Oakland, Austin, St. Petersburg, Fort Myers, San Francisco, Boise, Jacksonville, Detroit, New Orleans, Arlington, Tampa, Reno, Seattle, Denver, Mesa, Chandler, Portland, Aurora, Phoenix, San Antonio.

By Wolf Richter for WOLF STREET.

It was the most splendid condo bubble ever, topped off with a mania, driven by the Fed’s interest-rate repression that included trillions of dollars of purchases of MBS, which pushed down mortgage rates below 3%, triggering wild and woolly speculation from FOMO buyers and breathless investors – thinking of short-term rentals, long-term rentals, leveraged capital gains forevermore, a second or third home in the sun, a combination, or whatever.

In just 10 years into 2022 or 2023, depending on the market, prices exploded by 150%, 200% (Jacksonville, Tampa), 300% (Detroit, Aurora), or even 350% (Phoenix, Mesa) in the 20 cities we’re looking at here. Those explosive price gains culminated in a veritable mania from mid-2020 to mid-2022, and a good time was had by all.

Now these gains are unraveling. Condos are often the first and biggest movers in local housing markets – on the way up, and on the way down. And the price declines have picked up speed in most of the 20 cities we’re looking at here.

In some densely populated cities, such as San Francisco, condos make up a bigger part of the housing market than single-family homes.

Condos face all kinds of problems: They face too-high prices that exploded over the past few years. They face big special assessments for long-neglected structural repairs. They face dizzying increases in HOA fees. They face Fannie Mae’s ever-expanding Condo Blacklist that makes financing a unit in a listed building very difficult – and often it can only be sold to a cash buyer at a lower price. They face the threat that the condo building could end up on that Condo Blacklist. They face buyers that have to finance at mortgage rates that have returned into some sort of normal range. They face foreign-based owners who no longer want to live part-time in the US, such as Canadians, and are putting their condos on the market.

Long-term rental of condos has come under pressure from the flood of supply of new higher-end apartment developments that sprang up over the past few years. The vacation-rental boom over the past few years created a huge supply of vacation rentals, and demand for them may have peaked. For investors, condos are expensive to carry, and they can quickly become a money pit.

Successful sellers have figured out what it takes: Lower the price to where the buyers are even if it means giving up a big part of the recent gains, and accept the first serious offer that comes along because it may be the only offer. And two months later, prices may be even lower. He who panics first, panics best.

Price drops are spreading and steepening. In three of our 20 cities here, condo prices have already dropped by 20% or more from their peak through May. In two other cities, prices have dropped by 15% and 16%. The 20 cities are spread over 11 states, led by Florida, Texas, Arizona, California, and Colorado.

But Miami doesn’t yet qualify because condo prices haven’t dropped by 10% yet. In May, prices fell by 0.7% month-over-month, seasonally adjusted, by 4.1% year-over-year, and by 4.2% from the peak in January 2024. Prices are back where they’d been in January 2023.

The absurd price spikes fall apart. So here are 20 bigger cities where condo prices have dropped by 10% or more from their respective peaks in prior years.

Condo prices here are seasonally adjusted three-month average prices of “mid-tier” condos from the Zillow Home Value Index (ZHVI), which is based on millions of data points in Zillow’s “Database of All Homes,” including from public records (tax data), MLS, brokerages, local Realtor Associations, real-estate agents, and households across the US. It includes pricing data for off-market deals and for-sale-by-owner deals.

In the little tables for each city below, note the sharp month-to-month drops – a sign that the declines are heating up (the drops are not seasonal because the index is seasonally adjusted).

The left figure shows the drop from the peak. The right figure shows the still huge gains since 2000. In between are the month-over-month (MoM) drops and the year-over-year (YoY) drops.

This is what a condo bust in-progress looks like.

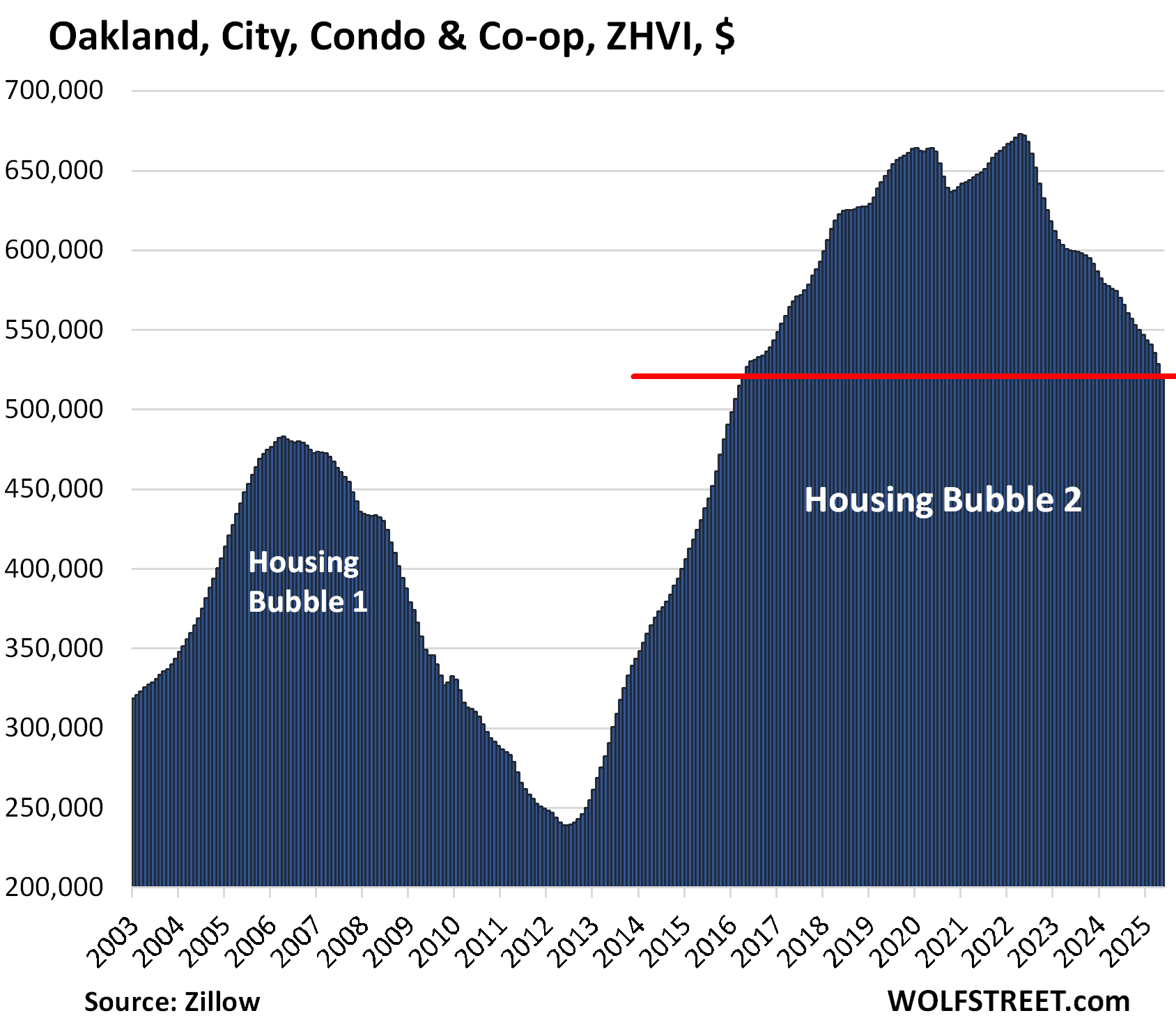

| Oakland, CA, City, Condo Home Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -23% | -1.7% | -9.5% | 171% |

Prices are back where they’d first been in April 2016. That was 9 years ago. The pace of the price drops has been accelerating.

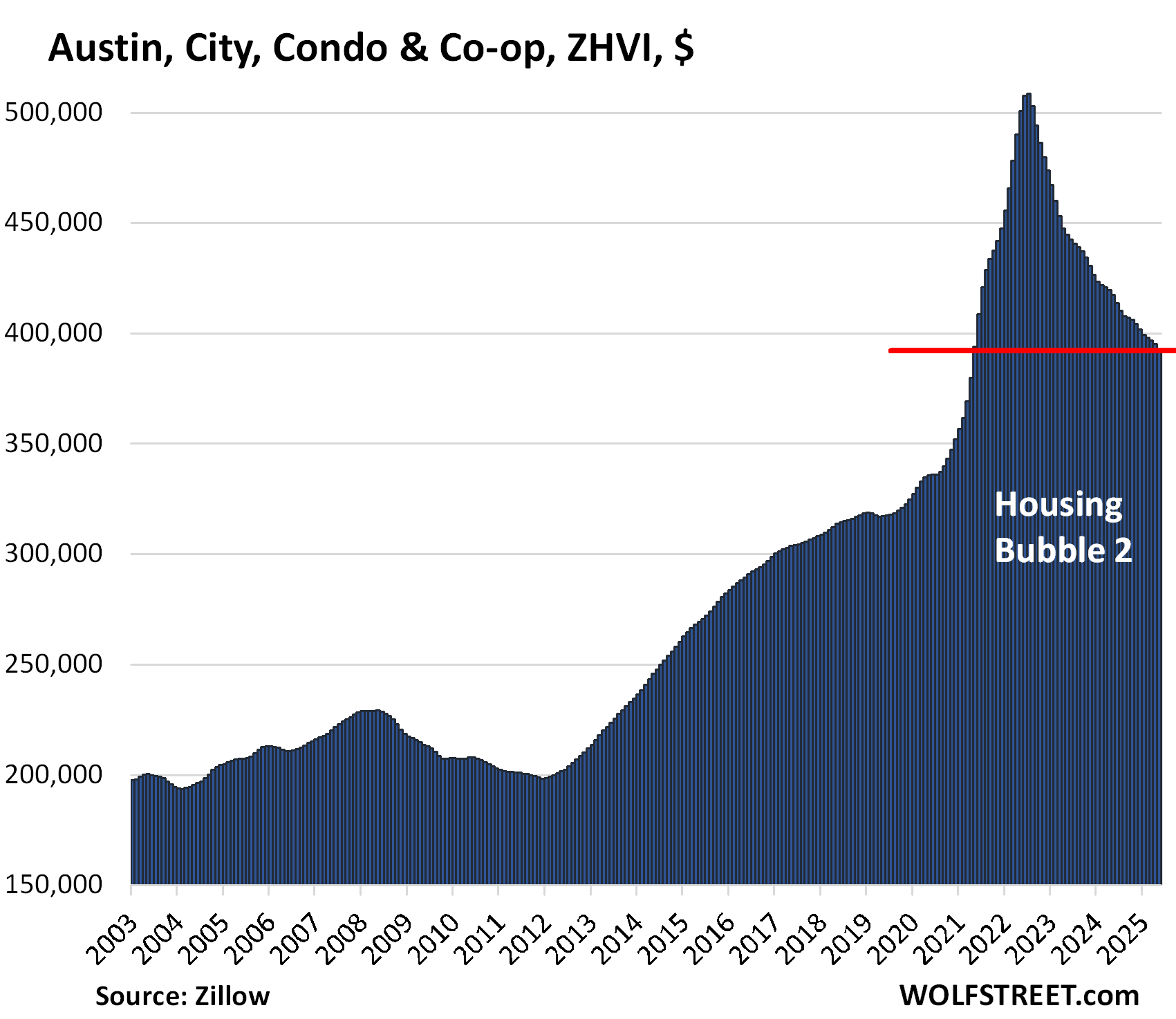

| Austin, TX, City, Condo Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -23% | -0.7% | -5.9% | 118% |

Lowest since April 2021.

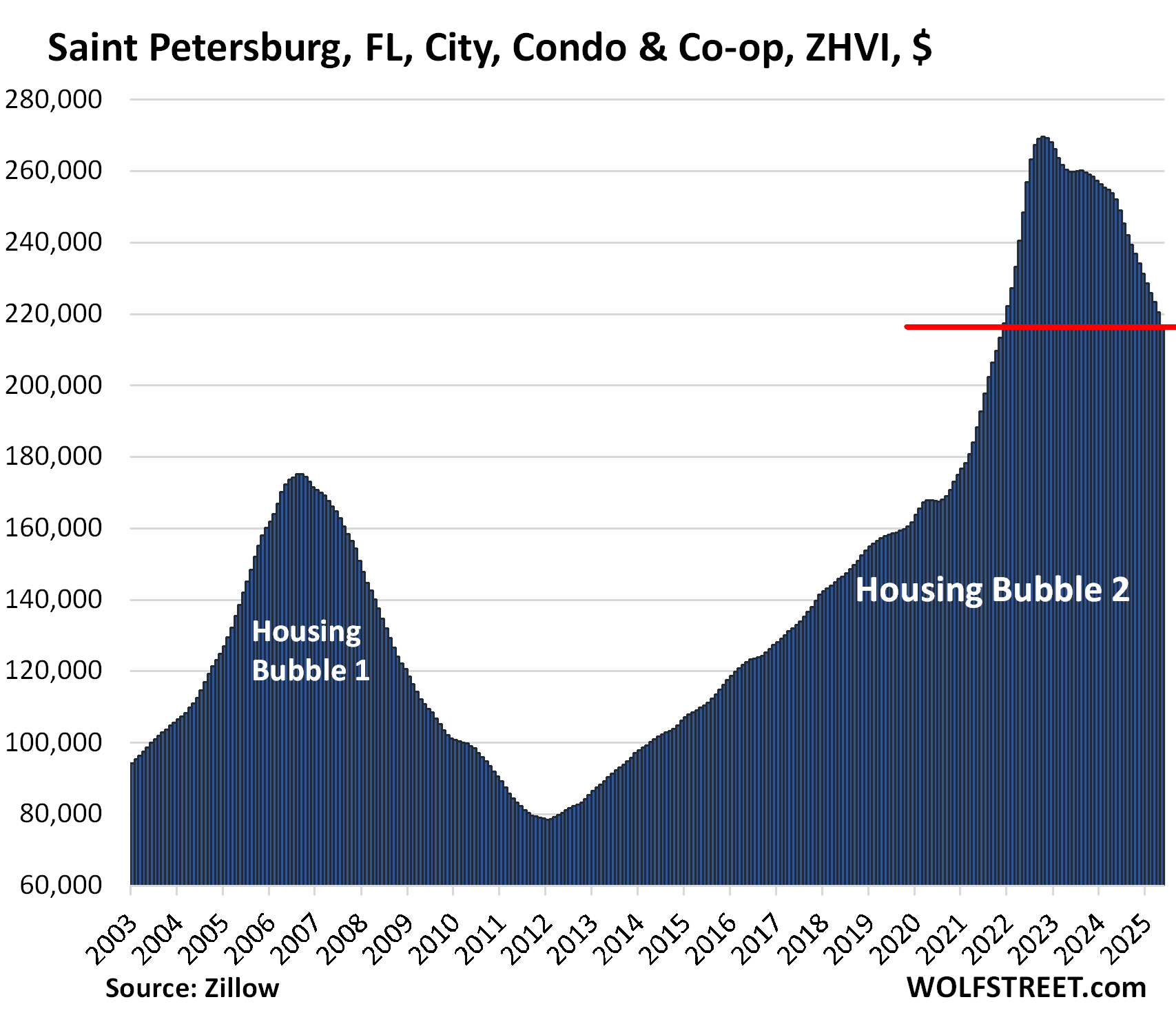

| Saint Petersburg, Fl, City, Condo Prices | |||

| From Oct 2022 peak | MoM | YoY | Since 2000 |

| -20% | -1.6% | -14% | 216% |

Lowest since October 2021.

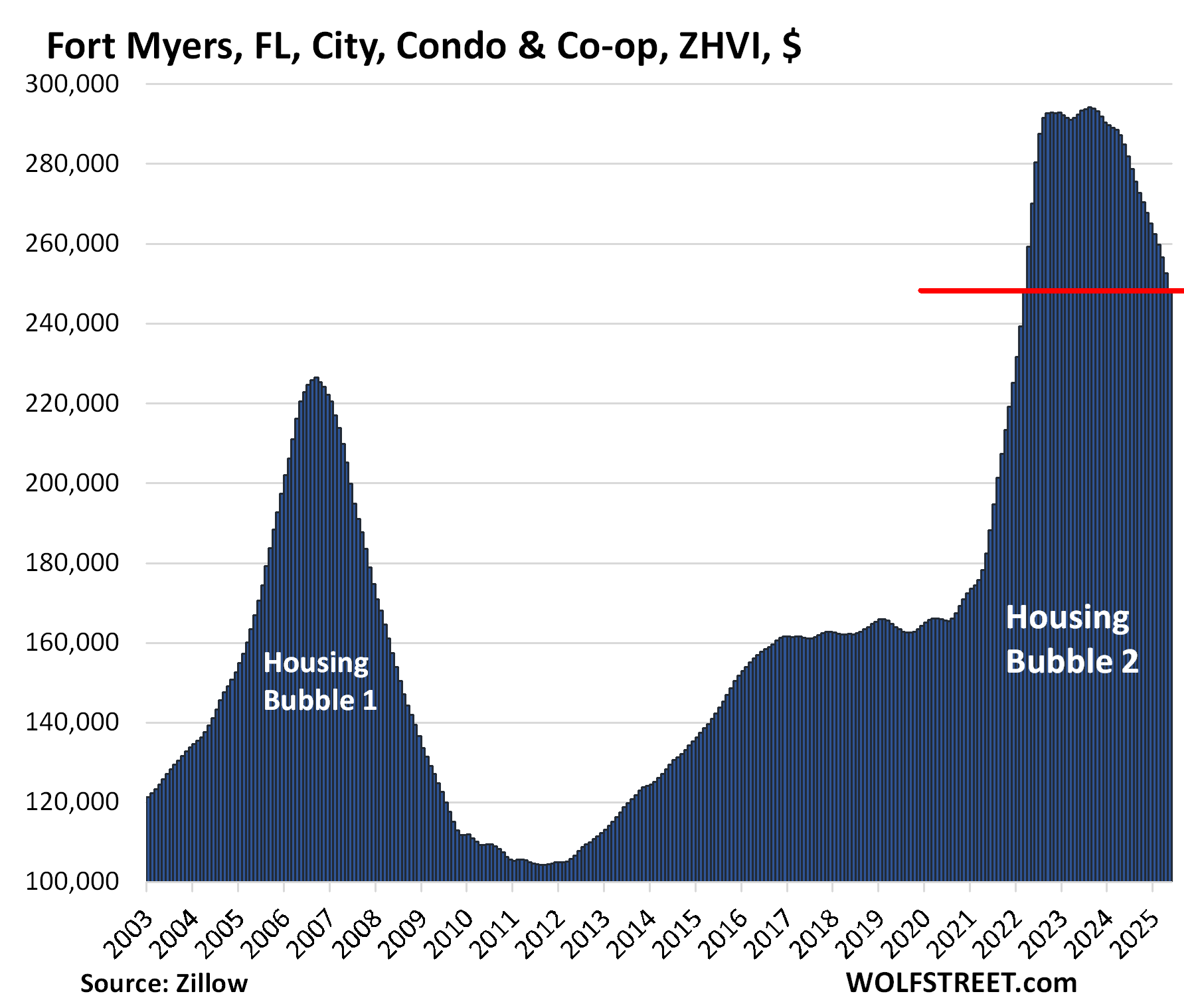

| Fort Myers, FL, City, Condo Prices | |||

| From July 2022 peak | MoM | YoY | Since 2000 |

| -16% | -1.9% | -13% | 152% |

Lowest since March 2022. Note the month-to-month plunge of -1.9%, seasonally adjusted. That was a drop of $3,500. That’s a big one, but it is dwarfed by the month-to-month spikes of around $10,000 in the spring of 2021 during the Fed’s QE extravaganza while inflation had begun to soar, on the much-hyped theory at the time: Buy real estate with a 3% mortgage, no matter what the price, to beat inflation.

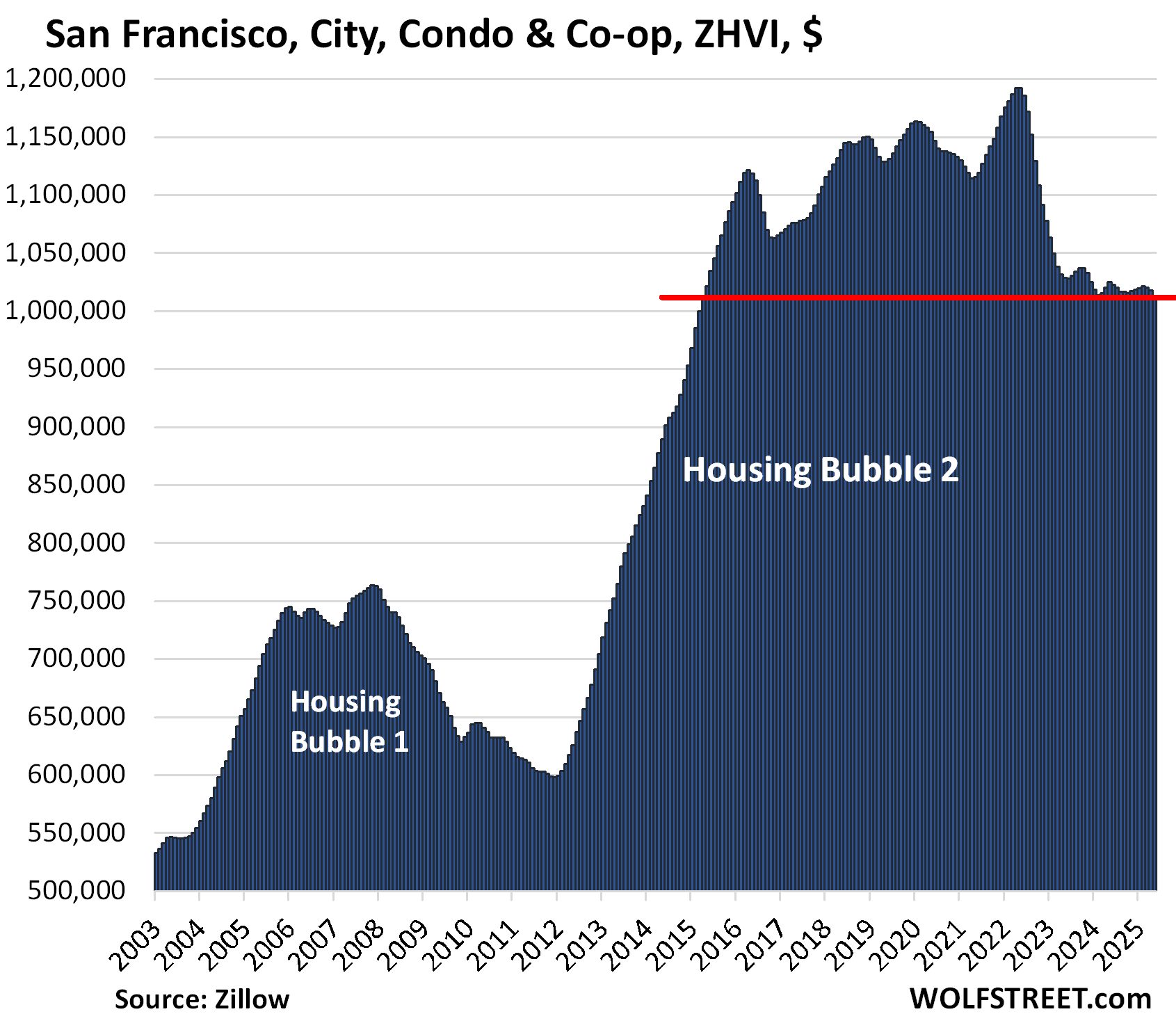

| San Francisco, CA, City, Condo Prices | |||

| From May 2022 peak | MoM | YoY | Since 2000 |

| -15% | -0.5% | -1.2% | 143% |

Back to March 2015.

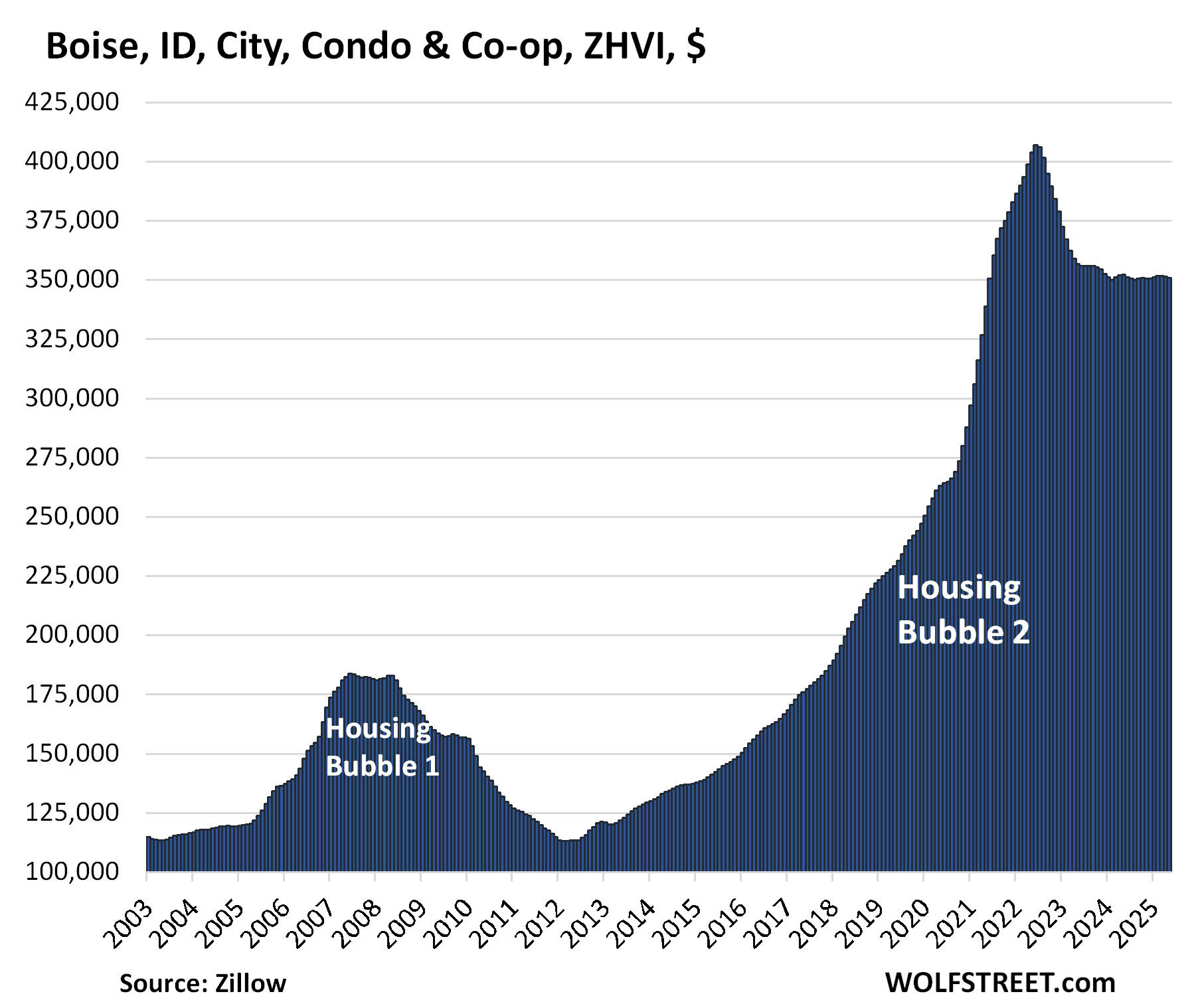

| Boise, ID, City, Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2001 |

| -14% | -0.2% | 0% | 221% |

Back to June 2021.

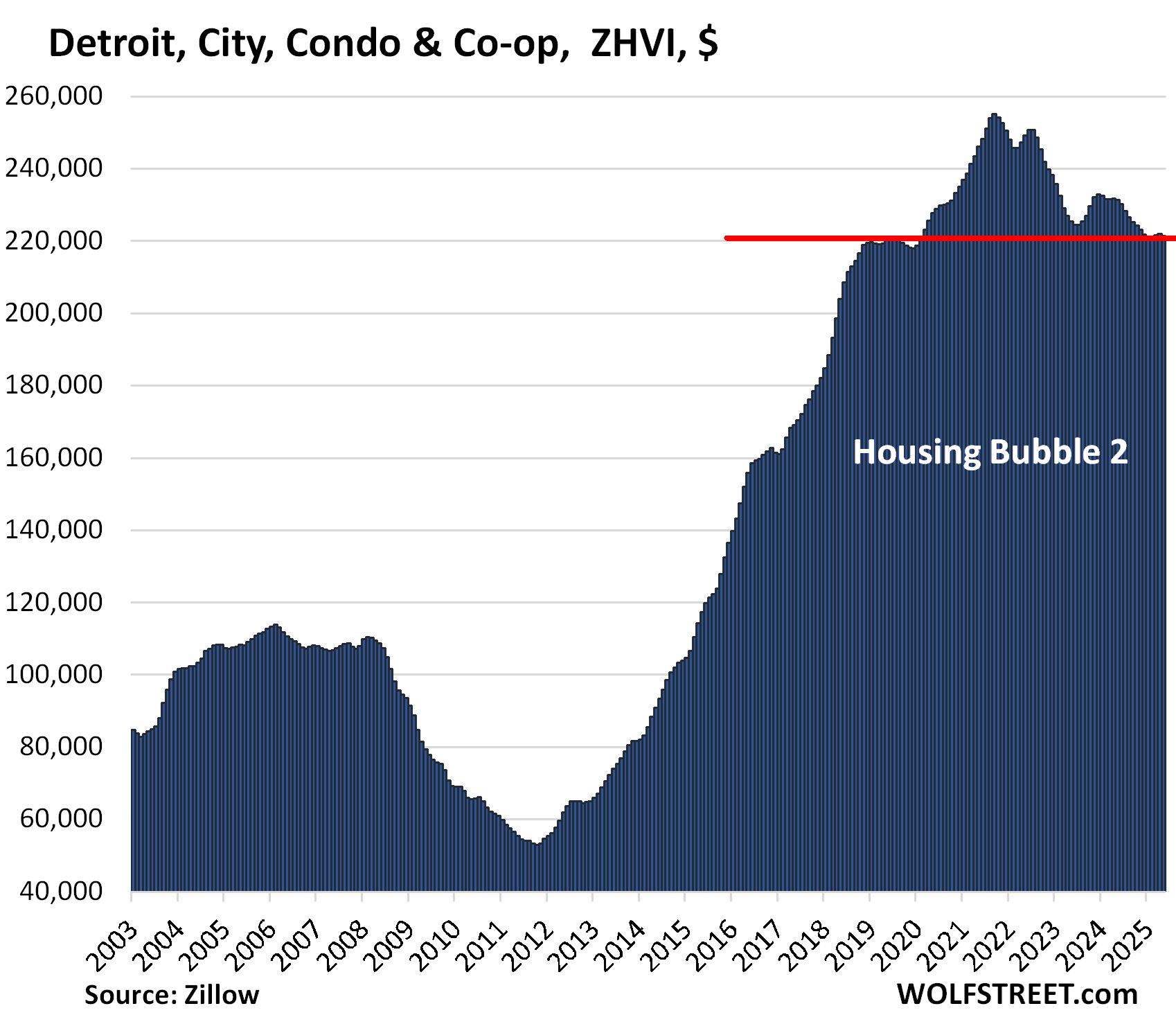

| Detroit, MI, City, Condo Prices | |||

| From Sep 2021 peak | MoM | YoY | Since 2000 |

| -13% | -0.2% | -4.3% | 271% |

Where prices had first been in 2018.

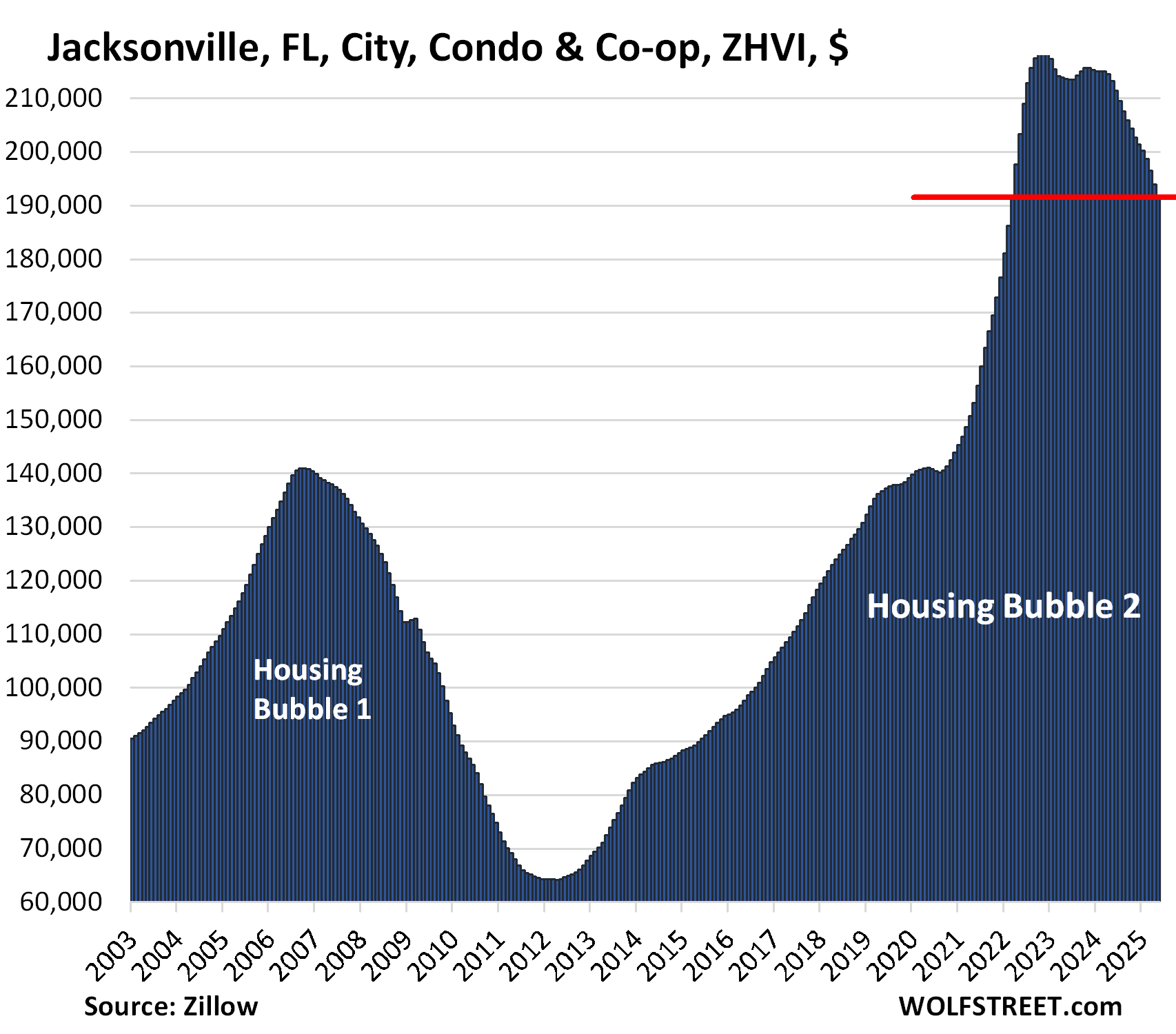

| Jacksonville, FL, City, Condo Prices | |||

| From Nov 2022 peak | MoM | YoY | Since 2000 |

| -13% | -1.3% | -10.2% | 164% |

Back only to March 2022.

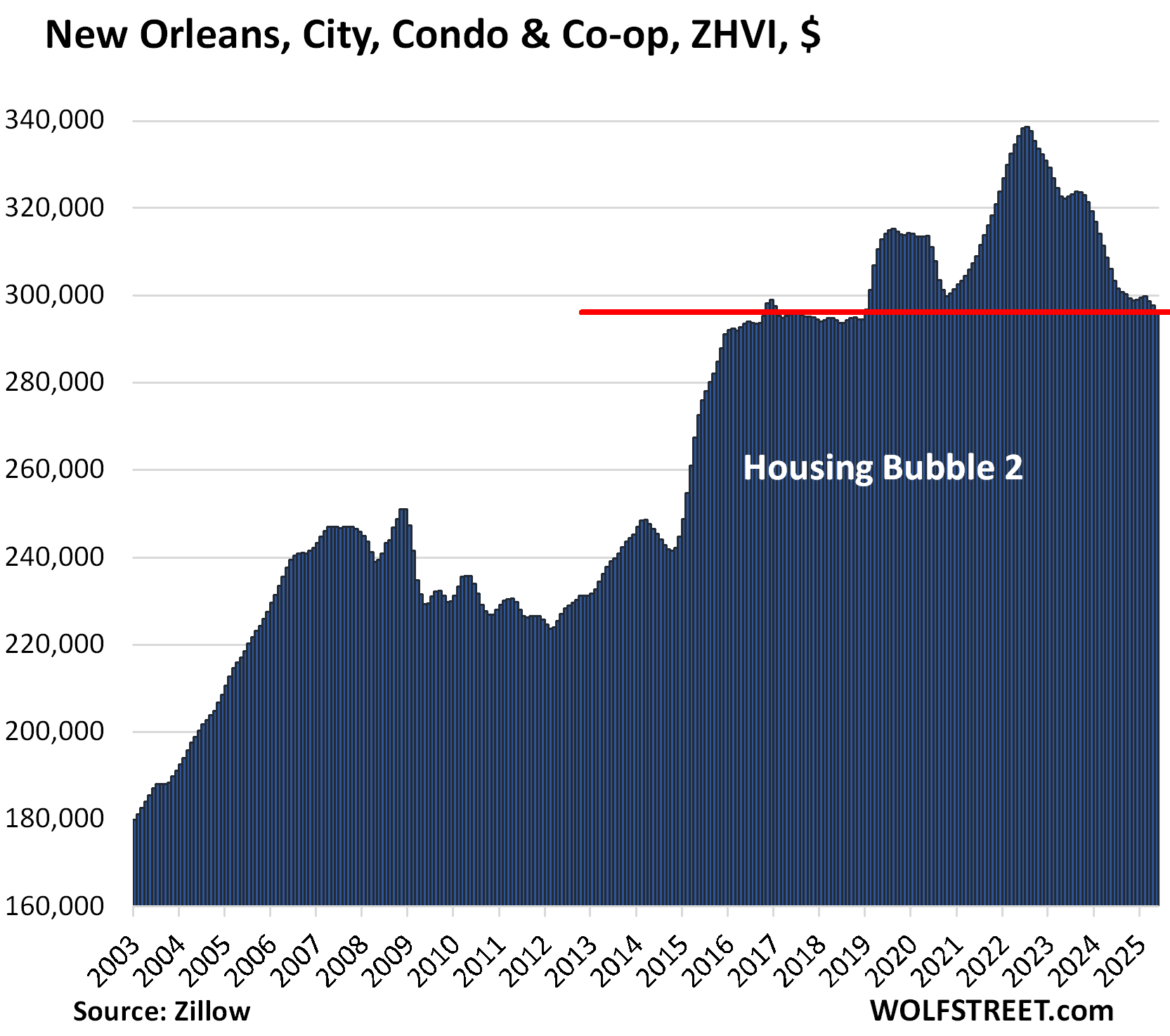

| New Orleans, LA, City, Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -12% | -0.4% | -3.2% | 100% |

Back to November 2016.

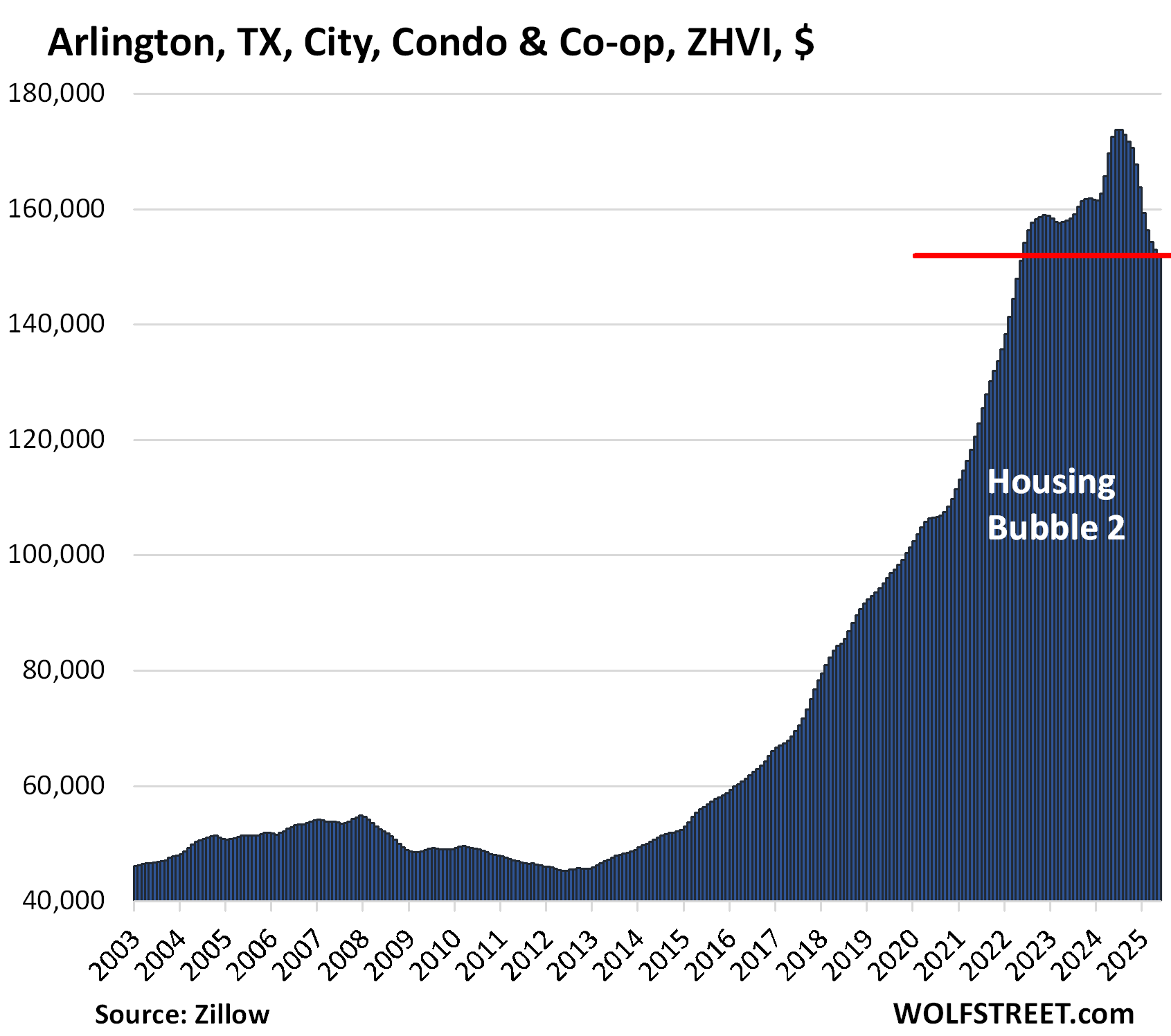

| Arlington, TX, City, Condo Prices | |||

| From Jun 2024 peak | MoM | YoY | Since 2000 |

| -13% | -0.7% | -11.9% | 246% |

Prices had soared by 262% in the 10 years to June 2024. Half of that increase came during the four years from mid-2020 through mid-2024.

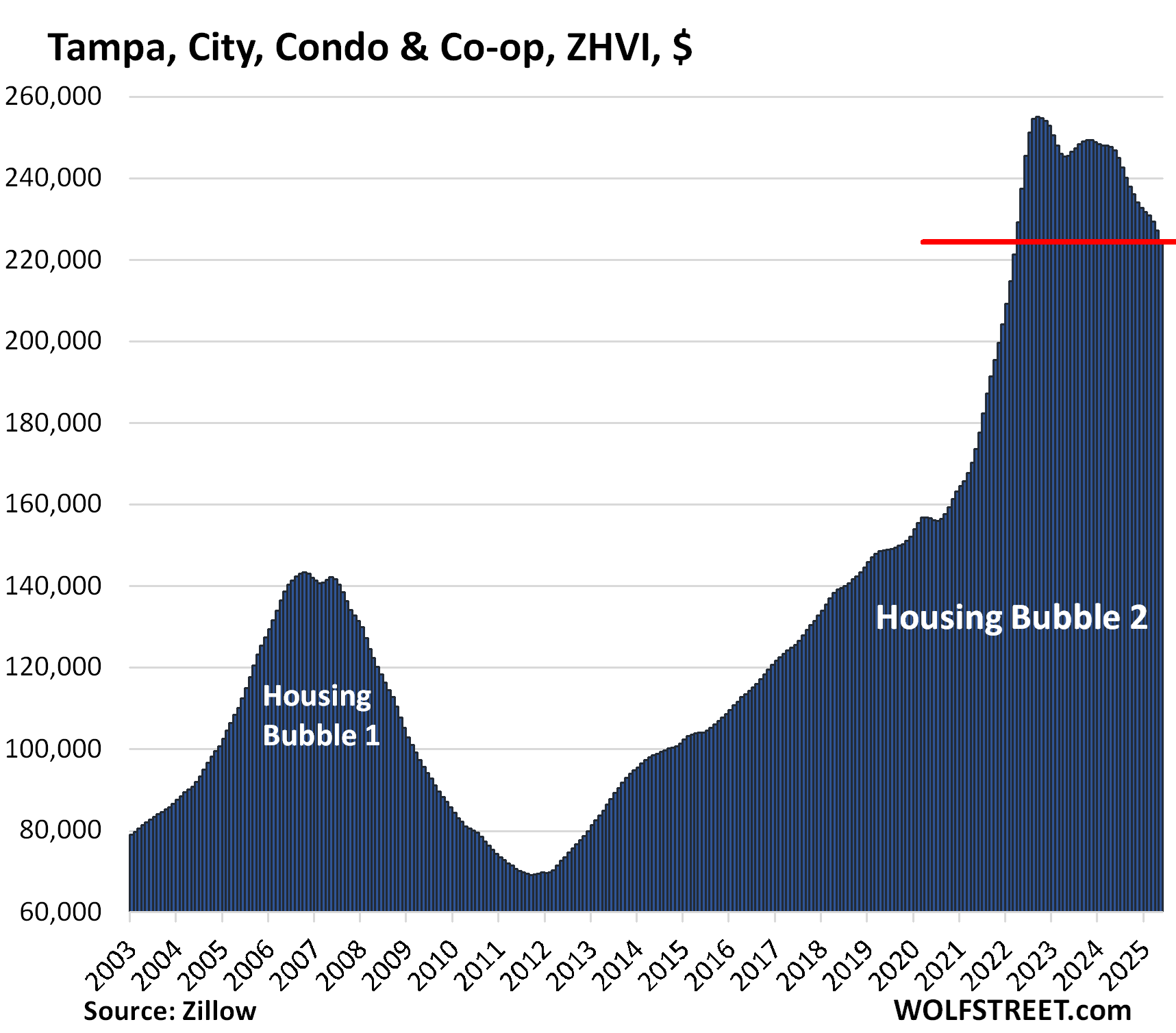

| Tampa, FL, City, Condo Prices | |||

| From Sep 2022 peak | MoM | YoY | Since 2000 |

| -12% | -1.1% | -9.0% | 285% |

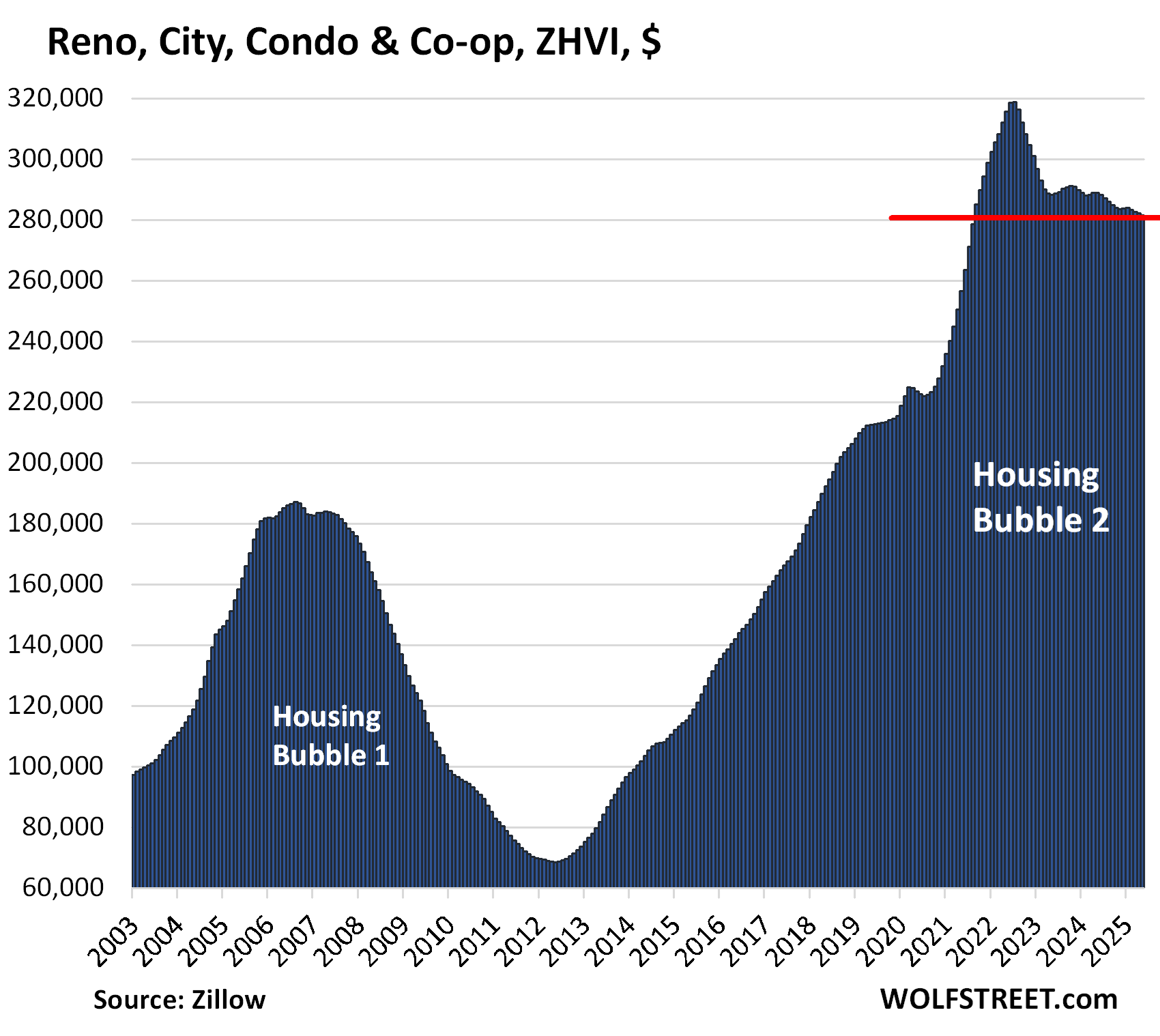

| Reno, NV, City, Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -12% | -0.2% | -2.6% | 255% |

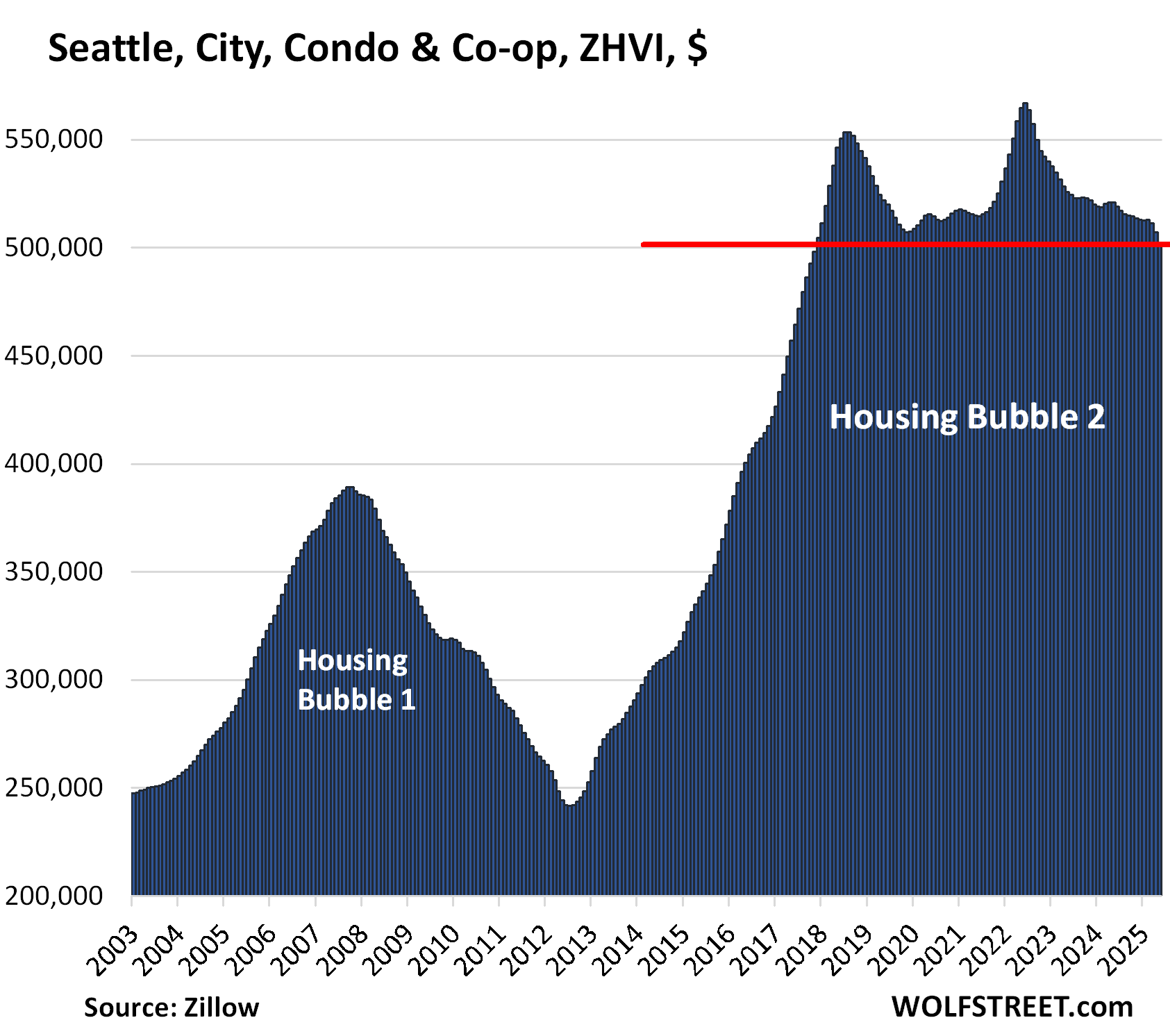

| Seattle, WA, City Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -12% | -1.1% | -3.8% | 143% |

Back to November 2017.

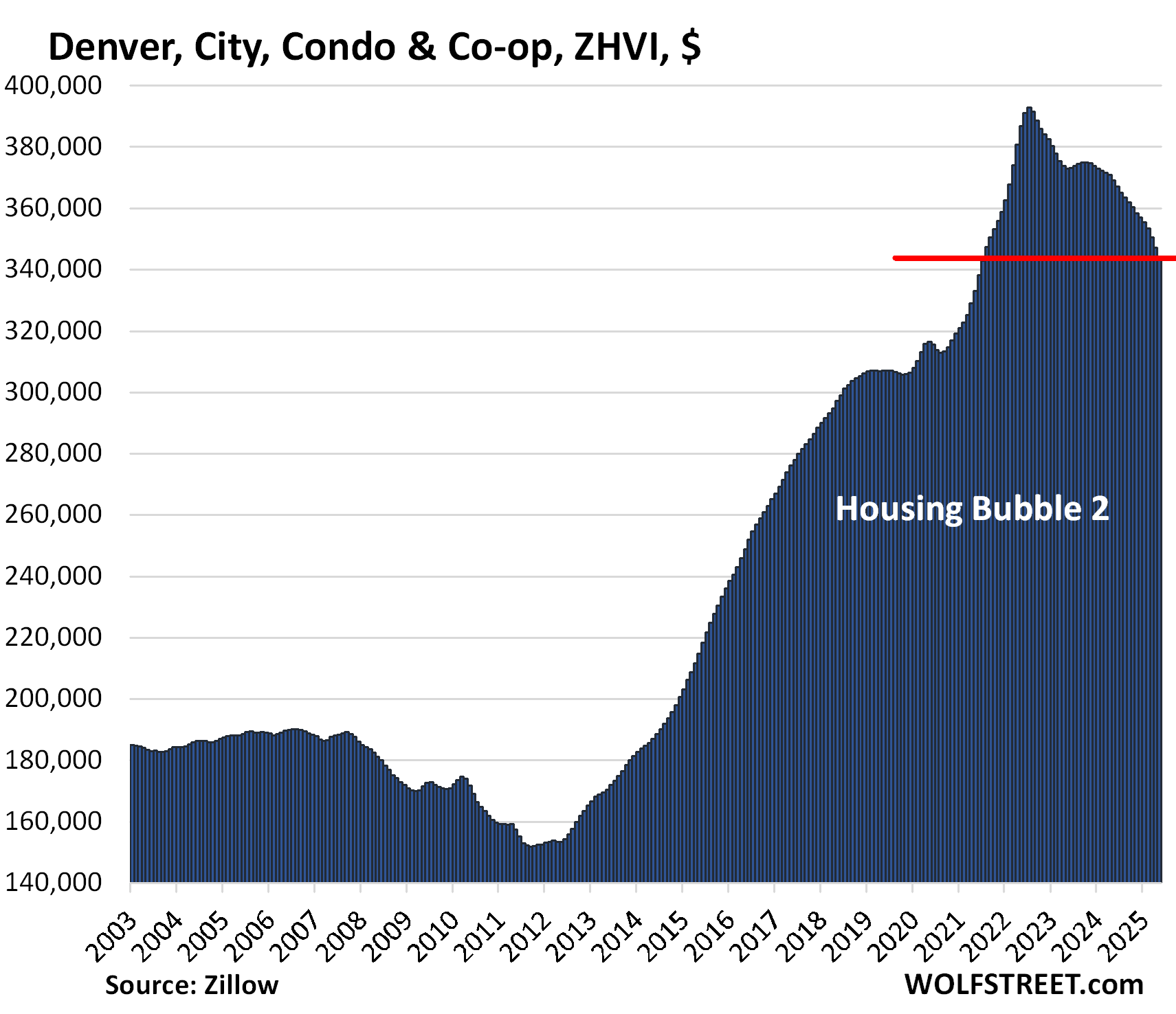

| Denver, CO, City, Condo Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -12% | -0.9% | -6.8% | 144% |

Back to July 2021.

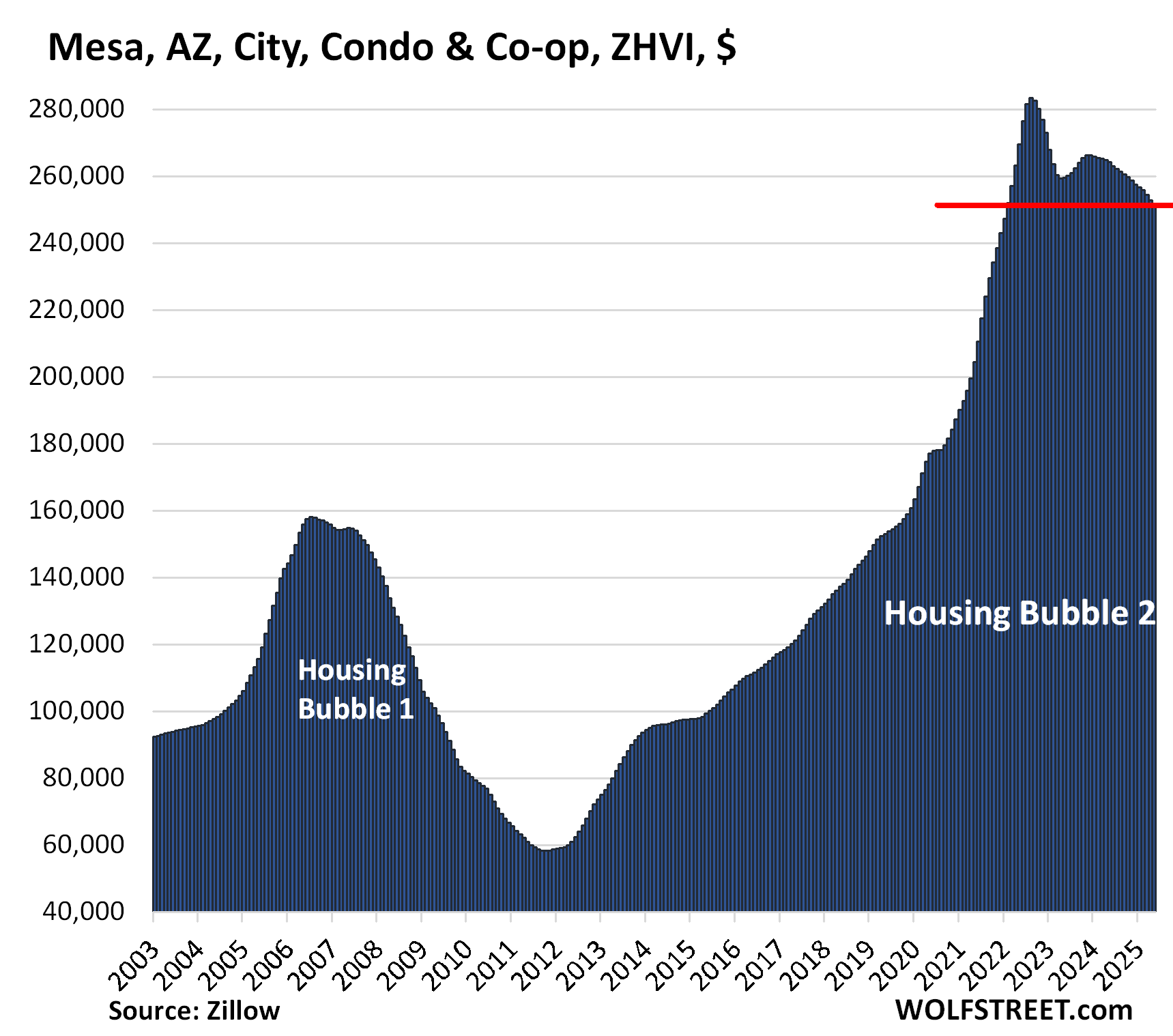

| Mesa, AZ, City, Condo Prices | |||

| From Aug 2022 peak | MoM | YoY | Since 2000 |

| -11% | -0.6% | -4.8% | 212% |

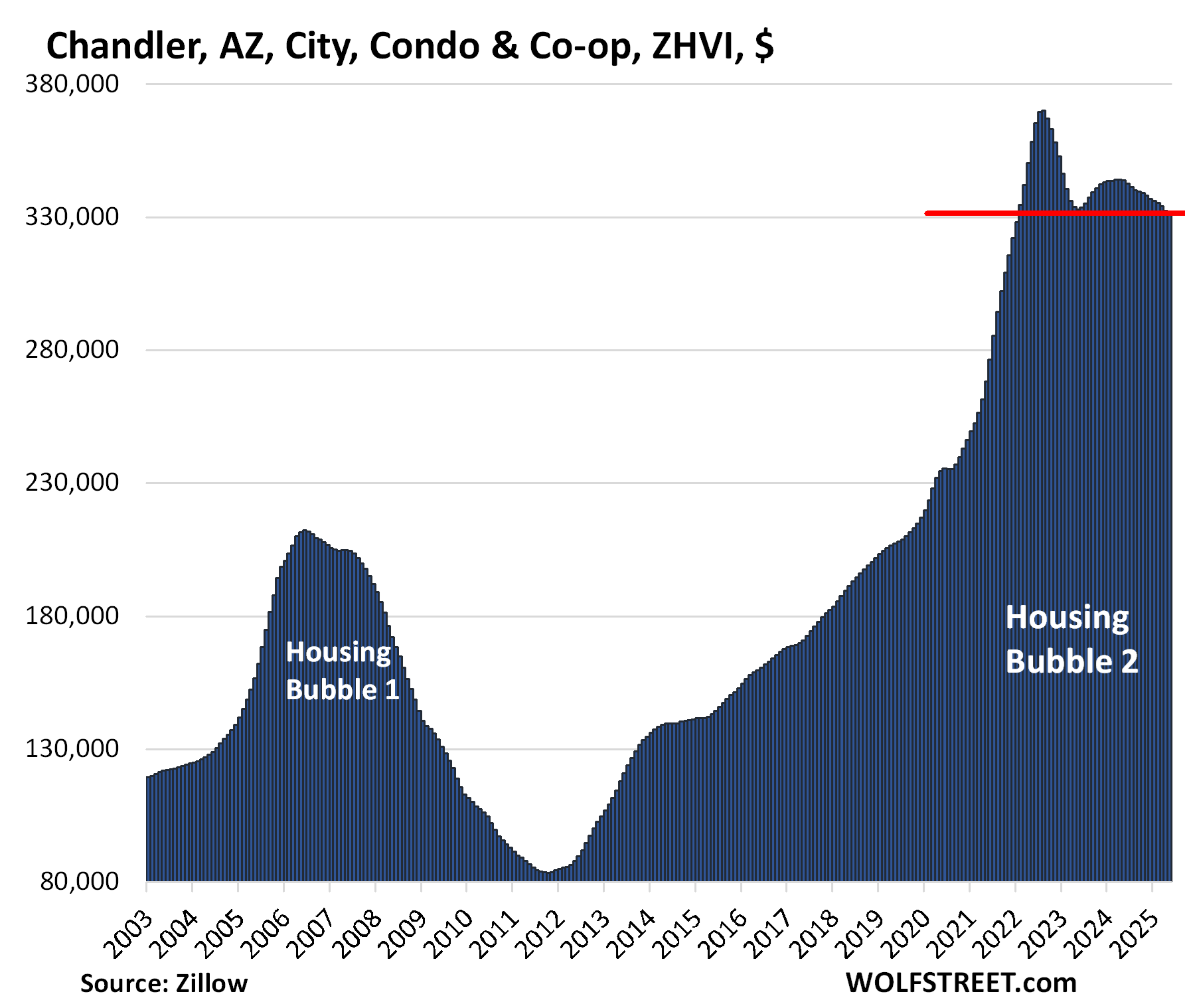

| Chandler, AZ, City, Condo Prices | |||

| From Aug 2022 peak | MoM | YoY | Since 2000 |

| -11% | -0.5% | -3.8% | 218.0% |

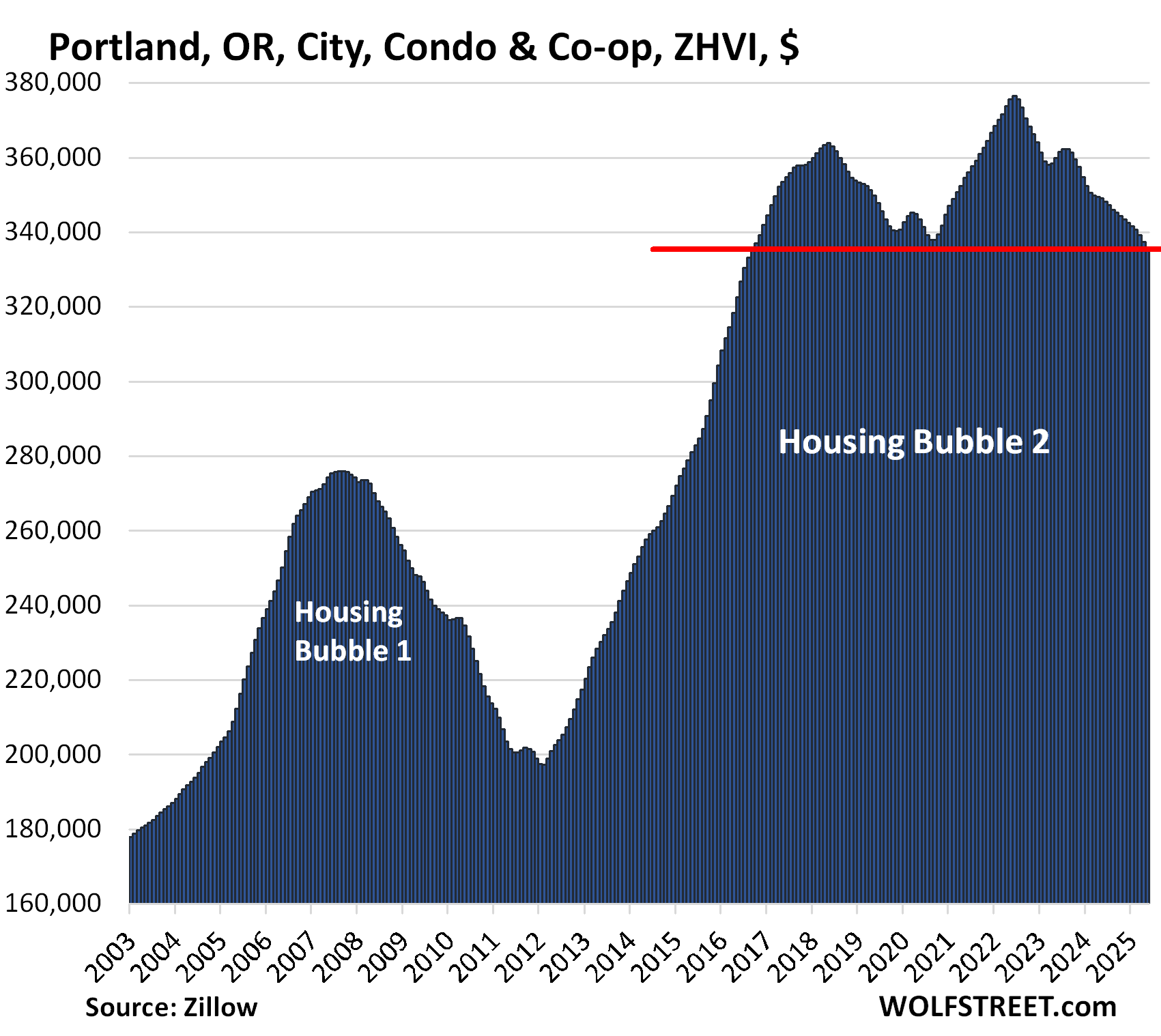

| Portland, OR, City, Condo Prices | |||

| From Jun 2022 peak | MoM | YoY | Since 2000 |

| -11% | -0.6% | -3.9% | 114% |

Back to August 2016.

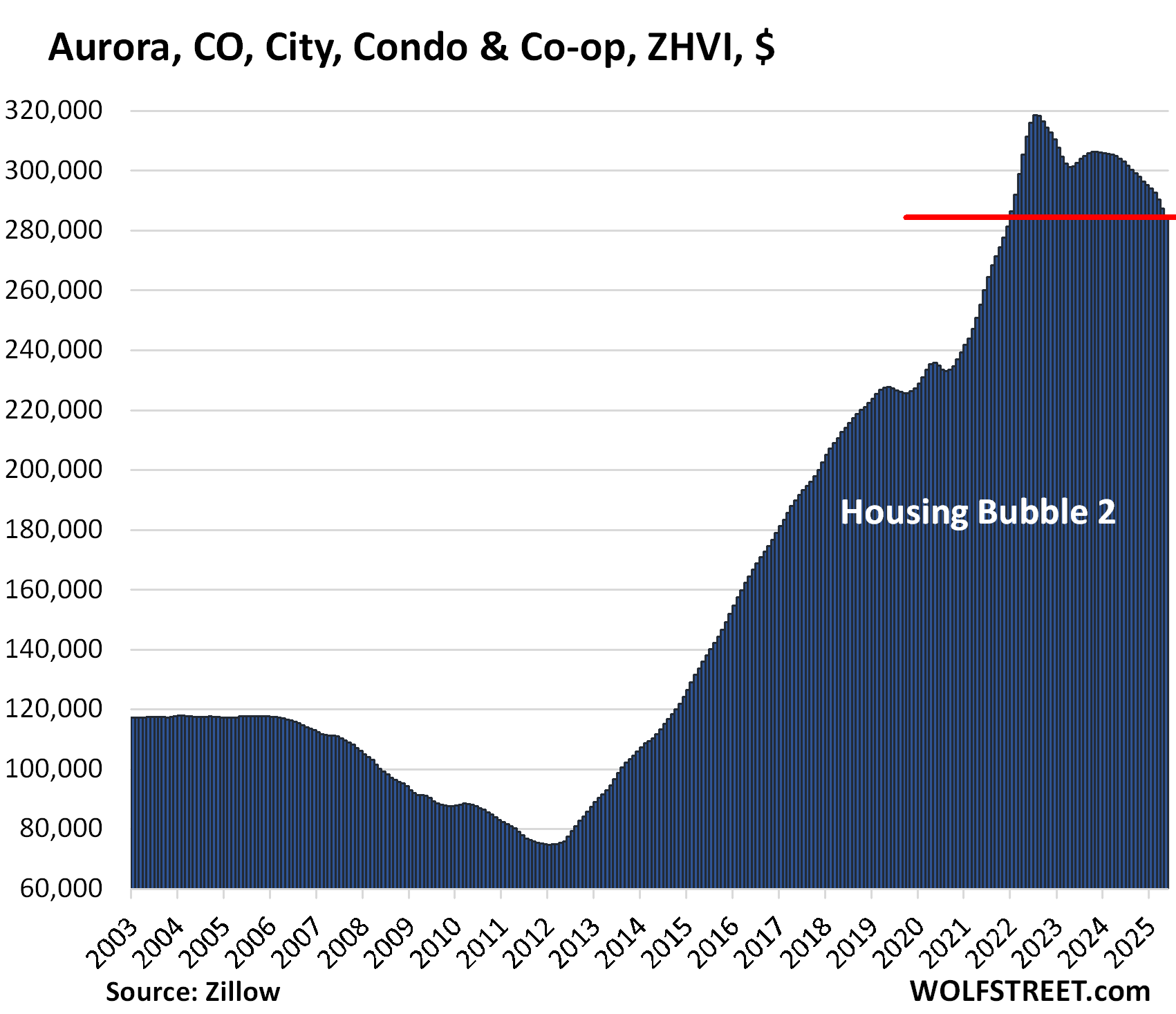

| Aurora, CO, City, Condo Prices | |||

| From Jul 2022 peak | MoM | YoY | Since 2000 |

| -11% | -1% | -7% | 216% |

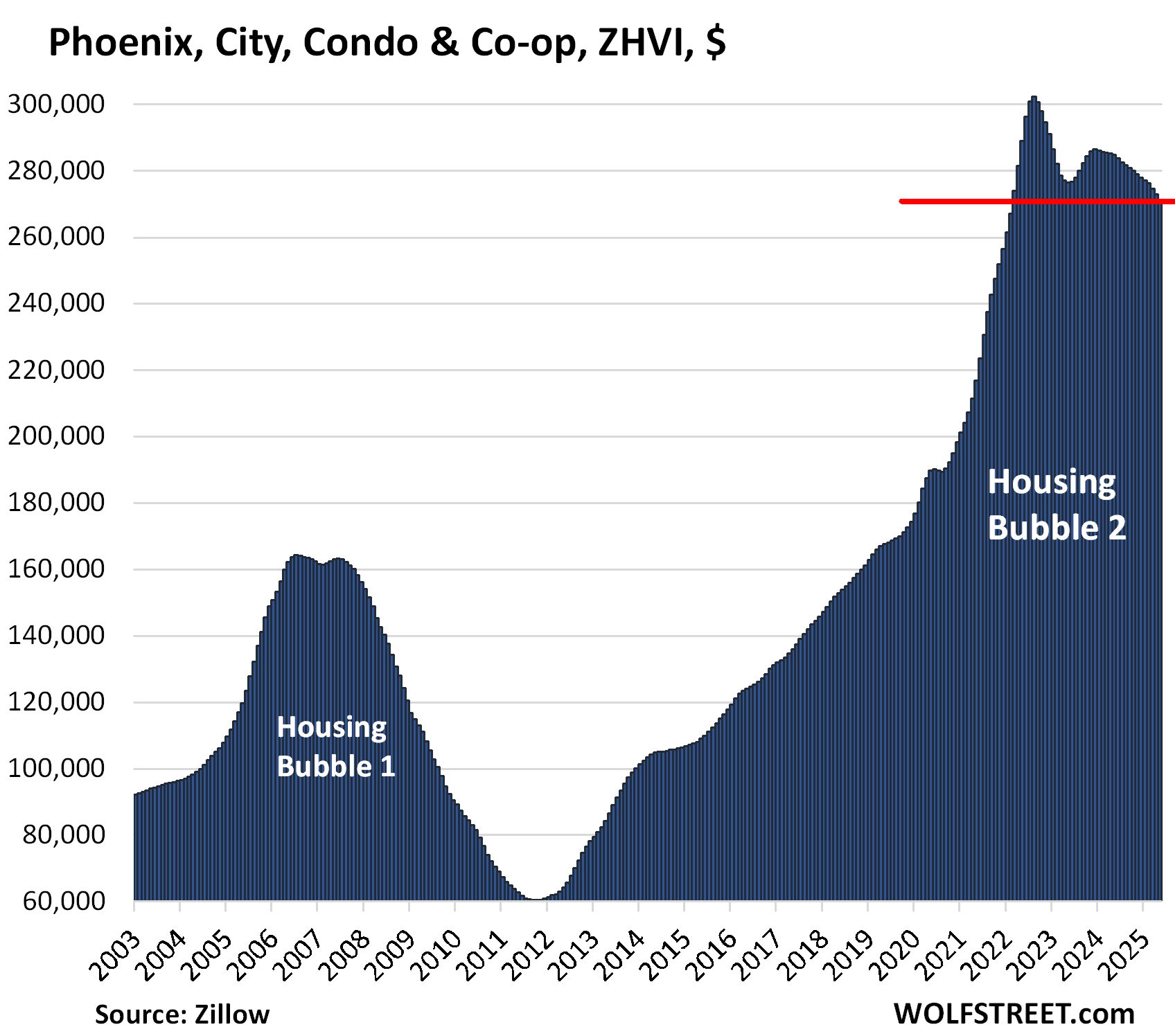

| Phoenix, AZ, City, Condo Prices | |||

| From Aug 2022 peak | MoM | YoY | Since 2000 |

| -10% | -0.7% | -4.8% | 243% |

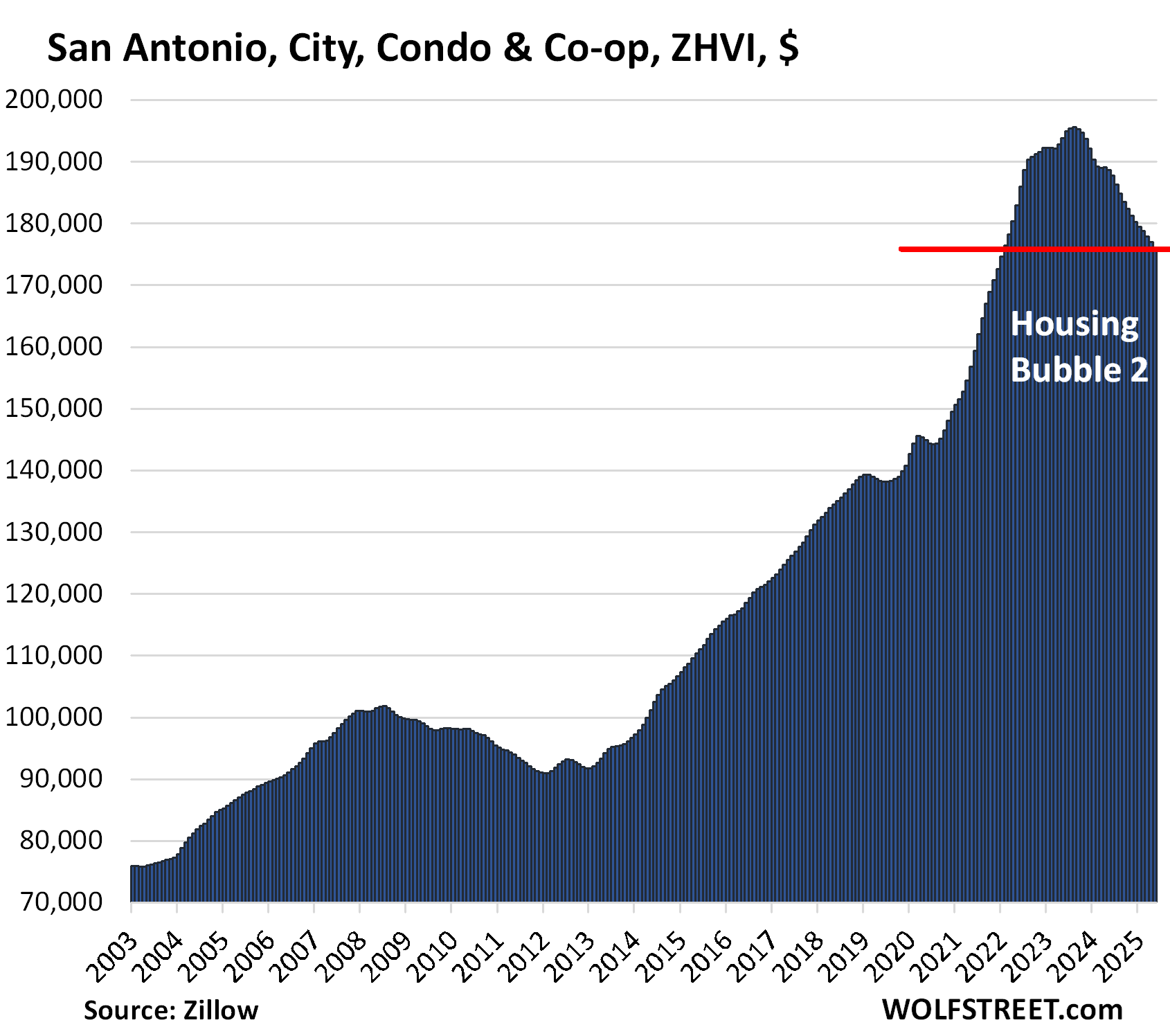

| San Antonio, TX, City, Condo Prices | |||

| From Aug 2023 peak | MoM | YoY | Since 2000 |

| -10% | -0.5% | -6.7% | 133% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Maybe this is getting more obvious even in SoCal, currently you do see a lot of condos asking for ever higher, probably even the highest rent from the owner. Think a lot of these owners, especially investors are backing out from selling and someone has to pay for their sky high mortgage (especially if they bought in the last 3-4 years) and escalating HOA and property insurance. Hopefully people aren’t biting paying $4k+ for some crappy condo. These people need to be force sell and eat their loss and not find a way out of it.

The good news is that nobody pays rent that is too high just because they think the rent might go even higher in the future.

Thanks WR for this report.

Condos are the first to fall then SFR follow.

Hoping prices come back to sane levels.

I definitely see this here in Denver. As mentioned before, my adult daughter teaching school here is waiting out this price drop in real time.

Good luck to her. During the last bubble prices dropped for five years, but the big drop occured the first year. I expect the same this time around. Once prices start dropping after a huge multi-year rise, a lot of smart sellers react. A little buyer patience can pay off big.

As long as there are buyers waiting breathlessly on the sidelines to jump into real estate at the slightest fall in price, we’re not going to ever see much of a decline at all in overall prices.

But they aren’t, obviously.

Will be interesting to watch over the next few months. I feel the price decline will accelerate until prices get back in line with incomes.

The prices still have a ways to go before normalcy is reached.

What price do you consider ‘normal’ for oil per barrel? $10 or $100?

San jose?

Coming along but doesn’t qualify for this list yet. Minimum requirement is a drop of 10%. San Jose MoM: -1.4%, YoY: -2.7%, from peak-3.8%. Patience.

San Diego is similar.

Let’s go Oakland! Market is very soft out here and really hoping this is a multi year trend shaping up. Would really love to finally pick up a nice discounted house and lock in that low property tax for the long haul. Didn’t have the means after 2008, but I’m very prepared this time and really hoping for the opportunity. Thanks Wolf!

Yeah Wolfman,

Beach condos in Panama City Beach are for short term rental investors charging +$350 a night for 1 bedroom during season and $150 a night off season (plus cleaning and administrative fees).

These beach condos HOAs are at least 90% non homestead exemption, with a vast majority being owned by those living out of state.

Shores of Panama (built around 2006, 23 stories, 709 units, around $750/month for HOA assessments for 1 bedroom) had a tumultuous period back in 2022 based on the News Herald articles where the owners sued the HOA board for a ~$9 million special assessment.

A lot of those deep-pocketed bubba owners from Atlanta, Huntsville, Nashville, etc come down a few weeks a year to stay in their beach condo units like at Shores of Panama.

I live in a mature, built-up suburb with few available sites for new development. There had been a flurry of proposed smallish condo developments on repurposed lots such as abandoned schools or small commercial properties. Developments were for multi-story, “luxury” with amenities like roof top social and fitness areas but with skimpy parking. and green space. City planners loved them and beat down NIMBY complaints by residents. In June 2022 a local small businessman decided to try development and applied for a permit to build a 46-unit condo across the street from me. Four years later nothing has happened. Many other area projects have also stalled, and developers do not answer calls from reporters from the local newspapers.

Of interest is the SP global mortgage backed securities index graph. It was 148.29 on July 8,2020. On Jan. 3, 2022 the index was 146.57. By June 14, 2022 it had fallen to 130.52. On June 18, 2025 it is 138.07.

Could the MBS indices be a leading indicator of future housing prices?

The Washington DC condo market is holding up well. Main reason, WFH has ended, people are forced to move back closer to work, traffic jams are horrendous as people abandoned public transportation during the pandemic and are slow to go back, and the price of townhouses are still out of sight and unaffordable for most government workers. A lot of the sale of condos are new renovations and conversions. Wolf has the charts.

I’m seeing a drop in short term rental price and increased vacancies in the (larger) summer mountain resort towns this year. Even last year places would be booked up by now, and it is possible to get a great deal last minute now, harder to do in the last several years.

Their condo for sale listings don’t have such a change yet, but it’s hard to sort out who really needs to sell in fractional ownership types of places.

Ive always wondered why New York Metro area or specifically Long Island isn’t included in these studies/reports. It seems like everything gets snapped up here regardless of price. I have noticed that homes coming up for sale, while Redfin and other sites say the % has increased, they seem to be sitting a lot longer. Not sure on the status of rentals, maybe they are in higher demand as people ‘sit on the sidelines’ waiting for the right time? You have any data on this Wolf?

I understand that while we have a lot of rental units around, I don’t think we’re a vacation destination like Florida/Texas/Cali.

I would say NY Metro/Long Island is similar to the San Diego/Orange County markets in California. People with lots of money, from many places. Usually these places are the last ones to show up in the data.

NYC is 100% a vacation destination. The amount of tourists in NYC alone in 2024 was equal to the amount of tourists who visited all of Texas in 2024. When I worked in Manhattan pre-Covid, the amount of tourists to fight through daily was absolutely mind boggling. Yes, California and Florida are on another level by themselves.

Yeah I almost forgot about NYC itself. When the crazies were allowed to roam the city and heckle/harass people, plus the congestion tolls, I stopped going in. Wife and I used to enjoy a date night every once in a while in the city and now we don’t bother at all.

I was leaning towards more of a beachy/sun filled skies type of ‘vacation destination’ lol. I dont go to San Diego to see the zoo or visit the town center, I go for the beach front resorts.

There is still plenty of wealth floating around here.