September marks third year in a row of sales wobbling along crushed levels.

By Wolf Richter for WOLF STREET.

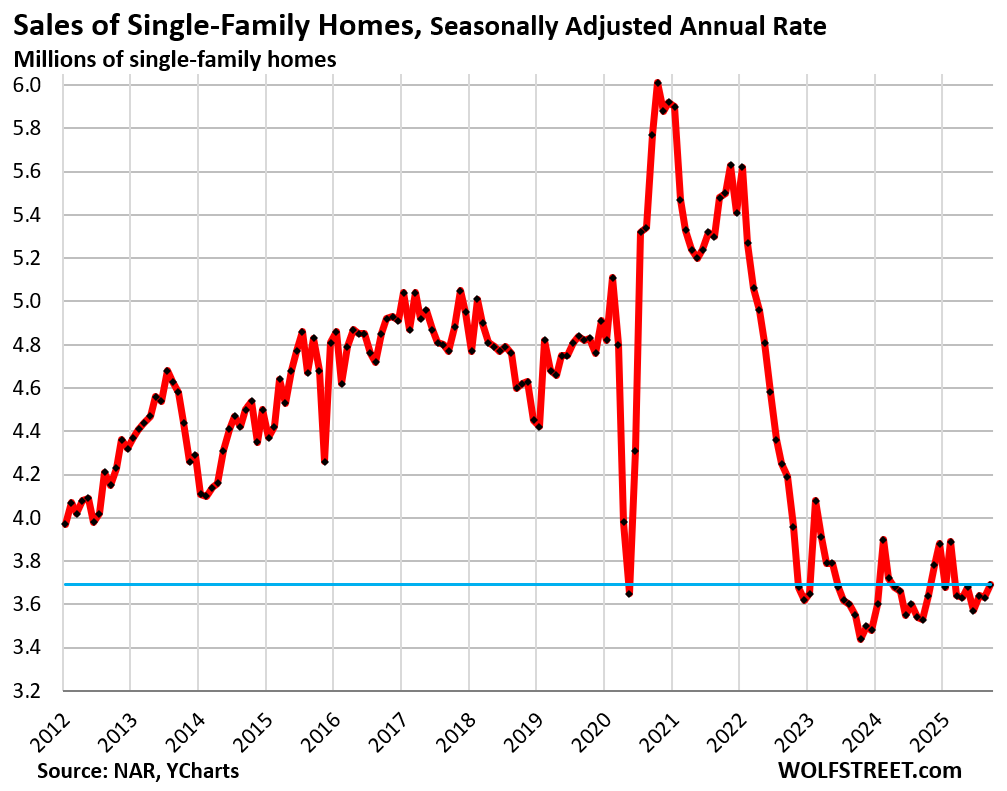

Sales of single-family homes that closed in September rose seasonally adjusted by 1.7% from August to an annual rate of 3.69 million homes, according to the National Association of Realtors today.

Compared to the totally crushed September 2024, sales were up by 4.5%. But sales were still down by 23% from September 2019 and by 2% from September 2009, during the depth of the Housing Bust.

September marks the third year in a row that sales of existing single-family homes have wobbled along totally crushed levels (historical data from YCharts):

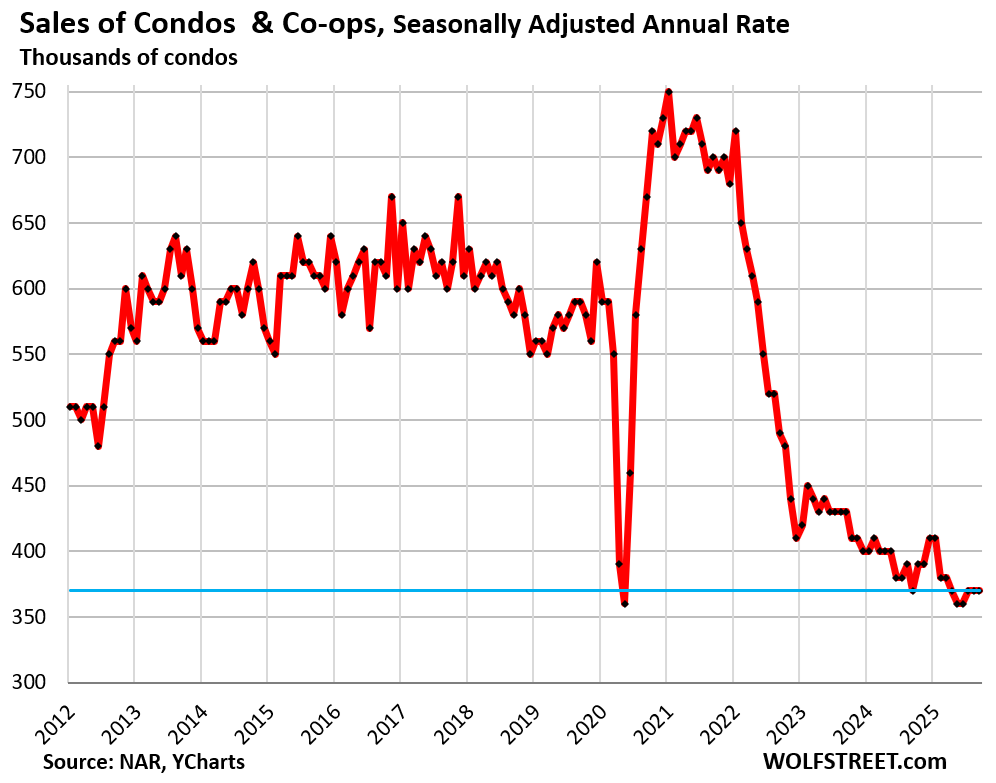

Sales of condos and co-ops that closed in September were unchanged from the prior month for the third month in a row, at a seasonally adjusted annual rate of 370,000 condos, barely up from the record lows in NAR’s condo data going back to 2011.

Compared to the crushed levels of September 2024, sales were flat.

Compared to September 2019, sales were down by 37% (historical data from YCharts):

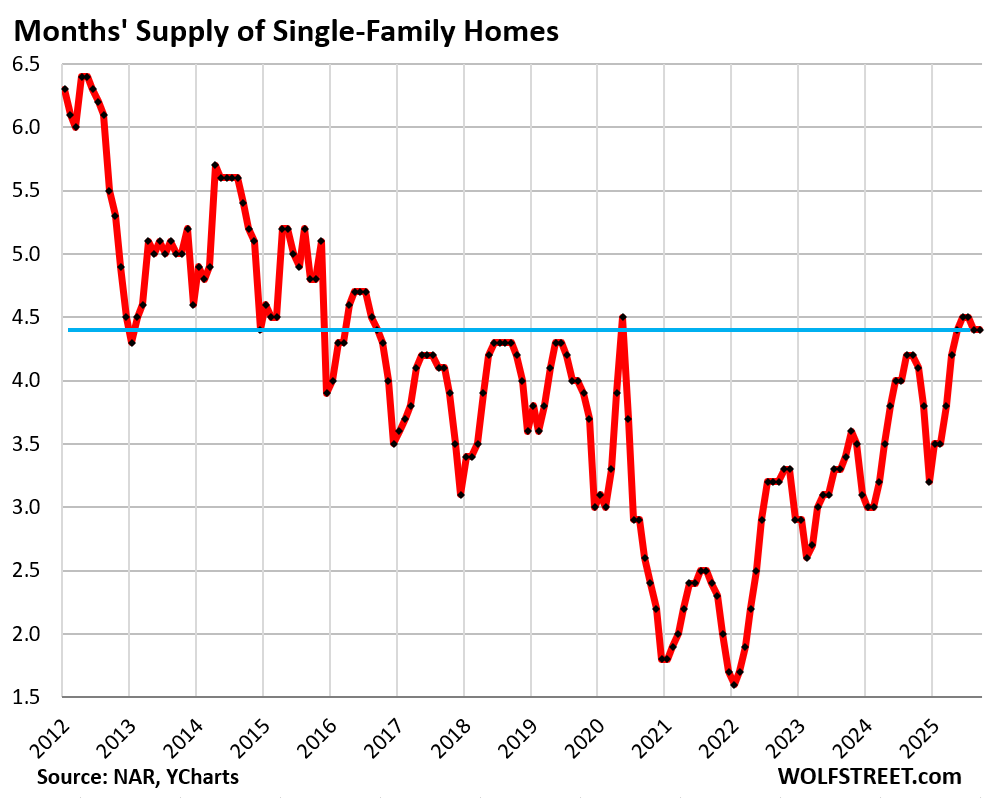

Lots of supply.

Supply of single-family homes remained unchanged at 4.6 months. Over the past five months, supply has been the highest since Lockdown May 2020, when closed sales had collapsed, and before then the highest since August 2016.

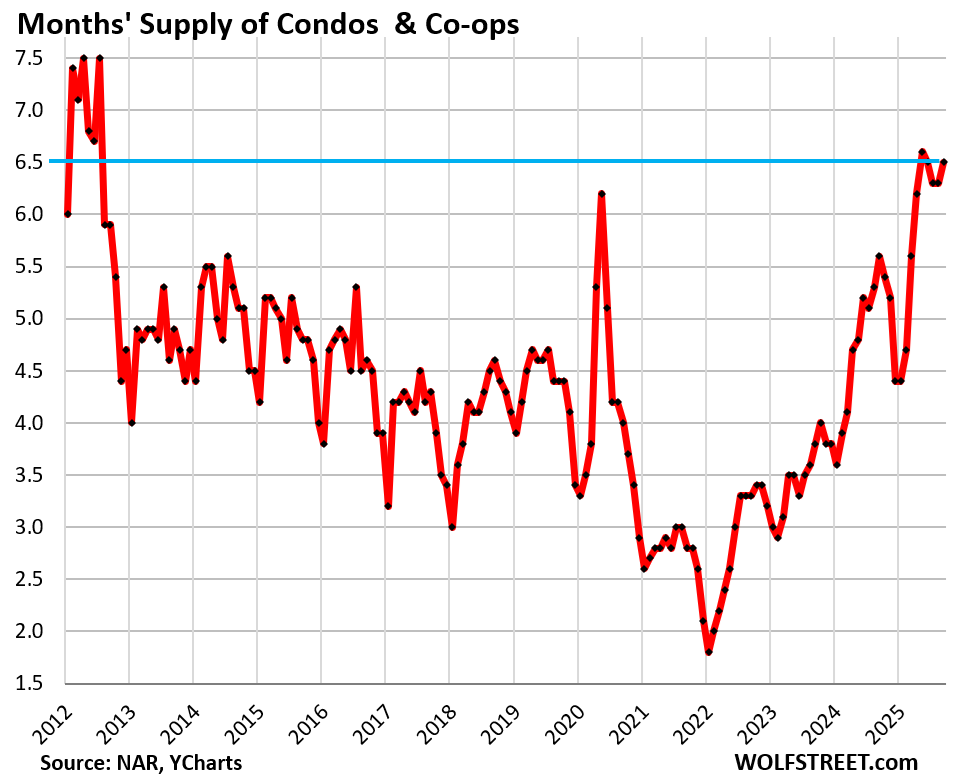

Supply of condos jumped to 6.5 months in September. Over the past four months, supply has been the highest since the Housing Bust.

Supply was about 48% higher than in September 2019:

Condo price drops YoY, single-family home price still up YoY.

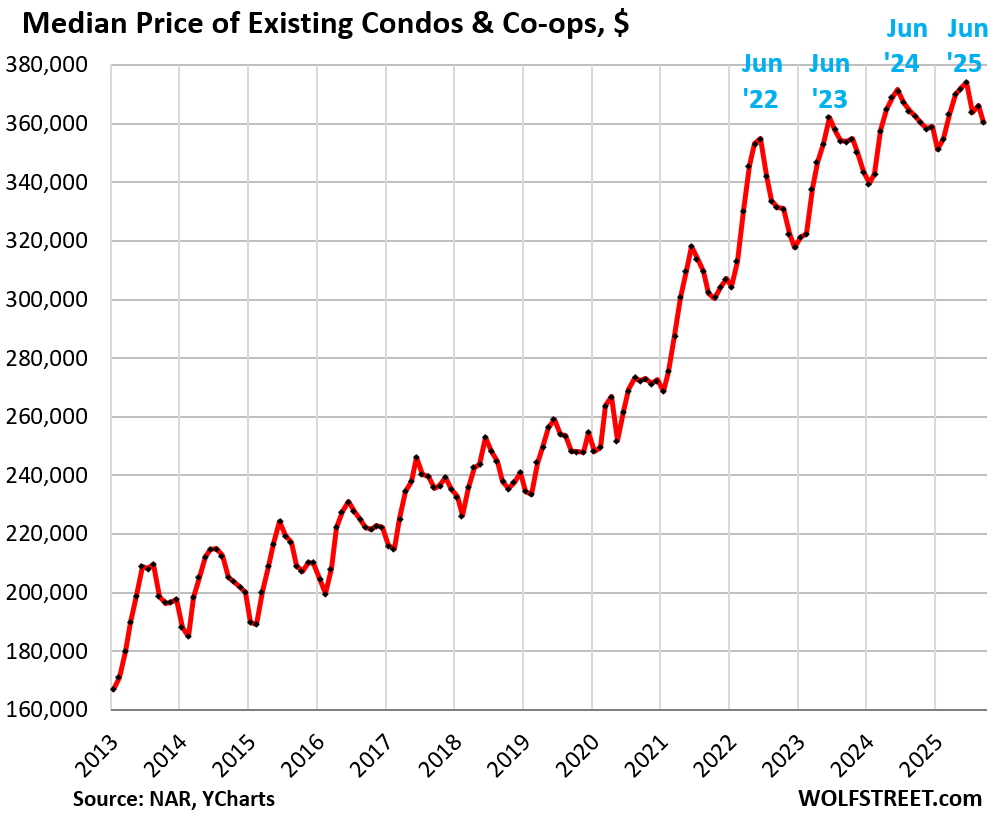

The national median price of condos and co-ops dropped 1.6% in September from August, far larger than the typical seasonal drop, to $360,300.

Year-over-year, the price was down by 0.6%

This measure of condo prices had exploded by 43% from mid-2020 through mid-2025, most of it during the two years of mid-2020 to mid-2022.

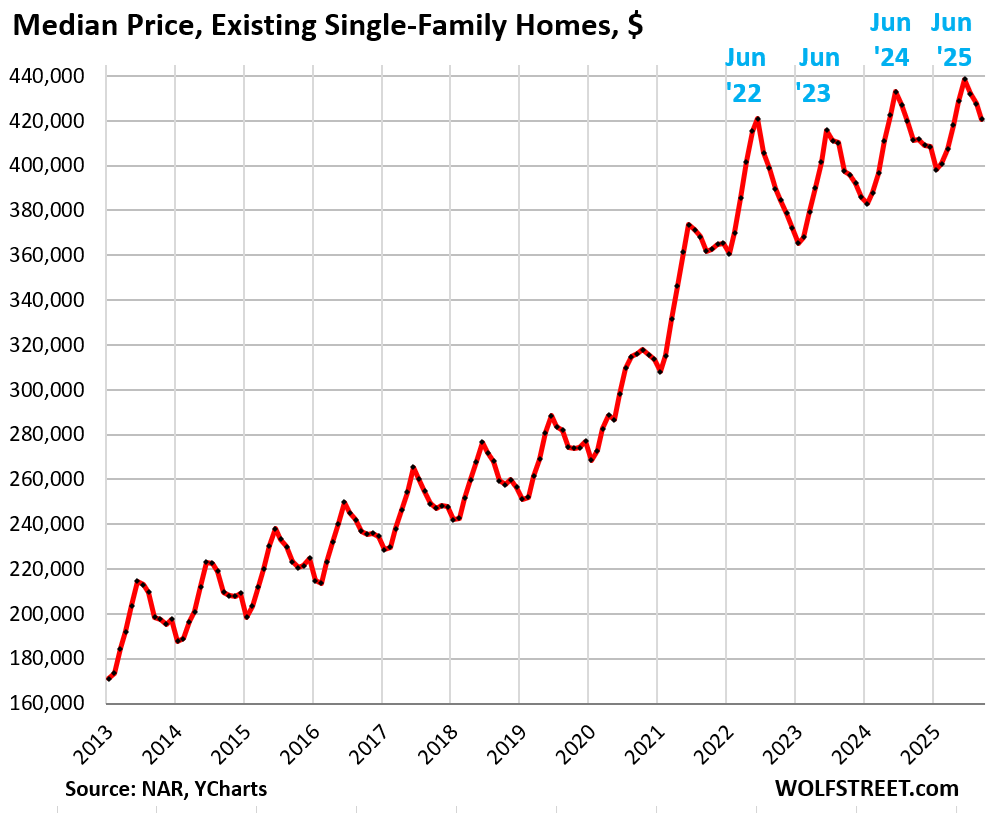

The national median price of single-family homes fell along seasonal pattern in September to $420,700. Year-over-year, the median price was up by 2.3%.

This measure of the median price of single-family homes had exploded by 47% from June 2020 through June 2025, most of it during the two years of mid-2020 to mid-2022.

June normally marks the seasonal high each year. The index is not seasonally adjusted. The seasonal zigzag is a result of shifts in the mix of what sells, which shifts the median price up or down.

Price action in individual markets differs hugely from the national median.

Price movements and direction differ massively market by market, with prices dropping in some markets and rising in others. A national price index throws all these individual markets into one bucket and calculates the national figure.

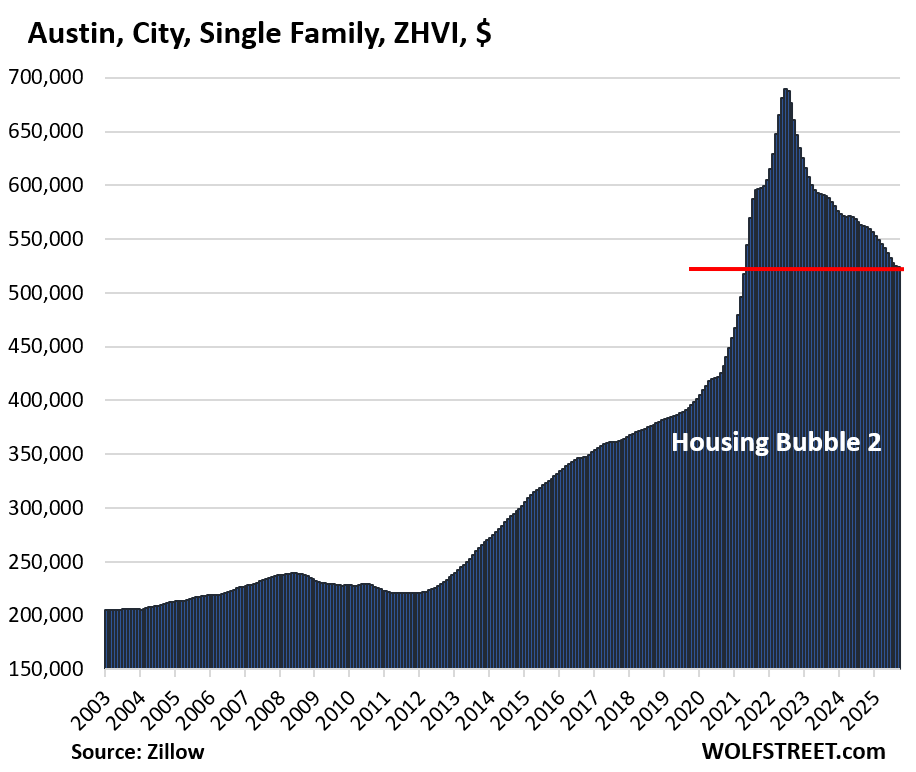

Prices have been spiraling down in many markets since 2022. Here are the 15 bigger cities where prices of single-family homes have dropped by 10% to 24% from their peaks. They include Oakland (-24%), Austin (-24%), Cape Coral (-20%), New Orleans (-19%), San Francisco (-16%), etc.. Here is Austin, for example:

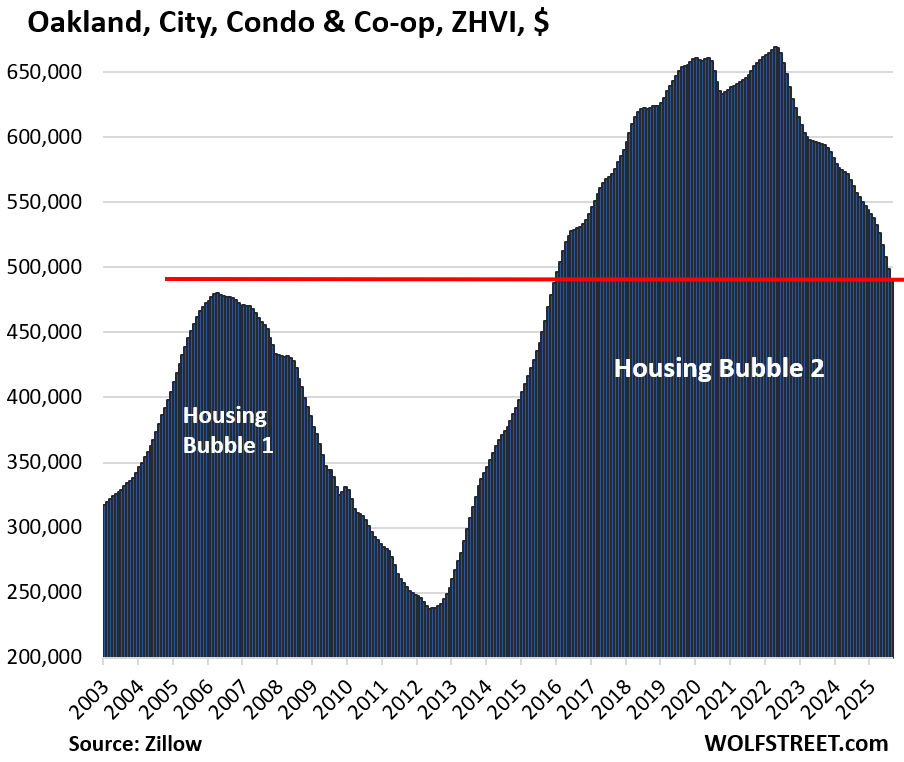

And here are the 23 bigger cities where condo prices have dropped by 12% to 28% from their peaks. They include Oakland (-28%), Cape Coral (-28%), Austin (-25%), St. Petersburg (-25%), San Francisco (-16%); Jacksonville (-16%), Tampa (-16%), Denver (-15%), etc.

For example, here is Oakland where prices dropped to the lowest level since December 2015 and are nearly back to the peak of Housing Bubble 1:

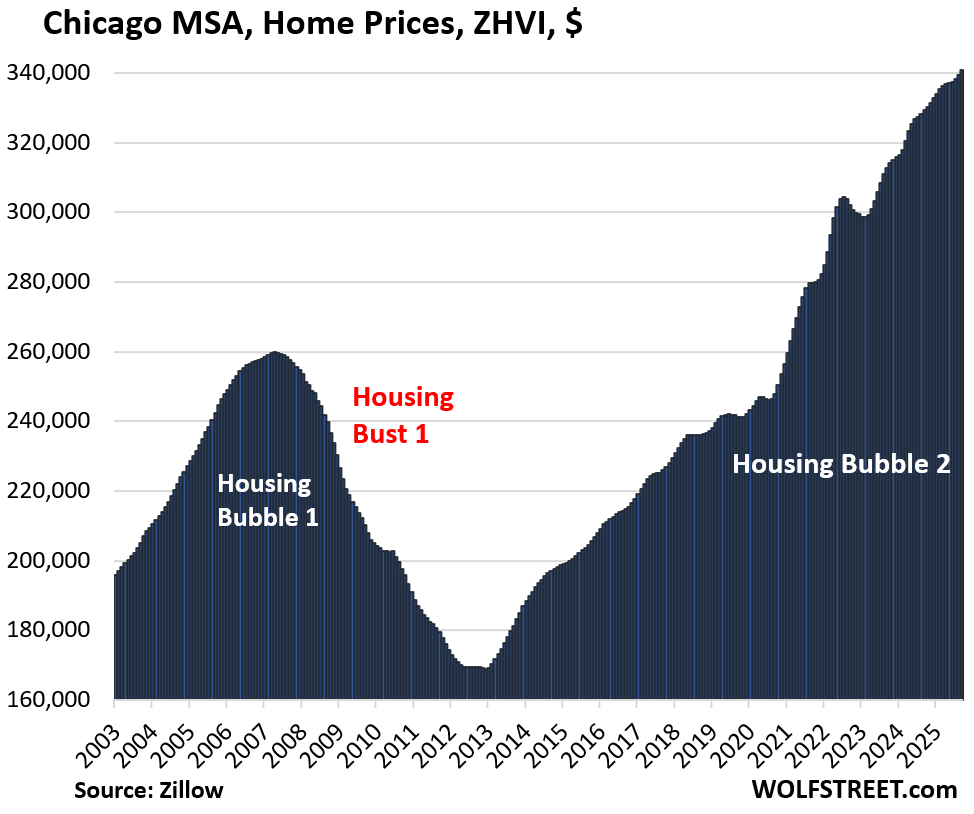

But in other markets, prices have only flattened out. And in some big markets, such as New York, Philadelphia, and Chicago, prices are still rising.

The huge Chicago-Naperville-Elgin, IL-IN metro, where prices of single-family homes and condos increased by 3.5% year-over-year to a new record – the largest YoY increase of the 33 biggest and expensive metros we track here – forms the opposite end of the spectrum from the Austin metro (-23% from peak) and the San Francisco metro (-11% from peak). Every market dances to its own drummer:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Tax all the 3% mortgages. It was a generational handout that never should have happened. That’ll unfreeze the market quick.

How can a debt ever be taxed? What are you smoking?

Special assesment. The 3% mortgage was a stimulus tool to get people through the pandemic, which is obviously over. Its now lingering on to distort the housing market to an epic degree.

It’s not that hard buddy. Go back to the beach

CM

What do you want next ? A special new assessment tax on properties that are owned free and clear ?

Explain how mortgage free properties are different in market consequences from the much maligned 3% mortgage on properties.

We already get taxed on the insane price appreciation that resulted from those 3% mortgages in the form of ever-increasing property taxes.

No free lunches.

Chunky Monkey –

i think the go- bar-mint should put a tax on every breath you take – say a penny per breath. It would be a ‘clean air tax’ or ‘carbon footprint tax’.

Get real, buddy.

Why should they tax low mortgage rates? Maybe they should tax low IQ scores. 😜 😉

Sour grapes much?

I don’t have a 3% mortgage, but the wholesale breaking of contractual relations is a step too far for me. The 3% mortgage wasn’t a tool to get people through the pandemic, it was a government policy choice to keep the housing market soaring through the pandemic. I think it was a bad policy, but anyone taking out a mortgage under those conditions shouldn’t be penalized for taking advantage of existing market conditions. Espousing a new distortion, “special assessment,” to rectify a previous distortion is nonsensical. The government should step back and stop distorting the market altogether.

This all shows why democracies fail. People who get free stuff from the government fight like hell to keep it.

TSonder305,

How is taking out a loan getting free stuff? I’d argue democracies fail when the rules are changed arbitrarily and people conclude the system is rigged.

Yes, the 3% mortgages was a stimulus tool specifically designed to get people through a financially uncertain time in the pandemic. It has now distorted the market to such a degree that an entire generation is priced out of homeownership.

The income needed to qualify for the median priced home is $120k whereas median household income is like $80k. The gap has never been wider in American history. Trying to defend the 3% mortgages is self serving. The government effectively anointed winners and losers in the housing market, which is a drastic departure from the free market system that America is supposed to be

Dude either this guy or someone else here came up with the same idea and it is just dumb as hell.

This isn’t even weed like commenting. This is meth.

On primary residences, I wouldn’t support that. But I absolutely would on rental properties.

Guess who would pay that extra feel good tax?

The renter.

Or, the owners would sell them to people who want to own and live in a house.

Pretty obvious that Monkey boy is not one of the folks with a 3% mortgage. Different tune if he were.

And why is it that the people that actually own a home, or even more than one, are always the evil bad people, and anything that ever happens that is seen as bad in the housing sector is their fault? I never did understand that

lol landlords always thing they can pass their expenses onto the renters – guess what , you can’t! Rents are declining

Try and think through the negative consequences of what you’re asserting here. Basically no one should ever trust contractual relations ever again. You favor a particular carve out, for primary residences, which magnifies the distortion. You are proclaiming to know who the winners and losers should be. What about a renter who owns a home they currently rent out due to having to move for a job?

Once you “modify” these mortgages, what’s to stop the government from declaring that mortgages above a certain size, even if a primary residence, will be subject to a special assessment? Then we’ll just change interest rates arbitrarily, which is essentially what a “special assessment” is. The path forward is to never suppress interest rates like this again, not to try and rectify one policy distortion with another distortion.

At a high level, I like the idea that an increased number of families could afford to own a primary residence (if they desire).

While there are a number of factors that contribute to the current housing situation, I think that changes to the current approach to taxation could be part of the solution…

In my opinion, it isn’t financially painful enough to carry a vacant property in some areas while property taxes also contribute to the barrier of home ownership for many.

It has been a while since I lived in Texas, but they used the “homestead exemption” to allow for lower property taxes on one’s primary residence. (I may be misremembering, but the qualification for the exemption was owner occupied as a primary residence; limit one per assessment year)

I’m curious if the idea of reducing taxes on one’s primary residence to a greater degree than present (thereby making a primary residency comparatively more affordable) while also increasing property taxes on non-primary residences (vacation homes, long term rentals, short term rentals, etc…) would be a net positive?

Yes, some of that would obviously, immediately get passed on to renters (but maybe changing their rent/own calculus). And maybe it would impact municipalities by making their tax revenues less predictable…

But, it would also make low vacancy short term rentals a difficult business decision… and it would make it expensive to let a house sit on the market forever above market price… and it would obviously pinch those with a vacation home… In general, it would make owning any vacant property more financially painful.

There are times where I think the benefit of making ownership of a primary residence comparatively more affordable would be worth those costs.

Wolf – I’m curious if you have thoughts on whether or not a ramped-up version of the homestead tax exemption (drastically lower taxes on a primary residence vs. non-primary residences) would be good for society?

Lastly… Wolf, this is my first comment ever… I’ve been lurking for some time and I sincerely appreciate your work.

“Wolf, this is my first comment ever”

Welcome aboard.

“Wolf – I’m curious if you have thoughts on whether or not a ramped-up version of the homestead tax exemption (drastically lower taxes on a primary residence vs. non-primary residences) would be good for society?”

I’ve never thought about it and have no thoughts on it.

You don’t get 3% loans on 2nd homes or rental properties.

Taxes + insurance + maintenance + HOAs + upkeep + utilities + security + etc.

Make holding a house, you don’t live in or rent, very expensive despite a 3% mortgage.

The only time it does make sense is 15% appreciation, year aftet year.

Which isn’t happening anymore.

@2banana Taxes + insurance + maintenance + HOAs + upkeep + utilities + security + etc. are “already” very expensive and few people (even those without ANY mortgage) let real estate they don’t use or rent sit empty for very long.

Interest rates on non owner occupied loans are always considerably higher.

@Chunkymunky Should we also tax the guys that bought new Hondas and Chevys with 0% financing?

Great idea, AI. We should also tax the guys who got below-market rates on energy improvement loans for things like solar panels. /s

So you want to tax people who are paying their mortgages according to their mortgage contracts with the goal of forcing them out of their homes?

Let us know when you get to $38,000,000,000,000.

Ridiculous.

How about we retroactively tax all PPP money? At a 100% rate.

In the last 3 years, between June 2022 and June 2025, single family home prices were up 20K, or 1.6% per year. That’s below inflation, insurance,

taxes, repairs and mortgage rates. Basically, single family home prices

deflated in real terms.

Not everyone crunches numbers. Be careful, there’s always someone that wants a house priced 5 years ago that’ll cry foul.

Not in SoCal particularly not in 🍊 county CA 😂 also with the same 10% annual increase, the difference between $350k vs $2,000k is huge 😮 consumer psychology @ full display with regards to housing market. 🧐 right now the “battle” is between sellers who live in summer 2022 vs buyers who look @ comparison between 2007 & 2025. & interestingly an unseen “strategic” alliance between those who bought the properties @ higher rate while waiting on rate drop & those who are waiting on rate drop to buy. 😂 Housing markets itself is a stage for comedies, documentaries & thrillers 🤓

Depends on the area. My area is up way wsy over that. Location location location.

“Compared to the totally crushed September 2024, sales were up by 4.5%.”

As predicted I am already seeing tons of MSM headlines proclaiming lower rates to the rescue and we are back up baby! The desperation in mainstream to try to get any FOMO demand restart is quite something else .. At least it’s very predictable 🤣

“and we are back up baby!”

No, we’re still down by 23% from Sep 2019 and below Sep 2009 during the housing bust, baby!

And we’re below where we’d been earlier this year when rates were quite a bit higher, baby!

Look at the chart, baby!

Wolf, do you have a chart handy that shows months of supply going back over the decades?

I know the world has changed over the years, and it’s faster to sell a home now than it was, but it would just be interesting to see this going back 20, 30, or more years. Thanks!

All you have to know that it used to take weeks from listing a property to putting the printed ad in front of someone. Now it’s instant. everyone can look at hundreds of properties every day, video tours, details, etc. Mortgage approvals happen much faster. Processes have become digitized instead of mailing documents back and forth. And on and on. That’s why long-term supply comparisons are bonkers.

Haha I know Wolf, when I say we are back up baby! I am channeling mainstream or house humpers BS talking points which they have no problem propagate everywhere.

I’ve always considered the 30 year fixed rate mortgage as an advantage in the United States. However, now I am wondering if a 25-30 year mortgage that renews the rate every 5 years or so, akin to Canada, is actually a better system. Perhaps it would be more fair so that a certain percentage of the population doesn’t get to lock in at once-in-a-generation interest rates. Looking at Canada, it certainly doesn’t appear to prevent a housing bubble though.

It’s a gift to those trying to sell homes. Not so much for those trying to buy them.

Tangental view:

Mortgage holders are subject to prepayment risk… essentially like a callable bond.

The 30yr mtg should have a higher yield (/rate) compared with other “non-callable” fixed-rate 30yr debt i.e. Treasuries.

Better is when prices are set by the market you know good old fashioned supply and demand. Just get the government out of the mortgage business.

QE MBS again: There is a new QE proposal to purchase MBS; specifically for Fannie Mae and Freddie Mac to buy $300 billion dollars of the stuff. Idea is tied to some ratio of 10 year and 30 year treasury bonds, to alleviate weak investor demand for the stuff. Since both are quasi private/public corporations, looks like a backdoor money printing racket to pump up housing prices some more.

QE my ass.

NO ONE OTHER THAN THE FED CAN CREATE MONEY AND DO QE.

Fannie and Freddie have to borrow money to buy back anything. They cannot create money. They’d just swap one debt for another.

All MBS are callable, and Fannie and Freddie call them all the time when the principal balance of the mortgage pool runs down due to pass-through principal payments. Which means they BUY THESE MBS BACK. Then those remaining mortgages get packaged into new MBS and sold again. That happens ALL THE TIME. That’s how MBS work.

So why have Chicago-area home prices risen, faster than elsewhere? The place was already relatively expensive, real estate taxes are highest in the US, the economy is stagnant, the ruling politicians are perhaps entertaining but not competent.

The only reason I can think of it’s that it’s costly and difficult to build new housing there, so maybe that causes prices of existing homes to rise. But surely that’s not unique to Chicago.

prices risen, faster than elsewhere — I can make stuff up too

real estate taxes are highest in the US — not true and not that unique

the economy is stagnant — not stagnant compared to many places

the ruling politicians are perhaps entertaining but not competent — not unique

it’s costly and difficult to build new housing there — you’re just flat-out wrong

stay clueless taxpayer, that’s how the government likes you

…oh, and yes Illinois is messed up in a lot of ways but drama queen exaggerations are in a different category than merited harping.

Chicago has low inventory, and while expensive – it’s much more affordable for the local wages. Heck in spring of 2023 – you only had to spend 34% of your HH gross income on mortgage payment. Compare that to a place like Tampa – what was 50% of your gross income. Sun belt is way over valued and will crash while Chicago will stay flat or rise

Those Median Price vs Sales charts have some reconciling to do. Like the man(El Lobo) says, we’re past the days of continual price increases. Prices must drop to entice current and future buyers. With overnight rental buying stagnating, I see an equilibrium beginning to emerge where real estate establishes a foundation. We are definitely not there yet. Drops of double digit percentages, depending on location, are still in the cards. Too much money in too few hands. Gotta give something back to the next generation of homebuyers.

We have two different housing markets. Bosses want people back in the office. Because of that, NYC, LA, Chicago, Boston … the housing demand is decent and the housing prices in the desirable suburbs of those cities are grinding higher. SFR rentals are fetching top dollar.

The only one that surprises me is SF … SF should be doing as well as the other cities I mentioned above. That one confuses me. Google just told my daughter that she needs to be in the office, so she is moving to Mountain View in a few weeks.

But, in all those pandemic locations, it seems as if the bottom is going to fall out. Those “remote work” zip codes are going to get hammered. There are so many. I would be frightened if I owned a home in one of those places. They are so screwed.

At my age, I turn away more jobs than I agree to do.

Your comment makes sense, so I checked my books to see how

many jobs we did accept this year. We are up about 20%.

In 33 years, it has been the highest % of jobs for new construction, v.s. existing. I see the price declines on existing home sales.

But the land rush is still crazy. It doesn’t help that we are near deep blue

cities that have created zoning nightmares for your average buyer, or mom & pop developer.

The remote workers who were going to be one with nature

quickly realized why their parents & grand parents moved to the city.

“September [2025] marks the third year in a row that sales of existing single-family homes have wobbled along totally crushed levels…”

U.S. housing is the most unaffordable ever. Does anyone really expect that sales are going to magically, or unexpectedly jump higher from here?

If mortgage rates drop by 100 bps (1%), that’s still not enough to stimulate sales. Price is inversely proportional to rates. Prices would then go up, or remain the same. Artificially low (6% due mostly to $38T (with a T) national debt. Existing home sales (EHS) are still in the gutter, since EHS sellers are refusing to drop prices (for now).

I don’t see rates going below 6% unless there’s a deep recession. Then there will be high unemployment and even fewer buyers. Rates won’t fix this. Only lower prices. Prices are sticky to the downside right now. Just like in Housing Bubble 1.0 (HB 1.0), but price is set at the margin. Death, divorce, dislocation (job change or layoffs), and other factors force some sellers to sell (at lower prices). This will drive the market (lower) going forward.

Summary: Rates aren’t going down much from here without a deep recession. Wages aren’t going up enough from here to improve affordability. The only thing left is for prices to come down. I estimate by 40%, based only on 30 yr. fixed rate mortgage rate change from pandemic to now. That doesn’t include the massive increase in carrying costs due to high inflation since 2020.

Like in HB 1.0, this will take several years for mean reversion. RRE is illiquid. Then add demographics: a) 15M boomers will leave us in the next 10 years, b) U.S. birthrate is in the gutter, c) illegal immigration has reversed. Where’s the demand going to come from? Boomers will be selling and downsizing. First time buyers are on strike, and rightfully so, either by choice or necessity. Need lower prices. The Fed did this.

Asset bubbles always burst. It’s not different this time. Lower housing prices are good. Prices are too darn high.

Correction (Oops!): “Artificially low” (6%…

People buy the payment. A mortgage payment has two major components, principal and interest.

If you decrease interest rates the same payment covers more principal. The principal is the price.

Instead of exercising discipline, people buy a higher priced house for the same monthly payment.

Then everyone wonders why prices went up.

You can’t fix stupid.

Long time no see, Doc. Welcome back!

Comment of the day.