The income data from the Census Bureau is here. Men, sit down.

On the surface, the data looks benign, with trends improving. And this is what you will see when you look at the media coverage of the Census Bureau’s Income and Poverty report (PDF) released today:

- Median household income, adjusted for inflation (via CPI), rose 3.2% between 2015 and 2016 to $59,039, the second year in a row of annual increases.

- For “family households,” the median income rose 2.7% to $75,062. For “nonfamily households,” it rose 4.5% to $35,761.

- The official poverty rate (weighted average threshold for a family of four = $24,563) inched down from last year to 12.7%, about the same as in 2007, before the Financial Crisis made a mess of people’s lives. In total, 40.6 million people live in poverty by this definition.

- The poverty rate for families fell to 9.8%, from 10.4% a year earlier, affecting 8.1 million families.

The survey is based on respondents at 98,000 addresses across the US — so a very large sample. Household income includes the amounts of money that the household received during that year from each of the following sources:

- Earnings

- Unemployment compensation

- Workers’ compensation

- Social security

- Supplemental security income

- Public assistance

- Veterans’ payments

- Survivor benefits

- Disability benefits

- Pension or retirement income

- Interest

- Dividends

- Rents, royalties, and estates and trusts

- Educational assistance

- Alimony

- Child support

- Financial assistance from outside of the household

- Other income

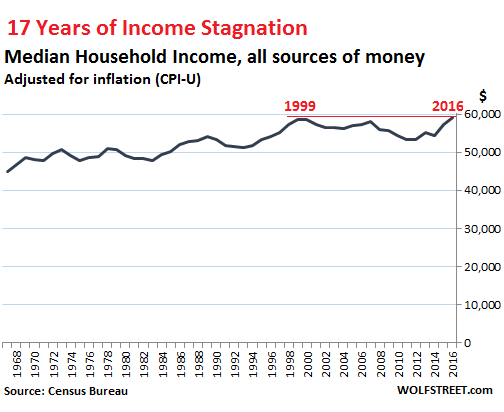

All these sources combined form household income in this survey. Adjusted for inflation via the Consumer Price Index for urban consumers (CPI-U), the median household income, at $59.039, has set a new record, beating the prior record set in 1999 ($58,665).

This was the good news, with median household income finally a tad above where it had been 17 years ago:

And that’s what the media focused on, this triumph of 17 years of stagnation, rather than decline. But buried in the data is a bitter reality for men:

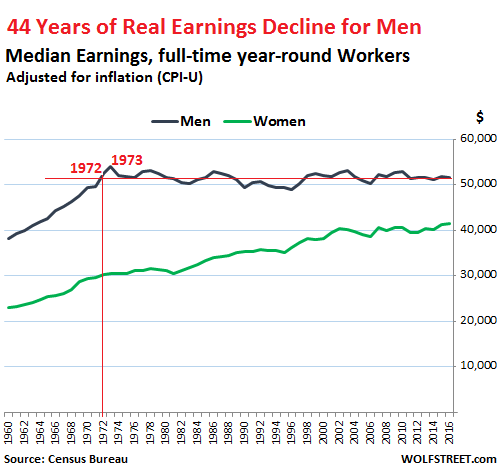

44 years of real earnings decline.

For women who were working full-time year-round, median earnings (income obtained only from working) rose 0.7% on an inflation-adjusted basis from a year ago to $48,328, continuing well-deserved increases over the data series going back to 1960. The female-to-male earnings ratio hit a new record of 80.5%, after steady increases, up from the 60%-range, where it had been between 1960 and 1982. And while that may still be inadequate, and while more progress needs to be made for women in the workforce, it was nevertheless the good news.

Men in the workforce haven’t been so lucky. They have experienced the brunt of the wage repression over the past four decades, obtained in part via inflation, where wages inch up, but not quite enough to keep up with the Fed-engineered loss of purchasing power of the dollar.

Median earnings for men who worked full-time year-round fell 0.4% in 2016, adjusted for inflation, to $51,640. On this inflation-adjusted basis, men had earned more than that in 1972 ($52,361). And it’s down 4.4% from the earnings peak in 1973 ($54,030). This translates into 44 years of real earnings decline:

Time after time, when several years of earnings increases in a row gave hope to men, to where earnings finally rose a tiny bit faster than the official rate of consumer price inflation, a new bout of inflation whacked their real earnings back down where it had been before or even lower.

But throughout this period, nominal earnings (not adjusted for inflation) for men have increased. This makes the loss of purchasing power an insidious effect that simmers beneath the surface.

So when economists at the Fed and elsewhere spout off about the benefits of consumer price inflation, and how it isn’t enough, and how there needs to be more of it, a mantra endlessly repeated in the media, ask yourself: Who benefits from inflation?

There are beneficiaries from inflation: Companies whose sales and earnings rise on paper with price increases without having to sell an extra thing; companies needing cheap labor; or borrowers with fixed-rate debts and incomes that rise with inflation, such as corporations and governments that issue bonds.

But consumer price inflation whittles down the purchasing power of labor and thus weakens consumers. Working women are affected by this just as much as working men; the difference is that women have started out far behind and have seen earnings increases that exceed inflation. And men have not.

So a good way to get the consumer economy off the ground would be to bring consumer price inflation to zero, and make that the stated goal, and allow for real wage increases for men to translate into more consumer demand. Stronger consumers might be a good alternative to the current debt-funded consumption growth that is creating legions of debt slaves — even if it comes at a small cost to corporate profits.

Vitamin World has just filed for bankruptcy, as has Perfumania Holdings. Toys R Us hired a bankruptcy law firm, as has Bon-Ton Department stores. All in just two weeks. Read… Brick & Mortar Meltdown: Bon-Ton Department Stores Hires Bankruptcy Advisor

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

– Mrs. Elisabeth Warren already uncovered this in 2007. She gave an excellent speech, filled with solid data in that year. But her message was a more sober/negative one: “The US middle class is dying”.

http://jugglingdynamite.com/2014/04/15/elizabeth-warren-on-factors-ailing-the-middle-class/

(a video of about 55 minutes in duration)

– Mrs. Warren was then a professor at Harvard and since 2012/2013 now one of the senators for the state of Massachusetts.

https://en.wikipedia.org/wiki/Elizabeth_Warren

-The speech is from march 2007 and was held in Berkeley, California.

I’m making $16/hr right not half-time as a 1099 …. on the $11.50 an hour I made back in the late 80s I had an apartment in Costa Mesa, motorcycles, and I just didn’t cook at home. I’m pretty sure the money I’m making now would translate to min. wage back then.

The way to live now is to be a minimalist, cut down, cars are no longer cool, improvised living spaces are “in”, etc.

And they wonder why people aren’t making the frivolous purchases they did a couple decades ago.

She is a fraud. She purports to be a champion of the middle class, but has blocked a real audit of the Fed – the arch-foe of the middle class – and threw in with Goldman Sachs puppet Hillary Clinton, the epitome of the corrupt, crony capitalist status quo.

Yeah, whew! We sure didn’t get a guy who wavers left, right, contradicts himself in the same speech, is a hack who made less money on his inherited bundle than he’d have if he just put it into an index fund, a bombastic TV show host with hair borrowed from Wally George. Who won’t drain the swamp because he’s in tight with not only our swamp creatures but Russia’s…

– BOTH candidates for the 2016 US presidential elections are/were Extremely corrupt.

– The REAL “arch-foe of the middle class” is increasing productivity. Because it undermines demand (but this something only a very few people understand).

productivity is actually declining. The real arch foe of the middle class is global wage arbitrage–by design. Illegal immigration has been compounding the problem-again, by design

How much does the CPI really reflect the on-going loss of purchasing power? Electronic gadgets and imported consumer goods have become cheaper, evidently. Shelter, education, medical care, food, taxes, energy and related goods and services have gone up in prices by margens more than the CPI…

And then there is debt. Nominal household income should be reduced by a weighted index for the totally unpayable debt that was incurred in the reporting period.

And finally there is an important distribution issue that masks the steady slide towards precarity in the life of most US residents.

Considering the above the report is alarming. And this is the current situation just before a disturbingly high risk of contraction of paid jobs in the next recession/depression…

Tell me what (lie) you wish to come up with and I produce the corresponding “factual” statistic to prove it!

Paul, Montevideo-Basel

The Democrats openly and the Republicans secretly want:

More legal and illegal immigration

The Republicans openly and the Democrats secretly want:

More globalization

Companies accidentally:

Increase serfdom – CEOs are the new lords

While economies grow, since the world is not balanced; there will be shifts amounting broadly to a zero-sum game.

With our 2 party system and their wants of immigration and globalization; incomes would necessarily decline. No one talks about these trends TOGETHER. One party decries globalization while other decries immigration. And no one mentions CEO greed helped by both trends.

Why would the trend to lower or stagnant incomes get better?

CEOs are not the new lords, they are the tools of the real “not-so-new” lords: the rentier, the investor, the leisure class.

“CEOs are not the new lords, they are the tools of the real “not-so-new” lords”

Not any more.

The Globalised Vampire Corporates currently allied with china are the most dangerous thing Humanity has ever faced.

They do not have allegiance to or even the interest of their stockholders at heart. They owe allegiance to the Corporate culture first and foremost that’s how they get to be CEO’S, and stay there.

The Globalised Vampire Corporate, is about the Globalised Vampire Corporate, nothing else.

The economic nationalists who are trying to wrestle the Republican party from the Bush-era globalists are very much concerned with globalization and immigration policies that leave Americans in the dust.

That’s why i have two wives keeps me out of the poverty level. Good women are getting easier to find.

I am bothered by your headline. It implies economic life is a zero sum game–whatever women gain, men lose.

Would you use a similar headline if the comparison was, say, Asian American income rising and white American income falling?

Is any little gain won by one group always at the expense of the next workers down the line?

Good point. Women evidently are being penalized less in Capital’s plundering of Labor. Plunder on then. Nothing can be done. New stock markets highs are wonderful. I’m glad somebody’s banking that money. Think how much more wonderful it will be when they finally get their promised tax cut!

I’m bothered by the chart.

Women’s real earnings should rise faster than men’s, but men’s real earnings should also rise, and at some point they should merge. So women’s earnings are on the right track. Men’s earnings have been on the wrong track for 4 decades. It’s not a zero-sum-game. It’s caused by inflation that eats up purchasing power – and the small nominal earnings gains that men have made.

Maybe the headline should read “43 years of real earnings decline for men, by men”.

This has not much to do with women.

“This has not much to do with women.”

Except that women vote. I’m not saying women should not have the vote, but would this situation have come about if they didn’t? Or women judges in a host of family law courtrooms? There’s a reason for the MGTOW movement.

I noted that two of the income sources in the list, alimony and child support, are almost always from men and to women. They also come straight off the man’s income before he gets to spend it, and added to the woman’s income, effectively counting that income twice even though it can only be spent once.

“alimony and child support, are almost always from men and to women.”

Increasingly, women pay alimony and child support too.

And men vote as well and still preside over the majority of family law courtrooms. I am not saying men shouldn’t get to vote…. but … what is your point?

I think all this “equal pay talk” is just a covert operation to keep inflating the housing market, someone should put up a chart of for example – a single male working as head of household in 1985 and housing prices back then and begin from there.

I’m sure it was something like 10X a single men earners pay, now fast forward to today and it is probably 10X-20X BOTH Men and Women pay.

Basically by shifting the focus to constant men vs women they take the focus away from the real issue with is rampant speculation on just a place to live decently.

My 2 cents

Women are displacing men in the workplace because they are cheaper to hire. At one point my income put me at the highest 2% of women earners, and I still made half what my male colleagues made. It takes a pitifully low number to put a woman in the top 2% too.

I also quit a job once because the guy I hired to work for me was paid more than I made as his boss. Not much has changed since I stopped working.

GE is openly advertising for female engineers. The effort is positioned as an opportunity for women, but it is also clearly an opportunity for GE.

I see that has a good thing for everyone. There were decades when no women engineers were hired at all.

I listen to the radio a lot (no TV) and they even talk about it on the air, how “radio personalities” who are women get paid very, very much less than male ones. Same listenership, etc., but they’re paid less. It’s sad to say that when I’m “hangin’ with Langen” (Maureen Langen) or listening to Christine Craft, they’re getting paid far less. They’re just as sharp as the guys, just as entertaining. Imagine the stink if Brian Copeland, who’s very entertaining and who is also black, was paid a third of what the white guys get.

This is point no. 2349572991384947 why Unions are good, because under a proper Union, you’re pay grade X, with Y years in and that’s it. Just like the Army.

I listen to the radio some, but have never heard a female “personality” be even vaguely as entertaining as a good male “personality”. The same certainly doesn’t extend to literature, there are many excellent female storytellers. Something in the verbal expression is very different.

I hire pharmacists for a living. 65% of the market is female. The men and women all make within 10% of each other. The pay gap for equivalent performers in equivalent professions is largely bunk.

We have two pharmacists in the family. The male has more than 20 years in the business and does well. The other is a young woman new to the industry. She works for a drug store chain and has to teach on the side to pay off her student loans. Overall the pay for the industry is down, which is consistent with the industry becoming more female.

Ahhh .. but the real question is how many of those hires female or otherwise are H-1B’s versus US citizens ?

Assuming you work for one of the chains and your company’s hiring practices live up to the norm when it comes to hiring pharmacists all bets are a lot verging on the majority

TJ ( the real TJ .. :-)

Here in Oz we had a shortage of pharmacists so they imported a bunch.

Then they started up more programs at teh universities.

They didn’t stop importing them however and now…………..

Yep, the pay stinks, there is an oversupply, and they still keep importing them!!!

So women labor competes man’s salary down and at the same time, men are inventing sex robots to compete women out?

Divide and conquer. A maxim old in Roman times.

Good heavens, what industry did you work in? As a female engineer I never experienced that . Were you working half time?

I was in computer consulting then and working half time was considered to be 40 hours a week. I wonder if you know how much you make in comparison to your male colleagues. If salaries are not published, you don’t know. If you are unionized, you are not on the high side of tech earners anyway.

All the women I knew who thought they made good money were all poorly paid in comparison to their male colleagues. This is true even with women CEOs in all industries.

It’s probably worse that you think.

Economic life might be a Ponzi scheme.

Heck life itself might be one.

I don’t really know what women complain about. In software field if a woman knows how to program, even if she is half as much knowledge as the male colleagues, she’ll be treated like a queen.

Software development teams which mainly consist of geeks who have hardly touched a woman will hire women at a drop of a hat.

It is so unfair that women keep complaining. Just amazing. Service oriented customer facing jobs will almost exclusively hire women, and I hardly see any difference in the salaries. Where does all this complaining come from? If anything, it should be men complaining, not women.

It is basic identity politics: divide and conquer.

I wonder if this supposed gender gap is even real. Not in my experience (at least in Spain, where I come from).

I don’t see this supposed gender gap either.

As a matter of fact, if you ask me women have it far easier. My manager who hardly has any time to explain stuff that I need to know, sits with 2 women in the team for hours and explains all the details to them; it’s as if they have a private tutor to them while he has no time for the male employees like me. And no, he is a married geek, he’ll never touch them. He teaches them stuff because he just finds it pleasurable to have them around.

In retail, unless it is some difficult job that requires muscle that women can’t do, women are always hired first. The unemployment between unskilled male workers is far far higher than between unskilled female workers.

The gender gap is low to non-existent if both men and women have:

– same work experience and education level

– same job

– same number of hours worked

That’s not to say there are not companies where pay is inequitable, but in general it usually comes down to women having kids, taking time off to bond and recover, and prioritizing those kids over their job and ultimately their compensation suffers over time.

So presumably the organic fix for inequality is steering women educationally toward better paying careers and possibly coming up with more flexible work scenarios for all parents in those careers that allow it (work from home, flexible work hours, etc).

In my company I don’t see this gender gap

Infact.. if company has to lay off people women are the last to go ..

It’s an era of being diverse..and feminism

Davis – Hostile workplaces rife with sexual innuendo, dick pics, not-too-kind banter, all kinds of BS are a very well documented thing. You must not be familiar with tech culture – we call the guys who do this stuff “techbros” and it’s not a compliment.

A hiring bias toward women in STEM is not a documented thing other than in gov’t jobs.

Alex: I’ve been in tech companies for a while. Tech teams are dying to hire women for multitude of reasons. The fact is that there are not that many women with good coding skills to hire. I have been seeing this first for many years. And women on the team are not held to the same standard. If the woman on team wants to take the lighter tasks, no one objects. If a male member does the same, he’ll be kicked out in no time.

I don’t know how old you are but there were many women in the tech field when I was working in it. Over the years we were pushed out.

Starting out I made the same money as the guys, but women don’t get the chance to move up like the guys do. I was given project management responsibilities without the title, the pay, and without asking me if I wanted to do it. I have worked for managers with no degrees, and/or no degrees in the field. I experienced sexual harassment as well, but I considered that more of a Wall Street culture behavior than a tech industry behavior.

This was all on top of the grueling work that programming and project management can be.

There’s been multiple articles in The Atlantic , NYTimes , WSJ etc over the past 12 months on the extreme gender biases in Silicon Valley , digital gaming and the Tech industry in general verifying what you’re saying to the letter .

Suffice it to say .. gender bias is alive and well in the tech industry . So much for techs ongoing promise of egalitarianism .

Some time ago, I was watching a discussion on PBS about the remedies to the financial crisis that was in full swing. The three male participants, a bunch of facile Wall Street and academic court jesters types, all agreed that the measures were adequate. The sole female participant maintained they were just kicking the can down the road.

So there you have it, a lack of team playing skills.

Petunia – what’s happened is, there were a lot more women in tech in the 80s and from then to now they’ve been pushed out.

Dilbert, a cartoon, is merely reflecting reality showing that one lady engineer and a sea of guys. And the lady engineer’s a sharp and tough cookie because she has to be.

Truly depressing charts!

Compare 1999 average prices to todays average:

Student Loan for BA was 18k, now 29K.

Average home price was 119k, now 188k.

Disney one day pass was 41, now 96.

Cell phone was 40.24, now 73.

Movie ticket was 5.06, now 8.33

Milk was 2.88, now 3.65.

Six pack of Bud was 4.01, now 5.99.

Etc….

And the retail, restaurant, car pundits wonder why we are not spending?

Wolf, typo on first Bullet point regarding “between 2015 and 2015”.

Thanks about the typo.

I’m in Michigan and a gallon of milk is $1.21 and eggs are .43 a dozen at walmart and a matinee ticket at the movies is still $5. Republic wireless has a cell phone plan for 13 per month.

Those are certainly outliers.

James, glad to hear you have it good up there. These were National “averages” posted across numerous websites. I’m in CentralTexas and eggs are and have been expensive for years. Even the cheapest of eggs are inching close to $4. Bacon is crazy expensive. And no, I do not shop at Whole Foods. Non fancy (non organic, non extra protein) milk maybe $2.25.

The older theaters still have $5 matinee, $8.50 at night. But the cost of popcorn or a drink, or even water is ridiculous. I don’t partake but just wondering how families can afford it. Check out the falling ticket sales and falling stock of those theater chains…I guess they can’t.

Wondering what your State college tuition is? What are your gas prices?

I have heard there are some good deals on Houses in Michigan though. :-)

Does anyone take the Chapwood Index? I am wondering how different price inflation is in different areas. More rural, larger cities, wealthier States?

TheDona – if you can keep chickens at all, you’ll thank me for advising you do. They’re entertaining, they’ll eat your table scraps, and provide very nice eggs.

Movies in the city cost $13 at a normal theater. Most people don’t go to the old run down normal theaters anymore. They have all been converted to high end theaters.

$16-$18 dollars a ticket. Assigned seating. Reclining lounge chair. Alcoholic drinks and restaurant food are available. Smaller screens and cozier theater.

Thats in So-Cal anyway.

I recently noticed a former employer created an HR mantra about “reallllllllllllllly wanting women and people of color” to apply (in Timbuktu USA). I very recently noticed their new hires were all women except one Asian man. No matter your race, color, or creed, how can this behavior be acceptable (let alone legal)? It’s bullsh/t and I’ll never work for that place again. Wondering if I should contact them or not (as if they cared)…

Carlada, this plays into the diversity narrative they are cramming down our throats. Companies bragging about their diversity is code for cheap salary. The push for welcoming all immigrants with open arms is code for we want a slave class we can pay the cheapest possible minimum wage to…(and can subsidize with the taxpayers shrinking take home pay).

By the look of the diminishing consumer sales numbers across the board, one would think the Overlords could see the handwriting on the wall.

I would never work for a company openly recruiting just women or minorities, and I am both. This is like a flashing sign saying we never wanted women or minorities before, but now we are willing to try.

Funny My wife of 25 years never worked and I increased my annual income from around 35k in 1977 to 250k in 2008 when I retired effectively Guess IM NOT average

The first thing you need to do is adjust your 1977 income to inflation. Between 1977 and 2016, the Consumer Price Index rose 315%. So 35K in 1977 would be $145K in 2016. So you already made a heck of a lot of money in 1977 for a guy just starting out. Try to make $145K starting out today!

Then the rest of the increase is due to increases in productivity and skills … you got better and faster and did bigger and better things. That should pay more.

But the median earnings data is for all men as they cycle through their working life, with young ones entering and others, like you, retiring.

A couple of comments:

1. As a family increases in size, the marginal cost of housing that additional person is probably close to zero. The additional cost of each person in a housing unit is limited to such things as electricity and water. Ever wonder why so many people new to a country cram into one housing unit?

Food is another cost that impacts the bottom line on a marginal basis more than that additional housing cost.

2. Just how many ‘families of four’ are there now anyway? What is the official poverty rate for an individual? With those family units there is more government assistance going to them than a single person.

Here in Australia the worst position a family unit can be in is one working person and one retired with no children. That family unit gets screwed over on everything.

And by the way, at US$29,600 equivalent income in Australia you are at the 32.5% marginal rate. That also means that a person on minimum wage here working a full time job who gets any kind of pay increase next year is going to be in that bracket.

So if they get a A$1000 increase in income the government here will take $325 of that as income tax, another $25 as medicare tax, 1.5 cents per dollar reduction in the low income offset for every dollar over A$37,000, and it will wipe out any rebate on the mandatory 15% tax on retirement payments paid by employers.

That last one is a big whack as if you make A$37,000 you’ll get a A$500 rebate. If you make A$37,000.01 you won’t get the rebate. That will save the government here a lot of money over the next few years.

And by the way, the cost of living here is much higher than in the USA.

Wolf – Frederick was juuuuust in time to get onto what I call the escalator. There was a sort of wage escalator in operation that was set up right after WWII and midway through the 1970s it broke down. By the time I entered the work force in1980, the escalator was broken, but if I’d entered the workforce in1975, say, I could have taken just about any cockamamie job and it would have been just up, and up, and up.

Instead I entered the workforce during a recession and what’s worse, I fell for the college scam. I’ve never recovered. In my area, I’m damn lucky to make the $12k a year I do now and get to sleep under a roof.

I also hopped on that escalator just a few years later. I identified the demographic obstacle of too many baby boomers competing for the same jobs, or too many youngish bosses that prevented promotions. Many of those had advanced degrees of MA/MS or were ABD.

During those years I devised a strategy to overcome that obstacle, by seeing how I could avoid having to compete with so many people. Why make myself one of a thousand when I could make myself one of a handful. That involved researching, learning and applying technical skills and then planning to go to grad school. I looked at many options and decided that business school was the most interesting. The MBA degree gave me access to higher paying and faster growing jobs at a very good time. People who graduated a few years later got slammed with a market crash and some never recovered.

The more I prepared, the luckier I got, or so I told myself. I freely admit that someone doing exactly what I did, only a few years earlier or later, or in a different city or whatever, would not have benefited as I did. Now I try to help others find their way, as I owe the world for my good fortune.

I’m surprised household income hasn’t increased 30% or 60% considering how many households have doubled and tripled up. The fact that households have increased a few percentage points in income despite the double/tripling number of people living together, is not a good sign. When your household doubles in size and your income is up less than 5%, there’s nothing good in those numbers.

BTW, millennials who work tend to live in shared environments with family or roommates, so their households may show large incomes, but they are barely surviving.

should also add more debt per capita as per capita debt has been rising faster than wages.

the data is at St Louis Fed’s Fred site.

In 1974 I was working as a 3rd year carpenter apprentice, (BC Canada), just out of high school. I had worked in the trade from age 13 for my brother who was a builder, and my time was recognized by industry and Union. I was paid $7.00/hour. When I drank at the local pub I could buy 4 glasses of draft beer for $1.00. (Yes, I was underage and loved every minute of it!!) When I smoked, cigarettes were under $4.00/ carton, call it an even 45 minutes work. Bread was around $1.00 per loaf. A case of 12 beer (bottles) from the Govt. liquor store was around $3.00. In other words, I could buy 2 cases of beer for one hours work, or about 25 glasses of draft. I could fill up my small truck with gas for about 1/2 hour work. I could buy 3 trucks with one year of net pay. You get the point.

Nowadays, the same apprentice would need 1 hour of work for the case of beer, 2.5 hours of work to fill the small import truck, and 4 hours of work for the carton of cigarettes. 1.5 years of work for the same small truck. A home? My $35,000 starter shack would cost $200,000 today. My starter home in ’75 cost 2 years take home pay. An apprentice today would need 5-7 years of take home pay to play the housing game in the same town I grew up in.

My last formal employment was working teaching construction and mechanics at a high school. I made the same amount of money as my female colleagues. With a Masters degree, 2 trade certifications, and 17 years experience teaching I made $85,000/year, about 2/3 what I would have made working in one of my trade(s) in the Private sector. But, I received a pension as part of my renumeration that is sound, currently funded at 105%, with a yearly COLA. My RRSPs purchased privately have not been so great. Our greatest gain was made by selling an expensive home and buying a fixer-upper in the country. The newly re-built home is irreplaceable. It took thousands of hours of sweat equity to achieve it, and it was something my wife and I did together.

I am 62 and have been retired for 5 years. I am also currently building a rental for future income/investment.

The only thing working people can do to get ahead is control personal debt. I have always done so and we have always lived below our means. It may not be good for the economy to live in such a manner, but I wouldn’t trade my life with a billionaire. In fact, one reason why we never buy lottery tickets is that it would ruin our lives. (plus, the odds of course).

People, working men, can still get ahead if they have a plan, strategy, and limit debt. My kids are doing well, and while it is certainly harder these days than when I started working, they also waste a lot more money due to easy credit. If you look around, wherever you live, the latest group of immigrants show you how it is done. There is a reason why Surrey BC and the Fraser Valley is populated by Sihks and Hindus. There is a reason why they own the 7-11 stores and work in the mills and fields. They are buying a home, then another, one day at a time. When I was a kid it was the Italians. You just have to suck it up and accept that no one is owed a living, and that most companies and organizations will try and screw with your wages; certainly if they have to.

Life is still good in North America, but you need a plan and a strategy to follow; plus skills and work ethic…..and you absolutely have to control debt.

regards

Unfortunately the situation is not like that at all for the very rich.

What is happening is that they have parasitically sucked all of the gains for themselves.

Productivity has almost doubled since 1973. It would have grown even faster were it not for vulture capitalism, which really isn’t productive. Most of the money is worthlessly used in areas like stock buybacks, a waste for society.

https://www.ineteconomics.org/uploads/papers/LAZONICK_William_Profits-without-Prosperity-20140406.pdf

Other predatory practices have been covered extensively by Wolf here – but the bottom line is that the rich are waging class war on the rest of us. We are losing and badly.

Paulo – Exactly where I screwed up is the first day I set foot on a college campus and the other major screw-up was when I called the number on a little ad in the newspaper and actually sat and interviewed with the local Union rep for the carpenters’ union.

I grew up messing around with wood and tools because my dad was a hobby carpenter of amazing ability. I’d use up this whole screen talking about all the stuff he designed and made.

My Dad was at least as stupid as me. He thought programming computers was a viable way to make a living you could raise a family on. His real skill was in carpentry and I mean from making a little wooden box to put on your desk to literally designing a house and presiding over its construction.

Being white (and he was very white; it appears the brown-ness I got from Mom’s side originates from a group called Tatars, Tatar tot jokes in 3… 2.. 1…) makes for a hard life in Hawaii. But being a carpenter, a tradesman, life would have gone much easier for him, and for us. He’d get little dribbles of work for places like Grumman or the Hawaii Visitors’ Bureau, but you can’t live on crumbs.

I agree that life is good on the Mainland USA. I don’t live in the atmosphere of fear I did where I grew up; that’s why I got out of there. I could go out on the street here on the Mainland and do fine. There’s food, no end of useful stuff being thrown out, and all kinds of casual work that can be gotten.

You will never live as well as a European here, but 99% of us are stuck because we’ll never have the money to emigrate. You will likely never own a car or a house, but even on my $12k a year, I’ve got Norman Rockwell’s Five Freedoms.

Oh, to clarify, I mean, I interviewed with the Carpenter’s Union guy and he wanted me to drop college and start training – at a very good pay rate, something like $7 an hour – and I chose to stick with the life-wrecking college idiocy instead.

Now, I agree that college in most cases is waste of time. As I have mentioned here before, I’m going through interviews for new software development, and in the interviews you are supposed to know the details of so many different technologies that makes you think are these people for real? Academic wise, I’ve always been an overachiever all my life, and if I have problem with these expectations, imagine how an average programmer feels.

To give you an idea what a software development interview, at least in the Bay area is like, imagine this: You are an architect and wherever you go for interview, they expect you not only to design the house, but expect you to do the bricklaying, plumbing, electrical wiring, etc. So, you are not only supposed to design the house, but also build it all by yourself. And it is not enough that you say you will do it, no; right in the interview, you are asked detailed questions of how you do plumbing, wiring, bricklaying, etc. Oh, wait, you are also supposed to know how to handle mortgage and taxes for the building.

Most of the times when I’m in the interview, I really feel like giving the interviewer a finger, and tell him to go … himself.

Just to add, so, that’s the reward that a lifetime of academic overachievement has given me. Higher education is a joke these days.

Reasonable conclusion. See

http://mcduffee-associates.us/dissertation/valed.pdf

for my simplified cumulative discounted cash flow analysis of the value of post secondary education in 1999.

Higher education is certainly more expensive these days, and for many people just out of high school learning a trade at a two-year tech program may be a wiser choice than taking on debt to get a bachelor’s degree.

But, I don’t think that getting an engineering degree, for example, is a joke R2D2. Hell, I got a bachelor’s degree in physics 32 years ago, and have done absolutely nothing relating to it since, but I wanted to study physics and math; so I did.

Dan Romig: If you don’t care about money, or good life, then it is not a joke. You take a look and see many realtors in the past 20 years have done better than many in tech despite the fact that most of them have a high school diploma; this is specially true in countries like Canada, Australia.

Higher education, assuming you are in a field that is in demand, like software engineering just ends up in high stress jobs which hardly pay any meaningful salary. I basically have no life because if I want to have a job, I have to keep learning; what kind of life is this? Higher education might bring you good life only if you are becoming a medical doctor or dentist, and that is because that allows you to have your own business and offer your services directly to people.

A college degree is only worth what you make of it. It is still the bar to attain corporate jobs for 99% of us. Most companies it is a requirement to have a 4 year degree to get in the door. But it depends what the degree is in.

The only mistake some people make is overpaying for a 4 year or grad school. Many take out loans to rent housing and cray shit. You need to weigh job opportunities against education invesment.

George McDuffee: Thanks for the link to the document; that’s the kind of analysis that I should have done when I started going to university.

There are other issues/damages as well. As an example, I am so busy learning to keep my job that I can’t spent time to seriously learn about money, stock market, bonds, etc. So, when it comes to money and investment, I am an illiterate idiot.

Hear hear! Thanks for a genuinely inspirational tale, witth solid, real world examples. I remember the summer of 1978. I was painting houses for a realtor in Detroit. My partner and I 916-17 yo at the time) worked our tails off, and made 450-550/week. To this very day, accounting for inflation, I have never made more. Given that I was a kid, living with my parents with virtually zero direct living expenses…. That was as good as it ever got.

No complaints, but the real money for a working man is gone. It has been gone for a long, long time, and it is not coming back.

Inflation makes your housing debt look smaller, year by year. Inflation also hides the fact that your employer may actually be paying you less, year by year. A mixed bag.

I suppose I don’t think the chart is fundamentally a story about inflation.

I’d say the chart is really about the effects of declining labor power, globalization, and the long-term hard sell of the idea that ALL boats would be lifted by fee markets and trade. The people who made these arguments (or their patrons) benefited from them, but many if not all of them knew damn well that “a rising tide lifts all boats” was a lie. It’s a winning metaphor. It sounds “right”. But it doesn’t apply to what they engineered.

Ed, you Said, “Inflation makes your housing debt look smaller, year by year.”

That is one of those often cited half-fallacies. Inflation only makes debt look smaller if it is WAGE inflation, not consumer price inflation. In other words if your pay is stagnant, your debt remains the same burden. If your pay rises due to wage inflation, then it helps pay off the debt. But wage inflation is precisely what men are not experiencing. See chart.

If your real wage is flat and there’s 2% inflation, your debt has shrunk relative to your income. I’m not saying that makes the median homeowner rich, but it is a real thing.

Best rgds

Ha, sorry. Debt payment, assuming fixed rate mortgage, which is I think the standard way to look at it. If u just consider debt, it could work out all sorts of ways, depending on what wild kind of mortgage one has. :)

“Inflation makes your housing debt look smaller, year by year.”

Interest rate repression, and bogus inflation calculation could make your housing debt look smaller. Straight from the FED, central banking playbook.

What’s more important, household income or savings? Just about everything I’ve read about savings in the last year paint a much uglier picture than income numbers do.

Good point. Those good blue collar jobs used to come with a pension. Savings (including retirement money) chart won’t be prettier, I agree.

The existence of modern cartels makes it possible to enforce hiring quotas of women. Large government contracts require suppliers (and their suppliers) to track and report percentages of female workers and managers. The legal community also serves as a watchdog to pounce on any organization that looks like an easy target for a discrimination suit. (yes, I know people working in procurement claim to have never seen such practices in 30 years.)

Companies due not have to fear being at a disadvantage with hiring quotas when they know their competitors have the same issues.

Industries and professions that reward participants purely on performance are filled with men: flipping homes, realtors, venture capital, home repair trades, software consulting, content creators, website creators, mobile app developers, etc.

It should be common knowledge that the Fed’s policies are meant to benefit only a select slice of society. As you say, consumer price inflation is in no way meant to help the consumer. Rather, the Fed wants the consumer to load up on debt to benefit those institutions that earn a profit from that debt, in the same way it keeps rates low to force investors into a risky stock market. It’s amazing that such an undemocratic agency is allowed to do what it does. 10 years after the financial crisis caused both by its actions, and inactions, and with hardly any growth since, the Fed still receives fawning treatment from the financial press. It makes you wonder, just how badly does the Fed have to make things, and/or allow things to get so bad, before it will be forced to account for its incompetence?

The so called Feds and media are both under the control of the same group. So, never expect for the media to treat the Fed negatively ever.

Paulo has touched on the answer. Anything in the system is fixed.

The farther out of the system you go , the more independent you are and the more of your equity is kept by you rather than expensed away.

Build a house or a substantial fixer-up and you avoid the much higher taxation, ( outside labor and implicit taxation on that labor, profit, much more borrowed money).

The more you can work away from urban areas, the costs of living will be lower, and any work you can do yourself is taxed at a much lower rate. Its a question of the government not being able to judge the amount of labor you do and its taxable value.

The more the oligarchy can financialize you existence, the more taxes they can extract out of you and the higher your expenses will be.

Bingo. Thanks for the nudge. And to Alex for his comments.

My son is an electrician. He ditched his local contracting company, found work for his staff, and returned to working away making 3X what he did in the rat race. He does side-jobs when the mood strikes. The point is this, if you land a roving gig you actually have more time off because when you are at work you can totally focus on work, and when you are at home you are left alone. I used to fly and manage a small airline. I had to specifically instruct dispatch not to call me at home unless it was an emergency. That was a unionized environment to boot. Other industries are worse. Even when I taught school I would get calls at home evenings, and always worked at least one of the weekend days off either marking or setting up.

Working away is okay and it isn’t a bad way to go. I know helicopter pilots who live in Mexico and work in the arctic. When they are home they turn their phone off. Every trade and profession has these opportunities, you just have to search them out.

regards

FWIW an observation from my 1999 dissertation appendix.

http://mcduffee-associates.us/dissertation/femwork.pdf

You may also find my conclusions in 1999 of interest

http://mcduffee-associates.us/dissertation/Chapt5.pdf

feel free to browse the entire site.

1% of the worlds population owns what 95% of the rest owns…the other 4% pays the taxes….the deep state has almost killed the goose….next step thin the ranks and enslave anybody left….1984 came and went and nobody even noticed…American middle class is history,…it’s just to hard for people to face the truth…can you?

Mugsy – My product/company right now are are stuck in hang-fire, because I need to come up with buckets of money to give to the IRS first.

I’m seriously wondering if I should do it at all. I think it’s a great product I’ve thought up and I think a lot of other people will think so too, but the $150 a month to join TechShop and the $200 for the two classes I need to take, the cost of filing the fictitious business name, the cost of materials. of course I’ll have to send several of the product out to some people for free, the fees for all the papers and licenses I have to file …

I’ll have to go back to playing my trumpet (I can make as much as $60 playing Friday-Saturday-Sunday) or come up with some other black-market racket to even have a chance to do something “legit”.

Meanwhile the rich aren’t paying 20% income tax, they’re paying nothing or next to it.

I’m not convinced if inflation was zero, there would be incentive to increase wages? I always thought the curves of supply and demand were applicable even to wages.

Agreed.

But it is really hard to DECREASE your employee’s wage. In other words, negative inflation makes higher real wages likely . . . For those who stay employed. :/

The article is right 100% that inflation makes it possible to decrease real wages. That has happened to minimum wage folks, of course. I probably was too positive before in saying inflation is a mixed bag. It is for the middle class. It’s been bad for the very low income working poor, if they don’t qualify for food stamps, welfare, etc.

And there are the gains in real productivity.

After reading all those comments i’m getting a third wife.

You mean you’ve been limiting yourself to only 2 wives? Oh, the humanity :).

Bad though the stats are the global median income is about $1400 USD a year. There is no real global middle class, only the very very poor and the super rich.

If you eat three squares, own a home or a car then you are very very wealthy.

It’s a world of squalor and dire poverty out there. TV only shows you the sparkling towers in the cities, not the shanty homes below the towers that stretch to the horizon. China is no exception.

Can someone help me with the numbers; if earnings rose 0.7% for females and fell 0.4% for males then how did the overall number increase by more than 3.0%?

Household income, which rose 3%, includes the 18 sources of money (see the list in the article), such as #1 earnings, but also dividends, government aid, etc.

“Earnings,” which fell 0.4% for men and rose 0.7% for women, is just the money earned from working. It includes no other sources of money.

The CPI can no longer be used as a measure of inflation. It has been heavily manipulated for decades. Do any of you really believe inflation has only been 1-2% for the past few years? You can go to Shadowstats.com where the economist John Williams recalculates the CPI based on the original methods.

Highly depends on which consumables and assets you look at. I would do back flips if price in housing were only rising at 2%. Try 8% yoy in my area…

Food has been fairly static, gas is down. You can still get a used budget sedan for about the same price as in 2003.

Education costs are rising way faster than 2%. Rent is rising faster.

Telling the boss what he wants to hear is a time proven way for promotion/advancement…

Although it doesn’t account for real differences between incomes, here are a couple of things to include into the equation :

1. Men are biologically wired to compete, women to cooperate. That can be seen already at an early age and in workplaces where women outearn and probably outnumber men.

2. Relativizing declining real wages seems to be nicely working as a red herring. The country has been highjacked by those who have become disproportionately rich and powerful without contributing any real value and for these people we are just targets in their virtual reality.

I hate to say this, but without leverage against the, the rest of us are fish in an overcrowded pond, discussing life, while waiting to be eaten.

Silly Me – Check in on any all-female workplace where it’s a constant Mixmaster of cheap shots, innuendo, and backstabbing, then check in on any infantry company, sports team, or “gotter get’er duuuuun” workplace where it’s a sausagefest and re-evaluate your words.

Blanket statements like “Men are biologically wired to compete” … etc are just not true.

I’ve also seen stuff like “Men understand mechanical things, women are more verbal”, well, I worked at a WWII submarine memorial and I found it 50/50 between men and women whether they were genuinely interested in – and understood – the technical details we were dishing out.

you know the inflation figures have been fudged by our government over the last 50 or so years. The working class has been thrown under the bus. The average factory wage according to the government was 6400.00 in 1960 which would be over 75000.00 in todays $ if measured correctly. Just a declining standard of living for the folks in flyover country . And folks wonder why Trump was elected. Lol

Well those same folks rejected the “socialist” republicanism of Eisenhower which included strong support for collective bargaining, strict limits on banks, strict controls on monopolies and heavy investment in infrastructure for the libertarian republicanism of Reagan. They knew the consequences.

I haven’t read all the comments so someone may have mentioned this.

Seems to me that the real beneficiaries of inflation are governments and corporations that pay back borrowed funds with cheaper dollars. The fact that prices go up is essentially another transfer of wealth from the consumer to the governments and corporations.

“Seems to me that the real beneficiaries of inflation are governments and corporations that pay back borrowed funds with cheaper dollars.”

Cat,

That was, and is currently, the accepted paradigm….Hence the Government target of 2% inflation…insensible, yet like the magic of compound interest, effective in managing national debt.

Governments and Corporations? How about 30 year fixed mortgages? We all have benefitted, and many will continue to do so until the music stops…it’s very faint, but I can…still hear it…I think.

I was on the sales force of several large software companies in the 1990s. There was no difference in compensation between genders. Oh, and aggressive , ball busting men were called A-holes. Not admired. Same for the women. Equally disliked.

My take from this release is that the MEDIAN person is doing okay — their income has kept up with inflation (since 1972 for men) and has grown steadily for women. So “real” income is the highest ever for the median HH!

The more important story is what has happened to the two tails of the distribution. My husband and I are 50’s, dual income, college grads and make about $190k. Probably fairly typical for California. But folks that didn’t go to college or are work in certain sectors of the economy make very little. So the spread between families has gotten so much greater than when we were growing up in the 1970s.

When you look at wealth rather than income it is even more stark. It seems we are hurtling ever more toward a “winner take all” society. I actually wish we were more like other countries where the income distribution is tighter and our taxes were more geared to a good social safety net. I think people on the average would be happier.

Check California’s income tax charts. People making very little are not getting taxed and often get free health insurance (definitely for their children). They are not suffering. Often they get subsidized food and rent. “Winner take all” is often at the bottom of the income charts.

Respectfully william, our HH at $190k is on easy street — even in pricey CA. We do not begrudge paying taxes that go to programs to help others. Yes, a few poor people work the system and get a few goodies, but generally they have a pretty rough go of it.

My mother lives on $890 a month social security, so I am well aware of all the programs to help the poor. It is a ton of work to keep her enrolled — and the benefits she receives are fairly minor. Her “subsidized food” as you call it is $85 a month. I actually like paying CA’s high income tax and knowing that a tiny bit of it goes to help people like her.

Much of CA is not pricey. Home prices can drop upto 90% by driving 50 miles.

If everyone paid a share of income taxes, even a small amount, there would be more consensus among the residents for prudent use of taxes by the gov’t.

A couple of observations on the numbers and some amateur psychology:

1. It is apparent that the rate of growth in median household income is no longer fast enough to give a lot of people a healthy vision for their future. If you look at the ’50’s through the ’70’s, income growth was fast enough that at least your average white American had little concern for their future or that of their children. It was only going to get better.

2. The numbers don’t take into account the precariousness of people’s employment. Imagine making the median income today and yet knowing that you had a job with your company for the next 30 years, and had healthcare paid for and a great pension.

In some ways the country is in much better condition today than 40 years ago. Better built cars, more entertainment, better chance of living through cancer.

But in some ways it is also much worse.

– There’re a number of other metrics that don’t bode well for the US economy. E.g.:

– Median Household income peaked in 2000-2007 and never reached that peak again (chart from 2011 (???)).

https://1drv.ms/i/s!AluvxwylJSzygSEIwjag_8AH0izW

– Labour participation rate also peaked in the year 2000.

https://1drv.ms/i/s!AluvxwylJSzygSIdSBwEUkrnVwF9

– We here in the US had a babyboom that started in 1935 (No, NOT 1945) and lasted up to 1961/1962. And 65 years laters those babyboomers started to retire in the year 2000 (= 1935 + 65). No, the babyboomers did NOT start to retire in the year 2010 (= 1945 + 65). See the black line in the chart attached.

https://1drv.ms/i/s!AluvxwylJSzygSOVQknRByNkhoqb

Source: Harry S. Dent.

And despite the Census Bureau’s Income and Poverty report, there are tent cities sprouting up in every city in the SF Bay Area. I’ve been here since 2002 and things have never been this bad.

The college scam and YOU!

https://www.reddit.com/r/collapse/comments/6ztkp9/americans_losing_faith_in_college_degrees_poll/

Charts like these are almost to simplified to draw any major conclusions from.

There is a lot of disparity based on occupation as to which groups are seeing wage growth and which are in decline. It would be far more interesting to see those numbers to see if there are any occupations benefiting from wage growth.

Or if really every is getting shafted by the investor class as they absorb all the additional wealth generated by our increased productivity.

A good piece until your policy suggestion–reduce inflation to zero, say what!.

To hit a target inflation rate of zero, the Fed would need to raise interest rates significantly–it restrains inflation by reducing economic growth, which raises unemployment. Higher unemployment is the lever it uses to restrain inflation!

Is that the solution you prefer? A proper policy would focus on how to restore worker bargaining power, which improves with low unemployment…

There is no connection between low or zero consumer price inflation and employment. But there is a big connection between consumer price inflation and the destruction of real wages.

Interest rates should be higher. They should have never been this low, except for a brief period during the crisis when credit froze up.

Low interest rates have caused a host of problems. They’re in part responsible for the slow pace of corporate investment in productive activities, and they’ve pushed corporations to blow money on share buybacks instead (with borrowed money). They have caused asset bubbles all around, including housing. Among other things, this has driven housing costs up to where housing costs eat up too much of consumers’ incomes, and these consumers don’t have enough money to spend on other things.

Low interest rates have wiped out the cash flow to savers, who have $9 trillion in banks that has been earning next to nothing for eight years. That destruction of income has caused them to cut their spending. And this has been one of the reasons consumer spending hasn’t risen faster. 2% of $9 trillion is $180 billion a year. That’s around 1% of GDP.

Interest rate repression of the type we have seen over the past eight years has caused capital misallocation.

Interest rate repression has insidious impacts on the economy. And some folks at the Fed see that too and they now want to back out without blowing up the construct they have built.

A policy goal of zero inflation would do great things for the real economy, though it might hurt the participants in the financialized part of the economy. A “policy goal” – whether it’s 0% or 2% — doesn’t mean that the Fed reacts every time inflation deviates a little from the goal.

With consumer price inflation, you have to ask: “Who benefits and who gets hurt.” Labor gets hurt because it crushes the fruit of their labor.

I’ve always questioned the inflation metric as well. If there is anything that destroys purchasing power and quality of life- it is a policy aimed at creating inflation.

“If there is anything that destroys purchasing power and quality of life- it is a policy aimed at creating inflation.”

Ray,

If inflation is coupled with real growth, and wages reflect that growth, than it is acceptable to the working man, and a big win for the Government. This occurred between 1960 and 1985 (M/L) and people lived relatively well, and the Government, with taxes collected and debt sold, prospered. We received the crumbs…and the crumbs provided many of us a decent life.

If there ever was a “golden” era in American life, it was a result of that deficit spending, and that insensible 2% inflation target.

Now, of course, without 3-5% growth and with income stagnation, we are screwed.

(daaaamn… talk about throwing down the mic!…. it got QUIET….mad quiet…)

The picture becomes clearer if the average income is compared to the change in costs of things people buy with that income; most notably the price of houses over the same time period.

Incomes flat and asset prices rising = swindling of wealth from poorer to asset owners through currency printing.

Even the middle class is starting to feel the effects of assets outside their price range.