Treasury Yield Curve Steepens. Bond Market a Wee Bit Nervous?

By Wolf Richter for WOLF STREET.

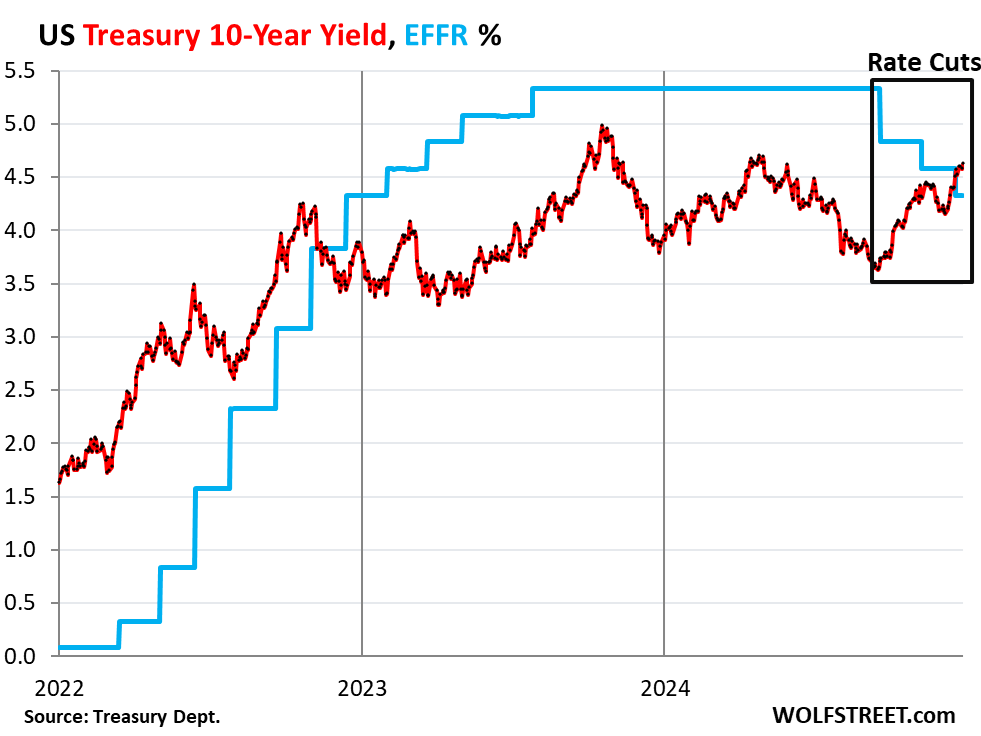

Treasury yields and the now un-inverted and nicely steepening Treasury yield curve passed another landmark on Friday, maybe the first such landmark ever: While the Fed cut its policy rates by a full percentage point, long-term yields have risen by a full percentage point.

Since September 16, the low point two days before the rate cut, the 5-year yield has risen by 106 basis points, the 7-year yield by 105 basis points, the 10-year yield by 100 basis points, and the average 30-year fixed mortgage rate by 100 basis points.

The 10-year Treasury yield reached 4.62% on Friday, the highest since May 1 (red), while the Effective Federal Funds Rate (EFFR), which the Fed targets with its policy rates, was 4.33% (blue). This equal move into opposite directions of the EFFR and the 10-year yield is amazing.

The yield curve steepened nicely after un-inverting entirely.

With longer-term Treasury yields rising, while short-term Treasury yields haven’t changed much during the week – no longer pricing in any rate cuts during their time window – the yield curve has steepened further, after it un-inverted entirely a week ago.

At the longer end, 5-year and 7-year yields rose by 8 basis points during the week, while 10-year and 30-year yields rose by 10 basis points, with the 30-year yield rising to 4.82%, the highest since April.

The chart below shows the yield curve of Treasury yields across the maturity spectrum, from 1 month to 30 years, on three key dates:

- Gold: July 25, 2024, before the labor market data spiraled down (which was a false alarm).

- Blue: September 16, 2024, the low point two days before the Fed’s initial cut.

- Red: Friday, December 27, 2024.

Even though the yield curve has gently steepened this week, it remains fairly flat, with only a 31-basis point spread between the 2-year yield (4.31%) and the 10-year yield (4.62%), but that spread has widened from 22 basis points a week ago.

In other words, investors are accepting still low term premiums. But when the yield curve was inverted until recently, longer-term yields were lower than short-term yields and the term premium was negative.

As the yield curve normalizes, it will steepen further and term premiums will rise. This could happen in two ways: With shorter-term yields falling or with long-term yields rising, or both.

Why the divergence of the 10-year yield from the EFFR?

Among the primary reasons the Fed cut its policy rates by 100 basis points, as it pointed out many times, were the loosening labor market conditions and the substantial cooling of inflation since mid-2022.

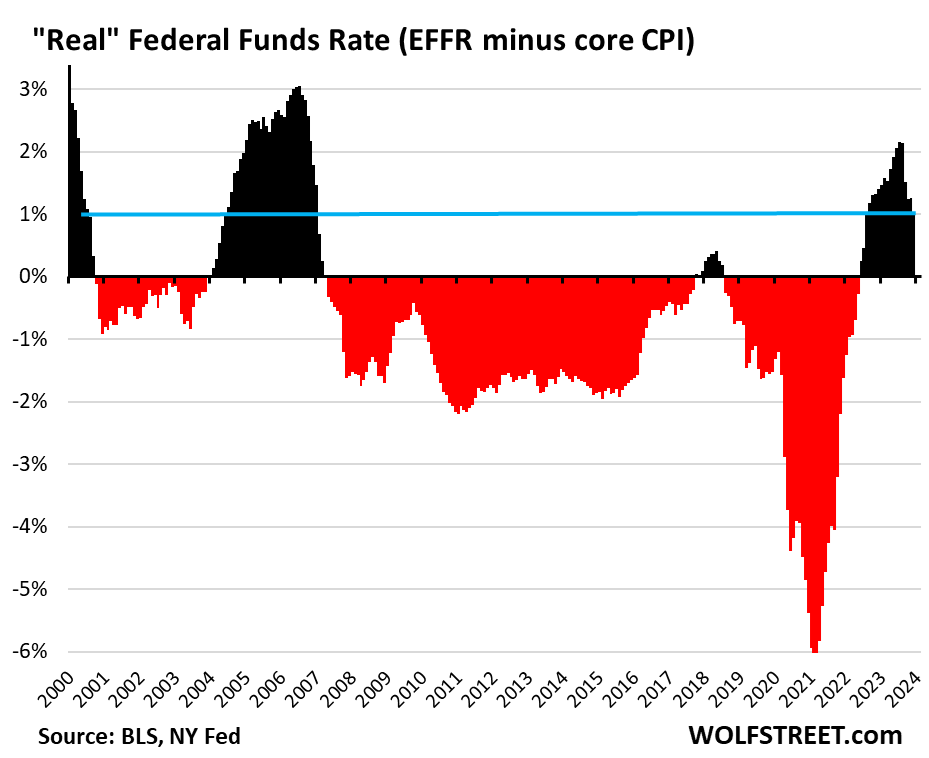

The labor market remains relatively solid, but it shouldn’t loosen further, the Fed said. And inflation has cooled from the highs in 2022, with all major inflation rates – CPI (2.7%), core CPI (3.3%), PCE price index (2.4%), and core PCE price index (2.8%) – well below the Fed’s policy rates and well below the EFFR (5.33% before the cuts, 4.33% currently).

With inflation rates lower than the EFFR, the “real” EFFR is positive (adjusted for inflation). Compared to November core CPI, the highest of the main inflation readings at 3.3%, the real EFFR currently is +1.0%. Since 2008, the real EFFR was mostly negative.

But the Fed didn’t cut because it saw a recession coming. Seeing a recession is the normal reason for cutting rates, but the economy has been growing at a pace that is substantially higher than the 15-year average, there is no recession in sight, and economic growth seems to have picked up in the second half, running above 3%.

The fact that the Fed has hiked rates so fast and so far, and has kept them there for so long, and that inflation has cooled so much, without the economy going into a tailspin, but cruising along at an above average pace, is historically unusual.

Faster economic growth often leads to higher longer-term yields. Conversely, recessions lead to low longer-term yields. Normally when the Fed starts cutting rates, it sees a recession, and longer-term yields are falling along with the Fed’s policy rates because the bond market too is seeing that recession.

But this time around, the Fed cut amid above-average economic growth with no recession in sight – so that’s unusual – and longer-term yields have risen amid this solid economic growth.

The bond market is getting a wee bit nervous.

Inflation concerns are now re-emerging. It has been warming up again in recent months. The Fed itself at the last meeting projected a scenario of higher inflation by the end of 2025 than now, and higher “longer-run” policy rates, and its reduced its projections for rate cuts from four to just two in 2025 for those reasons. Powell at the press conference said that the rate cut had been a “close call,” and doubts emerged during the press conference that there may even be two cuts next year.

And there are concerns that continued stimulative fiscal policies and additional tariffs will provide further fuel for inflation.

In addition, there are rising concerns in the bond market about the ballooning US debt, and about the flood of new supply of Treasury securities that the government will have to sell in order to fund the out-of-whack deficits. Treasury buyers and holders are spread far and wide, but higher yields may be necessary to reel in the mass of new buyers needed, even as the Fed is shedding its Treasury holdings through QT.

These are worrisome thoughts for potential buyers of long-term Treasury securities; they want to be compensated through higher yields for the risks of higher inflation and the risks this flood of new supply might bring.

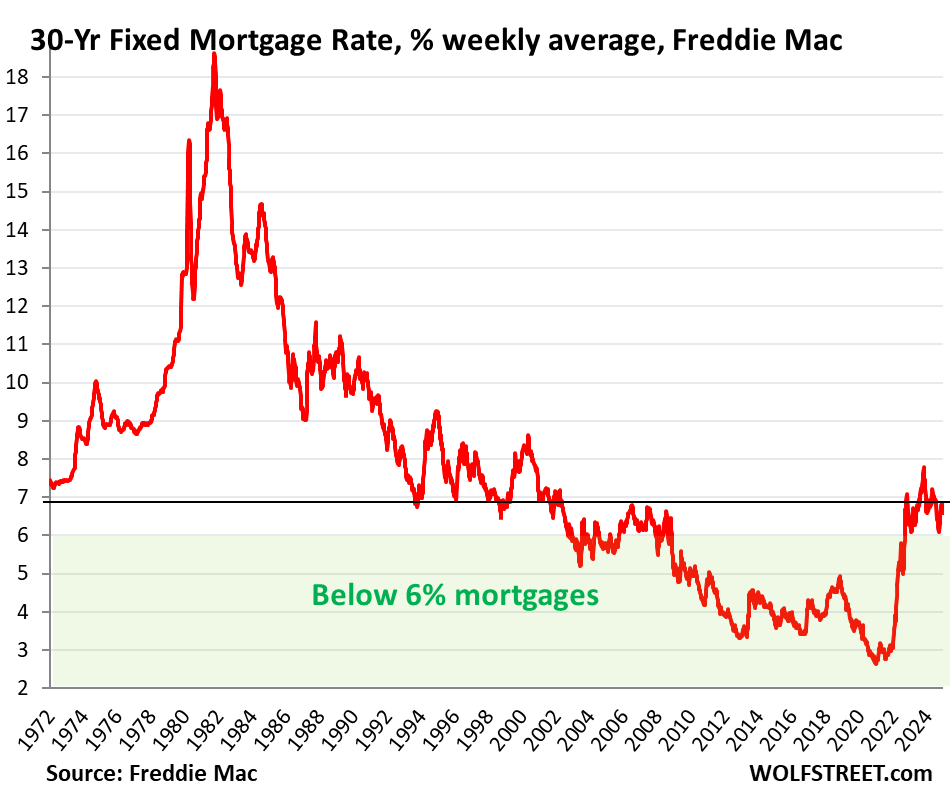

Mortgage rates back around 7%.

Since the rate cut in September, the average 30-year fixed mortgage rate has risen by 100 basis points, from 6.11% to 7.11% on Friday, according to the daily measure from Mortgage News Daily.

The weekly measure from Freddie Mac has risen by 77 basis points over this period, to 6.85%. These higher mortgage rates despite 100 basis points in rate cuts have driven the real estate industry up the wall.

But those 6%-plus mortgages were normal in the decades before 2008, even during times of rate cuts. It’s only after 2008, when the Fed’s QE and interest-rate repression distorted everything, that these low-rate mortgages began to mess up the housing market. So maybe it’s time to get re-used to these kinds of mortgage rates that were normal before 2008.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How high will the yield on the 10-year US Treasuries go in 2025?

The bad fundamentals, rising Inflation and rising Bond issuance by the U.S. Treasury ( given $2 Trillion deficits and Yellen/Biden issuing heavily in short term T Bills instead of locking in low interest rates) create a major problem

If history repeats itself, longer term bond yields will rise until something serious breaks in the economy or markets .

Certainly reaching 6% Ten year bond yields would do the trick.

Maybe lower.

+6% mortgage rates were not unusual before 2008 but the rise in the cost of homes makes them unaffordable at that interest rate.

Basically, a cogent analysis that describes my understanding.

With a nagging feeling that the game is rigged.

Silly, me. Looking at a graphic of American worker productivity versus their wage makes me commit to trying to live in the make believe world that I grew up in.

Which has survived calamitous. erroneous historical decisions like Vietnam and Iraq.

This is my prediction for 2025.

Mr. Richter, I am an old commodity trader used to trading spreads in futures markets. What is “full carry” in a yield curve like we have in government securities? Perhaps there is a trade here – buy the 2 year note and sell the 30

Year bond at “full carry” and wait for a recession.

What do you think?

“…and wait for a recession.”

How long are you willing to wait for that recession and pay the carrying costs of the trade? People have already been waiting for that recession since July 2022.

David Rosenberg said if a recession didn’t happen in Q1 2024 he would have “egg on his face” guess he has been eating a lot of eggs this year LOL … probably like a lot of pundits.

Rosenberg was one of those who spent the entirety of 2023 shrieking for a Fed pivot back to easing–because of course the economy was *this close* to a catastrophic lapse into recession. And he’s spent the last few months doing the exact same thing, now calling for a steady diet of 50bps cuts. Being a pundit means never having to say you’re sorry.

You make money only if the spread between the 2-year and 30-year remains unchanged or narrows (flattens). However, if the 30-year bond yields rise or 2-year yields fall, or both, then you lose money.

Assuming that the interest rate is a randomly distributed variable as defined by the codified, romance of the normal distribution.

I presume that the interest rate is determined by a committee of wealthy people to whom we have ceded our rights.

There was a 40-year downtrend in bond yields from 1980-2020. Yields will probably trend up for at least a decade, especially if the dollar gets devalued to make interest payments affordable. Up for 3-4 decades is certainly possible if deficit spending (and monetary expansion) continue. Just my opinion.

There are 3 ways to address 36 Trillion in debt.

1) Raise taxes- not happening.

2) Cut spending- good luck.

3) Print more and inflate your way through it- bingo.

Long rates continue to climb.

If taxes were raised and there was a clear showing and transparency of how that money would be spent, I think more people would support the idea.

90% of government spending is already spent from defense, entitlements and interest payments on our debt. Not much to cut. Given the circumstances, it seems we have a revenue problem.

Asset inflation has masked low economic growth. The U.S. stopped being a free market under “Easy Al” Greenspan (1987), who collectivized the economy by printing money 💰 and lowering rates to keep zombie companies afloat. Interest rates should be set by the free market and money printing should be illegal. The Fed is a Marxist Politburo. If unprofitable businesses could die, then viable businesses would generate more tax revenue. A flat income tax would also generate more revenue, not to mention put the accountants and tax lawyers out of work, and shrink the IRS. Social Security should stop investing in government bonds and pay for itself.

Actually we have an entitlement problem. Raise retirement age by a few years and the problems go away. But voters don’t want that.

Inflate their way through it…hmmm….

Why am I thinking about one of the most terrifying moments of Squid Game? And that’s at various points in the show when the everyday people contestants announce their debts owed in terms of “billions”.

Having suffered through the first 20 minutes of the Squib Game, I withdrew my participation.

However much the everyday American is at risk like the squib.

This is the way, and has always been the way and everyone has always known it was going to be the way. There is no issue that isn’t best solved by inflation. So there will be inflation.

Under the “I”………….7% long Treasuries…………

Bloomberg: Yellen Says Treasury to Hit New Debt Limit in Mid-January

Treasury Secretary Janet Yellen said her department is likely to begin taking special accounting maneuvers sometime in mid-January to avoid breaching the US debt limit, and urged lawmakers to take action defending the “full faith and credit” of the US.

“On Jan. 2, 2025, the new debt limit will be established at the amount of outstanding debt,” Yellen wrote in a letter on Friday to House Speaker Mike Johnson and other congressional leaders.

The Treasury will be given a short reprieve, however, because outstanding debt is scheduled to decrease by $54 billion on Jan. 2, thanks to the expected redemption of securities held by a federal trust fund.

The extra headroom is likely to be exhausted by Jan. 14 to 23, Yellen said. At that point, the Treasury will resort to special accounting maneuvers to help keep the government funded.

It’s serious this time, but Scott Bessent is head and shoulders above Ms. Yellen.

In what ways?

The product of George Soros is head and shoulders above Yellen? I am sorry this does not compute.

It’s not a limit/ceiling – it’s a new floor.

A lot of things are said about Jimmy Carter, but one thing I always remember is that he wanted to implement zero-base budgeting, i.e. don’t build annual budgets by some incremental increase based on previous expenditures , justify expenditures by need.

In an ideal world it may have worked, in the world of bureaucracy, never.

Although I would argue that with the EFFR languishing in the zone where the interest paid by borrowers is greater than the inflation rates, but the interest received by lenders, after tax, is less than the inflation rates, its kinda in no man’s land.

I was waiting for you to write about this. I am confused, though. To what degree do Treasury yields depend on Fed rates, and to what degree do they depend on buyer demand? Is it 50/50, or what?

Milo,

As we can see here, longer-term Treasury yields have a mind of their own and don’t have to follow the Fed’s policy rates. Those longer-term yields are driven by the bond market. Unless the Fed knuckles the bond market under with unlimited QE, it has a mind of its own. But the Fed isn’t going to do any knuckling under because there is inflation, so it’s doing the opposite: QT. And the bond market is on its own.

I smell inflation. Someone has to fund that deficit, and last I checked everyone was still voting “Not Me”.

In case you missed the memo, both teams are converging on the solution of “fuck it, we can go into as much debt as we want”… with Trump suggesting removing the debt ceiling so they won’t have an official limit on spending. Perhaps I may be missing the nuance on that idea, that maybe it’s just to avoid this same repeated drama of government shutdowns every year. Still, I don’t think you’re likely to be voting your way into the black any time soon, not without serious consequences. Either your social security check will be eliminated, or it will soon only buy you a weeks worth of groceries and that’s it.

You are dreaming if you think people will vote to cut social security. Any politician who does that will be voting for his exit from office at the hands of every old codger who votes.

I would have agreed with this all my life until a couple years ago. Now, it’s entirely possible. First, raise the age of retirement enough so those receiving it are a smaller minority. THEN slash the benefits to save the system, and the majority will go along with it just fine.

My bet is this the solution.

Raise retirement age a bit, over time, to match the fact that people are staying healthy longer and raise income limit a lot so that multi-millionaires and billionaires pay more than a drop from their buckets, and pols can keep us old codgers from voting them out. The solution is not that hard but common sense is in short supply.

Trump’s DOGE is a ruse. Trump and Musk’s demand for eliminating the debt ceiling is just the easiest way to secure an extension of the tax cuts that expire or cut more. There is no way any politician will reduce spending. In fact, if mass deportations occur, these illegal immigrants will be housed on average four months in private detention centers at a cost of over $200 per day (~$24K) at the expense of tax payers. Just follow the money and you’ll understand Trump and Musk’s true intentions.

The real ruse is coming up with a government agency with the exact same acronym as the crypto scam you’re invested in, using the government office to personally financially benefit off of a pump and dump scheme. The richest man in the world just can’t get enough, so he thirsts for more money from impressionable gamblers to feed his fat pig face and ego.

You mean someone has to fund that national debt or it will cause inflation, but this argument has been made for over 50 years and yet, we keep on increasing the debt to infinity. Whenever it finally matters will be some sour economic times.

In 1972, it cost 6 cents to mail a domestic letter in the US. Now it costs 73 cents. I’d say we have had a lot of inflation over the years even if high tech gadgets have come down in price. I wonder if the Bank of Canada has had second thoughts since it dumped its gold holdings and bought US government securities instead.

It actually costs a lot more than that to mail a letter. USPS subsidizes your cost.

Try sending that same letter with UPS ground and see how much more it costs. You’re getting a bargain with what USPS charges.

But actually, most people send/receive mail via email, and that costs nothing, zero. So most of the mail is now free, which is massive deflation?

Who on earth mails a letter anymore? I haven’t sent an actual USPS letter in years. Agree with Wolf on this, email replaced letters and there’s no inflation on something I get/use for free.

Why I do, during Wolf’s annual fundraiser and yes it contains an old fashioned check. All for .73. However, he sends me an email back as I have enough mugs.

In 1860 it cost $5.00 ($250 today) to send a letter by pony express across the country. Later it was reduced to $1.00. The riders made $100 a month ($5,000), surprisingly, roughly what letter carriers make today in both Canada and USA in their own dollars.

Then came the telegraph and trains. Pony Express died after a couple of years.

And 73 cents today is ~eq to 1.5 cents in 1860.

etc etc Numbers R Fun.

Mr Richter what level do treasury yields need to rise to for the current levels of the stock market to come down signifigantly? Or is it a lot more complicated than that? Too many other factors involved?

you didn’t ask me, but my opinion is that the stock market has nothing to do with treasury yields at this point. once bubble mentality exists, and people think stocks will keep going up because they keep going up, it becomes a positive feedback loop and a self-fulfilling prophecy. they’re not buying based on valuations, but on the idea that they will keep going up. therefore, it doesn’t matter whether safe yields are 0, 4, 5, or 7%. if you can get 25% or more by buying tech stocks, why none of those come close.

the stock bubble will persist until people think, on a macro level, that there is a real risk of losing their investment. as long as they think stocks are risk free, they will keep buying, no matter how stupid the valuations.

Narrative economics at its best.

can you elaborate?

I agree with you with the provision that at some point the delusion ends and then look out below.

It’s interesting that there are actually multiple groups inflating the bubble.

There’s the 90s-style tech bubble around AI.

There’s the true gamblers pouring money into leveraged Bitcoin/microstrategy ETFs.

There’s the large group of “responsible” folks that have bought fully into the idea that the S&P has and will return 8% in the long term, and time in the market and index funds are the only solution to investing, and every dime you don’t have invested is money wasted.

There’s the 401k auto-pilot folks who barely even know they are investing.

Potential home buyers need not worry too much about mortgage rates. It is so easy and inexpensive to refinance. Just follow rates lower whenever that happens.

It is always better to buy at higher rates and lower price .

Higher rates can be refinanced to lower rates if possible but you can go lower price if you have already paid higher price

Buyers are not that stupid hence the crashing sales volume

Sure, if you think rates will go back down to 2% or 3% soon. But not if you think rates will be in the new normal of 6-7% for quite some time.

Richard Grahman

But rates have been going higher. You’re engaging in reckless risk-taking with your home if you overload yourself with the mortgage because you count on refinancing at a lower rate, but then rates don’t go down, but up, and you can’t refinance and you’re stuck with the too-high price you paid, and with the too-high mortgage payment, and you’ll become a slave to that mortgage.

Go for it if you have enough cashflow for 8 plus years without needing to refinance. Everyone buying now is betting on refinancing, when it doesn’t happen, housing price might fall 30%, I’ll take out a 9% mortgage then

Waiting for lower prices even if it means missing out. QQ

Prices are falling in some areas. Note that Wolf’s previous article to this one was “San Francisco House Prices Drop Back to 2019, Condo Prices to 2015, as Tech Jobs in the City & Silicon Valley Evaporate after Drunken Hiring Binge”

Now if there is a recession from much higher tariffs and/or higher than anticipated (by business anyway) deportations….

I’ve been hearing “those” radio ads again that talk about how rates “have finally started coming back down” and it’s time to “contact us about how we can save you an average of $XXX”. Oh boy.

Last 3 weeks I have received emails and a call from loan servicer saying a refi could save me $101 off the payment 3 weeks ago and $98 last week 😀…

I said I will just wait for the next “triggering event” to refinance…

Or perhaps higher for longer… strong economic growth, 4ish trillion deficits annually… looking forward to seeing what shakes out….

What really matters is not that rates go higher or lower, but that the capital appreciation of his house outpaces those, which it has since 2012 by a vast margin.

Rates and mortgage payments are irrelevant in this scenario.

You can’t eat your house. Unless it is one of those gingerbread houses. IMHO, a house is a place to live such that you are not homeless. If someone allowed you to speculate on a house such that you cannot eat, sell now! Before this asset drops further. You are an old-timer and watched house prices drop 50% from 2007-2012. We can only take more hopium wishing for a soft landing if rates stay high.

My point is that don’t become so house poor addicted to the hopium that rates will go down. They will but it may take 10-15 years. In the meantime, house prices will fall (hopefully less than 50% like last time)

“What really matters is not that rates go higher or lower, but that the capital appreciation of his house outpaces those”

The “capital appreciation” of my house is a complete work of fiction because my house is not for sale. No one can ever know how much someone would buy for it because it will never be sold.

@ShortTLT

It will be sold. Maybe not while you are a living breathing owner, but it will be sold.

And the person selling it will not use a list price from a random number generator. Capital appreciation is a real concept.

“Slave to the mortgage” describes all of China.

Wolf I have a question:

IF you broadly agree that QE fuels asset speculation, (by a method that I am not fully equipped to describe precisely, but lets say by providing low cost liquidity to investors and companies, that increases their appetite to speculate) , and QT reverses that tendency, where would QT provide a signal to sell the market?

I know ideally it would be the moment QT starts, but in this case as you have described previously, a lot of the additionaly liquidity was sequestered into RRPS (now 0) and bank reserves (which I assume are deposits not lent out).

What signal should we be looking for in the macro landscape to short the stockmarket? You mentioned in prior articles that bank reserves falling to about 3 trill would be a minimal level, but I’m not sure that would be the right signal.

A monthly US deficit of 100 or so billion, along with foreigner net selling (as the USD strengthens) might have put us within reach.

However I believe that government borrowing might still be stimulatory and not immediately lead to people having to sell their stocks.

I feel broadly, when available savings to households after net investment in government securities, turn negative, the stock market has to sell off, but not sure how to look for this event in the data.

A little confused here.

I do believe 2025 is a once in a lifetime shorting opportunity, but I want to be precise with my timing.

Morgan, et alia, has/have described the possibility of knowing in advance either the bottom or the top of any market at zero.

With all due respect, WR knows better than to speculate on this question, as does anyone with any common sense.

Loved whenever that happens. In whose lifetime do you expect rates to be lower? After a stock melt-up and a deflationary crash? Interesting times ahead

Tankster-

If those theories floating around that, in the unfolding future, BIG moves in stocks and bonds will be compressed in to shortening cycles, then maybe both the “stock melt-up” and the “deflationary crash” will transpire in hundreds of days rather than hundreds of months. The former has arguably already occurred.

The US and global institutions of money, banking and public finance are in for a severe trial. My hunch is that it will be in my lifetime….and I’m not young.

Respectfully.

Rates can rise for years, the megatrends last decades.

Thanks for this summary of the shifting yield curve, Wolf.

Is the size and speed of the increase in treasury yields (2 years and beyond) over the past 3 months likely to lead to stresses due to portfolio markdowns (e.g. banks, mutual funds, hedge funds, private debt, collateral accounts, etc)?

Also, years ago many loans were tied to the bank’s “prime rate.” If this is still a thing, does the rise in intermediate rates pose any significant threat of a rising effective loan rate? Will this upward shift in yields crimp commercial lending by tightening cash flow projections (due to higher interest costs)?

The variety inherent in one’s portfolio will determine if general conditions can affect it greatly. A portfolio that is well-balanced, mature, and time-tested won’t be as vulnerable to the vicissitudes of the market as will a newer, less valuable portfolio. Your mileage may vary.

It looks like this time is different (i.e. no recession in sight), but it’s nonetheless still interesting to notice that the last few times the “real” EFFR was positive, asset prices did meaningfully correct

Eyeballing Wolf’s chart, it looks like the EFFR was about 3% over the inflation rate the two times we had serious corrections since 2000. It would be interesting to see that chart over a longer term to see if there is a correlation there.

The bond market sees the Fed’s cuts, despite data suggesting no cuts, as absolutely inflationary. This is why there has been a big surge in long-term treasury rates. I am tempted to buy some 20-yrs, which are approaching 5%. But the spread (say 20 year minus 3 month) has to be much higher for me to jump on the 20s. The Fed is all about getting the timing right with its cuts and hikes, something this Fed has never succeeded in doing.

It’s much easier to land on an aircraft carrier when Godzilla isn’t mudwrestling right beside it.

The Fed itself expects two cuts next year. Why doesn’t anyone ever listen to what the fed says. They tell the whole world – IN ADVANCE – exactly what theyre going to do and then they do exactly that. Always.

Uh, no. The Fed started its rate cutting with a 50 bp drop. Nobody expected that. But maybe you are being sarcastic. If so, type /sarc after your comment.

I don’t think CCCB was being sarcastic. It’s generally true that the Fed has stuck to it’s previously telegraphed rate moves. The 50bps cut was an exception, sure.

But… in the past, the Fed funds futs market had been predicting more rate cuts than the Fed had been signaling, yet now it is predicting /fewer/ than 50bps of cuts next year… And Powell himself explicitly said the path of rates is less certain.

What nobody are you talking about? That was well predicted by many/most.

Is it just solely fears of inflation?

If the Fed does QE then government borrowing is credit expansion, if they don’t then the government borrows from the existing money supply. I wonder if given the mass of incoming government debt, for every country really, is starting to run into the constraints of the money supply.

The current political narrative of the USA is domestic expansion but the savings rate is still as dire as ever.

https://fred.stlouisfed.org/series/W986RC1Q027SBEA

Savings, households and institutions

Just so we know what the linked chart says: The link is for the seasonally adjusted annual rate of “personal savings” (line 43 in the BEA’s full release table of GDP), which in Q3 was nearly $1 trillion SAAR.

After 14 years of 0% interest rates, plus trillions of dollars from the Fed,the Trump and Biden Administrations,the economy will eventually find its bearings and adjust to the new realities…

I am not holding my breath waiting for that to happen…

That chart showing mortgage rates over a fifty year timeline is a hoot…

And people are bitching about 7% interest rates!!!!

I’m still having a problem with these inflation forecasts. Every service I purchase is going up 10% or more. Went to my car dealer the other day for an oil change and decided to inquire about this $500 dealer prep charge that was added to the purchase price of the Mitzibushi Mirage I purchased there last year. The dude told me I was lucky I only paid $500. The current dealer prep charge is now $800, and is regulated by the State of Maryland to cover all the overhead in preparing the car for sale. That’s one hell of a price increase in just one year. Maybe the 10 year and 30 year bond market knows more than these shills like Yellon, Powell and pumping out on a daily basis.

LOL, you’re focused on the prep charge that went up by some peanuts, according to some yokel salesman trying to talk you into paying it (you believe what a car salesman says???), when prices of new and used vehicles have actually fallen by thousands of dollars.

The last time I bought a new car I knew going in what I was willing to pay. When they started with all the extra charges I told them I was only going to pay what I had decided in advance.

They said they wouldn’t remove the charges so I walked out. The salesman ran after me and said that they would sell it to me afterall for the price I said I would pay.

If you get your oil changed at the dealership, you are choosing to pay the highest price you possibly can for this service.

It looks like your Mirage uses the same 5W-30 that my car takes. Two-packs of 5 qt jugs are $40 each at Costco, and it looks like you need just shy of 3 qts of oil… with that + a couple of oil filters (<$10 at autozone), your next three oil changes would total less than $60.

I get the point you were making Mr creature is that prices are rising fast, noticably fast on most everything. Story’s abound…and I see no reprieve from the warden. I wouldn’t expect my money to get me further down the road, instead, I’ve decided not to go down the road, but being alive it actually traveling down the road so…I guess I’ll team up with miss penny and make due.

Long term yields have more room to rise with the increased incoming coupon issuance.

Down with TLT.

The change in that yield curve from July to December is just astounding! From a massively inverted ski jump to as straight and flat as a wheelchair ramp.

This statement:

“As the yield curve normalizes, it will steepen further and term premiums will rise. This could happen in two ways: With shorter-term yields falling or with long-term yields rising, or both”

..I would agree that intuitively the Govt needs to pay more interest to borrow longer. And the flat ramp means that now they are. BUT – with the timing of QT, isn’t it possible that if the deficit is reduced to say $1T next year (Growth, taxes, “efficiency”) and the Fed decides that it’s time to aggressively swap out MBS for TBills – then the Fed could buy more or less ALL of the 4 to 13 week supply (maybe $350B a year) and do it at 3.5%, which forces everyone else who would have bought those 13’s to go to the 26’s at maybe 3.6%, and onward and upwards until the ten year buyers eagerly vacuum up the supply at 4.0? Then 4.5 on the 30 and mortgages at 5.0?

Lower, flatter, better for housing and all other debtors. And if inflation is rolling along at ~3.0% the Fed can say “hey, our rate is 50bp above that, give it time”.

I’m envisioning a flat and anchored UST supply with a consistent buyer of the entire short end and everyone else taking what they can get out on the curve. After the deficit insanity of the last several years a supply of “only” $1T with 1/3 gobbled up by the Fed might seem like a scarcity. Just a thought.

The 13 wk bill has the most moneyness of any of the new-issue Treasuries. It’s almost equivalent to cash.

In theory, the RRP rate sets a floor on how low the 13 week yield can go. If there’s too much demand, money will shift into the RRP. Why would you lend to the Treasury when the Fed pays more?

But I don’t think the Fed would buy out the T-bill market… they want banks to hold more Treasuries going forward.

Just to follow up – banks would hold more Treasuries, only they’d be the 26 week to 1 year Bills that the Fed left on the table for them. I think the Treasury would be perfectly happy selling the entire short term supply to the Fed at ~3.5%. Just my opinion.

Long term rates will go higher, even if the fed lowers theirs. Why would anyone tie up money for 20 years at 5 or 6 percent?

Does anyone buy and hold stocks anymore? Then why would you buy and hold fixed rate debt?

Eveeything has changed with thousands of options right from your phone. All the time it is getting faster, cheaper, and more options.

If you are waiting for rates or prices to go down before buying a home you NEED, you are playing a fool’s game.

News flash: Prices are the same, but going down due to inflation and replacement costs!

If you want a lower rate, pay a bit extra every month.

If you can’t, then you can’t afford it in the first place.

The only real reason for home prices falling is desirability. That is a very real risk for many areas.

“News flash: Prices are the same, but going down due to inflation and replacement costs!”

No, prices are going down in quite a few places, and inflation makes that decline worse. Here are some examples of prices going down, not including inflation:

Well they are not going down in CT. They have plateaued and are proving the accuracy of the adage that home prices are notoriously sticky. Cherry picking individual markets is not a good way of looking at it IMHO because there are a 1000 housing markets. I think the most one can say at the moment is that the National run up has stopped and there could even be some seasonality in that.

I think you’re misreading Wolf’s comment. Wolf’s comment specifically notes “prices are going down in quite a few places,” and then provides some examples. The comment only addresses markets where prices are going down so those examples make sense.

Wolf’s comment doesn’t suggest prices are going down in every market, only in quite a few places. Are you disputing there are quite a few places where prices are going down? If anything, you’re comment is “cherry picking” because it references prices not going down in one market, CT, as some sort of counter to Wolf’s point that prices are going down in quite a few places.

If the home prices have increased in unison all over USA because of one factor: cheap money then it’d fall in unison with some lag here and there.

People always come here and write: Not in my neighborhood because real estate is local.

Rojo, IS correct:

Gotta ask, how many times it is needed to express the concept of ”locationX3” for everyone to get it???

In our little ”hood”,,, prices for ”tearer downers” have definitely leveled off as of now, with those prices at $275K PLUS cost of demolition, as has been the price/cost for many months.

This is clear as the old house right behind us just went for that in one day after and despite being gussied up to be livable and is now being demolished.

rojogrande

I thought that was more or less what I said. There are a 1000 housing markets in the USA. And are you disputing the old adage about sticky housing prices? He actually said prices are going down in quite a few places which I think is something of an exaggeration. Plateauing seems to be the more general condition across the USA as Zillow predicted earlier in the year. Quite is a rather fungible term. Even in the couple of cases cited housing has only lost a small part of the run up and I wouldn’t be surprised to see SF bounce back. I don’t know Austin well enough.

Joe,

“He [me] actually said prices are going down in quite a few places which I think is something of an exaggeration.”

So just going down my list of the largest 30 markets, from larger to smaller, seasonally adjusted, three-month average, mid-tier, single-family, except where noted in markets where condos are a big part. Condos in general look worse. Here are the decliners of the 30 largest markets.

etc. etc. etc. just keep going down the list

Well one thing is for certain housing prices have doubled in price and totally unaffordable to many.

People like to whine and complain, both negative behaviors, me, I like to listening to whiners and complainers it makes me feel smart and above it all…time for my tea.

Oh dear Wolf. Looks like I’ve been censored in an entirely civil response to the litany of modest price declines in house prices.

Joe,

Your comment was deleted and you’ve been promoted to my gray list because you argued with something that no one had said, and that kind of argument gets blocked.

I said: “prices are going down in quite a few places,…”

You replied: “Cherry picking individual markets is not a good way of looking at it IMHO because there are a 1000 housing markets.”

I let that go.

Than you struck out again in another comment: “He [me] actually said prices are going down in quite a few places which I think is something of an exaggeration.”

To which I replied with my list of 18 of the 30 largest markets where prices are currently declining, and in a bunch of them are down YoY and from their peak in 2022. That proved the correctness of my statement “prices are going down in quite a few places” 18 out of 30 largest, or 60% of the markets. So apply that 60% to your “1,000 markets.”

To which you replied “Wow Wolf, OMG the sky is falling.”

No one said the sky was falling, or anything like it. My statement was “prices are going down in quite a few places” (and I proved that with my list). So you started a new argument (with “the sky is falling”) because you were wrong in your prior comments. That’s a fallacy of argumentation (“straw man fallacy”). And that’s over.

So now you made it worse by arguing about my moderation. And I have to waste my time explaining to you what you should have figured out on your own.

“Why would anyone tie up money for 20 years at 5 or 6 percent?”

If that’s all you need to cover your nut, then you do it and relax. If that’s all you need on half your portfolio, then you can relax about owning overpriced equities on the other half because you have 20 years to recover.

“Does anyone buy and hold stocks anymore?”

Yes, the overwhelming majority do. And they’ve been rewarded with historically unprecedented returns over the past 5, 10, 15, 20 years, so there’s no motivation for them to change. Most investible net worth in this country isn’t changing hands on Robinhood each day.

“Then why would you buy and hold fixed rate debt?”

Same reason: 2.5% *real* yields to maturity works for people with enough assets to have “won” (current TIPS yields). Can they do better by day trading? Maybe. But why try to snatch defeat from the jaws of victory?

CH exactly described my situation as to why I would readily accept a 5 – 6% current yield on low-risk 20-year U.S. treasuries. A safe, steady 5% return on my savings is more cash flow than I need at this point to comfortably cover all family expenses, without drawing on any principal, and I can additionally plow back some of the “extra unused” interest I earn from that 5% return from long-term treasuries into short-term, more liquid fixed instruments such as CDs to add further buffer in the event of substantial future inflation. A guaranteed, risk-free 5% is more than adequate for me. I don’t need a mega yacht in the Mediterranean or a Gulfstream private jet. I’ll take a good night’s sleep and that Federally-backed “meager” 5% return, thank you!

But you’re missing all the fun in bitcoin, Nvidia, and Tesla. They are going to $10 Trillion each.

I would caution against assuming the liquidity of CDs. Often times the early withdrawal penalties are large. You could always ladder 13-week Treasuries – I used to have a ladder with something maturing every week.

These days I use a combination of SGOV in my brokerage account and Capital One’s HY Savings account for my interest-bearing but liquid cash. CapOne I can move to the checking acct instantly, and SGOV needs three days (two to settle and one to ACH over to my bank).

Last I checked, SGOV pays 4.2% and CapOne 3.9%.

P.s. I’m starting to see 10-year agencies with nearly 5% YTM in the secondary market.

NB: not actual investment advice; for fun and entertainment only.

“Does anyone buy and hold stocks anymore?”

“Yes, the overwhelming majority do.”

+++++++

How Many Americans Own Stock? More Than You Think – The Motley Fool

About 162 million Americans, or 62% of U.S. adults, own stock. The top 1% holds 50% of stocks, worth $23 trillion. The bottom 50% of U.S. adults hold only 1% of stocks, worth $480 billion. About …

re: “projected a scenario of higher inflation by the end of 2025”

They must have been previously reading me.

Contrary to Nobel Prize–winning economists Milton Friedman and Anna J. Schwartz’s “ A Monetary History of the United States, 1867–1960 “ monetary lags are not “long and variable”. No, the distributed lag effects for both real output and inflation have been mathematical constants for over 100 years

The 2-year rate-of-change in money flows, the volume and velocity of means-of-payment money, the proxy for inflation, rises in 2025 (after bottoming in August).

Debt-to-GDP ratios are obviously contrived metrics. Unprecedented large deficits “absorb” a disproportionately large share of N-gdp (as gov’t spending is a component / factor of gDp).

To appraise the effect of the federal budget deficit on interest rates, it is necessary to compare the deficit, not to the debt to a GDP-ratio (a contrived figure), but to the volume of current net private savings made available to the credit markets (including the monetization of gov’t debt by the commercial and the Reserve banks)..

Nothing contrived about it. Government spending on everything from warships to cleaning up superfund sites IS part of the economy. And additional state and local government spending of around 4.5 trillion is also part of the economy.

The odds are the 10 year is going higher. Debt is 36 trillion, the deficit is around 2 trillion or around 6% of GDP, and Trump and the Republicans are promising to extend his 2017 tax cuts and introduce more as well as some expensive spending programs. Little faith can be placed in the promises of 2 billion of spending cuts because of the content of the Federal budget and every program has it interest group including a lot of Republican politicians whatever they say so this means even higher deficits (3 trillion?). What is going to bring all this to a close is the markets which is what happened at the start of the 90’s.

watch the almost daily treasury auctions. 500 billion a month and rising.

somebody has to buy those bills & bonds. And as rates rise, more to sell.

Most of those auctions just refinance maturing securities. Nearly all of these huge T-bill auctions refinance maturing T-bills. For example, 1-month T-bills mature in one month and are then refinanced (rolled over). These roll-overs are NOT new supply, and they do not require new demand. These roll-overs would continue even if the debt suddenly stops rising because Congress suddenly passed a balance budget, LOL.

What you need to watch is NEW supply. New supply has been running at about $160 billion a month.

Does that include the rollovers of treasuries and MBS securities owned by the Fed but rolling off with QT?

I would argue that those QT roll-offs are as important as new treasury issuances in this.

All Treasuries are rolled over when they mature, meaning that the government sells new Treasuries to raise the funds to pay off the maturing Treasuries. That’s the roll-over. It doesn’t matter who holds them or buys them.

The way QT works is that the Fed will not buy the replacement securities of those that matured, and someone else will have to buy them. So the supply is the same, but one big buyer stepped away from the market, and some other buyers must take their place, tempted by the higher yields.

So the Fed gets paid the cash for the securities that matured but doesn’t replace them, and instead destroys that cash it received. That’s QT

Would a large part of that new supply be funded by treasury investors reinvesting their ever increasing interest revenues? So it is really only the primary deficit that needs to be financed in the short term (at least until a large number of investors want to/ need to withdraw their investments, which is when the party will end)

https://www.cbo.gov/publication/59711

A trigger for that ‘wants to’ would be short term interest rates falling.

Much of the deficit is currently funded by money market funds invested in t-bills. I keep reading that when short term interest rates drop, that 7tn in money funds will have to go somewhere and the theory is it goes to the stock market. BOOM TIMES.

But when it leaves, there is no one to buy t-bills when they rollover, so short term interest rates simply can’t drop without blowing up the treasury market. And what happens to the stock market then?

https://wolfstreet.com/2024/12/13/money-market-funds-large-cds-small-cds-and-total-deposits-americans-huge-piles-of-interest-earning-cash-as-rates-drop/

An important clarification – but $160bn/month is still plenty to absorb!

Yes, HUGE. Everyone worries about it.

Re: mkt getting a wee bit nervous

The most dependable thing about mkts, is for expectations to be incorrect. Mkts always inflect max pain when people don’t expect declines.

Between the deficit, treasury issuance, money supply, inflation and the entire spectrum of pandemic low to now, everything seems broken, and confusing, making a logical directional bet here is virtually impossible — and there’s definitely a disproportionate amount of unease — and a wee bit of nervousness.

As the roulette wheel spins wildly, it’s a safe bet to think that most people will get things wrong — which helps amplify volatility and our perpetual state of being nervous.

I’d be remiss to not plug the Buffett Indicator, or go off topic with his hamburger thesis:

“ “To refer to a personal taste of mine, I’m going to buy hamburgers the rest of my life. When hamburgers go down in price, we sing the ‘Hallelujah Chorus’ in the Buffett household. When hamburgers go up in price, we weep. For most people, it’s the same with everything in life they will be buying — – except stocks. When stocks go down and you can get more for your money, people don’t like them anymore.”

I feel strongly that we’re at an inflection point that plays out within weeks — but, the nature of this pandemic everything bubble — offset by the super resilient optimism has been extremely puzzling — extremely disconnected from prior realities, which makes virtually any investment bet unpredictable.

For that clarifying reason, the reason for markets to be uncertain is uncertainty. That’s the key ahead, I think — there will less conviction and greater hesitancy, and volatility will rip people apart in a whipsaw blender of stupidity — which ultimately is exactly what needs to happen.

Afterwards, sometime in the future, the price of hamburgers will be attractive Again.

Well, beef is not the most affordable option anyway and government subsidized. Perhaps we need more subsidies to decrease the price of the hamburger. Eat the offspring of the dinosaurs instead.

Great reply glen,

Sitting here eating a double spinosaurus burger thinking.

The gov coming in to help individuals and businesses is similar to a parent helping their child through life.

That’s an interesting quote. Does it apply to housing too? More for your money every year?

I know we’re all supposed to hate and fear deflation because it makes people “put off purchases”. Even in food, clothing? I imagine a mom with her hungry children at the grocery store – maybe when inflation is -1% in food. “Now I know you’re starving kids but those chicken nuggets will be seven cents cheaper in a year so let’s hold off..” Or shoes – just squeeze your feet into those size 8’s another year junior and we’ll save 1.5% on the 11’s next Christmas.

Deflation in goods – hamburger, cars, clothes, phones, even housing materials should be welcomed and encouraged. Land and people’s time might become more valuable.

The inflation effect is the exact opposite of what you’re saying…. Inflation leads to people buying things before they go up in price causing more demand and more inflation… Deflation is great as long as you have a job which if we actually had deflation many wouldn’t so both present problems hence why the slow inflation of the ten years pre COVID was the good times

Should be “..hate and fear DEflation…” In the second paragraph.

Sorry for the typo, the comment should make sense now.

Fixed.

That is. I give up. Jerome Powell has officially killed recession. This is historical. Economic cycle no longer exists. The mythical soft landing has been achieved. All macro economics textbooks have to be rewritten.

We’re going to get a recession someday, that’s for sure, it just may not be in the near future. My guess is that when the AI investment bubble implodes, and stocks tank for example 50%, with some biggies down 70% or more, and people get really nervous and start cutting back, that’s when we might get a recession. Something like that happened during the Dotcom bust. As the S&P 500 tanked 50% and the Nasdaq 78% over a 30-month period, people got nervous, and cut back, which led to short shallow run-of-the-mill recession.

There won’t be a recession in 2025. The Dot.com bubble ended with the contraction in legal reserves until Nov 2002 (the stock market’s bottom).

Stocks bottomed in March 2009 when money flows, required reserves bottomed.

They made it clear when they rescued First Republic and SVB. It’s like when someone abusing Vicodin decides to choose fentanyl addiction over sobriety and exercise. In this new post-2008 world the Fed has decided that its job is to push the fentanyl

DM: Janet Yellen issues grim warning to Congress over America’s fiscal future

Outgoing Treasury Secretary Janet Yellen has issued a stark warning to Congress about the United States’ fiscal future. In a letter to Republican House Speaker Mike Johnson on Friday, Yellen claimed that the federal government will hit its debt limit as early as next month unless Congress takes action. Otherwise, she said, the Treasury Department would have to begin taking ‘extraordinary measures’ to prevent the US from defaulting on its debt.

Such measures may include suspending certain types of investments in savings plans for government employees and health plans for retired postal workers, which would be restored once the debt ceiling is increased or eliminated.

‘Treasury currently expects to reach the new limit between January 14 and January 23, at which time it will be necessary for Treasury to start taking extraordinary measures,’ Yellen wrote, according to NBC News. ‘I respectfully urge Congress to act to protect the full faith and credit of the United States.’

Once the US hits the debt ceiling, the government cannot borrow any more money and will default, leaving it unable to pay bills unless the president and Congress negotiate a way to lift the limit on the ability to borrow. The debt ceiling was previously suspended in June 2023 following a contentious negotiation over federal spending, work requirements for receiving government benefits and funding the Internal Revenue Service.

But the suspension is now set to expire on January 2 – and when it is reinstated, the national debt would automatically increase by the amount of debt that has been incurred since the suspension.

I believe that we are getting closer to something breaking very hard that just might burn some bond shorts. The major currencies have been getting crushed. The Rupee , Won, Real, Yen, Canadian dollar Euro to name a few. Chinese interest rates at all time lows. Europe a complete mess. Everyone worried about tariffs being inflationary but not talking about how contractionary they are. You’re starting to see the cyclical stocks and some of the semis in downtrends. I think one nice spike in rates will kill the stocks and turn bonds around for a good rally.

Very interesting thesis! I’d like to explore it more if you have a source article

This sounds like the dollar wrecking ball theory, i.e. if the dollar gets too strong vs other currencies, it will negatively affect trade to the United States.

As Wolf pointed out recently, the entire yield curve has now uninverted.

So we can start the countdown to recession. 12-18 months? That’s a long time for a lot of things to happen… and go wrong.

Anecdotal, but here in Canada (Greater Toronto Area) a few of my friends were laid off a few months ago and unable to even find those temp agency jobs which pay minimum wage with no benefits.

I remember a few years ago, the bus I used to transfer at after my classes were packed with young adult newcomers and study visa holders going to work in the warehouses (a few stops away) during the evening shift.

The warehouses there are not hiring now. How a lot can change in less than 5 years.

Canada’s GDP per capita has fallen below that of Alabama and West Virginia. Very soon it will fall below Mississippi, the poorest state in the United States.

Hard to believe now, but it used to be at par with the US average during the Harper years.

True…The GDP per capita of the poorest state, but housing and rent prices of the richest cities. What an oxymoron.

Such a shame because Canada has huge quantities of untapped energy resources just waiting to be developed.

This was before the huge surge in immigration over the last few years. It is this that has pulled down the per capita number. The population of Canada has increased from about 35 million to 40 million in 5 years. Nothing to do with Harper stardust.

GenZ, GenX Toronto native. The real problem was the massive immigration past ~3 years. Too many people chasing too few jobs and we are just noticing ~6 months as we skip along the water about to go into a mild recession. It will be mild bc the USA is firing on all cylinders.

I’m glad to see more fellow Canadians on this site!

And yes, the past three years were the years of increased “population growth”, long lines for entry level jobs, and artificial demand for housing that skyrocketed for a while.

Agree, what if the inflation narrative is over bought and we see lower prints in Q1 and economy goes into a recession. FED will be forced to cut rates aggressively and inflation could turn into deflation. Bonds seem to be over sold due to inflation narrative that may turn out to be false in 2025.

“Deflation” hahahahaha, you people never give up, do you? In my entire life, there were only a few quarters of mild year-over-year deflation in the US, and the rest was inflation, lots of inflation.

The core PCE price index, which the Fed uses, has NEVER gone negative year-over-year. In its entire history, it didn’t ever show year-over-year deflation.

The only time CPI showed deflation year-over-year was when energy prices collapsed. But energy prices cannot collapse forever, and so these episodes of energy-caused deflation were brief and mild, while inflation in services continued just fine. The Fed isn’t going to worry about a plunge in energy prices.

The only 2 market mistakes I made was when the CPI fell in 2010 which led to QE2 (and changed inflation expectations), and in 2021 when we subsequently got another stimulus check (but my time series got axed).

It’s amazing how you twist so many things into absurdity. The Fed did not start QE because oil prices plunged and eventually and briefly led to negative CPI in 2009, but because of the impending collapse of the financial system that was getting wiped out by the massive waves of mortgage defaults, and the collapse of MBS, as collateral values found their way back to earth, from their over-inflated state. This mortgage dynamic started in 2005/2006, and led to the Financial Crisis of 2007-2008, with Bear Stearns collapsing in March 2008, and Lehman filing for bankruptcy in September 2008, with other financial institutions, including AIG, getting bailed out by the Fed. The price of WTI hit $150 a barrel in July 2008, in the middle of the Financial Crisis, and then plunged, and in early-mid-2009 led to negative headline CPI. Core PCE, which excludes energy products and services, never went negative. QE2 was Bernanke’s way of extending QE1, as was Operation Twist, and QE3 (“QE Infinity”), none of which had anything to do with inflation/deflation and everything to do with Bernanke’s promoting the doctrine of the “wealth effect,” as he himself explained to the astonished American People in a Washington Post editorial in 2010: making the already wealthy far wealthier so that they spend some of those artificial gains and thereby stimulate the economy, which has turned out to be one of the most destructive economic policies ever.

100% correct on the events leading up to QE in response to the crash of 2008 Wolf. It had nothing to do with oil. The sub prime collapse was the causa proxima of the crash (it commenced in the fall of 2006) but the causa remota that turned a fairly routine RE crash into total catastrophe was all that unregulated sliced and diced MBS and derivative activity. However, not sure I agree with the censure of Bernanke who along with Tim Geithner and Paulson did a superb job of pulling the fat out of the fire in the 2008/10 period. Bush was not wrong when he said this sucker could go down. I was running a fair sized manufacturing business at the time when credit markets stopped functioning in 2008 and it was quite scary.

“Bonds seem to be over sold due to inflation narrative that may turn out to be false in 2025.”

I’ll gladly take the other side of that trade.

Rising rates have lead to major cracks in the market before. 4.62% risk-free on the 10-year (and climbing) vs an overvalued stock market sounds pretty compelling.

I’ve been reading”When Money Dies”, which documents the Fall of the German monetary system pre WWII.

Interestingly, monetary authorities stubbornly refused to admit money printing had anything to do with inflation, even when hyperinflation set in. They attributed inflation to psychology, speculative behaviors, and a wage price spiral.

As prices went up, monetary authorities insisted they needed to print money to provide adequate liquidity, thinking money printing was a response to inflation and not its cause. Monetary authorities thought the wage price spiral was not too harmful, provided there was ample liquidity to support it.

There was general failure to consider the financial condition of minority interests, such as pensioners and non-union laborers. People who lacked political power were consistently hammered by inflation without relief until they lost everything.

Industrialists enjoyed the wage price spiral because it gave them excess profits at the expense of others.

Its an interesting read that follows the hyperinflation crisis month by month.

I hope they focus on Mefo bonds and the various certificates issued to help control their deficit — and the sad ending to that use of derivatives — and the obvious metaphor for using bitcoin as some insane hypothetical treasury reserve…

The foundation of WWll finance for Germany was the illusion of not having massive, monstrous debt or deficits.

Bobber-

An insightful read.

One of my favorite conclusory quotes from the book:

“When people do not understand what is happening, or why it is happening, and have no idea about what to do about it, and are not told, panic must follow.”

—Adam Ferguson, When Money Dies

As we’ve experienced regularly in the past, we have some “panic” coming our way. Those tasked with managing financial stability will, as in the past, have “no idea about what to do about it.” As in the past, large and small fortunes will change hands. IMHO.

“There was general failure to consider the financial condition of minority interests, such as pensioners and non-union laborers. People who lacked political power were consistently hammered by inflation without relief until they lost everything.”

Yes, inflation is terrible. Wage increases lag inflation so the majority of working voters have to wait and suffer in the meantime. I can’t think of any President who survived after an inflation increase. Carter, Biden.

The book was excellent. The motivation for ramping up inflation was to pay off excessive WWI debt with cheaper money. The people suffered.

I hope the motivation to pay off the US debt doesn’t lead to the same outcome.

You might also like Siegfried Kracauer. He wrote a column in the Frankfurter Zeitung during the Weimar era that frequently focused on the impact of economic reconciliation on the common folk.

Or you could watch Murnau’s films. ‘The last laugh’ is particularly relevant to this discussion

The great inflation of the Weimar period in the early 20’s was basically precipitated by French occupation of the Ruhr. This produced mass strikes so the government had to go on printing money to pay the strikers.

Abolish the FED and let the free market decide interest rates

The markets already do that in the $36 trillion Treasuries markets.

There’s a reason no central banks allow this.

I get what you are saying but there is no such thing as free markets, and even on the spectrum of free market economies we aren’t near the top. Not even clear how that would function. Clearly you would need massive regulatory oversight which then makes it not free market anymore.

Do you think the overall decreasing “excess” liquidity in the financial system will force the Fed’s hand to reduce/pause/reverse QT? I may be oversimplifying but I am basically looking at overnight RRP levels to gauge excess liquidity.

ON RRPs represent one bucket of excess liquidity, this one of money market funds. Reserves represent another bucket of excess liquidity, this one in the banking system. Different buckets. So ON RRPs going to near-zero just takes some cream off the top. It’s reserves that matter. It’s reserves that decide when the Fed will end QT.

The Fed could also exempt banks’ Treasury holdings from Basel III leverage ratios, which would reduce the need for those banks to hoard reserves. After all, banks can just borrow from the Fed using those same Treasuries as collateral if they need the liquidity.

And we know that Bernanke dismissed monetarism’s connection. As Dr. Richard G. Anderson (the world’s leading guru on bank reserves) wrote me in Nov. 2006:

“Spencer, this is an interesting idea. Since no one in the Fed tracks reserves…”

That’s how Paul Volcker stopped inflation. He applied reserve requirements against NOW accounts in April 1981

Looks like the 2010s was a bad time to be a young saver. Effective negative interest rates…My Millennial cousin used to complain that HISAs from online banks paid at most 0.50% here in Canada, with the Big 6 paying at most 0.10%.

Now I’m grown up I got a 6% 1 year HiSA offer from the same online banks.

In my opinion, the low interest rates of the 2010s punished savers and rewarded the housing speculators.

Housing speculators are still hoping for the 0.99% variable rates and $5 million dollar starter homes in world class York, Peel and Durham region.

What are you talking about if you were in the markets you saw one of the greatest bull runs in world history…cash ‘investment’ instruments are only ever supposed to keep up with inflation and not beat it.

The Buffett indicator is telling me not to invest in stonks right now. People are handing over their life savings on a memecoin named after a bodily function.

Since 2015 after the oil price collapse, it’s expensive for me to buy USD stonks unless I’m certain that the Canadian dollar has room to go lower by another 10 cents just to make up for the app forex rates and transaction fees.

A 6% rate for a year in liquid savings isn’t that bad, especially when in a TFSA account the interest isn’t taxed.

Perhaps it’s the wording but we’d all agree it was a good time to be a young speculator but not a good time to be a young saver.

Depending on how young and your resources you probably didn’t have enough money to compound into anything significant and most will have whatever wealth they have created destroyed here soon enough when they experience an extended bear market🎢

That was Bernanke’s wealth effect’s intent: Bernanke, pg. 287 in his book “The Courage to Act”, “Lower long-term rates also tend to raise asset prices, including house and stock prices, which, by making people feel wealthier, tends to stimulate consumer spending”

But: “Housing is considered unaffordable if it costs more than 30% of an individual’s income”.

The big surge in housing prices has really happened in the last four years. Bernanke’s QE occurred 14 to 16 years ago.

FRED inflation adjusted house prices nationally (the old Case Schiller).

https://fred.stlouisfed.org/series/CSUSHPINSA

The link you provided is for the Case-Shiller index, NOT inflation adjusted.

Wolf, yes my bad there, put it down to a senior moment but it in fact it just reinforces my point that house prices nationally were increasing at a fairly routine rate until about four years ago. See long term trend line.

Easy to say but easy money policies were the only available remedies for the US economy which nearly went over a cliff in 2008-2012. The Obama administration got no help from the Republican congress with fiscal remedies so monetary policy became the only game in town. Remember they even voted down TARP when a Republican was in the White House.

tarp should have been voted down, as it was a bailout with no conditions.

there’s one point people have made here before that bears repeating. if the only way to stop the economy from collapsing is to create the worst wealth inequality we’ve seen in generations and to foment social unrest, don’t be surprised when people want change, and take more and more radical steps to get that change.

Er it passed in essentially the same form a few weeks later after the market collapse caused political panic.

Wolf, yes my bad there, put it down to a senior moment but it in fact it just reinforces my point that house prices nationally were increasing at a fairly routine rate until about four years ago. See long term trend line.

As usual, great analysis, but the question still remains:

Why has the Fed cut 100-BP?

You’ve explained the divergence, but why anything more than the 50-BP cut in September? The last two cuts just don’t seem to add up. Rather, it makes the Fed look like they’re not looking at the data everyone else is looking at. And the best question of all is WHY did the Fed feel compelled to cut 50-BP in September? Did the late summer jobs number really spook them that much?

“…but the question still remains: Why has the Fed cut 100-BP?”

I answered that question in detail, including a chart.

The Fed specifically wants to normalize the yield curve.

“The Fed specifically wants to normalize the yield curve.”

I don’t know if that’s true or not, but assuming it is for a moment, I highly doubt they expected to do it by cutting the federal funds rate. It is not normal for the long end of the curve to go up in yield while the Fed cuts rates. This is one of the points of this article, which I agree with: It’s unusual behavior and there is not a lot of historical precedence for this (that I’m aware of).

I’ll add: I can’t remember a time either when there are rate cuts and QT at the same time.

“It is not normal for the long end of the curve to go up in yield while the Fed cuts rates.”

It’s also not normal for the yield curve to remain inverted for two years.

“I don’t know if that’s true or not”

Here’s my thesis for why I think the Fed wants to normalize the yield curve:

Ever since the Fed started hiking in 2022, bond volatility has been significantly elevated, as represented by the MOVE index.

Since the shift to secured financing, Treasuries have become important for use as collateral against loans and repos.

With elevated bond volatility, Treasuries are basically worth a little less as collateral. The entire secured lending complex will function better with less volatile collateral.

The Fed feels that by normalizing the yield curve, they can reduce the MOVE index and allow funding markets to function more smoothly.

This brings up a discussion (from a previous article) where Wolf and commenters traded thoughts on “manipulation” v. “control.” In my view, the latter is the end sought by the Fed, while the former is the means. Control of what? — stability.

Trouble begins with erroneous theory, and then is complicated by unintended consequences. Of course, an occasional black (or even gray) swan complicates the picture.

Eventually, when fire breaks out, the primary firefighting tools are fiscal and monetary stimulus. The Fed, and we, are living the unintended consequences of the last several fires.

Time to rethink the three mandates of the Fed… IMHO.

The Fed has one mandate which is more important than all others: ensuring the smooth functioning of the Treasury market and collateral-backed funding markets (repos etc.).

(I think) The Fed feels normalizing the yield curve is conducive to this goal, because it will reduce bond volatility, and Treasuries will effectively be worth more as collateral as a result.

ShortTLT-

When has price fixing — and what is yield curve management if not the setting by officials of duration spreads? — ever ensured “smooth functioning,” other than for relatively brief periods.

Eventually shortages or overproduction obtain.

But maybe that is your point?

Not difficult to understand. The Fed has engaged in QT of longer-maturity bonds at the same time that it has targeted a lower fed funds rate. In other words, it’s the direct result of Fed policy.

How much longer the Fed will continue QT before financial markets scream ‘uncle’, however, remains to be seen.

At this point, it really doesn’t make any difference what the markets want to ‘scream’ at all.

Indeed. Powell has explicitly stated that QT and rate changes are independent tools.

Based on previous articles and analysis here thanks to WR, it seems that QT is going to roll along forever, but practically it will be so small that it won’t even matter.

The Fed will probably stop rolling off Treasuries in 2025. They will state that they’ve reached the “ample” reserve level they were targeting. THEN, they’ll start buying TBills again to keep this ampleness relative to the growing economy. This won’t be considered QE, only maintenance of the reserves. Pre-2008 Fed balance sheet growth wasn’t QE either.

MBS will just roll off in the background at $15+B a month. But in a ~30T economy with 38+T in government debt that level of QT is nothing. They can let those MBS trickle off at $15B and also do Bill/Bond Twists of $200B a month when needed without ever officially engaging in QE again.

The way the Fed explained the sequence after QT proper ends (and it may not be in 2025) is like this:

1. The Fed will maintain the balance sheet, despite the growing economy, for quite a while at that level, before it will let the balance sheet grow again with the economy. Yellen did this too, and assets flatlined for four years (Jan 2014 – Dec 2017). This means that relative to the economy and relative to the US debt and currency in circulation, the balance sheet is going to shrink further.

2. Throughout this process, the Fed will shift its holdings from the maturing notes and bonds to T-bills. There are nearly $7 trillion in T-bills outstanding, and growing, far mor than the Fed has room for.

3. It will let MBS run off entirely and replace them with T-bills.

4. At some point, years from now, the balance sheet will start growing again, with its holdings continuing to shifting to T-bills.

Since QT started in mid-2022, people have said the Fed would have to end QT, would be “forced” to end QT, within a few months or “next year” because of yada-yada-yada, and yet it has continued. The Fed can likely take $1.5 trillion out of reserves (they haven’t gone down at all so far) before they reach “ample.” So that would be at least 2.5 years more of QT, so the middle of 2027 before it ends.

Don’t we want the curve to un-invert (hence the term, “normalize”?

Yes, which is why the first subheading reads: “The yield curve steepened nicely after un-inverting entirely.”

And under this subheading, below the chart of the yield curve, you will find these 3 paragraphs”:

“Even though the yield curve has gently steepened this week, it remains fairly flat, with only a 31-basis point spread between the 2-year yield (4.31%) and the 10-year yield (4.62%), but that spread has widened from 22 basis points a week ago.

“In other words, investors are accepting still low term premiums. But when the yield curve was inverted until recently, longer-term yields were lower than short-term yields and the term premium was negative.

“As the yield curve normalizes, it will steepen further and term premiums will rise. This could happen in two ways: With shorter-term yields falling or with long-term yields rising, or both.“

“substantial cooling of inflation since mid-2022” My ass.

First you have to learn the meaning of two words:

Prices = level ($)

Inflation = rate of change of that level over a period of time (% per time period).

“Inflation has cooled” a lot, from over 9% year-over-year in 2022.

What you’re complaining about are “high prices,” but if those prices don’t rise much anymore, then “inflation has cooled.”

Long yields are rising because who in their right mind would buy a 10 year at 4.5% from a government that is fiscally paralyzed. Cutting the budget to any significant degree is functionally impossible. Once the spending reaches a particular level, under the current political dynamic, it cannot go down.

Every cites the trade weighted index to “prove” that USD is strong. But does it really “prove” anything. It’s time to consider the possibility that current metrics are reflecting a slowly awakening loss of confidence in the USD, especially offshore.

“who in their right mind would buy a 10 year at 4.5%”

“current metrics are reflecting a slowly awakening loss of confidence in the USD”

If that’s true, then why are rates so low?

I would personally never buy the 10-year at 4.5%… but the fact that it’s not higher means other people are.

I had built up a large position in 20-30y treasuries & gilts over the last 18 months around 4% yield expecting the curve inversion to herald a recession as it has in the past. It was beginning to weigh heavily on me and I exited around 4.40% before the last Fed decision. Never felt better about taking a small loss! (around -4% net carry)

The “loosening” in the labour market has given the FED the false sense that inflation will go to target into 2026. It seems they are now hedging for the “soft landing” and are willing to risk the bumpy ride sideways in CPI.

Excellent article and comments as usual.

All the best for New Year and 2025 everyone.

DM: Jimmy Carter dead at 100: Former US President passes away in his Georgia home almost two years after entering hospice care

NYP: San Francisco house prices plunge amid widespread tech layoffs

The Golden City is losing its shine.

Housing prices in San Francisco have plunged to pre-pandemic levels amid widespread layoffs in the tech sector, SFGATE reports.

Despite still being one of the more expensive metropolitan areas in the US, prices for condominiums and co-ops in the city were down 14.7% from May 2022 and now average $986,000.

Those prices have not been seen since 2015, according to Zillow data analyzed by Wolf Street.

LOL, they finally read my article and copied my content?

Published right here on Dec 26:

https://wolfstreet.com/2024/12/26/san-francisco-house-prices-drop-back-to-2019-condo-prices-to-2015-as-tech-jobs-in-the-city-silicon-valley-evaporate-after-drunken-hiring-binge/

I don’t think they have humans there anymore, just AI.

Apparently so!

Dude, Like everyone everywhere is copying your presentations; some are honest enough to give you credit, many are not. I see what appears to be your language, word for word a lot…