Under pressure from the banks, the government may take down the site.

There is no telling if the Consumer Financial Protection Bureau (CFPB) will even survive the next few years, given the opposition to it in the White House, Congress, and the banking lobby because it has become just too inconvenient for banks.

One of the inconvenient aspects for the banks is the CFPB’s database of consumer complaints against financial institutions and other companies. This database is public and can be searched.

Remember Wells Fargo? It became the most hated bank in America in 2016. You can go to CFPB’s site and search this database for Wells Fargo or any other bank and see what crops up. Go ahead, take a look while you can and put your bank of choice in the search box — before the data base gets taken off line.

So I searched for Wells Fargo, and the first item that crops up at the very top is this report from September 2016: “Consumer Financial Protection Bureau Fines Wells Fargo $100 Million for Widespread Illegal Practice of Secretly Opening Unauthorized Accounts.”

Or the next one down, from August 2016: “CFPB Takes Action Against Wells Fargo for Illegal Student Loan Servicing Practices.”

If you click on “Reports” in the left sidebar, the top report is this: “What you need to know if you were harmed by Wells Fargo.” This goes on, search page after search page. Clearly, it would be a lot better if this dang site got taken down.

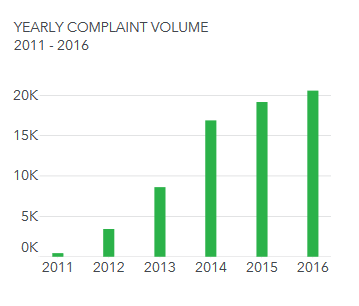

Then there is the “Monthly Complaint Report.” It summarizes consumer complaints against banks by state, for all 50 states. For example, the report for October 2017 (Vol. 26) shows that the CFPB “handled” 91,482 complaints from 2011 through Oct 2017, to which 97% of the companies responded in a “timely” manner.

And it has this chart of the annual nationwide volume of complaints that it “handled”:

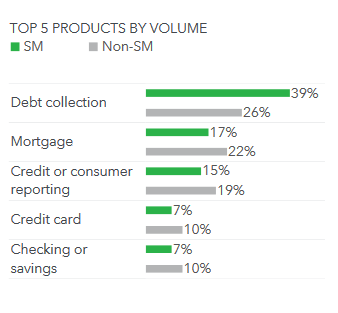

Among the top five “products” that triggered those complaints, “debt collection” is Number 1 (SM = service members, veterans, and their families):

Among the big states: CFPB handled 9,667 complaints in California, 8,528 in Texas, and 8,195 in Florida. However, it handled only 2,930 complaints in New York.

These are just the complaints the CFPB has been able to “handle” – that is, get companies to respond and deal with them in some manner. But as of June 1, 2017, the CFPB has received “over 1,218,600 complaints.” As of that date, about 1.13 million complaints remained “unhandled.”

“This database has become an extremely useful tool that can increase the accountability of powerful financial institutions on behalf of the consumer,” explains a report by Lend EDU, which dug into this data base more deeply by analyzing “exactly 223,992 consumer complaints” and built a table of 49 banks, from regional banks to the largest behemoths in the US, and ranked them by the number of complaints per $1-billion in deposits.

In 2016, Wells Fargo had over 10,000 complaints and was in third place with a ratio of 8 complaints per $1-billion in deposits. But it has begun to clean up its act, apparently, and in 2017, the number of complaints was down to 8,465, or 6.48 complaints per $1-billion in deposits, which moved it down 5 slots into 8th place.

The number 1 bank with the most complaints per $1-billion in deposits was TCF Financial Corporation, in 2016 and 2017. In fact, its complaints-to-deposits ratio deteriorated from 12.30 in 2016 to 13.59 in 2017.

Below is this list of 49 banks for which the CFPB received at least some complaints between January 1 and December 10, 2017. They’re ranked from Number 1 with the most complaints (TFC Financial with 13.59 complaints per $1 billion in deposits) to Number 49 with the lowest complaint ratio (Western Alliance Bancorporation with 0.18 complaints per $1 billion in deposits).

However, LendEDU dug around long enough to find a dozen banks for which the CFPB had not received any complaints at all last year. These are in the second table below. In both tables, “deposits” are denoted in billion dollars.

| Rank | Name | Complaints | Deposits | Ratio |

| 1 | TCF Financial Corporation (TCF National Bank) | 246 | 18.1 | 13.59 |

| 2 | SunTrust Banks | 1,159 | 162.7 | 7.12 |

| 3 | Citizens Financial Group | 782 | 113.2 | 6.91 |

| 4 | Fifth Third Bancorp | 698 | 101.5 | 6.88 |

| 5 | Citigroup | 6,600 | 964.0 | 6.85 |

| 6 | U.S. Bancorp | 2,338 | 342.6 | 6.82 |

| 7 | Comerica | 380 | 57.8 | 6.57 |

| 8 | Wells Fargo | 8,465 | 1,306.7 | 6.48 |

| 9 | KeyCorp | 670 | 103.4 | 6.48 |

| 10 | Bank of America | 8,069 | 1,284.4 | 6.28 |

| 11 | F.N.B. Corporation (First Naitonal Bank) | 124 | 21.9 | 5.65 |

| 12 | Huntington Bancshares | 441 | 78.4 | 5.62 |

| 13 | CIT Group | 165 | 29.6 | 5.58 |

| 14 | M&T Bank | 514 | 93.5 | 5.50 |

| 15 | JPMorgan Chase | 7,747 | 1,439.0 | 5.38 |

| 16 | PNC Financial Services Group | 1,374 | 260.7 | 5.27 |

| 17 | Regions Financial Corporation | 514 | 97.6 | 5.27 |

| 18 | Synovus Financial Corp. | 131 | 26.2 | 5.00 |

| 19 | Webster Financial Corporation (Webster Bank) | 104 | 20.9 | 4.99 |

| 20 | Popular Inc. (Banco Popular) | 170 | 34.2 | 4.96 |

| 21 | BB&T Corporation | 680 | 156.1 | 4.36 |

| 22 | First Horizon National Corporation (First Tennessee Bank & Capital Bank) | 70 | 22.1 | 3.17 |

| 23 | Commerce Bancshares Inc. | 62 | 20.4 | 3.03 |

| 24 | Chemical Financial Corporation | 39 | 13.8 | 2.83 |

| 25 | MB Financial | 38 | 14.4 | 2.64 |

| 26 | BancorpSouth Bank | 27 | 11.8 | 2.29 |

| 27 | People’s United Financial | 74 | 32.5 | 2.27 |

| 28 | Umpqua Holdings Corporation (Umpqua Bank) | 44 | 19.9 | 2.22 |

| 29 | Trustmark Corporation | 22 | 10.2 | 2.15 |

| 30 | Associated Banc-Corp (Associated Bank) | 43 | 22.3 | 1.93 |

| 31 | Old National Bancorp | 18 | 10.6 | 1.70 |

| 32 | Bank of Hawaii | 24 | 15.0 | 1.59 |

| 33 | Zions Bancorporation | 79 | 52.1 | 1.52 |

| 34 | IBERIABANK Corporation | 31 | 21.3 | 1.45 |

| 35 | UMB Financial Corporation | 20 | 16.0 | 1.25 |

| 36 | Great Western Bancorp | 11 | 9.0 | 1.23 |

| 37 | BankUnited | 25 | 21.2 | 1.18 |

| 38 | Investors Bancorp Inc | 15 | 16.9 | 0.89 |

| 39 | Valley National Bancorp | 15 | 17.3 | 0.87 |

| 40 | Sterling Bancorp | 9 | 11.0 | 0.81 |

| 41 | Cullen/Frost Bankers (Frost Bank) | 17 | 26.4 | 0.64 |

| 42 | Prosperity Bancshares | 8 | 16.9 | 0.47 |

| 43 | East West Bancorp Inc. | 11 | 31.3 | 0.35 |

| 44 | Fulton Financial Corporation | 5 | 16.1 | 0.31 |

| 45 | PacWest Bancorp (Pacific Western Bank) | 5 | 16.8 | 0.30 |

| 46 | United Bankshares Inc. | 4 | 13.9 | 0.29 |

| 47 | Bank of the Ozarks | 4 | 15.7 | 0.25 |

| 48 | Cathay General Bancorp (Cathay Bank) | 3 | 12.6 | 0.24 |

| 49 | Western Alliance Bancorporation | 3 | 16.9 | 0.18 |

And here are the dozen banks for which LendEDU could not find any complaints that the CFPB received in 2017:

| Columbia Banking System Inc. | 0 | 8.3 | 0 |

| Community Bank System Inc. | 0 | 8.6 | 0 |

| CVB Financial Corp. (Citizens Business Bank) | 0 | 6.6 | 0 |

| Glacier Bancorp | 0 | 7.8 | 0 |

| Hancock Holding Company (Whitney Bank) | 0 | 21.5 | 0 |

| Home BancShares Inc. (Centennial Bank) | 0 | 10.4 | 0 |

| Hope Bancorp Inc. (Bank of Hope) | 0 | 11.0 | 0 |

| Pinnacle Financial Partners Inc. (Pinnacle Bank) | 0 | 15.8 | 0 |

| Signature Bank | 0 | 33.7 | 0 |

| SVB Financial Group (Silicon Valley Bank) | 0 | 44.8 | 0 |

| Texas Capital Bancshares Inc. | 0 | 19.1 | 0 |

| United Community Banks Inc. | 0 | 9.1 | 0 |

| Wintrust Financial Corporation | 0 | 22.9 | 0 |

These are not complete lists. They’re samples of the nearly 5,000 commercial banks in the US. But if the public loses access to this database — in other words, if you cannot check out the bank before you do business with it — then, well, the worst banks would be the real winners.

And here are my stories about my darling Wells Fargo, such as: Wells Fargo Gets Clocked in California

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

TCF is a Minneapolis (“TC” = “Twin Cities”) centric chain. I can personally attest that I have never heard anything good about them ever from anyone… This is saying a lot, considering pretty much everyone has had an account with them at some point in time..

They also recently settled for illegally stacking overdraft fees and the like.

Doesn’t really surprise me at all that they top the list, really..

This is nothing new for TCF. “In 2008, overdraft fees earned the bank more than $470 million dollars.” CitiPages, October 28, 2009

http://www.citypages.com/news/tcf-bank-stadium-built-with-u-of-m-students-overdraft-fees-6723301

“The U of M(N) is one of over 100 colleges nationwide that have partnered with a bank for student I.D. services. TCF gets a near monopolistic position on campus, which brings them new accounts of almost 85% of all incoming students.

Buy a $1.50 latte with $1 in your account? TCF won’t decline the transaction-they’ll lend you .50, and hit you with a $35 overdraft fee.”

My how times have changed. In 1970, my parents took out a $60,000 mortgage for a home in Roseville MN from TCF, and the note was kept in-house, professionally serviced and all went smoothly for both TCF and my family.

Dan,

Oddly enough, I don’t know of anyone whose had a TCF mortgage that I can recall. I think everyone gets burned by them between the time they go to the U and buy a house. A lot of Wells mortgages tho, so that /really/ says something about TCF..

If you want in-house mortgages these days one has to go to a Credit Union is my guess, their systems are rickety (books of payment coupons, etc), but they’re not jerks. Although, like banks, it’s tough to know if they pass them on to Freddie/Fannie and service them, or actually own the paper. In my last experience, I think they actually kept the paper..

Excellent work!

CFPB needs to go. It’s just more government waste. How many clicks does their website even get? Probably fewer than yours.

Your probably wrong, but why assert myself?

Is your reply tongue in cheek or are you a bank employee ? Hmmm.

I agree Sergio. But for capitalism to work, there must be some symmetry of knowledge between consumer and producer. And with Republicans in control of all three branches, there is no way this pro-capitalism institution will be shut down.

This agency was the brain child of Senator Elizabeth Warren. Don’t blame the republicans for it. My problem with it is that they are funded and supported by the banks, the CFPB may keep track of complaints, but they don’t address them.

Wrong. CFPB has made the banks return at least $12 bn to consumers so far.

http://money.cnn.com/2017/11/25/news/wall-street-elizabeth-warren-consumer-financial-protection-bureau/index.html

IP,

They must have returned 12B of the 100s of billions they have stolen. Big deal. More Kabuki from CNN.

I can’t tell who is being sarcastic anymore.

Yes, that was sarcasm.

I’ve always appreciated good sarcasm; it makes me laugh. (But your comment isn’t and I’m not laughing.)

Sure. Its nuts to think the government and its agencies serve the public interest or that its officers and employees are public servants. Public be damned.

The free market, transparency, enforcement of GAAP, enforcement of fraud law, etc make life better for the consumers.

Which is why banks and the health care industry hate these items.

Except that healthcare is the least transparent and banks are the most.

“banks are the most”

*snort*

The list on the top offenders tells another story as well, it reveals the rise of the regional banks. Most of them were small regional or state banks, before the financial crisis, but now many compete nationally and internationally.

Banks are criminal organizations.

Their purpose is two fold: To enrich the executive management and maintain growth in stock prices for the benefit of large shareholders like Buffet.

The level of “servicing” they provide to clients is only relevant if it impacts bonuses and stock prices. Fraudulent loan practices are just good business as long as the cost of buying exemption from laws is less than the cost of compliance. (see MERS forclosures in the 2008-9 era and prosecution rates by the Obama justice department.)

Thor’s Hammer – Think about it: At the most basic level, banks would not exist if it weren’t for robbers, bandits, burglers etc.

Dow Jones just made a new high, if we could get rid of all these regulations we could all be rich, and none of this would matter

International ! Just because?

Issatt you speaking from the crypt Ronnie ? ( sarcasm and humor most definitely intended )

Oh wait .. that was sarcasm as well . Ahhh the vagaries of online commutations … sigh

Interest on excess reserves! The rest is blazing saddles.

From your last dive into “Securities Based Lending”, i found THIS on the web, trying to ascertain size of this “Hidden Lending” market:

http://www.foxbusiness.com/markets/2017/07/27/wall-street-needs-to-borrow-against-your-stock.html

Specifically, note “For brokerages, these so-called securities-backed loans have become a reliable source of revenue in the years since the financial crisis…..Several Merrill Lynch brokers said they have asked longstanding clients to open securities-backed lines of credit to help them hit bonus hurdles, assuring that clients wouldn’t need to use it or pay any fees for opening it…..Merrill brokers receive ongoing payments for getting clients to tap credit lines, and those loan balances contribute to year-end bonus calculations”

ECHOES of WELLS FARGO!

This list is AMAZING. Should be considered just like shopping “Bankrate.com”…!

I remember watching/reading old bank robber tales of the dust bowl days. At that time regular folks knew who their enemies were and actually hid the robbers or helped them get away. As the banks took over people’s land, either for themselves or for land consortiums or cronies, people learned daily what they were really about.

Of course as people learned which and when said banks were at risk, or believed were at risk, they quickly drew out their savings and a bank run began.

“Almost immediately after taking office in early March, Roosevelt declared a national “bank holiday,” during which all banks would be closed until they were determined to be solvent through federal inspection. In combination with the bank holiday, Roosevelt called on Congress to come up with new emergency banking legislation to further aid the ailing financial institutions of America.” http://www.history.com/topics/bank-run

Getting rid of the data base about complaints and even criminal activities in the banking industry is obvious cronyism. How the politicians will be rewarded and paid off will make for a very interesting future story. Certainly campaign contributions exist out in the open, but loans and preferred services are hidden.

Releasing the Tax Returns would help!!!!

Someone at some institution did a refi for Trump after every bankruptcy. As Woodward and Bernstein reported in their Nixon investigations, Deep Throat just said, “Follow the money”. Getting rid of oversight, reporting, the Mueller investigation, Mueller credibility, DOJ credibility, and Dodd-Frank restrictions, are all servicing the banks and their wealthy stock holders by this current Govt. They own the Republicans and they owned the Democrats during the bailout years. It’s always about money.

Excuse me, I just had a nap and woke up feeling cynical. Must be the weather. :-)

Banks are govt sponsored criminal enterprises.

Or they are the are the govt. Goldman Sachs (aka govt Sachs ) aspire not to be partner but to be placed high in govt positions. Ie. governor of a state or in charge of the treasury. The squid are everywhere in global government. Watch their stock price for the tell…..

For good reasons, the Independent press does look on Wells Fargo kindly:

http://fused.world/Independent/Wells%20Fargo.html

I’m not religious, but even the Bible takes a shot at money lenders.

Banks and drug dealers, both prey on the weak.

This “database” seems pretty neutered.

I do not see a way to access the various keys. To me a database is a versatile tool that allows me to use date ranges, various constraints in order to get very customized results. Perhaps there are some ways to do this, but it is not obvious to me.

If it were really public domain, you would be able to download the entire database and query it yourself.