Greetings Wolf Street

I’m Mike Ledney, a long-time reader of Wolf Street, and I’ve kicked around data observations with our host for some time now. I recently began recruiting a successor to lead the data and analytic functions of my company, American Risk Services, and Wolf thought this would be a good way to reach the right audience. I think he’s right.

If you, or someone you know, live in that world beyond spreadsheets, work in high level business analytics, understand basic data science, predictive modeling, forecasting, neural nets, etc., please read on. If that’s not you, check back in a couple of hours and I’m sure Wolf will have another detailed take on the latest data drop.

The Job – At the highest level I’m looking for someone to own the data, analysis, reporting, and insight delivery functions for our specialty insurance brokerage. Email me directly for a detailed job description: [email removed]

Feel free to share a resume there as well and maybe a few words on why you’re right for the job. I’ll answer each query personally and make every effort to provide quick and thorough feedback. Below I’ve highlighted skills and knowledge of particular interest, as well as a description of the company, comp tiers, etc.

We’re casting a wide net, an insurance background is not required, but you should be comfortable with the following tasks:

- Building, maintaining, optimizing, and expanding your own predictive models

- Synthesizing results and forecasts into reports and recommendations

- Communicating these results, reports, and recommendations to technical and non-technical users, decision makers, business partners, and clients

In short – get the numbers – figure out what they mean – explain it to everyone else. Exposure to the automotive asset class (generally), and auto finance (specifically), is infinitely valuable, but not necessary. We can teach you the business if you can do the math.

On this last point, I speak from experience – I started in auto finance 25 years ago almost by accident, after a Chemistry degree and a few years as a marketing research quant. It was the best move I ever made, and I strongly encourage business analytics professionals and those with associated skills to consider us, regardless of your current field of study. For you, this is an opportunity to apply your existing talents to a new asset class, one that is data intensive, logically consistent, and profitable across multiple business cycles.

You will work directly with decision makers. You will own your part of the process and have a seat at the table when the decisions are made. Your income growth will be determined by the profitability of the business, and you will be instrumental in driving that profitability.

That said, if you already know the auto business AND have the data skills, I’d REALLY like to talk to you. Ours is a very specific slice of the auto-finance risk pie. It requires a detailed understanding of vehicle depreciation from granular to macro, twenty years back and ten years forward. If you already have this aptitude, I’m that much closer to retirement.

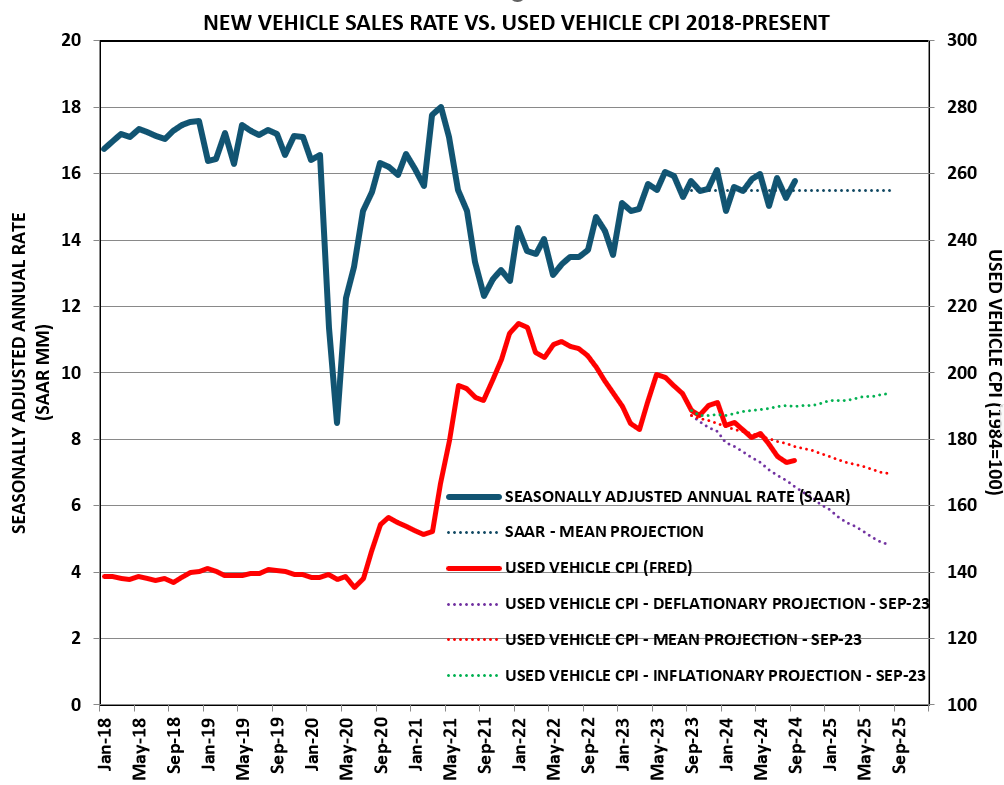

Can you use this knowledge to build models and systems to project our business performance and that of our clients / insurance partners? Do you understand the impacts of negative equity and incentives on the secondary market? Can you speak sensibly about the following chart? What’s your over/under on the dashed red forecast line? (click on the chart to enlarge it)

For candidates with industry specific experience this is the opportunity to take over an existing shop and run it your way. Get familiar with the current data structure / insights engine, then modify them as you see fit. Master our system, then make it your own.

The Company – American Risk Services (ARS) is an insurance brokerage, underwriter, and administrator operating within the Assured Partners (AP) family of agencies. Our clients and partners are a who’s who of auto finance captives, dealer groups, and insurers. We started out in the early 90s as the Lender Services Division of Great American Insurance, developing collateral and asset protection coverages for banks and captive lenders. In automotive these offerings included Residual Value Insurance (RVI), Guaranteed Asset Protection (GAP), and we were first to market with Excess Wear and Tear (EWT) in 2004. As a standalone entity, ARS was born in 2010 when this Lender Services Division went private, retaining key data, systems, and personnel. Twelve busy years later we were acquired by AP for a healthy multiple, reflecting a proven history and solid expectations for the future.

We’re small – ARS has about 30 employees and on any given day there are 15-20 people in the building. Our small size allows us (forces us?) to be nimble and efficient. Our flexibility translates into sticky relationships with our clients at all levels; we’re able to do things that they simply cannot get done in-house. We’re better, faster, and more reliable than their internal support teams so they come to us first. Most importantly, they know our interests are aligned. Our business prospers when theirs does; if that sounds attractive to you, this might be a good fit.

We’re also huge – As part of Assured Partners (a $5bn enterprise) we have access to benefits, resources, and opportunities that were unavailable to us previously. Our 401k and healthcare options have grown fivefold since the acquisition. If we need to spin up a new server, we just need to know who to ask. Traveling? We’ve probably got a discounted rate at a nice hotel within walking distance of the client site. It really is the best of both worlds.

Compensation, et al – Starting salary depends on what’s in your toolbox and what you’ve done with it. We’re casting a wide net, but below I’ve tried to increment the value of general and specific experience within a handful of broad ranges. Don’t consider these binding, everything is negotiable, but this should help you figure out whether it’s worth your while to follow up.

- Recent grads with < 2 years of experience in a parallel field (actuarial, CPG, retail, attribution, marketing mix, non-auto finance, etc.)

- $60-$70k/year with opportunity for 50%+ growth in base salary within 2-3 years – you’ll be a lot more valuable after we teach you the business

- Increase this estimate by ~$10k for each additional year of experience in a parallel field, up to 5 years total

- 5 years of parallel experience -> ~$100k starting salary – 50% growth opportunity within 2-3 years

- Industry specific history in or adjacent to auto finance is worth another ~$30-$50k in annual salary

- $90-$120k @ 2-3 years / $150k+ @ 5 years

- Someone who can walk in and do the job on day one?

- You know how much this is worth, help me craft a package that works for everyone

We’re in Cincinnati, and candidates with < 5 years of industry specific experience would be expected to office here 3 or more days per week for at least 2 years. If we’re gonna teach you the business, you’re gonna learn it in situ. However, a generous relocation package is available. More broadly though, we’re in the process of hiring our next generation of executive leadership, and this role is a key part of that team. Your peer relationships will be vastly stronger if forged in the same foundry… That said, if you can do the job on day one, nobody cares where you sit.

If any of this sounds fun, email me for the job description or just send me a resume.

I’ll take questions in the comment section but don’t expect me to defend or indict the auto industry. We at ARS are nothing but a flea on the wagging tail of that behemoth, but we’ve managed to parlay that into a fairly comfortable existence.

I now return you to your regularly scheduled Wolf Street – Mike Ledney

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Go Reds! ⚾️

LOL, I think that’s part of the problem with Ohio…too red!

Me thinks the implosion has already started.

I get news updates on “picks” and just start laughing uncontrollably.

When you go to the circus it’s for entertainment, you def do not expect Barnum and Bailey to start running Washington DC.

🤡

“On this last point, I speak from experience – I started in auto finance 25 years ago almost by accident“

Is there a pun in there?

You should run ads in the Insurance Journal!

WOLF STREET readers are an immensely intelligent bunch of professionals spread across all kinds of industries. It’s the perfect place to look for great talent.

It looks like they are looking for someone in their investment side not their auto risk side. I have an estimated trade in value of my vehicle, half the value 2 yrs ago. If I used it for collatoral the interest on the loan would be ridiculous. The insurance would have to include the collatoral loan at the value of that loan. That would not work in Florida unless you had vehicles that retain their value, vs just what the graph shows.

This post is actually working really well as a lead generator. I’ve gotten 7 or 8 resumes in ~12 hours (most of that overnight), several of which are worth pursuing.

More importantly, insurance is just a peripheral part of the role. We model markets and consumer response to market movement, then make bets that we have to live with for 3-7 years. There’s nothing actuarial about it, but a smart actuary could do it, if so inclined.

For anything close to a predictive model, the right person needs to interpret insane government regulations and tax credits to force consumers to buy autos they would never buy in a morer freer market.

Wonder if purple hair and being a looser takes me out of the running….actually I’m retired so count me out.

My brother in law is a data scientist but he isn’t in the job market right now. I passed this along for his awareness in case anything changes.

Thanks Ralph – please ask him to pass it along to his peers and contacts if he’s not interested.

Kudos to the “outside the box” thinking regarding turning your site into a recruiter referral tool.

Just plain old curiosity regarding the salaries listed, they seem low. These are candidates with high level math skills, BS and “STEM” degrees. We hire out of college with 1 or 2 summer internships at $70K in Texas, $85K in California to do a lot less than what you’re asking. We still end up with a shortage of entry level engineers.

I have someone looking for internship in DataScience.

Can I get your contact info if possible?

Thanks

Jon – I’m gonna have to borrow one from Wolf – RTGDFA!!!

Sorry – couldn’t resist – your friend can contact me directly at mledney@americanriskservices.com

Thanks Michael,

Apologies. I already saw your email address as provided in the article.

I meant my comment more for Nunya.

Thanks for putting this beautiful story for this position. I am sure, anyone getting this job would be a lucky one based on your description.

Jon,

I wouldn’t be able to provide much help, I’m in a totally different field. I was just pointing out what seemed to be a low salary and also how many industries are competing for the same talent pool.

Cincinnati is cheap, but you get what you pay for. You’ll never see this metro on the list of “imploded housing markets” because we won’t get to a $300k median before the air goes out of the bubble.

Plus – there’s a wealth of data talent in the area; Kroger, 84.51, P&G (and its ecosystem of suppliers), Luxottica, GE Aerospace/Global Ops, TQL. If this approach doesn’t take I’ll poach someone local, but that’s not my first choice.

I eat time series analysis for lunch. I don’t know anything about auto finance, but if you give me all your numbers, tell me which ones are bullsh_t so I can exclude them, and which variables you think are important, I can tell you the statistical probability of whether or not you can predict anything useful from them and at what level of confidence. You can predict anything, but the confidence interval is what matters, and it is almost always huge in economics. It is why nobody is good at accurately predicting with any consistency anything that is interesting in economics, no matter how many Ph.D.s he has in economics or how many years he has studied econometrics. Look at all the “geniuses” and their models at the Fed and look how often the Fed is wrong. (Powell’s only saving grace is that he sometimes comes across as appropriately humble, but not often enough). Maybe someone has come up with a good predictive model, but he is keeping it to himself while basking in the sun on his own Caribbean island.

Unlike Powell, we don’t have a 4 year term. Our performance is measured quarterly in EBITA, and for more than 25 years (to borrow a phrase from the crypto bugs) – number go up.

Secondly – the Caribbean might as well be south Florida. We in the predictive modeling set prefer the Tropic of Capricorn

How true those words are. You can predict anything from a “model” if you leave out the measures of variability — as has been done in the “projections” in the above charts.

And I bet not 1 out of 100 people on the street even knows what a confidence interval is! The other popular trick is stuff like : Wow! a 6 sigma deviation! That only happens by chance 1 in 3.4 million times !! Except the underlying distribution is unknown and most evidently not Gaussian so the statement is BS.

Reminds me of “technical analysis of stock charts” where the self-appointed gurus claim to make forecasts from chart patterns that have no more predicitive value than flipping a coin. There also, if someone has the perfect system, why do they try and hawk it on Twatter? They could make millions for themselves with their own funds.

Thurd2, have you read the book Noise: A Flaw in Human Judgement? I have but I don’t predict for a living. Curious to know what someone who does predict for a living thinks of it.

As a complete outsider looking in, this seems like a great position for someone with the right skillset – I haven’t got anything at all like the right skillset, but you seem like the sort of people/company that it’d be good to work with/for. Nicely written.

The best predictive “model” would be gamed and by its nature quickly become ineffective as it disproportionately interferes with its subject.

Even to the quantum level this holds true as observations on state change the state.

I wonder if we’re all really living in a universe set in motion by economists simulating some interest rate adjustment scenarios.

Let the entire universe play out and see which had the better outcomes over the longer term.

Powerful agents acting on predictive models ensures the success of the model. Over time, however, other actors figuring out how to profit from causing significant variances in the market can force the model to be changed. It’s a never ending game.

You are correct. The exploitation of each market inefficiency merely leaves tracks that are scouted by other participants and adopted until what was profitable exploitation of the recognized inefficiency becomes a crowded trade and only marginally profitable thereafter.

Civilization really got going when division of labor did. We are well into the niches between the niches and between those niches……..etc, etc, ad absurdum.

In the so called sciences, too, it’s all very appropriately called busy-ness.

Quite a game…….Magister Ludi?

I commend the seeking of talent from a enthusiast site such as this. The regular crowd this site attracts I would expect to be above average intelligence and most importantly able to THINK outside the mainstream box.

Sure technical skills are required. But the ability to THINK is generally far more important than technical skills. (Though the skills necessary to perform the data crunching is obviously needed.)

I’m not interested in this, but:

-I’m a mathematician an economist and an engineer. The last one is my career.

-I too have sought out employees from other niche group of clever people.

“…most importantly able to THINK…”

Ay, there’s the rub – I spent 5 years in a lab earning a PhD and I haven’t been back in a lab since. But those years were not wasted. In addition to moving the science ball forward an inch or two, I learned how to learn, and that has made all the difference.

This sounds quite low, I was making 90k in today’s salary when I was just a lowly analyst doing perl scripting and grep gruntwork.

Repeated from above…

Cincinnati is cheap, but you get what you pay for. You’ll never see this metro on the list of “imploded housing markets” because we won’t get to a $300k median before the air goes out of the bubble.

Plus – there’s a wealth of data talent in the area; Kroger, 84.51, P&G (and its ecosystem of suppliers), Luxottica, GE Aerospace/Global Ops, TQL. If this approach doesn’t take I’ll poach someone local, but that’s not my first choice.

Great advertisement for the job! I’ve been doing risk analytics on service contracts and related backend products at a major OEM for a little over a decade.

If I was looking for to move jobs and didn’t love what I do, I’d definitely apply. I know how challenging and rewarding a position like this can be.

Best of luck on the search! I look forward to updates when you find the right person.

Thanks Jon – please forward to anyone who might be interested.

Service contracts have to be fun right now – how many times have we heard the term “services inflation” here? Motor Vehicle Maintenance and Repair is a huge loss driver for GAP these days.

Adding on to other comments – these salaries are low. Given that the average data scientist in Ohio can work remotely, you’re competing with the entire nation. I am a data scientist and was paid $120K annual starting salary by Amazon 4 years ago, so I’m sure they’re paying more now. The job sounds super interesting, just wouldn’t jump for the salary.

Good luck Jorge. We ain’t Amazon, but we’re retiring in our 50’s on these salaries.

If you really find the job interesting please follow up, I’m happy to pay the right person what they’re worth, but you gotta help me make the case.

Retiring in 50’s, that’s the way to go!

Great advertisment! If i had any real statistical and analytics education i would apply in a heartbeat. Moving to cincinnati for a job in a field in which i have zero experience is probably not the best idea. Still, very nice of wolf to post about this kind of cool jobs on the site.

Mike,

I actually do know someone who would be a perfect fit for your job.

But I’m sure my wife has absolutely no interest in “un-retiring”.

Good luck in your search!

Thanks anon – Maybe she has some less retired friends…

Oh, I am considered the resident Luddite grouch, but I’m actually quite happy with my past and can usually enjoy my present, and just passed my 2023 estimated non-payment of the most critical Bio homeostasis dues, so just existing is all gravy now.

Thanks again.

Thanks for sharing! I would love to apply as the job sounds quite interesting and his connected to what I do now, but unfortunately I do not think I have a strong enough data science background to be competitive.

Best of luck in your search.

You might want to take a deep dive into the video game industry to scoop up the boom and bust cycle of data folks over there that typically work on the microtransactions / behavior part of the larger data sets these companies develop and market to their games.

Way back when for vivendi and activision when I consulted we’d rack up large teams for the early stages and downsize once product went live. This happened regularly for tons of companies I’m sure lots of folks looking to leave the great state of California now if the pay and working hours are decent.

This actually is pretty good money in Cincinnati. The living expenses are very low. I will retire early. I’d live under an overpass in SF.