Household cash in money market funds jumps to a record but CD balances begin to decline.

By Wolf Richter for WOLF STREET.

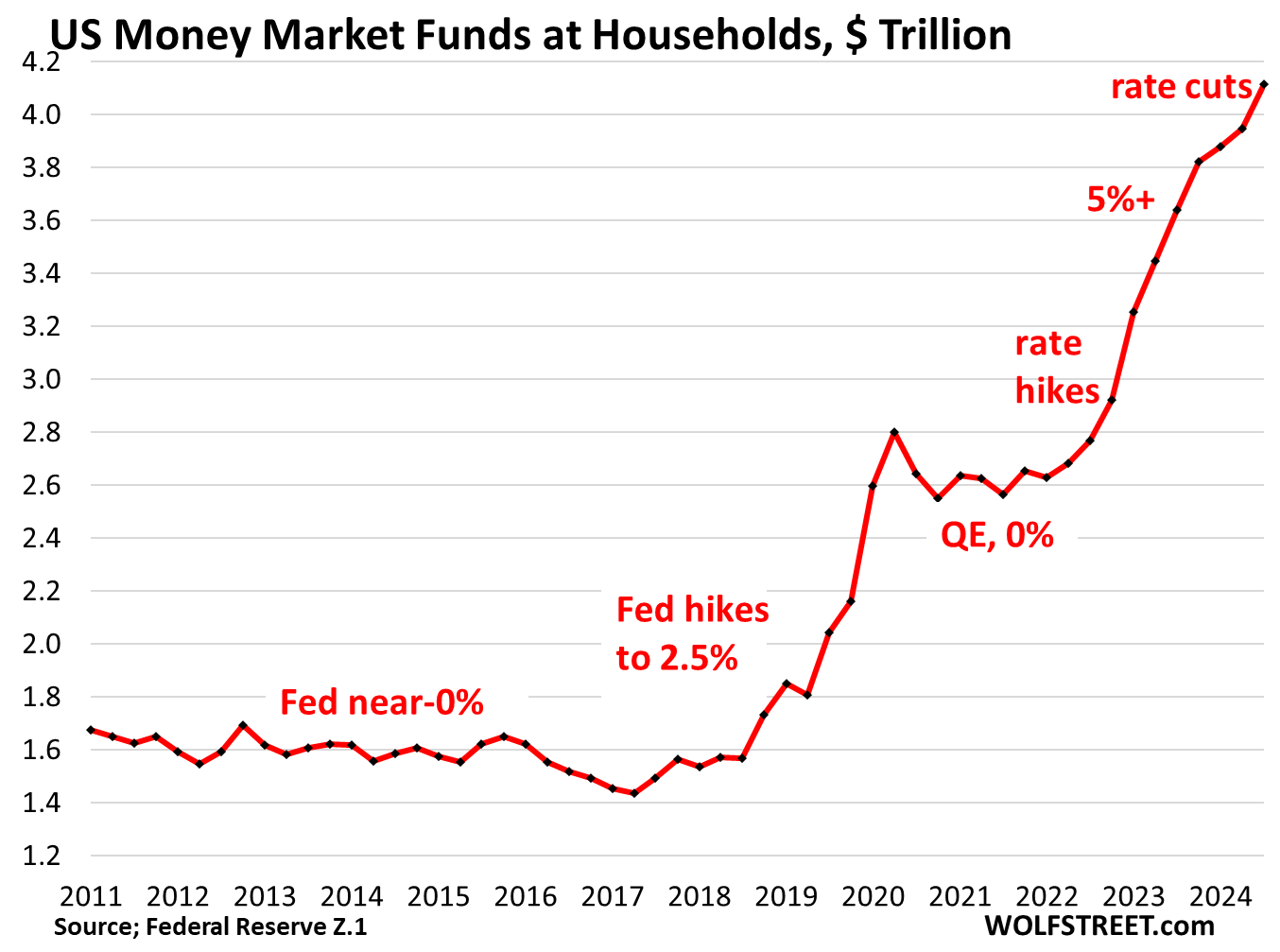

Balances in money market funds held by households at the end of Q3 jumped by $167 billion from the prior quarter to $4.11 trillion, according to the Fed’s quarterly Z1 Financial Accounts released yesterday. This massive jump in MMF balances occurred even as the Fed started its rate-cut cycle with a 50-basis point cut on September 18, and even as MMF yields have been meandering lower since July in anticipation of the cuts.

Yields of MMFs roughly parallel three-month Treasury yields but are often a little higher. Three-month Treasury yields started descending in July from about 5.36%, and by September 18, the day of the rate cut, were down to 4.76%, and by the end of September, they were down to 4.60%. But even those lower yields were still good enough, and households poured more cash into MMFs in Q3.

These MMF balances include retail MMFs that households buy directly from their broker or bank, and institutional MMFs that households hold indirectly through their employers, trustees, and fiduciaries who buy those funds on behalf of their clients, employees, or owners.

MMFs are mutual funds that invest in relatively safe short-term instruments, such as Treasury bills, high-grade commercial paper, high-grade asset-backed commercial paper, repos in the repo market, and repos with the Fed – the Fed’s “Overnight Reverse Repos” (ON RRPs).

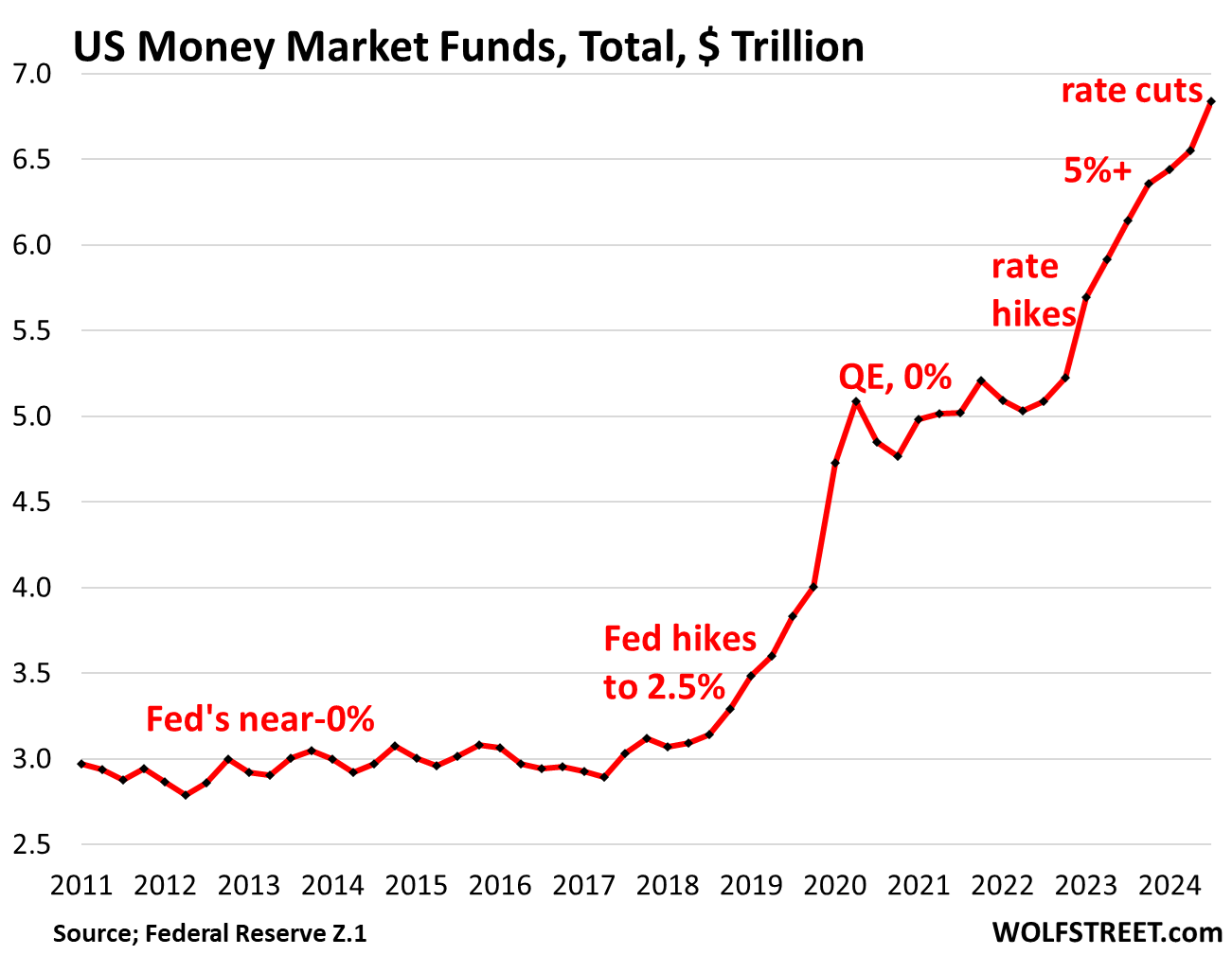

Total MMFs (held by households and institutions) jumped by $291 billion in the quarter to $6.84 trillion at the end of Q3, having ballooned by 53% since Q1 2022 when the rate hikes started from near 0%, and having more than doubled since 2018, when the prior rate-hike cycle took the Fed’s policy rates to 2.25%.

But even after the Fed started cutting rates in 2019 and slashed rates to near 0% in Q1 2020, cash continued to pour into MMFs. It wasn’t until Q3 2020, that relatively small amounts of cash left MMFs, and then balances remained essentially stable. When yields started rising again in 2022, a tsunami of cash washed over the funds. And that has continued so far despite lower yields:

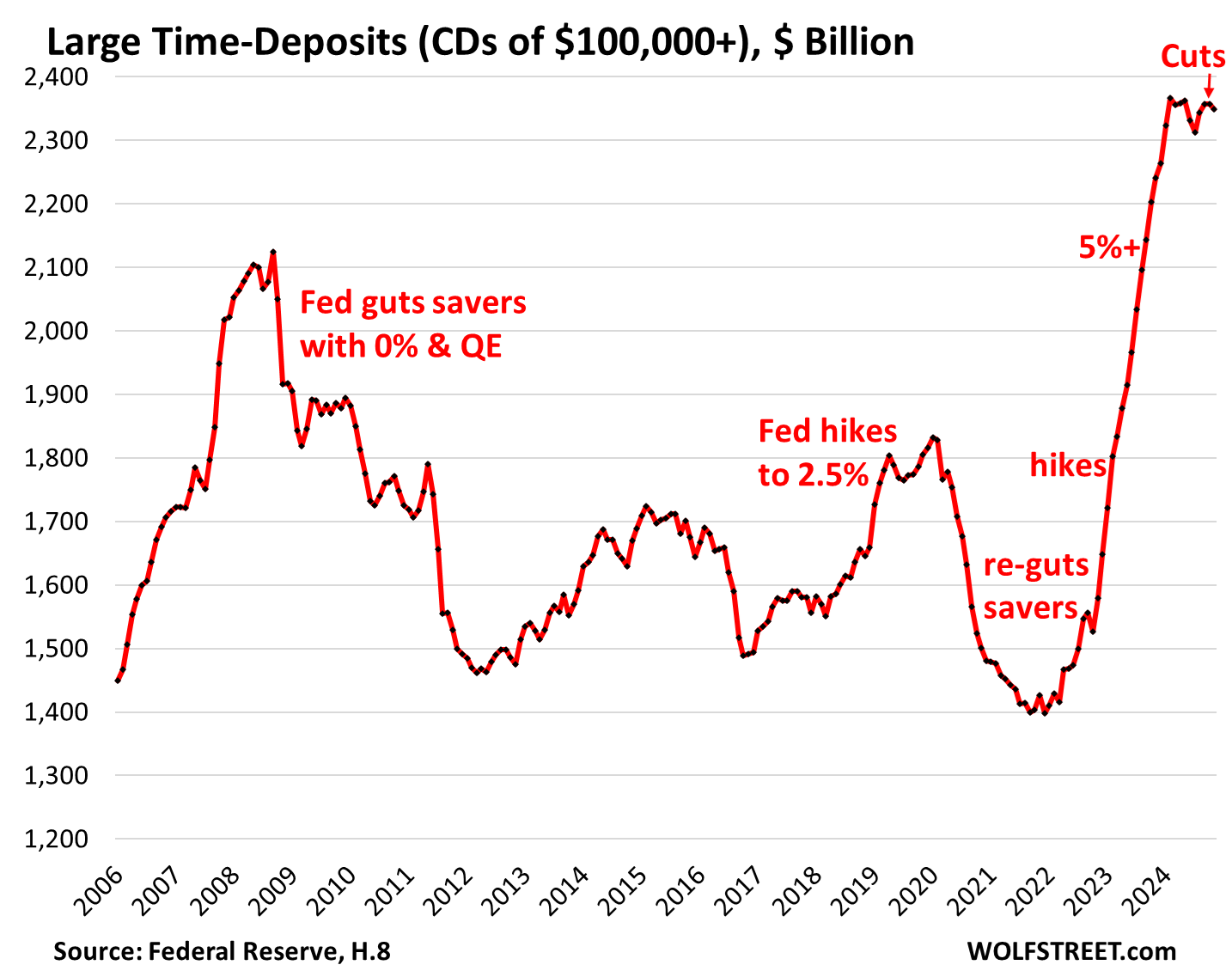

When MMF yields began to move higher in 2022, banks had to respond by offering higher yields on CDs and savings accounts in order to motivate new customers to put their cash into the bank and to motivate existing customers to not yank their cash out. But paying higher interest rates on deposits increases banks’ cost of funding, and they don’t do it unless they have to in order to hang on to their customers’ cash (deposits).

Deposits – loans from customers to banks that form the primary funding of banks – are generally “sticky,” especially in checking accounts and low-yield savings accounts that customers are too lazy to empty out. This stickiness of deposits means that even when rates rise, a big portion of deposits doesn’t get the higher rates but stays at those banks nevertheless, and customers pay the “loyalty tax” to the bank. Banks count on it. Some deposits did leave when yields rose, and banks had to deal with it by selectively offering higher interest rates.

But by early 2024, banks had enough deposits and started dialing back the interest rates they offered even as MMF yields were still over 5%. And cash stopped pouring into CDs.

Large Time-Deposits (CDs of $100,000 or more) peaked in February at $2.37 trillion and then sort-of flatlined with a dip in June and July followed by a partial bounce-back in August and September. Then balances eased again, to $2.35 trillion at the end of November, according to the Fed’s monthly H.8 banking data released today.

In the two years since March 2022 (when the rate hikes began) and February 2024, large time-deposits surged by $951 billion, or by 67%. And when banks started dialing back their rates, the surge stopped, but the balances have remained sticky so far at these levels:

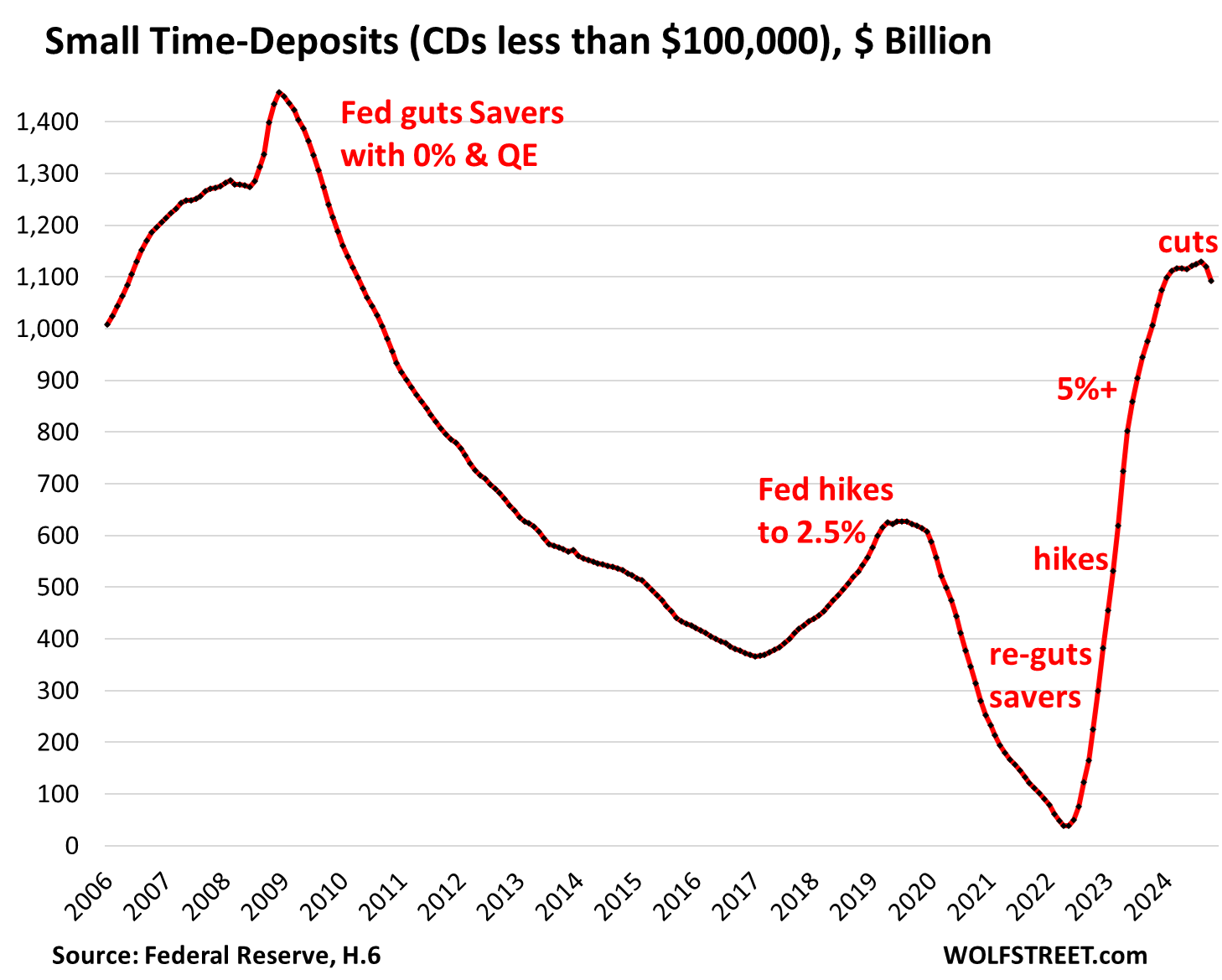

Small Time-Deposits (CDs of less than $100,000) dropped to $1.09 trillion in October following the first rate cut, according to the Fed’s latest Money Stock Measures. The data for November has not yet been released.

These small CDs reflect what regular folks are doing with their savings. When the Fed gutted their cash flow from savings in 2008, they lost interest in CDs and the cash reverted to savings and checking accounts, or went somewhere else.

From the end of 2008 through mid-2022, these CD balances had plunged by 97%, despite the rate-hike hump in 2018. When rates rose in 2022 and 2023, balances exploded. These small CDs are very sensitive to interest rates; they’re not “sticky” at all. They come and go.

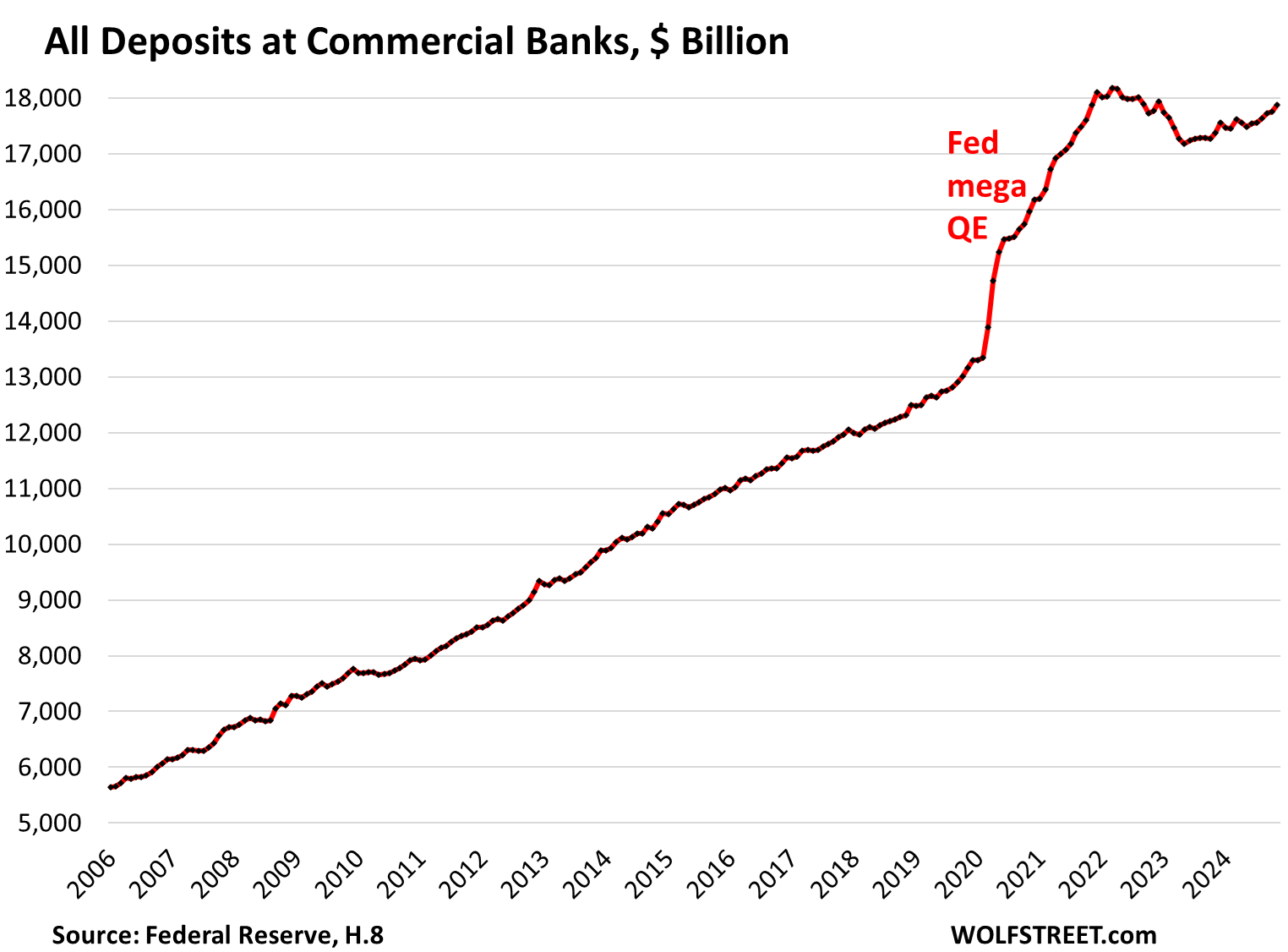

Total deposits at all commercial banks edged up to $17.9 trillion in November, according to the Fed’s banking data released today. These are deposits by all bank customers: households, businesses, and state and local government entities. But the Federal Government’s checking account is no longer with commercial banks and is not included here; during the Financial Crisis, it was moved to the New York Fed.

All commercial banks combined lost about $1 trillion in deposits between the initial rate hike in March 2022 through May 2023, just ahead of the last rate hike. This kind of plunge in deposits, in dollar terms and in percentage terms, had never before occurred in the data going back to 1975.

Three banks collapsed during that time – Silicon Valley Bank, Signature Bank, and First Republic – and another was forced to shut down by regulators – Silvergate Capital – because depositors tried to yank their cash out all at the same time. But starting in June 2023, deposits started slowly rising again and have by now regained a large portion of the plunge:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

ZIRP encouraged people here to gamble on Canadian real estate.

It got even worse in 2021 and 2022. Foreign investors were knocking at people’s doors offering cash payment for these coveted Canadian real estate.

Fast forward to today, price cuts from bubble prices are becoming the norm. I’m beginning to notice a lot of layoffs and people in financial distress these days despite the low 70 cent loonie.

5-year bond yields are not going lower despite rate cuts.

I think, across the board, bond yields are not going down with rate cuts because many educated people know cuts are probably happening too soon and by too much, and that cuts themselves are inflationary.

Any good dividend stocks out there in oil/gas, utilities, and reliable blue chips? No real estate. Thank you.

Look at Vanguard’s VIG ETF. 20% return last year. There’s a few others.

I have long loved VDIGX. Not advice.

UNTC. After paying their special dividend this year, they’ll have paid $7/share in total dividends. Current share price is $35.

For fun and entertainment only; not investment advice.

I’m trying to spend my large pile cash

but have to be patient while housing prices drop

Why not just buy Bitcoin? It’ll be a far better yield than some dividend stock for boomers

“It’ll be a far better yield”

The yield of bitcoin = 0%. There is no yield, it doesn’t pay dividend or interest. You’re just praying to find greater fools you can sell it to at a higher price.

Many of us are waiting like you for prices to drop. But I’m worried when they fall a little more or more that all of us who are waiting will join the market and the prices will go up again. It would take something shocking like the 2008 crisis to kill people’s desire to buy and for a very long time

People like Anonymous are funny. Only a lucky few make their fortunes over night. Most that try lose big.

But I guess that’s the Millennial way.

You’re right, how foolish of me. Oil & gas exploration is indeed for boomers. Gen-z heat their homes by maxing out their GPUs on bitcoin mining.

Morningstar.com lists several dividend stocks. Highest dividends were from two chemicals industry companies DOW and LYB, both in ethylene/ polyethylene.

Utility stocks are a RE investment.

35 years Potomac Electric Power

JEPI & JEPQ

Yup, Sure was nice that 5% yield, now it’s nice to get 4% yield.

Mr money bags wont be pleased with 3% yield…

guess carrying mortgage when we sold this summer was good idea

getting 5.5%

and if they default we get property back and 35% down

You’re too kind. Never did that for less than 10%.

Mr. Toad-

Please define “Mr moneybags.” Is he a saver? A banker? An industrialist? Or somebody else.

When Walter Bagehot (over a century ago) quoted the old saw that “John Bull can stand many things but he cannot stand two per cent,” I believe he referred to the average saver.

While this “average saver” is harmed by yield suppression, most bankers, promoters and industrialists object to such policies very little.

Respectfully

Throwing hot potatoes at us, so we jump from the frying pan of cash into the fire of overpriced equities.

Morningstar is pushing the rebalance from equities to bonds. I’m looking at high dividend funds and bond etfs and they’re mostly nipping at 3%. MMF still paying low 4% and so I’m holding, for now.

This will be the most interesting FOMC meeting of the year. Even if another rate cut seems inevitable, what they signal for possible rate cuts next year has some impact on what banks will pay on CDs, and actual rate cuts will eventually hit MMFs.

With stocks at record valuations having CDs and MMFs that appear to pay more than inflation provides some comfort for investors who are in capital preservation mode – until the government releases its revised numbers.

Having a number of large CDs paying 4.5 to 5.2% come off my ladder in the first half of the year, I will certainly be watching closely.

This meeting will be one of the four a year when the FOMC releases its Summary of Economic Expectations (SEP), which includes the Dot Plot. The SEP will give us an idea of how their outlook has changed on the economy and rates. I expect a further uptick in the median projection for the “longer run” federal funds rate target. That “longer run” rate is the median projection by the FOMC members where they see “neutral.” it has been coming up steadily with every SEP and in September was raised to 2.9% at the median, with expectations ranging from 2.4% to 3.8%.

Yes, want to see those Dot Plots.

I am still expecting a rate cut this week, but I am curious to see if there will be any dissenters on the cut. Maybe Bowman again? Any others?

Let’s hope a few others wake up. Can’t understand their thinking while looking at the #s

“in September was raised to 2.9% at the median, with expectations ranging from 2.4% to 3.8%.”

So let’s not be surprised with a December median of 3.3% and a range of 2.8% to 4%. And then the fun really arrives March 2025, when the FMOC delivers its first 2025 SEP.

For now at least, slowly building inflation lurks almost everywhere.

This median is very incremental and slow moving, meeting by meeting. If the median goes to 3.0% from 2.9% from one meeting to the next, that’s already something. And then to 3.1% at the meeting after that, etc.

I agree with Wolf. The Fed needs to *gradually* prime the bond market for higher rates – not shock them.

Transmitting monetary policy via messaging is a big part of the Fed’s philosophy. Powell has explicitly stated this at one of this year’s fomc pressers.

The velocity of money is a function of interest rates. Once rates peak, momentum takes over.

I’m curious how this data matters when most people I know with large cash savings are buying treasuries not leaving it in money markets?

Also since the fed seems intent on cutting regardless of economic data – I’m curious where this money goes once short term yields drop below 4%. Will people spend it, put it into the stock market, or put it into housing?

Spend == inflation

Stock market == new highs

Housing == sustaining current prices or further inflating them

Yes, these are my same concerns. I am sitting on decent cash pile and wonder which direct to take if rates drop below the 3% range. I think its possible the melt up continues without a substantial recession. But I hate the idea buying assets at the current valuations. Everything seems so out of whack. There has to be drop at some point in the future.

MM1,

Replying to your first paragraph:

1. “I’m curious how this data matters…”

There are close to $7 trillion in MMFs, and close to $10 trillion in MMFs and and CDs mentioned here. Since when do $10 Trillion not matter???

There are $6.39 trillion in T-bills, and a lot of them are owned by institutional investors in the US and foreign countries. Only a small portion is owned by retail investors.

Money market funds offer some advantages over T-bills, including:

A. convenience: MMFs automatically re-invest the interest payments. With T-bills on auto-rollover, the interest gets paid in cash when the bill matures, and only the principal gets reinvested, while the interest payment sits in your account not doing anything until you invest it. So after every rollover, you’ve got to go into your brokerage account or bank account that got the interest payments and do something with it. This is good for retirees who use the interest payments to live off, but it’s a hassle for others that are accumulating capital.

B. being able to sell at face value: If you want to sell T-bills through your broker, everyone is going to take their cut, and the buyer is going to buy at a discount, so you’re not likely to get face value (and the buyer gets all the interest). But when you sell a MMF, you get $1 per share, with no loss or cuts or commissions, and you get the interest up to the day of the sale. So if you don’t know when you need the cash (say for the downpayment of a house or going back into the market), then a MMF can be a better deal.

But T-bills are more secure than MMFs, which are bond funds which can experience runs on the fund, which can trigger some small losses if the fund “breaks the buck.” So if you want 0% chance of capital loss, you go for T-bills. If you can accept a small risk of small losses, you can go with a mix, for example.

T-bills and MMFs both have their place and purposes

2. “…when most people I know with large cash savings are buying treasuries not leaving it in money markets?”

You’re confused if you’re comparing MMFs to longer-term Treasury notes and bonds. You’re comparing apples and oranges. Longer-term notes and bonds are a risky investment. They’re fairly illiquid and subject to massive losses when yields rise, as we have seen (and gains when rates fall). People took 50%+ losses selling 30-year Treasury bonds they bought at auction in mid-2020. That’s bond math. It caused three regional banks to collapse. Investing in bonds is a different type of investment than MMFs and T-bills. It’s higher risk and higher reward. The three regional banks imploded when those risks turned into losses. People who buy bonds now are gambling on falling longer-term interest rates. Don’t ever throw MMFs (no gambling) and longer-term bonds (gambling on falling interest rates) into the same bucket. But bonds and stocks can be thrown into the same bucket.

Also, broker restrictions occasionally prevent one from selling T-bills prior to maturity. I have a couple CUSIPs that I’m unable to liquidate at the moment.

I’d like to point out that people have other options than that.

1. They could withdraw it as physical cash, put it in their wallet, and hold it. In every financial crisis, people do this, and the money doesn’t get spent on anything. It also no longer circulates, so it’s just “there”.

2. They could use it to pay down debt, while the originators of debt don’t create enough new debt for net increases. For example, people with MMFs and mortgages could pay the mortgage down, while mortgage originators didn’t make enough new loans because people with mortgages, but without MMFs, were defaulting at higher rates and thus spiking the default rates. Net result, less money loaned into existence.

The 2nd one can happen in dozens of ways, for just about every type of loan, lender, and borrower. Even better, they happen in dozens of ways for every type of financial crisis. The big question is will there be some sort of crisis to trigger this reassessment of risk upward?

For myself a 25% drop in interest rates means a 25% drop in income. At the same time I don’t see Mrtg rates dropping much. Don’t see rates for consumer loans dropping much. Don’t see much of a drop on my unused line-of-credit.

Lower rates seem mainly to benefit Government and perhaps large corporations. It may show up i gross statistics as being a net positive for the “economy”, but its a net negative for many individuals.

No sign that debt issuance by those who “benefit” from lower rates is going to moderate, so lower rates on increasing debt ? The rates go up and down over time, but total debt only expands…

Take a look at GAB, owned shares for decades, never missed a dividend.

Current yield 10.73%

Yes, you told me to take a look, and so I did.

This is a closed-end equity fund. Over the past 25 years, the share price has fallen by 50%. So you lost 50% of your principal unless you bought at the low points somewhere along the way. Over the past three years, it’s down 21%, including during like the biggest stock market rally ever. How can an “equity fund” go down when equities soar? The yield today is high because shares have fallen so far.

UTG: 8+% div yield and +20% since the summer of this year.

For fun and entertainment only; not investment advice.

Probably the worst time in generations to jump out of money mkts and into the overvaluation , over leveraged — overbought bubbles that are hoping to be further extended into the most worthless equities that have ever existed in human history!

Is the money in the MMF really cash? These funds are mostly backed by short-term Treasury bills, and if people actually spent the money or bought stocks, the funds would have to sell Treasury bills, which would drive up short-term interest rates.

Yes.

“cash” has many meanings. Money market funds are short-term liquid low-risk INVESTMENTS.

“sell Treasury bills, which would drive up short-term interest rates”

Fed policy rates put a ceiling on T-bill rates.

Still T-Bill Chillin’

Every time I look at an alternative investment, I look at the risk.

After some consideration, I sleep fine with the T Bills.

yes, 4.4 is not 5.4, but IMO the risk is very elevated out there and this coming year looks….bumpy, to say the least.

I see folks paying 1.5m for a TAR netting $5O-70k after expenses and before taxes. To me, that is insane.

Que: The Doors “When the Music Stops”…

So Small Time-Deposits (CDs of less than $100,000) went from a total of around $40 billion a bit over two years ago to $1.1 trillion today.

Sounds like a lot of small timers are totally freaking out as to the future and moving a whole lot of real money from? to the safest place they can find. So why are equities still booming? Who is buying them?

A lot of small CDs were funded with people moving money from checking accounts and low-yielding savings accounts into CDs. When interest rates were near 0%, small CDs paid near 0% and they weren’t worth the hassle, and the cash just stayed in checking and savings accounts. When interest rates rose, it made sense to move some of the cash in a checking account to a CD.

Thanks for the explanation. Much appreciated!

Hi Wolf, will there be an impact to T-bills when the debt ceiling is reinstated on Jan 1, 2025?