The Fed caused it, but it won’t do much to contain it.

Boston Fed President Eric Rosengren — considered a “dove” on the Fed’s policy-setting committee — has been warning about the commercial real-estate bubble in the US and what its demise could do to banks for two years. But in his speech on Financial Stability on March 22, he added ever more emphatic concerns.

Like all central bankers, he can’t warn publicly about an approaching problem because it could trigger the very problem he’d be warning about. In this manner, no one at the Fed saw the last bust coming. So Rosengren started out his presentation, “Financial Stability: The Role of Real Estate Values” – by clarifying this: “First, I am not here today to predict problems, but rather to suggest we continue working to head them off.

The phrase, “continue working to head them off,” is ironic because he also pointed out what has caused these problems: “very low interest rates” that were “wholly necessary” and that he “strongly supported.”

But the risks are massive.

Rosengren finds that “the root cause of the financial crisis was a significant decline in collateral values of residential and commercial real estate” and “exposures across the banking system that are correlated and sizeable.”

Real estate becomes a trigger for a financial crisis because of its high leverage. For banks, these properties are collateral. When property values tank, the collateral is impaired. Defaults rise. Then broader problems spread into the economy. Property owners experience a reduction in income. Homeowners see their paper wealth evaporate and financial stress rises. At some point, banks begin to fail.

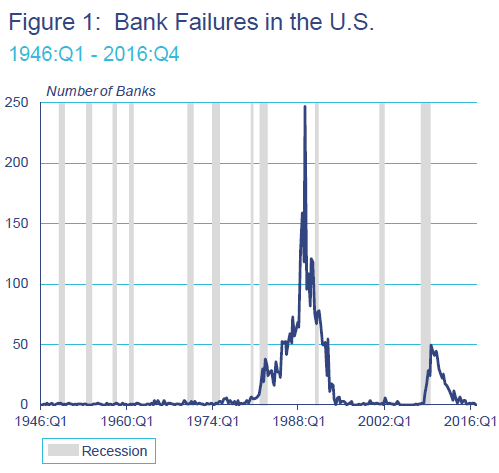

This chart shows the number of bank failures, regardless of size. In the decade before the Financial Crisis, the banks had become huge. Thus, fewer but huge banks failed:

The data includes failures and assistance transactions of commercial banks, savings banks, and savings and loan associations. S&Ls are included beginning in 1980 (source: FDIC, NBER, Haver Analytics).

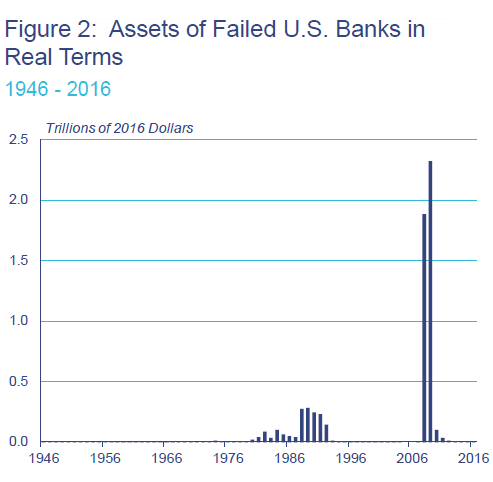

But when these fewer huge banks failed, all heck broke loose. This chart shows the asset values of the failed banks, adjusted for inflation:

As property prices plunged during the Financial Crisis, the balance of CRE loans that were 90+ days delinquent soared to over 7% of outstanding balances; and delinquent home mortgages soared to over 8% of outstanding balances.

Real estate has a significant financial stability implication because real estate tends to be leveraged by the owners, and those loans represent a significant exposure for financial institutions that are themselves highly leveraged.

As losses from these assets (the loans) hit banks’ capital, the banks shrink their lending, which crushes economic activity and also makes it harder to sell properties as potential buyers cannot find banks willing to lend even at depressed prices. Liquidity in the property market dries up.

And the magnitude of this today?

Financial institutions hold $3.8 trillion of CRE loans (including multi-family residential) and $10.3 trillion of home mortgages. So this is a $14-trillion problem. The $3.8 trillion of CRE loans are primarily held by:

- Banks: $2.02 trillion or 53% of total

- Life insurers: $460 billion or 12% of total

- Government Sponsored Enterprises (GSEs, which include Agencies such as Fanny Mae) & Agency commercial mortgage-backed securities: $521 billion or 14% of total

- Non-Agency commercial mortgage-backed securities: $544 billion or 14% of total

Among the banks, smaller banks (less than $50 billion in assets) hold the lion’s share of these CRE loans: $1.2 trillion. Larger banks, with over $50 billion in assets, hold $767 billion. In other words, the smaller banks are terribly exposed to CRE.

This comes on top of $10.3 trillion in home mortgages, of which taxpayers, via the GSEs, are on the hook for $6.3 trillion, smaller banks for $1 trillion, and larger banks for $1.6 trillion.

That $14 trillion of real-estate debt is why real estate can trigger financial crises, and why real estate bubbles, when they implode, are so pernicious.

And CRE lending has continued to surge. For Rosegren, the numbers are worrisome:

Over the past year, holdings of commercial mortgages by the banking sector have increased 8.9%, while bank holdings of multifamily mortgages have increased 12.0%.

This growth has occurred while bank supervisors have been cautioning about the potential risks emanating from the high valuations in some sectors of the real estate market.

But the impact of the guidance from regulators over the past two years about the risks of lending to a sector in a full-blown bubble has been “modest,” he said, as lenders continued to support soaring prices, particularly in the apartment sector.

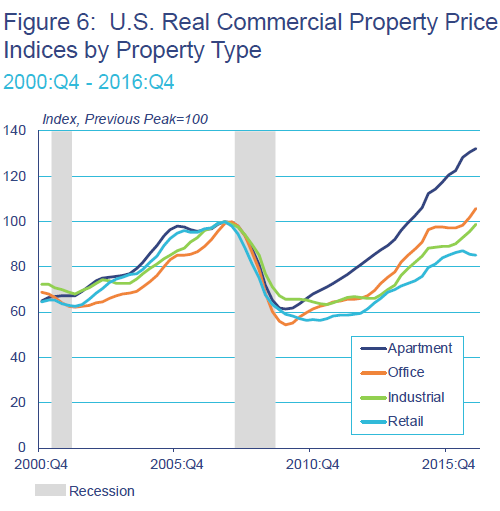

This chart shows the price increases by sector, adjusted for inflation. Prices of apartment and office buildings have soared above the crazy peak of the prior bubble. Note that retail (light blue line) is starting to strain under the collapse of brick-and-mortar retailers:

The indices, adjusted for inflation via the GDP deflator, are based on repeat-sales of properties of $2.5 million or more (Source: Real Capital Analytics, BEA, NBER, Haver Analytics).

The problem with apartments is that rental income faces the reality of maxed-out consumers and of a lot of new supply coming on the market. Though rents have soared over the past years, they have not soared nearly enough to keep up with the price increases of apartment buildings. As a consequence, “cap” rates (net operating income divided by the price of the property) have reached the lowest level in 16 years.

So what can be done about it? Raising rates significantly would stop the price increase and reverse the whole thing. But rates won’t rise enough. According to Rosengren, “there is the possibility that equilibrium interest rates may remain relatively low.”

This would require a greater emphasis on macroprudential tools if valuations became a source of concern. However, with limited macroprudential tools available and only a modest price response to date to guidance, it is prudent to keep a healthy, ongoing focus on the sufficiency of these tools and their ongoing enhancement.

In other words, rate increases may not be enough at the “equilibrium interest rate” to deal with this bubble, “guidance” hasn’t really worked so far, and macroprudential tools are too “limited.”

Reading between the lines, it appears the real-estate bubble is once again putting financial stability at risk, but the Fed, which caused this bubble via low rates and QE, is now nudging up interest rates too slowly and too late to an “equilibrium rate” that it knows is too low. And as this bubble runs its course toward a crisis, the Fed will once again pretend it isn’t happening.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Today they reported that the art markets are experiencing declines. Over the years, I have seen a high correlation between the art markets and real estate prices. The high end art prices, over $50M, are down about 50% and the mid-priced pieces, over $1M, are down about 30%. This seems like a good indicator of what is coming to the real estate markets.

yikes , a canary on the canvas !

… or an elephant in the bloom …

The ‘wave’ of inflationary money creation by the Fed (it used to be called ‘open market operations’, is now QE) historically has begun with the bonds and ended with the art and collectibles market upon the necessary increase in interest rates to alleviate inflation (as expressed in the CPI) caused by the initiation of open market operations.

The decline of the art market is indeed the canary in the cage, and again, historically, real estate could well be next.

One effect of higher interest today would be the expectation of a higher cap rate, now very low. The problem is how would it be realized, if cap rate is a function of price and price is a function of cap rate. Without leverage to increase rents, it would seem that prices must fall.

If there is no market for your house, does that mean the mortgage company won’t foreclose?

they didn’t last time. I personally know somebody that lived mortgage free for 48 months……and the taxes were paid on time every time by the bank.

What is the time lag?

In the end the workers pay but they don’t earn enough to support these artificially inflated prices which the created through artificially low interest rates for far far to long which has now created higher artificial inflation but the fed can’t rase interest rates enough with out causing damage the very beast they created. I’m convinced that if the fed was democraticaly elected they would not have gotten away with it and they would have lost there jobs along time ago and we would not be in this mess we are in

I wouldn’t be too convinced of that. Congress seems to skate by on their poor performance, insider trading, and kowtowing to special interests just fine.

At least you would have 1 vote. The way it is now you have nothing

Thomas Jefferson warned us long ago, “If the American people ever allow private banks (the Fed since 1913) to control the issue of their money, the banks and corporations that will grow around them, will deprive the people of their property until their children will wake up homeless.”

Ole T-J also warned us that if we gave up on an agrarian economy placing the emphasis on finance we’d wind up consuming ourselves as all the necessities of life gradually eroded away in the name of profit . Hmmm .. shades of Gail Tverbreg’s writings as well Kunstler’s in between his conspiracy theory rants .

Thank you for the heads-up on Ms. Tverberg & Mr. Kunstler. I agree with Kunstler’s view of the national debt, deficits and the Treasury’s quickly disappearing pocketbook. He’s right, IMO, that the two parties are ignoring the financial predicament that the USA finds itself in.

As I recently commented on WS, Obama doubled the debt in his 8 years in office from around $10T to $20T. The CBO projects the ‘Gross Federal Debt’ to increase to $30T in the next decade. This has and will happen while our GDP creeps upward at a couple percent per year.

Mr. Kunstler’s five minutes on a recent Fox News interview:

http://video.foxnews.com/v/5363878500001/?playlist_id=5198073478001#sp=show-clips

Yep, and the lesson there is that the American people have. In other words, there’s no lesson. Moving on.

Real Estate is purchased by investors & developers .. the real estate owned .. is subsidized by the nation & it’s citizens .. via negative gearing … discounted capital gains tax .. all manner of corporate & business tax deductibality possible.

The properties are manipulated .. to express a thriving .. vibrant & competitive real estate market .. nothing could be further from the truth.

1. If a buyer cannot afford to .. alone .. to purchase & maintain the financial outlay of a real estate property .. they need to suffer the consequences of that financial hurdle .. just like anyone else & not expect to be bailed out by the Nation or it’s citizens .. they are freeloaders / parasites feeding off the system.

#. But it get worse ..

2. The real estate is not bough & sold creating the vibrant & thriving market .. properties are regurgitated by the original owners .. so no real selling & buying is happening at all .. it is all pretend .. creating false price hikes / only a GENUINE buyer can create a new & higher valuation of an item for purchase .. & not any contrived propaganda.

3. Photoshop is so good isn’t it .. take a dump .. dress it up .. sell it to yourself via a sister company .. then head for the bank to & present the new valuation on your dump & BORROW MORE MONEY.

When the bubble bursts ..

Interest rates will go up .. the current owners will not have the capacity to make repayments on loans for fiction property’s .. & they will declare bankruptcy.

There will be a fire sale where the same buyers with new company’s will buy back the real estate at INCREDIBLY DIMINISHED PRICES.

The will make a killing.

Q:

What about the banks left holding the TRILLIONS in defaults on the monies borrowed.

Monies borrowed FRAUDULENTLY.

Can the BIG 6 BANKS of the USA handle such a loss ?

I seriously doubt it & this is why interest rates have not risen.

An Even Bigger Q.

How to raise interest rated & not SELF-DESTRUCT.

Holy Cow !

It’s a Barnum & Bailey world just as phony as it can be.

HAVE WE NOT LEARNED .. ANYTHING.

2008 GFC –

A bank has no business giving out loans to PEOPLE WHO CANNOT AFFORD THEM.

Here the .. POOR .. were touted / squarely named & blamed .. as the reason for the mortgage defaults.

In fact it was the CORPORATE HOT SHOT GUN who was propped up by GOVERNMENT CONCESSIONS & TAX DEDUCTIBLE PRODUCTS as far as the eye could see.

Who pretended he could afford a round at the poker table & could not.

He was bluffing all the way.

How will the global banking system get through this orgy ..

In the mean time there are many citizens who have been DELIBERATELY CUT OUT OF THE REAL ESTATE MARKET.

“The Young who can’t afford to buy their first home .. let alone into the property market'”

YES THEY CAN ..

THEY HAVE THE FINANCIAL MEANS .. & THE STAMINA TO MAKE GOOD.

People are wising up, vehicles are for living in, houses are for selling to foreign speculators and money launderers. This is why lease vehicles are losing their appeal, they arent the right type of vehicle to substitute for a house. Live in a lease new car, suv, or truck? cant do it. A late model van, no problem. Pick one up used for $1000.

In my town at least there are lots of little-used motor homes and RVs owned by retirees with the generous pensions of a bygone age. They buy them new, use them for a while then through failing health or inertia they end up rotting in their driveways for years. They don’t sell them, I’m guessing, because it means giving up on the dream of roaming the country ever again.

If someone could make the right sales pitch to pry them away from retirees (or their estates) and get past zoning laws there’d be a nice business in repurposing these as budget residences for the poorer and less secure generations that followed them.

Thats pretty much what the whole Tiny House thing is all about . A tiny little .. and I must say very livable especially if you’re younger little mobile home looking more ‘ home ‘ than ‘mobile’ for around the price of a medium luxury car . The difference being the homes are self contained not needing hookups so you can even park it in your parents backyard if the zoning laws allow it . Tack on a nice used P/U into the deal and you’ve got yourself a lifestyle worthy of this insane age we’re in . Gotta tell you .. if we were sending a kid off to college we’d be looking into buying one of these for them rather than paying overinflated dorm prices . Then the kid has a home to take him/her as far down thru life as he/she choses once they graduate . Fact is … if we were 15 or so years younger we’d be seriously considering one for ourselves in these turbulent times

Hmmm… maybe. Seems I’d have to spend a lot of time in very close proximity to a very talkative wife. Maybe she could live in the tiny house, and I’d live in the RV parked next to it.

You can live in your car, but you can’t drive your house.

I’m still freaking out that my rent went up $1000 a month. We’ll be ok – still saving a bit but we just had the conversation about our profligate spending and pledged to each other to spend less.

Screw the economy – we’ve got to look out for our selves.

T

Rent went up $1000?! MOVE.

One man in Seattle had his rent go from the $2,000 range to 8 grand.. Where does he go? I had no sympathy for the banks when they blew us up in 2008 and I’ll have less next time.. How many foreclosed homes were bought with tax payer’s money for pennies on the buck with no regard for those who lost them and now these homes are the basis for skyrocketing rents and house prices that few can afford. 40% of Seattle homes are now $1 million or higher and it turns out we are in 10th place in Puget Sound. Whole blocks are slated for the wrecking ball and the thousands who live there are just a temporary impediment. “At some point banks begin to fail”.. Banks don’t fail because they get bailed. It’s the people who don’t have friend in this government.. They’re the ones who fail..

When I look at teardowns in Seattle’s Central District going for ~$600,000 on Redfin, I know something’s seriously wrong here. I don’t care if you work for Amazon, a 20% down payment is $120,000, and I don’t know anyone near my age (early 30s) who’s got anything close to that amount stashed away. Maybe $120,000 in student loan debt, but that’s a separate issue.

But, when 3% down is the new 20%, any price is affordable! Prices will keep going up forever, you can’t lose! Buy now or be priced out forever – it’s Seattle! *sigh*

Will the last person leaving Seattle please turn out the lights.

Do you remember those day’s????

DONT think it cant happen again.

Too many city’s are pricing themselves beyond the reach of workers, when that happens, only a few have what London Ny, Zurich, and the political city’s, Washington, Berlin, Tokyo, Etc, have, that keep then inhabited.

The rest can and will die, like Chicago, which is taking the entire state with it. And Michigan isn’t much better.

My rent fell 18% last year. I expect another decline when I renew this year.

Went UP a thousand a month That’s nuts I agree with Keith Move

Stop freaking out and get out. If you don’t, the landlord will own you.

– The FED is NOT responsible for the bubble in real estate !!!!!!! Just ask yourself (@ Wolf Richter) : What’s the average duration of a (real estate) loan ? Do banks lend money for real estate projects based on the 3 month T-bill rate ?

So, I simply can’t see why the FED can responsible for blowing this bubble.

– Blame Mr. Market for dropping rates this low. Then investors start to search for higher yields (in e.g. real estate).

– Instead one should blame the Federal government. In an attempt to shore up the real estate market(s) several branches of the government started to issue from 2009 onwards mortgages on very (/extremely) favourable conditions. Like only 5% down. Sheer insanity. And now those mortgages are coming to bite the banks in the rear.

– Those very favourable conditions were provided because in 2008 the Current Account Deficit was shrinking and the Budget Deficit was exploding. And that had MAJOR implications for the US housing market (Complicated story).

How can you STILL try so hard to miss something this big one?

The Fed acquired long-dated US Treasuries and it acquired mortgage-backed securities as part of its QE – and it’s still acquiring them to replace maturing securities – with the explicit goal of creating such demand for these securities that yields would plunge, which they did. This caused mortgage rates to plunge in parallel.

In other words, the Fed used these methods to control and manipulate the markets, and it worked.

To wit, the Fed currently owns $1.8 trillion (with a T) in mortgage backed securities. Compare this to the quantities of mortgage-backed securities listed above. The Fed bought these MBS with money it had created out of nothing (it credited this money to the accounts of its primary dealers who sold the Fed the MBS). This new money then went somewhere else to drive up asset prices elsewhere.

Plus, through its interest rate repression on the short end, the Fed created an environment where institutional investors can borrow short term at low interest cost, the larger ones in the overnight market at a rate near the federal funds rate, then buy homes with this money and rent them out. Currently about 37% of all homes are acquired by investors. CRE is all owned by investors. The large institutions can issue bonds, and they can securitize their debts into mortgage backed securities, rent backed securities etc. in a market where interest rates are artificially low because of the Fed’s policies which manipulate market rates.

Denying that the Fed manipulates interest rates is just silly. In the future, if you suffer these kinds of thoughts again, please keep them to yourself because I’m getting tired of reading them there. You keep saying the same thing on every article that mentions the Fed’s policy. After a while, it just becomes propaganda.

Even if the Fed is not adding to its portfolio bond via QE, buying by the ECB has and will have a similar effect upon US rates (as long as currency risks can be hedged)

If I may add one small thing to the mix Wolf . The consumers responsibly in the debacle . How many home buyers knowing full well they could barely afford a $250k home allowed themselves to be talked into $500-750k McMansion’s by unscrupulous real estate agents and lenders ? Too many to count unfortunately . So yes Wolf I’d place say 60-70% of the blame exactly where you do . But the other 30-40% falls firmly on the shoulders of the consumer putting aside all fiscal responsibility , common sense and discernment in the quest for Bigger is Better and ” Oh look at me and where I live ” .. even though they can barely afford the taxes never mind the mortgage once the ARM goes up a notch .

And the fact is they … the consumers are doing it again .

And with cars too …double whammy.

I’d have to reduce that percentage of blame viz. the consumers a bit because they were told, repeatedly, by everyone in authority, that 1) housing prices never go down, and 2) they could always refinance. That was the mantra from the entire capitalist class and their flunkies in the business press. Remember, “The Sage of the Eccles Building” told them, there is no housing bubble. In fact, the vast majority of “respectable” Economists told them that bubbles can’t exist because markets are flawless epistemological machines that “discover” the truth (thanks Hayek). So, Joe the Janitor might have bucked that entire trend and said to himself, “better safe than sorry”, or he could have gone with what he was being told and bought a nice big house for his wife and kids.

In my view interest increases have triggered the collapse of loans and leases. The Fed must reverse its increases and drive interest rates down to zero again. having gone down the road of ever increasing debt – a strategy invented by Reagan and Volker – the Fed cannot go back to ‘normal times’. There is simply too much debt out there and it can only be stabilized through ultra low interest rates.

Soon US interest rates will be below zero, as the US has to follow Japan, Europe, Switzerland…. into the deep swamp of ever increasing debt.

And the end result is collapsing demand which drives down prices.

There is only one way out and that is lower prices. Much lower prices.

Agreed How can Americans afford to pay more for housing when we are struggling with competition due to globalization In my mind prices need to reset at least 60 percent maybe more

…… and yet for a moment of abject insanity from the Mile High City’s [ Denver ] residential real estate market ;

In spite of a number of potential buyers being driven out of the market by the interest rate increases …

Sellers are stoping taking offers after five hours of showings .. real estate agents are double triple etc ( I’ve experienced as many as ten ) booking showings in order to create a sense of urgency … buyers are still paying a hefty premium out of pocket or by other means over and above the appraised value in order to close .. and prices continue to ascend skyward with seemingly no end in sight .

Go figure . Either I’m missing something or this is gonna end very very badly .

I’m really struggling with this here in Portland. Our only debt is a little bit in car loans, and my salary is good, but the house we’re renting would cost another $1K per month to buy, plus the downpayment. We’ve been saving for a downpayment, and this summer is probably our first official chance to buy, but our rent is low enough relative to income that I’m having a hard to time penciling it out. I’m thinking I’ll first just pay off these car loans, then we’ll be debt free and we can worry about a house in the next couple of years…hopefully after things pop??? Of course, everyone says it’s only going to go up here, so every day is a struggle to hope we’re right.

I’m with you DH. Keep your cheap rent, get debt free and buy the house later. At these prices, I find it hard to make the argument that a homeownership is a great investment.

Yes, you are paying someone else’s mortgage by renting, but they take on the real risk of a substantial price decline. And with interest rates being this low, the tax benefits aren’t that impressive unless you’re in a high bracket or plan to buy a very, very expensive place.

Housing for the end user is a horrible “investment”. It costs you money…. alot of money every day you own it.

If the only way to “stabilize the current debt (let alone more deficits) is through ultra low rates”, then it is inevitable that central banks buy more and more debt.. At some point the central banks will own virtually all sovereign and most corporate debt .

The “governor” in federal deficits is the fear that higher deficits mean higher rates.

But what do government deficits matter when governments know that central banks will be buyers of their debt,no matter the price ?

And if deficits do not matter then why should there be any Federal taxes?

And what is to prevent the Federal governments from absorbing all state pension liabilities if federal deficits do not matter.

What prevents the central banks from annually cancelling a specified % of the debt that they own.After all they conjured up the money out of thin air .What do they lose if the debt is cancelled.

I strongly disagree with the idea of lowering rates, again.

There are consequences in life. By bailing out irresponsible speculation stumbling in the frantic search for short-term yield is simply compounding the problem, (pun intended…and yes, many use it).

You either believe in Capitalism in the free exchange of goods and services, or you don’t. You cannot have it both ways. Irresponsible development based on easy credit leads to over-building. Overbuilding should eventually lead to lower prices and consolidation. The prudent investor, those who have assets left to acquire those properties that were built without a proper business plan or appreciation of the bubble, should be able to operate without Govt. interference or supports. Renters of those suites or projects, should be able to briefly enjoy lower charges as this consolidation takes place. Consolidation should not be permitted by margin and/or more debt. There need be real assets of a realistic value to be used as collateral in financing this consolidation.

Of course, the reapeal of Glass-Steagal simply opened up the casino, 24/7.

All we hear about is Growth Growth Growth. Reality these days looks to be between 1-2%. Political foggers say it should be 4%. We already have virtually 0% interest rates trying to stimulate growth, the little that we do have. People need to wake up and realize that we cannot substitute real and necessary growth with debt. Maybe we have reached a peak….and maybe we reached it a few decades ago.

0% and negative% is pure and simple thievery. It will create a cash and barter society, after this whole mess collapses.

regards

Paulo,

It is not what we think is right or wrong, but the FED will be forced to lower interest rates again. It is the only way to delay any catastrophic consequence as long as possible.

What I have learned in life that is we cannot go back and start a ‘normal ‘ life again, when we have decided on a certain path. If we are married and we are not happy with the situation, we could marry again, yet the former wife is still there and we have to be committed and we cannot start life again as a 20 year old lad.

The same is true for the FED. It has decided 30 years ago on ever increasing debt as an economic tool to create growth at low inflation. It looked fantastic, yet the consequences are felt today. If the FED pricks the bubble through higher interest rates, the damage will be huge now. I am pretty sure that Yellen does not want to do this in the last months of her tenure. The next FED president will also very likely delay the inevitable as long as possible as he very likely does not want to be in the history book to be responsible for an economic catastrophy. So, the only way is to carry on as long as possible. Maybe we can carry on another 30 years, just like Japan is doing so. 90 % of all people will be fine with this.

But consider this:

With a desire for unlimited immigration, you have unlimited supply of renters, paid for by our grand old Uncle Sam. This leads to a BIG win for Corp America and what’s another $10T in debt for our Uncle.

Never underestimate the stupidity of an Uncle with access to unlimited funds.

As others wiser than me have said: What could possible go wrong.

“And if deficits do not matter then why should there be any Federal taxes?”

Because capitalism fails if people know how the system actually works. Certainly the federal government could be the employer of last resort with a guaranteed jobs program. But what are the consequences?

Surly employees who know they could split whenever they want so they don’t have to take any management bs. High wages because there will be a high demand for labor.

When people know that they could vote themselves a better world through a guaranteed job program, why wouldn’t they? And how does one grow rich in that environment?

Please expand on the Volker comment. DIdn’t Reagan essentially fire Volker for not ” playing ball”?

“– the Fed cannot go back to ‘normal times’. There is simply too much debt out there and it can only be stabilized through ultra low interest rates.”

WRONG the fed has to go back to normal times and drain off the excess liquidity or the US will follow japan into decades of stagnation.

“Soon US interest rates will be below zero, as the US has to follow Japan, Europe, Switzerland…. into the deep swamp of ever increasing debt.”

Real US interest rates, Real inflation adjusted, are already below Zero, and have been for some considerable period of time. But are slowly returning to close to Zero.

The US does not have to follow the failed ever increasing debt policy experiment of Japan. Which Japan is still looking for a soft way out of.

Or the ever increasing debt, poured into the bottomless pit, of insolvent french and club-med bank’s policy, of the Corrupt ECB.

Germany just Issued another very timid NO to ECB Italian bail out policy. http://uk.reuters.com/article/uk-ecb-banks-bailout-idUKKBN16U0QD?il=0

Germany dosent want to be the one to break up the Euro zone. However it also is not going to bank roll it with the money that belongs to the German taxpayer. Which ultimately means they may have to break up the Euro Zone. In to at least 2 to protect German Austrian and other Northern balanced or Surplus budget states, to protect the interests of their tax payer’s.

The Mafiosi at the Ecb and his masters in Rome, are trying it on this year, as it is a German election year.

Personally I hope it blows up in their faces.

Owners of commercial real estate have sucked out the equity already through debt. If you’re in an city in the U.S. you will see lots of empty commercial real estate which means the owner is collecting no rental income but still has to pay the debt. Landlords refuse to lower their rents because they still have to pay back the equity they already spent. This problem will swell as fewer retail and restaurants are willing to open. Ground floor used to be prime space but that’s no longer the case. It’s probably the most undesirable space considering the price. Put back the equity, pay down the debt and lower the rent you are charging or the market will respond with a pop.

And yet .. when it comes to commercial real estate at least here in Denver and the surrounding Front Range the skylines are filled with construction cranes wherever there’s a developable piece of land for as far as the eye can see … as you drive by the plethora of commercial For Rent / Lease signs

Colorado is the 2nd fastest growing state in the union so a commercial real estate boom is not surprising. Moving to strictly residential housing, we have housing affordability issues all through the Front Range and Denver. I would be shocked to not see a real estate boom due to population growth. I am hoping that this boom helps alleviate the soaring costs of living in CO.

Rents are being pressured in Denver already due to affordability issues. There are still a lot of people moving to Colorado, and our population increased by 100,986 people between 2014 and 2015. I don’t see this migration into CO stopping anytime soon due to our state being a good place to work, raise kids, and retire. We have beautiful scenery, a vibrant economy, good healthcare (ranked 6th in the nation), decent education (ranked 20th), hopping beer scene and marijuana industry, and great weather. It seems like Colorado has something to offer to anyone wanting to move here.

Rental rates in Denver are falling as is population when illegal immigration is figured.

Lower rental rates is better than empty buildings. Ask any land lord.

I are one (residential) and can tell you the highest cost to a landlord is vacancy. I don’t raise very often and not much and kept tenants for a long time.

I’ve seen the same game played in Italy and Switzerland.

In the former country is not going well and it’s playing a big part in the NPL fiasco which will take down the Italian banks and probably a couple of their coalition governments.

In Switzerland it started slowly in 2014 but really gained momentum last year: CRE vacancies are soaring, even where in 2013 you had to pay premium rents (Zurich, Lugano etc). Most Swiss landlords are leveraged to the gills and, very much like in the US, the bulk of those loans are held by the smaller banks, many of which are still owned (partially or totally) by the Cantons.

The main difference between the two countries is Italy tried every single dirty trick in the book to keep book values high, resulting in such a massive glut in CRE in some areas the only cure for it will be the wrecking ball.

In Switzerland book values are already dropping, and with them rents: while most landlords are leveraged in astonishing fashion, Switzerland is a nation of renters even more so than Austria and Germany. Let’s just say this is a good time to either renegotiate your existing contract, move to better premises or owning a moving firm.

Commercial rents are dropping in Switzerland? That is interesting. Do you have access to data that you could share? Year-over-year percentages, vacancy rate changes, etc. would be great. This data may not be available for the nation, but maybe you could get it for some of the major cities. Thanks.

I can get vacancies for a few cities in a short time (hopefully).

“Put back the equity, pay down the debt and lower the rent you are charging ”

Wow! That is rather hilarious.. in a game of leveraged Monopoly. You keep putting houses and then hotels on the land until you charge so much that no one can pay. This is the system we are working under. Except in Monopoly there aren’t any leveraged loans.. So in this game, when the other players can’t pay, the entire game crashes… And starts over..

How in the heck can a person or company or corporation pay down a loan when they are already over the edge.. When playing a game of high leveraged high stakes poker and you get called holding a bad hand, there isn’t any thing to do but fold…

Many or most of these apartment/condo projects paid way to much for the land (buildings they tore down) that they built on.. The entire project and loan is based on exponential growth in rents..

When there are to many projects, to much supply, then the rents go down and not up.. Supply and demand.. So many of these projects were planned for one scenario and now face something entirely different.

Everything has a buyer at the right price. Driving rates back to zero will solve nothing.

“Currently about 37% of all homes are acquired by investors.” – Wolf

New home sales rose 6.1 percent last month to a seasonally adjusted annual rate of 592,000, quite a lot more than some “analysts” predicted.

Wonder if 37% of them were to investors? What’s the trend (if any)?

I don’t have that data you’re looking for. But we know that a big part of new condos (usually while still under construction) are purchased by investors. They’re hoping to sell these “pre-construction” condos once completed. I’ve been covering this situation in the Miami market, for which I get the data. I don’t have data on other markets, but I would love to get that data.

Here in Denver for a boots on the ground view we’ve got several factors in play . 1st – Out of state ( and country ) private equity buying multiple properties for investment [ mostly single family homes and townhouses ] … 2nd – Multiple individual investors including those taking out 2nd mortgages on their homes in order to invest purchasing multiple properties … 3rd – 420 business men and women buying multiple properties in order to ‘ invest ‘/ launder their profits [ though even the Title Companies and banks can’t figure out how they’re converting their cash to cashiers checks in order to close ] … and 4th – a fair amount of less than honorable/desirable foreign individuals and entities using the Denver market in order to launder their money

So here according to my sources [ our FA , Personal banker , several real estate agent friends and associates/contacts within the press ] best guesstimate is 40% + leaning towards 55% of homes [ and condos ] purchased over the last 18 months are going to ‘ investors ‘ .. using that term somewhat loosely

I have been a commercial mortgage banker for over 30 years in the ultimate boom/bust market in the country- South Florida. The latest round of development and investment had senior lenders providing no more than 65% of cost, with the gap coming from private equity shops, pension funds, and family offices. Pre-construction condominiums required purchasers to put down 50% of the purchase price, a common practice in Latin America, from where a majority of buyers emanated.

Given the rise of the dollar, that second 50% due at closing feels more like 70%.

The cascading wave of luxury apartment development is going to be painful. Job creation is such that in South Florida, 46% of 18-30 year olds live with Mom and Dad. Add to that student debt, and the anemic new household formations, and it looks like a train wreck waiting to happen. Its in its nascent stage NYC and SF.

First in line for wipe-out are the equity investors, PE, Family Offices and Pension Funds who sought higher yields to offset Zero interest rates.

Madam Fed must also real8ize increase rates, increase dollar KABOOM goes $9T in offshore dollar denominated debt.

It’s a fine mess.

Thanks for the boots-on-the-ground insight. Great comment.

I agree – in Brooklyn you are seeing the same thing. Banks are not giving the same level of funding so its mezzanine loans, private investments that are on the hook and stand to lose the most when this implodes.

“Pre-construction condominiums required purchasers to put down 50% of the purchase price..”

That was the case a couple of years ago but it has changed to 20%-30% down and required in increments to get sales so they can get their loan.

I really question weather there exists a fundamental “shortage” of available housing for sale causing prices to escalate to pre recession 2.0 levels. From what i can glean from mainstream reporting is that many living units are sitting vacant/under utilized and are not primary residents. The 6 million plus that lost there homes last recession have finally repaired their credit and saved for down payment are purchasing homes at elevated levels. This new paradigm of a high ratio of non primary resident ownership to existing potential supply is a troubling trend.

Interest rates are NOT the fundamental flaw of whatever you want to call the US’s present “economic system”.

Adam Smith wrote in “An Inquiry into the Nature and Causes of the Wealth of Nations”:

“Every individual necessarily labours to render the annual revenue of the society as great as he can. He generally neither intends to promote the public interest, nor knows how much he is promoting it … he intends only to his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for society that it was no part of his intention. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good.”

To me, all of the above boils down to Gordon Gekko’s “greed is good” in the movie “Wall Street”.

Today’s Elite, along with the vast majority of the thoroughly brainwashed members of the bewildered herd, erroneously think that all they have to do is “follow my greed”, and things will turn out just great for not only an infinite number of billions of people, but also for an ever-forgiving Mother Earth.

In short, no greater bollocks have ever been written than Smith’s. But the 0.1% in Smith’s day loved it (at least the above part of it), and so do the 0.1% of today.

And because the 0.01% controlled the world then and the 0.01% controls the world now, bollocks (AKA trickle down economics) is still The Official Truth that the Elite will not allow to fail. Unfortunately, that means that the Elite, intentionally or unintentionally (when pushed by the irresistible, “invisible hand” of greed), WILL / MUST start nuclear WW3 in order to obtain a return on their investments.

Because the population of the world is not, as it used to, increasing wildly enough to create enough demand for the capitalists’ wildly-over-capacity, large-scale capital equipment, and the War On (of) Terror and the War on Drugs are not anywhere close to being big (expensive) enough, WW3 it will be.

For the Elite, when it comes to generating profit, whether they know it or not (plausible deniability), “all options are on the table”. Their financial and political minions will push the button for Them and, shortly thereafter, this time around “the business cycle”, They will plead innocence at the pearly gates rather than in a court room in Nuremberg, or in a corporate boardroom on Wall Street. THIS time around, the “profit” from “unintentional”, “unexpected”, “it struck the world like an asteroid from space” war will be dispersed equally among all people.

Hooray, capitalism/greed!!! Hip Hip Hooray!!

way back when, on south street in philly, i used to get cheesesteaks at ishkabibble’s, which was where many of the cops got their’s, because they were healthier, the steak was hot-steamed, as opposed to fried.

any relation?

No.

The root cause was collateral collapsed and the banks were already experiencing problems with loan quality?

The bonds tanked during a thirty year bull market in bonds?

Who unloads their paper first?

Now that Europe was able (draining 350 billion dollars out of the American money markets) to have a 250 billion dollar free money five o clock crack give away to the banks, will they start blaming the stressed homeowner for CRE problems?

The real estate bonds were getting smoked day after day in 2008?

After changing the accounting and blaming the minority homeowner for walking away from their mortgages, the president made appeals from multiple areas of the white house and finally TARP……. Its worst this time!

Feds behind the curve, mortgages are getting easier to get and multi-family construction has been growing fast. And now residential SFRs construction are on the upswing as well. It does look like the bubble is gaining critical mass. Another year or two?

This is totally off the topic of this thread, but well within the topic of the website:

I have been following the national debt. December 1, 2016 it was 19.9 trillion, today it is just under 19.9 trillion. I am confused. It has been going up at a pace of 100 billion per month, but it has been flirting with, but not broken through the 20 trillion barrier for a full quarter.

Is there a systemic fix I don’t know about? Is the treasury holding back on paying some bills? Is a bunch of off-shore money coming home and getting taxed? What is the explanation for what I am seeing?

Yes

The Treasury Depart faces the Congress-imposed “Debt Ceiling” of about $19.9 trillion that was reactivated a few days ago. Until the debt ceiling gets lifted, the Treasury cannot increase the amount of official debt. So it now uses what it calls “extraordinary means” – borrowing from other government entities, like pension funds – to make ends meet. This works for a while but not forever. The out-of-money date is in the fall. If the debt ceiling isn’t raised by then, all heck will break loose.

So the gross national debt will remain at about $19.9 trillion until the debt ceiling is raised. And then, the next business day usually, it will jump by $250 billion or $350 billion or so in just one day. Over the following few weeks, the Treasury will issue a huge pile of bonds and pay everyone else back. That’s how it always worked. Until then, our gross national debt will remain at the current level of ca. $19.9 trillion.

@Wolf, do you think the next housing crash will be worse than the last?

When do you think it’ll happen?

This time, everything will be different, given the amounts of liquidity out there globally, and the still very low interest rates. Even the last housing bust took about four years to reach the bottom – and that was very fast for housing, hence the sense of “crisis.” Housing moves slowly. It could take many, many years (as in Japan) for all this to unwind.

I keep thinking about Japan, too, but, even though the full housing unwind took something like 15 years, homes lost more than half their value in only something like 5 years.

As someone who was planning on buying a house in the next year or two in Portland after years of planning, I feel like I’m throwing darts at the dart board, but we’re trying to stay smart and wait.

Rent one for half the monthly cost. Then buy later after prices crater for 65% less.

Yeah, 2/3rds of the monthly cost is where we’re currently at, which is worth it to us (rent is still only 15% of our income.) The question is if this huge drop will really happen in a year or two here in Portland, rather than another five.

Rents are already sinking, demand at record lows and falling.

For single family homes in Portland?

Portland, Seattle, SanFran, Dallas, Miami, Manhattan.

I’m hanging out too. I could buy now but I don’t like what I see coming. Can’t hurt to rent and get debt free.

Thanks, can I see some of those stats so I can study? Where do I look, Housing Bubble?

Front page news. Business news anyways.

Sit tight and watch the prices fall.

Not in Portland. Zumper, which Wolf often links to, still shows a percent or two increase YOY in Portland.

Check transaction prices. Most MSA’s are negative right now and many are negative YOY>

It’s already happening. Collapsing demand, falling rental rates and prices, delinquencies up.

Did you need a personalized telegraph?

I think you are getting a little carried away with your ” Collapsing demand, falling rental rates and prices, delinquencies up” prognosis.

Not here is Seattle. No collapsing going on here, i’m afraid.

In Seattle too. What are you afraid of?

Show us the collapse in demand in rental rates and prices in Seattle that you claim are currently in effect ?

Study the data.

Here are the rental rates for February via Zumper. The article lists the 100 largest rental markets and movements in rents.

In Seattle they’re still rising year-over-year, but at much lower rates than before. There are some declines on a monthly basis, down from the peak, but it’s too early to tell if this is a turning point or just a lull.

http://wolfstreet.com/2017/03/01/peak-rents-dive-in-costliest-cities-soar-in-mid-tier-cities/

Interestingly regulators might be responsible for popping these bubbles of inflated asset prices.

This is because SEC Regulation RR, which was mandated by Dodd-Frank, became effective on December 24, 2016. It impacts an important source of funding for risky Commercial Real Estate and subprime auto loans. The rule states that issuers of ‘securitized’ bonds ( MBS, ABS, CMBS ) are required to retain a 5% interest ( in all or the lowest tranches ) of every new asset-backed security they originate.

https://www.sec.gov/rules/final/2014/34-73407.pdf

This means at least 5% of the risk in securitized real estate, and auto loans must now be retained by the companies responsible for pooling and packaging their loans into securities for investors. My guess is new issuance of CMBS securities ( used to finance retail stores, malls, hotels, rental apartment complexes ), and ABS securities ( providing loans to auto finance, and credit card companies ) will slow. Most of the companies securitizing these deals use high leverage, and target a high volume of new issuance to make money. I doubt they have the equity to meet this new SEC requirement, so the portion of bond deals they retain will likely be financed by debt. This is pretty risky in light of accelerating delinquencies for commercial real estate, and auto loans. For this reason new financing in these sectors should meaningfully slow, and if not the issuers of these bonds are building balance sheet risk that is unsustainable. A slowing of new financing is particularly problematic for commercial real estate because CMBS bonds typically pay only interest, and roll over ( are refinanced ) into new bonds at maturity to avoid paying the principal due.

More than 5% of every pool is held back by issuers anyway because they can’t find anybody stupid enough to buy it. That 5% can be totally worthless. This regulation only codifies what is already happening.

There are a lot of misconceptions about what mortgage pools look like, from what I am reading here. No two pools are alike because they are tailored to the interest rate environment or to a particular client base. The tranches generally mimic the entire range of T-Bills, Notes, and Bonds, and can include other bonds or indices as well.

The one thing that is generally true in any pool, is that the farther out the tranche, the less likely it is to be paid off in full. This is not a default but a function of prepayments. If you go all the way out with a zero coupon tranche, you will never see a penny.

This is good info. So what’s to keep the bank from compensating themselves by adding some requirement for the borrower to make up the difference (thus compensating the bank for their risk?)

Assuming banks won’t hesitate to pass their costs/risk along.

What I’m getting at here is there is now a hard limit on the quantity of this type of debt that can be originated per issuer. If they have $5 million of cash for retaining securities on their balance sheet, they cannot issue more than $100 million of debt. Additional leverage to fund these markets, and the laying off of this risk onto investors is now restricted.

Because they get to pick and chose what they sell and determine the prices as well, your point is not valid. The entire deal can be manipulated because they control every aspect of it, at the point of origin and beyond. They can mark the tranches where ever they want, to make that 5% look valuable enough. If they had to keep 5% of every tranche then you would have a valid point.

Ah……..the issuer calculates fair value and determines capital structure for individual tranches they retain. You are correct. Silly me, I naively thought if a regulation requires issuers to retain 5% of bonds they securitize on balance sheet, then they could’t originate more than 20X their balance sheet assets in new bonds. Maybe the leverage game for securitized bonds continues. :-)

nero followed whom? discuss.

as to the housing market, it is a function of being able to pay notes, however the prevailing method.

Well…. not really…. Not at all.

With current housing demand at 20 year lows as a result of grossly inflated prices 300% higher than trend, the only path forward for housing is falling prices to dramatically lower and more affordable levels.

What makes you think another bailout wouldn’t be in the works ?

If the asset can’t support the price then maybe the printing press

runs until the scales balance ?

Which further collapses demand. Housing demand is already at 20 year lows as a result of all this subprime lending.

This whole debacle will play out like a global version of the Japan stagnation. Not exactly, that rarely ever happens.

But we are almost guaranteed 10 years or maybe 20 years of global economic stagnation. The only major country i see growing it’s economy in a meaningful way is India… and then only maybe.

I’m under the impression prices fall when demand falls off a cliff. FWIW, this doesn’t strike me as inflationary.

Perhaps the FED wants us to believe in inflation and full employment or whatever, just as they said the housing market was healthy circa 2008?

Back door bailouts QE to infinity. bank cartels running the show with their pais. only way to stop this crap is bring back glass-steagall act, pass legislature to keep institutional investors and foreign investment out of single family homes. all these countries are run by super criminal syndicates- backed by banking cartels – promoted by media whores so don’t look for any of these countries to protect their own people anytime soon with logical legislature. these creeps have learned that “Crime does pay and pays a lot better than being legit”. the only thing that needs to unwind is all the sewage that populates government offices across the world. if the world ever gets better caliber people running their institutions, then things will change. don’t hold your breathe – it is worse than it ever has been. the people running the show would make Al Capone blush. yes it is that bad and worse. i fall off my chair laughing when i hear the ridiculous sh*t coming from the media whores. QE to infinity = zero credibility to infinity.

More QE just collapses demand even further. And we know collapsing demand leads to falling prices.

“More QE just collapses demand even further. And we know collapsing demand leads to falling prices.”

That is a pre QE rule being applied to a post QE market.

It dosent necessarily work that way.

So, what does a person do with the cash in the bank? If he/she shouldn’t buy commercial property or real estate and the banks can crash, is the cash unsafe even at a large institution like Bank of America or Wells Fargo? What can a person do with the cash they have which was in savings to buy a house once the bubble burst. Where can that person put the money. Unfortunately, someone I know is in this predicament. Should I advise them to withdraw the money and put in their safe deposit box? Or should I tell them to put it into to a couple of different banks and keep it under 250K so its insured? or buy physical gold or ETF gold? Any good advice?

I’m not suggesting what your friend should do with their money. But in terms of cash in a safe versus in the bank, here are some thoughts:

Assuming the person is in the US, the money is safe in an FDIC-insured bank as long as the FDIC rules on deposit insurance are followed.

https://www.fdic.gov/

You can for example use your broker to buy dozens of FDIC-insured CDs from different banks and squirrel away quite a bit of money that way, while staying within the FDIC limits. And when you need cash, you can even sell them via your broker at a negotiated price. When rates are falling, this is a good deal because you’ll get a premium. When rates are rising, it is not a good deal.

Don’t let scaremongers tell you that the money isn’t safe in an FDIC-insured bank. It is safe. Sure, if the sun crashes into the earth, your money is likely gone, but so are you and everyone else.

Even during the big bad Financial Crisis, no FDIC-insured deposit lost a dime. I went through three bank failures in my life and never noticed the difference. That’s how it is in the US. It may be different in other countries though, like Cyprus….

Definatly spread it around, well under FDIC limits, and within FDIC regs. Keep some CASH somewhere.

NOTE

A safety deposit box controlled by a bank IS not the place to keep CASH or other Liquid, Semi liquid, or liquidate-able security’s, or valuable items’s.

When Bank’s have issues, their security box rooms, also do.

In greece when the bank’s reopened. No box could be opened. with out a state/IRS inspector present, to inspect and record, the ENTIRE contents of the box.