We already know who.

Inflation “looks quite good,” Chicago Fed President Charles Evans said so eloquently in an interview even before today’s Consumer Price Index was released.

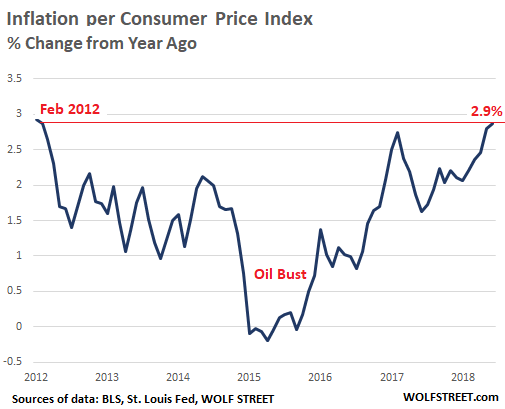

Today, by his standards, inflation looks even better. In June, the Consumer Price Index for all urban consumers rose a brisk 2.9% compared to a year ago, the sharpest increase since February 2012::

Without the volatile food and energy groups, which weigh about 21% in the index, “core” CPI rose 2.2% in June compared to a year ago.

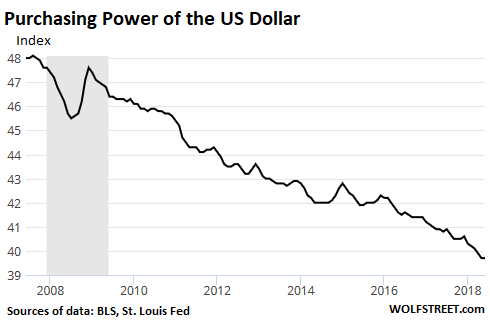

And the purchasing power of the dollar – which the Bureau of Labor Statistics also provides as a helpful reminder of what consumer price inflation actually is – dropped 2.7% from a year ago. In May and June, the dollar’s purchasing power reached, as it just about always does, a new record low. The chart below shows what the purchasing power of the dollar has been doing over the past decade:

Inflation is good for companies and landlords because it means they’re raising prices and rents, and they can report higher revenues without having sold a single extra thing. Their input costs may also rise, but they’re hoping that those increases will be less, and that in this manner, inflation will inflate their earnings. For that reason, they and their Wall Street hype jockeys love consumer price inflation. But they hate wage inflation because it eats into the hard-earned inflation profits. And the Fed has been trying to help out.

So the question arises: Who is paying for this inflation that the Fed has been strenuously trying to obtain over the last few years and that it now has obtained to the satisfaction of even its doves, such as aforementioned Mr. Evans?

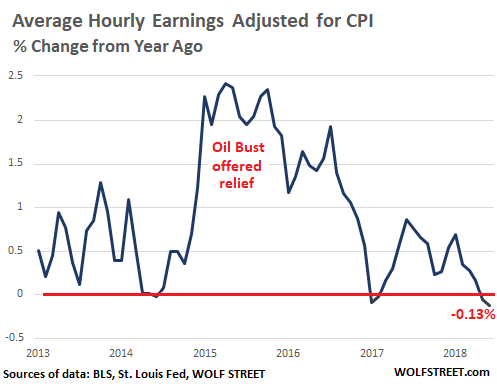

Average hourly earnings for all employees in the private sector in June, according to the Bureau of Labor Statistics, rose 2.7% from a year ago. This was at the upper end of the miserably slow growth range that has prevailed since 2010. The range peaked at a year-over-year increase of 2.8% in September 2017 and bottomed out with an increase of 1.5% in October 2012. It doesn’t take much inflation – however inflation is measured – to turn these feeble nominal wage increases into real-wage declines.

And this is precisely what happened in June. Mr. Evan should be pleased.

The nominal wage-increase of 2.74% was more than eaten up by inflation as measured by CPI of 2.87%: Real wages fell by 0.13% from a year ago. Workers pay for consumer price inflation:

Wage inflation, if it were allowed to exist, could more than compensate workers for consumer price inflation. Wage inflation would also help consumers pay off their debts. But wage inflation is precisely what the Fed fears the most.

The Fed understands that declining real wages, if they decline long enough, will eat into consumption in a consumption-based economy, and will further diminish consumers’ ability to pay credit card debts, auto loans, and the like, in a credit-dependent economy. Hence the Fed’s mixed feelings about consumer price inflation: If it gets just a little too high, it triggers broader effects that might turn the corporate party into a mess. And in this manner, today’s data will embolden even the doves to nudge interest rates up further.

And the last doves are coming around to more rate hikes. Read… With this Inflation, What Will the Fed Do?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Listened to Fed meetings where Yellen would praise consumer price inflation and then cite wage inflation as ‘worrisome’. So they’re making it absolutly clear that they WANT your costs to rise while your wage stagnates.

They should just come right out and say that the Fed’s primary mandate is to make debt serfs of us all.

They should just come right out and say that the Fed’s primary mandate is to make debt serfs of us all.

Anyone still in doubt as to this private banking cartel’s true purpose needs to read “The Creature from Jekyll Island.” The Fed’s “primary mandate” has been crystal clear since it’s 1913 inception, especially since the scale of its financial warfare against the 99% has ramped up dramatically since 2008.

ummm, have you been sleeping in late? Debtpushers love them credit criminals…

serfdom is grand huh?

Patrick, being a debt serf or becoming one is actually the nicer part of our existence within this 21st century globalized kleptocracy ….no, really.

At least you won’t get impaled on a stake like in the Middle Ages, by some angry warlord or burned at the stake for questioning the authorities.

You also get the freedom to choose your particular form of financial slavery (i.e. your job or work that pays taxes to your masters) and become a deemed industrially-useful yoke to the spinning wheels of our never-ending consumption-driven growth economy.

You may not realize it, but sometimes ignorance may be truly blissful.

If you have the luxury of time to find out the Truth and really think deep about this, you will flip or resign yourself to the futility of it all.

In summary, the logic goes like this:

There HAS to be a global elite, hidden or otherwise, to rule the world.

What’s your alternative? A democracy where everyone is equal? Has equal wealth and equal political power? How is that going to work out?

And besides, most people do NOT want to stand up as leaders or be responsible to drive the vast anonymous masses.

Can a society of humans work in a completely egalitarian system where “all men are equal”*? and no one takes instruction from anyone else? and everyone is talking over each other like on Twitter?

It may work for monkeys howling in a jungle but I can’t see how that could work for a human civilization.

A civilization implies organization.

Organization implies hierarchy.

Hierarchy implies a system of rulers and the ruled, or those making up the rules and those who are forced to live by those rules.

An incorruptible and benevolently-designed AI, might conceivably replace the class of human rulers in the future, and set absolutely logical rules for humans to abide by, but would you really want that to happen?

Therefore, being humans with our less-than-ideal human nature, those who are lucky to end up within the rarefied class of humans making up the rules will naturally make them to benefit themselves first, while those who are impelled to live by their rules always gets the short end of the stick…if they even get a stick to begin with. lol.

We can never reach the democratic ideal or the socialist ideal ever. Whatever -isms you fancy is just an absolute ideal-ism that is forever out of reach. So, those being ruled will continue to squeal and be abused and exploited in one form or another, as they always have been since the dawn of human civilization.

Now, the fact is most people can’t handle this inevitable conclusion, because we all prefer not to know the truth, and so most of humanity just continues to numb themselves via the nightly news propaganda or find solace in some quasi-religious dogma or drinking themselves to sleep … or tripping out on their weed which is the fashionable thing now it seems.

That was rather comforting actually.

Are the big problems in our lives today -economic and otherwise – better or worse than the big problems that are always a part of life in all eras and for all people? For most people globally,it has never been better. Most complaints aren’t about objective conditions, but about comparative ones, i.e. why does that person have more power and wealth than me.

Thanks for a shot in the arm.

Gore Vidal famously said: ”

“Whenever a friend succeeds, a little something in me dies.”

I think that most of “us” would settle for a more “level playing field” of justice. I don’t think the majority of humanity abhors “competition” but does hate when those that “make the rules” continue to get away with sliding past the laws and justice that only the proles are supposed to obey. History tells us that that is the time the guillotines are marshaled to try to bring the “rules systems” down to earth. Sometimes it works and sometimes it doesn’t.

I believe in capitalism; but not in a free for all kind. In my mind capitalism is a game. A serious one. But it cannot be allowed to overcome the general needs of the “commons”. Selling used cars is different than allocating taxable monies for the good of the commons, such as public education, environmental protections, clean water, air, etc, etc.

There is plenty of room for both ideologies. In our neoliberal world we have allowed that game of capitalism to overcome everything else. It is proving and will prove to be our downfall.

Did we not learn anything during the last economic disaster. The crooked justice system? The continuing crushing of individuals to gather together to fight the dastardly globalization “rules”?

Not everything in this life can be “privatized to exploitation”.

There is room for “capitalism” and the “Commons”.

It’s up to the people to understand the differences. This is not “idealistic thinking”; it is very pragmatic and leaves room for both capitalism and the needs and the future ongoing improvement of society.

You cannot have a sports game where as in the case of US football, as the crowds watch the opening kickoff ball in the air all the referees leave the stadium for the pub down the street. What do you think will happen?

sierra7: “I believe in capitalism; but not in a free for all kind. In my mind capitalism is a game. A serious one. But it cannot be allowed to overcome the general needs of the ‘commons’.”

Capitalism, properly defined, only succeeds to the degree it serves the “general needs of the ‘commons’.” The problem is that the colloquial version of ‘capitalist’ includes (by careful design) those with privileged access to freshly-printed central-bank fiat currency. That is, ‘capitalists’ acquire the ‘ownership of the means of production’ by way of money printing, not by way of saving, which would require payment to savers in the form of interest, even if such savers were mere members of the ‘commons’.

“Did we not learn anything during the last economic disaster.”

The primary lesson to be drawn from the “last economic disaster” is that the Federal Reserve exists to serve the investment bankers. The Federal Reserve created money out of thin air to buy (in the form of “quantitative easing”) the soured assets (mortgaged-backed securities, collateralized debt obligations) of the politically-privileged investment banks at book value. Your underwater mortgage? Tough luck. The actual purchasing power of your savings? Tough luck. There was nothing ‘democratic’ about any of this.

The primary function of hot-button politics is to draw attention away from such privilege.

sierra7, I think you missed my point totally. Start by defining your “a more level playing field of justice”.

Who decides that level? You?, Me? Wolf? or They (whoever “they” happens to be), which brings us back to square one, isn’t it? lol.

My point is that whatever “-ism” you subscribe to, you still can’t avoid having a system whereby someone or group makes the rules while others have to follow them, and therefore, those who makes the rules wins the game.

I’m not saying all those in the privileged class making up the rules are born scumbags, some of them might consider the greater good as an afterthought if the voice of their better angels is loud enough…but for the most part, I doubt it.

Anyway, all it takes is a small proportion of bad hats in the ruling class and you will skew the results in wealth/power distribution significantly over a relatively short time.

Now, the more depressing news is that even if you somehow manage to do the impossible task of removing all the scumbags within the ruling class and achieve an utopian socio-politico-economic system; a mere RANDOM series of wealth flows in a system still generates vast and PERSISTENT inequality. The scumbags within our ruling class only accelerates the extant process and/or helps to widen the wealth gap between the extremes. It is almost as if a law of Nature mandates a rich-poor gap in all organizations.

I have already shared my reasoning using the compelling chain of civilization->organization->hierarchy->rule-makers-&-takers leading to inevitable inequality.

Now, here’s the damning experimental proof (you can try for yourself) for that inevitable conclusion: https://en.yaronshemesh.com/inequality/

Warning: Once you fully comprehend the implications, you may never be the same person again, because you would realize that our individual destiny could be largely beyond our control and the human condition as a whole, is that much sadder.

But there’s no need to say the good is all because of capitalism. Capitalism can use all those old-fashioned methods when they’re handy.

Read _The Devil and Mr. Casement_, by Jordan Goodman.

An account of the operations of the Peruvian Amazon Company harvesting rubber for the world market in the upper Amazon basin around 1910.

A better question.

Who likes deflation?

Every working family and anyone with money saved.

I’ve imposed my own “deflation” by following two rules for myself: No alcohol and no restaurant meals. I mean, I can break the 2nd rule once in a while, as for the first, well, if Barack Obama calls me up and wants to hang out and talk about the Punahou Carnival over a fine Scotch, yeah, I’ll break it that once.

Public transport has been growing in Santa Clara County, and transportation is probably the 2nd biggest expense after housing.

Someone who dumps the car might find it easier to rent that mother-in-law cottage or room with its own bath, but no parking. I know back in Newport Beach, there are really rather nice places like this to rent on the Peninsula, just zero parking.

So, unless you’re, I dunno, homeless or something, you can “deflate” things for yourself with a little thrift. And for that matter, the one homeless guy I know who I know a bit about his finances, p!$$es his money away and that’s why he can’t afford a better drum, as I keep pointing out.

That’s what really bit me in the ass, myself. When I was in my 20s thinking I was poor, and that I’d worry about saving once I’m no longer poor. Well, I was not poor, not by a long shot, and even when I really was poor, I look back and realize there’s a lot of saving I could have done.

Testify, Brother 2banana.

Can I get a “Hallelujah!” in the house?

How about a hearty “HARRUMPH” for the Governor.

you are the enemy, consume, obey, propagate, consume…..

https://www.youtube.com/watch?v=JI8AMRbqY6w

The ‘haves’ don’t care, and the ‘have-nots’ get assistance from government, everyone else is getting clubbed like baby seals with higher costs lumped on top of already high costs. Everything you touch is going up and an American worker is in the crosshairs of automation or immigration. Of course, the advertised answer is another credit card.

Wolf, the Fed has been grooming imaginary numbers for so long that they don’t want to know the truth or admit the truth, anymore than the owner of a 401K with a loosing portfolio. Pretend and imagine are the name of games for these ‘bankers’, and shoot…for 60% of Americans too.

The intent of government statistics is not to tell you the truth, but to allow you to remain comfortable with the public lie. Asset prices are no longer driven by the economy, but now drive the economy. Massive leverage by way of debt is the root cause driving up asset prices.

The economy is much weaker than the narrative promoted by government, banks, and reinforced by the financial media. Plenty of real world statistics show that the average household is struggling under a mountain of debt and is living paycheck to paycheck. As debt becomes ever more unmanageable it begins to collapse, as to will asset values since debt is the other side of asset valuation.

The bond market is where to expect this trend to show first. As inflation creeps ever higher, so will bond yields. When bond yields rise, bond prices fall and the bond bubble collapses, taking the everything bubble along with it.

The bond market has become ‘jittery’, as the “Bond Bear’s” have dug in with the net shorts in 10 year Treasury futures positions having hit record levels, as the yield curve continues to flatten.

Economist John Williams says that inflation, as measured in the 1980’s, is now about 8%. Based on this, we have to adjust reported GDP downward by about 6%, which means real GDP is about -4%.

Look Dudes, we have been in a depression since 2001. Fortunately, MSNBC and Bloomberg are all over this and things will be fixed up real soon.

You know whats weird is for certain things I can still buy cheaper in the US than in Canada even with the 35% exchange rate.

But I have really minimised visiting the US because it’s too expensive staying at hotels, food, entertainment, …

I wonder if the high USD versus other currencies is negatively impacting US tourism?

Yes it is.

Mesnwhile those who have USD to expens are having a blast in countries whose local currency dropped heavily against the mighty green.

As a Canadian, do your patriotic duty and refuse to buy anything made in the US. Do not visit the US or patronize any US company. Encourage your representatives in Ottawa to abrogate any treaty with the US and close the border. Quit NORAD and forge closer ties with other countries. The US must be isolated and defeated.

@ Escierto,

While this Canadian understands and can appreciate your opinion, I think it is very important not to confuse American citizens with the multi-national corporations and Govt that hold so many in bondage. It’s the same, everywhere, and in every country. Plus, we cannot confuse the Govt. acting in the name of the population with the people, themselves.

Having said that, and while I believe what I said, in our house we still check all product and food packaging to ascertain it is not produced in the US until such time friendship and mutual respect is once again SOP.

If all of us buy local and pay with cash as often as practical, whatever side of the border we live on, we will all help starve the organizations that oppress. No pun intended….we don’t have to buy in.

I look at this snippet: “tariffs on Canadian softwood lumber are pushing up the cost of wood, claims the U.S.-based National Association of Home Builders (NAHB), adding approximately USD $9,000 to the cost of single-family homes in the United States.”

This antagonistic policy is harming more people south of the border than north. A friend of mine has a cedar company specializing in export cedar shingles to the US market. He told me that despite the imposed 22% tariff, he can’t keep up with his orders. That, is some real unintended inflation passed on to citizens. It’ll just have to play out for awhile yet. Somehow people will have to transcend the stupidity.

As an American citizen who lives on the border with BC, I share your sentiment. I will no longer visit BC or buy Canadian syrup (that is your major export, right) until Trudeau is thrown from office. By the way, we are still inundated with Canadians pouring in to buy milk, gas, groceries and everything else America they can scoop up here in WA.

Gian,

It seems to me that you might have missed Escierto’s sarcasm — at least that’s how I read it.

Canada isn’t Minnie pearl when it comes to tariffs either…..cry me an Ottawa river….

35%? Thats Venezuela territory.

Q: “But Who Pays the Price of All This Inflation?”

A: Almost everyone who bought a home in the last 5-6 years. If you have purchased stocks in a retirement or investment account during that period you have also paid the price of inflation. Homes in several cities are up 100%+ in the last 8 or so years; the S&P 500 is up over 300% in the last 9 years. 2-3% per year CPI looks lame in comparison, especially considering that it is a number published by the government.

If inflation “looks quite good,” then why are the 10 and 30 year bond yields still below 3%? Someone is not buying the Fed’s theory of hot inflation.

Inflation is going to get even more out of control if Trump’s proposed 10% tariff on $200b of Chinese exports gets pushed through. There are many many chemicals, raw materials, ingredients and parts/components included on the new list that U.S. manufacturers import very high volumes of in order to keep their production costs lower. Many manufacturers will be forced to pass along these increases, on top of rising freight and oil costs. These tariffs will hurt U.S. manufacturers way more than benefit the much smaller proportion of companies Trump is trying to protect. Many products are still made in the USA, but a high percentage of them are manufactured or blended from imported inputs. You can tell that there isn’t much strategy behind this proposed list considering there are many fertilizer raw materials included, meaning many fertilizer prices will increase – causing even more pain for farmers on top of the export tariffs China imposed. I have also heard that China has recently just stopped buying certain agricultural products all together, rather than publicly announcing tariffs on them. When so much business in China is state owned and controlled (or easily can be) they can just stop purchasing – this is on top of other ways China can fight back without announcing anything (not the case in the U.S.). If Trump’s game of chicken does not end things will get crazy.

“But the purpose of tariffs is not to make products more expensive for consumers though that is a consequence; the purpose is to motivate manufacturers to invest and produce more in the US???”

What a laugh….tariffs is just another TAX period….. US Manufactures are NOT going to leave China with 50 cent an hour workers and pay American workers $10 an hour to build factories to make products…..Now maybe a 500% tariff might level the playing field a little.

Steve,

It’s a tax on importers. It’ll squeeze their margins. And importers will react. If they try to pass on the tariffs and raise prices, consumers won’t buy. Companies always and already charge the maximum price they can and still achieve their sales goals. If they raise prices, their sales will collapse. So they’ll have to operate on thinner margins or they’ll have to look at their supply chains and route some production back to the US.

Don’t cry for the importers. They just got a huge tax cut (along with the rest of Corporate America).

Some inflation may not be the result of criminal activity, but a good proportion is, for example:

A) When banks increase earnings by creating fee generating multiple false accounts and deducting the fees from clients’ checking accounts, that’s criminal income;

B) When private equity or corporations buy hospital emergency room medical practices and urgent care practices and increase the earnings therefrom by more than tripling the billing for such services by:

1) up billing;

2) intentionally assigning out of network physicians and providers: and/or

3) so that the patient can be billed in full, intentionally purporting to have not been informed that a patient is a Medicare beneficiary and thus protected by the fee limits of Medicare,

some of it is legal income some illegal income, and always at the expense of the consumer.

And, since usury is now legalized, usury interest and is increases that was previously criminal is praised as income now.

How is it possible that the consumer is not harmed?

Who pays the price of all this inflation? Simple: the 99% who on the globalists’ incorporated neoliberal plantation have no intrinsic worth beyond whatever economic benefit they can generate for our oligarch overlords. The Fed, meanwhile, goes about its historic mission of debasing the currency for the proles while gifting its financial sector accomplices trillions in fake money to buy up the distressed assets of the increasingly pauperized middle and working classes.

On a related note: a group of women who thought their “private” Facebook group to discuss their genetic predisposition to breast cancer was their little secret, just found out that the creepy Orwellian company to which they so willingly entrusted with their most intimate secrets was – gasp – selling that data and information to whoever would pay for it. Cue another worthless apology from Zuckerberg and more bloviating from the Republicrat duopoly’s corporate whores who are pocketing his lobbyists’ fat checks to sell out their supposed constituents.

https://www.cnbc.com/2018/07/11/facebook-private-groups-breast-cancer-privacy-loophole.html

Great piece Wolf, as always.

And let’s not forget that inflation acts as a ghost tax that cannot be directly blamed on any Congressman, thus not threatening his/her re-election. Inflation is a tax that is levied mostly on those who have their savings in fixed income. If a significant part of your assets is in real estate or stocks, the inflation tax is not as brutal.

It’s not so easy as saying “invest in real estate or stocks to reduce the pain of inflation”. Real estate and stock inflation isn’t always synchronized with consumer price inflation. And with today’s debt loads, if rates rise to combat inflation, a lot of stocks will feel more pain from rising debt-service costs than gain from higher prices. Ditto for REITS or anyone with real-estate funded with an adjustable-rate loan.

Real estate’s in a bubble and the bull market is very long in the tooth. It’d be entirely possible for inflation to continue while real estate and stocks drop. For example, the 1968-1982 period featured both rising consumer price inflation AND deflation in stocks and real estate valuations. And back then debt loads were far lower.

Meanwhile, savers in fixed income have options today that weren’t around before. IRA savings in TIPS are sheltered from inflation, as are savings in short-term investments provided interest rates track inflation rates (for a change…)

The Gov’t of course wants inflation rates higher than interest rates, in order to goose nominal GDP and keep debt/GDP ratios and debt-service payments from blowing up. That allows for more deficit spending, enabling the crooks in Congress and the power-lusting deep-staters in the Executive branch to spend more money on their cronies in the healthcare/military rackets while devaluing everyone else’s money.

“But Who Pays the Price of All This Inflation?”

I have a better question:

Who profits from it?

I answered that in the article :-]

Mostly. I was looking for more. There’s a deeply insidious side to it. Another time, maybe.

There are more sides to it than for one short article for sure. I highly recommend this more in depth but still concise analysis by James Rickards, in summary,

“For all of these reasons, governments favor inflation. It can increase consumption, decrease the value of government debt, and increase tax collections. Governments fear deflation because it causes people to save, not spend, it increases the burden of government debt, and it hurts tax collections.”

https://archive.darientimes.com/41327/rickards-a-central-bankers-worst-nightmare/

Traditionally inflation hurts those on fixed income the most. During a time before COLAs were defined the retirement check did not keep up. The difficulty for new retirees is when they end their working life with a mortgage. Often they assume that their generous pension benefits are sacred trust, while that may not be the case. Inflated home values offer no investment value if your alternative is just as expensive (or assisted living) . Inflation helps the worker who can obtain a low rate fixed rate mortgage and watch his or her wages double over the next decade. It also helps government which pays interest on a lot of low yielding debt. Curiously the TIP fund etf responds inversely to rising inflation because it assumes rising rates will negate the fixed yield portion of the note, ergo inflation is bad for inflation securities investors. Monetary inflation is far out reaching implied growth, which tells me the central banks are trying to avoid inflations evil twin. Who does deflation help?

Savers, similar to price discovery…

the housing market is fixed…..I don’t know why everything talks like it isn’t….the fed, treasury and govt. created drive thru lanes for foreign entities, hedge and pe to create American pottersvilles……aint it a wonderful life….

Yup, inflation looks really good!

Inflation is the primary tool to harvest wages from wage slaves who can’t afford to buy assets, not even a simple house to live. It is a great way to guarantee that earned income continues to trickle up to the wealthy who most of the stuff.

I know Evans would agree, everything is humming along and working perfectly. Float some bonds at a ridiculously low rate, take the money and buy assets, use the assets to suck up the wages of the working class and let the Fed pay off your bonds through the inflation tool that is working so well.

I think we can all agree those guys at the Fed are genius’ and truly courageous, they acted quickly to make sure the crisis did not simply pass by without the ultra-rich vacuuming up more and more of society’s wealth. They are truly doing god’s work!

Inflation looks quite good guys! Let’s give them a pat on the back and encourage them to keep up the good work. After all, the heavy responsibility of owning stuff is best left to the wealthy – you have enough to worry about let them handle it (now get back on your hamster wheel).

I would suggest going on a consumer strike but that’s like telling an addict to quit the drugs, you are an addict and there is no stopping you so go ahead and spend, spend, spend.

Members of central banks have had more than courage. Each time Bernanke entered the meeting, he was a gladiator heading to the ring, cutting interest rates like they were barbarian heads. If I were a fat CEO or trust fund baby, watching this legend, I would be inspired enough to buy a Tesla or send my first born to private school. The 99% could massage my feet as I toss fruit remnants in their hair.

“But wage inflation is precisely what the Fed fears the most.”

Wolf, I respectfully disagree. The Fed would love to see continued wage inflation that matches up with price inflation. This would then be an overall inflation that would eat away at the massive debt we have; all of which is one of the main reasons our government inflates the money supply.

Without wage inflation, we have stagflation which further tanks the economy.

The reality is we have both things going on, depending on the business sector.

What the Fed and government would die for, is some serious productivity growth. Unfortunately that is pretty much DOA throughout the economy including tech.

“But wage inflation is precisely what the Fed fears the most.”

No, what the Fed fears most is exposure of its true pernicious role in screwing over the American middle and working classes and pushing them down the road to serfdom. Thankfully, our corporate media and captured “representatives” will go to great lengths to keep the sheeple in the dark.

Having been lucky enough to buy after the downturn of 08′ I’m a huge benefit in my line of work. I’m a Civil Engineer and what I mean by benefit is that my competition is getting “gentrified” AND the pay rate is increasing to meet inflationary prices of rent. The downside is that I’m hoarding cash for another opportunity to buy a second home. When it finally comes, it’ll be a blessing and a curse depending on whether or not I’m able to maintain a steady income.

There will not be another pull back in housing. The Fed likes housing (and other productive assets) inflated beyond the reach of wage earners. If you want that second house you will need to cough up 10 to 40 times the annual wage of the typical worker. The Fed likes the world they created, they didn’t bring us here by accident, this is the reality they wanted and they will not reverse course.

The financial crisis was 10 years ago but the Fed Funds Rate is still below 2%! People need to stop pretending we are in the midst of a massive policy change – we are not – inflation yesterday, inflation today and inflation tomorrow and forever. The game plan has not changed.

CASH IS TRASH – panic now (it’s too late to avoid the rush.)

excellent comment but rates are going up and it will be the lead actor in the housing correction of 20-30%

PTI and DTI are enemies of loans….plus the treasury 5 year hold on bulk or any purchase of foreclosed homes is over….they are selling into this high as we speak….they are better at this than all of here…

Sorry sir, the Fed is in a dangerous game with weighty consequences and unfortunately the pendulum has swung again. Many things will crash once interest rates reach a tipping point including housing.

\\\

Wolf, I saw that in the data the inflation for “Housing” Jun 2017-2018 is 2.8%. If we take into consideration your previous article from 28th of June for rent in US a rudimentary average of the data shows a 9.12% and 7.82% YtY increase for 1B and 2B respectively. I am aware of the method is a ballpark figure, but it’s waaay off from what is in the inflation data. This housing data does not in line what I have been reading at wolfstreet…am I missing something?

\\\

Yes… Inflation is calculated by what people consume. If you own your home, it’s an asset, not a consumable item. If you live in it for 30 years, your housing cost (mortgage payments) don’t rise over this time (taxes, utilities, etc. do though). Since a home is considered an asset, like stocks or bonds, it is not included in the various consumer price indices (home price increases are asset-price inflation, which is not officially tracked). Rent and “owners equivalent” are included in CPI under “shelter” which is a service!

That housing is lumped together with stocks and bonds, explain the high regard for the economic profession. All the more so when there is a full scale government support for this assetial necessity.

\\\

Thank you for the clarification. Found it -> “Shelter” = 3.4%.

\\\

Still is far from what I read on wolfstreet if you ask me…so I tried to go through the manual…the manual for CPI calculation for “shelter” category is very complex and I gave up…just made no sense to me…I like your method of simple and transparent calculation much more.

\\\

The CPI estimate of shelter cost inflation does a terrible job of tracking real world housing costs. The rent survey is pathetic and the “Owners Equivalent Rent” survey is farcical. (The OER survey asks a handful of homeowners what their home “would rent for” if they rented it, and then imputing that as their effective cost for having shelter. The only person to whom that might make sense is an academic economist with no sense of reality.)

If CPI-shelter were an accurate inflation measurement, the signal it sent to the Fed would have forced rates to rise much sooner in the early 2000s, nipping the first housing bubble much sooner and avoiding the Great Recession.

Arguably single most useful thing that the Fed and the econometricians in the government could do in the next 5 years would be to rethink and rework CPI-Shelter to more accurately track the impact on household budgets of housing price changes. Accurate housing inflation would lead to better calibrated monetary policy and go a long way towards avoiding bubble catastrophes.

Its been at least 40 years since the US government has been interested in the economic prosperity of those that elect them. As a result, hese policies that happen when the US “elects” a president who has no idea how to run a country let alone a business. Just look at who he chose as commerce secretary, wilbur “king of bankruptcy” ross.

So, the landlords are profiting from real price inflation while consumers are suffering from the reduced purchasing price of the dollar. Not a good picture. Add in the effects of the trade war and this could get really bad for the consumer class.

There is however a silver lining to all this price inflation (at least the inflation which can be attributed to tariffs). Once the trade war escalates well over the 1 trillion dollar mark, that should just about balance out the shortfall in the Trump budget. (- sarcasm)

Tariffs cause a margin and profit squeeze for Corporate America. And this margin squeeze will motivate Corporate America to bring production back. Prices are established by consumers willing and able to pay them. So you think consumers are going to pay $5,000 more for a Chevy because it’s made in Mexico over a Honda that is made in the US? Not going to happen.

Some math and comment:

1) 2% inflation rate: Time to halve your money = 35 yrs. 36 yrs. by “rule of 72”.

2) Assuming inflation has reduced the purchasing power of the $ by 95% (5% left), here’s a quick inflation calc. from Federal Reserve Act of 1913 to today (105 yrs.): The return on your money by monetary slight-of-hand: -4.9% annual return, but it’s back-end loaded, mostly after 1971.

3) If “nominal” wages are increasing at 0% annual rate and inflation is running at “2%” annual rate, what’s the real return on your earnings? Answer: -2% annual rate. Hence borrowing to make up the difference. Bankers are happy.

4) Yes, inflation is a) “always and everywhere a monetary phenomenon”, meaning that an increase in the money supply dilutes the value of said dollars and reduces purchasing power, b) a covert tax, and c) a clear violation of the 5th Amendment:

“No person shall be… … nor be deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.”

5) And yet here we are: “Clowns to the left of me, Jokers to the right,

Here I am, stuck in the middle with you.”

“The first duty of a man is to think for himself” – José Martí

“The last duty of a central banker is to tell the public the truth.” – Alan Blinder, former Vice Chairman of the Federal Reserve, 1994 on the PBS Nightly Business Report

“Fiat money eventually always goes back to its intrinsic value – zero” – Voltaire (Are we there yet?)

another great comment, I believe PE, Hedge and foreign PE whom were gifted by 44 potus a loosening of foreign home ownership taxes and how many homes they could buy will be selling here at the top

Also the bulk foreclosure debacle did have a 5 year no sale clause that will be peaking in 2019, 2020….expect a lot of selling, RE for sale inventory rose 12% this month, its building…

While companies extract a benefit from rising inflation it is usually pretty small since their input costs tend to rise as well. And those companies who for some reason can’t pass along price increases to their customers will actually get squeezed.

To me, the only true beneficiaries of rising inflation are debtors with longer-duration, fixed-interest obligations. In a zero-sum economic terms they get the most benefit out of rising overall inflation (at the expense of the holders of said debt instruments). The holders of this debt get screwed over the most — and there are a great many of them (remember that the bond market is much larger than the equity market). These bondholders put their faith in the Fed, thinking it will protect them by putting a cap on inflation (which the Fed could do very easily should they want to). Alas, they may just end up being the latest party to get screwed over by the Fed’s games.

Max Power,

It is always said that inflation helps homeowners pay off their 30-year fixed-rate mortgage and that they’re beneficiaries of inflation. But wait…

Only WAGE inflation helps homeowners deal with their debts. Consumer price inflation hurts homeowners because it uses up more of their incomes for buying regular things.

The opposite is the case with companies: consumer price inflation = increased revenues for them, and so consumer price inflation helps them pay off their fixed-rate obligations. But wage inflation is an increase in costs that makes it more difficult for them to pay off their obligations.

Agree in principal but in practical terms, as shown from the chart you included above, from an overall perspective wage inflation is actually higher than CPI over the five year term 2013-2015 (and anything over than a couple months span inbetween also). In that case the inflation we’ve actually had is positive for someone with a mortgage. With respect to the -.13 difference point in time refrecnce, while not good is still in the stable range (and more than made up for by the overall positive trend over a longer span of time). We’ll need to see real wages declining on a more permanent basis (say 6 months or longer) to call it true declining real wage trend.

Also, what I noted is still true for corporate and government bonds — a yuuuge market which is getting bigger by the day thanks to the massive equity-for-debt swap of the past several years.

Re: “wage inflation is actually higher than CPI ”

Only on average. Distribution matters. For most actual people, wage inflation is below CPI and has been for quite a while. For instance, go to FRED and look at real median hourly earnings of production & nonsupervisory workers — zero progress since the 1970s, even with the government-massaged CPI which is also a badly skewed average.

The distribution of wages has been progressively skewed, with rising wages only on the high end of the distribution.

Also, the inflation experienced by those with lower wages is much more painful than that felt at higher income levels. At lower incomes, people are living hand to mouth and rent, food, and gas inflation are killers. Inflation has a serious impact on lifestyle. At mid incomes, education and healthcare inflation are killers. Inflation keeps you from getting ahead. At higher income levels it’s more about organic vs. generic produce, luxury vs. normal vehicles, 401K savings levels. None of that will really change someone’s life.

The blue bloods in Congress exempted themselves from everything that makes life painful for normal citizens, so they haven’t got a clue.

They want inflation, then they don’t. Move goal posts. Its all nonsense. Banks must win (damn the populace) is the policy.

If you read Nomi Prins “Collusion” the reason CB moves don’t make sense for their reasoning is because their moves are in collusion with other world CB moves or against them if they want antagonist moves. Their moves are not always about the sovereign nation in which they reside.

Another note is if the stated CPI is understated, then the GDP is overstated. And if CPI is understated then Wall Street receives the higher praise for part of their claimed growth is really inflation.

Official national debt has risen about 8.8% per year since 1913. The exponential rate of increase since 1971 has been about the same. Given the recent tax cuts and spending increases, the probabilities for new wars, and the likelihood of an over-due recession, debt will increase at the same 8.8% per year or faster.

More than three-quarters of American workers (78 percent) are living paycheck-to-paycheck in 2018 to make ends meet — up from 75 percent last year.

January 2012: Double Cheeseburger McDonalds $1.07 inc tax

January 2013: Double Cheeseburger McDonalds $1.29 inc tax

January 2014: Double Cheeseburger McDonalds $1.59 inc tax

January 2015: Double Cheeseburger McDonalds $1.71 inc tax

January 2016: Double Cheeseburger McDonalds $1.92 inc tax

About 9% per year compounded annually?