“Consumers just don’t seem to be showing up….”

As much as we would have liked to, the Dow Transportation Average wasn’t kidding. It has plunged 27% since its high on December 5, 2014. Nearly two-thirds of that plunge came over the past two months. Transportation companies are singing the blues. Railroads, trucking, air freight….

Union Pacific, the largest US railroad, reported awful fourth-quarter earnings Thursday evening. Operating revenues plummeted 15% year over year, and net income dropped 22%.

It was broad-based: The only category where revenues rose was automotive (+1%). Otherwise, revenues fell: Chemicals (-7%), Agricultural Products (-12%), Intermodal containers (-14%), Industrial Products (-23%), and Coal (-31%). Shipment of crude plunged 42%.

So Union Pacific did what American companies do best: it laid off 3,900 people last year.

This is what CEO Lance Fritz told Reuters about the American consumer: “What’s causing us some concern is it’s hard to figure out where the consumer is at.”

Consumers were sending mixed signals. Spending is shifting from retail of goods toward services. People were buying automobiles, and auto shipments rose in the quarter. And unemployment numbers looked good, he said, but labor participation “is lackluster and consumers just don’t seem to be showing up to purchase goods and services.”

And another disappointment about consumer behavior, according to Fritz: “There was a widespread belief that consumers would turn the savings from low fuel into spending, and we haven’t seen that so much.”

Canadian Pacific, which is trying to buy US rival Norfolk Southern in a deal that is vigorously contested by other railroads, reported a 4% drop in fourth-quarter revenues and a 29% drop in net income. Among its biggest decliners: crude-oil shipments (-17%) and consumer-products shipments (-24%). It garnished the report with an announcement of up to 1,000 layoffs.

CSX, in its earnings release earlier in January, reported a revenue decline of 7% for the year.

On January 7, the Association of American Railroads (AAR) reported on the deterioration in shipment volumes late last year. In December, total volume dropped 8.9% year over year: intermodal containers and trailers, which had been holding up for much of the year, edged down 0.7%; and carloads (bulk commodities, autos, and the like) plunged 15.6% [read… Rail Shipments Plummet to Recessionary Levels].

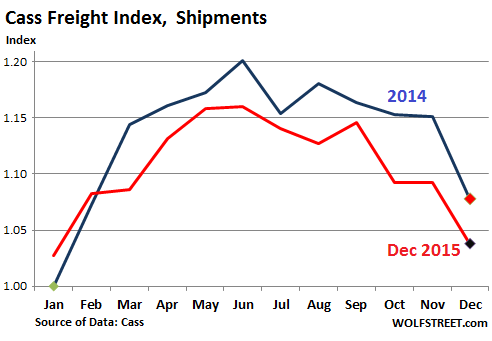

This was echoed by the Cass Freight Index, which tracks freight transactions by “hundreds of large shippers,” regardless of mode of transportation, including by truck and rail. It does not cover bulk commodities, but is focused on consumer packaged goods, food, automotive, chemical, OEM, heavy equipment, and retail.

In December, shipment volume fell 3.7% year over year. Note how the index for 2015 (red line) has been lower that in 2014 (blue line) every month, with the exception of January and February:

The Cass report added some bitter morsels:

In retrospect, 2015 did not even begin to reach the heights we reached in 2014. By the end of 2015, both shipment volume and expenditures fell back to 2013 levels.

High inventories are a problem for retailers, wholesalers, and manufacturers, so a majority of goods were discounted.

Export demand was way off in 2015 because of global economic conditions and the relative strength of the U.S. dollar.

Consumers remained cautious about extending any new credit for holiday purchases, waiting for the best bargains. Retailers had hoped the extra cash generated by still-falling gas prices would boost sales, but instead consumers increased their visits to restaurants and similar businesses.

The never-dying meme of gas savings going into brick-and-mortar retail! Instead it’s going into housing costs, healthcare, education, etc., which have risen relentlessly, and for many people have soared.

Boeing chimed in last night: It said it would cut production of its 747-8 freighter program “to match supply with near-term demand in the cargo market.”

While global air passenger traffic was still growing, it said, “the air cargo market recovery that began in late 2013 has stalled in recent months and slowed demand for the 747-8 Freighter.” It cited industry data that showed that air freight in November contracted in volume by 1.2% year over year.

This threat of a “transportation recession” is the expansion a theme we’ve been following for a while and that Moody’s called the threat of an “industrial recession”:

Slowing demand leads companies to delay investment and cut costs to protect their profits. But these measures create a cycle that further weakens demand, leading to recessionary conditions that could keep the industry from rebounding as quickly as it did in the wake of the Great Recession.

What’s amiss in the US goods-based economy? High inventories and sluggish demand.

As the Dow Jones Transportation Average has been pointing out, these conditions are now rattling the broader transportation sector to add one more sub-recession to the growing list that already includes the “earnings recession” and an “industrial recession,” both of which are linked to broad economic recessions. The only exceptions occurred in the early 1950s. Read… This is Where Industrial Production Normally Meets a Recession

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The slow down is picking up momentum. And will be felt, once again, most strongly at the low end of our system. Lay off announcements seem to be coming at a regular pace now.

Layoffs are a desperate attempt to wring labor costs off the income statements, lifting bottom lines and equity prices. With the prospects of top line growth dwindling, there can be found no other narrative to support profit expansion.

I am late … and tired … coming to this thread … but I really enjoy the … brute frankness I find here.

Tonight I bout 32 pounds of ham from a local (chain) store for the cost of 21 bucks. I think this is just product from the holidays that didn’t sell through and they are trashing it if it doesn’t sell soon and getting very aggressive. The discount was literally $15 off per ham and many were marked at $20. The norm was 10 pounds. I will be back at open to see if anything is left (I honestly didn’t get more because, having bought three, I thought I was missing a gimmick and I had to leave after checkout).

I dressed it all out for the freezer at 32lbs @ $21.40, keeping the trimmings and hocks for soups.

Our Walmart here was closed in the recent closings. They started off at 25% everything in the store and today was the first 50% everything left in the store. Between the wife and I we have gorged on discounted foodstuffs (to the point we are going to be feeding the ravens with the previously stored stuff to make room for the higher value stuff). All we bought was dry goods, canned goods, and stuff for the freezer.

She was very happy about all this savings over the past days. I was sad. I had to explain what is happening and why this is the cheapest food we will ever get the chance to buy ever again.

Something wicked this way comes.

As a gringo on the street, I never had this sense of deflation before. But as an educated poster here – it feels like oblivion. Like I was just in a war and can’t imagine the things I am seeing – knowing something worse is what is true. I feel numb. It is the thousand yard stare at ham prices way below what I know the store cost is – and knowing it will never be that cheap again because they got burned badly – the price goes up or they go out of business.

And the next time I need to buy ham, despite how I might horde, I will pay dearly and many in my community simply wont be able to pay – perhaps me included. I wonder if the job situation here is much worse than is let on in our local press.

When I get my tax return, I am going to pay off my last secured asset. That marks a new page in my life. I don’t know if that is good, or bad, but for the first time, I feel like I am fighting for myself as opposed to someone else.

Sorry if this is soppy – it hit me lately how badly my local community is just frankly screwed with no hope.

Sad.

Regards,

Cooter

‘Something wicked this way comes.’

Definitely.

More layoffs mean less consumption which means more layoffs which means less consumption …..

Which eventually leads to a deluge of insolvencies at all levels.

Which eventually will topple the global financial system.

Which will collapse civilization.

We are about to see what would have happened in 2008 if the central banks had not acted. This time around they are out of bullets

Not so. “Bullets” are Federal Reserve Notes and they are unlimited.

Not so. See Japan. No matter how much they print – no matter how low rates go (negative now) – growth does not return – deflation is never far away.

Eventually they will just explode the entire economy.

There are limits to what QE can achieve.

QE is NOT a perpetual economic motion machine.

The Japanese taught me, change 1 thing, observe, consider options carefully, before making further change.

Which is also basic engineering fault finding.

They started the QE experiment in a big way, they are still working to the orderly success of and exit from it.

New finance minister, new/change of BOJ action. Very predictable. if you understand a little of their culture.

This NIRP move, will not be an off the cuff snap decision.

Will it do what they want, and will it increase demand for Japanese state notes as the BOJ has been the only buyer in volume of late.

Does the BOJ want to pull short term notes into negative also?

A lot of that money parked at the BOJ, will go, somewhere.

There is no exiting QE – it can be paused — but there is no exit – see Japan

Anyone thing we have seen the last of QE from the US? They have paused it – but trillions are still floating around — and before this is over trillions more will enter the global economy out of the US

The main reason Japan has gotten away with this for decades is because the rest of the world was relatively healthy – Japan could sell into that.

Now the entire world it printing.

And not only is the printing pushing on a string — but the string is actually pushing back (see toxic side effects of QE)

In light of the current situation I am changing my handle from Peepot to Thomas Malthus

There is a successful exit to QE however Japan like israel is an economy that is continuously maliciously attacked.

Whilst all the major CB’s are doing different things, as leftist politically motivated Keynesian’s with leftist support continuously bully Austrians and change direction half way though an event to please their taker voters.

It gets very hard to see. Or get a steady indication of direction. The fed is trying to get above zero Eu is still pouring on QE, China the land of lies is really doing?? Japan has decided it is time to force the banks to use their liquidity. Japan is also trying having a non performing loan zombie company clean out. These two events are connected.

The Problem for America is how do we undo the mistake of the misdirection of QE II and III. And deal with the results.

The problem for the planet is how do we deal with china that has taken all the western QE liquidity, wasted it, and added much more of their own.

Compounding it with massive lies about their financial situation.

No body brought Japanese QE outside Japan. The Japanese are not stupid enough to let that happen.

so better to watch, and maybe learn from their vaguely controlled experiment..

Yes, and a great way to profit on this trend, or hedge one’s long position if one is so inclined, is to short aircraft leasing companies. These companies lease often old, expensive to maintain crafts to the major Airlines. After the recent boom, they may be next to feel the sting of reduced air shipping and travel demand.

And because the leased assets will be first to go in a downturn, those companies stand a real risk of total loss. Again, shorting them may be a great way to hedge long positions.

The northeast is experiencing a terrible winter storm today and all the news outlets are showing pictures of the empty supermarket shelves. As a Floridian I know that stocks get pretty low before the hurricanes arrive, but even by those measures, the shelves back east look very bare.

It should be obvious by now that economists, and banksters do not do actual research, especially out here in BFE.

The biggest problem with our consumer economy? CONSUMERS/CUSTOMERS DON’T HAVE NO G.D. MONEY!!!!!!!

At best, (and assuming he’s managed to keep his job 2009-2014) the typical Joe Blow is getting 2-3% pay raises, when the defacto inflation rate is triple that.

Or if you are like me, your new job (assuming you can find one) means you are working harder than you were in 2008, and making 30% less.

And this is in aircraft maintenance, one of those jobs where there is (supposedly) a “shortage of skilled workers”.

The free marketers are well on their way into turning this country into a Third World s##thole. Too many kids are starting to say “Screw college, why go $150K in debt when I won’t be able to make more than $12/hour?

“….And this is in aircraft maintenance, one of those jobs where there is (supposedly) a “shortage of skilled workers”. ”

aka “we want quality workers, but we don’t wanna pay for them”

You see, for corporations they are supporters of their lauded free market only when it’s convenient for them. When things go south it’s the free market that fails them, never the other way round.

Jon, don’t be a DBag. If you can’t accept the middle class is being squeezed then you don’t give a pinch of coon s**t about the subject. I am not sure how such an attitude is defensible if you are remotely familiar with what is really going on in the economy (at the ground level).

My point is BE OBJECTIVE. Is that too much to ask?

I don’t like to be aggressive with comments, or replies, but I am watching very serious s**t hit the fan in my local community and I know plenty of people are doing everything they can to hang on … and are going under anyway.

My understanding of what is going down tells me many of my peers (and perhaps me) are going down in the long run as well.

And frankly, all I see when I look around the marketplace is oligopolies who lobby for their niche and protection. Need an example? I live in one of the highest health care cost markets in the US. In 2013 me and the wife had basic physicals – 1k each – our deductible – each.

I now blow that money overseas doing basic medical (we are both healthy) and my insurance seems to be willing to provide benefits. Stay tuned for the outcome.

Regards,

Cooter

Cooter, where do you live?

“Coal, -31%”

At least the air will be clean for the thousands of laid off coal mine, railroad, and mining equipment employees standing in the bread/unemployment lines.

agreed. this really irks me. but they’ll have healthcare!

Air will be clean? On what planet? Look up dammit….its called geoengineering, and there’s nothing clean about it. You will be late to the party.

“Coal, -31%” At least the air will be clean for the thousands of laid off coal mine, railroad, and mining equipment employees standing in the bread/unemployment lines.”

Yep – GDP and fossil fuel burning are 1:1 correlated.

If all the clowns wanting an end to burning fossil fuels get their way — we’ll all be looking at blue skies…. and breathing clean air…

While we starve to death

“Yep – GDP and fossil fuel burning are 1:1 correlated.”

Not quite. They used to be, but haven’t been in a couple of decades. More and more GDP on less and less fossil fuel.

That is not what BP is indicating:

Figure 1. Comparison of three-year average growth in world real GDP (based on USDA values in 2005$), oil supply and energy supply. Oil and energy supply are from BP Statistical Review of World Energy, 2014.

Image: https://gailtheactuary.files.wordpress.com/2015/02/world-growth-in-oil-energy-economy-2013-logo.png

http://ourfiniteworld.com/2015/02/05/charts-showing-the-long-term-gdp-energy-tie-part-2-a-new-theory-of-energy-and-the-economy/

Do you have better info on this?

Thanks for digging up the info.

The chart you linked (from Tverberg’s article you also linked) is very good. It shows the growth in consumption of oil and all Energy (which includes non-fossil fuels, like hydro, solar or nuclear), and it shows GDP growth, all global.

So the oil line isn’t a perfect approximation for fossil fuel consumption. But I couldn’t quickly find a better chart that includes coal, nat gas, etc.

The chart clearly shows that oil consumption grew at faster rate than GDP in the 1970s, but the relationship reversed in the 1980s when oil consumption started growing a much smaller rate than GDP. Over the past 3 decades, according to this chart, oil consumption growth was below 2% mostly (and in some years negative), and GDP growth was between 2% and 4% mostly.

So, with regards to oil, the chart shows that the 1:1 relationship between fossil fuel and GDP has been broken decades ago.

Thanks again for digging up this chart.

It’s of course not exactly 1:1…. but it is pretty darn tight …

The chart goes back to 1972 – where do you see the break between GDP and fossil fuel consumption?

I don’t see that (neither does Tverberg) The blue line pretty much follows the green line.

‘We know that there is a close connection between energy use (and in fact oil use) and economic growth in recent years.’

Do you disagree with Tverberg?

Splitting Hairs.

Let’s see. How many types of recession do we have?

1/ Freight recession

2/ Industrial recession

3/ Transportation recession

4/Earnings recession

5/Consumer recession

How about just facing reality and call it what it really is. DEPRESSION.

There was no recovery from the 2008 crash. The 1% and Wall street got pumped up with a bunch freshly printed hot air balloons. The remainder of society was left to fend for itself on government handouts and crappy service sector jobs. Most of those at part time, while costs for needs continue to rise. People spend on needs not wants first.

So how about we stop beating around the periphery and call it for what it really is. It’s a depression. We have had the “Great Depression” now we are experiencing the “Greater Depression”. This will prove to be true, as future historians look at it through an unjaundiced eye.

Of course. I’ve argued for years that the so-called ‘economic recovery’ was a gigantic fraud.

That said, there was bound to be a decent sucker rally in stocks.

It may continue for another week or two.

But eventually investors will be forced to look at earnings, which mostly suck.

Unfortunately for Wall Street, the Fed does not have the ability to print revenues or profits.

So, no matter how much lipstick you put on this pig, it is still a pig.

The problem with the market is that there are no fundamentals left. One might as well consult a magic 8 ball instead of Bloomberg.

When things are this manipulated, this baked, the only option is cash or cash equivalents.

Reality has to show up again for the non-insider to have a game.

In my personal, very uneducated, unqualified, no-right-to-say-so opinion, I think the insiders have so rigged everything and the blog-o-sphere has so exposed everything, that the game that used to be is no more; the SUCKERis gone.

When I was young, I watched it, knew it would, blow up in 99. When I was older, I watched it, knew it would, blow up in 08. After that, I was out. I haven’t been in, nor will I be in. All the fame, bluster, noise on TV is for someone else – not me. Who? F**k if I know.

But they must be damn fools who weren’t banking in 99, 08, or now.

The con ran out of gas almost 10 years go. Nothing but money printing, buy backs, and mark-to-unicorn since.

DID IT GET THEM A BAG HOLDER?

Nope. Hahahaha ….

So, park your s**t in a safe deposit box or a TreasuryDirect account and wait for the fireworks.

And if you are going to bust my balls about TreasuryDirect, please post about where you are moving to capitalize on the collapse.

Regards,

Cooter

High-grade scrap metal has potential, IF, you have somewhere cheap, to sit on it. Looking also for a “Cheap” place to stash a few hundred thousand liters of Diesel as now may be close to the time to get it. Might buy an old hull and put some in it

“And if you are going to bust my balls about TreasuryDirect, please post about where you are moving to capitalize on the collapse.”

This has been the problem for a while, what, WHERE, as Land, can, and will be “Socialized”, by the HATE anybody with anything, O bummer, Sanders clans.

Treasury direct, as you are in the US, would be safer than any bank, but just as confiscate-able, if not more so.

Time you had somewhere to run a small number of Pigs and Beef stock. You can always buy things, with GOOD meat and fish.

God damn…don’t put anything in a safety deposit box. They are unsafe, because the US can confiscate everything in them.

Bury it somewhere.

Completely agree. Gold and silver — in a strong box or safe – in the ground.

And the unfortunate thing is this is as good as it gets.

When collapse hits we’ll look back fondly on the years 2008 to 2016.

Proven Dow Theory says Dow Transport proceeds the Dow Index. Well Dow Transport has been in the bear market for some time now.

Baltic Dry Index is notoriously inaccurate and played down by the bulls but event the ardent bulls cannot deny that freight recession may herald or harbinger of Great Recession II.

Today’s bounce is a mere dead cat bounce to be sold thru as 8 yr bull market is tired to say the least with echos of 2008 and 2000.

We learn history so as not to repeat it.

When the Baltic is high the pundits point to it as a leading indicator…

When it collapses the pundits say it is of no relevance.

Given that on line purchasing is so prevalent, I’m guessing that the Dow transport contains the components of this as well as other goods transports? So, would amazons sales of goods be showing a decline as well? Not thier cloud and entertainment services.

“So, would amazons sales of goods be showing a decline as well? ”

If they already are, its uglier still, as On-line, is still stealing, from brick and Mortar.

Theirs should be in the next set to fall, unless there is a leveling of this decline.

Friend needed yellow ink jet cartridge–Amazon 2 hour delivery of Yellow 3 pack for $32. Went to Office Depot to get just one instead, price for 1 was $32 but none in stock. OD did have 3 pack of Y, C, M for $64. Went home ordered from Amazon and said, “Why do I even try to go out and buy something anymore?”

Same happened to me with Office Depot, different product. That place as a brick-and-mortar entity is dead.

A credit card is generally used for online purchases….

Connect the dots….

38 pc drop in American Express Q4 earnings, plans cost cutting

http://www.bignewsnetwork.com/news/240508265/38-pc-drop-in-american-express-q4-earnings-plans-cost-cutting

All credit card companies are down, as main street, and most everything else, is down.

Are the sales of Online retailers, down, if so, as much, or more than, Main street. In both number of sales, and $ values of sales, is what you need to ascertain. Then watch those # to see if there is an accelerating decline, going into spring 16

To discover, if some of the Main-street drop, is a continuation of the migration to Online. Or there is a larger drop occurring .simple credit card company numbers, wont tell you that.

UPS Fed-ex, have been saying ugly things , How ugly. Compared to Main-street.

A number of Amex problems are company specific … among them, it charges merchants more and just lost some big merchant partners.

I couldn’t find info on Visa and Mastercard.

It would interesting to see what is happening there.

If they are not seeing increased volumes that is hugely worrying

An easy way to approximate this is to check the revenues. It’s not 100%, but it’s close.

Visa’s annual revenues in 2015 (fiscal year ends Sep 30, so it does not include the holidays) were 9% higher than in 2014. MC fiscal year ends in Dec. So no annual revenues reported yet. But in Q3, revenues were up about 4% yoy.

It seems they’re doing ok. Americans (and people in other countries) use credit and debit cards a lot, as the use of cash is being replaced. Some of the electronic payment forms run through the visa system as well.

“Canadian Pacific, which is trying to buy US rival Norfolk Southern.”

That was before the Canadian dollar plunged and debt was cheap. Now I would watch my back and pray that Norfolk Southern does not launch a counter bid, and buy Canadian Pacific on the cheap.

Here in the Pacific Northwest, we have been getting a nice bump from Canadians coming down, over the border, filing up on cheap gas, then acting like over-indulged Americans for the weekend, spending on esoterica, like youth basketball tournaments. (Our tourneys in Seattle were half-full of Canuck teams.)

That will all change this spring. The loonie collapse will have ended that.

I will be looking for a new gig as basketball ref.

it’s been going on for a while, no need to wait till spring. they must have had pent-up savings.

am starting to eye canada. just looking for now.

hmmmm, interesting observation. i like the thinking.

a lot of interesting possibilities in canada, but i see home field refereeing might be ready to arise.

i say we just merge the countries, and tell the rest of the world to get bent.

politely.

I am a huge Corb Lund fan (Alberta).

For folks that like my comments, go search his YouTube (he is a musician – a very, very talented one) and enjoy.

I have done eight shows now on my local PBS station and I have featured one of his songs in pretty much every one. Right up there with Ray Wylie Hubbard, Turnpike Troubadours, and Chris Knight.

Talent, talent, and more talent. Great music!

Regards,

Cooter

“i say we just merge the countries, and tell the rest of the world to get bent.”

Thats been on the cards for a while, issues mainly being Crazy US gun laws, and Crazier US political system. Gets the constitutions revised, without an anti British/royalist, aggressive element sitting at the table.

It was prophesied that it would probably come about, as a counter to a serious NA economic contraction.

Would also shut down the insane increase in unskilled US immigration as the gaps would be filled with Unemployed Canadians.

It will happen unless America becomes to much of a mess for Canadians to go near, due to mass US unskilled immigration.

One possible conclusion is that many consumers can’t afford to spend both on cars and consumer goods. And many people are driving very old cars. In the last week I have seen two people by the side of the road dealing with overheated radiators. A sight I haven’t seen for 20 years. And cars are very expensive relative to many people’s incomes, even used cars.

car credit is readily available, consumer credit not so much.

those people you saw probably have NO credit.

i like my old car, it’s 17 years old and almost paid for. back from when i had credit……

I live in Alaska and more times than I can count I have seen older folks (I would peg them at 50+) on bicycles riding here to there.

Now, I get that for the hippie types and kudos to them – but these folks really seemed like the working to stay alive redneck types. Hell, sometimes I am like “that dude stole that bike from a kid” … think like that.

Older folks who have to ride the bus are very common here these days.

Regards,

Cooter

The cognitive dissonance of the upper powers that be (Government, CEOs, Financial echelon) has become laughable. So out of touch with the actual consumers (peons,serfs, slaves…whatever we are now) , who are supposedly driving the economy. None of this makes any common sense. Gee I saved $100 dollars at the pumps this month so I am going to go out and spend a thousand to celebrate? Also, none of the powers that be have mentioned the healthcare haircut.

Last year there were daily flip flops on consumers not saving enough, next day too much savings when they should have been spending. Not enough for retirement …then Boomers hoarding cash. Meanwhile the most corporate cash hoarding by corporations ever recorded.

Several commentators have mentioned Thomas Pikkety and wealth inequality. Accumulation of wealth is not self correcting. Which IS common sense….who wants to give up their huge piece of the pie.

Wealth inequality has reached the end of the rubber band stretch. It either needs to snap back pronto or break and have a revolution.

Speaking of healthcare, I take a brand name blood pressure medication, since most of the generics have intolerable side effects.

Last year it was not covered by my useless Obamacare health insurance, so the discounted price for the uninsured was $157.30 a month.

For 2016, the medication is now covered by my useless Obamacare policy, so the new price is $228.09, which I have to pay until I meet an annual $4,500 deductible. Thank you, Mr. Obama.

I guess I’ll just cut my restaurant budget and clothing budget for the year so I can afford the extra $70 a month.

And people wonder why the economy is collapsing…

Learn to vacation abroad, fill your script, and quietly bring it home.

Or, for that matter, stay abroad.

I am so angry at the docs in my town jacking me on basic services that unless I have an emergency they can f**k themselves. I have an international vacation coming up and I am doing my whole ball of wax in a foreign country. And my insurance was very agreeable to reimbursement. Hell, I might walk away with almost no out of pocket due to the low costs abroad.

Will be happy to advise if I get covered (or not) – will be a month or two from now. Just nag me.

Healthcare in the US is an oligopoly at this point. Just another tax, another tax, and yet another tax.

Tax. Tax. Tax.

Regards,

Cooter

I talk to a guy from Chicago back in 2010 that had Surgery in India because the doctor was an expert he could not find in the US. He said that it was 90% less than the US cost AND his insurance was more than happy to cover almost all the expenses.

I ended up going there for the same reason in 2011. One of the best decisions I ever made.

DUH!! Buy the medicine not using the healthcare.

I did that for years on a bladder medication. No insurance involved and it was cheaper that way.

They can’t have it both ways. The government killed their golden goose. No tax revenues from the lower middle class (that’s me now) and the retirees who are still working. When the corporations go down, and nearly all will in the depression they don’t admit to ( after all, they’re so big, they need all the consumption that is now gone), the government won’t have any power.

ha, ha……looking forward to the change, even if I am broke.

What a crazy world we live in, the real economy across the world is deep in recession but the stock markets are still going up because central banks are simple printing more and more money. What is the endgame for more QE from the ECB and FED?

Actually, stock markets rallied today and some yesterday after a massive three-week selloff. Many of them are deep into a bear market. Almost $8 trillion has evaporated globally this year. So the world might just be getting a little less “crazy,” as you said.

Yes but Mario Draghi promises more QE in 2016. I’m sure Yellen wouldn’t be outdone and follow suit. Is it really possible that central banks around the world can simply print their way to reflating the stock markets? Companies can simply take on more debt to buy back their own stock?

Are you Roman? Well, then money printing doesn’t work.

Please recount your understanding of the decline of the denarius with regards to debasement, government deficit, and empire stability. I think I missed that bit in your comment.

Or, perhaps you could recant the story of the Byzantine empire and how they managed to roll for 1k years. Gold?

Did you know wiki has 32 amazing kinds of lying?

https://en.wikipedia.org/wiki/Lie

This is probably the most fascinating list of all the lists I have ever read. Print or write and put on the fridge. Just opens ones eyes.

And if you are trollin’, you need to step up the game. :-)

Welcome,

Cooter

What is interesting is the crash may occur just in time for the elections. So critics will be able to put the blame on the Democrats in the same way they put the blame on the Republicans at the end of the Bush 43 presidency.

LOL. He lays off 3000 people and can’t understand why there is no consumer demand? DUH!

Glut in supply + lack of self supporting jobs + loss of $boomer = recession ( since 2007).

I read somewhere back in time that the boomer inheritance was priced into the financial markets in 1995, 21 year ago. (a full generation).

———————

I am a boomer so I cannot remember the 30’s, however this feels like the early 60’s Britain to me.

YMMV

What planet does Fritz live on? How out of touch can one be???? So, I saved $100 this month on gas and now going to go charge $1000 to celebrate? Oh wait…I had to charge $5000 to meet my health deductible. Aaand by the way, credit cards can charge 29.99% on credit cards. But bless your worthy little heart Fritz, you were getting zero interest.

My apology. I am being redundant in my comments. Just so angry at this “Gee I don’t understand why consumers aren’t spending” meme. Rather like Hillary saying she didn’t understand if she was the Establishment question. Deep breath and walk away from the computer. LOL

Wolf,

Can we please get the “like” buttons? I feel it’s time.

Can we?

Regards

LG

I’m not sure I understand. Could you clarify? There is a like button at the top and bottom of each article (they just look a little different).

On the other hand, if you were being ironic, I have to admit, I’m too slow, I’m not getting it. Maybe because it’s Friday.

Wolf, I think the request for a like button refers to the ability to like individual comments, sort of like Disqus, or rating-widget.

Yes a like button or rating widget .

Just to agree with people.

Thanks. Good idea. I’ll try to figure out what options I have without having to go through a third party, like Disqus.

I will disagree, although most might also disagree.

I don’t need a “like” or “don’t like” to summarize an idea made in a post. If I don’t like something, I will creatively, constructively dissent.

Isn’t that why y’all like coming here?

For god’s sake, let us all think and engage like educated (or at least opinionated) adults. Hell, let’s even troll for that matter – it is much more classy than the mindless “like” button.

On that note, screw keeping score. Our planet is 4 billion years old and will be 5 billion 1 billion years after we are gone. Does score matter? No. Right. But thinking makes a difference – between you and I.

Let’s settle on that as a common path.

Regards,

Cooter

P.S. Dumb software is smart enough to click a button, but is vastly too dumb to post a clever rebuttal. If you don’t know the difference between AI and I, well, there ya go.

Consider that before scoring everyone’s rebuttal.

I agree, likes on each comment is useful.

Disqus has a good system.

We use like button in some fiance forums, to indicate, read you, in comments, as manners thing. don’t have dislike, as you, dislike, in post.

+1% in Automotive is NOT A RISE.

It is the luring of more gullible consumers into AUTO LOANS that will NEVER BE PAID BACK.

But how awesome to have Wi-Fi in the car they are going to live in….for basically the same price as Wi-Fi only in an apartment. Huge savings. Invest in car parks with portable showers on site. Thought I being being sarcastic…but now think I may be ahead of the curve on Hooverville investments.

I’d buy a 1978 F150 highboy in good condition in a heartbeat.

What year is it?

Regards,

Cooter

Chris,

Take heart. Your car is only 17 my 1993 Cadillac is what… 23 now. It is mine, nobody else would want it most likely. Actually, it’s a nice old ride.

Yes, the consumer is not buying because he doesn’t NEED anything just now. Besides, he is broke, no or, low raises, costs not included in costs of living have kept geezer payments flat, while healthcare continually rises.

So, what makes the learned expect growth? Any farmer knows ground without fertilizer yeilds little. It doesn’t have to be expensive fertilizer, but anything helps. The economy hasn’t been ‘fertilizing’ the consumer in years!

Still this retired investor is looking for more downward moves to buy into a few things at great prices. If not, well, I’ll just wait for another time.

Who knows, I might need a newer car someday.

JPF.

I came in late, and frankly, a few beers in. Long rough week at work. And a little salty as far as my mood goes.

Anywho, to the point, I got a short story from my old man (drafted vet) you will like.

So, my old man has an uncle (way back in the day) who graduated from Texas U (Austin) as a doctor and settled in Paris Tx. He bought a brand new Mercedes Benz 4 door 240D turbo – burnt orange. Drove it for a number of years and eventually sold it to my old man – good price.

Despite my old man being a finance major (masters) from UT, he still cites this car price as a benchmark for inflation (hint: good deal). Gotta spot the bias!

To this day my old man still drives that car. To give folks an idea of what a REAL car is … the transmission sits on rails … so if you need to service the clutch you simply unbolt and ROLL BACK the tranny, swap parts, roll it forward, bolt it back up, and you are done.

This car is engineered like a TANK. He is up to almost 500k miles.

So, to the point, he went shopping at Walmart one day. He comes out and some young buck it eyeing the car. It is old, and orange, but it is very classic for those that know the look – you don’t see these anymore. My old man walks up to him, starts conversation and the kid is just kind of respectful about the whole thing (still driving a classic, etc).

The kid tells my old man, after some conversation for a few minutes, “Boy, you got your money’s worth!”

Teed up the old man, who said, “Not yet!”

First time I heard it, I laughed. As I got older, it became a goal. I don’t think I can outrun him on a half a million mile car – but I am a stubborn sob, just like my old man … and he is getting a run for his money!

To everyone else – good advice – find a car you can milk for 500k with minimum service.

Regards,

Cooter

Good post Cooter!

I sailed with a great Captain who said autos were the most expensive, wasteful things ever created if you do the math.

A car driven at 50 mph will hit 100k miles in 2000 hrs of operating time. 2000 hrs is 3 months operating time. So we take a $30k item and throw it away after 3 months use. Waste!

The piece behind all this is that junk bonds cost are rising.. It is getting much more expensive to get money. And most debt hasn’t yet been defaulted on. Boy what a mess this is going to be.

What always amazes me is how long these cycles take to play out..

Looks to me stocks should go a little higher. The bounce hasn’t yet hit the 38.2 fib yet.. usually a bounce goes at least to the 50% line.. Many go to the 78.6%. This one is pretty weak so far. Volume has been declining since the open, except for a spike on the close. Wonder where that came from?

The global economy is grinding to a halt.

The central banks have done everything they can to try to prevent this — including ZIRP and QE.

And now they are powerless to stop this.

The deflationary death spiral Bernanke so fears is now upon us.

And there is no way out

Maybe CB’s are waking up to the fact of excess debt strangling demand. Now from the BIS –

http://thenewdaily.com.au/money/2016/01/12/bombshell-destroy-debt-star-banking/

I can’t speak for households generally but I can speak for my household. I’m self-employed and I generally rely on insurance companies to pay me, and right now insurance companies are hoarding cash, big time. Thus, my income dropped 48% in 2015 from 2014. My wife had a bit of a raise (what her boss is saying may be the final large merit increase of everyone’s career at this particular company) but it was almost entirely offset by the increase in health insurance premiums. We also had a child this year, so now we’re spending a lot more money on child care. So, yeah, we’re not spending money. No new clothes, or furniture, or vacations, or cars, or household knick-knacks, or housewares. Just paying off the high deductible health insurance premiums from the delivery, and looking forward to 5 more years of $1,000 a month child care at the local daycare.

debits

Have you seriously ” ran the numbers” on just one parent being an ” out of the house wage-earner”? Lots of things to give up to reduce expenses; one car or one bland older model you pick up in Florida from a senior citizen who no longer drives ( think Buick); cut your own hair, use no makeup, drop the cable/dish plan ( read books instead of watching the talking heads hanging on the wall); make all your meals from scratch, grow a garden, learn to can and freeze, don’t eat out ; shop at 2nd hand stores – the list in endless. Get off the wheel and you will love your new life!

Meanwhile government services and jobs are WAAY up!!!

Need to do NOTHING?? Get a government JOB!!

Sometimes it’s fun to come in late. Had a Mother Nature enforced break due to the Nor’easter and for once I wasn’t resentful ? I just slept for two days. Hang in there Cooter you’re doing a bang up job.

Guess what I came across today?

On the “Business Insider” website Wolf’s article was reprinted:

http://www.businessinsider.com/us-in-planes-trains-trucks-recession-2016-1

They even referenced 5 more articles from Wolf Street.

Yes, I’ve been a regular contributor on BI since 2011.

Excellent post. Well written. However, recent data points from our logistics business tend to suggest that fears of a “freight recession”, while real, are exaggerated. Our business remains strong and it is improving.

In addition, there is a recent article in the Journal of Commerce supporting this view:

http://www.joc.com/trucking-logistics/truckload-freight/swift-transportation/top-us-truckload-carrier-fear-freight-recession-overblown%E2%80%9D_20160126.html

I have included a link to your article in our post on this subject as a counter-point:

https://www.airandsurface.com/blog/freight-recession/

Paige, SWIFT’s operating revenues dropped 4.4% yoy in Q4! That’s NOT a sign of a booming sector! That’s right in line with the other data of the transportation recession.

SWIFT was helped out by a change in fuel surcharges. And that was it.

Wolf, your point is very well taken. To clarify, I did not mean to infer that everything is rainbows and unicorns out there. Clearly the economy has slowed and some sectors are struggling greatly. The oil patch, commodities and those that haul them (i.e. railroads) have taken it on the chin.

There are, however, industries that are not in precipitous decline and, while they may have slowed, they are not in a “freight recession” in the narrowest sense of the word.

I think that given the magnitude of the stock market’s woes, it is easy for the talking heads to shout the sky is falling. It is easy to see why it would jaundice their perspective.

Other industries leaders, perhaps Swift among them, perhaps paint too rosy a picture. American Airlines just reported record Q4 profit.

In my opinion, based on a limited data set from our company and anecdotal evidence from our customers, the truth is probably somewhere in between.

It’s not falling — but it soon will.

A recession isn’t the end of the world. It just means a decline in economic activity for a period of time. So a freight recession would be -1% to -5% yoy decline, or something like that, for a couple of quarters in a row. Railroads dealing with commodities have been looking at much bigger problems. Trucking (thanks to low fuel prices) is looking at that milder -1% to -5%, just like SWIFT.

It’s enough of a shift to where trucking companies have slashed their orders for new trucks. See the travails of truck makers and engine makers.

Normally a recession would not be a major issue….

Interest rates would be reduced and stimulus would be rolled out – and the recession would end.

Unfortunately not only are interest rates already at zero — stimulus rolled out including many trillions of dollars of QE.

And in spite of all of this we are sinking.

What do we do to get out of the recession that is coming?

I would suggest that this time is different. Very, very different