Turns out, younger people live their lives, and have always done so.

By Wolf Richter for WOLF STREET.

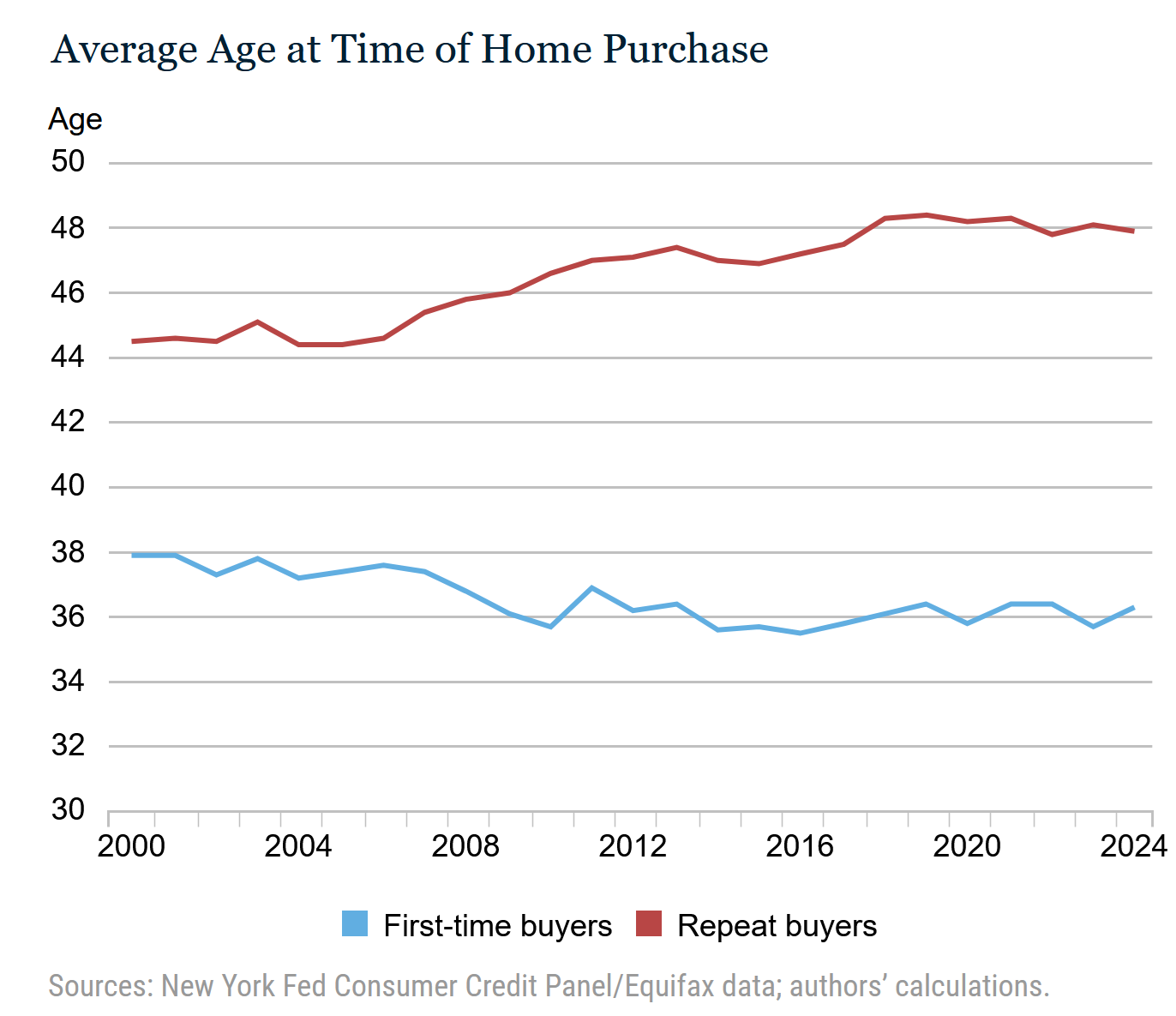

The average age of first-time home buyers has essentially not changed since 2012, and compared to the early 2000s, it has declined marginally. In 2024, the average age of first-time buyers rose to 36.3 years, from 35.7 years in 2023, but was below 2021 and 2022.

For the past 13 years, the average age has been in the range between 35.5 years (2016 low) and 36.4 years (2022 and 2021 high), and this range was lower than in the early 2000s, when the average age of first-time buyers (FTBs) was at 37.9 years (blue in the chart).

“And so, despite the financial challenges in transitioning from renting to owning, over the past decade households have managed the transition at essentially the same average age,” the NY Fed’s analysis said, based on NY Fed Consumer Credit Panel/Equifax data (chart by the New York Fed):

But the average age of repeat buyers – those buyers who buy a home for the second-plus time – has increased by 3.5 years over the two-decade time span, to 47.9 years in 2024, from 44.4 years in 2003 and 2004, despite the 0.5-year decline from the high in 2019 of 48.4 years (brown in the chart above).

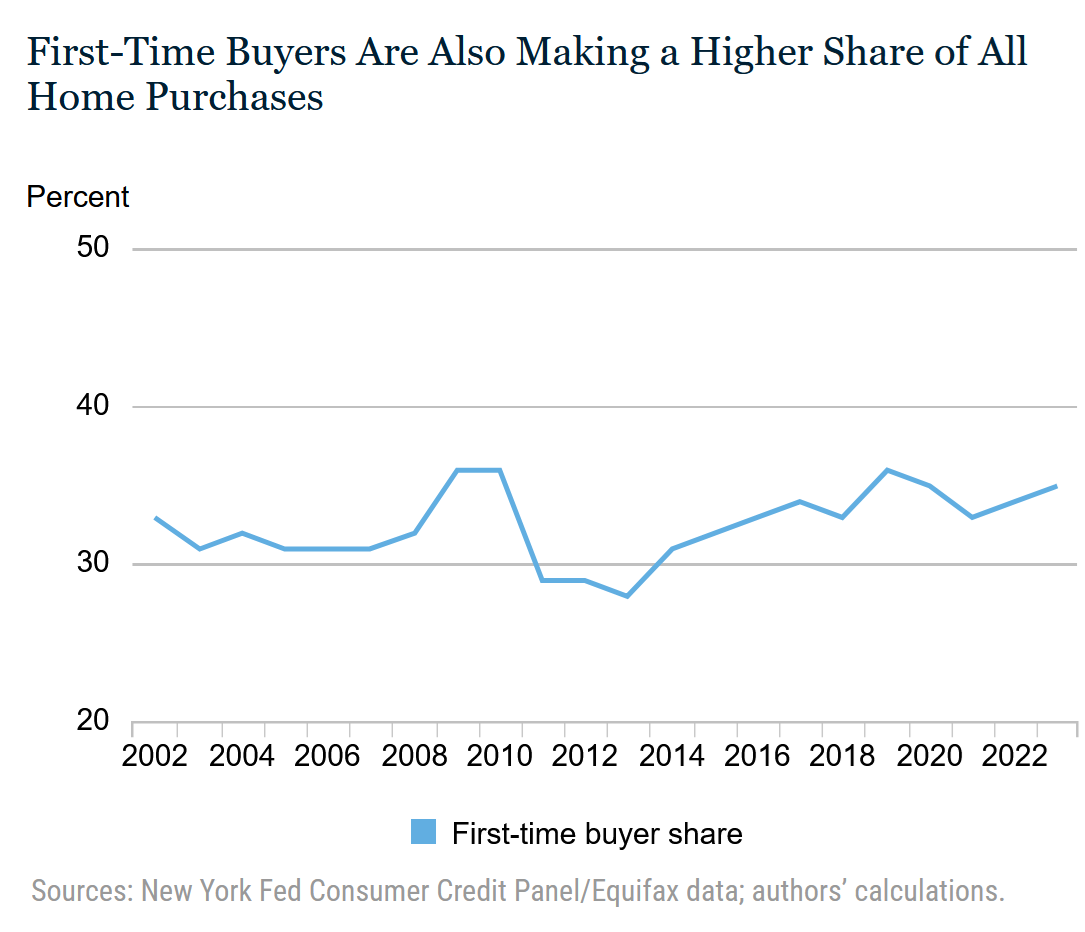

The share of home purchases by first-time buyers has also increased over the past decade, with drops in some years and gains in others.

In 2020 and 2021, the share of FTB home purchases dropped because homebuying went into a frenzy, and the purchase volume of non-FTBs soared. But then the frenzy froze over, purchases of existing homes plunged, while FTBs kept at it, kept buying, and their share increased again to 35% of total home purchases in 2023, according to a NY Fed analysis in February (chart by the New York Fed):

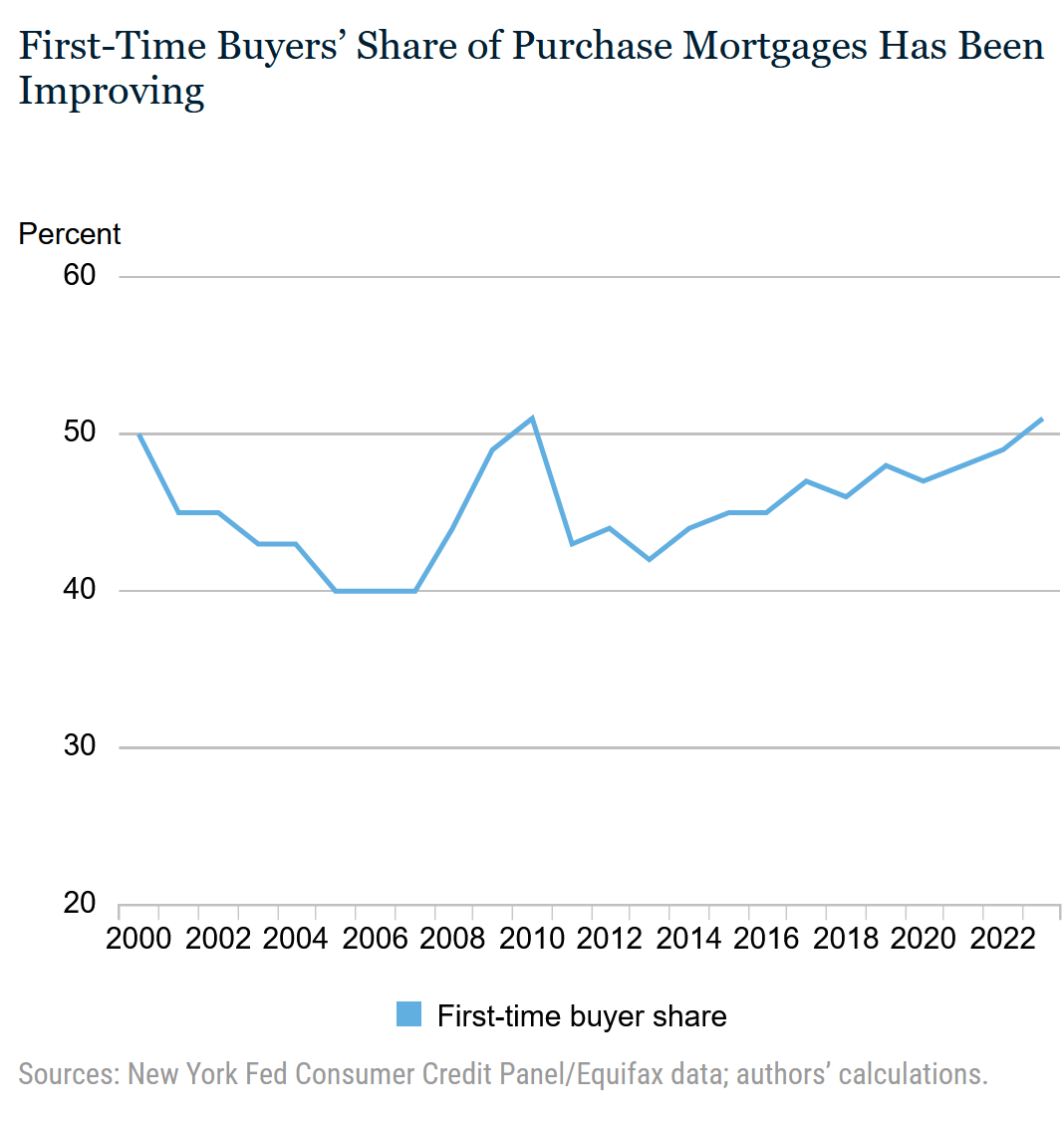

The FTB share of mortgages to purchase a home has also increased over the past decade to 51% by 2023, up from 40% at the low point in 2005 through 2007 (chart by the New York Fed):

FTBs are important to the housing market and to inventory for sale, and the entire industry is watching them and is praying for them, because they actually represent incremental new demand by taking inventory for sale off the market without putting inventory on the market.

But many repeat buyers – such as families that move – don’t represent new demand; they’re just swapping homes, they sell a home to buy a home, thereby adding one home to the inventory for sale and taking one home off the inventory, and so overall have no impact on inventory (+1 -1 =0).

Obviously, many younger people are eager to buy a home, but that has always been the case, and eventually they buy a home, and that has also always been the case. And the average age at which they do that hasn’t changed much either, and has actually declined a little since 2000. And that makes sense because younger people live their lives, and have always done so.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Such a great point and true to the date. Millennials are going to Boom into this age range over the next 10-15 years. Inflation is here to stay as Millennials start buying more homes as they enter late 30s, 40s.

Did you actually read the article? The article made no such point.

If you’re still waiting for Millennials to suddenly show up and buy, you missed the train. Many of them already bought. Millennials are already repeat buyers. The average age of Millennials is already higher than the average age of FTBs.

GenZers are the new buyers that are coming up. Boomers and the prior generation are exiting this housing market and the world. And lots of new construction is piling on the market, and those deals appeal to FTBs.

Much better than I expected with rising costs over the decades.

It would be interesting to see how much code, zoning, utilities hookups, permits etc have added into cost of a new house over the last 40/50 years.

I’d argue the new home is built (if done correctly naturally) is a far superior product and way more upscale than my 1955 home I purchased. Or have methods managed to contain costs. I dont know.

There is just no comparison to what the consumer settled for then in even a low end house compared to today.

I watch these new homes go up that have stapled foam in place of wood sheathing. Vinyl siding in place of brick. I can’t agree with you.

8t – mebbe examine scientific evolution of ‘strength of materials’ vs. ‘durability of materials’ and the usage decisions made at the time incorporating the known in both both factors…

may we all find a better day.

Hello 8ticks1,

Going to have to disagree with you. New build quality, both labor and materials, is seriously deficient compared to pre-millenium. Of course, this is just my opinion, so no insult intended. The proof will be evident in a couple of decades. I won’t be here to know if I’m right or wrong on this.

Cheers,

–Geezer

NJGeezer

My 1985 Buick was the best car ever built!

🤣

Some improvements are better energy efficiency, better slab and foundations, quieter floors, and more useful layout.

Downsides are PEX instead of copper pipe, ICF instead of cement block basement walls, and modern lumber.

Boomers are in the market for only time pine box construction.

Go long pines?

Pretty funny Wolf yes go long pine boxes because that’s what I want and the demand is surging !

I did read the article, but maybe my understanding of the Generations and population/demographic sizes are wrong. My understanding is that Millennials are currently ages from 29 to 44 years old. Born between1981 and 1996. According to your chart, the average First Time Homebuyer is 36 and average repeat buyer is 48. Doesn’t that mean that there are lots and lots of Millennials to move into those 2 categories over the next several years? Especially into the “Upgrade” category? And Millennials are much Greater in size than GenX, so doesn’t that mean there are going to be much MORE homes bought as Millennials move into those ages?

What you said that I replied to — note the future tense “going to”:

“Millennials are going to Boom into this age range over the next 10-15 years.”

What I said:

“If you’re still waiting for Millennials to suddenly show up and buy, you missed the train. Many of them already bought. Millennials are already repeat buyers. The average age of Millennials is already higher than the average age of FTBs.”

When the interest rate is 7% and the average cost of a home is $400000 I don’t care what your age is how are you breaking into the housing market and then how about the insurance company’s grab doubling the rate of homeowners insurance and their profits are record high!!! and then how about all the school districts and townships and countys that have doubled their taxes Just in the last 3 years!!! Literally when you own a home you have a target on your back it makes it utterly impossible for a young couple to buy a home so they need the rent and their option there is 1500 to 2500 a month, The interest rate is unsustainable at 7 percent with the cost of housing and the cost of taxes and insurance it should be about 3% that’s the only way they’re gonna be able to afford to live and I’m a home builder for 40 years so no one knows more about this subject than me

Great stuff!

I came to the states in 1998, right when real estate prices started going up, up, up.

1/ Would be interesting to see those graphs going into the 70ies. I still would not expect much difference in graphs though — prices were better, but mortgage requirements — stricter. Very curious though.

2/ FTBs represent new demand, but LTBs (people selling and leaving the market — renting, etc) represent boost to supply (in addition to new construction). I can’t imagine how one would get that data, but also would be curious to see that churn — people entering and leaving housing market.

In the next 10 to 15 years, the Millennials born in 1980 will hit age 50(2030) age 55(2035) and 60(2040). If they are delaying buying homes right now the average age likely increases until they see favorable buying conditions. If the average age increases further they run high risk with a 30 year mortgage within 15 years of that mortgage loan from forced layoffs and health problems for example. The Millennials are also at higher risk of having negative equity buying homes in senior Boomer and Gen X neighborhoods. Where the home owners are done supporting raising kids after age 18 are in their empty nester years delaying selling maybe aging in place. Both the Boomers and Gen X are often beyond the average peak years earning cycle will face tougher times in the coming years maintaining the homes. Where they could potentially reverse course as far as owning an dump too many homes on the market. The buyers won’t buy them based on their own age range above age 40 as I stated with the Millennials but more likely the younger Gen Z. Right now, Gen Z isn’t doing so well financially speaking nor entering a stage of cohabiting heterosexual relationships that lead to a long term commitment towards marriage and children to wanting homes. With all the expected inevitable outcome with more Boomers and Gen X hitting senior age status allot of them have poor retirement planning have their homes to draw equity from or face selling to fund their retirement. It’s not looking bright for the US housing market going forward.

“GenZers are the new buyers that are coming up.” think this is especially true for really HCOL areas like SoCal…hell, keep this price insanity going, and up every year…then it will just be boomers that are buying and selling to each other since they own the most wealth out of any generation..

Yeah boomers and GenXers looking to expand or whatever.

Too few resources (houses) for too many people Awash in so much money.

Someone needs to hoover it back into the money machine.

At least Munger put it in perspective for us.

Boomers own most of the wealth because they’ve had the longest time to build it (40-50 working years), not because they have some sort of magic. They got lucky in being able to buy a house before the insanity of Bubble 1 and Bubble 2 (and Airbnb as well).

What do you think happens to that boomer wealth, including their homes, over the coming decades? It’s all the same wealth. The oldest generation is just the one hanging onto it presently, until they don’t.

This data is contrary to all that we hear on MSM. I saw a graph recently on the % of 30 year old’s who are married and own a home. Reduced from 70% in 1950 to 12% in 2025. Wonder where that data came from.

You’re comparing dissimilar data. You mentioned “30 year old’s who are MARRIED and own a home” (emphasis mine). Wolf’s article didn’t mention anything about the home buyer’s marriage status. Rates of marriage in this country have fallen off a cliff since the 1970’s… for obvious reasons.

This data is based on actual purchase and credit data (Equifax).

And it has zero to do with marriage. The age at which people marry, if they marry at all, has moved out a lot over the decades. I don’t know why you drag this into here.

Tougher house pricing has 2 off-setting effects – neither of which appear in your data.

Higher earners delay a few years making average age higher.

Lower earners just never buy – making average age actually Lower (and total purchases smaller).

Your chart neatly shows the cancelling out and pretends nothing is going on.

You need to include at least total purchases in any analysis

People who never buy never show up in the data. Effect on average age is zero.

Here you go dispensing advice while making no sense.

That was my thought exactly. Data is easily misleading if you want it to be.

Say wealth stratified to the extreme. You could have the average age of first time home buyers go as low as 18-22. Mommy and daddy pay for a house for the kids. Meanwhile the poors never buy anything and just rent eternally.

This seems to be more of what I’ve seen personally. Wealthier parents try and force their kids to buy ASAP with down payment help because “Real estate only goes up!” And the kids gets a house young.

Meanwhile the kids of less wealthy parents who don’t provide support in much of any capacity just rent forever.

It also doesn’t just come in the way of down payments either. I know a lot of people who have their parents provide child care so both parents can work, provide food/dinner, pay for their vehicle or insurance, etc.

I’m single, until recently was making 120k/yr in a MCOL area and have 0 safety net or support structure from anyone. I have a decent down payment saved up but I’d be living paycheck to paycheck. Now I’m down to 70k/yr due the the “Best Job Market Ever!” And I’m glad I haven’t bought anything. If the Great Freight Recession keeps steam rolling everyone I’ll be a permanent renter myself.

The key point is “married”

The percentage of married 30 year olds has dropped

Both could be true. Wolf’s data covers the average age of first time buyers. It doesn’t say anything about the percentage of the population that is buying homes.

The second chart shows the first-time buyers as a percent of all home purchases.

…historic sidebar to the ‘1950’ start date of NR’s anecdotal graph-at that time, the U.S. was in the middle of a strong postwar economy for a very large cohort of younger Americans eligible for ‘VA-FHA’ home loans (can still recall in my SoCal youth that term on countless billboards over the years colorfully, and bigly, advertising the parade of subdivisions arising out of former-farm/pasture or otherwise ‘undeveloped’ land…), an inconstant situation that, lacking its own data points, would demand great care in any extrapolations from said graph…

may we all find a better day

OK, I’ve come back with a comment that I think makes sense (though I’m sure you’ll disarm me of that tentative confidence in no time!). You have provided an interesting statistic, but I think it potentially misses or misdirects from a bigger story; an even more interesting statistic would be average age people acquire their first home based on the year of their birth (I realize you’d have to make some strange choices in how to represent the data, see below*).

The reason I feel that this is more interesting is because the statistic you have presented (average age of first time buyer) does not bring in information about the magnitude of homebuying across the population — for example, if homebuying sinks to 10% of typical rates for 20 years, the generation that was 20 years old when this period started is seriously negatively impacted in terms of their overall homeownership even if average age of first time buyer stayed constant during that period.

*Now of course, the question becomes how to run the numbers on that, because you can’t get an average age from those who have never owned a house, and you can’t compare the generation born in 2000 to the generation born in 1980 with the statistic I mentioned, because you only have a collection of <26 year-olds for the 2000 babies and <46 year-olds for the 1980 babies. It would be comparing apples and oranges for this statsitic. So you'd have to put some filters on the data that would be imperfect in the end: Maybe only consider 1980 babies and older, and only count up to 45 year-olds in each year's population, and for the folks in those populations who never owned a house, assign them a home-owner age of 45. Maybe there is a better way, but I'd find this statistic much more meaningful for trying to compare which generation has it best/worst in terms of homeownership.

36 is too old to be buying a house if you have a family. The ideal age to buy a home is around 28, I would say, but the downpayment requirements make that impractical for many, unfortunately. There is no limit to the ways traditional capitalism shafts society.

The average age wasn’t 28 since Adam and Eve.

that last thing a <30 year old person wants is to be tied down

Given the high cost of childcare, I would rather rent and afford to have 3-4 kids than buy using all my money and max out at 1-2 kids. I may even be a first time home buyer in my late 40’s but it doesn’t matter much to me at this point as long as I have the flexibility to live in a good school district.

As a person with one child I’d prefer one with our nanny and 2-3 exotics as God intended.

I often see a data set from NAR that says the median age of first time home buyers has been increasing. Why are these charts so different?

This is based on actual purchase and credit data (Equifax). NAR’s figure is based on what its Realtors out in the field reported to NAR over the years. In addition, NAR is a lobbying group for Realtors.

Hmm so the Equifax data would miss homes that are bought, let’s say, by a parent, but for all intents and purposes it is used as their child’s house. Any sense of how much of an impact this would have on the data?

Your question doesn’t make sense. If the parents buy a home, the parents are the buyers, and they’re not first-time buyers but repeat buyers.

If you count those parent-bought homes as kid-bought homes, and as first-time buyer homes, then the share of first-time buyers would even higher than it is.

Does this data include purchases that didn’t require a conventional mortgage reported to Equifax then? Like cash purchases, inheritance, or loans from family? I would think NAR would also be interested in implying first time buyers are fine.

“I would think NAR would also be interested in implying first time buyers are fine.”

No, NAR wants lower interest rates, much lower interest rates. It’s a lobbying organization and has been clamoring for lower interest rates for years. It has not been clamoring for lower prices, LOL, though that would really help first-time buyers.

I’d like to see the data broken down by demographics. I’ll admit my viewpoint is based on anecdotal evidence but I believe social factors play an important part in the data. For example, I see certain races seem to place a greater emphasis on home ownership than others. I’m guessing it may have to do with factors back in their home countries and the open doors to home ownership that exist in the US. Home ownership means security to many folks. To others it’s a means of investing.

For example, I see multi-generational families buy a home as a group here(Hawaii being on the expensive side) but I don’t see many Caucasian families willing to do make that sacrifice. They’d rather wait around for the parents to die.

I know one Chinese family in SF that claims they’ve never sold a property. They date back many generations there and have accumulated somewhere around 1,000 rentals, mostly in the Bay area. The kids are trained up from a young age to continue the tradition.

If you’re into social studies or racial/cultural studies, DEI, that kind of thing, it might be interesting. This is an econ and finance site, and I have zero interest in that. If you’re looking for something like that, you’re in the wrong place.

Interesting data! Wolf could you please share the Fed’s data? It is so counter to what the narrative says where no young people can afford homes. Or is average purchase price also dropping?

This is based on actual purchase and credit data (Equifax), as spelled out in the article. Links are provided in the article.

We’ve heard from plenty of millennials here in the comments that have bought homes, and we’ve heard from parents whose millennial kids have bought homes. Many millennials are making tons of money. They’re running companies, they’re in charge, they’re out there doing stuff.

Yes, affordability is low. But it’s not much worse than it was in 2005, see the Atlanta Fed affordability tracker — unfortunately, it doesn’t go back further. And people are still buying homes.

Wolf,

As near as I can figure, this data is

based on mortgages in credit reports,

and not “actual purchases”. Even with

this being a subset of sales, it’s a very

large subset, and surely closer to the

truth than NAR’s survey data.

J.

All,

A mea culpa. In the February blog

post, the author mentions using data

from Redfin for cash purchases when

constructing the “First-Time Buyers Are

Also Making a Higher Share of All Home

Purchases” graph.

I had locked in on the use of the Fed’s

CCP, which only uses credit reports.

My bad, and sorry for the noise.

J

This doesn’t tell you the percentage of 30 year olds buying a home. The percent of 30 year olds buying homes could increase if home sales decrease, or home sale stay flat with increased population. Not enough data here to determine.

Bingo. The total number of homes being bought now is historically low, especially compared to the overall population.

Therefore, there actually are a lower percentage of Millennials and Gen Z buying homes by the age of 35, compared to previous generations.

The total number of homes being bought has plunged because prices are too high, and younger people shouldn’t buy ANY homes at these prices, let the boomers sell them to the angels in the sky, and then those prices would come down in a hurry. The buying by first-time buyers is what’s holding up prices. If they want lower prices, they need to stop buying, for crying out loud. I said this before too.

On the other hand the average age of getting married and of having kids get steadily older (or never).

Presumably because the financial burden of 1 parent funding house and kids is too much.

If you wait until you can “afford kids,” you’ll never have them. My dad’s advice and 100% correct.

David I’m real glad your dad didn’t lead me to bankruptcy!

lol

Kids are a joy.

They can break your heart too.

I’m glad I had 3, and hope for grandkids at some point in 10-15 years.

I’m happy I waited until I was in my 40’s to get married and have kids…

“Presumably because the financial burden of 1 parent funding house and kids is too much.”

LOL, my generation already didn’t want to and didn’t have 3.8 kids on average, because we already had easy and widely available methods of birth control, including or especially women. Boomers were the first generation to come of age with the pill. The average fertility rate for people of my vintage dropped to 2 kids per woman. Fertility rates have continued to drop. Fertility rates have dropped globally for many decades. Easy and widely available methods of birth control have a lot to do with it. Now pregnancy is actually a choice, rather than something that just keeps happening over and over again.

As I’ve posted repeatedly. The median household income for prime homebuyers’ age group (35-45) is $110k+ and that supports a pretty median home payment. No you can’t buy a townhouse in Manhattan or a SFR in North Beach, but a pretty typical $400-$500k home is doable for a pretty typical 35 year old household.

Notably the percentage of FTB’s and their market share are as high as they were after the bust, indicating that affordability is on par with 15 years ago for those households.

Those waiting for another 2008 housing depression will keep on waiting.

That might be true for the nation, but not for the state of California. The California Association of Realtors publishes the household income needed to afford a home, and it is way above median the median home price for just about every California county:

https://www.car.org/marketdata/data/haitraditional

Wolf would likely call this BS reporting from CAR to manipulate the Fed to cut rates. Ninetheless, they publish these numbers.

So, homes are obscenely overpriced. There is no disagreement here. No one should pay those prices, and if people refused to pay those prices, or couldn’t pay those prices, we wouldn’t have those prices. We’d have much lower prices.

But the people with median incomes aren’t buying median homes. What you people ignore is RENTING, which takes a big batch of people with below-median incomes off the buying list altogether and thereby changes the mix of who is buying. And so the median income of HOME BUYERS is much higher. The median is heavily skewed by changes in the mix. It’s a logical fallacy to compare median incomes to median home prices because it ignores the effect of renting by changing the mix, and therefore the “median income” of who is left to buy homes.

The median household income is the income of the household in the middle. If you take the bottom third out because they’re renting, then the remaining median income is much higher.

Here is my explanation of median and how it is skewed by changes in the mx:

https://wolfstreet.com/how-median-home-prices-are-skewed-by-changes-in-the-mix/

@Wolf,

I couldn’t agree more that people are getting the home prices they deserve by being willing to buy at obscene prices.

Your linked article suggests to me that there is a transfer of wealth from savers to debtors as the result of these purchases, because the “gatekeepers” underwriting the loans are looking the other way rather than denying loan applications. They are motivated to underwrite bad loans, that will be securitized and tranferred to “investors” almost immediately after closing, because they get paid *today* for a risk they will never be held accountable for.

Loans for mortgages to people who can’t pay is nowhere near the levels that same activity was at in the 2000s though. Back then you had alt-a loans where people had no money, job or assets. That’s how you got all those ARMs that blew up and then nuked the entire mortgage-backed fixed income sector in 2008. To the extent that mortgage originators, shadow banks, etc knew this and didn’t care because they could make the money now, that was black letter fraud and should have been prosecuted. But everyone was doing it. I don’t think remotely the same situation applies today though.

You could have posted the same exact post in early 2007 and it would have also been true. We measure home affordability by median income vs median home price. It has its flaws, but it accurately signals if home prices are vastly over-priced or not. Atlanta Fed home affordability monitor is a good tool to track this.

I know a lot boomers thinking their home value doubling in five years is normal, but sorry – it’s not and it will revert to the mean.

If this data had come from anyone but Wolf, I would have said Fake News but then I thought about it more.

I bought my first home at 27 but that was 32 years ago. I was kind of an outlier in my hometown being college educated and having spent the previous 5 years eating Macaroni and Cheese while I built a small business.

Even then, most of my other friends from High School were just starting to look for a first house and at that time, $40K could get you a 2-bedroom starter home.

My parents, boomers, were 35 and 33 when they bought their first house.

My paternal grandparents were 32 and 28.

My maternal grandparents were 35 and 32

The numbers make sense. A college grad in her early 20’s doesn’t make real money until their late 20’s. Saving a tidy sum for a down payment takes time while one is paying rent. The below 30 buyers that I have come across have all had substantial help from parents.

Another old timer……Viet Nam war era……bought first home with GI loan…$24K, no down payment. About $80 monthly payments. Was great….now 96 andpeeking over the edge.

Tom

Would be interesting to see what first time homebuyers are buying.

Specifically, the split between homes and condos over time, assuming this data captures both types of purchases.

I know from my friends that aging people have become condo or co-op buyers because they’re easier to deal with (no stairs, nothing outdoors to take care of, etc.). They sold their house and bought a condo/co-op. Some buildings cater to these down-sizers. I sold my own beautiful bachelor-pad 1,800 sf condo to a couple like that back in 2000.

I hear you. My brother-in-law has been making plans to move to Florida to a retirement community called the Villages… They are on the affluent side so, thinking of people like that and also the ones that like to live in high rise urban settings, there are definitely plenty of expensive condos out there.

If I was to think in percentages, though, the vast majority of the condos that I see going up are not tailored to that demographic. I feel like I’ve got a pretty balanced view of those things, but it doesn’t everybody?

Interesting point. If the insights that into trends for homes vs. condos was to have value, you’d also want to have some sense for the weight and spread of the price range.

My current (and likely last) abode is ~2300 sf, one level, 55+ community with plenty of amenities. My yard is gravel & cacti, and I’ve spent about $1.2k on yard work in almost 2.5 years. I like my space and more so, I love my high ceilings (10-14’ sloping).

Every home prior had stairs. And there were all in places with more erratic weather patterns.

My 28 yr old wants a house in thr Seattle burbs, but they’re just unaffordable right now. Even with $500k down you’re looking at $32-3600/month. So we’re waiting. I fully expect this to correct.

Wolf,

Your example describes our situation 100%.

Kids all out on their own. We had a much bigger house with stairs and a yard.

A condo – all on one floor – is much easier to deal with.

The second time home buyer age is increasing because they

financed mortgages with negative interest rates gifted by the Great Bernanke and the Fed for 10 plus years. They are locked in their first house or second house if they refinanced. To buy a house today would in some cases double their mortgage payment plus it takes a larger mortgage to buy the same house because of how the Fed inflated asset prices.

Their is lesson to be learned here and it is sometimes you should look a gift horse in the mouth. The Fed has never ever been your friend.

There’s a couple additional factors. Once you’ve got skin in the housing game, you’re pretty much in. Outside overheated big city markets, housing valuation doesn’t matter all that much outside of a bust, because if you are moving because you have more equity towards your next purchase. Yes you can sell and cash out now and wait for the next downturn while renting, but once you are established, most people want to keep those luxuries – your own yard, no shared walls, garages, no landlord, and so on.

Two big things are keeping repeat buyers as a lower percentage – the first touched on plenty here is the sub-4 mortgages. I certainly won’t be selling my house any time soon, partly because of those savings. The second part hasn’t been touched on, which is the necessity to move or sell. Some of these things remain the same like space for kids, safety/security, or big upgrades. However, the employment part of the equation has been heavily impacted by the post-covid era of remote work.

Both me and my wife have switched jobs in the past five years and we don’t need to move because we both work remote. A much higher percentage of high earning professionals with good pay can now work remotely, so they no longer have to move if they take a job in a different city or state. My “office” is in Maryland, 8 hours from me, and the majority of my wife’s clients are 3 hours away. Previously our work sites were 12 and 14 miles. Repeat homebuyers often move out of necessity and not desire.

It’s still rather difficult to argue that the median home price compared to the median income is not rather lopsided.

And median incomes dont really go up that much even in expensive states like NY or CA. Last time I checked the median income in CA was only $42k.

What can you buy with that?

Back in the 1980’s the home to income ration was in the 3-4 range now it’s closer to 10

That’s incorrect for California.

Median income for a 1 person household is $50k, not 42, and for a 2 person household it’s $102k.

But you want to look at prime buying age households and that’s $105k as of 2023, so it’s almost assuredly over $110k by now.

Google shows median income for 2023 at $42k Yes that went up since then but I doubt that much.

But even if you take $50k (which it probably isn’t) that still doesn’t make much difference.

bruce

Citing AI BS in the comments is the 8th deadly sin of commenting.

Median household income in the US was over $100k in 2023:

https://fred.stlouisfed.org/series/MEFAINUSA646N

In California, the median household income for married couples was $131,674 in 2023

https://data.census.gov/profile/California?g=040XX00US06#income-and-poverty

In San Francisco, the median household income for married couples was $200,478 in 2023

https://data.census.gov/profile/San_Francisco_city,_California?g=160XX00US0667000#income-and-poverty

Wolf – Bruce posted median HHI. You posted a link to median family income. They are two different measures

StPeteDave

Bruce’s number is still BS

Here is median household income, 2023: $80,600

https://fred.stlouisfed.org/series/MEHOINUSA646N

Howdy Folks. Purchased 1st house at age 20. Old now and retired and currently homeless. Homeless is more fun……

Oh! Now we know why you are Debt-Free, Bubba. Doesn’t sound like much fun, though.

Howdy Kaden. Full time RVing is not for most people. Pretty sure only about 1 million or so are fulltime RVers……

I don’t consider living in a R.V. as being homeless, although I do see your point. It’s 1000 times better than living on the streets (that’s what I was thinking when you said ‘homeless’. I’m glad you’re not living on the streets! Cheers to your R.V. and cheers to being Debt Free! Thanks, Bubba!

Yes, homes are not an investment.

Homes are for families.

When you retire sell and get rid of all your junk and downsize to a couple of suitcases.

Wolf, I keep reading that homes are unaffordable. But the data of the first time home buyers say it is not that different from year 2000.

If the data shows that first time home buyer age isn’t increasing… And that houses are massively overpriced… We can extrapolate that first time home buyers are lack discipline (FOMO) and/or are loaded enough not to care.

Tail end of the boomers here. Bought my first house at 25 (just out of law school), my second at 33 (and rented for a couple of years before that because I had moved locations and didn’t want to buy right away), and my current house at 38 (needed more room for kid number 3, who is 10 years younger than kid number 1). And added a lakehouse several years ago at the age of 62 (that’ll skew those repeat buyer numbers up).

House affordability index is showing that it is harder for most folks to buy a house. Income inequality, the GINI metric, is rising.

Age is irrelevant.

American Yale Professor Irving Fisher’s price level is not falling. Housing prices can fall far from the tree.

Mid-baby boomer, bought first condo at 28, got married and bought second primary at 35 with wife, and we held onto our condos as rentals. Have continued to acquire more rental properties. Guess you could call me a hoarder and part of the local inventory “problem” in North County San Diego.

One interesting thing, I wonder if there’s public record that shows on record the oldest age someone became a first time buyer and with a 30 year mortgage, 65 or 70?

The way things are going in SoCal, I bet I can probably beat that record if it’s only at 70 and I will be sure to take out the longest mortgage term I can get away with….80+30….I don’t see any issue there..

I wondered about that.

Can someone qualify for a 50 year mortgage when they are 85?

It’s probably cheaper than renting.

That would skew the data Wolf presented.

the kind of BS people come up with is just astounding. There were 4 million sales of existing homes and about 600k sales new homes in 2024, and the very small number of people that are that old and do get a regular mortgage, if any, is going to skew the numbers??? 🤣

LOL not to mention I am pretty sure 50 years is not really a thing. if it is then I like to know where I can find one and maybe I won’t mind buying an absurdly overpriced house with that kind of financing term, even at my current age, I highly doubt I would make it to the loan end term..

LOL! Wolf, I think some of these responses are a testament to the creativity of the readers of your excellent articles. It shows thinking outside the box. Your articles are the best information we have for the future(barring actually having a functional crystal ball).

I refi’d when rates were at 2.5% when I was in my late 50’s. I purchased in my early 50’s but not as my first purchase. I should have listened to all of your excellent data and refi’d for 50 years at 2.5% and then locked in a 30 year guaranteed Treasury Bond at 5+%. It would have paid PI for my home for the rest of my expected life. I was too conservative. Crazy times.

Thank you for all you do.

FYI 50 year mortgages do exist but many are too short lived to truly enjoy them. I’d truly like to try to take out a 50 year mortgage when I’m 85 just to see if it can be done.

Maybe I’m just a troublemaker.

First time buyer age is far higher than I thought. This is surprising.

Interesting info, which counters many narratives on the social sites, that homes are unaffordable and no young people can start a family because of it and boomers and PE are to blame. (Not in the article…but the data shows nothing to see here…)

Hello everyone! I bought my first home in the Midwest a few months ago when I was 27. I’m 28 years old, and chose a home a street over from my parents to be close to them, so location was important but also affordability.

I didn’t give into high prices but rather chose a 1900 square foot home with three bedrooms and two baths that was owned by a Silent Generation couple that grew too old to take care of it. The home was built in the early 1960s and they were the first and only owners to have it until I bought it.

It was dated, so I paid only $180,000 for it and started modernizing it. They took good care of it and it is structurally in great shape but it needs a lot of work.

Good to see you all!

Yes, parts of the Midwest are still very affordable.

Thank you for your help and a common sense understanding of our times.j

Wolf, I believe those statistics exclude cash and institutional buyers. Also, classification of a FTHB has changed over the years. If one borrower hasn’t owned a home in the last 3 yrs they can qualify as a FTHB, which often leads to lower mortgage rates and potential down payment assistance.

And just today on a very prominent financial site

– “Americans Are Getting Priced Out of Homeownership at Record Rates.”

Lower prices are the solution obviously. But the clickbait purveyors and their water carriers don’t ever say that.

If people didn’t buy or couldn’t buy at these prices, we wouldn’t have these prices. You have to have a buyer for a price to be established.