before these areas reach their maximum affordability since they probably have average wages well below the bubble cities.

Nothing cash flows at current prices and havent in many years..

The “investors” you’re speaking of are nothing more than degenerate gamblers.

Many moons ago I was interested in buying a condo in Honolulu to replace the one that I had sold a number of years before that.

So on trip to Hawaii I spent a number of days looking at what was available. Honolulu used to have some huge swings in prices both up and down.

After doing all the numbers not one place I looked was I able to buy the place, cover all the costs using a mortgage (30% down), and get it to be cash flow positive.

Even with using an unrealistic 100 % time of occupancy rate would the figures have worked out.

One of the biggest mistakes I ever made. The one condo that would have worked out best zoomed up in price by several times. I should have just paid cash for the damn place and bought it.

That was similar to the situation just after I bought my first condo there. On another trip I found a nice two bedroom condo for a reasonable price, but was worried that the banks wouldn’t lend me the funds.

That would have been no problem as the seller just wanted to get rid of it and would have provided financing…………..yeah that one too went way up. Well over US$100k in less than a year.

Now I look at the prices there and wonder how in the world do people afford to live there let alone buy a place? Similarly vacation rental costs have soared as well and are two to three times what I used to pay for staying there.

Prices are two to three times what they used to sell for when I was in the market, costs have exploded with fees for some places well over $1000 a month. Add in all the other costs such as insurance, realtor fees, mortgages, etc and well…………..forget it.

No matter where I look, Japan seems to have some of the cheapest house and apartment prices in the world – outside of the big cities though.

That’s just a very long painful way of simply saying………. Prices have a very long way to fall.

“No matter where I look, Japan seems to have some of the cheapest house and apartment prices in the world – outside of the big cities though.”

Outside the major centres they are still slowly going down.

If it wasn’t so hard to get permanent residence in, it would be a good place to retire. As the basic cost of living is also stagnant or slowly decreasing.

There is good cash-work for part time old English teachers all over Japan outside the main centres.

Wont make you rich, but it will keep your mind occupied, and the wolf away.

That would be me. Sitting around counting my loot waiting for the next batch of overpaying stiffs to shit the bed. Wont be long now.

One bedroom apartments coming down due to what? Financially strapped people moving into multiple bedroom apartments with roommates? Overbuilding? People stupidly buying homes? All of the above? None of the above?

When Re value rise, rent should follow, even at a slower, in a

more compassionate, careful pace.

Rent shadow current market value.

When is too high & unaffordable, You have an vacant space.

A vacant space is landlord biggest curse.

It need CAPEX. Perhaps a major renovation.

Unoccupied RE is a huge cost center doing nothing.

You have to invest money to stay an owner. Invest in commission.

A reduction of 3% in rent might be a blessing, if you can find

a tenant.

If you can’t here is no waiting list for your property.

A bad RE market can go down and stay down for many years.

It just doesn’t move.

I live in Boston, just received my renewal from my landlord and this is the first year in 5 years my rent hasn’t increased. It’s still not ‘cheap’ but is a nice relief nonetheless.

Can you check what equivalent apartments rent for, and if they’re cheaper, confront your landlord with “I’d love to stay, but I found this great place, and it’s 15% less….” and see what happens. Just be ready to move if the landlord plays hardball.

If I may what might play out better leaving all aspects of potential ‘ hardball ‘ off the table ( assuming Smingles prefers to stay put ) would be to say ..

” Look .. we really have no desire to leave your building because [ fill in the blank ] .. but we are noticing rents for equivalent apartments are going down across the city and we were wondering if there was any way you could see fit seeing as how we’ve been loyal and good tenants for X number of years … to lower our rent a bit to come closer to what is on offer from the competition at present ? ”

Yes I know it sounds a bit weak … but you’d be surprised how well this tactic works more often than not .

Trust me though Wolf … when hardball’s the only reasonable course of action .. I mentored with the baddest and the best ( Peter Grant ) back in the day

Are you talking about Peter Grant, the manager of Led Zeppelin?

i don’t think it sounds “weak” at all. hardly. it sounds logical and reasonable.

Based on what we saw last year, our apartment is priced at a pretty good discount, so I don’t think we could find somewhere that much cheaper– based on what’s on Craigslist right now, it literally doesn’t exist. We pay $1900 for a 2br, most of what we saw was $2400 – $3000, so I think the $2600 in the article is accurate. We’re about a 15 minute walk to the subway, so I think that accounts for at least some of the discount– apartments within 5 or 10 minute walks in this neighborhood pay steep premiums, as most renters are young professionals who work down town and take the subway.

Boston also has a somewhat unique rental situation where the vast majority of apartments rent with a September 1 start date because of all the college students in the area. The utility companies (Verizon, Comcast) literally send hundreds of technicians from other regions to Boston for the first week of September to cope with all the demand. It makes the rental search an absolute nightmare, because everyone is competing at the same time (usually May – June – July) for the same start date. And then imagine the city on September 1… moving trucks EVERYWHERE, curbside trash EVERYWHERE (old furniture, etc.), everyone moving out of their apartments the morning of, while people are trying to move in. Nightmare.

I’m also a bad negotiator, and have a poor poker face. Would probably end up getting our rent raised :-)

If you’re happy, don’t rock the boat :-)

At the beginning of the year here in Portland, my landlord contacted me to renew our lease, saying they’d keep the rent the same now, but they’d raise the rent a couple of hundred bucks if we renewed again this summer (on a six months lease)…and they never even sent me a new lease to sign. It’s been nearly 5 months now, so I guess we’re on month to month at this point. Portland has new 3 month grace periods to remove tenants or raise rents over 5%, so I’m not too worried. lol

Related in Canada: just a few days after the biggest alternate lender. Home Capital lost 60 % of its share price and had to get a very expensive emergency loan- a major Alberta- based land bank outfit the Walton group has filed for bankruptcy. It has tens of thousand of acres in Alberta but lots in US too. Land bank here means a holder of land not a financial type bank.

This is going to be a devil to unwind, with 600 subsidiaries under the mother ship. Some of them are solvent.

Rental income as a percent of GDP just hit an all-time high.

http://www.marketwatch.com/story/rental-income-just-hit-an-all-time-high-heres-how-that-drives-a-wedge-between-haves-and-have-nots-2017-05-01

– According to Mike “Mish” Shedlock, Chicago (Cook county ???) is experiencing a large outflow of people. Think: rising (property) taxes.

Keep in mind that Seattle taxes have gone up significantly this last year and compliance costs are up as well due to new regulations. A1.5% rent increase is not nearly enough to cover the huge property tax increase since last year. Profits should be down for property owners compared to last year.

Yes they certainly have but for many rental properties rents are have nearly doubled in the lalst 5 years and 12% over the last 12 months is no uncommon at all. The landlord still has the upper hand at the moment despite numbers showing weakening I am not seeing it yet. Maybe the 10,000 new units coming on line this year will tip the scale.

Yet rental rates are half the monthly cost of buying. The millions of cash flow negative landlords attest to this.

I wouldn’t say half (if it was renters wouldn’t be so desperate to buy to avoid ever increasing rents) but agree its hard to buy a property in 2017 that pencils out favorably from day 1. But millions of cash flow negative landlords…to start with the entire Seattle metro is less than 4 million residents and even though prices are insane right now they weren’t even 3 or 4 years ago so unless you bought in 2006-2007 or 2016-2017 you are probably cash flowing quite well.

It’s half… or less.

In Orlando people are moving here in droves mostly because small jobs have been created and no income tax. Rental prices are still creeping up. Most of the people buying are new investors who do not understand the math fully. They will learn and be forced to dump their properties in a few years because they will not cash-flow in today’s higher prices.

I will go out on a limb and say the Fed isn’t worried about asset prices and neither should you. Not a reco to buy because the cost of maintaining your asset has gone up. Rents are not a product of asset value as the Fed likes to pretend, they are a factor of the cost to operate in terms of taxes, permits, and maintenance. At the bottom line the landlord factors in a few percent for investment return otherwise they would be in T bonds and skip the headaches. Despite high rents being a landlord is not a legitimate investment.

SF rents are definitely slowing. Tried to rent out my house for the same price last year, and not much demand at all.

But sales prices are HIGHER. So, it may be time to sell.

Sam