Here is the list of the Swiss National Bank’s top 50 US stock holdings, and how much of each it dumped.

By Wolf Richter for WOLF STREET.

What the Swiss National Bank had been doing was unique among the money-printer central banks: It created its own currency, as other money-printers did, but then it didn’t buy bonds or equities in its own currency, but instead used the Swiss francs to buy foreign currency, largely euros and dollars, and with that foreign currency it bought stocks and bonds denominated in those foreign currencies. In effect, it didn’t do QE in Switzerland over those years, but QE in other countries – ostensibly to keep the Swiss franc from rising against other currencies, primarily the euro and the dollar.

But this show created 132 billion Swiss francs in losses in 2022, the SNB disclosed earlier this year, the biggest annual loss in its history, amid falling prices of its stocks and bonds and big shifts in exchange rates.

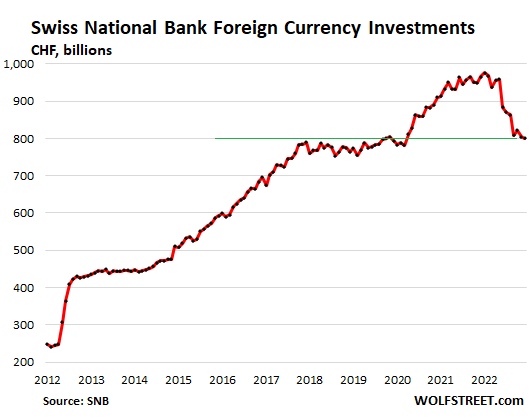

The total amount of “Foreign currency investments” on its balance sheet, including its US stock holdings, by the end of December 2022 plunged by 176 billion CHF, or 18%, from the peak in February 2022 to CHF 801 billion, the lowest since October 2019 and just a hair above December 2017:

At the peak in February 2022, its foreign currency investments amounted to CHF 977 billion ($1.06 trillion at today’s exchange rate), or roughly 130% of Switzerland’s GDP!

The drop in value of its foreign currency investments came amid declines in asset prices and big shifts in exchange rates. The SNB marks its foreign currency investments to market. Its foreign-currency bond holdings are not designed to be “held to maturity,” but are held for sale as part of its currency manipulation scheme, and stocks have to be marked to market anyway.

But don’t worry: The SNB, like any central bank that creates its own money, cannot run out of money and “go bankrupt,” or whatever, no matter how much money it loses.

The SNB’s Top 50 US Stocks on the chopping block.

Over the years, the SNB bought the good, the bad, and the ugly. Countless stocks imploded in its portfolio. Many others thrived.

In its new Form 13-F filings for Q4 with the SEC, the SNB disclosed that it held 2,687 stocks, down some 80 stocks from the prior quarter, as it closed out dozens of positions, some of which were stocks whose prices had gone to zero or near zero.

Of its top 50 stocks, in Q4, the SNB reduced its holdings of every single one of them. It had started cutting its top 50 holdings in Q2. In Q3, it had reduced its holdings of 42 of the top 50. Now it’s all of them.

Top 50 holdings at the end of Q4:

- Combined value: $65 billion

- From Q3: -4.5%

- From Q2: -10.2%

- Year-over-year: -17.3%

- Share count from Q3: -6.4%.

The SNB had started unloading its holdings of some stocks in Q2 already, such as Apple, Meta, Alphabet, and a bunch of others. For these stocks, Q4 marked the third quarter in a row of selling.

Apple on the chopping block: Apple has been its #1 holding. Since the peak of its Apple holdings in Q1 2022, the SNB has dumped 5.7 million shares, or 8.1%, and is now down to 65.3 million shares.

Tesla got cut for the first time. In Q3, the SNB had still added to its Tesla holdings. But in Q4 it dumped 623,902 shares, bringing its stake down to 10.8 million shares.

| Top 50 Holdings | As of December 31, 2022 | Change in share count since: | ||

| Value, $ Million | Share Count | Q3 2022 | Q2, 2022 | |

| APPLE | 8,486 | 65,315,868 | -4,826,740 | -5,475,740 |

| MICROSOFT | 6,906 | 28,795,370 | -1,996,285 | -2,098,985 |

| ALPHABET | 4,150 | 46,912,500 | -3,601,740 | -3,824,040 |

| AMAZON | 3,130 | 37,264,400 | -2,419,640 | -2,467,040 |

| UNITEDHEALTH | 2,016 | 3,801,661 | -264,065 | -279,765 |

| JOHNSON & JOHNSON | 1,888 | 10,685,700 | -718,116 | -719,716 |

| EXXON MOBIL | 1,868 | 16,938,376 | -1,317,815 | -1,426,315 |

| NVIDIA | 1,479 | 10,120,000 | -731,824 | -724,624 |

| PROCTER AND GAMBLE | 1,469 | 9,694,590 | -703,383 | -703,583 |

| VISA | 1,381 | 6,645,100 | -487,119 | -548,919 |

| CHEVRON | 1,357 | 7,557,690 | -531,642 | -890,542 |

| TESLA | 1,333 | 10,824,975 | -623,902 | -607,302 |

| HOME DEPOT | 1,314 | 4,160,700 | -293,266 | -369,066 |

| MASTERCARD | 1,219 | 3,506,700 | -256,757 | -279,157 |

| ELI LILLY | 1,201 | 3,282,490 | -217,558 | -228,958 |

| PFIZER | 1,169 | 22,810,112 | -1,506,129 | -1,583,329 |

| ABBVIE | 1,161 | 7,186,010 | -472,365 | -486,665 |

| MERCK & CO | 1,142 | 10,295,951 | -663,281 | -668,981 |

| META PLATFORMS | 1,115 | 9,269,300 | -670,310 | -747,310 |

| COCA COLA | 1,062 | 16,697,600 | -1,149,994 | -1,168,694 |

| PEPSICO | 1,013 | 5,609,000 | -383,804 | -392,204 |

| BROADCOM | 918 | 1,641,234 | -108,808 | -135,608 |

| THERMO FISHER SCIENTIFIC | 877 | 1,592,400 | -104,127 | -104,527 |

| WALMART | 869 | 6,127,500 | -434,083 | -490,483 |

| COSTCO | 822 | 1,800,300 | -119,699 | -123,299 |

| CISCO SYS | 802 | 16,830,000 | -1,115,820 | -1,190,120 |

| MCDONALDS | 788 | 2,990,200 | -214,757 | -235,357 |

| ABBOTT LABS | 781 | 7,117,380 | -470,885 | -532,485 |

| DANAHER CORPORATION | 745 | 2,808,708 | -184,562 | -139,262 |

| ACCENTURE | 686 | 2,570,900 | -174,038 | -170,638 |

| VERIZON COMMUNICATIONS | 673 | 17,068,798 | -1,131,403 | -1,140,703 |

| NEXTERA ENERGY | 668 | 7,985,400 | -528,282 | -528,782 |

| LINDE | 661 | 2,025,501 | -153,067 | -197,867 |

| DISNEY WALT | 644 | 7,409,425 | -484,546 | -488,246 |

| ADOBE SYSTEMS | 640 | 1,902,100 | -145,589 | -144,089 |

| PHILIP MORRIS | 638 | 6,300,300 | -417,622 | -422,622 |

| COMCAST | 626 | 17,898,200 | -1,476,229 | -1,725,429 |

| BRISTOL-MYERS SQUIBB | 624 | 8,678,300 | -548,557 | -776,957 |

| TEXAS INSTRS | 614 | 3,713,600 | -282,683 | -292,583 |

| CONOCOPHILLIPS | 611 | 5,173,915 | -431,614 | -463,214 |

| RAYTHEON TECHNOLOGIES | 606 | 6,000,881 | -444,533 | -472,633 |

| NIKE | 601 | 5,135,800 | -362,393 | -400,593 |

| HONEYWELL | 587 | 2,738,100 | -211,955 | -236,855 |

| AMGEN | 571 | 2,174,033 | -140,993 | -242,293 |

| SALESFORCE | 539 | 4,064,277 | -243,054 | -208,554 |

| AT&T | 533 | 28,961,984 | -2,063,278 | -2,022,978 |

| NETFLIX | 533 | 1,807,400 | -117,904 | -118,504 |

| ORACLE | 531 | 6,498,500 | -439,388 | -451,888 |

| UNION PAC | 526 | 2,538,000 | -185,316 | -224,816 |

| UNITED PARCEL SERVICE | 517 | 2,974,400 | -208,418 | -203,318 |

| Total | 65,089 | 521,901,629 | -36,779,338 | -39,575,638 |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Switzerland has serious problems, not the least of which is the ongoing, and prolonged, rescue attempt of Credit Suisse Bank. It is starting to look like it will be Switzerland’s Lehman event.

Swiss cheese ,hahaha

Credit Suisse and Switzerland’s problem is they got caught overleveraged long while the bubble is deflating. The Holy Trinity of Bubbles housing, stocks and bonds have another 70% lower or more to deflate! There are many more Primary dealers and countries who will experience a lot more pain as their liquidity evaporates and then insolvency!!

Would be interesting to see how this compares to total outstanding shares of these different companies.

They’ll never regret that move. That’s what happens when you buy stocks at stratospheric levels. A newborn baby could have told them just short the U.S. dollar you can’t lose.

They have no reason to regret. They’ve just given back some gains. BFD. And from using printed money. I would WAY rather have the performance of the SNB than a typical US hedge fund!!!

They basically got these stocks free free free traded currency for stocks that paid dividends,then top management stold = reaped benefits of dividends. Nice ponzui scheme but in corrupted world no consequences. They probably pay off politicans just like in good old USA .

Wolf, I’m a little confused by your comment about the SNB not doing QE in Switzerland. It would seem that the SNB still did QE in Switzerland, albeit indirectly. Whoever received those Swiss francs in exchange for US dollars would still need a place to investment them. So wouldn’t those investors have used those newly created Swiss francs to chase after Swiss franc-denominated assets/goods/services, which would have the effect of QE in Switzerland (more money chasing after the same amount of assets/goods/services)?

What am I missing?

Actually the post-2008 flight to safety sent the Swiss Franc to the stratosphere. Corps complained it made them uncompetitive in world markets, so the SNB liquidated some currency reserves to buy foreign currencies – thus devaluing their own.

I remember this quite well because the company I was working at at the time was purchased by a Swiss firm on the eve of the de-valuation (many Swiss companies executed such purchases at the same time to try to maximize their purchasing power before it was devalued). And in the following three months our Swiss buyer stripped it of assets and put us all out on the street. Good times.

Footnote: A couple years later I was working at a company that was purchased by a Japanese company just prior to Abe’s BOJ operations kicked off to devalue the Yen. And in the following two months (not three – the Japanese are more efficient, I guess) – our company was asset stripped and we all were put on the street. Again, good times.

I got out of that particular industry directly afterwards.

@BigAl,

What was the industry?

Do not let you get confused. You are completely right. By buying USD the SNB increases the CHF money supply. = additional CHF money chasing CHF assets, goods and services.

The USD money supply remains unchanged as the SNB cannot print USD neither physically nor digitally…

On the transaction path to USD stocks the SNB first buys existing USD deposits by creating new CHF deposits. And then they sell the USD deposits to buy USD stocks. The USD deposits are part of US M2 and remain net unchanged after the transactions are done – buy and sell.

Net somebody owns more USD deposits by selling USD stocks and somebody owns less USD deposits by buying CHF. Its a wash for USD deposits and therefore US M2 remains unchanged. Only the CHF deposits increase = only QE in Switzerland and no QE abroad…

What a great racket! Create your own currency then use it to buy shares of companies with real assets. Maybe we should all get together and do the same thing. We could call t the “Wolf Won”.

Seems like indiscriminate panic dumping as even the big energy and defense names got dumped with the FANGs and other high roller stocks.

Ted T. – Why have any wars over resources when central banks can just print infinite fiat currency and buy each others “stuff” ad infinitum. What are the rules anyway to infinite printing? Perhaps buying Greenland using infinite negative 100 year treasury notes wasn’t the worst idea, so how about the USA buy Taiwan and Ukraine instead create world peace? (Circular loop Sarcasm)

O.K. Yort you got me beat with buying Taiwan!

Better yet, buy U.S. stocks that pay dividends. That way your that funny money you printed actually has income stream from productive companies in other countries that can then pay for pensions in your country. Great gig.

All the top trendy, overvalued names. This is what the 20 year-olds are buying on Twitter.

Federal reserve has caused nearly the whole world to dance to their tune. They have turned investors into speculators who hold a stock for weeks not years. Not sure what the next step is other than we are in the lean years of the cycle.

Fed made a very big mistake with zirp and with staying easy too long. Market seems to be testing Fed to see if anything has really changed.

Didn’t the SNB make a really big (multi-billion) draw on the Fed Swap Line last October?

I’m probably being a bit skittish – but this smells at least a little bit like a de-dollarization op.

Yep, I think it was 6 billion. It was to bail out Credit Suisse.

Central bank “operations” are starting to hurt my brain.

They are the interface between

1) the real economy (production/valuation of real goods with utility, everything from toasters to human blood products (shout out to Swiss exporters) to payphone sanitizers (necessarily loud shout out to Douglas Adams) and

2) the purely financial (and easily CB manipulated) overlay that “represents” the underlying real economy.

When the SNB

a) starts printing its fiat (with ever more diaphanous claims upon real Swiss assets) to

b) buy up financial claims (equity) upon mostly real assets in intl companies (not counting Goodwill, by definition) in order to

c) lower the foreign exchange value of the Swiss currency so

d) Swiss export industries are not crippled, essentially

e) converting itself into the world-biggest, self-erecting hedge fund (known in other quarters as master forgery…)

I start really, really, really wondering if any of the players involved (anywhere on Earth) actually have a good grasp of the ultimate implications.

In a (wacky) way, the SNB seems to be sorta converting the Swiss currency into some sort of mutant multi-currency bancor/SDR (shout out to Keynes, ya old bastard) using intl equities as the underlying collateral.

But…any CB could at least *try* this black magic trick…

When I look at this, I think, boy those Swiss had better hope there is not a real market plunge, because they will lose alot more. They are selling off just 5% of the assets in any given quarter. That means they would need to sell assets for 20 more quarters = 5 years to get it all sold. I think they were buying MUCH FASTER than they are selling.

But here is the one big difference. The SNB is marking assets to market in their accounting, which is a much more honest way of expressing the financial condition. In contrast, our wonderful Federal Reserve uses hocus pocus accounting schemes. They DONT mark to market. The unrealized loss was 1 trillion in the past, although maybe lower since interest rates fell. And when the Fed sells at a loss they book it as an asset. Yea, sure that is an asset. Please let me sell you all my losses in investments as an asset.

So any investor who thinks it is smart to invest in this stock market /bond market has to face one fact – in order to reverse inflation and get back to any semblance of normalcy, the central bankers must all liquidate huge quantities of bonds and other assets. BOJ, ECB, SNB, Fed all have just huge balances of assets that they need to sell to YOU and YOU and YOU. YOU get assets dumped by the Fed and YOU get assets dumped by the BOJ…. you get the point.

But here is the huge conundrum. Let’s say that a recession causes interest rates to plunge. OK, so now the central bankers can sell their assets without a loss. Great. But do central bankers really want to be dumping assets in the middle of a recession? OK, then how about dumping the assets during good times? Well interest rates are high during good times. So you take huge losses on bonds when the economy is humming and interest rates are high.

So the central bankers are stuck in a real quandary. So they just let assets roll off the balance sheet, but that is what is causing the markets to continue their bubble and increase inflation, right?

In addition to price stability, the central bankers should have a mandate toward asset price stability. When housing doubles in price over a short time period, that is a problem, not a good thing. Houses have experienced massive inflation. Is that not inflation?

“the central bankers should have a mandate toward asset price stability.”

I dunno. They might take that to mean “stabilize at lofty levels”. And, that keeps me, and many others, far away from the equity markets.

I read Wolf because I’m not as smart as he is (in his arena). But, I’m smart enough to be a conservative investor. My gut tells me not to overpay for anything. Even if it is “sanctioned/supported/common” or whatever.

Let me add…

Did you ever do anything that you could argue fiercely in favor of, yet your gut told you otherwise?

For me, it’s always: Brain: 0, Gut: 1

I’m in same boat ,these valuations are rediculios. Will be many fools crying

“Federal Reserve uses hocus pocus accounting schemes. They DONT mark to market.”

Wait a minute…

1. The SNB does NOT mark to market any Swiss assets it has. It only marks to market its foreign currency assets because they are held for trading.

2. The Fed ALSO marked to market the corporate bond ETFs it bought during the pandemic — they were trading on the stock market, similar to the SNB’s portfolio. I reported on that back then. It sold all those in 2021.

All financial institutions should be forced to use mark-to-market because it would stop all this crazy money and leverage. Think about it. Mark to market forces risk managers to consider downside risk.

I believe that in the 2008 crisis they allowed financial institutions to stop reporting mark to market on some assets (MBS?). It seemed like a good idea in difficult times, but once again, every effort to prop up bad financial decisions creates the next bubble.

But thanks for the clarity, once again.

So why would it be appropriate to mark to market the corporate bond ETFs, but not the Treasuries? You can make up lame excuses for why that is the case, but in the end, the only reason to NOT use mark to market is if you claim that you will NEVER sell those assets before they mature. Because if you only roll them off, then the market price doesnt matter. Can you say that is true when you buy 8 trillion of Treasuries? Isnt that the very epitome of recklessness? Buying all that debt with a plan that you simply cant sell any of it before it matures?

I know, I can hear the response that central banks are different. In practicality of course, but in terms of creating moral hazard, probably not.

Our economic growth should be driven by technology advances, productivity gains and innovation, not financial manipulation.

“Isnt that the very epitome of recklessness? Buying all that debt with a plan that you simply cant sell any of it before it matures?”

That’s exactly what I do when I buy bonds, and it is precisely why I buy bonds — I buy when issued and hold to maturity, while collecting interest and sleeping well. Bonds are supposed to be handled that way. They’re called “Fixed Income” for that reason. Only speculators trade them like stocks.

From some random Swiss Miss investment place:

“firms questioned in the previous survey said that their investment plans would be positively influenced by technology. 58 per cent of survey respondents from the manufacturing sector expect this to be the case for 2023. Technological progress is thus replacing the demand outlook as the most important driver of investment expectations in industry. This trend is being accompanied by a sharp increase in the proportion of companies that plan to adapt their existing product ranges to the state of the art and add fewer new products to their ranges.”

Here’s one word to sum up the investment prowess of the new modern technology ecosphere, run by idiots wearing Buddy Holly coke bottle glasses:

2023 Word is *** Temerity

On the other hand, US companies are cutting costs to the bone and firing employees en masse and then announce massive buybacks to “increase shareholder value.” Look at Facebook go with a 40 billion dollar buyback announcement after firing 11k, some in very critical positions. Boeing? Ha, more buybacks at the expense of not developing a new airplane until 2035 (when Airbus will control 70% of the market for new orders).

It seems that 250 billion is on tap for stock buybacks this year, which should offset what we are hearing from SNB.

Reagan should never had made buybacks legal.

Stock buybacks are an integral part of why well timed short selling will trounce the “buy and hold” fallacy, e.g. BBBY. Wolf Richter is illuminating the path to wealth. It would appear that it is just the beginning of the SNB unwinding.

Buybacks were illegal ,then rich payed off politicians. Made them legal while working people inject labor into stock market Which is then withdrawn by Icahn ,musk and every other billionaire,millionaire god people areSTUPID

John Apostolatos,

As Wolf cited here nearly three years ago, Boeing canceled its stock buyback program…only they did so far too late. Incinerated $43 B buying shares going back to the middle of 2013. Just one of many stupendous blunders by the company this century.

In the years ahead, more likely that BA will be selling shares via secondary offerings. BA credit rating remains one notch above junk status so new debt is far too expensive.

Maybe they needed some cash for “oil” just like Japan did recently

The massive lost is never be a problem for SNB since it can create a magic money. Just imagine if you can create your own money and spend it legally, even thought you got a hotdog with it. You might still laughing at the close door and wandering why the 21st centuries human still accept this types of nonsense. When SNB books a profit, it will go to the Swiss government coffer. Wondering if the EM or Global South are watching this types of magic show and learning to master it as well.

Trying to figure out why the SNB holds so many different companies. With that kind of diversification just buy the indexes and get rid of the analysts. Record keeping and SEC filings would be a lot easier too.

1) SNB $1T investment reached congestion.

2) SNB created their portfolio when rates were negative and the dollar reached nadir. Their unrealized gains reached $1T, on top of dividends in US dollars, when the European rates were underwater.

3) DXY breached Mar 2015 high. It might move lower, before popping up. After cutting their “losses” to raise cash SNB 80% portfolio might popup.

4) SOB should hedge with DXY.

LOL!

BTMFD!!

From the chart it seems the SNB made many of its purchases between 2012 and 2018 when prices were much lower. So is it correct to assume they’re still sitting on massive gains even with recent losses at current price levels? Taking a peek at USDCHF the frank looks pretty stable through that whole period, rose against EUR and JPY.. so appreciating assets purchased with free money, now they’re cashing out?

I don’t know what I’m missing here, it just looks like they’re making out like bandits to me.

They mark to market. So they mark up when the market is up (they book gains), and they mark down when the market is down (they book losses). Just like your brokerage account. So you might be down 20% for year but still be up from five years ago.

We only know the details of what they have in US stocks. We don’t know the details of what other assets they have.

I see, thank you!

The Swiss backpedaling on equity valuation concerns is like a watchman on the titanic spotting a glacier, during a foggy night.

The Swiss and everybody old enough to walk is anticipating a recession, with earnings revisions and endless waves of impairments — While financial analysis gurus are anticipating bathtubs filled with endless cocaine and rooms filled with champagne fountains and non-stop orgies, hallucinating about stocks heading to sprawling utopian villages in Mars.

Earnings revisions are delayed, for the time being, but definitely ignore CPI revisions and rate hikes….

Data for November was also revised higher to show the CPI increasing 0.2% instead 0.1% as previously estimated. The government recalculated seasonal adjustment factors

“But don’t worry: The SNB, like any central bank that creates its own money, cannot run out of money and “go bankrupt,” or whatever, no matter how much money it loses.”

That’s not the only issue. The residual problem is that the SNB cannot remove previously created CHF to the same amount created by reversing these purchases, if they have net losses unless and until the price recovers. They can hold it decades through the upcoming biggest bear market in history if they choose, but it was entirely avoidable.

The currency exists and is a claim on future Swiss economic production. It’s a question of the currency holder’s preference.

Ultimately, this is going to be inflationary and make the Swiss population poorer. The SNB placed the financial sector and foreigners ahead of its domestic economy and population.

If I had done anything, I would have restricted foreigner’s ability to buy it, through exchange controls. Most of the increased demand is portfolio “investment” or currency speculation which shouldn’t be the Swiss citizen’s problem.

I’m so Naive. Just feels like this is fraud. I wish I could print money out of thin air, buy stocks and watch what happens. I don’t lose anything. The stocks lose value but it was fake money to begin with. I default and start over. What am I missing?

“What am I missing?”

A lot.

You’re missing someone willing to trade their dollars for your currency.

I find it worrying that Centralbanks invest in any kind of stocks and corporate bonds as it distorts the market. It is unfair competition as small companies does not have the same access to capital

I like to add that it seems that the SNB reduced only its overall large Cap portfolio or S&P 500/600 but not its small cap portfolio of US stocks… Therefore, Q3 seem not only to be monetary decision driven but also by portfolio assumptions…

What is your opinion? Good idea to switch out of US large cap into small cap?