But goods prices are relatively tame. Energy prices plunge.

By Wolf Richter for WOLF STREET.

As has been the case here before, the prior months’ data of the Producer Price Index were revised higher today, and on top of that came the accelerating price increases in October.

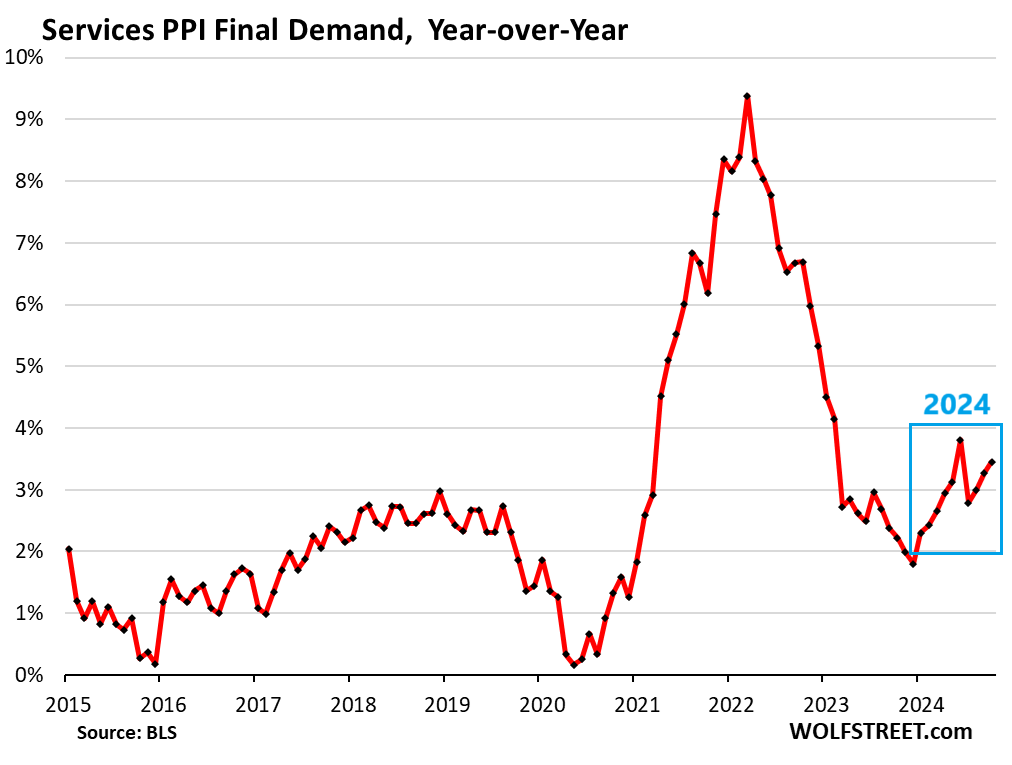

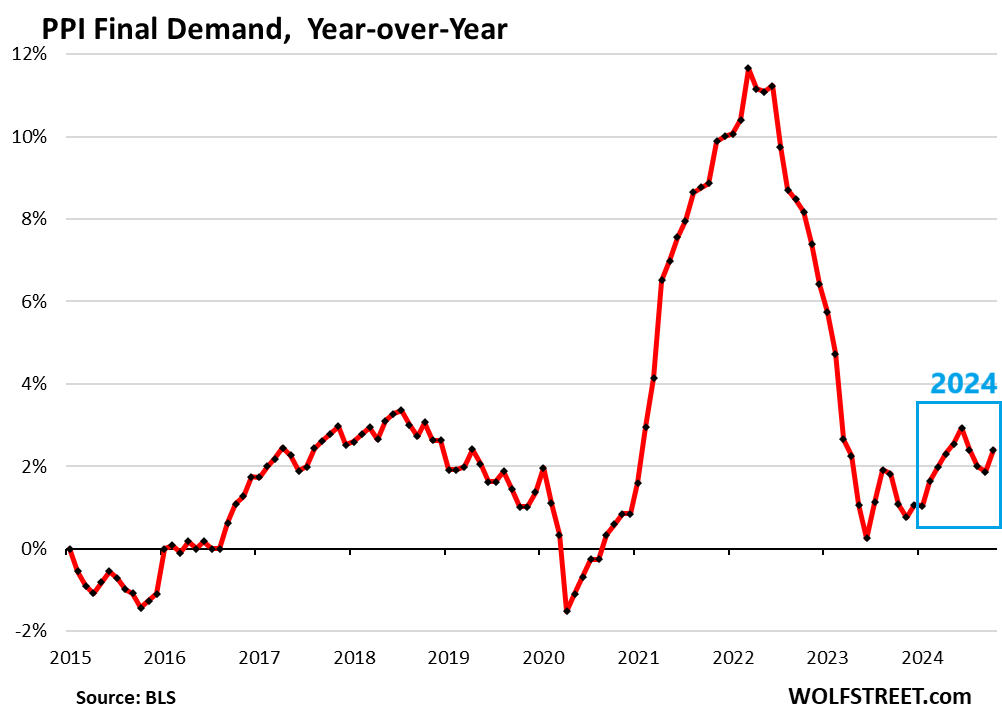

Energy prices continued to drop month-to-month, and food prices turned around and dropped month-to-month, and so that helped overall PPI, but it still accelerated to 2.4% year-over-year in October, compared to an increase of 1.9% in September. It was driven by the services PPI, which has been on an uptrend all year, and further accelerated to +3.5% year-over-year in October, compared to increases below 2% at the end of 2023. And it pushed the core PPI to an increase of +3.1% year-over-year, when it had been below 2% at the end of last year.

The PPI tracks inflation in goods and services that companies buy and whose cost increases they ultimately try to pass on to their customers.

The culprit is services. The PPI for final demand services accelerated to 3.2% month-to-month annualized in October. September was revised higher today to +2.3% annualized from the unrevised +2.0% reported a month ago, seasonally adjusted, according to data from the Bureau of Labor Statistics today. Prior months were revised higher as well.

This fits into the overall theme that inflation switched from goods to services in 2022, and has gotten sticky there, as we saw yesterday in the Consumer Price Index, where the services CPI increased by 4.3% annualized. Services are the majority of the economy and of the inflation indices.

Drivers of the month-to-month increase of the services PPI were portfolio management; machinery and vehicle wholesaling; airline passenger services; retailing of computer hardware, software, and supplies; outpatient care; cable and satellite subscriber services; transportation and warehousing services; and trade services.

Year-over-year, the services PPI accelerated to 3.5% in October. The September reading was revised higher to 3.3%, from 3.1% as reported a month ago. August was revised higher to 3.0% from 2.6% as originally reported two months ago, and then a month ago revised higher to 2.9%. These revisions in the services PPI are ratcheting the whole scale higher.

The freak drop in July in the chart below was caused by the month-to-month reading of July 2023 of +9.9% annualized falling out of the 12-month period, and being replaced by the -2.5% reading of July 2024.

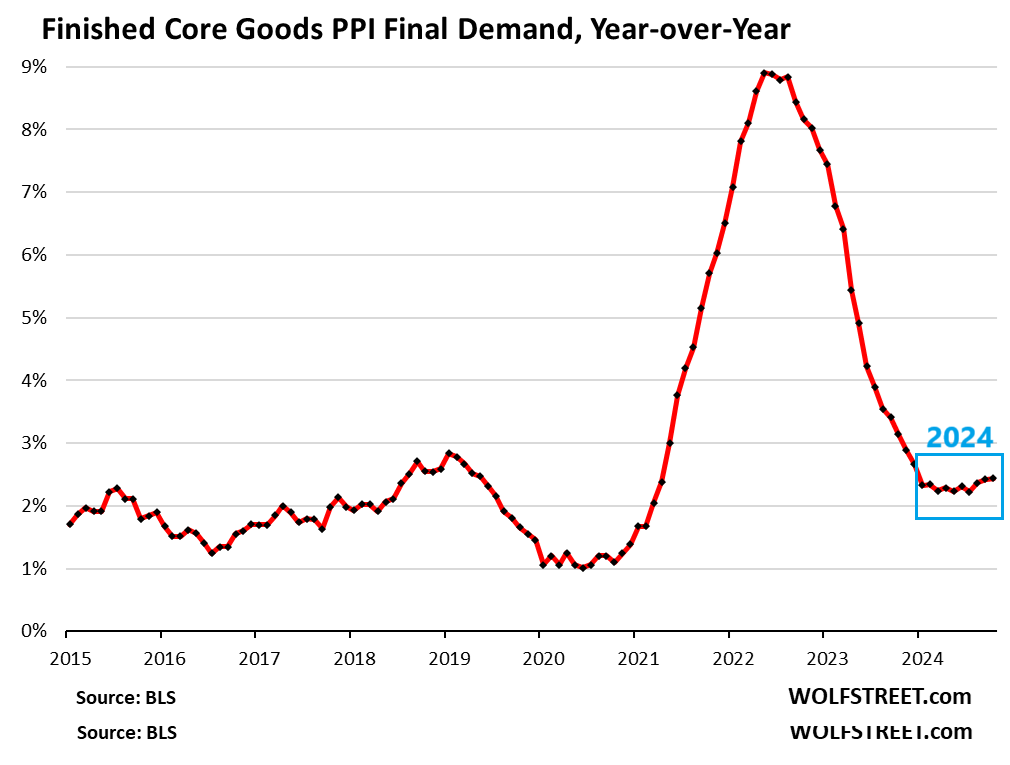

“Finished core goods” PPI has been tame. Many goods prices have been falling. The PPI for “finished core goods” includes finished goods that companies buy but excludes food and energy products.

The core goods PPI rose by 1.5% annualized in October from September, down from 2.4% in September and from 3.7% in August.

Year-over-year, the finished core goods PPI was roughly stable at 2.4% in October (rounded to the second decimal, 2.44%, it was, the highest since December 2023). The index has been all year in the upper portion of the pre-pandemic range.

As we have seen in the CPI as well, there have been no major inflation pressures in core goods in over a year. Inflation has gotten sticky in services. And core goods have been a big factor – along with the plunge in energy prices – in holding overall inflation down.

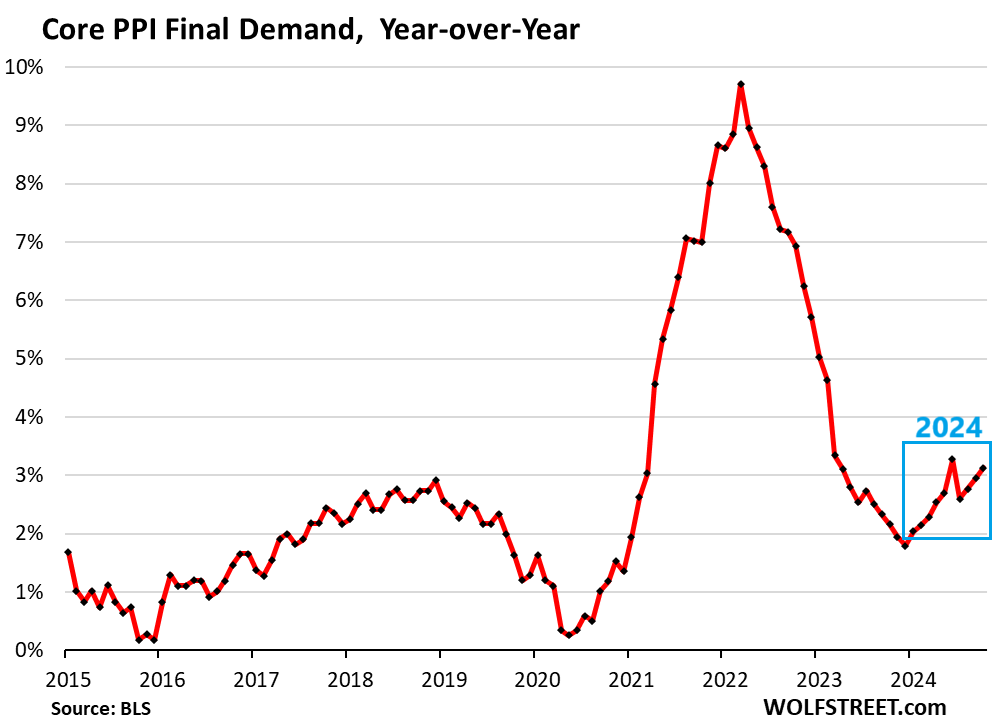

“Core” PPI accelerated to 3.1% month-to-month annualized in October. September was revised higher to 2.1% (from 1.9% as reported a month ago).

Year-over-year, core PPI rose by 3.1%, and September was revised higher to 2.9% (from 2.8% reported a month earlier).

The overall PPI for final demand accelerated sharply to 2.4%, compared to 1.9% in September (revised from 1.8% as reported a month earlier).

The plunge in energy prices since mid-2022 has kept the index down in the normal pre-pandemic range and has papered over the inflationary forces in services. But energy prices cannot plunge forever.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

1:04 PM 11/14/2024

Dow 43,750.86 -207.33 -0.47%

S&P 500 5,949.17 -36.21 -0.60%

Nasdaq 19,107.65 -123.07 -0.64%

VIX 14.20 0.18 1.28%

Gold 2,570.80 -15.70 -0.61%

Oil 68.58 0.15 0.22%

Thanks SoCal.

You’ve just killed the election bounce.

😉 /S

Questimate, 2016 to 2026, suggests cumulative 10 yr ~40% inflation.

PS CPI excludes things like taxes, fees, and interest rate impacts.

CPI’s OER captures HOA fees, property taxes, homeowners’ insurance, and maintenance indirectly on the assumption that homeowners expect to pass on these cost in the rents they would charge for their homes, which is what OER tracks. I pointed this out in my CPI article.

But this here is an article about PPI not CPI.

All sports are scripted entertainment not competitive sport, like politics…you have to be blind to think otherwise…it’s an empire of grifters nothing more…how many bubbles has the fed blown in 111 years since its inception…

“Empire of Grifters”

Yep.

“How many bubbles”

Taking a longer, historical view of things *does* help expose the cyclical, heads-I-win-tails-you-lose nature of the money supply/interest rate grift the G runs.

1) Fed prints unbacked money to buy Treasuries.

a) DC has more money to directly spend,

b) Interest rates drop, lowering cost of servicing accumulated G debt

c) Citizens’ inflation increases

2) Fed destroys/runs off unbacked money

a) With only economic actors left, Treasury interest rates rise

b) Cost of servicing accumulated G debt goes up but…

c) Higher returns on fixed income investments generate more tax revenue.

This closed system of built-in advantage has been constructed and refined for over 100 years.

MW: Powell says Fed doesn’t need to hurry to cut their interest rates

Trump’s term ain’t gonna be easy it seems

Back to beer and PIZZA! Warren just bought some Dominoes stock.

Damn, he is not eating healthy!

Quietly buy a stake, then disclose that you did, BOOM goes the stock. Then go on CNBC and hype the stock. BOOM goes the stock. Then sometime later, buy a little more and then disclose that, and BOOM goes the stock. Go on CNBC… Easiest money in the world. But YOU cannot do that.

It doesn’t always work though. Buffett tried to do that with BNSF, and it duly jumped a few times during the early phases of that hype cycle, but then spiraled down, and he started losing lots of money on his stake, so he then bought the whole thing. YOU cannot do that either.

Didn’t work well for Buffet’s gigantic stake in OXY either. At least it didn’t stay up. I never understood how that was legal. But I love it when it doesn’t work… Bill Ackman’s HerbaLife short cost his investors billions before he threw in the towel. (I have no opinion of HerbaLife.)

FEE has a decent fact check on BNSF and Keystone…

“As a bit of history, Buffett purchased BNSF in a $44 billion deal in 2009. Months later, in an interview with Charlie Rose, the sage of Omaha admitted the price tag was steep.

‘Buoyed by an onshore oil boom, Burlington Northern Sante Fe has become a cash machine for Mr. Buffett,’ Investment News reported in 2015.

“You don’t get bargains on things like that,” Buffett said in the interview.

But the truth is, Buffett did get a bargain (at least in hindsight). In just a few short years BNSF had become Berkshire Hathaway’s “single biggest profit driver,” Business Insider reported.

How did it happen? Oil transport had a lot to do with, Investment News reported in 2015.

“Buoyed by an onshore oil boom, Burlington Northern Sante Fe has become a cash machine for Mr. Buffett,” the news outlet reported. “The railroad had sent more than $15 billion in dividends to Berkshire through Sept. 30, according to quarterly regulatory filings. More stunning: The business is on pace to return all the cash Mr. Buffett spent taking it private by the end of this year.”

as Bobby Dylan said: “I can’t help it if I’m lucky….”

Someone’s got it in for me

They’re planting stories in the press

Whoever it is, I wish they’d cut it out quick

But when they will, I can only guess

They say I shot a man named Gray

And took his wife to Italy

She inherited a million bucks

And when she died, it came to me

I can’t help it if I’m lucky

….We cannot do that either!

Waiono,

As I said in my comment, Buffett bought smaller stakes and hyped them, then bought more, hyped them, etc. and in this manner accumulated a stake of 22.6%. Then the stock spiraled down, and so in November 2009, he bought the remaining 77.4% that he didn’t already own, and paid a big premium for it.

If you do fact checking, at least check the facts carefully.

Wolf: In a round about way YOU can do exactly that. Buying BRK stock makes you a partner of Buffett so YOU can benefit exactly that way. (He considers shareholders his partners).

Dominoes tastes like you backed up a garbage truck right into your mouth.

You know if people were really honest, MOST chain store restaurant food is tasteless and awful.

Slogan should be : Hyped Big, looks great..tastes like Garbage!

Danno,

Looks great in the commercials. Ever buy a hamburger from a fast food chain? Looks nothing like the commercials…

PPI inflation has been accelerating all year. CPI inflation, which tends to follow PPI, also seems to have turned back up.

When does the Fed realize that this is not “transitory”, and tighten up again to slow it back down?

The 1970s called…

Anecdotally, I have never seen less resistance to higher cash pay specialty physician emergency charges. Our county fair has one sized drink and it is $10. SOMEBODY is paying over 20% on credit card balances and we may need to step in with usury laws to prevent a hopeless future for our young Americans.

Beers are $18 at the Washington Philadelphia football game at NORTHWEST stadium tonight.

Do you at least get good beer for $18 or is it piss water?

I buy beer at 0.69 Euro for 1/2 liter. Good beer. A game I can watch anywhere.

20% APY is the price for being foolish enough to carry a balance on a credit card.

I wonder how much of a damper this will put on Trump’s economic policy plans; My guess is that the bond market is going to give him some headaches…

Seriously? Do you think he cares what the bond market does? Our Great Leader is bigger than the bond market. He has a magic wand and he will do anything he wants.

The bond market could sink the economy for the new administration. Once LT rates go above 5% on the 10 year Treasury, look out below. The Mortgage market will freeze up even more than it is today, and people who have to move will not be able to sell their homes. It could turn into a repeat of 2006/2007. There’s a lot of shadow inventory out there. Most of our recent appraisals are empty units.

Hot take: services inflation won’t go away as long as workers keep getting raises.

People want prices to go down, but they don’t want their wages to go down with them.

I know people are getting raises and spending.

But I think if this is the case then why hole sales are so down. Why are not people buying homes hand over fist if they are loaded.

On the similar note, if everything is awesome, why did Trump had a big win as one of his key point was economy.

People aren’t buying homes because it’s cheaper to rent.

So they are renting and spending money on nonsense, not saving for a house, waiting for rates and prices to come down

or, their incomes haven’t risen enough to pay the ridiculous housing prices coupled with 7% interest rates.

maybe much of whatever pay increase they’ve gotten has gone to pay insurance, child care or other things that have skyrocketed.

ShortTLT,

Mass deportations and such which I don’t see likely, could easily drive up the cost of labor further. Election promises rarely turn into realities as what is the point?

Glen – I agree, but an overheated labor market also gives the Fed more room to tighten.

I love all the people who voted for our Great Leader and then claim he is not going to do what he said or he won’t be able to do it etc. AG Matt Gaetz is going to give him the green light.

The social police haven’t weighed in on this yet.

I have felt the palpable fear in my friends from the south, and my daughter’s friends were very worried about the election result.

I am putting it in the same category as the wall (not built, NOT paid for by Mexico, remember?). Some “show” progress and miles of reality check/ resistance.

I’m from Minneapolis and remember 4 years ago (haven’t lived there in 20, but have friends there). I think the cost of social unrest and loss of productivity may become a reality check.

Gaetz will not pass Senate. May get a handful of ayes at best

And more importantly drive up the price of produce, and seriously reduce the availability thereof.

Mass deportation is just a tremendously stupid idea but fortunately I don’t think it is actually going to happen.

Do you think the demographic shift—babyboomers retiring, population growth rates stagnant, etc. Causing a prolonged tight labor market, thus keeping pressure on wages? I don’t have stats to support this, but would be interested in such an analysis.

…resource/population vacuums have manifested themseves in various ways across the centuries…

may we all find a better day.

Yeah, of course not. Why would they?

I’m not sure if there is any data on how much of every dollar spent has gone towards executive compensation versus folks working at lower rungs of the ladder. With the ever-rising executive compensations, I would hazard a guess that most of the recent price increases went towards the top guys lining their pockets even more. So why would the average guys accept lower wages especially since any recent increases probably helps them keep their head just above water.

Most of the executive compensation is in stock-based compensation, and that is NOT included in the income figures. So go back to the drawing board and come up with a new theory.

It would appear that the FED is going to try to tamp down Inflation via QT rather than higher interest rates. So far it isn’t working.

Inflation HAS come down a lot, as you can see from the charts. It’s just undead inflation. It keeps going at a lower but not low level, and it’s trying to rise from the coffin again.

Someone should make a Dracula movie out of that.

Fiscal policy (government spending up the wazoo) continues to work against the efforts of the Fed to lower inflation. Rate cuts probably should have waited a bit longer.

Rates should have been higher

for longer. The 50 point rate

cut looks more and more like

political influence.

“The 50 point rate

cut looks more and more like

political influence.”

Political influence? Eh, who knows. But bear in mind that the Fed is more than capable of this kind of cowardice on their own.

“Inflation” means nothing to consumers “price” is what the consumer feels and defines their sentiment. Sentiment is disconnected from the inflation rate because that rate never matches the increase in the price paid.

Housing is the most visible example of the disconnect. The rate of inflation or YoY both are many factors less than the price increase. Communicating to consumers should be in price increases not inflation rates. Consumers feel the compounded effect of those rates YoY.

Maybe just maybe the Treasury should be buying the Fed fund rates only and get back to a free bond market with the invisible hand taking care of the yield curve.

MW: Stocks end lower after Powell throws cold water on hopes for December interest-rate cut

Throws cold water? No, pelts it with ice cubes.

Services inflation will diminish once consumers have less money to spend. Without that happening, it never will.

The FED blew it when they cut rates before inflation was actually at 2%.

Higher consumer rates offered the promise of reduced consumer spending, but the FED withdrew them far too soon.

Current FED leadership don’t have what it takes to actually do their job well.

Don’t worry. They are going to have less. A lot less. Once the tariffs kick in and inflation skyrockets, there will be crying. Not to mention the crying when 12 million deportees head south along with 10 million other family members. It’s gonna be great!

T’s Bedminster golf club was caught with many illegals. Paying heavy equipment guy 10 bucks an hr, The gal in charge of doc check would tell them when forgery was lousy and to come back with better,

…when the record reveals that one, despite a long and loud investment self-promotion and hype, actually isn’t that good at business per nominally-accepted practices, little wonder their next career reinvention might have involved going into the gubment®ulation biz…

may we all find a better day.

When the government revises the CPI, do they revise the inflation adjustments the made to TIPS principals? If not, quite the incentive for the first print to come out on the low side, get to reality a bit later!

Revisions are up and down, depending on the month.

I don’t get how things like cable and satellite services and airline passenger services are included in the PPI for services. Unless your business is a hotel, cable and satellite services would barely show up on the balance sheet. Airline passenger services is a little unclear to me. The services to serve the passengers such as airplane mechanics, flight attendants, pilots, etc, of the actual service of flying passengers, which would be the final product, not a component of producing something? Or as I type this, are they considering this as business travel expense?

Airlines pay huge amounts for services, such as restocking the planes with food. Sure, they spend more on fuel, but that doesn’t make all the other services they pay for go away.

Russian inflation is 9%. They just raised their interest rates to 22%. If the FED had done that in the USA there would have been some very interesting changes.

LOL, did you check where the ruble is? The ruble has collapsed by 72% against the hated USD over the past 10 years. Since the invasion of Ukraine, it has plunged by 34%. And that decline against the USD comes on TOP OF the decline of the USD’s own purchasing power. So add those two together. Russia has a trash currency and a resource economy that has turned into a war economy. And the central bank is trying to keep it from entering uncontrollable inflation.

I’ve taken advatage of this 22% interest. Main risk is exchange rate. In case ruble continues its descending at least I could splurge on some caviar, vodka and diamonds.

The Fed raised rates to 5 and the stock market took off. They lowered 3/4 and the market banged new highs. It would be interesting to see what would happen if the Fed hiked a 1/4.

It looks like thr efficiency experts in the new administration should be after the services provided to the U.S. citizens. Lol, Oh wait, they have already done that.

…….. Possibly worker production in services can be increased for the benefit of stockholders and the owners.

Went shopping for necessities the other day. There’s no one working in the stores. No one even to ask a question. They are short of help. Had to load 200 Lbs of topsoil myselft into my SUV at Home Depot. In Staples, they had no one to lift a 120Lb box of paper into my basket and car. I would up getting sizzors and cutting the box and loading the reams one by one myself. What are they going to do for the holidays with no help and no workers?

We don’t need no stinkin’ workers.

Plenty of workers down this way in Texas. Send some buses down and we will ship you a bunch!

Anthony A.

Will they pass E-Verify?

Hard to find and keep good people in retail these days…

ShortTLT

Why?

Because entitled folks constantly berate them and treat them like crap.

It’s all minimum wage, no benefits, with an unpredictable schedule. You never know when they’re going to ignore your time off request and schedule you 40 hours, and then next month decide to cut you to 10 hours and now you can’t pay the rent. Go ahead and shoot me if I ever have to do that again.

Staples sent me an e-mail asking me how my experience was at my latest visit. I told them what happened and told them to call me for details. Instead of addressing my problem they asked a dozen questions about reward points and entering a $500 Sweapsteaks. I gave them a rating of 0 and put the same rating on Google. The same thing happened two weeks ago and nothing was done to correct their staffing problems.

Swamp – with all due respect, you might easily pick up a side gig with them. Best…

may we all find a better day.