Utility-scale battery capacity tripled in two years. California and Texas are the giants.

By Wolf Richter for WOLF STREET.

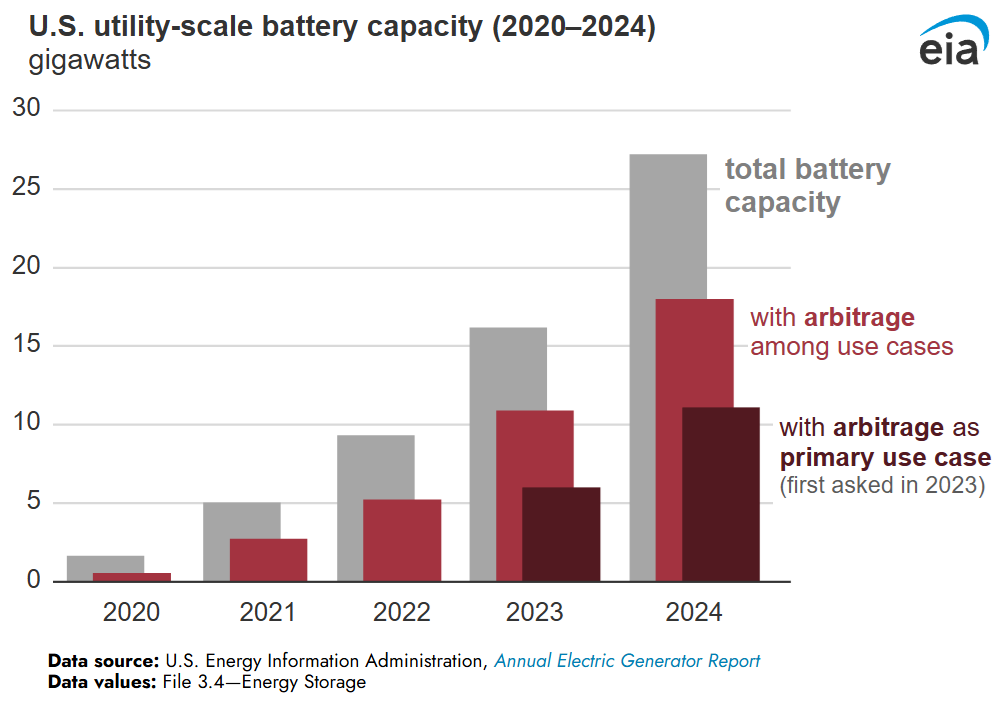

Utility-scale battery systems have been booming, especially in Texas and California, the two states with by far the largest installed capacity. In the US overall, installed battery capacity shot up from less than 1 gigawatt (GW) in 2020 to 27 GW in 2024.

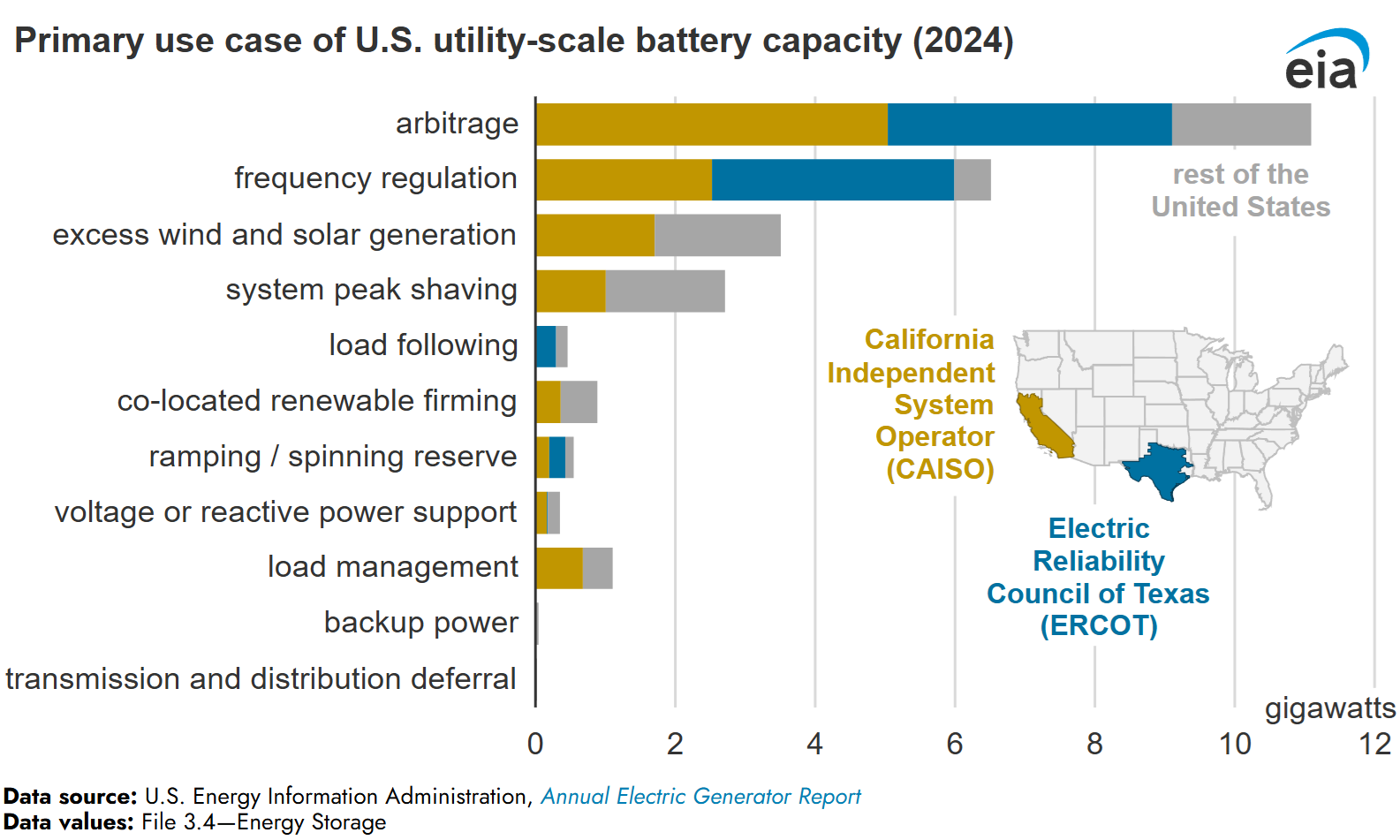

These batteries serve a variety of uses, but the top use by battery operators is price arbitrage: Buy electricity when demand and prices are low, such as at night, and sell electricity when prices are highest such as during peak demand times in the day, and profit from the spread. Wolf Street has long discussed the boom in battery installations, and their use for price arbitrage. Here are some numbers from the EIA about the use of price arbitrage.

Of the 27 GW of installed utility-scale battery capacity in the US (gray columns), 66% had price arbitrage among its uses (red columns), and 41% of the capacity was primarily used for price arbitrage (brown columns, chart via the EIA).

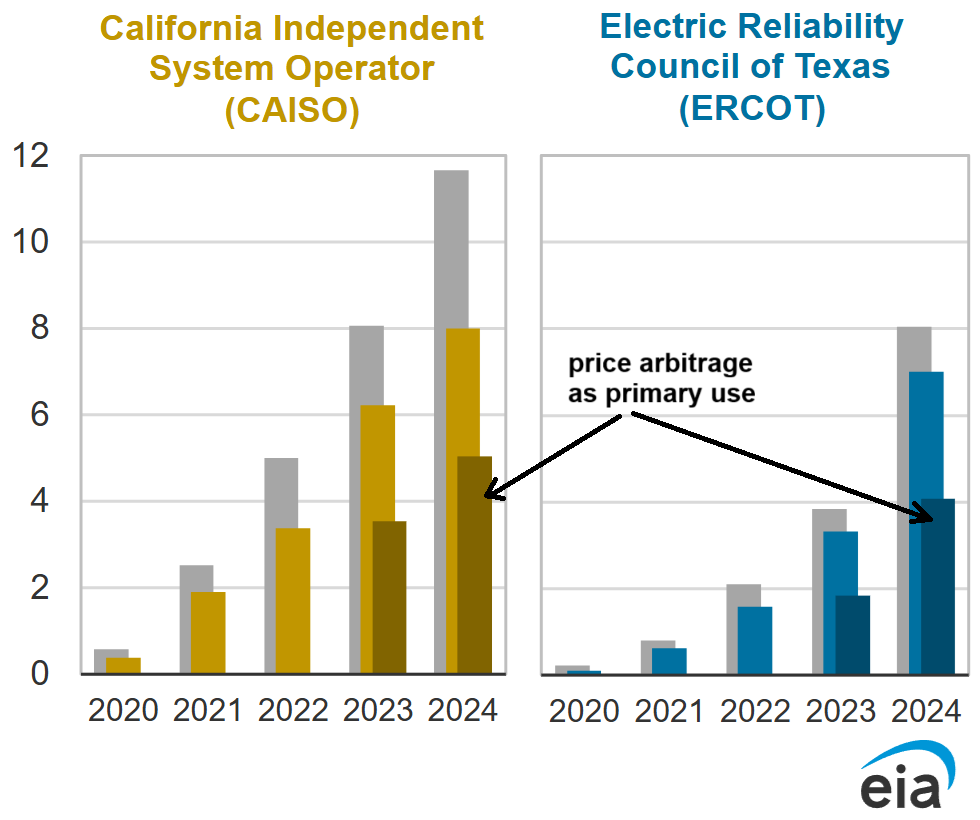

The California Independent System Operator (CAISO) reported 11.7 gigawatts (GW) of installed utility-scale battery capacity in 2024, more than double the capacity in 2022, and up from near zero in 2020.

In 2024, 43% of total installed utility-scale capacity was primarily used for price arbitrage (left chart below, dark brown columns, chart via the EIA).

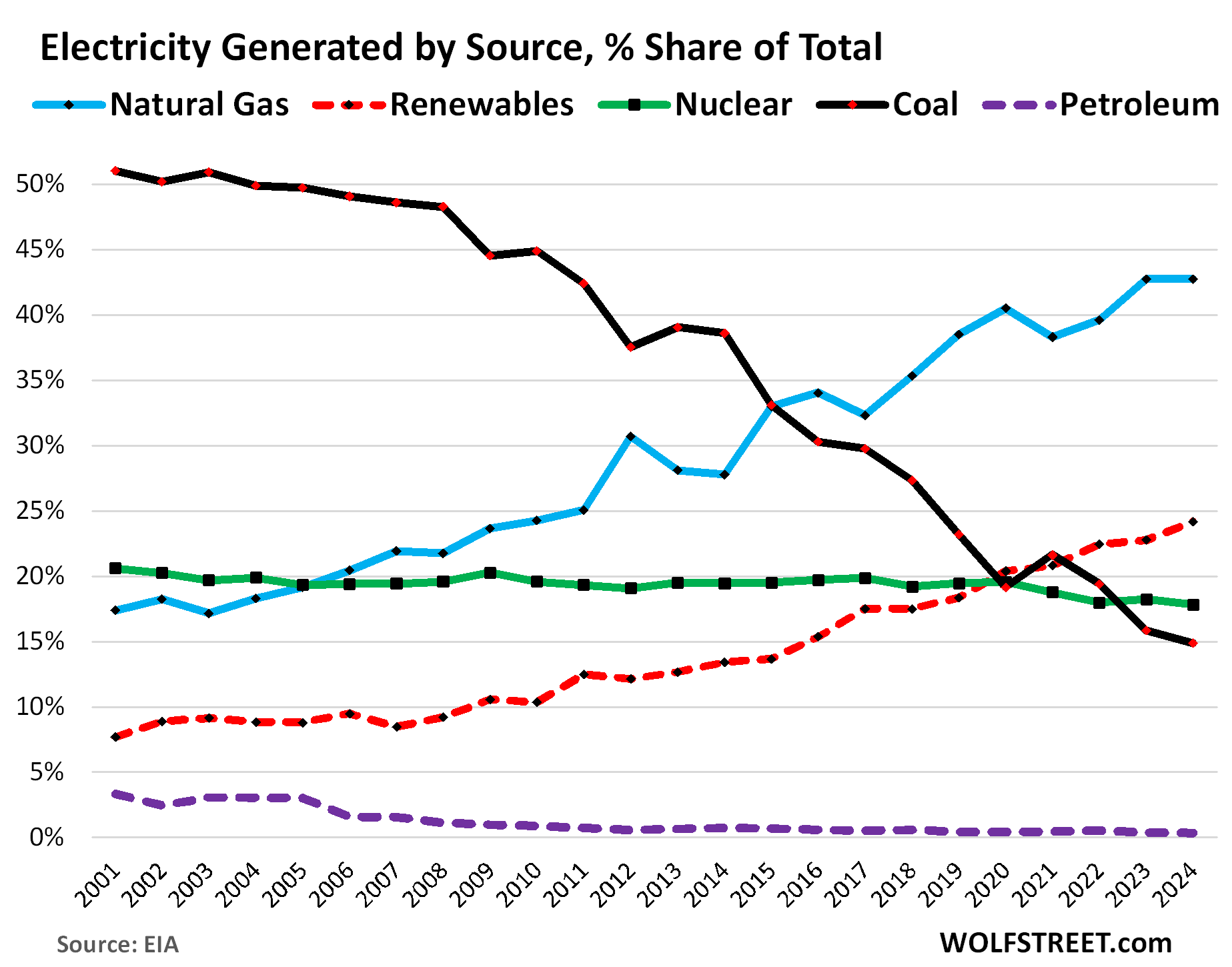

Of the US states, California is #1 in solar power generation and #6 in wind power generation.

The Electric Reliability Council of Texas (ERCOT) reported 8.1 GW of installed utility-scale battery capacity in 2024, up from near zero in 2020.

In 2024, 50% of the capacity was primarily used for arbitrage (right chart, dark blue columns).

Texas is #1 in wind power generation and #2 in solar power generation.

California and Texas combined accounted for 73% of total US utility-scale battery capacity in 2024.

Far behind price arbitrage, the other big uses of battery capacity were in that order: frequency regulation, excess wind and solar generation, system peak shaving, load management, co-located renewable firming (pairing wind and solar with battery systems at the same site), and others.

The EIA obtained this data from its annual survey of power plant activity, where it asked battery operators to identify the primary use case for their battery systems.

And in case you missed it: Demand for Electricity Takes Off. US Power Generation by Source in 2024: Natural Gas, Coal, Nuclear, Wind, Hydro, Solar, Geothermal, Biomass, Petroleum

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Buy electricity when demand and prices are low, such as at night, and sell electricity when prices are highest such as during peak demand times in the day, and profit from the spread.”

Cali utilities effectively do this via net metering (with NEM2, and even more so with NEM 3). They’re soaking up all that excess solar production at the wholesale rate from rooftops, and then selling it back at retail. The spread is crazy wide — we were paid less than 2 cents/kwh for our annual net overproduction. Time for an EV, to soak it up myself! Or, to run the heater a few degrees warming all winter.

I find the electricity mkt fascinating – especially with data center mania. It’s nice perspective to see the Primary Case chart, and get a feel for the mix of activities that are parts of electricity prices — and how the options can contribute to profit, as well as rate setting.

I knew batteries were part of backup storage, just as is natural gas and even coal, but to see the batteries as a frontline mechanism for spinning cash flow, adds to my thoughts about data center buildout.

I can’t help think that the Worldcom overcapacity story, for fiber, is playing out exactly the same way with processing capacity going forward. As I recall from a recent story, there’s still a lot of dark fiber — still unused from the Dotcom buildout — and those shareholders are still waiting for their investments to return something other than empty hype.

I can see the beauty of arbitrage and think the batteries are a game changer — but I hope our electricity providers don’t get caught up in mania, that ends up in financial disaster.