Canadians, fasten your seat-belt. Here are the charts.

The Financial Crisis in the US was a consequence of too much debt and too much risk, among numerous other factors, and the whole house of cards came down. Now, after eight years of experimental monetary policies and huge amounts of deficit spending by governments around the globe, public debt has ballooned. Gross national debt in the US just hit $20.5 trillion, or 105% of GDP. But that can’t hold a candle to Japan’s national debt, now at 250% of GDP.

And private-sector debt, which includes household and business debts — how has it fared in the era of easy money?

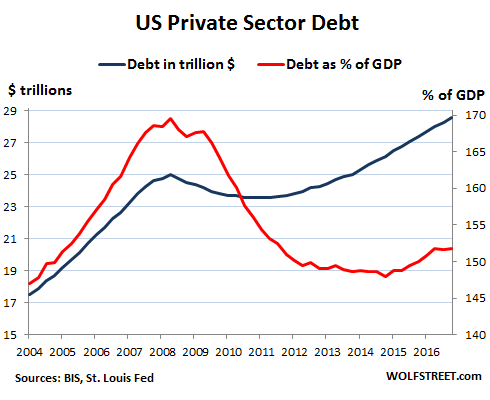

In the US, total debt to the private non-financial sector has ballooned to $28.5 trillion. That’s up 14% from the $25 trillion at the crazy peak of the Financial Crisis and up 63% from 2004.

In relationship to the economy, private sector debt soared from 147% of GDP in 2004 to 170% of GDP in the first quarter of 2008. Then it all fell apart. Some of this debt blew up and was written off. For a little while consumers and businesses deleveraged just a tiny little bit, before starting to add to their debts once again.

But the economy began growing again too, and private-sector debt as a percent of GDP fell to a low of 148% in Q1 2015. It has since picked up steam, growing once again faster than the economy, and now is at 151.7% of GDP, back where it was in 2005. This chart shows US private sector debt to the non-financial sector, in trillion dollars (blue line, left scale) and as a percent of GDP (red line, right scale):

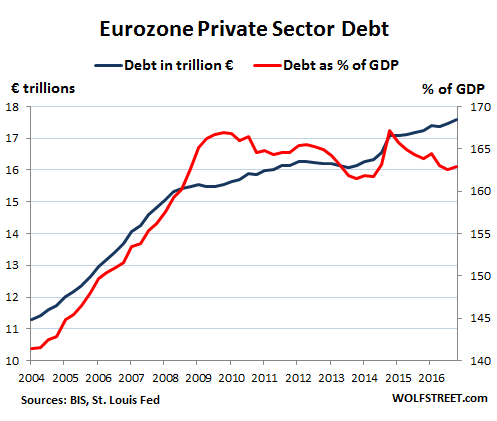

In the Eurozone, the pattern looks similar before the Financial Crisis, with total debt growing sharply both in euros and as a percent of GDP. But after the Financial Crisis, private-sector debt continued to grow in euro terms. As a percent of GDP, it largely leveled off, and as the economy picked up steam over the past two years, this debt declined to 163% of GDP:

These charts are based on data from the Bank for International Settlements and the St. Louis Fed.

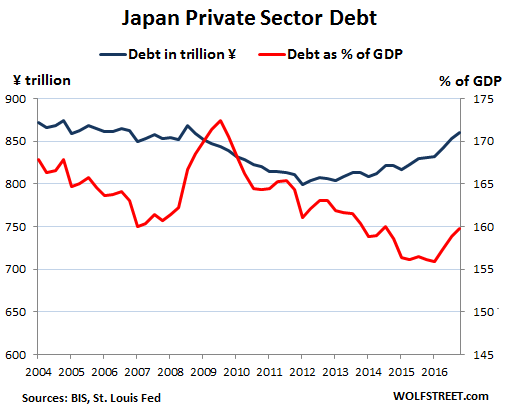

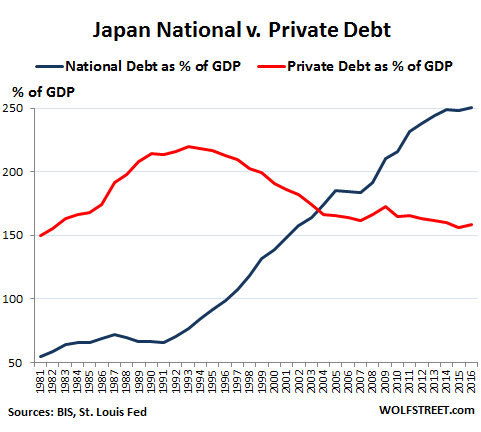

In Japan, private-sector debt declined over much of the period but over the last three years picked up a little. Debt as percent of GDP has zigzagged lower, though it recently bounced to 160% — higher than in the US but lower than in the Eurozone.

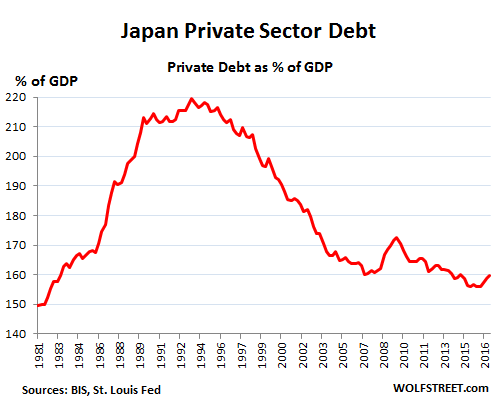

Japan occupies a unique place in the developed world. The private sector experienced a phenomenal credit bubble in the 1980s, with debt peaking at 219.5% of GDP in Q3 of 1993. This private-sector credit bubble then imploded in a more or less orderly fashion over the next decades:

But as Japan’s private-sector debt bubble deflated, the government went on a gigantic no-holds-barred deficit-spending spree. As a consequence, the national debt skyrocketed from 55% of GDP in 1981 to 250% of GDP in 2017, by far the highest in the world. The Bank of Japan has been monetizing much of this debt under the guise of QE to keep it under control:

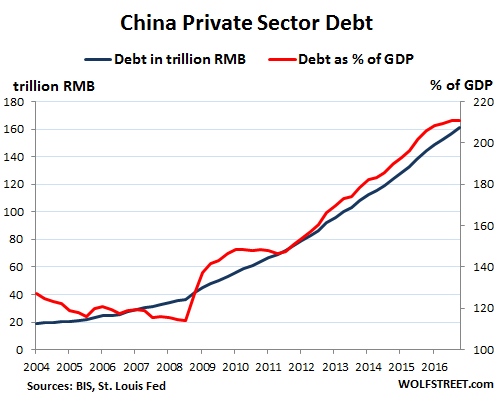

China is now where Japan was before its credit bubble blew up in the early 1990s. China’s private-sector debt – the part that has been officially acknowledged – surged from 20% of GDP in 2008 to 211% of GDP in 2017. This is the danger Zone where Japan got in trouble. It also assumes that China’s GDP numbers are not inflated. If GDP numbers are inflated, as many observers suspect, China’s private-sector debt as percent of GDP would be much higher:

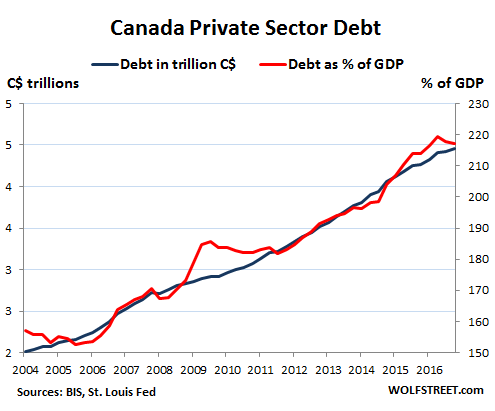

But wait, Canada rules! Private sector debt in Canada has more than doubled, from C$2.2 trillion in 2006 to C$4.5 trillion, and private sector debt as percent of GDP has soared to 217%, within a hair of where Japan was in Q3 1993, before the credit bubble imploded. Also note how eerily similar the charts for China’s debt and Canada’s debt are:

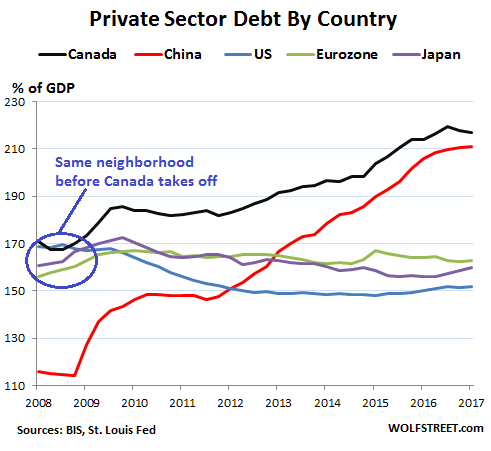

So Canada and China stand out in this group of debtor economies. The chart below shows private-sector debt as a percent of GDP with China (red) and Canada (black) up in their own universe, competing with each other to see whose debt will implode first. By comparison, the US, the Eurozone, and Japan look practically tame. Note how in 2008 Canada was right in their neighborhood:

Within this group of economies, when it comes to the next private-sector-debt bubble implosion, there are really two places to look: Canada and China. In Canada households are on the hook, being among the most indebted in the world. In China, the debt binge has spread across businesses and households alike.

In the US, the yield spread of Treasury securities has collapsed to lowest level since 2007, and even the Fed is fretting about it. Read… The US Treasury Market Smells a Rat

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

You missed Australia. We are the gold medal holders…

Yes, there are other countries I “missed,” including the Netherlands and Denmark. But I wanted to keep it focused.

Netherlands are kind of included as they are part of the Eurozone. And given the size, position, and capability of Dutch people to speak other languages, I think it is OK to treat them as just a region of the Eurozone in this context.

Denmark (and Sweden) are often sneaking under the radar because they are not in the Eurozone, however, “back in the day”, 2008-2009 Denmark executed the second largest bailout package in the EU right below Germany!

This was almost unreported, only a few articles even mentioned Denmark (Some UBS-Warburg analysts).

I doubt that anyone has changed their ways since then, everyone kept their job and their bonuses more or less. Rather, they would have doubled-down on whatever “worked” before.

And Sweden – Stockholm is maybe the richest property bubble right now; this, combined with construction prices that are 60% above the EU average (probably because of cartels formed between the largest builders and their suppliers*) something is about to be going down with the end of QE-programming.

*)

Scandinavia is a gift-culture.

One does not become an important person here only by accumulating lots of wealth or earning lots of money for the company. Ones importance is created by the ability to “give gifts” to others which makes them owe you something in return.

People here will often prefer to not do the best deal possible for their company, rather, they will do the best deals for themselves, within the limits of detection / decency of course.

This means that the people who orders goods and services are OK with the company they work for getting somewhat ripped off by subcontractors and suppliers, these extras left on the table are Gifts, they are now owed something in return. Important people are owed things.

Their employers are not too concerned either. In this market, they can just stick the bill to their clients. As long as the clients can borrow enough to pay, neither the suppliers nor the contractors care, they basically split the takings.

Once the party ends, the favours owed cannot be collected, people will fall from grace, there will be investigations and they will grass up each other. It will be fun.

In Sweden, add the fact that Swedes usually do not pay off their housing debt, only interest and expenses …

Rob,

I almost posted exactly that when I read the title of this article…..great minds….

I would call it a toss up, but I think we will go down together if it makes you feel better.

If Canada have to tighten their seat belts at 217 percent private debt to GDP then what must we Australians need do at 223 percent private debt to GDP.

https://tradingeconomics.com/australia/private-debt-to-gdp

There’s nothing we can do. It’s too late… Morrison can throw the kitchen sink at our bubble, it “aint gonna work.”

Just yesterday, I was trying to explain to a friend why he shouldn’t buy a rental property. Fell on deaf ears, just doesn’t understand the concept of debt to GDP or debt to Household income.

The “sheople” are still transfixed on the path to glorious riches.

The “slaughterhouse cometh.”

Very interesting. Canada made it all this way without a serious correction.

Although US debt didn’t change much related to GDP, my understanding is that the composition did change. In 2007 a lot of debt was mortgage debt and that debt at least had some home equity on the other side of the balance.

The debt now is more auto loans with a fast depreciating asset and student loans with a worthless degree. And companies have accumulated a lot of debt to buy back their inflated stocks, so no extra capital to pay back the debt.

Good point. In Canada school loans are definitely less and in general Canadians drive smaller, fewer and less expensive cars, Also not that the Bank of Canada never got around to money printing (QE).

In Canada the bigger problem is that the economy is growing based on immigration … more people (about 1% a year), need more housing, more roads, more … construction has been doing very well.

With most of the debt being real estate related, I would argue, that though it is very dangerous, it is less dangerous than US debt.

Still if you have an open bar (ultra low interest rates) you should not be shocked if people drink too much.

1. What is the meaning of private in China if the govt. owns everything?

2. Why can’t the govt. make itself while anytime since it owns both sides?

3. Why should an implosion occur at all? And if so what causes it? If you can anticipate it then the Chinese can too and deflect/prevent/ indefinitely delay it. Why can’t they?

Wolf I respect your work but you may also want to have a macro economics person as a consultant to address these questions.

Superficially the title is provocative and sounds logical but I doubt any of the countries you list will implode. None of them are Venezuela or even Argentina; the latter btw and Mexico are independently still sending sovereign bonds.

I now feel dumber for having read your comment. Please read a book

I’ll just address this one: “1. What is the meaning of private in China if the govt. owns everything?”

The government doesn’t own “everything.” For example, it owns all the land, but it doesn’t own the buildings on the land. It doesn’t own the households. Household debt is strictly private, as is much of corporate debt. Even government-controlled enterprises (the government is a major shareholder) issue bonds in their own name, and this is private debt, and it can default.

Any example of a Chinese GCE defaulting who daddy didn’t make whole?

Even in the good ol’ USA daddy didn’t let Fannie and Freddie fail?

Why would the Chinese let theirs default? They want to project their ascendancy on the world stage and these defaults can cause a domino effect showing that ‘The Emperor has no clothes’. Daddy won’t want that.

You can do it until you can’t, then it all falls to pieces pretty quickly. the problem now is that each new layer of debt produces less growth than the last layer (and the debt load gets bigger). China continues to look a lot like the US in 1929 and Japan in the late 80’s. They may, repeat may, be able to pull a Japan slow steady decline, but i would not bet on it. Demographics, pollution, and an incredible over emphasis on construction leave it ripe for a fall. Just hard to say when.

The Chinese government has a large net asset position in a growing economy and negative real rate debt. Just needs to make sure the asssets generate income/ RoE.

Most of all, China’s currency is tied to the dollar, so the Chinese government has no control over monetary policy beyond selling off its dwindling pile of foreign reserves. If the dollar strengthens too much, China’s financial system will crumble. China can print as many yuans as it wants, but it can’t print dollars, and dollars are what it needs.

Meanwhile, China’s ten-year bond has started breaching the psychologically-important 4% yield threshold as investors are belatedly getting more spooked about the country’s massive debt and credit bubbles and the government’s failure to rein in runaway speculation on the Ponzi markets and asset bubbles the PBOC has created.

https://www.marketwatch.com/investing/bond/ambmkrm-10y?countrycode=bx&mod=MW_story_quote

Kudos to truth. We’re making false comparisons, similar to US GDP numbers when US consumers get an assist from China. Macro is truly the only economics. Does Canada have a ROW central bank? Can they buy anything and everything, otherwise it may implode.

“Why can’t the govt. make itself while anytime since it owns both sides?”

I’m not sure what you mean here. Also, I doubt you understand your question.

Regarding 3. To a great extent the problem lies in why the debt was created. It’s easier to lay out the math than to put it into words, but if you can think of the integral of a continuous flow of mistakes which are erroneously assessed as private sector profits, with debt on the other side of the ledger, it becomes clear that this cannot continue for much longer.

None of these countries will implode. If they can handle 220 5% debt-to-gdp why can’t they handle 300 and then 400 and so on and if United States and Europe are still in the 100 they can easily get up to wear China and Canada are at right now so they are safe for a long time.

Sorry voice to text lol.

You better start typing again, and put that voice-to-text out to pasture.

:-]

My voice to text doesn’t work very well either and yet we are going to have self driving cars…….how about we just get the voice to text right first?

How about if humans first learned how to be safe drivers before using smartphones or any phones? Human drivers killed 40,000 people in the US alone and injured millions more. Humans are terrible drivers.

Forget voice to texts – how about we get simple low tech P.A. systems working properly. Ever tried to understand a store or airline/airport P.A. announcement? May as well use two tin cans and string.

Quite right. Consider Canada, with energy prices on the rise again, property prices will continue into the stratosphere. The median net worth of a Canadian is double compared to the US. That isn’t to say Canadians are so incredibly more wealthy (the top 1% certainly are)….but that Americans have fallen so far behind. Canada’s housing market is also buoyed by healthy immigration rates, averaging nearly 1% of the total population per year, which is more than 3 times greater than the US. Healthy immigration, high energy prices, healthy social safety net, booming housing — recipe for success in the post-global era.

Of course property will just keep going up in Canada forever, so nothing to worry about. (It’s already stopped going up everywhere except Vancouver, but anyway….)

Your comment, along with that of Truth Always, reminds me why debt crises happen. They happen because so many think as you do.

1. Why do you people keep bringing in Immigrants into discussion? Most immigrants, specially in a welfare country like Canada, will have depend on handouts for a few years; and even after that it takes them at least a decade to have any meaningful source of income.

2. There is so much hidden unemployment in Canada; your government is one of the biggest charlatan of a government around the world. If they say 5% unemployment, you can bet it is at least 15% if not 20% unemployment.

3. “The median net worth of a Canadian is double compared to the US.”: Equity in what? Equity in real estate bubble rather than in a productive, income generating venture?

R2D2 – Uhm, the Vietnamese and Cambodian workers I worked shoulder to shoulder with in the mid-80s were productive workers as soon as they could be after leaving Viet Nam/Cambodia, which was very soon indeed.

They were given some perks, I think something like 10 or 20 thousand dollars and some help to buy a house (this was when house-buying was something just about anyone could do, not an inherited class-determined thing like it is now) and you know what? Give a native born US citizen those perks and most of ’em would have pissed them away.

These people worked. They literally picked strawberries, any kind of work they could get. They went into electronics because, like me, they were told it would lead to a good living. We were all mis-informed, of course. Now they tend to be, along with the usual spread of white and blue collar occupations, owners of small businesses like barbershops, auto repair, etc.

Work is deeply ingrained in their cultures. You work. That’s what you do. Some of these guys were middle-aged men and they slept in bunk beds, 2-3 to a room, until they got married.

I simply can’t imagine that immigrants to Canada would take 10 years “living on handouts’ before they’re productive. This just isn’t how it works. I can think of two cases where this might be true: “Travelers” or Roma, or working-class WASP Americans, both groups seeing it as the right thing to do to milk the system for all it’s worth.

1) Because immigration provides for a ready wage-suppressed workforce that allows wage suppression, first at the low end, but then the pressure begins to move up the income chain. And who benefits from wage suppression? Consumers may at first, but ultimately, it’s those small numbers at the top of our economic racket.*** Even sicker, as you point out, who pays for this kind of immigration? Certainly not the rich, because as we’ve seen with the Panama and Paradise papers, it’s certainly not them. Yet, they’ve managed to socialize the costs of immigration onto others while they ultimately reap the benefits. Tales they win, heads we lose.

2) Unemployment numbers have been routinely suppressed for decades, just as real earning income from corporations are now regularly suppressed. As J.R. Saul wrote, “Reality is not in the real world, it’s in the measurements made by professionals.” And the professionals are the ones with the greatest self-interest in keeping this sinking boat afloat.

E-V-E-R-Y-T-H-I-N-G is a racket.

_________________________________________________________

*** I’m not worried about income inequality. As the numbers of ultrarich get ever smaller, it means their political might in the face of the mob approaches zero. And this ownership class are fools if they think the armed goons they’re promoting in both government and private circles will save them is just going to make it easier for them to ultimately be robbed.

They are masters of their own future misfortune, so therefore, I will shed no tears for them.

alex in san jose: Most immigrants make just above minimum wage for the first 10 years; above minimum wage is not called money making, that’s called surviving. True these people are used to hard life and so they squeeze out a few bucks even out of their little earnings to save, but that is not going to be enough for even a shack at current prices. So new immigrants are not going to have any impact on housing prices.

“Healthy immigration”

I shouldn’t be taking a drink of water when I read some of these comments. Oh my is Canada in some serious trouble if Nicko2 is serious.

“The median net worth of a Canadian is double compared to the US. That isn’t to say Canadians are so incredibly more wealthy (the top 1% certainly are)….but that Americans have fallen so far behind.”

Yeah… almost all of this is in home prices. The median Canadian home price is more than double the median US home price, IIRC.

Good luck with that.

“Canada’s housing market is also buoyed by healthy immigration rates, averaging nearly 1% of the total population per year, which is more than 3 times greater than the US.”

Right, because your natural replacement rate is so low, you need high levels of immigration just to keep up.

“Healthy immigration, high energy prices, healthy social safety net, booming housing — recipe for success in the post-global era.”

Well, that’s one way of looking at it, I suppose. To me, take away the positively spun adjectives, and Canada has a recipe for disaster in the VERY near future.

Private sector debt holders cant create money like the government can to pay the debt. In fact its perversely the debt issuers (banks) that get to create the money out of thin air that the borrowers have to pay back with real money. As debt soars it takes money out of the real economy which eventually crushes the debt holders ability to sevice the loan. You add speculation and leverage to the mix and you get positive feedback that works on in both directions. The debt bubbles are well past their tipping points already and are being held up by absurdity low interest rates that once again crush the real economy by rewarding speculators over savers and hard work. Once the intrest rates rise it is all over. If they keep them low for much longer their will be revolution due to growing inequality. Eventually we are going to have to swallow our medicine.

If that is the case why do governments not pay our taxes so everybody can get filthy rich?

What does private debt mean? Mortgage, credit cards and lines of credit for individuals. Or business debt as well?

Yes, all of it.

Canadian here,

Yes, the personal debt rate to GDP is nuts, but I have to think most of it exists as mortgage debt and the need to use credit cards for those urban residents barely getting by.

I live rural and have for many years, but I also have many friends still residing in a smallish city about 1 hours drive east, (pop. approx 35,000). My friends…age 50-70 have no real debt and are doing quite well. My kids, ages 33 and 37, have no debt beyond mortgage and that is much less than their equity and other assets. My friend’s children are also doing just fine.

In the same small city there is a housing boom going on. It takes well over a year to book a contractor. Why would that be? Well, you can buy a beautiful ocean view home for a fraction of a warren box in Vancouver or Victoria. People are cashing out and relocating, putting hundreds of thousands in the bank and maybe working part-time, if they feel like it. I assume someone booked a mortgage to buy their city homes.

Canada, like many large countries, is a tale of many countries and peoples. There is the French/English divide, of course. There is also urban/rural, northern/southern, coast/interior…whatever splits you wish to conjur up. But stats and averages don’t take this into account. It lumps us all in together. In the US the averages of SF is lumped in with Evansville Indiana, or West Virginia. Does it make any sense? Lumping in Vancouver, the GTA, Montreal, and their corresponding debt rates is quite meaningless, imho.

It is less than the US rate, but I have to wonder who is really farther behind in considering the costs of Empire retention and endless wars? The medical system differences? Infrastructure needs?

The whole kaboodle might crash and my life will still go on much the same, as will my children’s lifestyle(s). In fact, there will be better deals out there for those who live within their means. Our country will still have single-payer medical care and a few necessary social support services. There might be some adjustments along the way, but life will go on quite well for the majority.

Now, for the grossly indebted and those who lend to them it will be catastophic if the economy wobles. To that I can only say life is full of painful learning lessons, and good luck. Wisdom does not come easily and you will endure.

The bottom line is this folowing set of facts when evaluating a Country’s debt rates and an ability to go forward.

Canada is the only country on the list that is self-sufficient in energy times 2. We have ample water resources, timber, fish, and are many times more self-sufficient in food growing to our domestic needs. We have an established infrastructure and a well-educated population. There might be a comeuppance and reduction in expectations, no doubt. There might be relocations. But the fundamentals are sound. In fact, our greatest problem might be the lack of a secure border wall on our southern border! :-)

regards

correction: (man I need an edit function)

regarding: “It is less than the US rate, but I have to wonder who is really farther behind in considering the costs of Empire retention and endless wars?”

I meant to say the Canadian rate is MORE. But….

Happy Thanksgiving!

:-)

Paulo – Agree.

Besides, basing percentage amount of debt to Gross Domestic Product, is an exercise in futility at best. Since the GDP number is whatever the particular government wants it to be. This is not hard and fast data, more like soft and squishy, so it can be molded to the story line.

Garbage in? Garbage out.

Our resources will not stop the grossly indebted from bringing us down. Medicare and high immigration rates don’t make us special, as is often argued. They won’t save our real estate market or bail us out of debt.

Also, our energy self-sufficiency is a joke if you consider that we can’t even get a pipeline built.

I’m pretty sure most people here understand what stats and averages mean. There are some above the average and some below it. There are people who are more vulnerable and others less to an eventual crisis. Nobody claimed the situation is the same across the board, coast-to-coast, nor suggest that everyone will be in distress if ever a crisis strikes. It’s like with global warming, they show us the increase average temperature. Of course, in some parts of the planet, the average temp for that given year may actually be cooler, and some other parts of the world, the average temp for that year may be much hotter than usual. Does that mean that average global temp is meaningless? Of course not.

As for the last paragraph, so what? Those “sound fundamentals” have not prevented financial crisis in the past.

@Alistair McLaughlin

Exactly.

And for a country “self-sufficient in energy times 2”, we are still deeply at the mercy of the prices of the market, which Canada has practically no influence on.

If you are talking in terms of Noah ark, you might be right. That suggests the rest of the world is drowning.

For the rest, there is the market.

In reality, Canadian energy is very expensive to extract: shale oil certainly is, and conventional oil is pretty much gone.

Mineral resources has also been exhausted, and any significant mine opening is happening only in the hard to reach North.

The rich uranium mines are suffering from the lack of customers.

That leaves water, and hydro if the US want it.

That leaves the immigration industry, you know, taking on more people until the Noah’s ark sinks, too.

Note as well that the federal budget deficit this year is projected at around $20 billion. That would be $200 billion in the US (US essentially 10 times the size of economy). The US projected deficit is …. $440 billion (yeah right). And Canada does single payer health care.

“…That leaves water, and hydro if the US want it…”

Maybe it’s time Canadians stopped referring to electricity as “hydro” (originally “hydro-electric”) and used either “electricity” or “power” the same as the rest of the world.

“Hydro” means “water” after all, and most of our electricity is no longer generated from waterfalls here in Ontario.

hi wolf,

why are you saying our national debt is a mere $20 trillion? that’s

the figure the media tells us. you know very well the total unfunded

national debt (the real debt) is north of $200 trillion. i believe our

GNP is down to only $14 trillion. that’s an incomprehensible 14 to

1 ratio. it’s like someone making $30,000 a year, but owing $420,000.

this can only end in the worst depression the world has ever seen.

keep up your very good work.

We’re talking about actual debt issued as bonds. Unfunded liabilities are an entirely different animal. For example, as an investor, you cannot buy “unfunded liabilities,” but you can buy government bonds.

intosh,

What I meant was not that those listed (Canadian) fundamentals will save any country from an economic collapse, (particularly Canada!!!), rather, it puts economic collapse in perspective. Further to that it is easier to lift oneself higher with something to stand on (if there is a collapse).

Thinking about this topic I was reminded of my early adult years when I didn’t have a pot to piss in. But, we always had lots of good home cooked meals to eat and a roof over our heads. We didn’t go out for supper, ever. A big treat for my kids was a Sunday walk down along the waterfront where they could get a donut at a little cafe called Friar Tucks. My wife and I had a coffee. It wasn’t an equivalent $6.00 frapa whatever, it was a basic perked coffee. Our Disneyland vacations didn’t exist, rather holidays consisted of picnics at the beach on sunny days. Swimming. Hiking. Fishing….(all free).

My kids ended up doing well. Only my dauighter went to university…but they could do as well as they wanted to. My parents were poor as churchmice when they grew up in the Great Depression. They were beyond poor, but once again they always had enough to eat and a roof thanks to a good work ethic. Will a new economic collapse be harder than the Great Depression? Maybe. Will it be harder than my struggles? Maybe. To be honest I think my early-life poor days were better and people were happier in general than folks of today. I really do. With all the big houses and fancy cars I see today, financed no less, I don’t see a lot of satisfaction and contentment.

I think many believe that having more stuff = success and happiness. Sometimes, it takes a good sharp kick in the ass to appreciate what one does have. You can’t borrow and finance your way to a sound and satisfying life. If a reset happens people will just have to suck it up and say no to some things that aren’t really essential.

My sister-in-law, who I love and think is wonderful, is 52. She and her husband are planning their first house together. He lost his to divorce, and my sister-in-law rented her entire life. The lot they bought was around $200,000. The rancher they are planning to build will cost another $300,000. I would guess they will have $400,000 in mortgage debt upon moving in. At age 52??!! Who would do this? My wife and I have discussed this and have tossed around the idea of speaking to them about debt, and how that might feel when they are 60? But, it is just a lose lose situation. All that we said to them was we are here if they ever want to talk about building a house, and left it at that.

There is not much people, even a country, can do to stop people from becoming indebted. Sure, there can be tweaks to public policy, but in our ‘free’ society folks are also free to make mistakes.

If the bubble blows, there were a whole bunch of mistakes made by a great many people. If it doesn’t blow, why it’s ‘party on, Dude’.

regards

I know of schemes where the owners are half renters (don’t know what it’s called). They own the house while they live and pay the mortgage, and after that, the bank repossesses. Nothing’s left to the next generation. It’s baked into the cake.

Oh, the mortgage is lower as a consequence. It’s a casino.

Thank you, Paulo. As always, well-thought and spoken. Can’t help but think your informed, rural perspective lets us see the ‘party’ going on these days is not necessarily one that one wishes to attend. A better day to us all.

why are you saying our national debt is a mere $20 trillion? that’s the figure the media tells us. you know very well the total unfunded national debt (the real debt) is north of $200 trillion. i believe our GNP is down to only $14 trillion. that’s an incomprehensible 14 to 1 ratio. it’s like someone making $30,000 a year, but owing $420,000. this can only end in the worst depression the world has ever seen. keep up your very good work.

My understanding is that debt only “implodes” when the individual or govt can no longer make payments on their existing debt. This is unlikely to ever happen in a country whose debt is denominated in it’s own currency as it can always print more (albeit at the risk of triggering inflation).

The individual on the other hand is dependent on having a job which in turn is dependent on the health of the overall economy, so if the economy implodes so will private debt. This would rapidly trigger a negative feedback loop causing the govt to dramatically increase spending to compensate via various social programs and other attempts to stimulate the economy thereby further increasing govt debt. And since every economy always has cycles, this scenario is inevitable.

The lesson here seems to be that as long as we use debt carelessly to buy “toys” instead of using debt strictly as a tool for an investment that produces gain, we’re doomed to live in a world of boom and bust cycles.

Yes, you understand.

Existing debt continues to be existing debt. Unless the payment is based on floating rates, only the ability to pay affects the actual payment of debt. As long as income continues to flow, debt will continue to be repaid. Little will change. No implosions any time soon.

Rates on aftermarket debt may change if there’s a liquidity crisis or if the overall level of interest rates change. None of this affects the payment of the original debt by the borrower. However, a liquidity crisis will make aftermarket debt fall in price if people sell it for whatever they can get just to raise cash. I, personally, am waiting and hoping for this day to buy a dip that will pay well.

Raising rates will cause junk investment, aka paper flipping, to fall. They will also create an increase in interest income which will increase discretionary income which will increase spending which will increase investment that creates jobs. Good for Main Street and old time Wall Street, not so much for Wall Street paper flippers.

Rising rates will also create massive problems for the Eurozone and Euro-kick-the-can. Someday, an implosion is certain here.

consider the term “technical default”. Consider the term loan covenant.

A related question is, which central bank-blown Ponzi is going to implode first? China looks like a leading contender, despite the PBOC desperately trying to levitate sinking markets with huge infusions of printing-press funny money.

https://www.cnbc.com/2017/11/22/china-cash-injections-to-quell-bond-rout-liquidity-debt-fx-reserves.html

Substitute “Quantitative Easing” for “Debt Jubilee”… just a rhetorical “twist”. Here’s a good article on how central banks will deal with this growing debt problem, indefinitely. If all the major central banks are doing this, then whose currency will “implode”? None, unless it’s a relatively small economy with outrageous debt levels – the little people.

Justice, in financial matters, is none-existent nowadays.

https://seekingalpha.com/article/4084428-sovereign-debt-jubilee-japanese-style

Except that in Japan and China, dollar denominated debt is huge. And most of this dollar debt sits in the balance sheets of Asian banks, so I don’t know if this qualifies as private debt, but it’s just as debilitating. China may be the first to crash, but Wolf has made a good case that Southern Europe may be the spark that ignites the worldwide debt bomb.

I suspect a lot of the debt in Canada went into one of the following two items: 1. Real estate and 2. Financing oil sands extraction investments (which need relatively high oil prices to be profitable).

Both of these are on rather shaky ground.

I suspect car loans are number 2.,rather a small amount in oil sands extraction. It seems everyone is driving a new SUV or F150

Oilsands companies have shed debt (and assets) at a furious pace over the past 3 years. They’re actually in good shape now. In fact, they are a shining example of how a bubble bursting can actually be a good thing long term. With a considerable amount of pain in the interim of course.

Still, even the lowest breakeven point for tar sands production is around $60/barrel and we are now just barely there, while having already spent quite a while below the breakeven.

@MaxPower – The established surface mining operations are actually ~$23-27CAD a barrel (say Suncors Millenium mine), but you’re right in that the new mines (and Fort Hills is now the only one being built) is projected at around $37CAD a barrel. Suncor buying a majority stake in Syncrude has already brought their (Syncrudes) per barrel cost down by simplifying and restructuring the process. Definitely not the $60 break even cost that it was a few years ago, labour, materials and accommodation has gotten an awful lot cheaper up in Fort Mac in the 6 years I’ve been going up there on/off as a contractor.

For years I thought that the oil sands were an insane investment but I think what most forget is that the only major left – Suncor – (I’ll leave CNRL out, they’re bananas with poor safety practice and ‘we will hire anyone’ approach will bury them eventually) realized a LONG time ago what a bonkers business they were in. They know this full well, truly they do. Hence their focus has been on the upgrading ‘downstream’ operations at their various refineries (Edmonton; Montreal etc) where they can add value. Until the operations are outright banned by legislation, they will keep mining. Sure their margins are thin, but a profit margin is still a profit margin, it only has to keep the lights on and keep personnel just hungry enough for the ‘next boom’. Fly by night frackers they are not – the hard infrastructure is too big.

Mr. President, build that wall!

What, to keep the debt-ridden Canadians out?

;-)

To keep debt-ridden Americans in.

I am Canadian and I don’t see any crisis. I think that discretionary spending will screech to a halt and the country will stagnate for a long time. But the house building going on in southern Ontario is unreal. I’m sure the home construction is going on all across the Canada-US border. Incomes will go towards mortgages, car payments etc.

“It’s different here,” in other words. The mantra of every bubble believer everywhere. Our peerless prognosticators are surely right when they tell us we’re on a permanently high plateau of debt-driven prosperity.

And the Titanic was unsinkable that fine evening as it sailed boldly into the ice field.

I can’t believe you don’t see a crisis. Did you already get into the pot? I know it will be legal soon but come on.

The early 80s shown Canadian housing can crash when interest rates start to climb, buckle up.

I guess I also don’t see the crisis.

As opposed to the past, with normal, deflationary recessions, I think we can safely assume that any hint of deflation in a future recession will again be met with aggressive central bank rate cuts, a new QE program, maybe even fiscal stimulus.

If you’re holding real assets: real estate or even stocks – you are going to be fine. The nominal price will rise to reflect the increased money supply, but the underlying value doesn’t change. Your nominal salary also rises to reflect the inflation, but again your purchasing power doesn’t change as prices also rise. Your debt payments become easier to shoulder given that you pay with devalued currency. The only way to lose is to hold cash.

…we can safely assume that any hint of deflation in a future recession will again be met with aggressive central bank rate cuts, a new QE program, maybe even fiscal stimulus.

So governments have figured out how to prevent severe recessions and financial crises? Permanently? For real ?

I would expect to encounter this sort of blind faith at a revivalist retreat, not in a discussion about economics. This complacency about debt, coupled with an unshakeable belief in the omniscience of policy makers and the healing powers of government, seems to define a wide swath of the population. I already knew Canadians were sleepwalking off a cliff, but I had no idea we were this far gone. I’m officially frightened.

…discretionary spending will screech to a halt and the country will stagnate for a long time.

You just described a sudden, severe and protracted recession. Which would occur at a time when we’ve never been more indebted. Sounds like a crisis to me.

https://en.wikipedia.org/wiki/List_of_countries_by_external_debt

To whom does a nation owe: to its fellow citizens or to foreigners?

I believe that this is the most important question. The USA owes foreigners $19 trillion. No other nation comes close. Japan 3.5; Canada 1.8; and China 1.6.

Japan and China can repudiate all debts and still pay off its foreign creditors. Ok, their domestic economies will be in ruins. But, they can rebuild and move on.

What is the US going to do – repudiate $18 trillion and tell the foreigners to take a hike. The USA will be ruined internally and externally. The US, as a debtor, can not decree that its foreign debts do not exist. It is the foreigner creditor who has to assent to the rescheduling of US debt.

And, $18 trillion is too big to inflate away. Print away.

Focusing on the debt percentage to GDP seems to me to be misleading.

It seems you’re conflating government debt and private sector debt. A government can totally control its own debt if it is issued in its own currency, as the central bank can simply buy it (see Japan). This article was about private sector debt, including household debts and business debts.

“Repudiating” debt, as you call it, is a default. In the private sector, and for governments at the municipal level, the procedure for this is bankruptcy.

So according to my article, the US has $29 trillion in debts by the private non-financial sector plus another $20.5 trillion in Federal Government debt.

Not mentioned in the article are other debts, including debts owed by state and local governments, plus financial sector debts (including bank deposits), etc. This is also the case for the other economies mentioned in the article. But these debts aren’t what the article is about.

Wolf,

When you mention conflating debt, it doesn’t really matter. During the 07 – 09 Great recession, the government shifted debt from the private sector to the public sector by socializing the private debt and not allowing this debt to default. This reduced private debt at the cost of the taxpayers. In This Time is Different Reinhart and Rogoff showed that the anything over 90% gov debt / GDP causes growth to slow significantly and increases the possibiliites of a gov’t default. Default can come in two ways. Deflationary default where the debtor can’t pay. and the inflationary default where the debtor repays with worthless cash. In both cases the value of debt goes to zero.

Because of the ability to shift the debt burden to separate sectors of the economy and society, the only thing that one can really look at is total debt / GDP. In the case of China, it is tough to tell just how accurate their total debt levels are, and as you’ve observed just how accurate GDP is.

Japan after 1989 and the US after 2007 did the same thing by increasing gov’t debt to give the private sector some room to breath which also helped about the corporate overlords.

With so much “cash” sloshing around, eventually it will move into true costs of living rather than silly technology assets (I was in tech for 25 years) that don’t cause cost of living adjustment problems. but eventually the difference between these silly items and real costs of life become so great and, like loose water sloshing around a ship in a heavy sea, the liquidity will shift back into these real consumer prices. When consumer inflation increases the governments will become more obvious in their attempts to print money with QE and the like. When consumer prices go up at a faster rate then asset prices, the jig is up. I suspect then that printing will increase and inflation in consumer items and precious metals will increase dramatically. Since technology assets don’t perform well in inflation, they will get hammered.

But looking at just private sector debt, is not very meaningful. Total debt must be used to get a more accurate view of the situation.

“I believe that this is the most important question. The USA owes foreigners $19 trillion.”

Foreigners own ‘about’ 35% of us treasury debt, not all of it. Most is held by domestic parties.

https://www.forbes.com/sites/mikepatton/2014/10/28/who-owns-the-most-u-s-debt/#24b26818819c

I think this implodes when debtors can no longer service the debt, even at low interest rates. I see several pension funds getting to that point. They are debtors to the pension holders. As baby boomers continue retiring the problem will get worse.

I think the general debt implosion could be triggered by a recession due to pure exhaustion. Like other posters, it seems that everyone has a new truck or SUV. Anybody who wanted a new house and has the slightest financial capacity has already overpaid for one. Lots of future demand has been pulled into today.

It is not the behavior of the debtors that matters, although it is their behavior that keeps the consumption-driven economy going. It is the behavior of the debtors’ CREDITORS that really matters.

Significantly, IMO, the list of “systemically TBTF” banks has grown with the addtion of RBC to the list.

http://business.financialpost.com/news/fp-street/rbc-added-to-financial-stability-board-list-of-30-systemically-important-banks

What does that term “systemically important” mean, exactly? It means that the present “system”, whatever you want to call it, in which a microscopic percentage of the human population owns the vast majority of wealth and capital, while the vast majority of the human population is “deeply indebted” to that microscopic percentage, REQUIRES those TBTF banks in order to remain in existence.

What we are witnessing are the final stages (the outcome, the moment of truth) of the completely experimental “trickle down” economic model that the Fed and other central banks unleashed in ’08 – ’09. It is described as follows in the Fed’s one-page Bible.

———

“First, there was only darkness. Then God said, ‘Let there be light.’ Then God said, ‘Let there be a firmament in the midst of the waters, and let it divide the waters from the waters.’ Then God said, ‘Let there be banks.’ Finally, God said, ‘Let there be man.”

———

As you can see, contrary to what one might expect, there is no complexity to this completely new, wildly-dangerous economic experiment. It all boils down to this: TBTF banks come first; humanity later. That is, Humanity’s Ultimate Purpose is to serve the TBTF banks; not the other way around. Before humanity will be allowed to enter Heaven On Earth (Utopia), TBTF banks must first control everything.

And, slowly but surely, as all of the TBTF banks’ “enemies” (ironically, NON-TBTF banks) are being assimilated by the TBTF banks, “we” are getting closer and closer to Heaven.

Fed members know full well that the official inflation / employment statistics are pure B.S. and that inflation is in fact rampant and that low-paid people are borrowing and spending far more than they should.

In the past, under these circumstances, the Fed would raise interest rates without raising the rate of interest-on-excess-reserve (IOER), until borrowing and spending were damped down, but this cannot be done today. So some how, by “whatever it takes”, the Fed has to “encourage” banks to raise the interest rates that they charge for loans, as well as pay to investors, while at the very same time prevent the banks from moving their excess reserves (that they’ve been handed by the Fed during and after the crisis) into the real economy. Again, the Fed’s twin moves attempt to do just that.

The Fed-funded US military-security-industrial-complex’s vital role in this new experiment is to enforce Fed policy domestically and, globally, to literally force the rest of the world to continue to accept trillions of printed-out-of-thin-air USD as payment for REAL goods. (The latter is the REAL US “foreign policy”.)

To reiterate, there is very little complexity to the real, “forward going” goal of the Fed and other central banks. It is to do literally “whatever it takes”, including ignoring the Constitution and Bill of Rights, and, if necessary, even instituting martial law and mass domestic incarceration, to prevent TBTF banks from failing, thereby maintaining the Elite in the lifestyle to which they feel that they are entitled.

BTW, the new, young (woefully ignorant) Canadian Prime Minister is going to give a game-changing speech in the very near future. He’s going to advise Canadians to reduce their incredibly high debt by not spending an extra dime on gifts this time around the Christmas merry-go-round. Doing this will reduce their personal debt and really help the Canadian economy.

Merry Christmas and Happy New Year!

Wolf: ” You can not buy unfunded liabilities.” True, but as a taxpayer, you own them, ultimately. Think of it as a “gift” from your government, one that you can’t turn down……

An offer you can’t refuse?

:-]

Government is like a loving daddy; it cares so much for us the taxpayers. Its gifts are the type that keep on giving ? ?.

Tech bubble, and financial crisis both happened in the last 17 years, and so many commenters comment as if crisis has never happened in the last 1000 years, and thus never will happen. Are you blind?

I didn’t realize things were that bad in Canada nor that Canada had a high correlation with China with its debt to GDP ratio.

Other than B-20 and rising interest rates. I doubt there will be much change in the current policies to encourage more people to reduce their debt levels in Canada, as the federal government and provinces haven’t made any policy announcements that would impact private sector debt in the near future.

Canada has a unique system allowing homeowners to use their house as collateral to receive home equity line of credit (HELOC) to pay for expenses as long as they pay at least the interest on the credit line. If rates on the credit line do not rise above 5% (they are currently around 3.5%), I doubt there will be a pronounced downturn in the areas of the housing market policy makers can easily monitor.

Where there could be problems is in the private lending (shadow banking) industry and the HELOCs for people who don’t know the bank can reduce or ask for the entire HELOC to be paid off whenever they feel like.

I will provide some real life examples:

Someone I know, who gave money to a sub-prime borrower and the person has defaulted on their loan. Some private lenders in Canada do not give the full mortgage amount to the borrower, just enough to create the down payment required to get the rest of the mortgage from a regular bank or Mortgage Investment Company (MIC) at a lower rate (2% – 5%) than the private lender was charging e.g. 8%-10%. The new regulation, B-20, is going to end this loophole January 1, 2018. The lender thinks they will probably lose all of their investment to the borrower. I think the person finally gets it, sub-prime lending is a high risk business and the high interest rate they were receiving on the loan was not worth the risk of losing all of their money. They will hopefully be more cautious about their investments in the future and lend less money, and/or move their money out of MICs back into a big bank.

Another thing happening is a few MICs are not renewing the mortgages and borrowers have to either sell or find a loan shark to keep the home. These borrowers in the past would have easily gotten a mortgage from another MIC, or a contract drafted by a lawyer, creating a pool of money where several private lenders pay for a part of the loan. However MICs are not a bank and do not receive any money from the Bank of Canada (directly). If private lenders start to become scared of sub-prime borrowers, they can pull their money from MICs or not participate in future agreements drafted by lawyers, reducing the number of potential lenders sub-prime borrowers can get money from; and if prices for homes keep falling, they could be selling the home at a loss and owe the private lenders money. The lenders could sue, but if the borrower files for bankruptcy, then the lenders will not receive any additional money after the home is sold.

Luckily the person I know did not use a loan (it was their own cash savings) to lend the sub-prime borrower money. Borrowing money to lend to other people does happen in the shadow banking world, as people with HELOCs from big banks many of whom were being charged 2%-3% interest, were willing to take out large amounts of money to several people and receive 8%-10% in return for funding these risky ventures. If the private lender’s HELOC rate started to increase, and the private lender was having trouble paying the rising variable interest on the HELOC, as the money they gave was not being paid back, their bank could ask for the some or the entire HELOC to be paid off or raise the interest rate on the HELOC to a level where the return on the risky loan barely covers the HELOC interest being paid.

As more events like these start to happen to private lenders, I think less savers will deposit money in MICs or act as a private lender on a mortgage, requiring MICs to be more selective of the people they lend money to and/or not be able to renew the mortgage of riskier sub-prime borrowers. If the shadow banking industry is very large, this could spiral pretty quickly. But I guess we will have to wait and see how big the industry is in Canada.

Here in Victoria there is so many retirees who are forced to work because of the high cost of living.I’m scared because I don’t want to be one them.GTA,YVR and Victoria are so costly to live and are no place to retire if your not that rich.I have a friend,a single guy lives in Puerto Vallarta for 7 months a year on $900 cad a month.Thats where I’m going in a few years.Its funny I met one guy on disability from the states living there and he says the $1100 a month he gets is a much better quality of life in the good old USA.

Canada will not implode as long as Uncle Warren (backed by the US Government) continues to provide implicit bailout.

I am assuming this is what you are referring to:

http://www.huffingtonpost.ca/2017/06/22/warren-buffett-helps-bail-out-canadas-struggling-home-capital_a_22571206/

If so I partially agree with you. I don’t think he can back every lender though, but I could be wrong.

For a lender to have a hiccup of that size during an obvious boom in prices, how will they survive if or when the market corrects 25-50%?

Neoliberalism will bring prosperity to all.

Unfortunately, its new scientific economics, neoclassical economics, was a dud that was rejected in the 1930s.

It doesn’t look at private debt leading to the Wall Street crashes of 1929 and 2008:

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

They are pretty much the same; one bubble was blown in stocks the other real estate.

With the global gold standard for economics not looking at private debt another crisis will be coming shortly.

The West got its secret weapon, neoclassical economics, into China.

Somehow they have managed to see the coming Minsky Moment, but it’s so late things have got really bad.

China debt implosion coming up.

Along with Canada, Australia, Norway, Sweden, Hong Kong, South Korea, Belgium ……

Wolf, I was living in California just prior to the dot com crash. I was watching the mortgage craziness. I now live in northern Canada (Whitehorse). I don’t quite feel like I have a front row seat to what is going on in Vancouver and Toronto. However, from where I am sitting it doesn’t seem nearly as nuts to me as Silicone Valley was.

I hear that Canadian private debt is in the stratosphere. But is Canada suffering from a significant sub-prime problem?

If you were a Canadian, where would you position yourself to weather a coming correction? Would you seek to be debt free? Would you mortgage to the hilt and invest off shore? Would you just move to outer Mongolia?

This is not about subprime. It’s about being stretched beyond your limits i.e. you have no safety zone. What happens if you suddenly need to spend a lot of money on something whatever that is? What happens if you lose your job? What happens if enough people lose their jobs with no savings?

Being indebted to the hilt is fine as long as life continues to be perfect i.e. continuing rise in income, never a job loss, never an accident or illness that requires a costly operation.

Why do I even bother? After all the phrase “the best things in life are free” was invented by Westerners. Never has there been a more deluded group of beings in the universe.

Nigerian debt sounds good.

BFast,

I’ll just address one point you made concerning: “Would you mortgage to the hilt…”

Many Canadian mortgages are adjustable-rate mortgages. So when rates go up, payments go up, whether you can afford them or not. Also mortgages are full-recourse except in two provinces (Alberta and Saskatchewan). So “mortgage to the hilt” carries some very large personal risks. You can’t just let the bank carry the risks.

Wolf, We Canadians are well versed on whether we are getting into a fixed or adjustable rate mortgage. In Canada, a fixed rate mortgage with a term greater than 5 years is an oddity. How the American system will withstand interest rate hikes when they have 30 year mortgages is a bit beyond me.

I was unaware, however, that most Canadian mortgages are full-recourse. I will have to factor that into my strategies.

To fine-tune the risk analysis:

“Full recourse” doesn’t necessarily mean the bank will go after you. For example, in the US there are only a dozen states where mortgages are non-recourse (see link below). The rest of the states are recourse, including Florida. During the Housing Bust, banks in those recourse states could have gotten a deficiency judgment against the former homeowner and go after their personal assets.

But when the mass-foreclosures happened, most of the time the banks didn’t go after the former homeowner’s personal assets or income. It probably wouldn’t have been worth it. People who default on their mortgage usually have a reason (lost a job) and there is nothing to go after.

So in a massive housing bust, when millions of people lose their jobs and just don’t have the means to maintain their mortgage, banks might not be eager to spend a fortune chasing after each dime. If they had, the former homeowner would have sought protection in bankruptcy court, and the banks knew that. For the bank, it would be like throwing good money after bad.

But if this is an individual default in an otherwise OK economy, the bank would likely pursue a deficiency judgment if the homeowner is deemed to have assets or income to make this worthwhile.

https://wolfstreet.com/2017/04/25/mortgages-u-s-canada-recourse-states-non-recourse-states/

To add to Wolf’s point. US congress also exempted 1099 ‘Unearned Income’ as a result of mortgage default from taxation during the crisis.

Usually, what happens when you default on an under-water home (in the US, obviously) is that the lender, when they write off the loan, will fill out a 1099 UIS with the difference being between what was owed and what the lender was able to recover (from a foreclosure auction, for example), put your name on it and send a copy to you and the IRS, this amount then becomes subject to personal income tax. So, for example, if you had a $400,000 Mortgage that was foreclosed on and the bank sold the property at auction for $250,000, then all of a sudden you had $150,000 “income” that you had to pay tax on that year.

It happens to people who overleverage with rentals and stuff, one default will unwind all their properties – it’s not that they can’t afford to let one go, it’s that they can’t afford the taxes on putting one to the bank..

In short, how “full recourse” full recourse in the event of a national breakdown ends up being is questionable. It could go the US way where everyone got off light. But on the other hand, since it’s a private contract between the lender and debtor – revoking full-recourse would probably be illegal for the government to do – although regulating the crap out of it to the point of nonviability wouldn’t. They might just go the Ireland way instead and stick the borrowers with intergenerational debt.

Interesting times.

The borrowing and spending binge by Canadian households, businesses and governments (all levels) continues unabated. Growing the debt in the economy significantly faster than the economy itself grows seems to have developed into a way of life in Canada.

Canadian total (household, business, and all levels of government) debt numbers as of the end of June, 2017

https://owecanada.blogspot.ca/2017/09/canadian-total-household-business-and_19.html

As I have told my kids born in the 1980s : ” It’s not what you can afford when you’re working, what you can afford when you’re NOT WORKING.”

I locked my mortgage in @ 10% before the dung hit the fan in the 1980s. My brother-in-law didn’t take my advice and lock it his variable rate mortgage……his rate went from 11% to 21%. His Monthly mortgage payment DOUBLED.

IIRC it was Trudeau Sr who started most of our “Deficit Government Spending” back around the time when fiat money stopped being backed by anything than a government promise ( & we all know how much those are worth…ROFL).

Where one would be without work is a very good question: on the street, or reasonably OK? And how quickly would one reach the street?

That recalls what I think must be a 19th century definition of ‘middle-class’ which I heard from an old lady years ago.

Her father had told her ‘You are middle-class when you own at least one good freehold with no mortgage, have good furniture and china, and can live decently off the return of your capital without working’.

That person is confused. That is the definition of a rich person or at least upper middle class.

Just a question of time before it all blows.

What are the Gross Domestic Product (GDP) figures based on? (rhetorical question).

I’ve no doubt that the debt figures supplied in this article are correct, but I’d have grave doubts about using government-sourced GDP figures : simply because governments are prone to exaggerate “growth” data, given half a chance.

Debt as a percentage of GDP? Debt measured in nominal levels I think is far better to enable analysis. USA €$20.5 trillion federal debt and $9 billion of private sector debt makes for better understanding as to the extent of the debt problem.

If you check the article, you will see that the private-sector debt figures are presented in nominal currency amounts as well as % of GDP.

Your chart confirms my view that 2008 was a Fed inspired crash of the markets when private debt (and money creation) was rapidly growing beyond their control. The Fed and its minions are control freaks, and to the degree that all central banks are really one central bank, we should expect the coordinated effort to “stabilize” markets soon. While the Fed of the 90s used PPT to buy the market, the current Fed may use it to dampen the animal spirits, (if raising rates into a recession fails to do the job) which may come as a shock to DJT, but in the absence of leadership the Deep State always assumes a greater role. Enjoy

US corporate debt? They’ve been borrowing a fairly strong clip for a while now.

Oil prices have little relationship to Canada’s housing prices and so does immigration. Five years ago, the Premier of British Columbia announced coming LNG deals (nine) worth tens of billions of dollars and she boasted that thousands of high paying jobs would be created and that we would pay off the Provincial Debt (65 Billion at the time.) Not one of those deals happened and yet not a single person in B.C. seems to care because in my neighbourhood (East Vancouver) a 50 year old home on an average lot that sold 20 years ago (when the it was a 30 year old house ) for $300,000 is now in the $800,000 to 1 million range and don’t you dare request a home inspection.

I would watch for any tax holiday on the $2.5 trillion of untaxed ‘overseas’ corporate profits which companies are looking to repatriate. There are indications that a signifiant portion of this money is currently invested in corporate debt:

https://www.bloomberg.com/news/articles/2017-05-04/apple-buys-more-company-debt-than-the-world-s-biggest-bond-funds

Announcement of a tax holiday would likely mean fast liquidation of significant corporate debt holdings to pay for dividends and buybacks with repatriated money.

in the global markets the term “repatriate” is meaningless

German business confidence up.

Small business lending and optimism at record high: https://www.theepochtimes.com/in-sign-of-economic-improvement-small-business-loans-surge_2362884.html

Boo yah!!!! No crisis soon.

Spurred on by the moral hazard created by the central bankers since 2008, the debt donkeys, far from trying to reduce their debt loads, are using their credit cards with wild abandon.

http://www.telegraph.co.uk/business/2017/11/24/black-friday-spending-soars-8pc-despite-retailers-launching/

While China’s central planners keep jawboning about their efforts to reduce the country’s runaway debt and speculation, it’s debt bomb just keeps growing exponentially. Heckova job, Keynesians.

https://www.reuters.com/article/china-markets-debt/graphic-chinas-debt-pile-growing-fast-despite-years-of-efforts-to-contain-it-idUSL3N1NU37E

Canada has the dubious distinction of having the highest household debt levels. Cue the “It’s different here!” Bubble Believers.

https://www.cnbc.com/2017/11/24/canadas-household-debt-levels-higher-than-any-other-country-report-says.html

– This assumes that US GDP figures are not “fudged” too much. According to my information these GDP numbers are not “Inflation adjusted”.

https://www.peakprosperity.com/video/85854/crash-course-chapter-18-fuzzy-numbers

“Real” GDP numbers are inflation adjusted – via the GDP deflator.

“Nominal” GDP numbers are not inflation adjusted.

Both sets of numbers are published:

https://fred.stlouisfed.org/series/GDPC1

https://fred.stlouisfed.org/series/GDP

In the charts, click the “Edit Graph” button. And then select from the choices, such as GDP in dollars, year-over-year change in %, quarterly change in %, etc. You’ll see the differences between “nominal” and “real” GDP.

BTW, if you compare debt, which is not inflation adjusted, to GDP to get “debt as percent of GDP,” you also SHOULD use nominal GDP to get that percentage. You don’t want to create percentages from two data sets where one is not adjusted for inflation and the other is adjusted for inflation.

I am surprised that the age old solution for over indebtedness has not been mentioned. Inflation or in the present circumstance stagflation is the easiest way out for both the public and private sectors. Ramping up to 7 or 8% over 4 years and then down to what would be perceived as low inflation of 3% over 5 or 6 years. I remember being bailed out in similar circumstances in the 1970s’. It was a painless ride.

Interest rates were 18% by the early 1980s. It wasn’t “painless.”

^ What Wolf said x2. The glory of the 70s led to the demise of the 80s. Maybe you got ahead, but the generation behind you was buried for your gain. If I remember right there also was a bust in oil prices back then. History often repeats itself.

What FRED series are you using for private sector debt to gdp? The FRED household debt to gdp actually decreased from 2008 to 2016 (98% to 80%) yet you show that ratio at 150%.

US private-sector nonfinancial debt to GDP includes household debts AND business debts:

https://fred.stlouisfed.org/series/QUSPAM770A

Thank you