Prices from peak over 2 years ago: Toronto -15%, Vancouver -2.5%, flat for 10 months, Victoria -11%, Ottawa -10%, Montreal -1.8%. Calgary & Quebec set new highs.

By Wolf Richter for WOLF STREET.

The Bank of Canada cut its rates at the beginning of June, and not much happened in the Canadian housing market. Home sales rose by 3.7% in June from the beaten-down levels in May, seasonally adjusted. But year-over-year, home sales were down 9.4%, a sharper year-over-year decline than in May (-5.9%). New listings rose by 1.5% in June from May, the fifth month of increases over the past six months. Inventory listed for sale was up by 26% year-over-year. Supply ticked down to 4.2 months in June – same as in April, but a tad lower than in May – and up from 3.2 months in June last year.

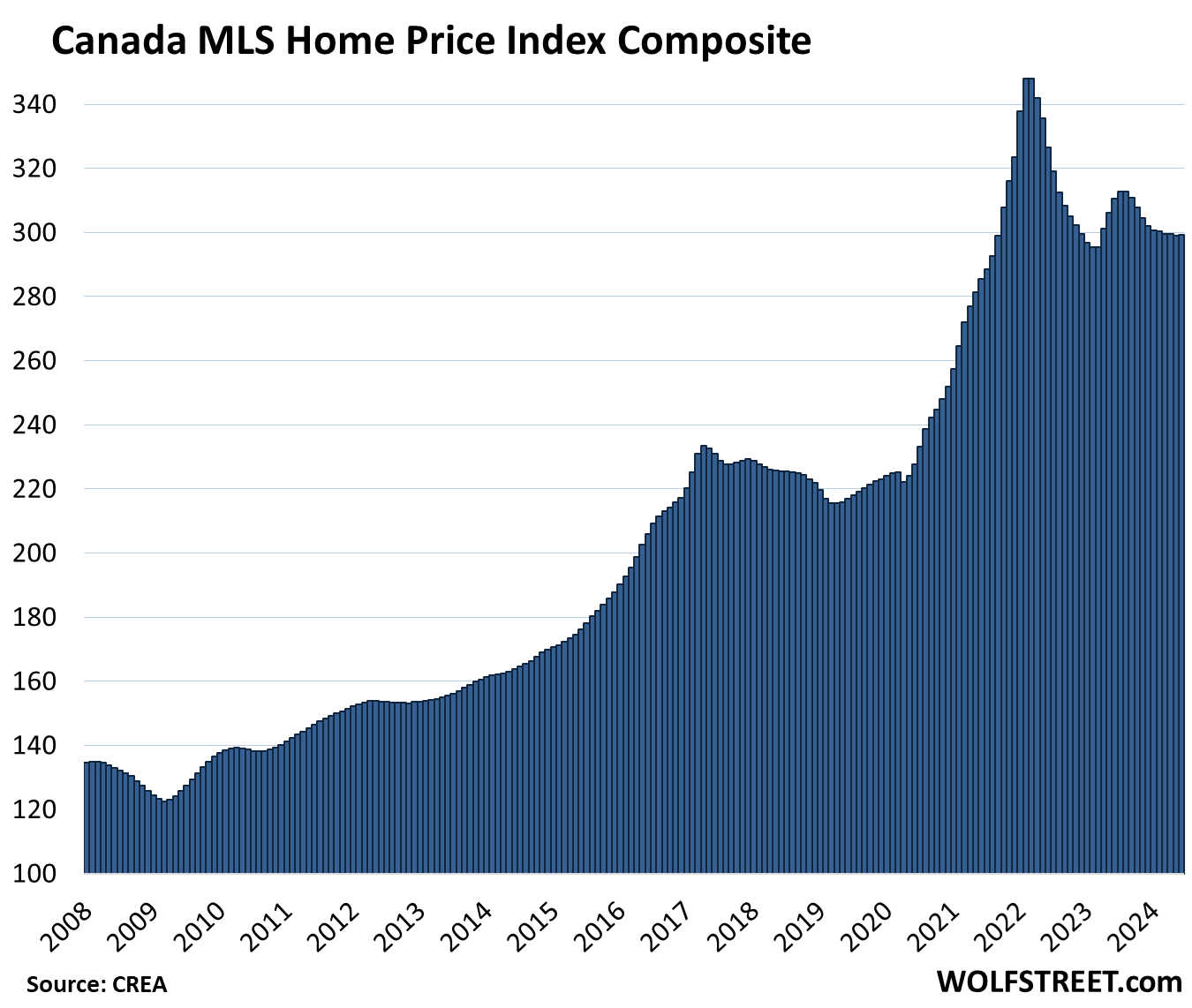

Home prices edged up 0.1% in June from May, seasonally adjusted, but essentially have been flat all year, with just minuscule up-and-down squiggles like this, after having declined in the second half of 2023, according to the Composite MLS Home Price Index by the Canadian Real Estate Association (CREA) today. Single-family prices ticked up, and condo prices fell further.

From the peak in February 2022, the index has dropped 14%, and is back where it had first been in September 2021. Year-over-year, the Composite MLS Home Price Index fell 3.4%, the third year-over-year decline in a row, with prices rising to all-time highs in some markets and falling further in others.

Home Prices in the most splendid Housing-Bubble Markets.

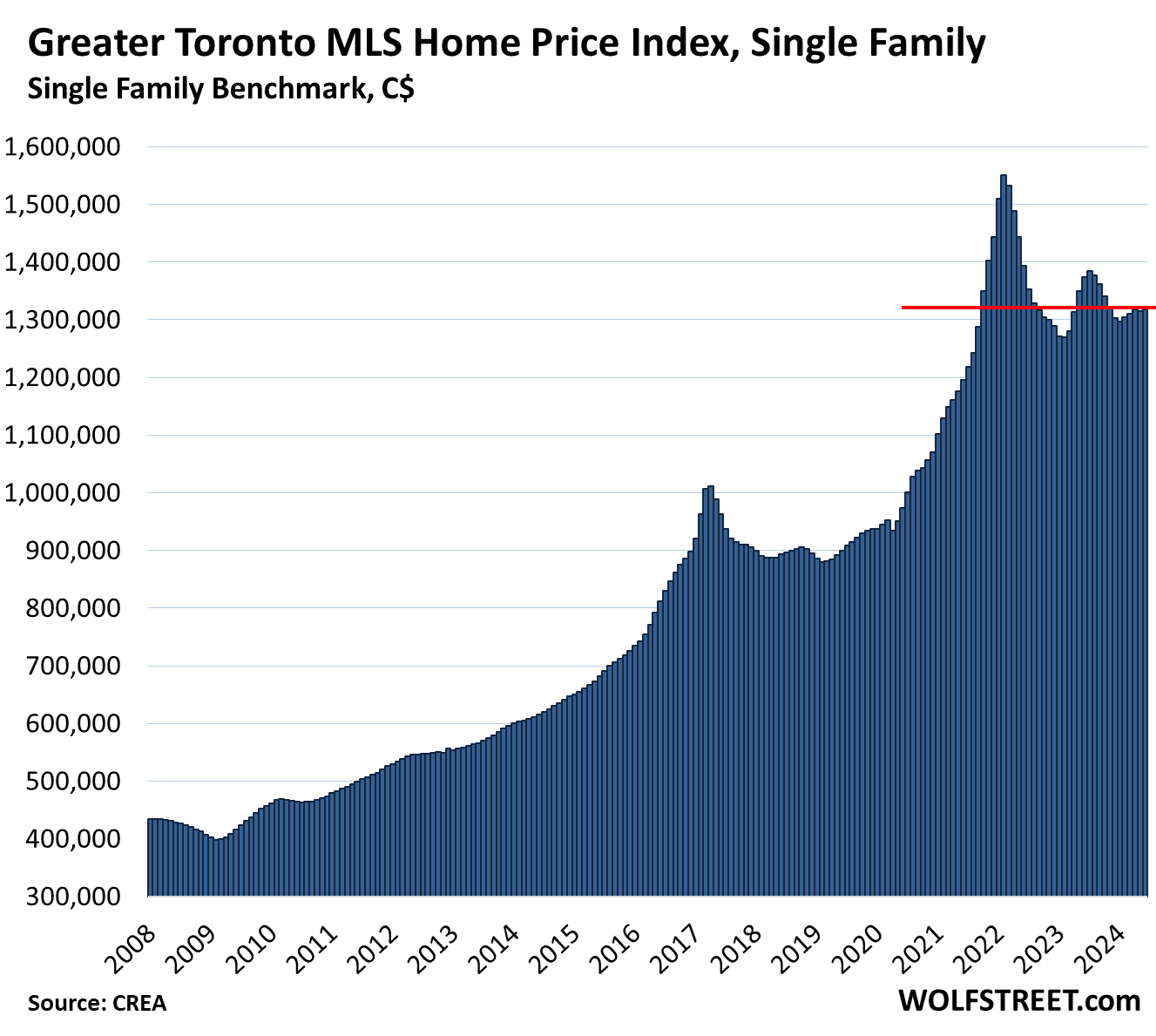

Greater Toronto Area, single-family MLS Home Price Benchmark Index (all prices in Canadian dollars):

- Month-to-month: +0.3% to $1,318,600; below October 2021

- From peak in February 2022: -15%

- Year-over-year: -4.0%, second month of year-over-year declines in a row (-2.6% in May).

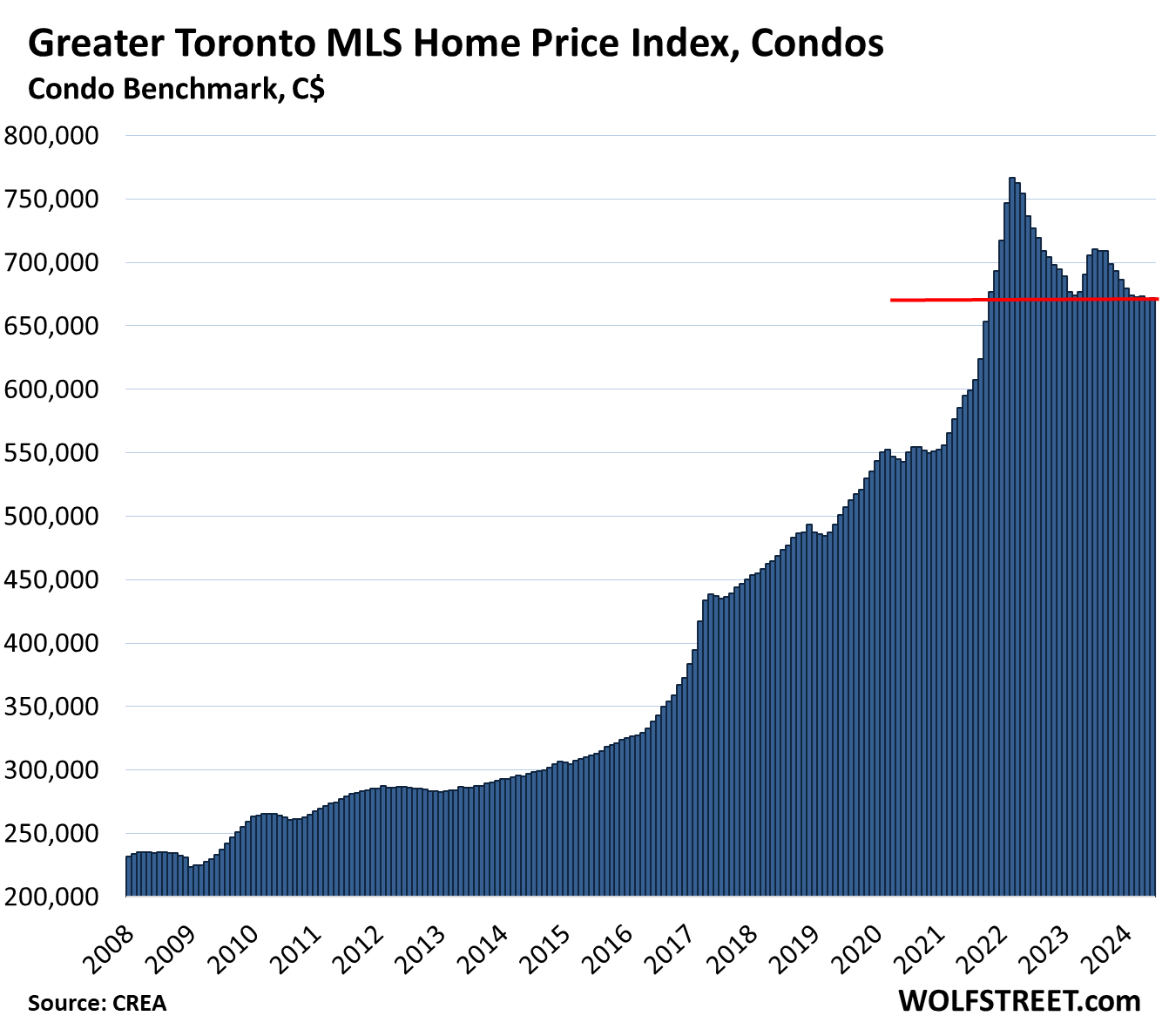

Greater Toronto Area, condo benchmark price:

- Month-to-month: +0.2% to $671,900 where it had been in November 2021

- From peak in February 2022: -12.4%

- Year-over-year: -4.8%

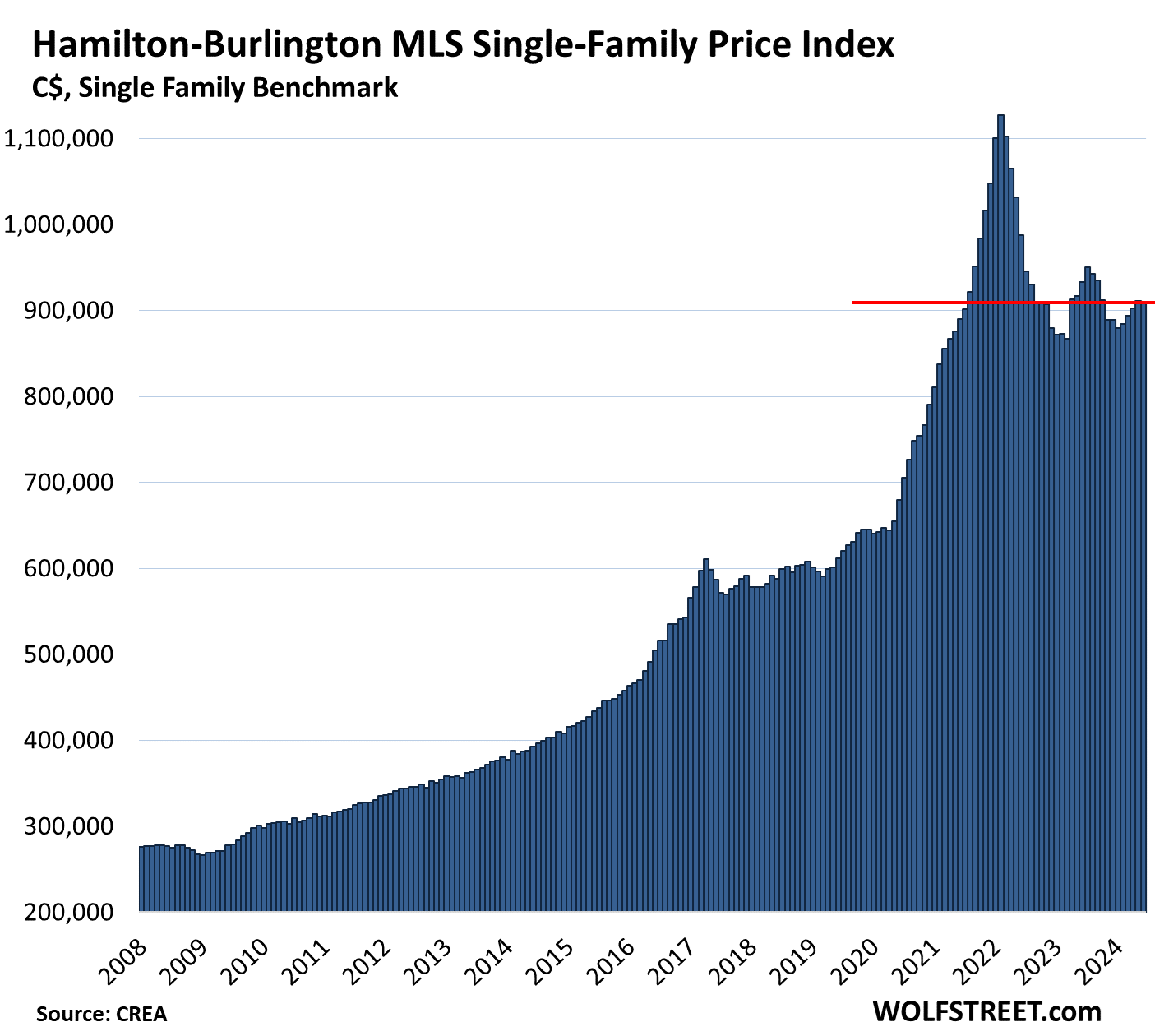

Hamilton-Burlington metro single family benchmark price (in the “Greater Toronto and Hamilton Area”):

- Month-to-month: -0.2% to $908,900, where it had been in August 2021

- From peak in February 2022: -19.4%

- Year-over-year: -2.6%, third month in a row of declines.

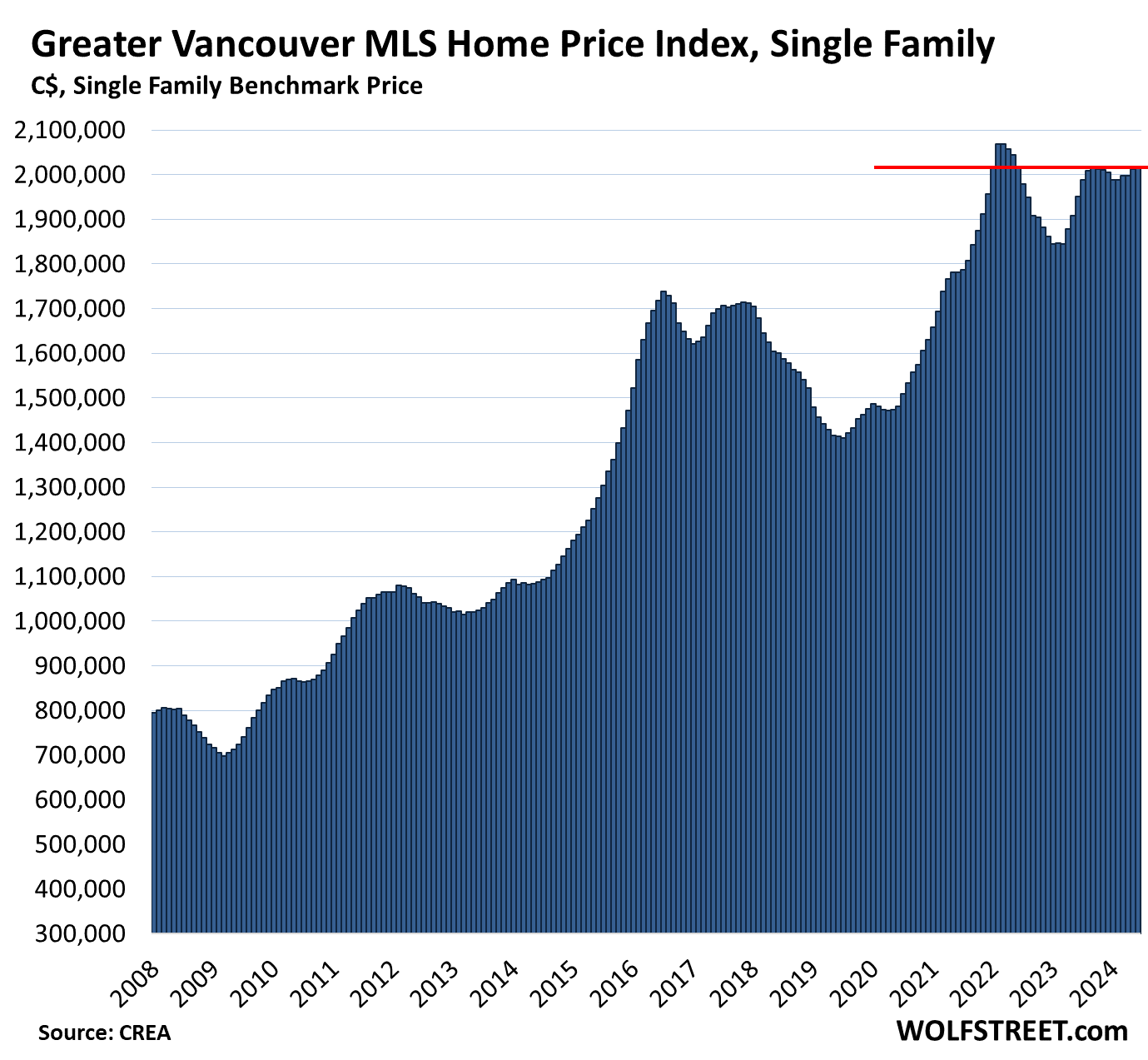

Greater Vancouver single-family benchmark price:

- Month-to-month: +0.2% to $2,017,100, where it had been in January 2022, roughly flat since September.

- From peak in April 2022: -2.5% or -$42,200

- Year-over-year: +3.4%, smallest gain since August 2023.

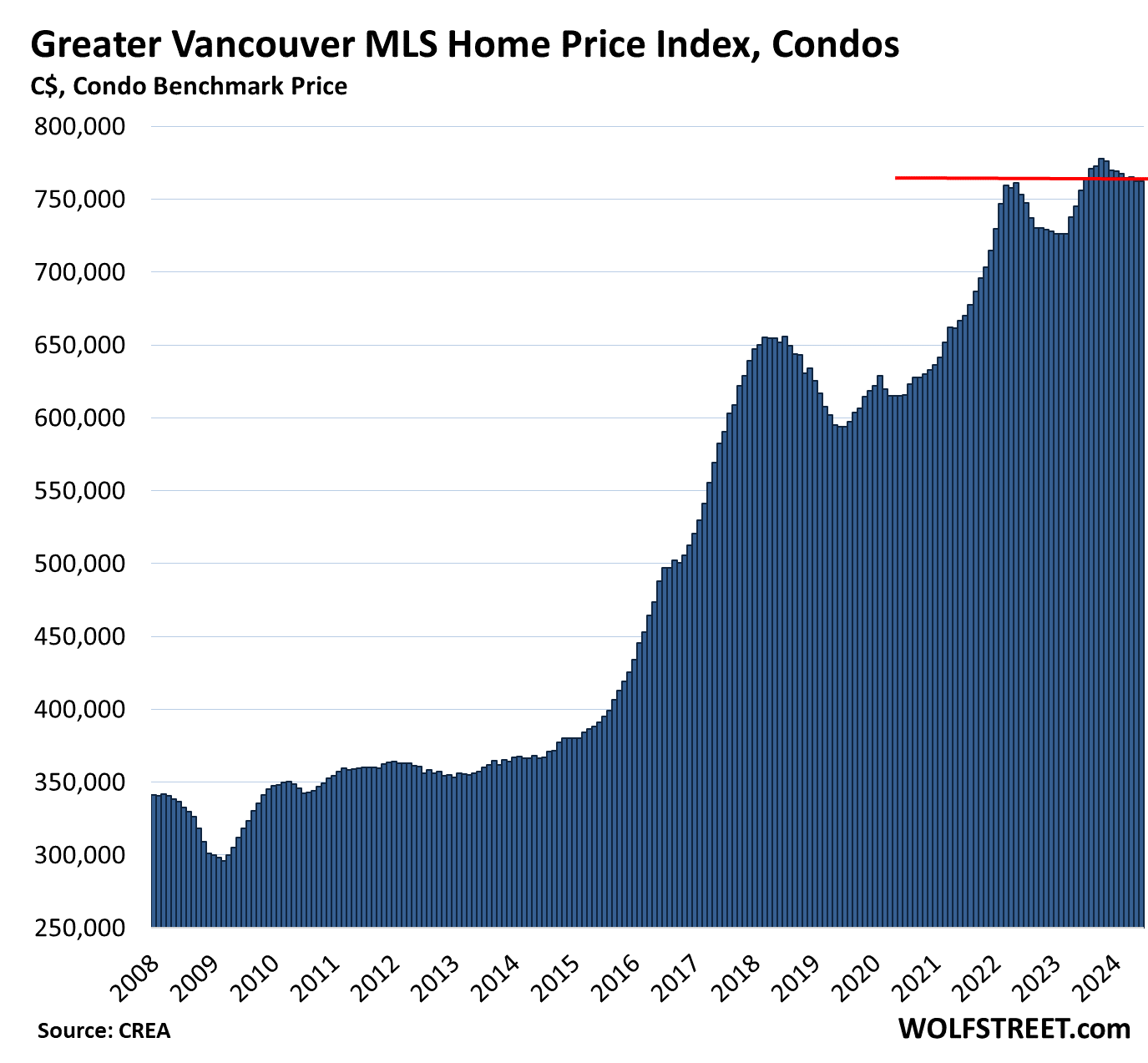

Greater Vancouver condo benchmark price:

- Month-to-month: unchanged, at $762,500, a hair above May 2022.

- Year-over-year: +0.9%, smallest gain since June 2023.

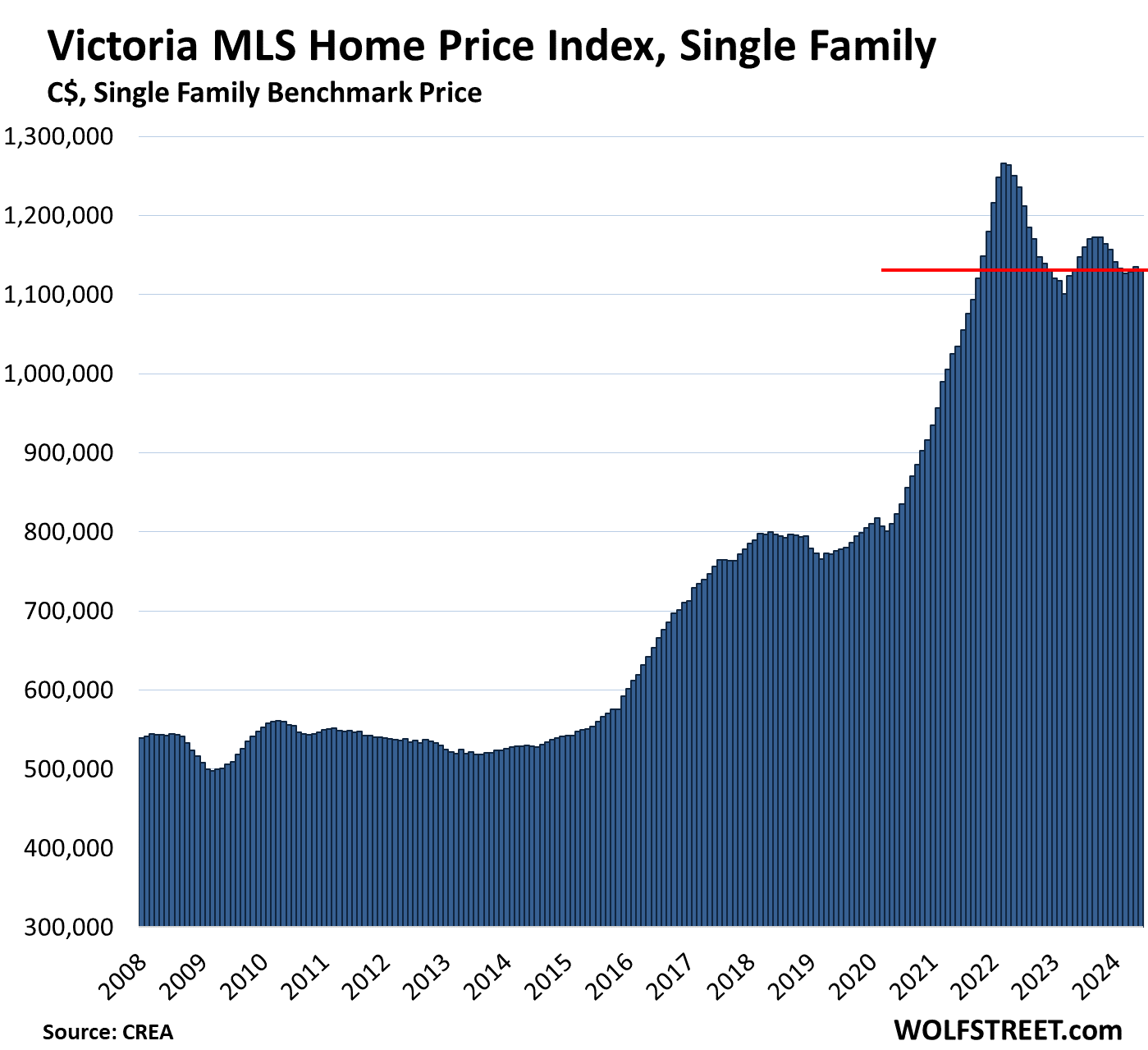

Victoria, single-family benchmark price:

- Month-to-month: -0.4%, to $1,130,700, below November 2021

- From peak in April 2022: -10.6%

- Year-over-year: -1.5% first year-over-year decline since August 2023.

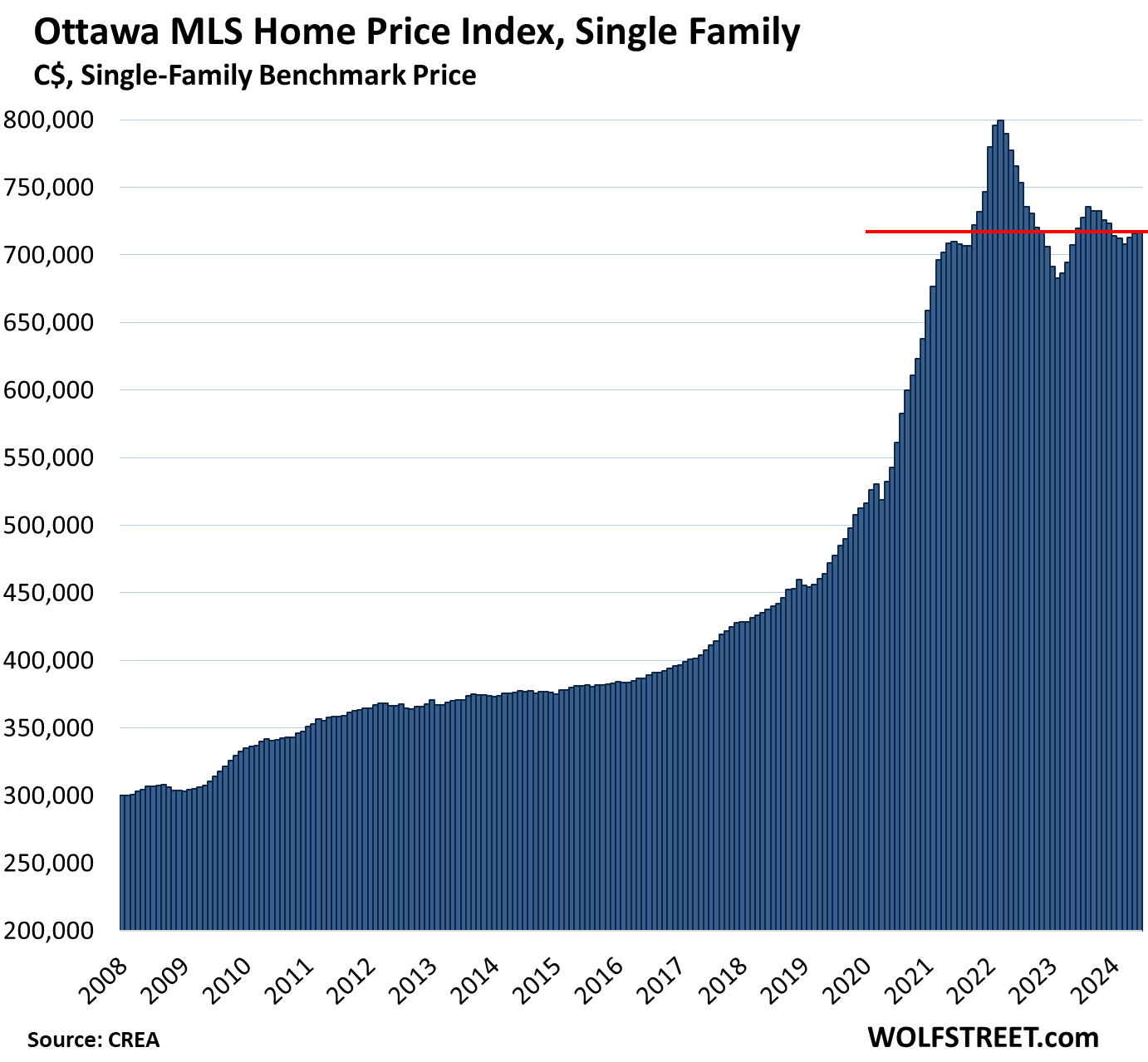

Ottawa, single family benchmark price:

- Month-to-month: +0.3% to $717,800, below October 2021

- From peak in March 2022: -10.3%

- Year-over-year: -0.3%, first year-over-year decline since July 2023.

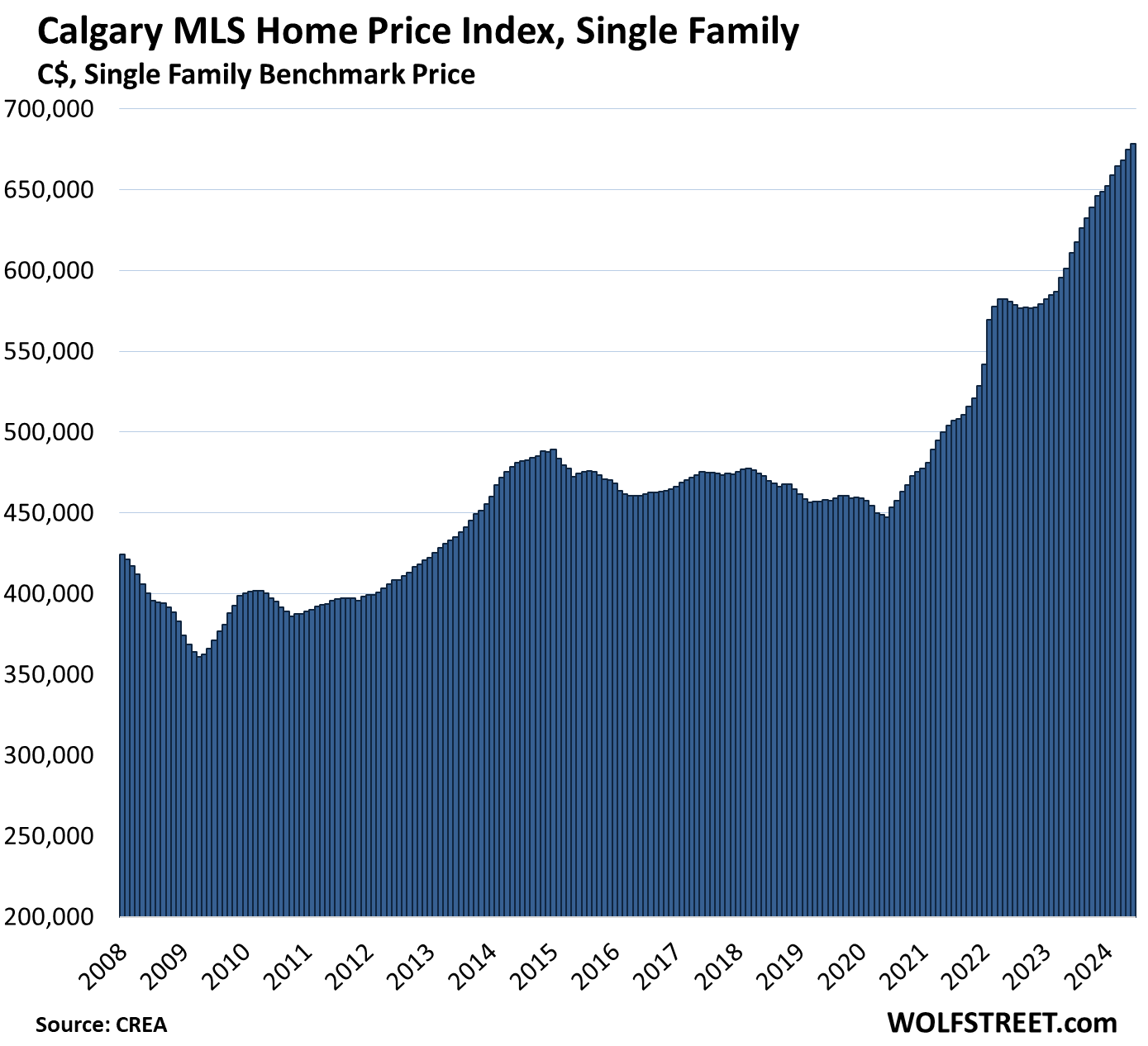

Calgary, single family benchmark price:

- Month-to-month: +0.5% to new high of $678,300

- Year-over-year: +11.3%. As big as this jump seems, it was the smallest since October 2023.

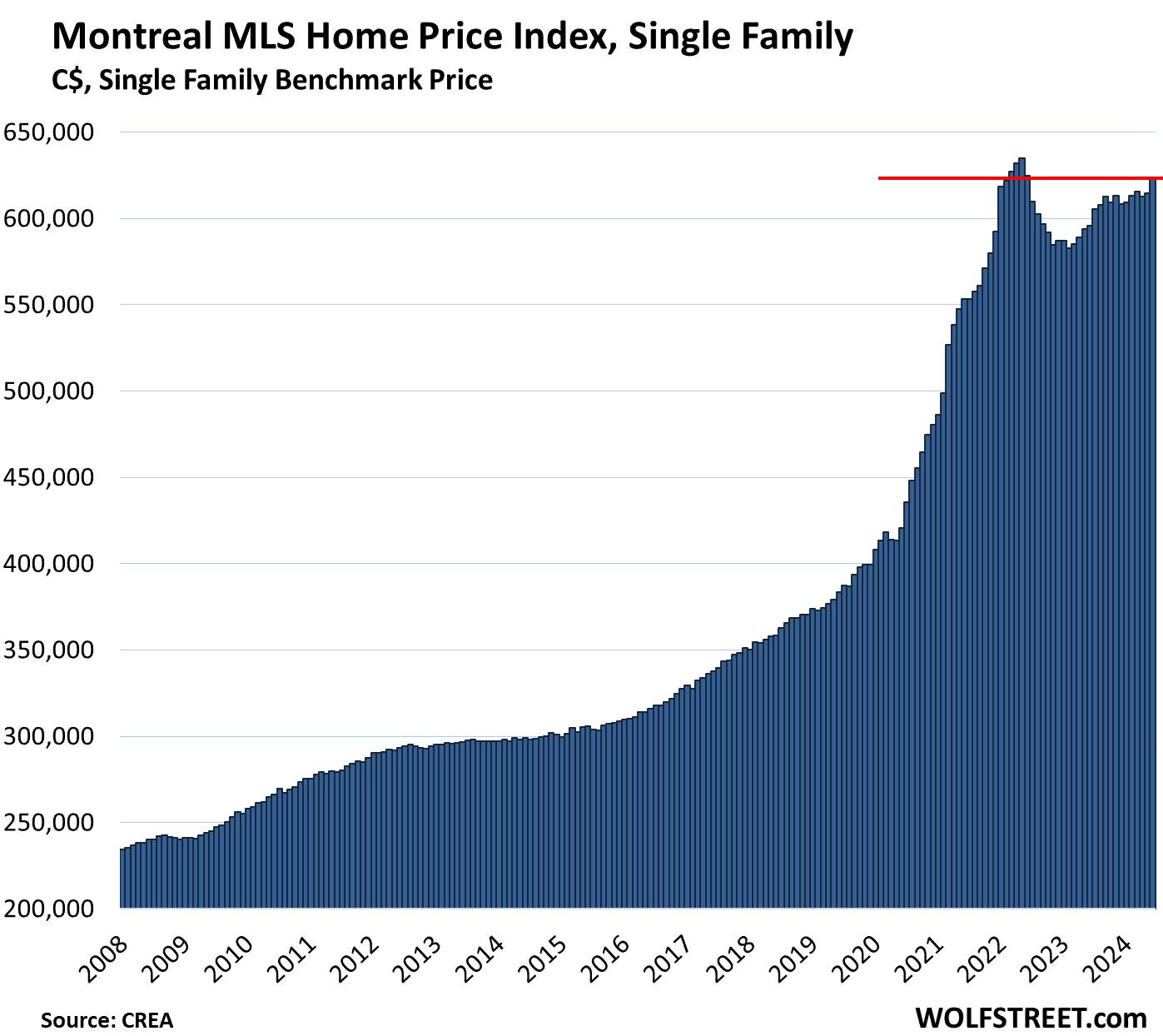

Montreal, single family benchmark price:

- Month-to-month: 1.4%, to $623,200, just a hair above February 2022.

- From peak in May 2022: -1.8%

- Year-over-year: +4.6%.

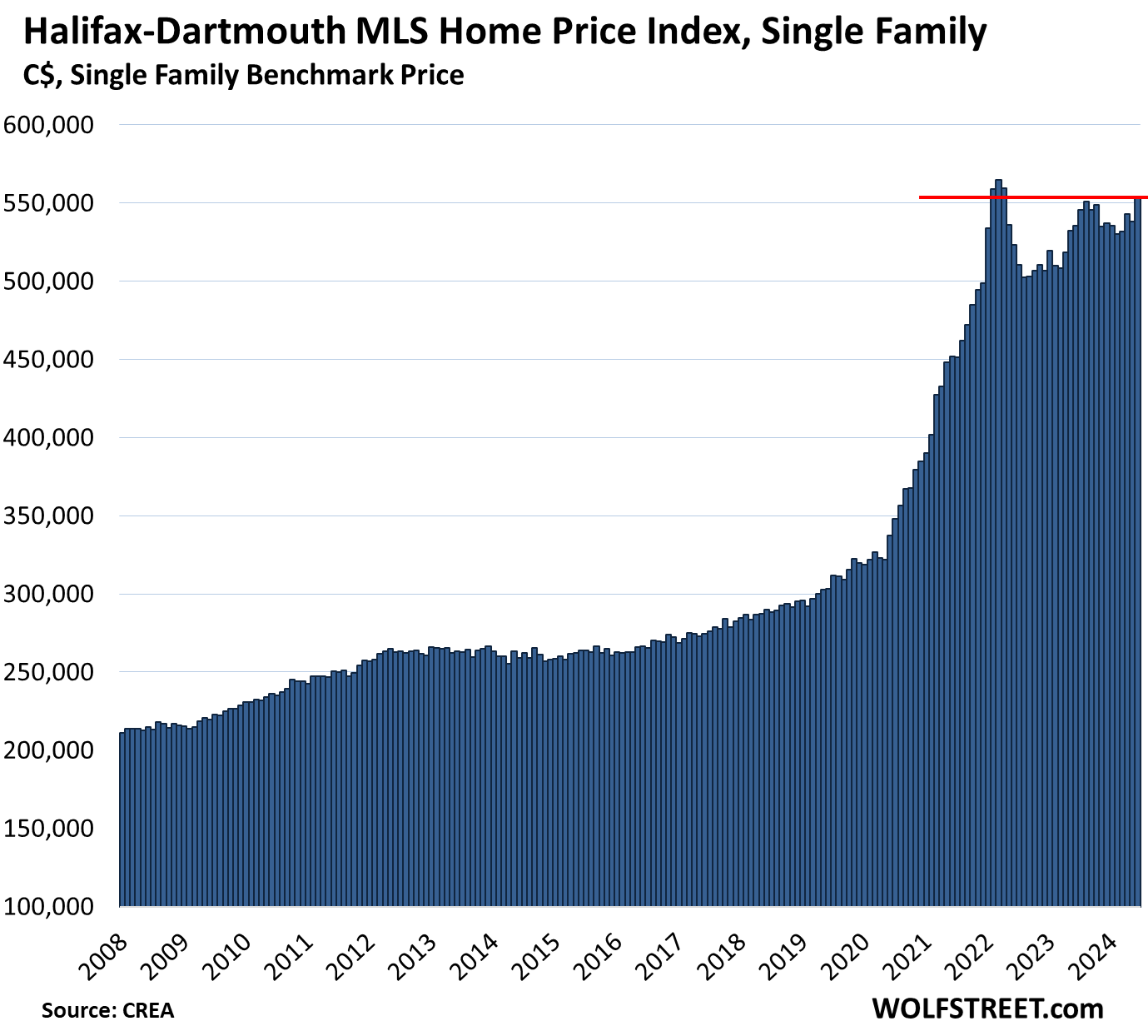

Halifax-Dartmouth, single family benchmark price:

- Month-to-month: +2.9% to $554,200

- From peak in February 2022: -0.8%

- Year-over-year: +3.5%.

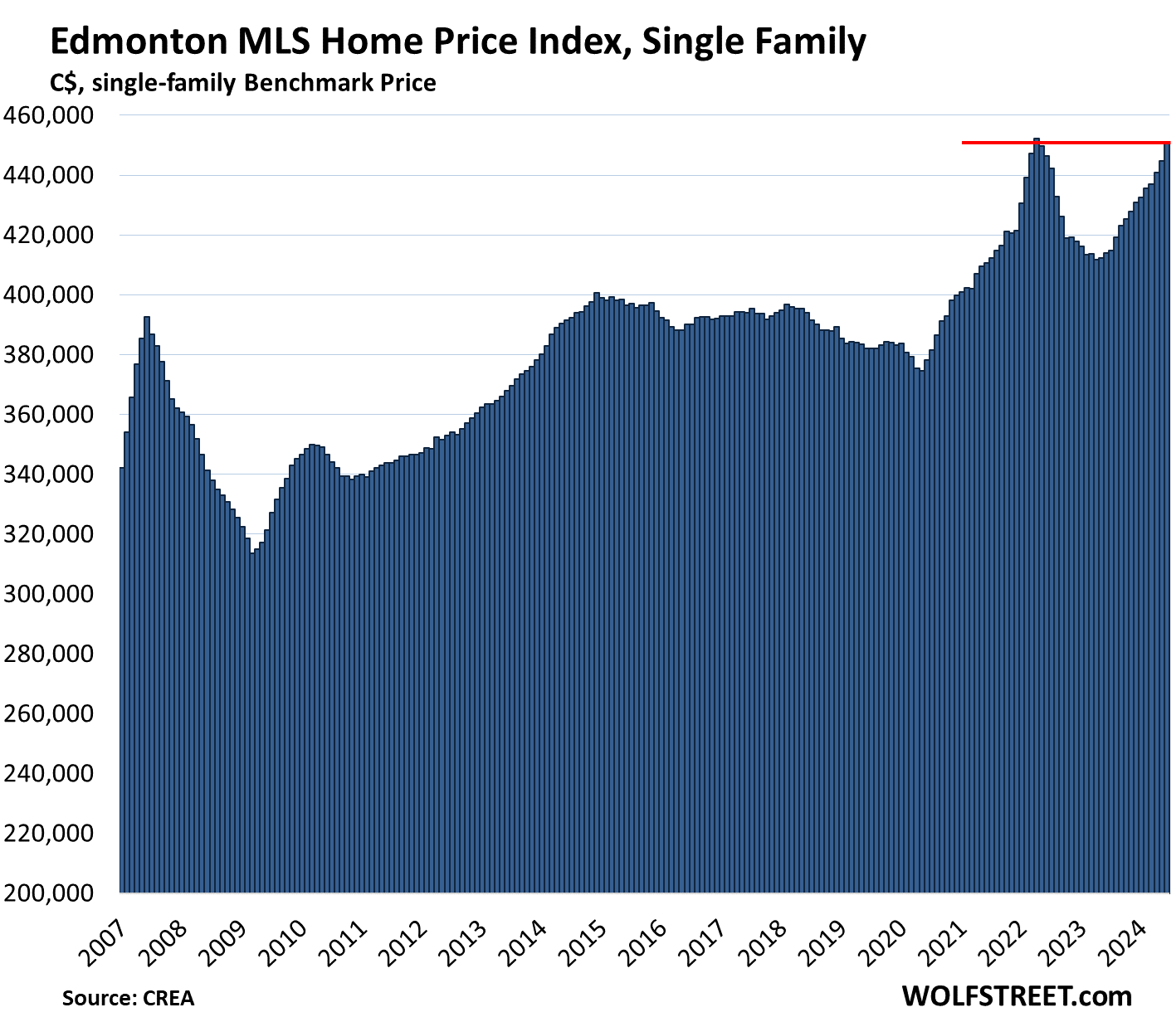

Edmonton, single-family benchmark price:

- Month-to-month: +1.3% to $450,700

- From peak in April 2022: -0.3%

- Year-over-year: +8.9%

- In the 17 years since the peak of the prior bubble in June 2007, the index is up 15%.

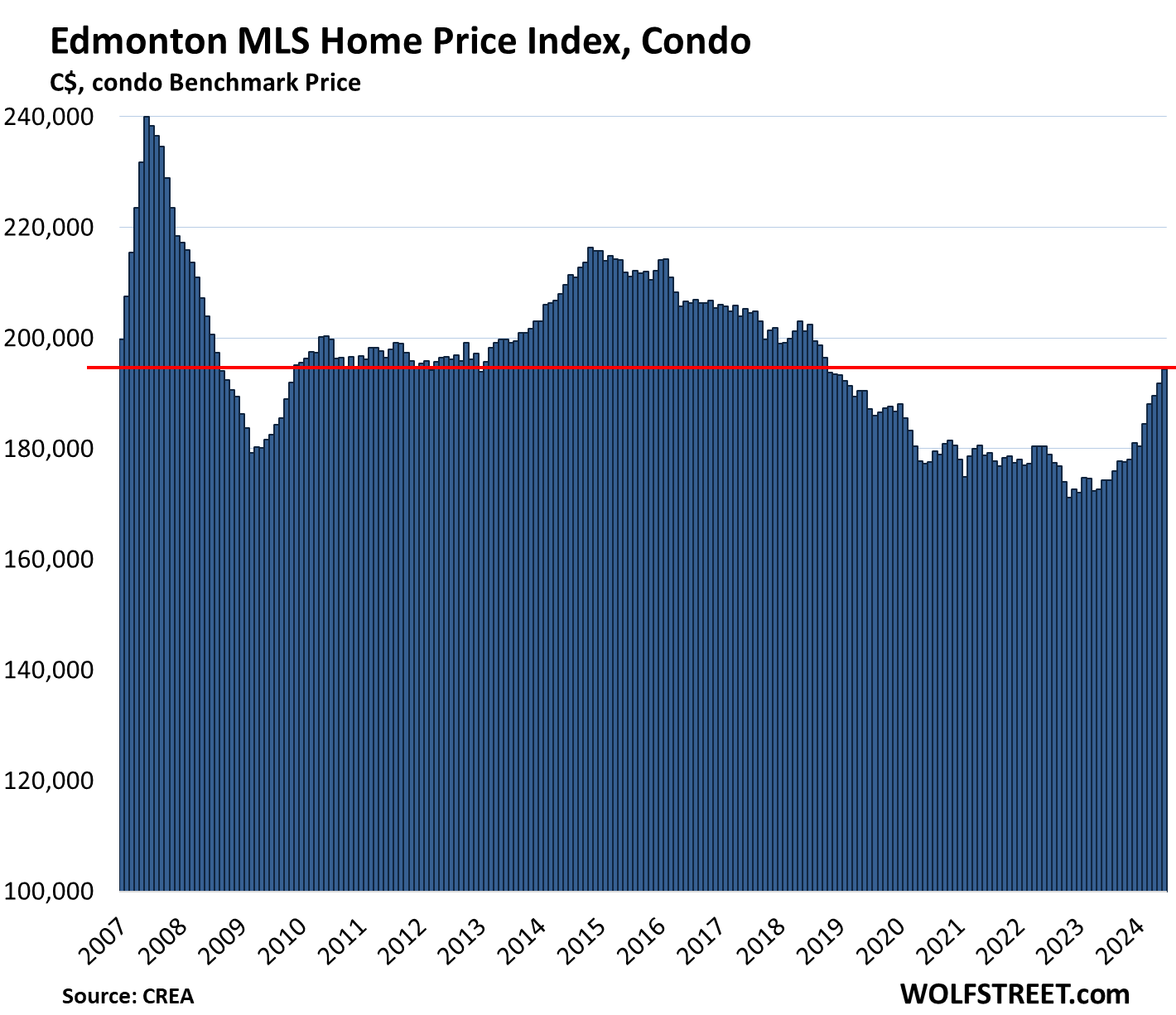

Edmonton, condo benchmark price: What an epic condo bubble looks like afterwards. Despite the surge in recent years, the index is down 19% from the peak in June 2007.

- Month-to-month: +1.3% to $194,300, first seen in December 2006.

- From peak in June 2007: -19%

- Year-over-year: +11.5%

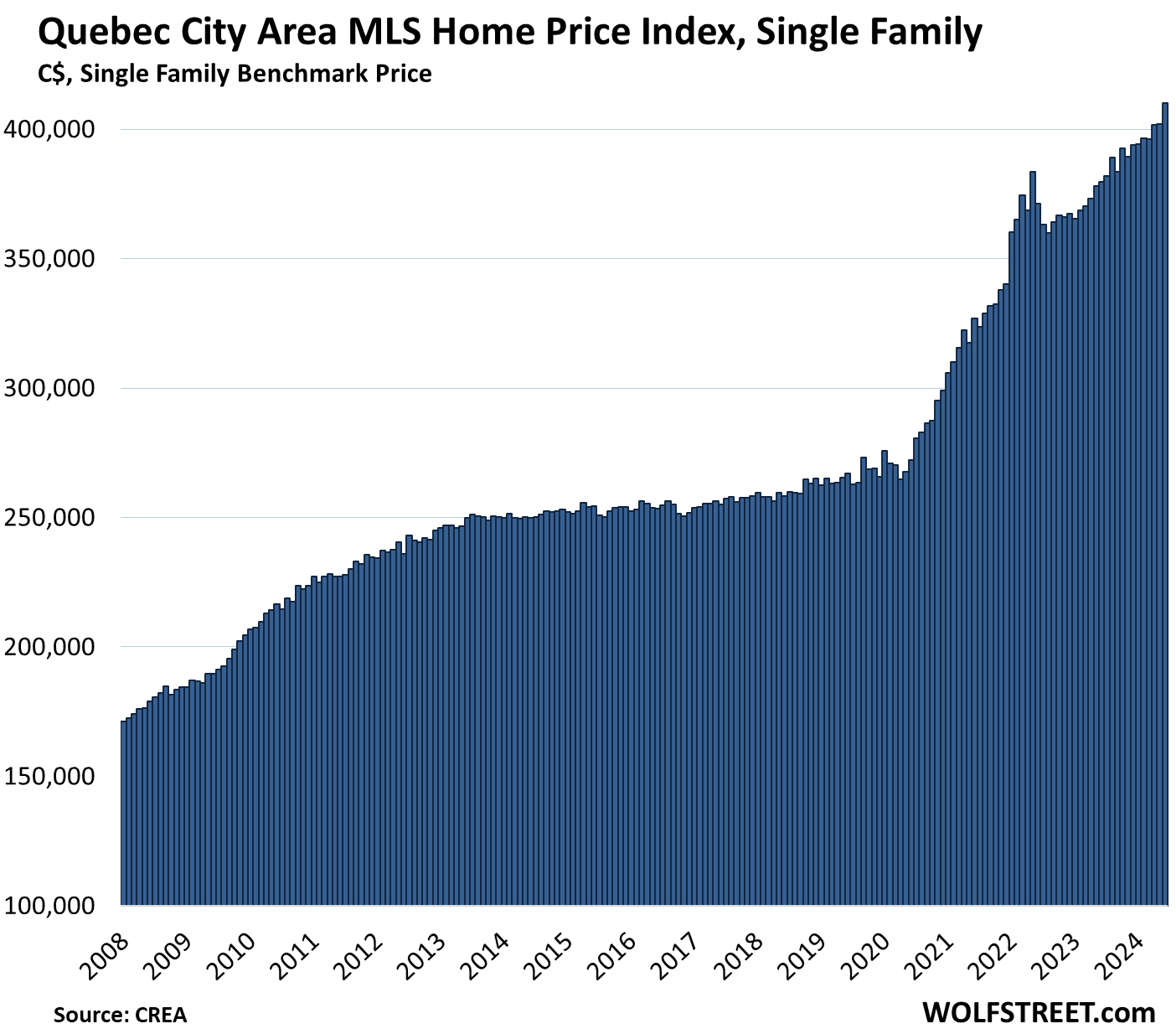

Quebec City Area, single-family benchmark price:

- Month-to-month: +2.0% to $410,000, a new high

- Year-over-year: +8.0%

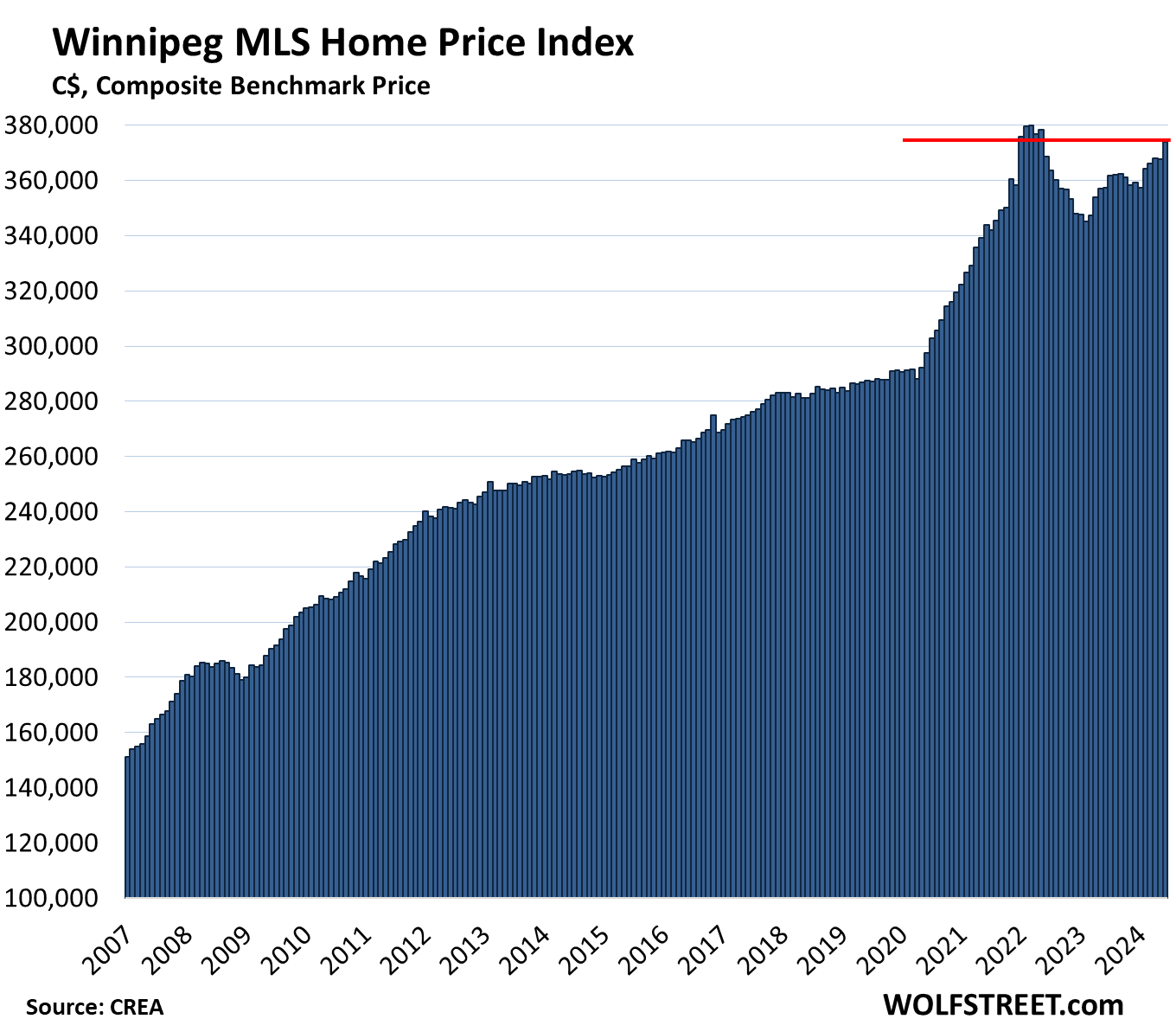

Winnipeg, single-family benchmark price:

- Month-to-month: +1.7% to $374,100

- From peak in March 2022: -1.6%

- Year-over-year: +4.6%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What is your view on homebuilders for the next 6-12 months?

(❁´◡`❁)

Sorry I don’t speak Gen-Z, can anybody translate this response?

LOL perhaps

Maybe a cutesy /shrug (best guess!)

At 2,738, Calgary’s number of home sales saw a 13% yearly decline

Average home prices do not show the true extent of price changes because of the substitution effect. When changes in home prices or mortgage rates reduce consumers’ buying power, they shift their purchases to more affordable options. As a result, the average price can under-represent house price inflation. Moreover, luxury homes have an outsize effect on average prices, and fluctuations in the number of luxury home sales cause fluctuations in average prices.

Despite Calgary’s resilient real estate market, it’s home to one of the highest unemployment rates in Canada. The rate climbed 0.4 points (+3.8k people) to 8.5% (87.3k people) in June. It’s up a whopping 2.3 points (+27.3k people) since last year—more than double the growth rate of the national average

Good article and stats. The Cdn real estate association just revised their latest forecasts in sales numbers and prices all downward….still in an upward trend, but lower rate of change according to them. Personally, I think it is all so much BS hype by RE hopefuls.

It is in Global News this morning, but links are not always appreciated so anyone who might want to read the article will have to search for it.

Two observations from hot market Vancouver Island. Sales waay waay down. Market stalled. Where I live, a rural paradise actually that had seen many younger buyers in years past, has not had one sale this past year. Not one. And….the asking prices remain unchanged. My son in law has an open house on his Dad’s patio home tomorrow. He has lowered asking price twice in the last 6 months, and had two haywire offers blow up because they were ‘subject to’ sales of the buyer’s home. The latest to tank was because a Kelowna condo could not be moved as so many have now flooded the market due to outlawing B&Bs other than in private residences. The patio home is 1/2 hour drive from Victoria and is very very nice, truth be told. In US dollars the patio home price is around 400K. People are staying put from what I can see.

Up to 80% of Canadian mortgages are up for renewal this year, but I have also read that might be 70%. So a mortgage that was 1.4% (like my son’s two houses) might climb to 7.5% overnight. Ouch. Prices will drop accordingly, and everyone knows this is NOT the time to buy unless you have to move.

Cheers.

Bankers on one side of the house and Politicians on the other. Suckers in the middle and bailout money on the bad bets. What is being taught in school that people can’t spot these schemes and there is little to no Free Market…just extration.

If I understand you on this, have ABnB condo rentals been outlawed? If so, is that just in Vancouver Island, just your province or is it nationwide??

It varies depending on areas, BC is trying bans while the federal gov’t is levying added taxes to short term rentals.

More taxes so they can develop more (affordable housing-gov inflated housing-work force housing) while they do their own inspections. Two tiered justice in the form of taxation and it’s socialized in the basic need of shelter. Great job gov your retardation for all to see, what’s the excuse ‘wallstreet’ bought your common sense.

With Condos haven’t condo fees risen sharply in the last few years? That means the total cost may not have dropped that much – making them far less attractive. As well many are tiny, meant to be investment purchases rather than purchase-to-live-in investments.

On top of all that what is received for those condo fees has fallen greatly. Many now don’t even offer a parking spot and they used to include utilities in many cases and now don’t.

Housing is still 5-20x a good gross wage so housing prices are still way over the long term norm of 3x a decent annual wage.

I’d say comparing prices of condos should include condo fee increases + what you get for that (in Canada you still usually pay property taxes on top of your condo fees, too…).

“I’d say comparing prices of condos should include condo fee increases…”

For single-family, homeowner insurance and maintenance and repair costs, etc. have surged as well.

In high price areas like Tahoe, Aspen and Jackson many condo HOA dues have doubled in the last 5 years due to the increase in insurance maintenance and repair costs plus the cost related to paying workers who do the maintenance and repairs to drive in from Reno, Glenwood Springs, and Driggs. We were skiing Memorial Day weekend and I saw flyers for some condos for sale that all had HOA dues that were higher than my first (PITA) mortgage payment. I just looked and there are two 1 bedroom condos for sale right now in the Village at the Palisades Ski Area and the MONTHLY HOA dues of $1,595 and $1,772

I really made a mistake typing PITA rather than PITI (Principal Interest Taxes & Insurance)…

The thing with the HOA dues is that they’re the same every month, until they get raised, and presumably, the HOA has a big reserve fund, so when the big shared boiler needs to be replaced at a cost of $100,000, they will pay for it out of the reserve fund. And then next year, the roof needs to be replaced, and hopefully there’s a bunch of money left in the reserve fund to do it, or else, the owners get a special assessment. So a well-run HOA makes the maintenance and repair costs very predictable. There are no surprises, and someone takes care of everything and you don’t have to mess with anything and waste time on this stuff – and that has value too

When you own a house, you might only have yard care expenses and some minor maintenance for many years. But then one day, your roof needs to be replaced, and that’s maybe $30,000 that you have to pay for yourself. And then your water heater goes out, and there’s a chunk you have to pay for that. And then you have a water leak from a pipe that destroys your wall and ceiling. And that stuff usually comes together. So you need to average it out over the long term.

I used to own a 1,800sf beautiful condo on the 23rd floor with huge views. The HOA dues seemed fair to me (ca. $460 a month by the time I sold it in 2001). They replaced the boiler of the tower at a huge expense and paid for it out of the reserve fund. Then lightening hit the tower and knocked a large piece of concrete out of the top of the building (I was at home when it happened one floor above me, and that was fun), and they paid for it out of the reserve fund, etc. Plus, there was cleaning staff and a person at the reception I think 24 hours day. They would buzz you when guests showed up. They took in packages, etc. And that had value, at least to me. It was a very worry-free way of living.

The reason why I don’t like condos anymore is because I have seen the politics and corruption that go on at the HOA board. It’s really bad. There were two landlords that each owned something like 30 units, out of 200 or so units, and together, they could pretty much get the majority of the vote on anything because few other people showed up at the meetings to vote.

My own home insurance have increased 300 percent in last 4 years

My friends home insurance increased 120 percent very recently

100% + at least in Toronto the increases have not yet filtered into the prices yet. This might actually make new units more attractive yet the bulk of that inventory is 1 bdrm oriented toward investors/AirBNB. That is yet another story unravelling here. Toronto and GTA is probably the center of what will happen to the condo market in Canada.

Over and above condo fee increases, there are special or extraordinary assessments, largely due to the condo boards not maintaining adequate reserve/sinking funds for periodic large maintenance issues due to the resistance of occupant owners to condo fee increases. These assessments can run to 10s of thousands of dollars. My retired mother-in-law’s condo building had an assessment of $30-40K per unit (depending on size of the apartment) due to delayed maintenance issues such as roof and balcony repairs and cosmetic refacing of the building.

Recently Florida has had extraordinary assessments of as much as $100K to upgrade older buildings to newly legislated standards due to the collapse of the condo that claimed 100 lives. Even if the buildings were maintained properly that was something that could not have been anticipated.

Actually that collapse -could- have been anticipated and acoided. Buildings don’t just collapse suddenly with no signs of distress. The collapsed building happened because of many factors: un-mitigated design defects, unexpected load from modern renovation trends, skipping prudent structural inspections, and ignoring symptoms discovered well in advance.

After that collapse, many nearby buildings DID start inspecting. Some discovered shocking cracks and corrosion in the concrete structures. Most are trying cheap patch-like repairs because the owners maintain the “if you do not see it you do not have to pay for it” mindset.

Hindsight solves all problems, but see what reaction you get at a board meeting by proposing to increase condo fees to pay for the implementation of policies of foresight.

It’s not pretty.

All the above. In my small, but aging, building I regularly press for more HOA dues.

We need new siding and roof (call it an easy $250,000). Several years ago we had about $20k in reserve and one owner was asking “why don’t we REFUND the ‘excess’.”

We have since upped our dues and had the building painted (upwards of the $20k amount).

At our last meeting we were talking about how other buildings had seen 100-400% increases in insurance rates. I pushed to immediately increase our fees. The other owners were in favor of “wait and see” as our insurance renewal is in the fall.

I’m the only owner occupied resident (the other owners that use their space have the commercial unit).

My building is a scraper by our area standards, but my deed restriction is an anchor, that won’t allow it to happen, until I can move.

David said: “ many are tiny, meant to be investment purchases rather than purchase-to-live-in investments.”

I live in one of these types of condos (in ski town USA). I am acutely aware that people believe that housing is an investment and even a primary home should be!

As my only home- ownership, I am simply Blessed to have a stable home. I have never thought that viewing a primary residence as an investment is a wise idea. A savings vehicle? Sure.

However I know of some around my town who are living in their primary retirement asset. If one was able to buy a “free market” home (the barriers to entry were somewhat lower 3-4+ decades ago) then they may be in a $5 million scraper (unless it’s considered historic/ then similar value with a much higher renovation cost).

It’s the state of the world now, not just unique to resort/ HCOL areas.

Canada housing prices just hard for me to fathom unless they have massive migration of rich folks . I still don’t understand how these prices are sustained . I’m retired but with my degree I would probably earn 150k usd which I don’t think would allow me to purchase a 400k home much less what is the average Canadian home.

Maybe it’s dual income no children . Regardless the prices are there someone is buying .

Here’s the explanation

A new analysis from Desjardins shows household debt to GDP makes Canada the third most indebted country on the planet, beat only by Australia and Switzerland.

But that is not for just houses, it is for the new cars, bling, events, and just about everyone I know takes a winter vacation at an all inclusive. Even my 23 year old renters this past winter went to Cancun for 10 days. Crazy. Math and budgets….dreams and the discipline to realise those aspirations, be it schooling, a house, a solid family, whatever. That is what is lacking up here and probably elsewhere, and then voters expect the Government, either right or left wing, fix all the perceived wrongs so they can get what they think they deserve. Nuts.

There will be parents paying for a $1500 Taylor Swift ticket in Vancouver this Sept. There will also be many parents pulling their kids out of school for a winter sun romp this winter. It is the new reality.

Canadians USED to be known for thrift and economic conservatism. Big time. This new trend has only been around for 30 years or so. Could social media have any influence on this? Don’t know. All I know is that when I was coming up one did not buy a house that required more than 1/3 of net income to pay monthly mortgage. Then, you paid the house off asap. I did this and it set me up for life. And for the last 20 years, this blue collar wage earner would tell people (when asked) that if they did not have a home of some kind fully paid for, they could not retire. My kids were brought up on this mantra. One is financially set at 45, but the other at 40 doesn’t seem to mind debt, so who knows how it works out for him?

My folks were products of the Great Depression and WW2. They struggled mightily to get ahead. Math is math. If people spend extra dollars on vacations, food delivery, restaurant meals, boats and toys, then don’t complain about the price of housing, food, or rising interest rates, imho. When I see someone buying bottled water or expensive iced coffee, well my parents would roll over in their graves for sure. I know I sound like an old conservative twit, but it might take some hard knocks for some people to wake up and accept that life isn’t a beer commercial. It is a serious business with fun and laughter for sure, but no guarantees.

Like Paul S I grew up with parents that were products of the Great Depression and WW2 (and real poor). Most adults 30 to 50 today were raised by Baby Boomers who grew up in the post WWII good times combined with the inflation that made almost every real estate purchase they made a home run. As an apartment owner I learn more about the personal financial situation of more people than normal but today it seems like “most” people (over half) from 20-50 is spending more than they make every year and making up the difference with debt, for my tenants in lower priced apartments it is mostly credit card debt, for the tenants in the $5K/month apartments I see a lot of installment sales (they are paying per month on the Peloton, the Tesla and the Rolex) and for my wife’s Ivy League friends that live near us on the Peninsula many now owe $4mm or more on the homes they bought for ~$3mm in 2012 after multiple refis pulling out hundreds of thousands each time…

It has been the Canadian way to get a mortgage that uses up your finances and get a HELOC for everything else. That includes your trip to Cancun, your new fridge, truck and travel trailer. Houses have gone up for 2 decades and people thought they were fine. Our liberal Government allowed banks to “extend and pretend” on VRM’s, keep the payment the same and extend the amortization. I’ve heard of a 93 year amortization. Our prices are much higher than the US and average income earners have been priced out for years. It was almost a bragging rights thing to think that your rich because your house is worth so much.

Having 10 or 15 people (formerly) illegally in one house helps to pay the bills. In suburban neighborhoods just look for a half-dozen cars in the driveway.

The Toronto solution: rescind the local zoning laws that prevented rooming houses in the majority of residential/suburban areas. Neighbors are not happy.

That explains my grandpa’s advice to me when I was a boy: “buy yourself 60 acres and put your house right in the middle of it”

If you think a person cannot afford to purchase a home with 2.7x income then you must spend an unusual amount on other expenses.

Plenty of people afford homes that cost 4x or 5x income without excess hardship.

Even at today’s rates, a home that costs me 4x my income consumes about 25% my gross pay

The rich Chinese emigrated from China to Canada in 2015 and 2016. Most of them went to southern Ontario which is the greater Toronto area. Some went to Vancouver. The foreign money from China is mostly in the greater Vancouver area. The local Chinese money is mostly in the greater Toronto area. They’re the backstoppers of any price drops. To get an idea of future trends in home prices one has only to look at the cities in Canada that are nearly 100 percent Asian.

It’s controlled by gov in cahoots with banks real estate. Look at cre and how much of that sector of floating by banks and real estate office. It could all be remote or an atm in a field but it is huge sums of money because that is their own business interest. Not that it adds value of anything near what it cost. When it’s just financialized, reality is out the window. And the cre collapse suspension is there in physical form with all these phono ‘offices’ that stem from the source of the problem

An 1100 sq foot condo in Brampton Ont, which is in the GTA, Greater Toronto Area, just sold for 237 K less than it last sold for in 2022. It sold over list in the high seventy K’s in 22 and after numerous reductions and relists, just sold for mid 500’s.

Next: Notice in Globe and Mail Legal Page.

‘Receiver offering 1400 units on 50 acres. Units are in various stages of completion’

This is the Barrie Ont, Urban North Townhomes by Pace Developments. Secured debt is 250 million. Total liens not known. One debt is to Rev Can for taxes collected on 270 units sold but not forwarded, total just over seven million. Re: the poor folks who made deposits, Tarion, the govt guarantor of deposits up to a point is expecting a record number of claims.

Slate Developments project in Vancouver is halted.

A strange narrative is being offered by various parties in the Globe and Mail, including reporters. It goes like this: the ultra low mortgage rates of a few years ago were normal, and the new rates circa 7 % are abnormal.

A few weeks ago the Globe had a feature in its RE section: a couple was selling their house and buying a condo. What was different about this ‘down sizing’ was they were in their 40’s with 2 teenage kids. A big factor: they were coming to the end of a 5 year term in their mortgage at, get this, 2.2 %!

These ultra low rates hung around long enough that the Globe has printed ‘Canadians are facing the highest mortgage rates in years’

Which is true. But before that, they had a period of the lowest rates in centuries. Or as a London banker opined: in 5000 years.

So dear Globe make up your editorial mind: which is the anomaly: a 5 year mortgage rate of 2.2 % or one of 7 %?

Good post.

“It goes like this: the ultra low mortgage rates of a few years ago were normal, and the new rates circa 7% are abnormal.”

And not a word about prices, no investigation into what caused prices to escalate. Gee, could it have had anything to do with the ultra low mortgage rates and the increased leverage they provided? These reporters (and the real estate industry they support) already know that without that, prices must come down. They just don’t want you knowing it.

“Slate Developments” appears to be a commercial office space REIT and thus not directly relevant to or indicative of the residential real estate market

Around 2006 the number of new housing units vs new immigrants/residents began to seriously diverge. NIMBY and bureaucracy ensured decreasing supply versus growing demand from spiking immigration. This, in large part, explains the price spikes. Supply vs demand. Prior to ’06, at least in the largest property market in Canada – the greater Toronto area “GTA” home prices were relatively flat. So if you’ve known nothing but rising prices for close to 20 years, “home prices only go up” becomes heavily embedded in the psyche of society. If the alternative is a savings account that paid close to 0, property seemed like a pretty great bet. In the GTA lots of retail investors bought property whose rental income yield cannot cover it’s carrying cost with the idea being that the owner will make up for it with ‘guaranteed’ price appreciation due to the demand v supply imbalance. In fact a friend who fell for the FOMO during the price spike in ’21 and ’22 bought a property and said that as long as the yield covered the interest portion of the mortgage, forget all other carrying costs, then it was a good investment.

Something to remember is that the whole housing market isn’t turning over at any one point in time. So when prices are as elevated as they are now, indeed most of the existing renters and even homeowners can’t afford to buy an “average” property in the GTA. But you don’t need everyone to be able to afford it — just the 5% or 10% or whatever % of housing stock that is bought and sold. However, this obviously creates tension and resentment in society.

Well said, an excellent summary of the situation

Would love to see the Okanagan included in this as well

Good post. We badly need some pricing correction but FOMO psychology, BoC, GoC and banks will do everything they can to keep prices from falling further. That may not be a good thing.

If governments could regulate property prices, the current collapse would not have been allowed

There is not much of a “collapse” some jurisdictions are – 15-22% from the absolute peak in 2022. A collapse which would probably be healthier would be returning to pre-pandemic levels.

It’s never too late to have a big collapse, right?

Even pre pandemic levels was 2x bubble compared to 2008. Canada is done if a true collapse occurs.

If government could regulate property prices there would be no houses to buy, except for Party officials and friends.

Time for the govt to bring in a million more middle aged men as “students” studying at Harvard Louis Vuitton Gucci University College of Stanford located in a strip mall near a massage parlour

Exactly only the strip mall isn’t tax free so there build a college campus at x100 the cost and the right off the ‘massage’ loans because it felt great but didn’t produce anything physical beyond a bunch of slimed like mucous as found on worms

Somewhere in southwestern Ontario i heard a realtor saying”

“500 houses listed newly and 80 sold.”

The tone was not optimistic.

That fits with a talk I had two years ago with a banker who advised to wait two years (until now) because 5 year term mortgage rates will reset to levels that people can not afford any more.

Somehow it feels like the edge of the cliff comes closer.