This is where hype (and money) goes to die.

Snap Inc., the parent company of Snapchat, reported late Tuesday that its revenues in the third quarter rose 62% from a year ago, to $208 million, while its net loss more than tripled to $443 million. How? It wasn’t easy, but here’s how they did it:

- Cost of revenues, $211 million, exceeds revenues, a troublesome indicator. Most of it is what Snap pays Alphabet for hosting its content in the Google Cloud.

- Research and development expenses, $239 million, also exceed revenues.

- Sales and marketing expenses, $102 million, to push those Snapchat Spectacles? More on those in a moment.

- General and administrative expenses: $118 million

Total expenses of $670 million, against revenues of $208 million. That’s what I call a business model.

When investors saw the results, shares (SNAP) plunged 17% in late trading to $12.53. They’re now 26% below the IPO price of $17. What is amazing is that shares had recovered partially from prior plunges as new hype surfaced about this being a buying opportunity.

The day after the IPO in March, shares hit $29.30, which gave Snap a market capitalization of $30 billion. Snap’s market cap now of $18 billion continues to be a head-scratcher.

For the nine months, the company’s net loss came to $3.1 billion, including the rich stock-based compensation of $2.5 billion doled out to founders and the people who’re working tirelessly to produce these losses.

Then there is this: The business is still growing, but beset by competition from Facebook, Apple, and others, growth is already slowing, according to Snap’s homemade metrics, in Q3:

- Daily active users (DAU) grew 17% year-over-year to 178 million.

- Average revenue per user grew 39% year-over-year to $1.17.

- Hosting costs per DAU rose 6% to $0.68 in Q3 2017. This is what Snap pays Alphabet to host its content in the Google Cloud. In its S-1 filing before the IPO, Snap disclosed this five-year $2-billion contract with Google. Good for GOOG!

And Snap disclosed another doozie today: “Excess inventory and related charges” of $39.9 million “related to Spectacles inventory, primarily related to excess inventory reserves and inventory purchase commitment cancellation charges.”

On October 23, there was a warning in The Information about those plastic sunglasses with a built-in camera that only 0.08% of Snapchat users ever bought:

Snap badly overestimated demand for its Spectacles and now has hundreds of thousands of unsold units sitting in warehouses, either fully assembled or in parts, according to two people close to the company. The disclosure undercuts Snap CEO Evan Spiegel’s recent contention that Spectacles sales of more than 150,000 had topped the company’s expectations.

So let me add a special note about these Spectacles and the Snap-IPO hype. In February, weeks before the IPO, one of the many promoters that were engaged in spreading the hype, sent me and other media outlets an email, which said:

“Hi Wolf, we wanted to see how Snapchat’s IPO stacks up against Twitter and Facebook’s, so we compiled extensive research and created an infographic illustrating Snapchat’s place in the tech IPO landscape based on key metrics, revenue and expenses, and user base.”

The “media kit” included “The Snapchat IPO Cheat Sheet [Infographic]” and this:

“We’ve also published graphics of a $5B sales forecast of the Snap Spectacles and the possibility of a Snapchat smartphone. Would you be interested in sharing or covering these?”

I get this kind of stuff all the time, from cryptocurrency promoters to loan-for-home-flippers promoters. This was the title of the infographic:

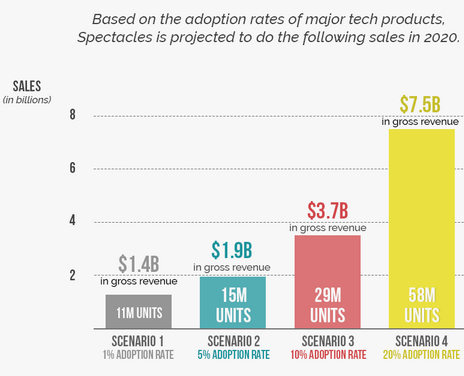

And this chart in the infographic shows four different growth scenarios for Spectacles revenues, including $7.5 billion in 2020. Put it in the LOL category:

“What are you guys smoking?” I wrote back. “I’d like to have some of that too :-)”

A good thing that Snap still sits on $2.3 billion in cash and securities extracted from investors via its phenomenally rich IPO, during which it raised nearly $4 billion, of which $1 billion went wisely to its founders and early investors. At least they got some of their money out.

How long before that $2.3 billion is burned up? Snap burned $220 million in cash in the quarter. At this rate, it’s going to take about 10 quarters to burn this cash. So unlike Blue Apron, which is running short on cash, Snap was hyped to such an extent before the IPO, including the $5-billion Spectacles nonsense and the silly infographic sent to media outlets, that it was able to extract nearly $4 billion from investors, who’ve been ruing the day.

Update: Today, Wednesday, Snap shares tank 16%, after it disclosed this morning that Tencent had acquired a 12% stake in past months that neither Snap nor Tencent disclosed. Tencent is ruing the day. Read…. Snap Gave Middle Finger to its Voteless Shareholders Today, after Disclosing Ugly Quarter Yesterday

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Snap badly overestimated demand for its Spectacles and now has hundreds of thousands of unsold units sitting in warehouses, either fully assembled or in parts, according to two people close to the company. ”

Maybe they can bury them with the millions of E.T. video game cartridges Atari buried in 1983 when the video game crash hit.

It’s the new CueCat!

https://en.wikipedia.org/wiki/CueCat

Thanks. I wasn’t aware of cuecat and it was fun to read the lists it has made into (the worst product of 2000s etc.).

Ugh, I remember that thing. It consumed so much memory that my PC ran like a tortoise. Plus, who is reading magazines sitting at their computer desk? I disconnected it after less than an hour.

I actually know someone, Carl, a serial entrepreneur, who made millions doing exactly the same with QR codes as the :QueCat. –

This guys business model is a B2B service, where customers can use their mobile phone to open a web page about the product the customer is interested in and the “service” charges per QR-redirect to the business selling the item (and on the user data collected). No actual customer would ever bother with this “product interaction” rubbish, but, the story is good enough to sell to “investors” and businesses.

Carl is very good at running some business up to speed, then selling on the exponential bit of the “S-curve” where “growff” extrapolates to infinity.

Being a funny, charming person too, there is lots of energy when he is around, he can probably sell anything to anyone.

—-

If there is something to learn from the dot.bomb era and infinite money it is perhaps that: “No idea will be stupid to everyone at the same time, so keep pitching it” and “With enough hype and money (thrust) anything will make it to the stratosphere, the landing is not a problem because that can be outsourced!”?

Fanjensen I want to work with Carl ? I’ve a business idea that comes close to the hype cycle s-curve it just needs running up and selling while growff is there.

The most astonishing thing is most of the ET The Extraterrestrial game cartridges Atari had buried at Alamogordo were not unsold units, but had been returned by customers for refunds.

Atari sold approximately 7 millions units of ET cartridges, but of these between 3 and 5 millions (sources are in conflict) were returned. On top of those Atari had grossly overestimated demand and had 12 million cartridges manufactured. At the time there were roughly 10 million Atari 2600 consoles around but Warner, Atari’s parent company, estimated ET and a few other titles would push that total considerably higher between 1983 and 1984.

So when all was said and done, Atari was sitting on anywhere between 8 and 10 million unsold ET cartridges. And this was on top of several other highly unsuccessful titles.

It was a mess for two reasons. First, in 1982 Atari accounted for 75% of the worldwide videogame market: Japanese companies still hadn’t entered the home console market in strength. Second, Atari was by far Warner’s most profitable division, earning over 60% of their profits.

Over the year Warner grudginly admitted they had disposed of 700,000 game cartridges in the Alamogordo landfill, but this contrasts with county records, which show the municipal landfill received in a single day twenty semi-trailers from Atari’s warehouse in El Paso. Twenty semis are an awful lot of game cartridges.

I’ve heard the Alamogordo landfill was escavated and a small number of cartridges recovered: the rest is apparently crushed so throughly and buried so deep as to be irrecoverable.

I wonder if one day the Smithsonian will lead excavation campaigns to the sites where Google Glasses and Snapchat Spectacles are buried…

Circuit boards do *not* do well when they’re damp, and mold and fungus will grow on them quite happily.

But this time it’s different! Everyone’s gonna have to have all the various permutations of Flappy Birds, and we’re all gonna need lots of fart apps, techies are changing the woooooooorld!

Nowhere to go but up!

Ungreen ungreen, this is the age of recycling.

They should be recycled.

Perhaps into ugly dark coloured shoes or some such

And we are running out of rare earths and other smart device material so we need recycling to clos the loop.

Wall Street pushes what is profitable for them — not what is profitable for you.

The truth and nothing but the truth! Well said.

Good analysis.

Snap, Apron and Cloudera are 3 IPO duds in a row since spring, yet the Nasdaq is up 35% Y/Y. That in spite of Uber and Airbnb never even making it out of the gate.

Late stage euphoria brought to us by our ever dependable GAAF’s.

Market cap of Snapchat at IPO, thanks to snake oil salesman/hype/BS artists = $30 Billion.

About half of which has gone up in smoke, as far as the suckers that bought into the IPO are concerned.

I can only contrast this with a “dinosaur” that I follow. ,,,,,Kansas City Southern (KSU).

A old school REAL investment, with real revenue, real dividends, and real assets.

Current market cap? About $10 billion. Or just about what Snapchat investors have lost in the past six months.

And the suits call me a dumbazz?

Are any of these meal kit outfits profitable? And if so, how so?

Thanks

Statement of Cash Flows is pretty ugly. Cash is up $150m. However, Operating Activities lost $559m and Investing Activities lost $1.6b. If not for the IPO bringing in $2.7b, they’d be done for at their spending levels. Unless I’m missing something, Wolf?

Good business model indeed. But if the owner of snap sells just a few shares since the IPO and clears a paltry billion for himself then it is a very good business model for him, no? Also good for those who can access the shares at the outset of the IPO and got out quick, i.e. insiders. Is this not the whole idea? As for the rest of the saps that eventually get flushed, well tough luck, try not to be a sucker next time.

Can they make as much as the $3 billion facebook offered in 2013? Especially considering that would be worth $4 bil+ now if invested in a total stock index fund at the moment? I’m not sure one way or the other, but interesting to think about.

There’s rumors that Google offered 10x that– $30 billion! Unconfirmed from both companies, so it’s hard to tell how serious it was.

Instagram (owned by Facebook) is eating their lunch, and there’s nothing SNAP can do about it. Every new feature they create will be duplicated almost instantaneously, and on a more popular platform.

Now you know why they sold non voting shares.

I like these stories about loss-making companies and their enormous valuations and think they are quite funny. Beyond the fun however looms the question what the existence of so many Snapchats, Teslas and Ubers means for the global financial markets and the economy. Saved and lent capital is put in large amounts into companies that burn the capital to ashes. This fire creates short-term heat (in terms of secondary revenue and tax effects) and absorbs energy (capital). I think this process, initiated by the low-interest policy, destroys equity large style and more and more assets accumulate on the balance sheets of central banks – the only entities on earth that have at least theoretically unlimited funding capacities. If that process ends everybody has nothing and the central banks own everything. Probably Lenin and Stalin would rejoice.

It is only the Fed’s “money for nothing” that supports these faux businesses. The “investment” bankers are funding the destruction of the competitors of these new businesses and destroying the real capital of others.

The Fed’s original job of Lender of Last Resort vs. it’s new-found job of picking and choosing winners and losers, is taking us down the path of corporate socialism. Only members of the party shall succeed.

uh-oh…here comes China…PJS

Why would a Chinese company buy non-voting shares? These shares give them no saying in how the company is run and don’t entitle them to “technology sharing”.

It sounds exactly like the kind of operation to launder money Chinese authorities are cracking down on. I expect Tencent to join Anbang, Fosun, Dalian Wanda, HNA and several other Chinese conglomerates to be gently reminded by the government through the usual combination of heavy fines, credit tightening and low-end executives being sent to jail or jumping to their deaths of Mobutu Sese Seko’s maxim “if you want to steal, steal a little at time and in a nice way because if you steal too much and get too rich overnight, you’ll get caught”.

“if you want to steal, steal a little at time and in a nice way because if you steal too much and get too rich overnight, you’ll get caught“.”

No no no

The new Xi clan rules are.

If you wish to steal, you must be a Paid up, clan and party member. Or have paid clan and party members for permission before you start.

Then, if you want to steal, steal a little at time, in a nice way.

Never flaunt your new wealth, large or small, or we will have to do something about it, to appease the people

Yet another case for some type of regulatory [mandatory] conservator-ship for large corporations, both exchange traded and private that are losing huge amounts of money, as this is having a significant effect on the aggregate economy. The poster child for this is GM, but as you note, there are many other examples.

The actual resolution process already exists in Chapters 7 and 11 of the bankruptcy act.

What is required is the ability of the SEC, or possible a board with representatives from other appropriate agencies and guarantee corporations (PBGC, FDIC. CoC, etc.) to administratively force a corporation into Chapter 11 (reorganization) [and after due consideration of the business plan/model, actual performance to date, and qualified projections, possibly into chapter 7 (liquidation) ], when the corporation exceeds certain guideline/criteria such as rate of “cash burn,” actual performance, and projected viability. The could be called the Corporate Euthanasia Act. Another prime candidate for corporate euthanasia is K-Mart/Sears.

So you want to give bureaucrats with regulatory agencies the power to hasten bankruptcies that are sure to happen anyway? Entirely unnecessary. We need a return to proper monetary policy, where there isn’t so much funny money chasing hare-brained investment opportunities. If interest rates were just 200 or 300 basis points higher, companies like this either never get off the ground or quickly go bankrupt. In no scenario can regulatory bureaucrats ever make up for monetary policy that essentially represses the risk-free rate of return to zero.

There is what we need, there is what we want, and there is what we have.

The problem is, the system is now designed to give banks, rich people, corporations, and hedge funds vast amounts of money at par or below inflation interest rates. Their is insufficient demand for them to actually invest this dough in productive enterprises. So they pour the proceeds into stocks, bonds, and real estate. They then pump and dump and pocket the proceeds before the inevitable plunge. The Powers That Be now consider the pump phase as the only means of “growth”, and since Capitalism dies without growth, the pumping will continue until the economy collapses. The kind of investment-led growth of the teens and twenties, or the consumer-led growth post-WWII, is now out of reach. So the elites use the only process they will countenance: wealth-effect trickle down. This doesn’t help 3/4th of the population, and is unsustainable, but it’s the last bullet in their gun.

Capitalism means you have money because you have money.

And you don’t have money because you don’t have money.

I feel that “taxation by artificial intelligence” is the only solution. Look, if you can design for the game “Go”, you certainly can design a system that looks at each individual, each business entity, and figures out the tax they should pay, that maximizes benefit to society and business. Something like a razor-thin margin food store, operating in a needy neighborhood, should get a negative tax rate, compared to three guys operating a hedge fund on Sand Hill Road and profiting millions per month. Those guys should get a 101% tax bill, which would discourage “fluck-rules” financial games.

No appeal. AI Tax has already considered your appeal…no.

As long as there is a system where gold makes the rules, the rules are long and arcane, people spend half a year looking for profits in the rules, this will go on and on.

Artificial Intelligence to the rescue.

In my opinion, the common problems with tax systems are vast complexity and a dire lack of transparency.

This will not be solved by trusting(!?) someone like me with wrapping all of that with an even more complex set of rules, creating a shinier and smoother surface.

Before one digitises anything, one has to scale the problem back to something that one can explain to the developers and write test cases for.

Even when “the developers” are mostly replaced by an adaptive algorithm, an “AI”, the problem to solve has to be expressed in a way that the “AI” learns what *we* want and not what “it wants” – which is usually to minimise the value some mathematical expression. It’s a machine, it doesn’t care how this is done and it doesn’t know what anything we feed into the training set means or what the goals really are. Concepts like “society”, “humanity” and “business” are just labels, categories, data-bins, for the algorithm to operate on nothing more. Could be “X”, “Y”, “Z”, it would work the same.

Simplification is the key. If we only used taxation to fund the government expenses with, life would be a lot easier.

The complexity generator is that politicians will try to use taxation to legislate and regulate human activities that they should or cannot legislate about directly (moral issues) and corporate lobbyist use taxation law written for their client to gain an advantage over the competition (cheating, gaming).

Many a “sound, common sense, value” that are expressed through tax law would be ridiculed out of parliament if anyone proposed them as legislation today.

I would get rid of everything and have a tax on income, however created, no deductions, government does not care what your operating costs or expenses are – that is now your problem entirely, as it should be. We keep VAT (I like the VAT), because it is a tax on consumption. One income tax rate for people, another for businesses. To manage the transition, we fix the rate so the revenue stays the same.

Businesses should be happy because there is now only one rate and no tricks they will save billions on tax-shelters and tax-lawyers (of course PWC & co will not be happy – off to the re-education camps with them).

People should be happy because now they understand taxation, nobody gets any advantage over them and life is simpler with only one number to report.

Government should be happy (but won’t be) because they can use all the money they spent on IRS on healthcare or something.

While an interesting proposal, the problem at this stage of AI development is that the goal(s) for a system to be “optimized”/”maximized” for must be selected by the [human] programmers.

Thus the Ideological preconceptions of the AI programmers, or more exactly their employers, will be critical. As is crystal clear in our current situation, no general agreement exists on the actual socioeconomic/cultural goals/objectives to be attained, particularly in a quantifiable/measurable sense.

Three college roommates come up with an idea to take crotch shots that disappear six seconds after their girlfriends look at them.

Three years later WS values this idea at 30 billion dollars.

This market cap is higher than companies like American Airlines, Humana, Allstate, CSX, Deere & Co, Southwest Airlines, Marriott, etc

See any problems here?

Thanks for the laugh!

I heard older guys are taking shots of their bank statements, and having way more luck.

LOL! You guys are on a roll today.

I’ve tried both ways and had absolutely no luck. Even the police seems not interested.

Accurate and entertaining! Post of the day – combines truth, humor and brevity.

Well done sir.

Sure, I can see the problem. The crotch shots are missing. Where is the top of this muffin?

The shots were of guys? Ew

So, a company with no given name, has a “Wall Street” (who?) valuation of 30 billion?

What when where how?

Back in 2000, I followed a stock, trading every day, that had a one million dollar valuation, and their only product was, “We are watching for opportunities…” Nothing else. But at least it was listed on the Pink Sheets.

What’s the chance that Google is helping to prop up Snap’s stock since they are the beneficiary of 400 M in cloud business. Probably never be able to find out but with so much money sloshing around, it’s highly likely all of these co’s are in bed with each other to various degrees.

What is really depressing is that so much money that could go to good use (like increasing the incomes of working Americans) is in the hands of such complete and utter dumba$$es.

Chinese hot money steps in to acquire a stake in this steaming turd.

http://www.zerohedge.com/news/2017-11-08/snapchat-soars-reversing-earlier-crash-after-tencent-buys-10-stake

Total BS. Snap shares are down 15% right now. Tencent (your “Chinese hot money”) acquired those shares in recent months, not today. Today the disclosure was made. Tencent’s investment is crashing today.

Watch for my article on this shortly.

Did Tencent buy woting or nonwoting shares ?

Here we go….

https://wolfstreet.com/2017/11/08/snap-gave-middle-finger-to-its-voteless-shareholders-today-after-disclosing-ugly-quarter-yesterday/

Further upsetting are the many reports of Snapchat stock being a favorite investment by millennials.

Further upsetting are the many reports of Snapchat stock being a favorite investment by millennials.

Why is that upsetting? Stupid should hurt.

Burned millennials could eventually become awake, aware, and a force for much-needed change in this country.

The potential revenue chart by itself isn’t funny. But you do have to have a damn good argument why such a device will gain traction and not fail like google glass… it’s sounds like they didnt.

Snapchat was in trouble before his glasses disaster. The glasses was just hype to keep the “dream” going and their biggest mistake was not doing like the Nintendo with the Switch and just do a limited production to increase demand.

The biggest mistake Snapchat made was not selling when a big company came knocking.

Google had the failure of the Google glass but unlike Snapchat it doesn’t depend on cheap credit to keep going.

Oh and heard about Amazon Fresh closing down almost everywhere? Amazon can bo longer waste money like water.

And Twitter still has no clue how to make money.

Actually, Twitter said in its last earnings that it’s going to be profitable next quarter. But Twitter’s use case is much more defensible versus Facebook than Snap: Facebook and Snap are both mostly for use with friends and family, whereas Twitter is much more public.

Never trust anything what a company just “says”. And even uf it looks profitable it will be while hiding the red, just like Netfix does.

All of these social media companies are different implementations of an electronic billboard. None of this is rocket science, and all of it is easily replicated. I keep seeing the same underlying ideas touted as billion dollar innovations. I don’t get it. I could write Twitter off the top of my head and in fact did write a similar program when I worked on Wall St. Even then this technology was no big deal. The hype surrounding these companies is ridiculous.

The tech is like you said pretty simple. It’s essentially down to which company can get a dominant market share, because once you have that, you can simply duplicate anything else that is being done on the tech side.

My guess is Facebook has now been established long enough that it has social media basically locked down. If you’ve got hundreds of friends and relatives already on Facebook, who wants to set up a new account on some other service and then rely on everyone else moving to that service as well?

There’s a joke that Snapchat is Facebook’s product lead. Every time Snapchat comes up with a new feature, Facebook replicates it (via Instagram) and to greater success.

It’s called the “network effect”. it is what everyone wants. Microsoft kicked it off with Office. Once everyone is using it, you couldn’t leave because of the proprietary data formats. And no one else could get market share. Facebook, GOOG, Amazon all have it in their own way.

Like Petunia says, none of the software is rocket science. But coming up with a network effect that locks out competitors is. SNAP doesn’t have one.

Petunia – I guess it always comes down to marketing and sales. Simple or complex, it has to be sold. Widgets or social media. It has to be sold. My dad was a salesman. I went into science and was surprised at how much selling I had to do. I agree that the hype is ludicrous. But, we have been programed to chase the shiny thing.

Get your pair now!

https://www.spectacles.com/shop/

Still for sale at a bargain $129. I wonder if any of the marketing geniuses at SNAP have considered lowering the price to….I dunno…..$14…..just so they don’t have to dump them into a landfill?

At $14 a pop, I’d consider buying a dozen pairs and throwing a Snapchat party. We could record each other logging into our eTrade accounts and shorting the stock……

Even the charging cable is absurdly overpriced…$10!!!

A lot of wearers of Google glass, or whatever those creepy glasses are called, have encountered intense hostility when they go into bars or other places and discover normal people aren’t too keen on being peeped at by dorks wearing spectacles that can record them and their activities. Normal, self-respecting people wouldn’t be caught dead wearing these “spectacles” in public.

I remember the nervousness when cameras were being put into cellphones. I can take crappy (probably) 640X480 video on my flip phone, for instance so this predates smart phones.

But in real life, I’ve got to be in tons of people’s selfies, and when I’m out playing trumpet this weekend I’m sure many (more) epic videos will be taken of me. The only thing that bugs me is, those who take pics or videos never seem to tip. The sole exception being near Halloween, a bunch of superheroes were going into Easy Foods there on Castro Street in Mountain View, and they got a kick out of me, and even more of one when I managed to play the old 1940s Superman theme. Then they took selfies with me and Superman gave me $5.

But for some reason, take the camera out of one’s hand and stick it on one’s face and all hell breaks loose and noses get broken. People go around with GoPros; they’re popular with bicyclists and joggers and so on, and no one flips their sh!t over that… So for some reason it’s that the camera is in the glasses that people really get bugged.

I wonder if it’s a case of “the uncanny valley” and this is a concept well worth looking up. If I’m filming you on my Eggo waffle sized phone, OK. If I’ve got a GoPro strapped on my head, it’s pretty obvious I’m taking video. But in the glasses, you don’t know if you’re being filmed or not. I mean, I see someone filming me and I know it’s not the time to cuss, empty my spit valve, pick my nose, etc.

I’ve forgotten who the underwriters were but this should reflect on them too, hopefully.

$30 billion is way too much money for one crappy toy. Anybody who fell for it deserves to lose their ass.

Wolf,

How did you arrive at $220M as cash burnt for the period?

As per Snap’s Q3 earnings report, linked in the article (SEC filing): $194.01 million in “cash used in operating activities” plus $25.95 million in cash used for “capital expenditures,” = $220 million or unrounded $219.961 million. This is the negative “free cash flow” also shown in the results (very top of the page).

wow. the hubris of it all.

I still haven’t figured out whether they want to be an internet marketing company, a sunglasses company, or a why-does-it-exist company.

In fact, I have a better idea for them. Why not just stop with all the other gimmicks and just go straight to manufacturing the buggy-whips? At least, those have a purpose.