Year-over-year, CPI and “core” CPI are starting to show the effects of the month-to-month increases since the “inflation is vanquished” summer.

By Wolf Richter for WOLF STREET.

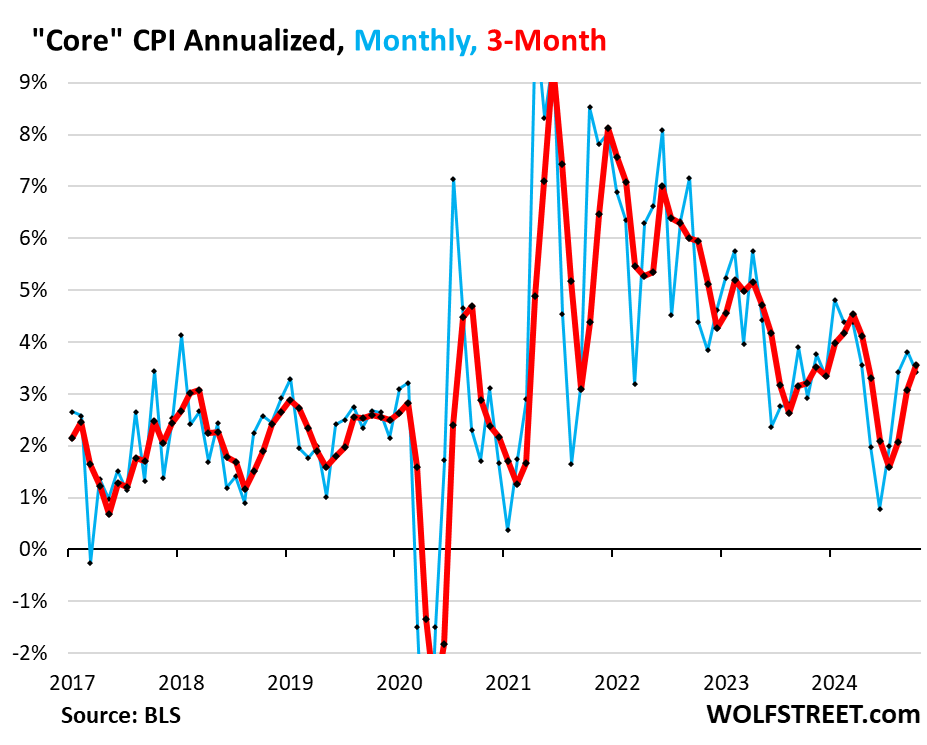

On a month-to-month basis, the “core” Consumer Price Index – which excludes the volatile food and energy components – rose by 0.28% (+3.4% annualized) in October from September. The last three months have all risen in this range of +3.4% to +3.8% annualized, the biggest increase since March (blue in the chart below).

The 3-month average “core” CPI accelerated to 3.6% annualized, the third month of acceleration in a row (red).

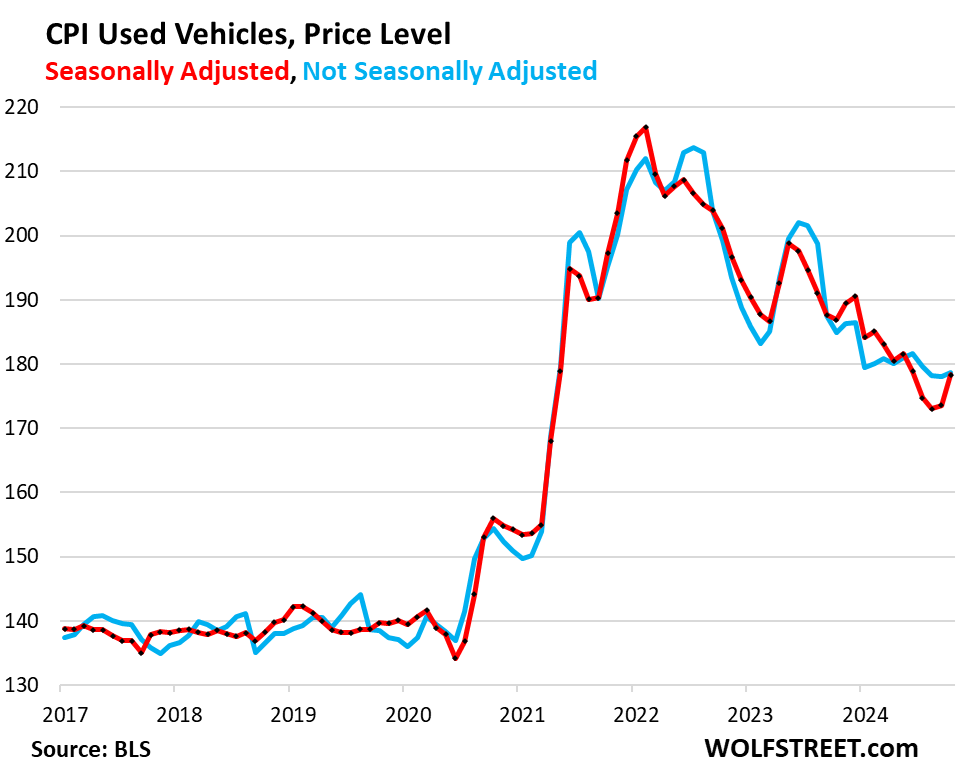

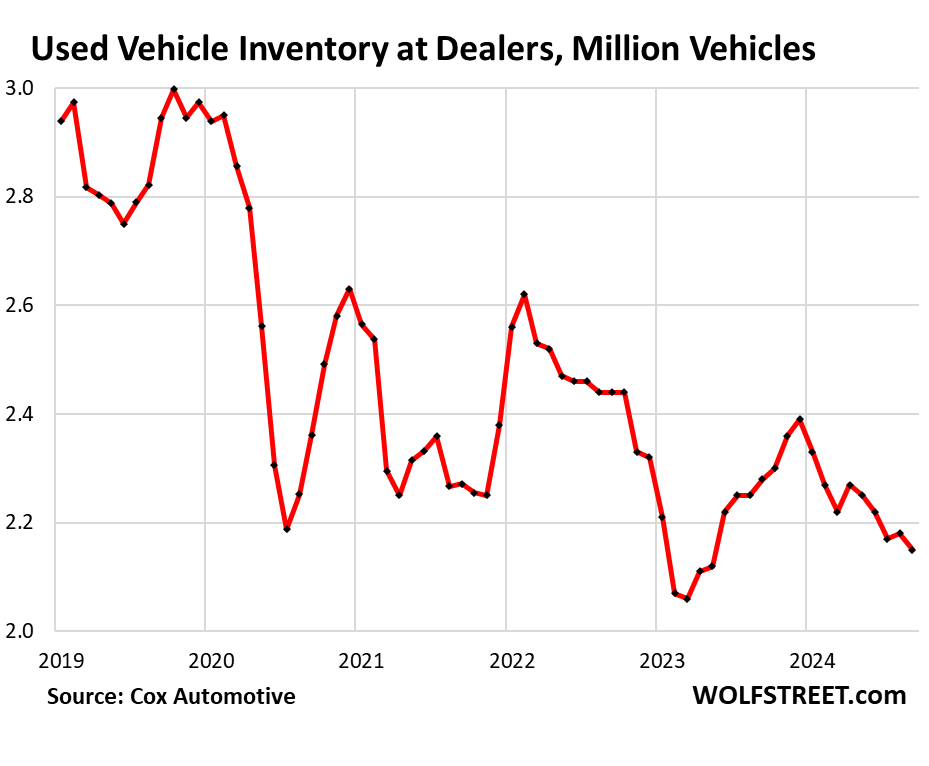

The stubbornly high core inflation rate was driven, so to speak, by the prices of used vehicles that rose for the second month in a row, having U-turned from a historic plunge, which had been one of the big contributors to cooling core inflation. But it appears to be over. Used vehicles have now turned into an inflation headwind, which we figured was coming our way, based on the rising prices at used-vehicle auctions where dealers buy to replenish their inventories.

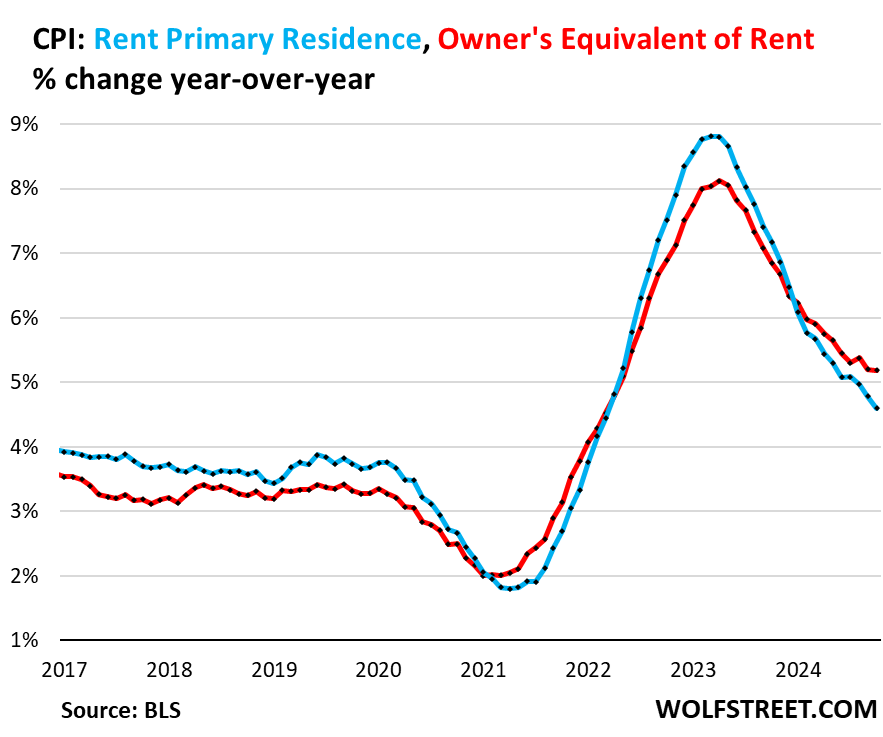

In addition, the biggest factor in CPI that approximates the costs of homeownership – including the soaring expenses of homeowners’ insurance, HOA fees, property taxes, and maintenance – “Owners Equivalent of Rent” accelerated to nearly 5% annualized, and the three-month average accelerated to over 5%, even as the index that tracks actual rents decelerated.

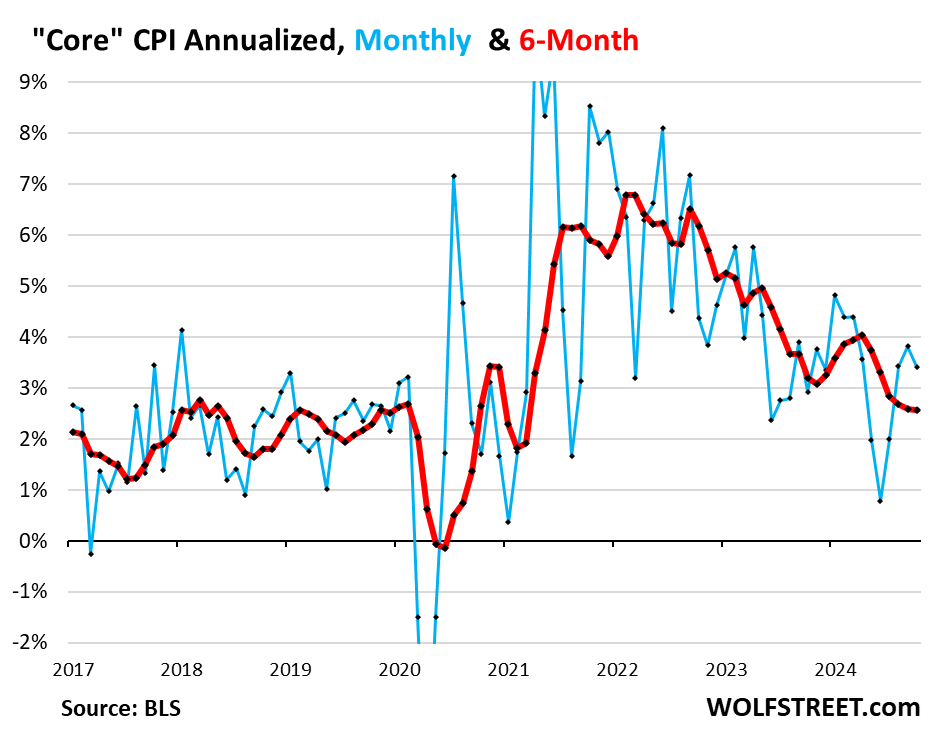

The 6-month average “core” CPI – which irons out most of the month-to-month squiggles – remained at +2.6% as it still includes the low readings of May, June, and July that will fall out of the average over the next three months (red):

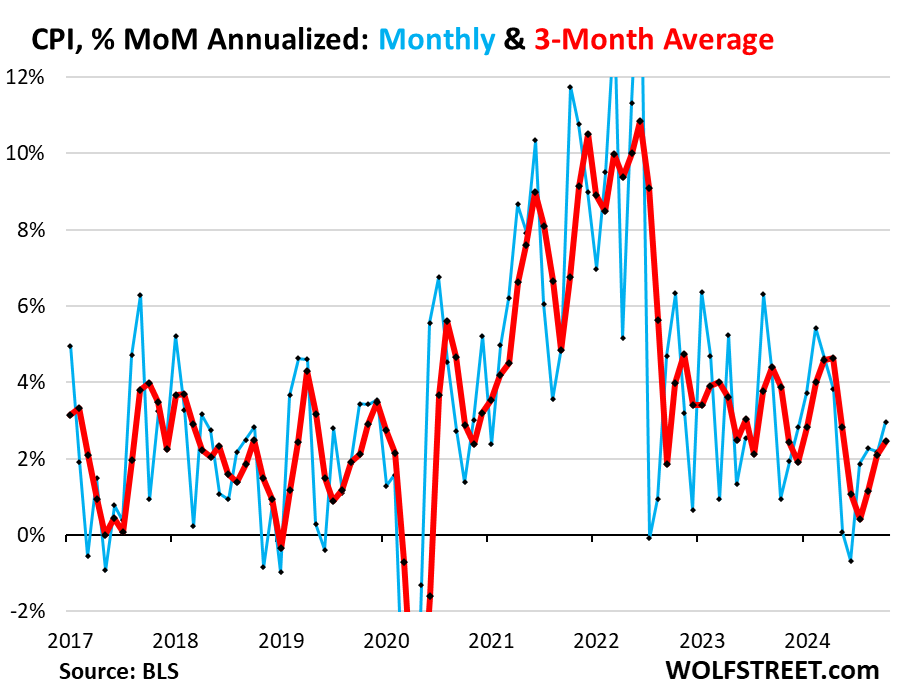

The overall CPI is still held down by the plunge in gasoline prices. But it accelerated to +3.0% annualized in October from September (+0.24% not annualized), the fastest increase since March, despite the drop in gasoline prices, and the fourth month in a row of acceleration.

The three month-average accelerated to +2.5%, also the third month in a row of acceleration.

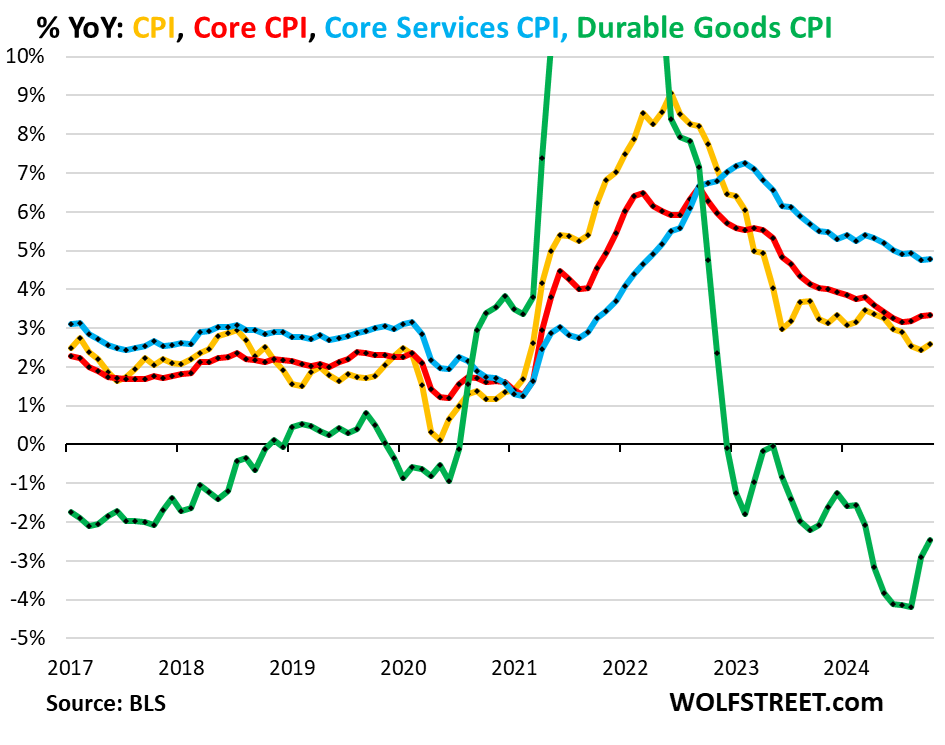

Year-over-year, CPI and core CPI accelerated:

- Overall CPI, despite the plunge in gasoline prices, accelerated to +2.6% (yellow).

- Core CPI accelerated slightly for the third month in a row to +3.3% (red in the chart below).

- Core Services CPI rose by +4.8%, same as in the prior month (blue).

- Durable goods CPI, which has been in deflation on a year-over-year basis since late 2022, became less negative, at -2.5% (from -2.9% in the prior month).

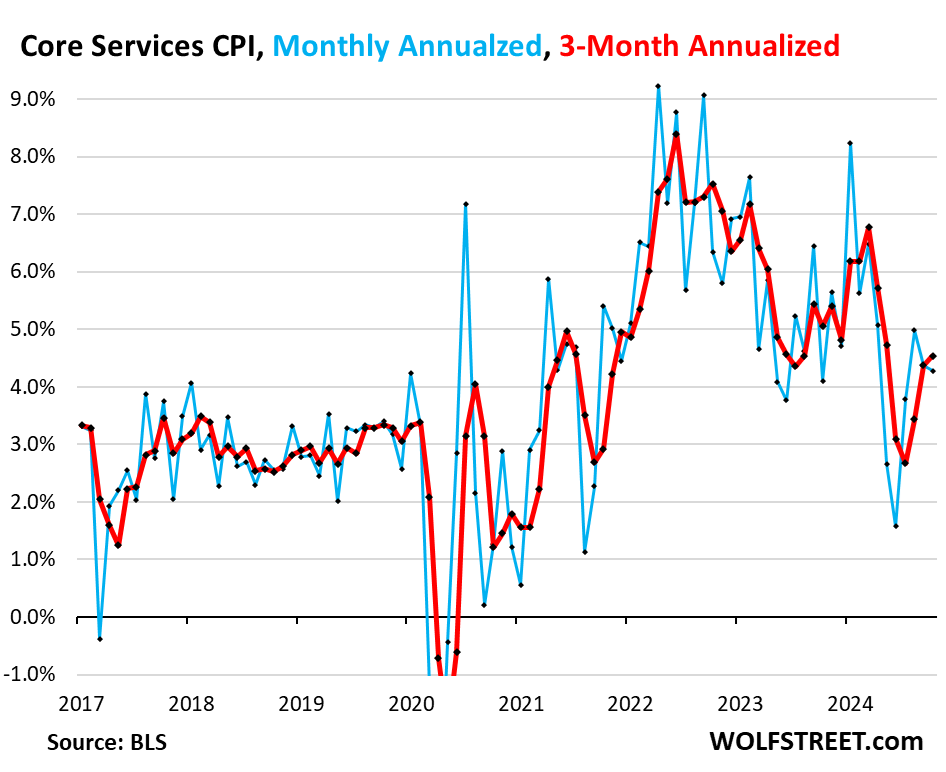

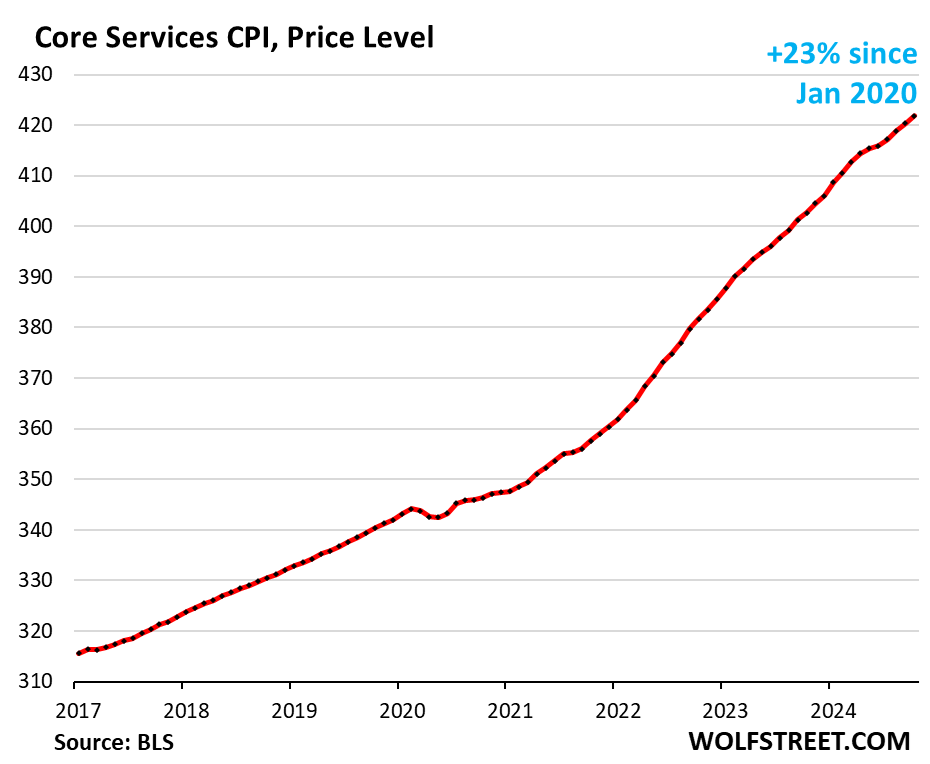

“Core services” CPI.

Core services CPI decelerated a hair to a still high +4.3% annualized in October from September, compared to +4.4% in the prior month (blue line in the chart below).

But the 3-month core services CPI accelerated to 4.5%, from 4.4% in the prior month (red).

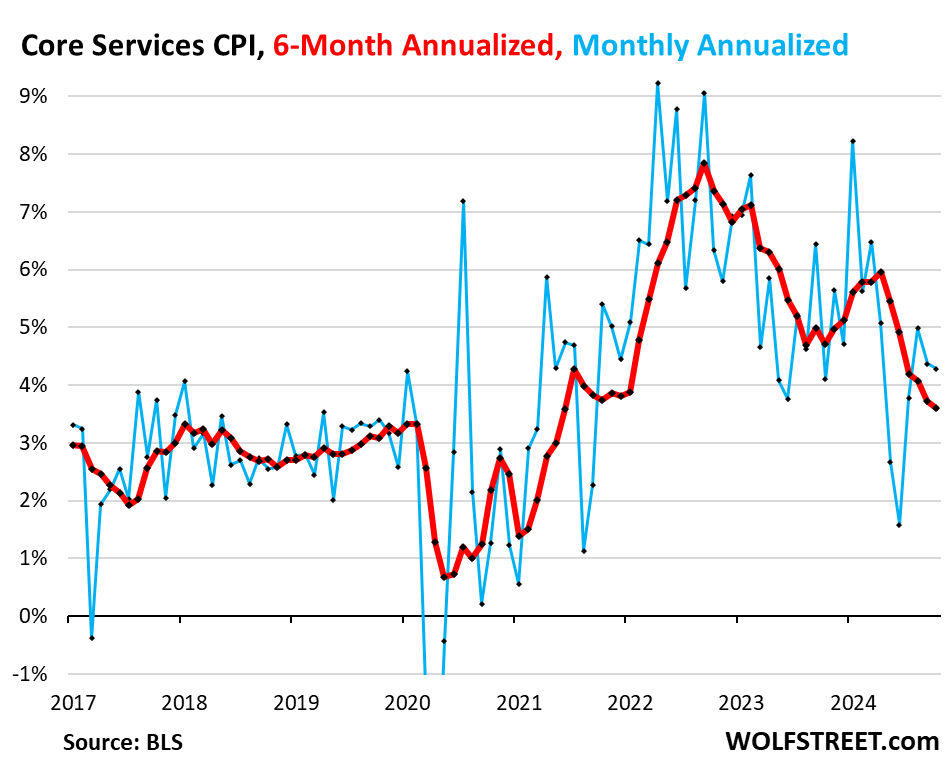

The 6-month core services CPI – which still includes the very low reading in May, June, and July that will fall out of the index over the next three months – decelerated a hair to 3.6% annualized, the smallest increase since January 2022 (red).

The housing components of core services.

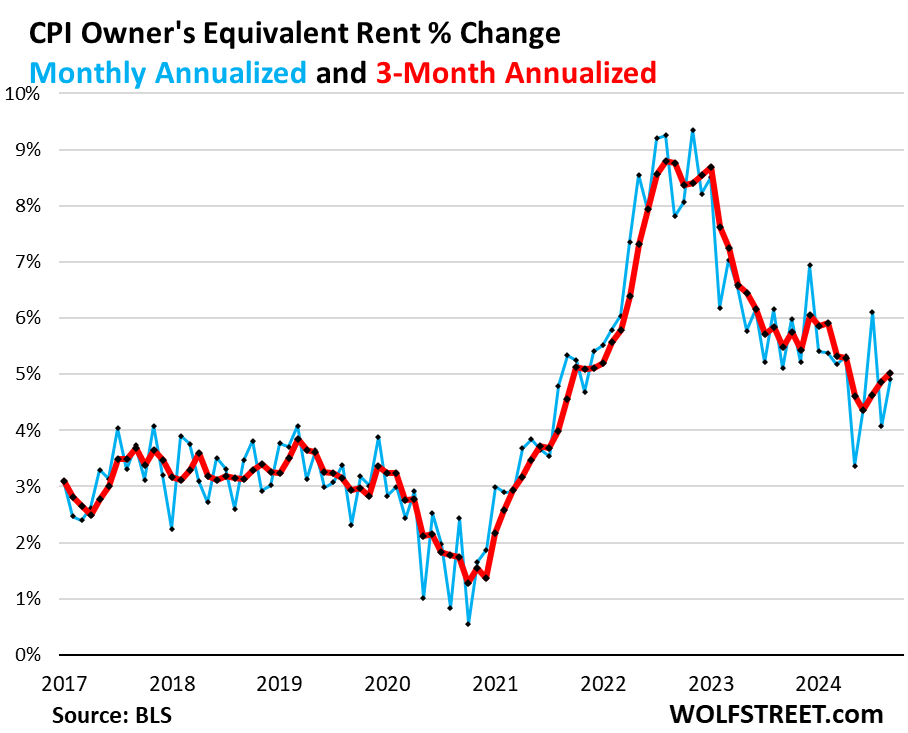

The Owners’ Equivalent of Rent CPI (OER) indirectly reflects the now soaring day-to-day expenses of homeownership: homeowners’ insurance, HOA fees, property taxes, and maintenance. It is based on what a large group of homeowners estimates their home would rent for, with assumption that a homeowner would want to recoup their cost increases by raising the rent.

It accounts for 27% of overall CPI and estimates inflation of shelter as a service for homeowners – as a stand-in for the costs that homeowners pay for, such as interest, homeowner’s insurance, HOA fees, maintenance, and property taxes.

OER accelerated to 4.9% in October from September and has zigzagged around the 5% line all year (blue in the chart below).

The three-month OER CPI accelerated to 5.0% annualized, the third month of acceleration in a row (red).

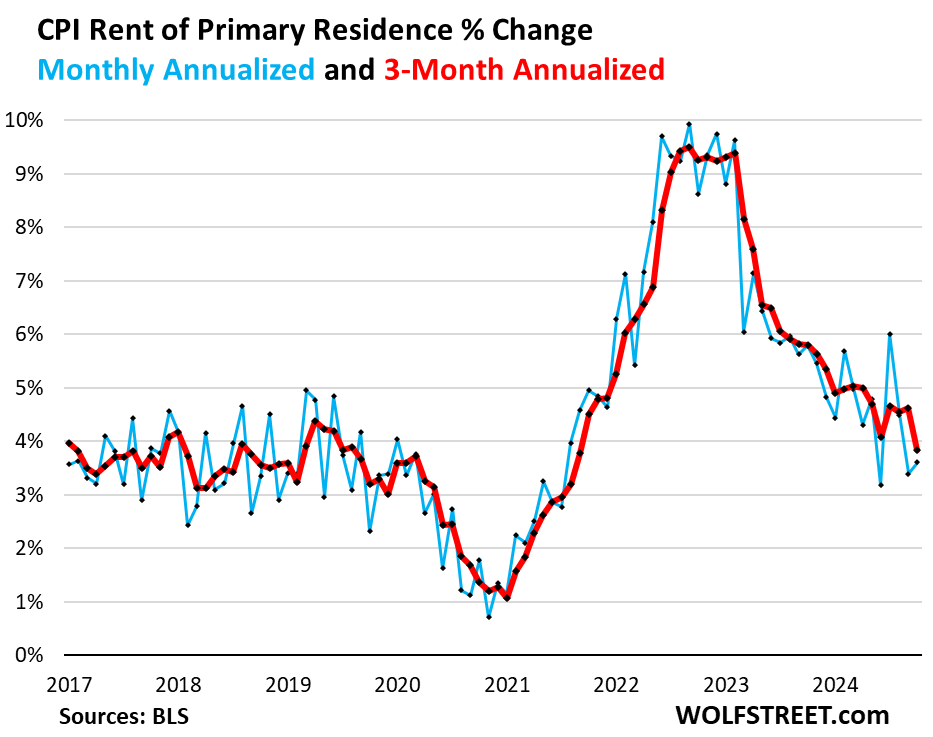

Rent of Primary Residence CPI accelerated to 3.6% annualized in October from September, up from +3.4% in the prior month (blue in the chart below).

The 3-month rate decelerated to +3.8% (from 4.6% in the prior month), as the high reading in July fell out of it.

Rent CPI accounts for 7.7% of overall CPI. It is based on rents that tenants actually paid, not on asking rents of advertised vacant units for rent. The survey follows the same large group of rental houses and apartments over time and tracks the rents that the current tenants, who come and go, paid in rent for these units.

Unusually, the OER CPI has been diverging from the Rent CPI and has been running hotter than the Rent CPI since earlier in 2024 on a year-over-year basis, likely as homeowners started figuring into their estimates the soaring costs of insurance, HOA fees, property taxes, and maintenance.

Year-over-year, OER rose by 5.2%, same increase as in the prior month (red line). But the Rent CPI decelerated further to 4.6% (blue).

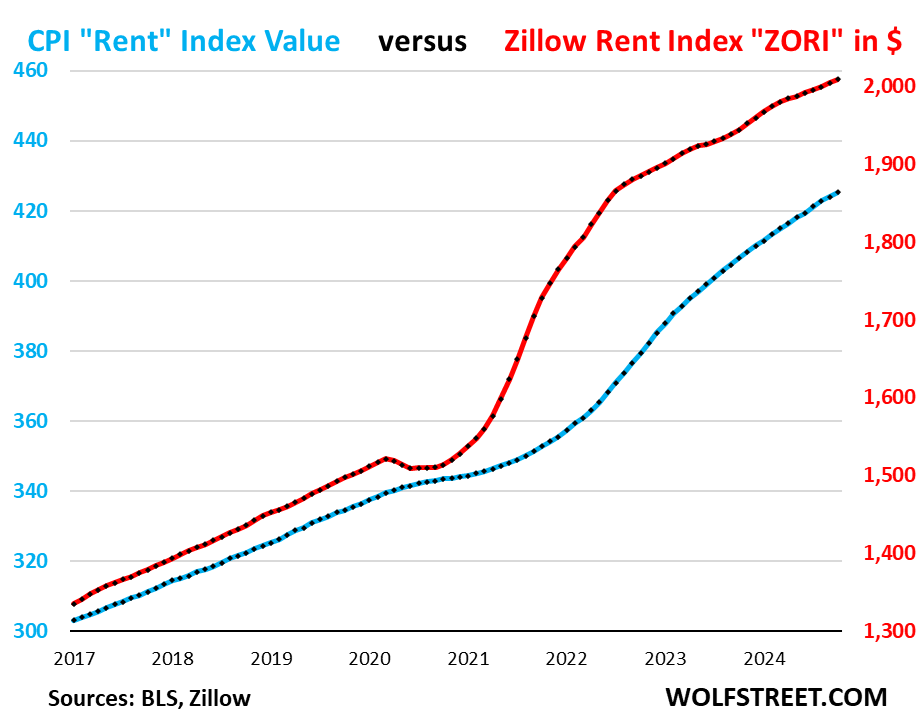

“Asking rents…” The Zillow Observed Rent Index (ZORI) and other private-sector rent indices track “asking rents,” which are advertised rents of vacant units on the market for rent. Because rentals don’t turn over that much, the spike in asking rents through mid-2022 never fully translated into the CPI indices because not many people actually ended up paying those jacked-up asking rents.

For October, the ZORI (seasonally adjusted) rose by 0.24% month-to-month and by 3.3% year-over-year.

The chart shows the CPI Rent of Primary Residence (blue, left scale) as index value, not percentage change; and the ZORI in dollars (red, right scale). The left and right axes are set so that they both increase each by 55% from January 2017.

Since January 2017, the ZORI rose by 50%, and the CPI Rent by 40%.

Since January 2020, the ZORI soared by 33% and the CPI rent by 26%.

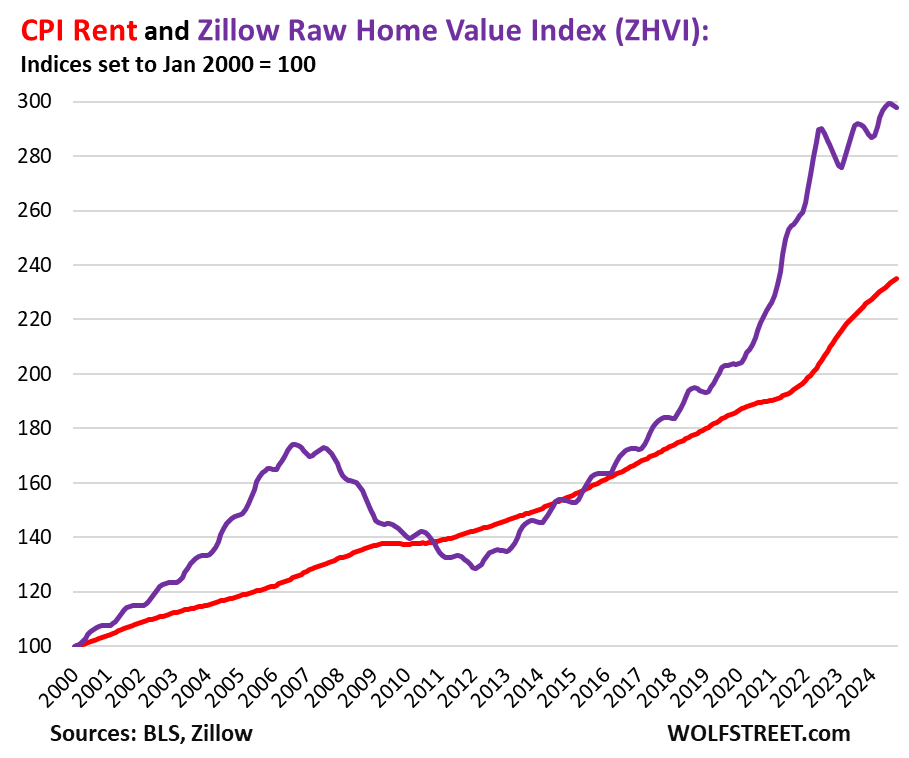

Rent inflation vs. home-price inflation: The red line in the chart below represents the CPI for Rent of Primary Residence as index value. The purple line represents Zillow’s “raw” Home Value Index for the US [this is also the data set we use for the Most Splendid Housing Bubbles in America ]. Both indexes are set to 100 for January 2000:

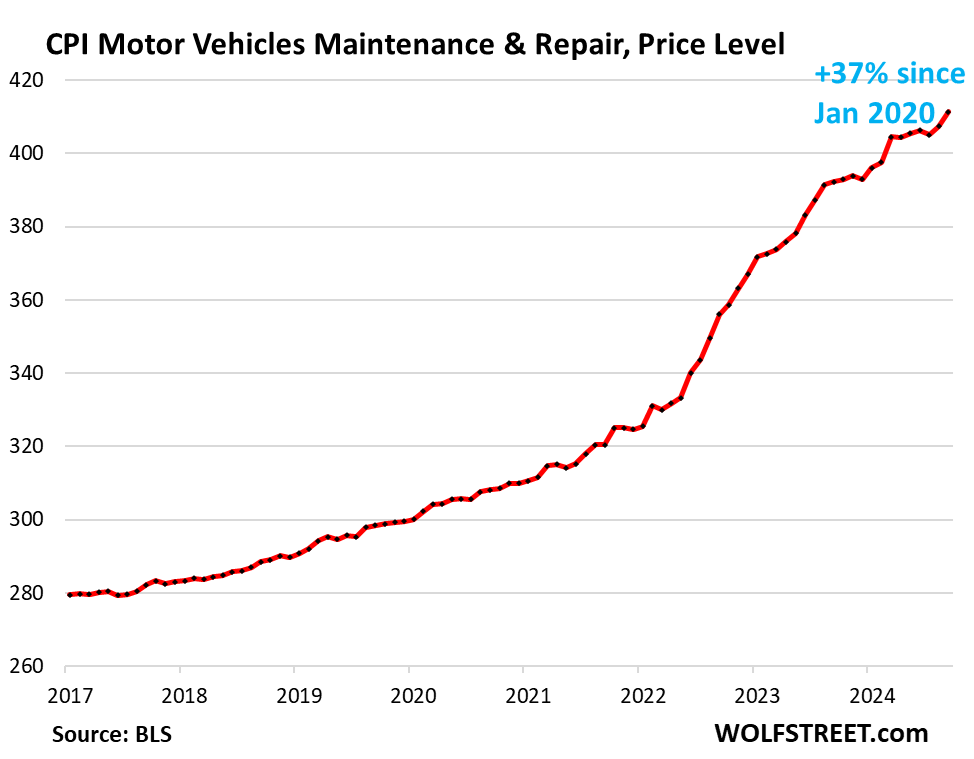

The CPI for motor-vehicle maintenance & repair spiked by 13.4% annualized (+1.05% not annualized), in October from September, after the 12.1% spike in the prior month, which pushed the year-over-year increase to 5.8%, the highest since June.

Since January 2020, it has spiked by 38% as labor costs of auto-repair technicians have surged, and as prices of replacement parts have surged.

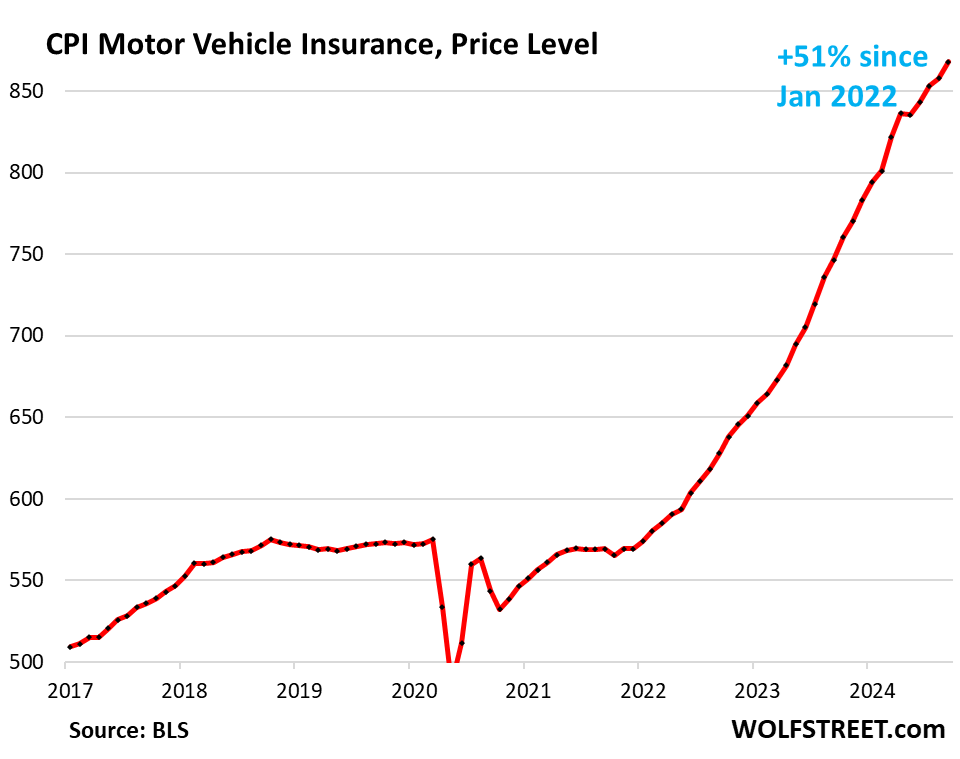

The CPI for motor vehicle insurance dipped in October, -1.3% annualized (-0.1% not annualized) after the 15% spike in the prior month.

Year-over-year, it rose by 14.0%. Since 2022, it exploded by 51%.

The massive inflation in motor vehicle insurance was fueled initially by the spike in repair costs and by the historic spike in used-vehicle prices (replacement values) in 2021 and 2022, though used-vehicle prices have plunged since then. Since 2023, insurers were able to fatten up their profit margins, which provided an additional boost of the CPI of motor vehicle insurance.

But the month-to-month pullback in October may be a quirk, given that it followed the big spike in September. There was a quirk like this in May, that was followed by four months of sharp increases:

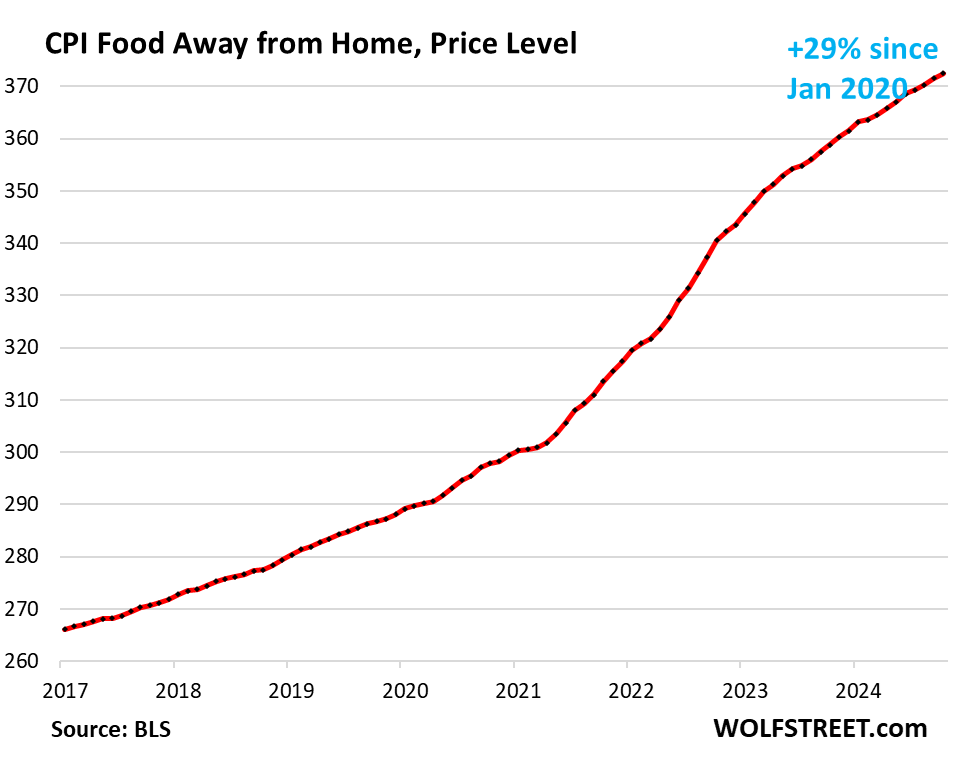

Food away from Home CPI – often called food services – includes full-service and limited-service meals and snacks served away from home, food at cafeterias in schools and work sites, food served at stalls, etc.

In October, it rose by 2.9% annualized from September (+0.24% not annualized) and by 3.8% year-over-year, the smallest increase since April 2021. Since January 2020, it has surged by 29%.

The Core services CPI overall has risen by 23% since January 2020.

| Major Services ex. Energy Services | Weight in CPI | MoM | YoY |

| Core Services | 65% | 0.3% | 4.8% |

| Owner’s equivalent of rent | 27.0% | 0.4% | 5.2% |

| Rent of primary residence | 7.7% | 0.3% | 4.6% |

| Medical care services & insurance | 6.5% | 0.4% | 3.8% |

| Food services (food away from home) | 5.4% | 0.2% | 3.8% |

| Education and communication services | 5.0% | -0.2% | 2.1% |

| Motor vehicle insurance | 3.0% | -0.1% | 14.0% |

| Admission, movies, concerts, sports events, club memberships | 1.8% | 1.2% | 3.2% |

| Other personal services (dry-cleaning, haircuts, legal services…) | 1.5% | 0.3% | 4.1% |

| Lodging away from home, incl Hotels, motels | 1.4% | 0.4% | -0.1% |

| Motor vehicle maintenance & repair | 1.3% | 1.1% | 5.8% |

| Public transportation (airline fares, etc.) | 1.0% | 2.4% | 2.5% |

| Water, sewer, trash collection services | 1.1% | 0.5% | 5.0% |

| Video and audio services, cable, streaming | 0.9% | -0.4% | 1.5% |

| Pet services, including veterinary | 0.4% | 0.9% | 6.1% |

| Tenants’ & Household insurance | 0.4% | 0.7% | 2.5% |

| Car and truck rental | 0.1% | -1.6% | -7.0% |

| Postage & delivery services | 0.1% | 3.9% | 9.8% |

Durable goods.

New and used vehicles dominate, followed by other durable goods such as information technology products (computers, smartphones, home network equipment, etc.), appliances, furniture, fixtures, etc. All categories have been experiencing price declines starting in late 2022, after the price spike during the pandemic. But the sharp month-to-month price declines in motor vehicles ended in September.

The used vehicle CPI flipped. In October, seasonally adjusted used vehicle prices spiked by 2.7% from October (+38% annualized), and even rose not seasonally adjusted, which is unusual because October is seasonally the weakest month of the year in terms of prices.

This massive U-turn reduced the year-over-year price drop to -3.4%, from double-digit year-over-year drops over the summer.

The plunge of used vehicle prices since mid-2022 had been a powerful contributor to the cooling of core CPI. But it has now ended. And this erstwhile strong tailwind for cooling inflation has turned into a headwind.

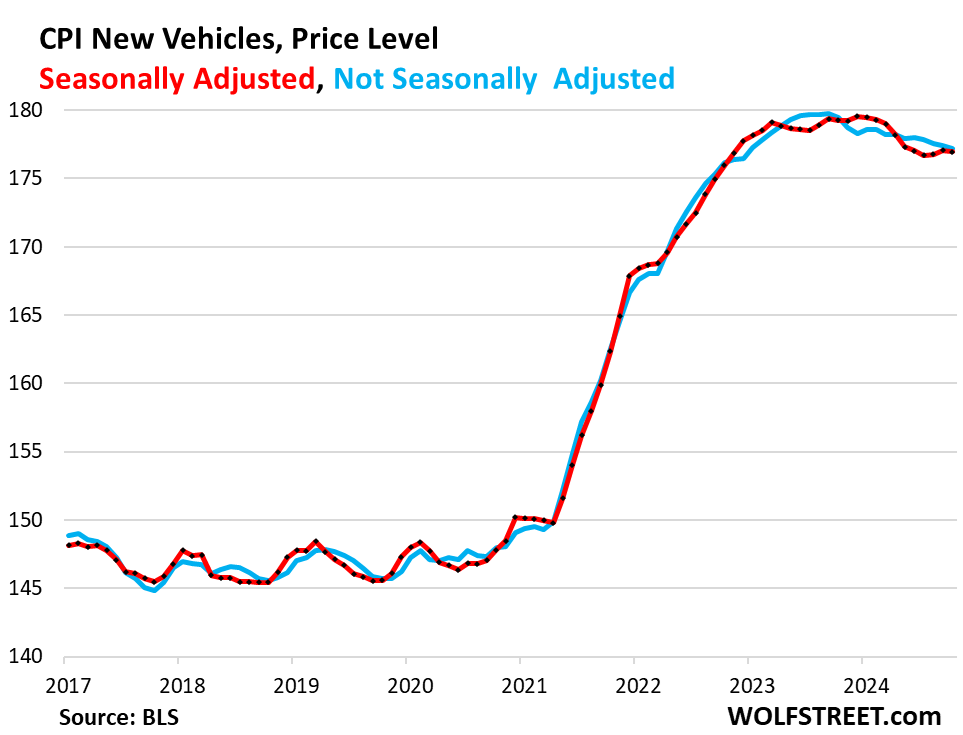

New vehicles CPI inched down by 0.6% annualized in October from September, after two months of small increases, seasonally adjusted (red). Year-over-year, the index fell by 1.3%. Since January 2020, the index is up 19%.

Unlike used-vehicle prices, new-vehicle prices have been sticky after the surge from early 2021 into early 2023 and have only given up a little ground since the peak, despite the glut of new vehicles on many lots. The big incentives and discounts that automakers and dealers are now throwing around to move their inventory essentially just undid out the big increases in MSRPs from the 2023 to the 2024 model year.

| Major durable goods categories | MoM | YoY |

| Durable goods overall | 0.1% | -2.5% |

| New vehicles | 0.0% | -1.3% |

| Used vehicles | 2.7% | -3.4% |

| Information technology (computers, smartphones, etc.) | -1.2% | -7.7% |

| Sporting goods (bicycles, equipment, etc.) | -0.5% | -3.1% |

| Household furnishings (furniture, appliances, floor coverings, tools) | 0.0% | -2.2% |

Food Inflation.

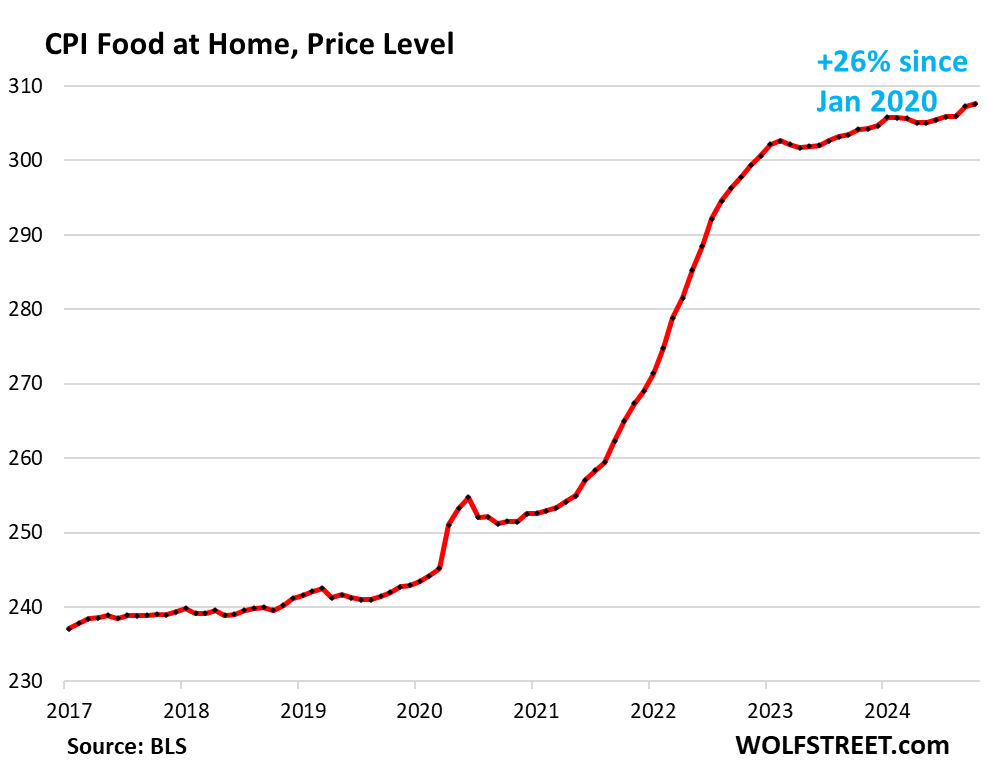

Inflation of “Food at home” – food purchased at stores and markets and eaten off premises – has flattened out in 2024 at a very high plateau. Inflation (a rate of change) has cooled, but prices remain aggravatingly high. The CPI for food at home is up by 26% since January 2020.

| MoM | YoY | |

| Food at home | 0.1% | 1.1% |

| Cereals, breads, bakery products | 1.0% | 0.9% |

| Beef and veal | -1.1% | 1.9% |

| Pork | -0.5% | -0.6% |

| Poultry | -0.1% | 0.0% |

| Fish and seafood | -0.3% | -1.5% |

| Eggs | -6.4% | 30.4% |

| Dairy and related products | 1.0% | 1.3% |

| Fresh fruits | 1.5% | 2.2% |

| Fresh vegetables | -0.7% | 0.5% |

| Juices and nonalcoholic drinks | 0.5% | 2.0% |

| Coffee, tea, etc. | 0.3% | 1.1% |

| Fats and oils | 0.1% | 2.4% |

| Baby food & formula | -0.7% | 0.9% |

| Alcoholic beverages at home | -0.3% | 1.1% |

Apparel and footwear.

Apparel and footwear are components of nondurable goods, along with food, energy products, household supplies, and other stuff.

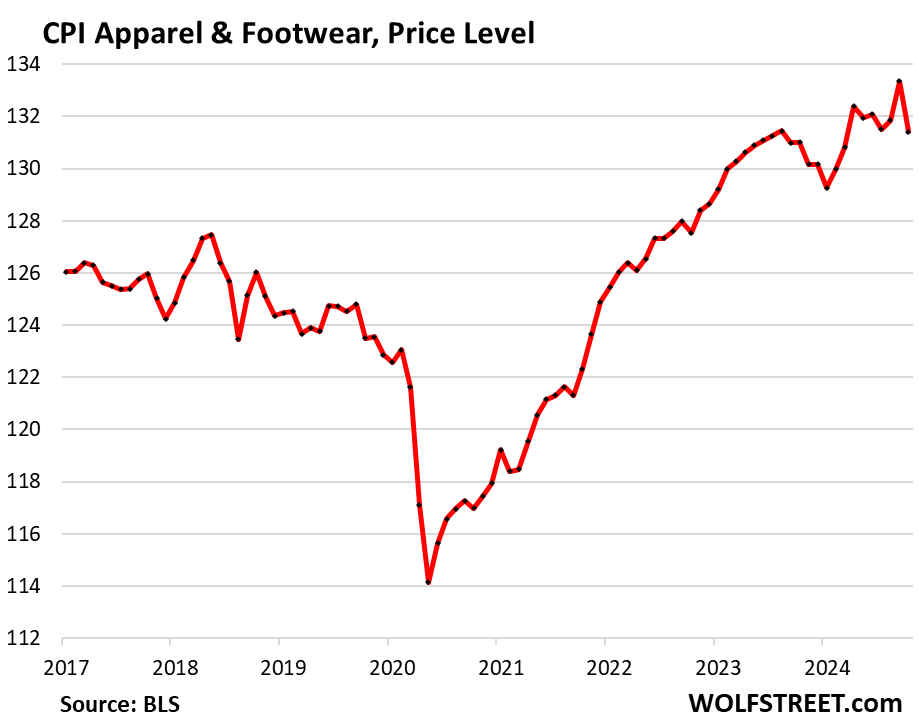

Month-to-month, the CPI for apparel and footwear dropped by 1.5% in October, undoing the spike in September.

Year-over-year, the index was essentially flat, despite some turbulence in between. The trend of deflation in the years before the pandemic seems to have ended:

Energy.

| CPI for Energy, by Category | MoM | YoY |

| Overall Energy CPI | 0.0% | -4.9% |

| Gasoline | -0.9% | -12.2% |

| Electricity service | 1.2% | 4.5% |

| Utility natural gas to home | 0.3% | 2.0% |

| Heating oil, propane, kerosene, firewood | -2.2% | -11.9% |

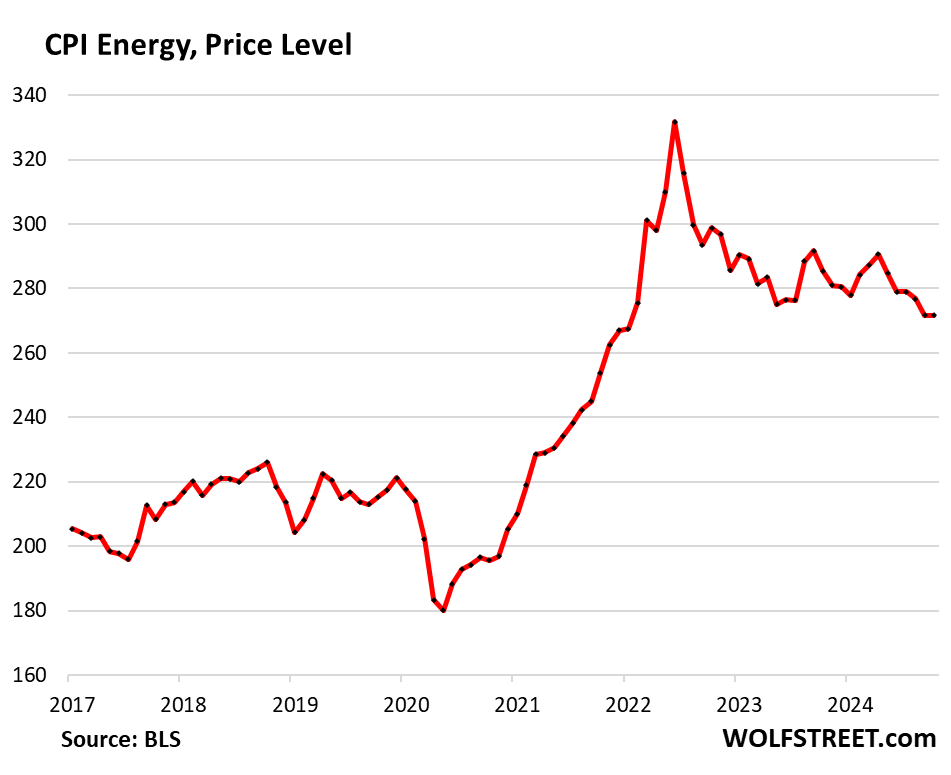

The CPI for energy, which covers energy products and services that consumers buy and pay for directly, was essentially unchanged for the month on a drop in gasoline prices and a big increase in electricity prices.

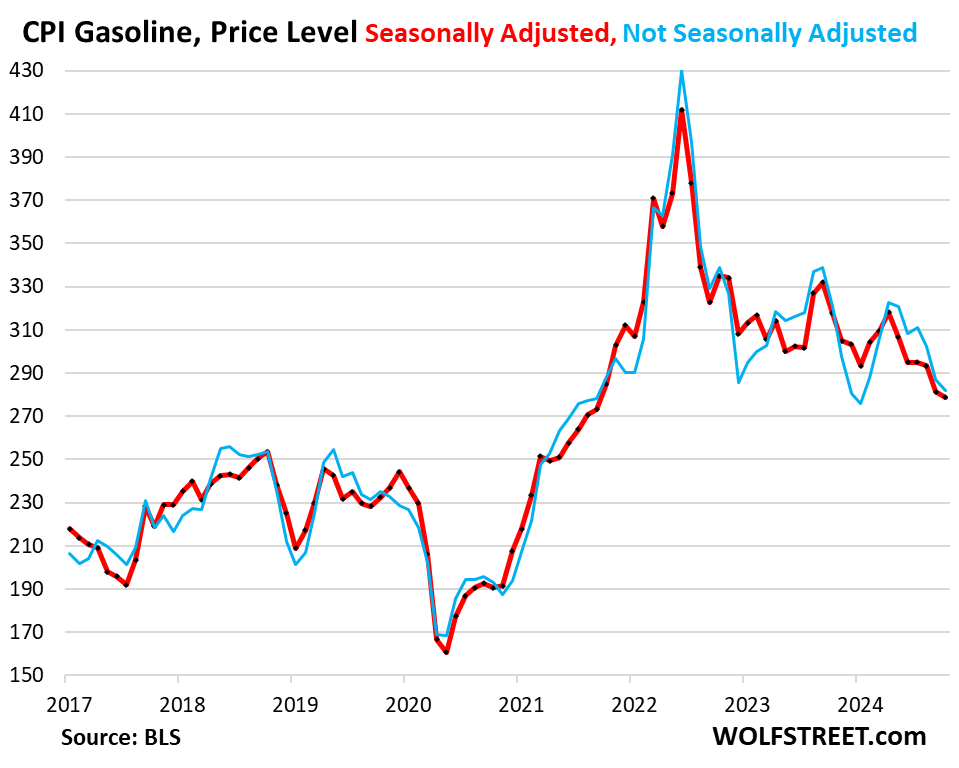

Gasoline prices, which account for about half of the energy price index, dropped further in October from September, both seasonally adjusted (red) and not seasonally adjusted (blue) and were down 12.2% year-over-year and down by 35% from the peak in June 2022. This was the big factor in driving down overall CPI:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

nice

Sorry; wrong reply button. Feel free to delete both comments.

It seems like for decades that the Fed & the market paid closer attention to the core inflation readings. Now, it’s like they ignore it and put more weight in to the headline number.

Ready to be schooled on this.

The markets will switch back to core when energy prices rise again, which will push headline inflation back above core inflation and core will be the lower number (the normal condition), and which is when they’ll ignore the headline number again.

Doesn’t this put the idea the Fed decisions are data driven into question?

The Fed always mentions both and always focuses on core PCE and still does. But markets and headlines are the culprits.

These charts are insane. The fed is drunk at the wheel!

“Calm down hunny I had some coffee”

And yet all of the MSM gurus are predicting another rate cut in December.

Again, the Fed is “trying” to push down short-term rates to help ease borrowing costs.

And now everyone awaits the Trump effect on the economy.

The US economy can print $, it won’t go bankrupt.

Results of the “most wreckless fed ever”, Powell should retire now with his “MWFE” title in tact.

It could be this shake-up happening in a few months might help break loose a few nuts.

Motor vehicle insurance seems to be haywire. Would storm damage be included actuarially? I checked back to my records and you are on the mark at +50% since ‘22. Have to call my insurance company.

Here’s a possible answer:

States vary, but in Florida in 2023 the law was changed so that garaged vehicles are excluded from the defaults in homeowner’s insurance policies. They can be added with a rider, but now if your car is wrecked by a falling tree into your garage, and you didn’t explicitly add it to the policy, it’s on your auto, not homeowner’s in Florida.

Premiums still exploded, though.

This is primarily why Mr T won the presidency

I pity da foo!

“The stubbornly high core inflation rate was driven, so to speak, by the prices of used vehicles…”

I actually laughed out loud… now my boss knows I’m reading WOLFSTREET at work.

Wolf, I know you have written before on this, I heard someone slightly mention on Bloomberg that Used Car sales increase in pricing for this month could be due to Hurricanes. Do you think that was more of affect on it or not that much ?

Wholesale prices (Manheim auctions) have been increasing for months, and so I predicted as early as Aug 7 (July wholesale prices jumped for the first time in a while) that used vehicle CPI (retail prices) would increase too, it just always lags a couple of months, and CPI did rise in September and October.

Wholesale prices have been rising due to very tight inventories and decent demand. I don’t see the hurricanes at fault here.

Oct 18:

https://wolfstreet.com/2024/10/18/used-vehicles-getting-ready-to-turn-into-inflation-headwind-after-historic-plunge-had-powered-the-deceleration-of-core-cpi/

Oct 7 (September wholesale prices):

https://wolfstreet.com/2024/10/07/more-evidence-this-may-be-the-end-of-the-historic-plunge-of-used-vehicle-prices-that-had-pushed-down-cpi/

Sep 9 (August wholesale prices):

https://wolfstreet.com/2024/09/09/this-may-be-the-end-of-the-massive-deflation-in-used-vehicles-that-pushed-down-core-cpi-wholesale-prices-surge-for-2nd-month-amid-strong-sales-growth-tight-inventories/

Aug 7 (July wholesale prices)., first paragraph:

“This may be the end of the historic plunge of used-vehicle prices that has unwound about half of the historic 60% price spike during the pandemic. The price plunge, which kicked off at the end of 2021, has been a substantial force in bringing CPI inflation off its highs, and it would be a bummer if that flipped now.”

https://wolfstreet.com/2024/08/07/used-car-truck-prices-suddenly-bounce-as-inventories-tighten-end-of-historic-plunge-that-helped-push-cpi-inflation-down/

14% YoY motor vehicle insurance sounds about right. My last couple of renewal offers were absolutely shocking. OTOH, they finally spurred me to do something I had foolishly neglected to do: drop collision coverage on my older model car. My bill is now much much lower– but, note, still *higher* than full coverage five years ago.

^^same I did this 6 months ago – my rate after dropping collision is my 2019 rate.

Lower bill higher risk for insurance.

Looks like CPI is slow and steady higher .

Heard a comment this am about inflation and a possible corporate income tax reduction . The discussion was would a tax reduction increase or decrease inflation . This commentator said he believed the tax reduction would only apply to USA based companies (made or served in USA soil) would hit the bottom line quickly and allow these primarily smaller companies to lower costs while keeping their margins the same. Makes sense to me

That’s what i’m saying! The deficit is way too small, we need tax cuts for corporations and the ultra wealthy!!! Gotta get the national debt higher if we really want to tame inflation, makes sense to me!

The ultra wealthy have never done better than under this current regime. BOTH parties are bought and paid for by the billionaires. Until people wake up from their stupors and realize this, it’s business as usual.

Exactly. Trump win caused bitcoin to go from 60k to 90k and tesla 50% gain in three days. What a farce. However, Trump previously did float the idea of replacing Powell with Kevin Warsh. Warsh being a former critic of fed policy would be a big win for the main street. Don’t think it is gonna happen though since it needs approval of congress.

“BOTH parties are bought and paid for by the billionaires. ” — Nothing new – this was how Huey Long described the situation in the 1930’s!

“The Democratic Party and the Republican Party were just like the old patent medicine drummer that used to come around our country,” Long once said. “He had two bottles of medicine.

“He’d play a banjo and he’d sell two bottles of medicine. One of those bottles of medicine was called High Popalorum and another one of those bottles of medicine was called Low Popahirum.

“Finally somebody around there said is there any difference in these bottles of medicines? ‘Oh,’ he said, ‘considerable. They’re both good but they’re different,’ he said.

“‘That High Popalorum is made from the bark off the tree that we take from the top down. And that Low Popahirum is made from the bark that we take from the root up.’

“And the only difference that I have found between the Democratic leadership and the Republican leadership was that one of ’em was skinning you from the ankle up and the other from the ear down — when I got to Congress.”

Lol because when companies get free money they instantly send that to the consumer with price breaks😂

More like executive bonus, dividends, or maybe they aren’t evil and pay there employees more. All things inflationary to some extent

transitory /trăn′sĭ-tôr″ē, trăn′zĭ-/

adjective

– Existing or lasting only a short time; short-lived or temporary.

– Continuing only for a short time; not enduring; fleeting;

I guess 3 years is a short time?

Since the earth is 6 billion years old, 3 years is like the blink of an eye.

Oh, get over it. The Fed already admitted that mistake and explained how it came about, namely that the models of the past were insufficient to deal with the situation of the day.

Nobody has a crystal ball and their choices were reasonable given the history and the data of the time. The fact that they choice was wrong doesn’t change that.

The reasons why they were wrong are only obvious is hindsight.

no, their choices were not reasonable even at the time, and many economics on both sides of the political spectrum said so. hell, i realized they were screwing up badly and I’m not even an economist.

and it wasn’t reasonable to continue printing for two years after it was clear the economy was recovering.

stop making excuses for these thugs.

The choices of ultra-low interest rates, doubling down on MMT/ Debt based economy, and SO many more, going back decades are somewhat mind boggling.

The answer is that American economic prowess is equated to geopolitical stability and therefore the bad behavior is easily overlooked.

What happens in a world where neither of those are true? I’m afraid to find out, but also that we might.

Where I live, a baguette at the grocerie is now shorter and thinner. Eggs smaller. Fewer sales and when they occur, smaller discount. Regular prices didn’t move (for the last 6 months or so). Does the inflation number take this into account?

Yes, CPI takes weight, quantity, size, etc. into account. Pound of coffee. OJ by the once. Beer by the sixpack. Meat by the ounce. Gallon of gasoline. Grocery store pricing data comes from detailed cash-register (point-of-services) data that the BLS buys from private-sector data provider Nielson. This data includes quantities, weight, etc.

Welcome back to the 1970’s. Inflation looks like is here to stay for while. No recessions in sight to help.

I loved the 70’s. Blew the balance of my youth doing whatever I damned well wanted….even going to college because I loved it….which probably makes me weird) Paid for it BIG TIME in 80’s double recession but was finally saved in ’85…and learned a lot……many were not….and suffer to this day.

They voted to blow up whatever they were told by talk radio that hurt them all so badly and unfairly….as a coastal elite I guess I’m one (by geography only…but probably never much more than a mile…maybe up to 20 by crow now….could never afford to live where I grew up)

But, I don’t think it will help them, they were thrown OUT in 80 and except for a few skilled grifters, will STAY out.

What am I missing here as I see inflation continuing to be a major problem moving forward based on the following?

– M1 money supply went from approximately $4 trillion in Q1 2020 (Covid), spiked to $20.7 trillion in May 2022 and has only receded to $18.2 trillion in September 2024. In fact, M1 has actually increased since from February 2024. Incredible!

– FED balance sheet was $4.2 trillion in March 2020 (up from roughly $1 trillion in 2008), spiked to a little less than $9 trillion in May of 2022 and has receded to roughly $7 trillion today. Up 7x since 2008, in just 16 years. Wow!

– Large employee bases have recently secured significant wage increase concessions over the past 3 months (e.g., Boeing & East Coast port workers). In the case of the East Coast port workers, they secured a base hourly pay increase from $39 today to $63 in six years (representing an 8.32% annual increase). Other wage increases have also been realized by employees across the country. From my perspective, wage cost push inflation is just gaining traction.

– If Trump’s deportation plan is successful, this is going to remove a certain amount of cheap, immigration labor that has been helping fuel the economy. Without this labor source, the supply of labor could fall while demand (see next bullet point) increases, thus pushing up labor costs.

– If Trump’s tax cuts are enacted, this could fuel new demand and give the economy a short-term adrenaline boost but may also drive inflation higher (potentially causing the economy to overheat).

– Again, looking out at Trump’s tariff proposals and if passed in law, will push higher prices through to the consumers as either a.) companies still import, absorb/pay the tariff, and pass it on to customers or b.) companies shift manufacturing domestically and absorb higher domestic costs. BTW, there is no magic solution to quickly on-shore foreign production (back to the US) as in some cases, there is little or no infrastructure remaining to even begin to manufacture certain products domestically.

– On the insurance front, I agree with everyone’s comments (either posted in this article or from previous posts) as everyone I know, and I mean everyone, has absorbed higher insurance costs across the board. I don’t see this trend changing anytime soon.

– WR’s data is spot on, impartial, and continues to point to inflationary pressures building again. Bravo to WR for offering such an impartial and reliable source of data.

– What in the world is the FED thinking, cutting interest rates into a elevated risk environment and declaring victory over the inflation monster? It took Volcker 4+ years and two recessions to finally tame the inflation beast. The difference between Volcker’s FED and today’s FED, Volcker had the balls to attack the inflation problem, even if the measures were very unpopular and threw the economy into a recession. Today’s FED is trying to be too cute and throws around terms like “soft landing” to defend interest rate policies. If you want to solve the problem, the FED needs to attack the demand side more aggressively, risk a recession, and combine more aggressive QT with appropriately set interest rates.

In summary, I’m not at all optimistic on the inflation front as based on the current monetary policy and proposed fiscal policies, inflation is simply now catching its breath and once rested, will reignite as it is just too deeply embedded throughout the economy (at this stage). Volcker knew this and acted accordingly. Today’s FED was a primary contributor to inflation (see M1 and balance sheet stats) and didn’t want to accept responsibility for their poor policy decisions (let us not forgot ZIRP). Yet they want to be viewed as the heroes for taming inflation with QT and increasing interest rates (by curing the problem they created).

What an absolute crazy world we live in which is about to get a whole lot crazier, volatile, and unpredictable as we say goodbye to 2024 and try and stay alive through the end of twenty-five.

On your deportation comment – I really don’t think that the effect of mass incoming migration on inflation is well established? Other than the fact that the last few years have seen both elevated levels of inbound migration and inflation… could be nothing.

Mass immigration is typically DEflationary, especially in an economy that has a demographic problem (most “developed”/ mature economies).

There’s a TON of building going on out there, and most young Americans don’t aspire to be construction workers, tradespeople or laborers.

I doubt there will be roundups of people. It’s great podium rhetoric but these are our community members, coworkers and classmates.

Also, did I mention the dire need? These are the folks that are helping us have the best GDP growth of the major economies today.

All you doubters. We are going to see a wonderful experiment on what happens when we deport 12 million people along with the departure of 10 million more family members. It could be a good thing to have a 22 million population drop. Or not?

Tracy asked: “– What in the world is the FED thinking, cutting interest rates…”

The Federal Reserve is owned by a cartel of private banks. The Fed will do whatever it takes to keep the private banks solvent. There may be some hidden financial currents not visible to us mere mortals (or Wolfie).

Real estate values will have to come down (or wages go up) to restore some equilibrium to housing. Add to the mix an incoming President noted for his real estate & business schemes.

Add a wildly over heated stock market to the mix. Then add some insane debt schemes (like super wealthy people who use their stock to borrow and buy $500 million dollar yachts). Stir vigorously, and see what happens next.

I admit that I do not know what is going to happen. But I am not feeling optimistic.

“What in the world is the FED thinking, cutting interest rates into a elevated risk environment and declaring victory over the inflation monster?”

I have adopted the thesis that the Fed is trying to normalize the yield curve and reduce bond volitility, which has been elevated since they hiked rates in 2022.

Notice they are still doing QT, which reduces demand for longer-durarion Treasuries.

What you said makes perfect sense, but there is one thing they could have done easily to stop this reckless and perverse animal spirit in the market right now; they could have simply paused instead of lowering rate in the last meeting or they could have lowered 0.25 instead of 0.50 in September meeting. All they have to do is not let market or politics dictate their policy. Bitcoin at 90k is just an insult to any intelligent investor.

the animal spirits in the market is their goal. it’s a feature, not a bug.

To what extent might higher auto repair and auto insurance costs be due to higher proportion of electric vehicles, which may be more fragile and expensive to repair?

I can’t comment directly on EVs, but the labor/ hour is a huge supporting role!

Recently had a bunch of work done on my 2013 Tacoma. I was out of town and they found a few extra items. I like and trust the shop, BUT I was a little disappointed that they billed me $70 to change a couple light bulbs!

$2.50 of parts, but they are a pain to get to, and it probably did take an hour. The “wage price spiral” is not completely made up.

Q to Powell: What is the Fed’s plan for possible stagflation?

A from Powell: (Deer in headlights stare)

He actually got that question at the last fomc press conference. His answer was something along the lines of sticking to the dual mandate so stagflation doesn’t happen in the first place.

Kind of a bland/uninteresting answer… but technically valid and definitely an answer.

For stagflation, you need a stag and a flation. We nailed the flation part. But we’re not anywhere near the stag part. Economic growth has been well above the 15-year average for the US.

There is no better source on this planet for accurate macro data than Wolf Street. We got an email today from our natural gas supplier that rates are increasing 22% effective next month. Just in time for the frigid New England winter!

But inflation? What inflation? WSJ says “no big deal, Fed will cut anyway”. After all, we gotta keep the S&P boiling along, eh? And here I went and bought some NVDA puts. What a dummy I am!

Trade in those old NVDA puts and get yourself some shiny new TLT puts instead.

This CPI report is playing out nicely at stockcharts, with the Pring indexes showing a nice weekly uptick in inflation, since April 2022.

The whackomole variables of inflation push this index up, regardless of what the Fed says or does, or what the media reports (except WR).

The index is a ratio of inflationary components versus deflationary components — and it clearly says the Fed is insane cutting rates.

!PRDI:!PRIl Pring Deflation Index (EOD)/Pring Inflation Index (EOD) INDX

It’s likely that the CPI will increase considering the new admistration, wouldn’t you agree?

YES: What’s a 10% cost increase when you’re getting 50% asset gains?

The people who make/ fund decision makers couldn’t care less about it.

When people hear “make the economy great” they never wonder “for who”? Also, they don’t know the economy has BEEN great, because nobody looks at global macro, or cares about GDP. They care about the bank balance and the grocery bill.

To Taxpayer: re Higher insurance costs due to EV’s or what?

I have a good friend (a lawyer, who worked for $25+ yrs for the State of TX

& lives in El PAso) & he recounted an absolute “horror story” about this issue.

He had a leased 2021 Honda SUV “hybrid” due for purchase or return coming up after almost 3 yrs. and had some jerk pull out and hit the front of his vehicle and then took off in a “hit & run.”

His nightmare with his insurance co. & the Honda certified Dealer began!

Because of unexpected snafus like “if you (the insured) report the accident to the police as a “hit & run” (yes, he did have this coverage included) then there was a delay in the dealer ordering the replacement

parts! His insurance Co’s rental car of 3 weeks expired because it took more than 3 weeks just to even start the repair! He eventually decided NOT to report the accident as a “Hit & Run” after this 3 week and had to pay for the additional cot to rent a replacement car for another 6 weeks!

SO…all in all he was out of pocket 100’s of $ & had major hassles to deal with partially because the cops just didn’t want to deal wioth this issue &

his insurance Co…kind of screwed him around too!

So re your question…It’s not EV’s per say, it’s a combination of poor law enforcement, weird ‘local” restrictions for dealers & repair shops, the insurance company (not a fly by night) and supply chain issue,, shortage of sensors in the front and rear bumpers and of course, as WOLF REPORTED, HIGHER LABOR COSTS!

OUCH!

CPI Rent vs OER graph looks pretty ominous… The last time OER > rent, both rocketed higher.

Inflation, Act II – coming to a theater near you.

Will be interesting what happens with new Congress on TJCA items that expire at end of 2025. On one hand it will increase revenues for tax collections but on the opposite side that would have the impact of lessening consumer spending which drives the economy and of course benefits corporation who have low tax locked in. Chips Act money might start kicking in which will be a positive, at least for a few years.

Obviously tons of ethical considerations but won’t be anyone to look out for those so I suppose Tesla is a good bet.

It’s a self fulfilling cycle – stock market is up because inflation is up which inflates revenue and earnings. Inflation is up because people feel richer because the stock market is up and they spend more. This continues until something breaks.

On a completely related matter, the 20 year Treasury bond ratcheted up to 4.752%, now the highest rate among all Treasury offerings.

TLT < $87 EOY

Turns out that there’s a nice inflation barometer that is sensitive to inflation and it’s unexpectedly turning higher:

Fitted Yield on a 1 Year Zero Coupon Bond

That’s far more sensitive than Move Index

Another thing I’m exploring is Inflation Linked Bond Fund Retirement funds

I think the biggest post election surprise will be how sticky inflation is, and how that ends up changing everything — especially as we see a new Treasury grapple with statutory limitations that really screw up the new budget — as the prior budget is somewhat exposed to far greater scrutiny.

We should have had a recession and putting that off further is utterly chaotic!

I’m not sure it’ll help if Russia has a currency crisis soon? Layers and layers of increasing trouble converging.

1 year zeros are just predicting where Fed Funds will be a year from now. The market is digesting the inevitability of higher rates.

Skip the retirement bond funds and just buy I-bonds from TreasuryDirect.

Sticky inflation is no surprise to me – I’m specifically positioned for it.

These used vehicle prices are why I spent two hours this summer sweating, wrenching in 107 degrees, in a borrowed suburban garage, to replace the starter motor on our CR-V. Now, reports from The Missus indicate that the car entered limp mode while taking the kids to school. Next up: a decent OBD2 scanner. I’ll be damned if I spend 30k on a used family car.

In later news, rent and incomes rise to meet obscene used house prices; bubble-bust hopefuls left disappointed.

You should get a decent 5-years old, 70k-miles vehicle for around $15k. Vehicles with 70k miles today are nearly new. Start looking around the internet. $30k for a 5-year-old vehicle… you’re talking luxury.

Inflation pain is what got Trump elected. Does he really understand that. Now does he care? He seems to always be calling for lower interest rates. And they say his policies are inflationary. Maybe his treasury pick and economic advisors will keep him in check.

I am pretty sure Trump’s economic advisors understand that increasing tariffs will increase inflation for a while. I have no objection to tariffs if they force ON-SHORING of our important industries, especially away from China. I don’t mind paying a little more for stuff. It is a security issue.

Hi Wolf. Some analyst are expecting increasing productivity to keep a cap on the inflation going forward. Any thoughts?

Thanks

They’re grasping at straws.

We were told this week at work that health insurance for the company is up 15% for 2025 and that’s with dropping Ozempic covered for weight loss only.

Only a part is being passed down to the employee level.

Is the employer part in PPI services and the employee part in CPI services?

Health insurance inflation isn’t tracked on the basis of premiums because the premium is just one aspect. Deductibles and copays change too, as does coverage (you mentioned one item that got dropped, but there are lots of things that are added or dropped or changed) and other aspects are changed, and it’s different for each employer, and individuals have different plans, and insurers offer different plans, coverage, and pricing in each state since health insurance is regulated by states.