Overcapacity “will be even greater than in 2009.”

“I would be open to the possibility” of reducing the fed funds rate “even further” and go negative, explained Minneapolis Fed President Narayana Kocherlakota on Thursday. Some folks just don’t get it.

Here are the results of seven years of global QE and zero-interest-rate policies:

Global demand is going from sluggish to even more sluggish. Emerging market countries are leading the way, it is said, and China is sneezing. Brazil and Russia have caught pneumonia. Japan is feeling the hangover from Abenomics. Even if there is some growth in Europe, it’s small. And the US, “cleanest dirty shirt” as it’s now called, is getting bogged down.

And here’s what this is doing to the shipping industry, the thermometer of global economic growth.

On one side: lack of demand.

Due to the “recent slowdown in world trade” shipping consultancy Drewry on Thursday slashed its forecast for container shipping growth, in terms of volume, to 2.2% for 2015 and lowered its estimates for future years. BIMCO, the largest international shipping association representing shipowners, issued its own, even gloomier report also on Thursday:

On the US West Coast, it’s been slow all year, starting with the labor disputes that weren’t resolved until mid-March. Since then, year-on-year growth in the second quarter was almost on par with 2014. But for the first half year alone, inbound loaded volumes dropped by 2% according to BIMCO data.

On the Asia to Europe trades, volumes were down by 4.2% in the first half of the year as 7.4 million TEU (Twenty-foot container Equivalent Units) was transported. Northern European imports fell by 3.6%, while the East Med and Black Sea imports fell by 4.8%.

Intra-Asia shipments remain a stronghold with ongoing positive growth around 4-5%, but the increased uncertainty surrounding the economic development in China adds doubt as to whether such a strong growth rate can be sustained for the full year.

At the same time, as shipping volumes struggle, freight rates have collapsed, and revenues with them.

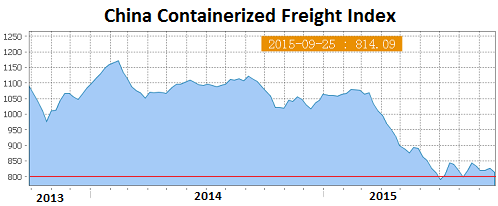

“The severe lack of exports from China” is reflected in the China Containerized Freight Index (CCFI), BIMCO pointed out. The index, which tracks freight rates from China to major ports around the world, plunged below 800 in early July for the first time in its history (it was set at 1,000 in 1998). It’s currently at 814. The red line marks 800:

On the other side: over-capacity.

Drewry estimates that an additional 1.6 million TEU of new capacity is being added to the container shipping fleet this year, and not enough ships are being scrapped. Hence a fleet growth rate of 7.7%:

As a result, Drewry’s Global Supply/Demand Index, a measure of the relative balance of vessel capacity and cargo demand in the market where 100 equals equilibrium, has fallen to a reading of 91 in 2015, its lowest level since the recession ravaged year of 2009.

But in 2016, another 1.3 million TEU of new capacity will be delivered. Drewry projects that its “Global Supply/Demand Index will fall to its lowest level on record over the next few years, indicating that the overhang of excess capacity will be even greater than that experienced in 2009.”

So freight rates have crashed globally. But graciously, the oil price crash led to lower bunker fuel prices, which has kept some, but not all shippers afloat.

Shipping lines have responded half-heartedly with idling some of their ships, but so far without great success in raising rates. And these ships are heavily leveraged, so idling them and not earning revenues while having to service their debts isn’t helping matters.

So shipping loans are a doozy.

Germany is a hotbed for shipping loans, to the point where Andreas Dombret, member of the Executive Board of the Bundesbank, highlighted them in February 2013 as one of the four risks to overall financial stability in Germany. He fingered two causes: plunging freight rates and overbuilding of ships of ever larger sizes, driven by “cheaply available financial means” – a direct reference to easy-money policies.

He waded into the bloodbath in Germany: shipping loan retail funds that blew up and were shuttered, banks whose shipping portfolios suffered heavy hits, an industry that was breaking down…. The Bundesbank was looking at it from a “broader perspective,” he said, with an eye “on the stability of the entire financial system.”

He knew what he was talking about.

A month later, the largest ship-financing bank in the world, HSH Nordbank, which had been bailed out in 2008, re-collapsed and was re-bailed out by its two main owners, the German states of Hamburg and Schleswig-Holstein.

The ECB, which now regulates the largest European banks and last year conducted the most intrusive stress tests in EU history, is putting pressure on HSH to finally clean up its bad loans, which still make up a stunning 23% of its total loan book, “sources” told Reuters in July. Even some Greek banks don’t have this much putrefaction hidden in their basements.

In the US, Citigroup sallied into shipping loans when it bought a “significant” part of Société Générale’s shipping loan book for an undisclosed price in June 2012.

“Citi is looking to increase their shipping exposure in the market, and it is easier to acquire loans rather than originate them from scratch,” the source told Reuters at the time. It would have “an edge” in dealing with the shipping loans because they’re mostly in dollars.

A year later, Citi converted about $500 million of loans to non-US shipping companies into complex structured securities in order to roll some of the risk off to other investors, for a price: a yield between 13% and 15%, “these people” told the Wall Street Journal. Not sure how the deal turned out and what happened to the remaining shipping loans on Citi’s books, but since then…

Here’s what’s been happening in bankruptcy court:

September 29, 2015: shipping company Daiichi Chuo KK filed for bankruptcy protection in Tokyo after four years in a row of losses, listing about $1 billion in liabilities.

February 2015: Copenship filed for bankruptcy in Copenhagen, Denmark, after losing its behind in the dry bulk market that has been struggling for a lot longer than the container market.

February 2015: China’s Winland Ocean Shipping Corp filed for Chapter 11 bankruptcy in the US.

“The combination of lower steel demand in China and the huge volume of new tonnage coming on line is what is causing panic and making this the worst bulk market since the mid-1980s,” explained at the time Hsu Chih-chien, chairman of Hong Kong and Singapore-listed shipper Courage Marine.

August 2014: Nautilus Holdings and subsidiaries filed for Chapter 11 bankruptcy in New York, listing $770 million in debts.

April 2014: Genco Shipping and Trading, owned by New York shipping tycoon Peter Georgiopoulos, filed for Chapter 11 bankruptcy in New York, listing about $1.5 billion in liabilities.

July 2013: Excel Maritime Carriers filed for bankruptcy.

There were other shipping companies that destroyed investor capital in a similar manner, and more will join. The dry-bulk fiasco started years ago, and the commodities rout has made it worse. Container shipping is just now getting put through the wringer, and the “financial pain,” as Drewry put it, will last for years.

This is what our dear soon-to-be professor Kocherlakota doesn’t get: When as a result of monetary policies, the cost of capital has been close to nil for the right folks for long enough, and desperate investors are out there blindly chasing whatever yields they can get, there are consequences: malinvestments.

And they beget overcapacity and over-supply, which beget the destruction of pricing power, which unleashes deflationary forces, which inflict heavy losses on companies in the sector, which finally seek refuge in bankruptcies, which finalize capital destruction. None of which beget a healthy economy.

So there are some issues in this distorted world, demonstrated by scary chart of a staggering reversal. Read… China, Russia, Norway, Brazil, Taiwan Dump US Treasuries

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks again for the excellent article.

Weakening global trade and shipping oversupply have been making the rounds since at very least mid 2014, when the CCFI had that plunge highlighted in charts. Not even consumer goods demand for the 2014 Christmas season could revive it.

The various blips which followed have been more the result of shipping giants such as Maersk attempting introducing higher rates (sometimes much higher rates) before being forced to backpedal by Asian shipping companies accepting spot rates and hence taking extra volume away from them.

Unless ships are scrapped/mothballed in their dozens very soon, the CCFI will remain at around 800, which is very bad news for shipping companies, the banks financing them and large shipyards and engine manufacturers such as Daewoo, Wartsila and Mitsubishi.

If one wants to have a measure of how disconnected stock markets are from reality, all he has to do is looking at stock valuations. Maersk is literally skyrocketing and at its one month highest. Mitsubishi Heavy Industries is exactly the same and today it has already shot an unbelievable 3.15% upwards: one may even suspect the Bank of Japandemonium has a hand in it. The only major shipbuilding/shipping stock getting slaughtered is Daewoo, which hasn’t recovered one tiny bit from the near vertical drop in July. Today however even this pariah stock posted a +1.43%. Simply unbelievable what traders drunk on optimism and investors desperate for any yield will do.

The HSH Nordbank collapse has also shown another trend which is swept under the rug: the incredibly bad shape German banks of any size are in and how little power (or interest) regulatory bodies have in forcing them to beef up their positions.

In this Germany is following in the footsteps of other export-driven economies and reminds very closely the situation South Korea was in at the eve of the 1997 Asian Financial Crisis. Nobody gave much (or any) thought about how loaded with dubious loans Korean banks were until the cascade of events starting in Thailand arrived in Seoul.

The problem is the 2015 German banking system is not only far larger than the South Korean one was in 1997 but adds a further twist to the play: it’s loaded to the brim with derivatives of any kind. Deutsche Bank alone sits on a pyramid of derivatives far larger than the one Lehman fell from in 2008.

Mindless optimism and the mad scramble for yields ensures those derivatives won’t catch fire… for now. But the silent bailout of many German banks (mostly owned at least in part by local governments such as HSH Nordbank) in the past two-three years hints at the fact the fourth world economy has problems she, and all those betting on her as an engine of growth for the euro-area, doesn’t want to see, let alone work to address. I see big troubles ahead. Not a massive collpase like many Chicken Little say, just very serious troubles.

“On the US West Coast, it’s been slow all year, starting with the labor disputes that weren’t resolved until mid-March. Since then, year-on-year growth in the second quarter was almost on par with 2014. But for the first half year alone, inbound loaded volumes dropped by 2% according to BIMCO data.”

And it will get much, much slower on the West Coast, due to the growing numbers of super tankers that will soon be able to sail through a widened Panama Canal (at a cost of over $5 billion, paid for by the Government of Panama) to US East Coast shipping ports. Labor disputes on the West Coast should all but disappear, as longshoreman there will be begging for work.

East Coast ports like those in Charleston, SC, Norfolk, VA Boston, MA and the Port of NY and NJ, that are being dredged to become large enough to support these super tankers, will be humming. Container shipping costs to Chicago will fall, and roads leading out of East Coast ports will be maintenance and traffic nightmares. There will be a tectonic shift in Asia to US shipping patterns.

“U.S. ports are busy deepening harbors and building bigger terminals to draw the bigger ships. Across the USA, public ports and their private sector partners will spend more than $46 billion in port-related improvements through 2016, according to the American Association of Port Authorities.”

“A just-released study commissioned by the Pacific Maritime Association argues that West Coast ports stand to lose significant volumes of cargo in the years following the Panama Canal expansion due to lower freight rates that will be offered on all-water Asia to East and Gulf coast services.

The study estimated that price levels on the Panama Canal route for Asia cargo bound for Chicago will drop 12-14 percent from $3,200 to $2,800 per 40-foot container in the three to seven years following the expansion of the canal, which is now scheduled to be open in early 2016. The current spot rate from Shanghai to the U.S. East Coast is $4,190 per 40-foot container, according to the Shanghai Containerized Freight Index.

The lower rates will attract less transit time-sensitive cargo now moving over the West Coast, it said. “In interviews with fifteen key executives in the transpacific supply chain, twelve projected that rates will go lower and produce a significant shift of volumes from West Coast ports to East and Gulf Coast ports,” the study said. “The overwhelming view of those interviewed is that the system will exploit the new capacity provided by the widened Canal three to seven years after it is in operation.”

It added: “West Coast Ports will need to respond with aggressive and innovative measures to avoid losing significant market share once the widened Canal is fully operational.”

The study was published in May but released only this week, just as congestion has brought the Los Angeles-Long Beach ports to a standstill and as negotiations between the PMA and International Longshore and Warehouse Union have broken down, spreading congestion throughout the West Coast port range.

The study points to the inevitability that container lines will deploy much larger ships on the expanded Panama canal route and will accept lower revenue per container to keep those ships filled. Container ships of over 13,000 TEUs will be able to transit the new set of locks, up from a maximum of roughly 5,000 TEUs today.”

I find it SO off-putting to watch these talking heads on CNBC (BS) bang on and on about the slow-down in the Chinese economy! Huh? Whaddya talking about? They seem to be implying that it’s the Chinese people who have stopped buying their own goods when it’s the REST OF THE WORLD that’s stopped buying Chinese goods and hence, the slow down in the Chinese economy. Duhhh! Doesn’t take a fifth grader to figure that one out, but we must maintain the illusion at all costs that the US economy is just fine, mustn’t we. These shipping rates, however, put paid to the lie. Any fool can see that goods ARE NOT leaving China to the rest of the world in the quantities they were in past years. But nothing to see here folks. Move along. That’s right.

Despite the dramatic sounding headline, this looks like a pretty mild slow down to me – shipping growth down to 2.2% ? West Coast traffic projected to be down to 2% growth ? A few bankruptcies and an errant German bank on the brink ? Not very worrisome in my book – no sign of impending collapse, is there ?

If I look out from where the Fed sits and I read this article, I see nothing but vindication of ZIRP ….. so, you have some overcapacity in a historically cyclical sector, but why would I worry to the point of rethinking free money for all ?

Looking at this sector, it is working !

OP

You didn’t look at the BIMCO numbers right below it that were negative – so not slow growth but decline across the industry. I put up both sets of numbers to give you a more complete picture.

And those are volume numbers. In terms of dollars, it’s much worse – because freight rates have collapsed, as the article pointed out. So revenues of shippers are collapsing.

At the same time, capacity is surging. Overcapacity is the killer – not the slowdown. Hard to see how you could miss this in this article that’s about building overcapacity, collapsing shipping rates, sending companies into bankruptcy, and a failed bank that lent money to them.

Bankruptcy means that many investors get wiped out: capital destruction. Bad loans the same thing. Is that, as you said, a” vindication of ZIRP?”

And the overcapacity thing is chained – that is, construction boom leads to supply infrastructure boom, steel, cement, glass, aluminum etc, (and production of other stuff booms, tools, appliances, fasteners, etc) – which drives commodity boom, leads to boom in commodity infrastructure projects, (with long completion periods,) and each booming sector supports the shipping boom, and it’s capacity boom. Then credit slows down, hits a brick wall, and the chain (train) stops. And the train wrecks wipes out a lot of bystanders as well. There is no such thing as a soft landing.

Overcapacity in steel, cement, coal, oil, etc, and commercial real estate, … and shipping. And the giant sucking sound of debt deflation, all that debt servicing sucking the dough out of all cash flows. First the colossal sugar rush of credit creation and demand on a large scale, then the credit ceiling is hit (maximum serviceable private sector debt), the giant sucking sound as the credit creation slows down, and the servicing bites hard. A colossal train wreck.

The chinese state is playing a last man standing wins, by piling on greater and greater numbers of mallacmax capacity 18,000 + TUE ships.

They may win, as the chinese state appears to be the only state in the game, and can work whatever financial wizardry the CCP command’s.

chinese goods, and chinese imports, on chinese ships, seems to be the unannounced ccp policy.

No money is a problem world wide. Cheap money begets low cost finance, all well and good as far as it goes. Workers struggling with inadequate raises, or old guys like me who discover there is ‘more money’* in NOT working, than in working soon do what is in their best interests. Having ‘FU’ power to be deployed, unshackles the working dude. Who needs to care what happens next? Deflation is a GOOD thing now.

* ONLY works well if one has saved diligently, preferably in a tax free venue like a ROTH, along with a tax deferred 401 or 403 type plan. Company sponsored retirements are always welcome as well. No debts helps accentuate the possibilities. Your mileage may vary.

This is such a slow moving train wreck that I am getting bored and losing attention. Part of me wants it the entire thing to just go away. I really understand why the general public isn’t paying any attention to this. A person can only be fearful of something for so long and they either go insane or just ignore it. Especially if there is nothing you can actually do to affect the outcomes. For years I was obsessed with all the data and stories but now I am just wondering if the destruction of capital will ever actually take place. Or if and when it does, will it actually matter to most of us.

Thanks Wolf, I read most everything you write.. along with David Stockman.

Dude totally. I am feeling your sentiment big time lately.

It’s grinding on at a geological pace.

I keep tabs on the alt press to see if it is taking on any new forms, but I am starting to seriously wonder if this could go on for 5 years? 10 years? 20 years? Are we just going to bumble along in a visionless, zero-growth, malinvestment stupor for as long as Saudia Arabia and Iraq can keep the oil flowing? Which by all estimates is decades. I love me some peak oil, but god dang the plateau is long.

The American status quo has grown so moldy… 14 years of pointless wars in the ME… increasing inequality… erosion of civil liberties… environmental degredation… visionless can-kicking… all moving inexorably at a glacial pace, with the glacial mass of all the worlds elites behind it. There are no heroes, just a critical mass of incompetent antagonists.

I don’t blame people for tuning this out… it’s the worst plot line ever.

Agreed, its much like waiting for paint to dry.

The thing is…

If no QE ZIRP then the 2008 collapse would have been total — far worse than the Great Depression because of the global supply chain.

In fact when you break that chain here’s some research on what happens — see page 55 onwards….

http://www.feasta.org/2012/06/17/trade-off-financial-system-supply-chain-cross-contagion-a-study-in-global-systemic-collapse/

We are of course going to collapse — that was baked into the cake the moment oil extraction prices began to rise beyond what the economy could handle …

HIGH PRICED OIL DESTROYS GROWTH

According to the OECD Economics Department and the International Monetary Fund Research Department, a sustained $10 per barrel increase in oil prices from $25 to $35 would result in the OECD as a whole losing 0.4% of GDP in the first and second years of higher prices. http://www.iea.org/textbase/npsum/high_oil04sum.pdf

THE END OF CHEAP OIL

Global production of conventional oil will begin to decline sooner than most people think, probably within 10 years Feb 14, 1998 |By Colin J. Campbell and Jean H. Laherrre http://www.scientificamerican.com/article/the-end-of-cheap-oil/

CHEAP TO EXTRACT OIL IS GONE

The marginal cost of the 50 largest oil and gas producers globally increased to US$92/bbl in 2011, an increase of 11% y-o-y and in-line with historical average CAGR growth. http://ftalphaville.ft.com/2012/05/02/983171/marginal-oil-production-costs-are-heading-towards-100barrel/

Steven Kopits from Douglas-Westwood said the productivity of new capital spending has fallen by a factor of five since 2000. “The vast majority of public oil and gas companies require oil prices of over $100 to achieve positive free cash flow under current capex and dividend programmes. Nearly half of the industry needs more than $120,” he said http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/11024845/Oil-and-gas-company-debt-soars-to-danger-levels-to-cover-shortfall-in-cash.html

Sanford C. Bernstein, the Wall Street research company, calls the rapid increase in production costs “the dark side of the golden age of shale”. In a recent analysis, it estimates that non-Opec marginal cost of production rose last year to $104.5 a barrel, up more than 13 per cent from $92.3 a barrel in 2011. http://www.ft.com/intl/cms/s/0/ec3bb622-c794-11e2-9c52-00144feab7de.html#axzz3T4sTXDB5

QE ZIRP and all the seemingly crazy policies have been attempts to offset the impact of expensive to extract oil…

Basically what they did was buy us another 7 years of BAU…

And now we are getting to the pushing on a string phase…. these stimulus policies are no longer having much impact

We are headed for a deflationary death spiral.

More on this here http://ourfiniteworld.com/2015/08/26/deflationary-collapse-ahead/

The CCFI has been updated. The index has fallen another 3.9% to an all-time low of 782.73. Also, the Shanghai Containerized Freight Index has fallen another 6.7% to 533.91. Collapse is the word to describe this.