Not quite, not yet, but it’s not good either.

Let’s hope that the problems piling up in the used vehicle market — and their impact on new vehicle sales, automakers, $1.1 trillion in auto loans, and auto lenders — is just a blip, something caused by what has been getting blamed by just about everyone now: the delayed tax refunds.

In its March report, the National Association of Auto Dealers (NADA) reported an anomaly: dropping used vehicle prices in February, which occurred only for the second time in the past 20 years. It was a big one: Its Used Car Guide’s seasonally adjusted used vehicle price index plunged 3.8% from January, “by far the worst recorded for any month since November 2008 as the result of a recession-related 5.6% tumble.”

The index has now dropped eight months in a row and hit the lowest level since September 2010. The index is down 8% year over year, and down 13% from its peak in 2014.

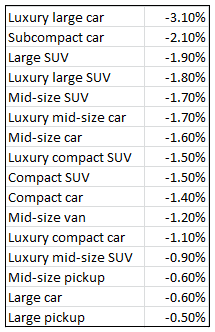

The price decline spanned all segments, but it hit the two ends of the spectrum — subcompact cars and the luxury end — particularly hard. The list shows the change in wholesale prices from January to February in vehicles up to eight years old:

NADA blamed three factors:

The surge in new vehicle incentive spending. Automakers, drowning in unsold inventories on dealer lots and desperate to move the iron and keep their plants running, increased incentive spending by 18% to the highest level in over a decade. This made new vehicle more competitive with late-model used vehicles. So this would be on the demand side.

The growing flood of used vehicles going through auction. Over the first two months this year, volume of vehicles up to eight years old rose by about 5% year-over-year. Volume of late-model vehicles – the supply from rental car companies and lease turn-ins – jumped 10%. So that’s on the supply side.

The IRS tax refund fiasco. Restaurants, retailers, and others are already blaming various February debacles on these delayed tax refunds. After the IRS was hit with millions of fake e-filed tax returns last year that claimed the Earned Income Tax Credit and the Additional Child Tax Credit, Congress required the agency to delay sending out refunds this year.

It’s big money. According to the IRS, refunds issued through February 10 plunged 69% from the same period a year ago. That’s $65 billion that didn’t make it into consumers’ bank accounts. But then the money was unleashed. In the week ending February 17, the IRS sent out a record $74 billion in refunds. By the week ending February 24, refunds were down only 10%, or $15 billion, year-over-year. So most of the problem was resolved by the end of February.

That might explain part of the problem on the demand side, at least at the lower end of the scale. But it’s hard to explain the plunge in prices at the luxury end. Also, these are wholesale prices. They don’t react instantly to a brief consumer cash crunch caused by tax-refund delays, now resolved. Something else appears to be going on.

The report, in attempting a forecast, cautioned:

February’s unusually soft showing makes pinpointing where used prices will go over the next few months a bit more challenging. However, given the slower than usual rollout of federal tax refunds, it’s assumed prices will be somewhat stronger in March and April than originally anticipated.

The Used Vehicle Index by Manheim, the world’s largest wholesale auto auction, didn’t pick up a massive drop in used vehicle prices over the past few months, though it too is showing some weakness. The index edged down 0.2% in February. The report pointed out that, “given a sharp decline in pricing in February of last year, the Manheim Index now shows a year-over-year gain of 1.1%.”

The index has dropped in six of the past seven months (chart), but in small increments, and as it says, “stability remains the watchword.” It too acknowledge headwinds for the market, including the “heavy new vehicle inventory and incentives,” and “a crazy tax refund season.”

Why are used vehicle wholesale prices important?

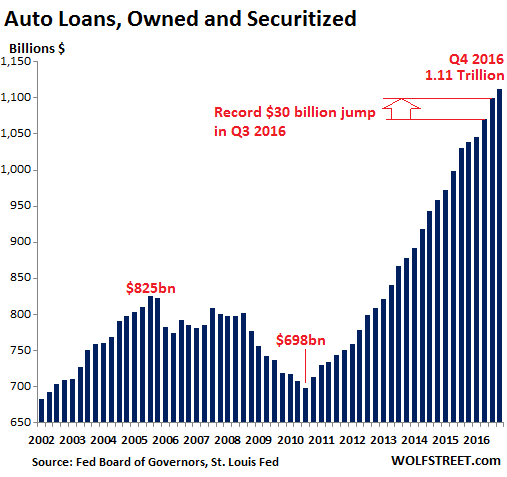

For one, they matter to lenders. Used vehicle wholesale prices determine the value of the collateral for $1.11 trillion in auto loans that have boomed on higher prices, higher unit sales, longer maturities (the average hit a new record of 66.5 months in Q4), and higher loan-to-value ratios (negative equity):

Dropping wholesale prices increase loan losses for lenders as recovery is lower. Declining wholesale values of lease turn-ins, if the trend persists, impacts how finance companies structure the lease terms, thus raising the costs for the customers and putting a damper on leasing activity.

All this puts pressure on new vehicle sales, further pushing automakers to pile on even larger incentives in order to move the units, grapple with inventories, and keep plants open. This works for a while – there’s nothing like big-fat incentives to bring out reluctant buyers. But incentives, when everyone is doing them, are front-loading sales. This is ultimately self-defeating and gets very costly even as sales begin to decline. It was a contributor in the collapse of the industry during the Financial Crisis.

And there are well-established patterns of customers switching between new vehicles and late-model used vehicles. Large incentives by automakers put pressure on late-model used vehicles. In turn, falling prices on the used vehicle side cannibalize sales from the new vehicle side. In other words, they compete with each other, often on the same dealer lot. Especially if demand is lackluster despite the incentives, these patterns can trigger a downward spiral that is difficult to get out of.

First oil & gas, then construction, then new vehicle sales. Read… How Auto Sales Are Getting Crushed in Houston

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Delayed tax refunds ? Thats odd seeing as how we filed ours the first week of March receiving our refund two weeks later . So though that might of been a blip in February that certainly is not the case as of March . Ahh .. but the glut of inventory , the sudden reality that all those leases would be coming back onto the lots , the mass of used cars available after the temporal new car sales bonanza after the election : due in part to the massive incentives on offer most of which were subprime loans . Now that sounds more like the root of the problem . Not a one month blip in the IRS’s turnaround time .

Which is to say much like everyone else lately … the auto industry’s looking desperately for a scapegoat in order to deflect their own culpability as they continue their ever tightening circle in the quest to consume themselves

I passed Manheim just south of Milwaukee today and I have never seen so many vehicles packed into that facility. Packed full. Just a few years ago it was maybe half full on auction days. It’s a massive facility.

I didn’t write this in the article. But it seems rental car companies are downsizing – or “right-sizing” – their fleets. They’ve been having issues recently. I suspect that ride-sharing companies are starting to eat into their revenues.

Also lease turn-ins are going to be a doozie going forward.

The delayed tax refund issue is likely a red herring.

That’s because every large tax preparer was offering interest-free tax refund anticipation loans in January and early February.

Excellent argument, Bob! Surprisingly, retail sales didn’t increase as much as expected in January? Check out this site and the Monthly Rail Freight Data chart. The only freight commodity that held up the shipping numbers in 2016 was–“Motor Vehicles” (click on the radio button on the right of the chart in the middle of the page).

https://www.aar.org/Pages/Freight-Rail-Traffic-Data.aspx

THEN, click on the “Petroleum Products” button. Does that make ANY sense at ALL??? All those auto shipments and petroleum is down 40%???

The RAL as you knew it is gone. Obama nipped that in the bud in 2010. The loans now are $1,250 or less and the approval rates are lower than they were in the days of $5,000+ RALs. The IRS delays are/were real.

I agree

Tip of the “iceberg” Wolf?

Looks like everything is rolling over today. DOW is way down. S&P500 is way down. The Russell 2000 small cap index (RUO) has fallen badly.

High yield corporate bonds (HYG) has fallen, as has the US Treasury 10 year (TNX)

Mix in international FX flow movements vis a vis the rotation out of euro denominated bonds and into US dollar backed bonds, which explains the reduced 10 year yield, and the USD falling below 100.

Something has come afoot. Could we be observing the much anticipated inflection point? It will be interesting to hear what the central bankers have to say in the coming days, as the ball is now in their court!

And still no mention that on 3/21 – 3/22 Iran officially stops using the Petrodollar…

I’ve seen stories and charts lately showing how the Treasury has very little cash on hand. Don’t know what they consider cash. Then today I saw a chart showing bank liquidity at levels as low as 2006/08. And talk of the dollar tanking.

This is in line with how I see this ending. Actual dollars being scarce and few wanting or able to borrow.

Still might not be time yet. Just have to watch and see.

Just wondering what others think?

Tax receipts down by >11%? Some growth, huh?!

Personally, I doubt that the government or any big organizations are capable of fundamental change. The issues are overwhelming. From Obamacare which has been terrible to the national debt (doubled by Obama?!). Now DT wants to spend another trillion which isn’t there? Mmm.

to distract the masses from the festering mess, I fear that there will be a war. Read “1984”. We live in Orwellian times.

Turkish ISIS supporter Erdogan calling the empress in Berlin names? What a lovely distraction! Over in Germany, this chancellor’s serial coups will cost the taxpayers >600 bn €.

Read up on the Target 2 insanity and you will be shorting German car makers ;)

My contributions here really aren’t all that relevant to the intent of this forum, I suppose – they are individualistic and generally counter – culture. Not the “big picture”.

Anyway, what I think is I have enough dollars on hand, no need to borrow and copious resources which are independent of the larger dollar economy.

Not sure if you read David Stockman’s opinion on that (he had an article on the subject maybe a week or so ago) – but the Trump Treasury has been paying out mature bonds as normal, but they aren’t reissuing new ones of the same amount at current rates (i.e. rolling) so the cash on hand goes lower and lower. Like 500B since October lower. I think he posted a couple days before the 15th and predicted the 15th as the day they would burn down to zero.

This might be an oversight where Trump’s administration doesn’t have the right people in the right places to run day to day operations, but at the same time I am not sure how his folks can miss something this big. And Trump knows how to work debt.

Working as intended is thus the proper assumption – but for what objective I couldn’t tell you.

Regards,

Cooter

In my view, the next crisis will break out differently from 2006/08. Those were the ancient days with some semblance of bank rules, hence the dollar shortage was the result of bank refusing to lend to each other as some were teetering.

We now live in a new era. No financial institution will be allowed to approach bankruptcy as it was known, until the whole edifice will go down at once.

I would assume the dollar shortage is oversees because of demand for US assets, as was reported just recently.

The Treasury is at the debt ceiling and cannot increase the dollar value of the bonds outstanding of about $19.9 trillion. It can only issues bonds in similar amounts to the amounts of bonds it has to redeem.

But it has to pay for ongoing government expenses. To do so, it will run down its cash balance. It will then draw money from other government accounts, government pension funds, etc. – the “extraordinary means” to deal with the debt ceiling – until Congress raises the debt ceiling and it can issue tons of new bonds and pay everyone back.

So if you look at the total bonds outstanding, they have not really budged and remain below $19.9 trillion.

Economic minor is correct. It may not end now, nor tomorrow nor even the year after next– but it will end. I credit Wolf with keeping us posted as the time marches to it’s just conclusion.

I put the “doom and gloomers” in the same back corner of my mind right next to all the “buy the dip” predictors.

Cash is king. I keep it near and handy. Then I read of global crop failures. What will my money buy if you can’t buy anything. And the people who ” head to the hills or New Zealand, etc.” what are they going to eat with all the fabulous wines they are taking with them?

Someone said that we are just shuffling deck chairs on the Titanic until it ends- cash, stocks, property, all worthless. Whatever.

New Zealand has a same problem as other countries. There is actually very big housing bubble. The economy is suffering and GDP plunged.

Simply there are not enough jobs here. There are no factories, country mainly produce milk and milk products. But the prices for milk go down so do the NZ dollar. It’s plunged from almost 0.9 for USD to 0.65.

But it does not stop migrants coming here. I don’t know what migrant will do here when they will know there is no job for them and no house for them.

I would recommend to watch this video: https://www.youtube.com/watch?v=SOWF6eIVqqI

Don’t know where you get your USD from but my bank was selling notes yesterday at 0.6974 so the cross is definitely over 0.70 by the time you factor in their margin. 0.90 was the historic high for the kiwi and that’s nearly 2 years ago, The lowest I remember the kiwi to be was 0.45 but that was a long time ago, probably the late nineties.

0.70 is close to the mid-point for the long term average and while I’d expect there could be some short term downside to the kiwi I don’t think there’s huge upside to the USD in the current environment unless interest rates there rise a lot faster than projected.

The NZ economy is going along quite nicely at the moment but I’d agree the housing market here has been completely screwed, mainly due to the sea of ‘investment’ dollars the world is currently floating in.

Recently was near 0.65 and it will go down again. GDP growth slow down from where it was before. Houses in Auckland go down in prices and construction is main factor of GDP growth and employment. There are a lot of non finished houses in North and city center. Fletcher – biggest NZ construction company had losses about 150m and it’s only begining.

The migrants are not going to return to home countries and high unemployment will mean high crime rate. Add to this that police underfunded.

“Houses in Auckland go down in prices”

Says Alex noobovsky

well he better come a see for himself.

The only house’s going down in price, are at the top end of the market, and were 35% OVER PRICED ANYWAY.

Anything sub 1M is going sideways or up.

Friend of mine just auctioned his 3 bedroom in Howick, nothing fancy, the bidding opened 300K above reserve, and sold for 1.75 M.

He had to catch his wife, when the first bid came in, she nearly had a heart attack on the spot.

They and the agent, thought they might get 1.2 M, at auction.

Do not feel lonely: NZ has plenty of company. This is the second phase of wholesale off-shoring.

In the first phase, finance was moving to the third world, and goods were moving in the opposite direction.

In the second phase, the economy was naturally gutted in the process, but needs to be propped up by super low interest rates. Hence the housing boom. And to keep the facade from falling, you need all those newly rich in from the (formerly) third world to come to the rescue. They seem to be eager to oblige.

You can imagine the third phase.

What you say applies to urban NZ not rural.

Teh rural backlash against immigrant speculators and multinationals is strong and growing. Thye have not and will not be allowed to own a major share of our primary produce industry’s.

Even Big bad fonterra is being told by producers. take your restrictive supply contract’s and stick them where the sun dosent shine from.

The chairs are being shuffled and some removed but unless you are the one with no chair, it just doesn’t seem to matter.

I’ve been out and about and there are many with no chairs already but few care about them.. There are many with virtually nothing but the systems they live in for the most part still delivers food so life goes on.

I really don’t think most people in the western world really has a clue as to the fragility of the system they live in. Food isn’t grown down the street or even in the next county. Much of our food is grown by huge agribusinesses a long way away from the population centers. And then it is dried and or processed and packaged and shipped to us from some where from a few hundred miles away to the other side of the planet..

Everything is leveraged.. everything.. If this breaks down, things could so easily become very messy. And instead of working to shore up the system or close all those water tight doors that supposedly made the Titanic unsinkable, we are telling the engineer to give us some more speed Scottie!

I read people writing flippantly about war and famine.. as if it would or is just an inconvenience. And the same about the environment as if it is something to be over come or beaten. All Fools who will go down with the ship fighting over the last chairs.

How amazingly ignorant supposedly intelligent educated people are.

The thoughts of what to do and how to survive have crossed my mind. Surviving may be more than an old geezer like me can do.. It may just end up being my time. I do have a fenced in raised bed garden and enough solar panels and batteries to run my pumps and refrigeration but things break and wear out. Including my body. And need way more than I can produce to keep myself going. People just don’t realize how many valves and circuits and chemicals we all use to make our overly complicated work.

No guarantees, just a ticket to ride. And I will ride until the end with as much gusto and enjoyment as the good lord allows. All anybody can do is try and be prepared and go with the script we’re given.

BUT the ship of state has hit an iceberg.. the crew is being amazingly slick at not only keeping the ship afloat but keeping the booze flowing and the band playing. If I can’t find a life boat I will just dance till the end.

jack, I believe you are thinking along the right lines. There are ways to arrange your affairs to make life easier in REALLY hard times, if one goes beyond just thinking about it. Cash “near and handy” is a good start. Now, you mention food. Storage is an immediate option, micro-production of your own can go deeper and longer, etc.

BTW, all “property” won’t ever be worthless. A beef steer in a pen will always be worth something, in the most basic way, measured independently of “price”.

I’ve never seen so many nice cars on the road. People don’t seem to worry about spending $50,000 or more on a luxury car in Seattle. Lots of people are going way above that and buying $100,000 plus vehicles. Seems like a bubble to me, and it’s rather crazy to see people spend $100k on vehicles when a $20k Ford or Honda will do. I guess people are trying to buy some self-respect for that extra $80k.

Where I live, BMWs, MBs and Audis are as prevalent as Honda Civics; I see Teslas surprisingly frequently too. Most of them are recent models. I always wonder if most of these luxury cars are just a shell hiding the driver’s real financial situation.

The average car price in the US stands now at over US$36,700. As this is the price paid by customers after incentives and other assorted rebates, list price is considerably higher, well north of the forty grand mark.

The main reason those auto loans are growing like mushrooms after a thunderstorm is due to the average loan becoming larger and larger to accomodate more and more expensive cars.

Before you ask, yes: these days it’s far easier to be approved for a large auto loan than it was a decade ago, especially if you have decent (not necessarily great) credit. Subprime may not be as big as a problem as it was before 2009 but those jumbo auto loans are a whole new can of worms which is slowly getting opened.

Big cars have some basic problems for the used market: they have questionable reliability, usually poor warranties and are expensive to maintain, thus owners are tempted to cut corners, especially on items not covered by maintenance plans (for example only one maintenance plan offered by BMW covers brake pads).

Wholesalers have parking lots full of Maserati’s, Bentley’s, BMW’s, Audi’s and Range Rover’s. Nobody wants them because they are huge repair bills waiting to happen, yet they have to keep high residual values to avoid taking away one of the pillars the car market is built upon: high tradein values.

How these cars are quietly disposed of without causing second hand values to tank is one of the best kept secrets of the car industry.

Brake pads are an easy swap, who would get a service contract on that?

So uh, where do the higher end used cars go? I still see a good number of older BMWs on the road here, and not just collectables like M3s and M5s.

I unfortunately had to replace my prior vehicle of 16 years recently, before this used car bust. Used car prices were insane, ended up paying a little less than average, and I freak out over the payments. Can’t imagine paying double.

Tesla is interesting from the lack of maintenance / TCO perspective. I like what they’re doing, overall.

Do you keep your blinker fluid reservoir topped off?

” …a $20k Ford or Honda will do.”

Or, here in the country, a 1995 Dodge-Cummins diesel pickup truck and a 1999 GMC suburban, both 4WD.

Current price (NOT value, price and value aren’t the same): probably about $2.5K, total.

When they talk about a 20K ford or honda. They are referring to a 3-5yr old vehicle. Not 20yrs old. A 95 dodge diesel or 99 suburban that is selling for $2500. Will need another $2500+ maintenance in the next 10K miles just to keep it going.

“A 95 dodge diesel or 99 suburban that is selling for $2500. Will need another $2500+ maintenance in the next 10K miles just to keep it going.”

If you are a fool who pays full retail for part’s or maintenance.

But a fool who pays full retail for part’s or maintenance, Would be insane to buy such a vehicle

GM, like other American car companies, is making more cars and profit in China as it is in the US, even after splitting the money with a Chinese partner company.

You don’t seem to understand that this is a world wide phenomenon.

China’s debt bubble is actually much worse than the one in the US.

Once someone rolls over, the entire world’s economy and corporate profits will roll over.

What isn’t known is the timing or the tricks left in the Magician’s hat.

Debt must be looked at with savings in mind. A person with $5000 in debt but $300,000 in savings is fine. A country that has bought infrastructure that will be used for decades with its debt is much better off than one that ran up debt paying off interest and waging war. Guess which one is China and which one is America.

“A country that has bought infrastructure that will be used for decades with its debt is much better off than one that ran up debt paying off interest and waging war. Guess which one is China”

Bridge, overpass, and viaduct, collapses are a regular weekly occurrence in china, as are high-rise buildings that simply fall over.

Yes america has simular problem’s, but the American bridges are 50 – 100 years + old, and past their use by date ,as opposed to the chinese ones that have 50 – 100 years to go before they reach their alleged use by date.

The chinese are avoiding some disasters, simply by demolishing and starting again, under the smokescreen of “redevelopment”.

The problem with all that debt funded chinese infrastructure. Is that much of it is failing after only 1/5 or 1/3 of its projected lifespan.

A country that borrows twice to build the same thing in 15 years. With huge corruption rake off’s each time, is in worse shape, than a country that wastes money on war.

As the corrupt get two feeds, not one, from the infrastructure game.

Judging from my experiences at auto dealerships I’m beginning to believe that they make more money from the outrageous prices on repairs, tires and gouging little old ladies than selling new cars.

I’m saavy with cars so when the dealership handed me a list of ‘standard maintenance repairs’ that totaled over $4000 dollars I just walked out. But I wonder how many people fork over the money because they know nothing about cars.

I suspect at least two dealerships actually broke my vehicle so they could fix it.

Perhaps they typically make money on overpriced used cars?

Dealer profit margins for US brands are thin in new vehicle sales. Most people don’t realize just how thin. So dealers have to make money where they can: in F&I, used, and service. So yes, your hunch is correct.

Situation is everything, to me. My local independent repair garage does the maintenance I used to do on my vehicles. Their mechanics are competent and fairly paid, The owners are children of old friends of mine (I’m 85) and we cooperate just fine.

Someone I know has been a service manager in car dealerships for over 30 years and he lives very well. He makes a good middle class salary, but all the real money comes from his commissions on repairs customers don’t really need. He was making more than $100K before the financial crisis and makes more now.

I have a friend who is a finance manager at a dealership. He makes over $250k in fly-over land. No shortage of income for those car dealers.

Really … Service managers are paid a commission,,, I think Not…

Salary more likely…..

No he gets a monthly commission check every month besides his regular salary. This is the practice at every dealership where he worked. Plus he gets to take a car home every night, so he never needs to own or insure a car.

That depends on the dealership. Typically, and at our place:

The people working with customers – we called them “service advisers” – were on commission (% of what they each wrote).

The techs were on commission (% of “flat rate,” by team).

The person running the service shop (“shop foreman”), the body shop manager, the parts department manager, and the person running the entire service department (“service manager”) were on salary plus bonus based on the department’s bottom line.

A dealership is a sales operation, almost all of it, including parts and service. Nothing happens until something is sold.

But more and more people lease instead of buying, no? So, on average, I would assume fewer repairs and services per owner.

A big issue here is the inclusion of all the software and other electronics in modern cars. Eric Peters had some comments about this on his blog:

“The engine in almost any car built since the ’90s is a marvel of durability with a useful service life three to four times as long as an engine made back in the ’70s. What was once burning oil and knocking rod bearings by 75,000 miles is today hardly even broken in.

But the electronics that are critical to the operation of the engine won’t last that long.

And when they begin to serially fail, the cost to replace them relative to the value of the car at that point becomes problematic. And there are more than just engine electronics. Everything in the car is controlled by a computer. This includes even the power windows, which are no longer a simple system consisting of a switch and a motor. There is now a thing called a body control module – and when it fritzes out…

The profusion of soon-to-be-old news eGadgetry has increased in tandem with the exponential uptick in extremely elaborate, software/sensor/computer-dependent mechanical systems.”

[Apologies if my attempt at italics for the quote doesn’t work)

Today’s cars are impossible to repair oneself, are dependent on auto industry proprietary software which will need updates and may become unsupported — contrast with your dad’s or grandfather’s car 30 or 40 years ago which could be repaired in one’s garage with a bit of skill.

(Recall that cars can now be disabled remotely if the loans aren’t paid!)

The Eric Peters piece touches on the same issues as Wolf’s, and the comments there are also useful. Here’s the link:

http://ericpetersautos.com/2017/03/21/subprime-on-wheels/

Fault code diagnostics are what today’s mechanics need to know. You almost have to be a computer scientist to be a mechanic.

Fault code diagnostics, works the same as chequebook diagnostics.

Replace the part/part’s broken by the problem, repeatedly.

Not the Fault/part actually causing the problem

Fault code doesn’t tell you what is wrong. It just tells you where to look. Example P-0171 code on ANY vehicle indactes system lean. Could be anything from vacuum leak, to a failed fuel pump. Many extra tests involved to determine cause. Another common example: code P0445 evap system large. Could be anything form a loose gas cap, vapor line, pressure sensor or fuel tank seal. Again have to different tests to pin-point.

To be a competent auto tech you have to know computers, HVAC, electronics, hydraulics, brakes, chemistry, metalurgy, welding, hazardous waste, emmissions, etc….. Modern vehicles run on a network, part wired & part wireless. You got anywhere from 10-20 or more separate computer modules, including a server…. Auto Tech salaries do not pay enough for hardly anyone to be considered a competent autotech. That is why it is so hard to 1st diagnose, and 2nd repair these modern vehicles. Then throw in the 50K worth of tools, scanners, computers and software that is necessary–very expensive overhead. People will only spend so much to repair a vehicle before they give up, and get another vehicle.

And the electronic modules, particularly in BMW have a separate Computer code #. In BMW now, and all cars soon if you do not have the code to go with the module it will not work. So joe average can not swap out the faulty module for a used one and has to pay a Gazillion $ to have a new on fitted by a BMW dealer or agent.

Hence I don’t touch BMW any more, and advise everybody else to boycott them as well. Soon like BMW ABS modules, modules on your car will fail, after X many cycles, because a computer, tells them to.

Those particular modules are over $ 1600.00 each plus fitting.

Also BMW it the only major manufacture that does not readily share tech info with the aftermarket. Just this morning I advised a customer against buying an ’09 from the local ford dealer as the nearest BMW dealer is 150miles away.

√+

In time I believe they will all try this, unless BMW is stamped on, HARD, over it.

Consumer protection, is overdue, to get involved in these BMW scam’s. Where are the Ralph Nader’s when they are needed.

Almost every gasoline powered vehicle built in last 10yrs utilizes a mechanical engine system called Variable Valve Timing (VVT). Where before your motor would be fine at 5-10psi engine oil pressure. Most need at least 30psi oil pressure to drive the v-v-t systems. Very delicated and sensitive to oil weight & viscosity. many new cars require only sythetic–some of this stuff is $10qt & requires 6-8 quarts. Miss a couple oil changes and the engine begins to fail, and lifespan is severely shortenned. Many are failing before 150,000. Then the newer transmission are all at least 6-speed now the 8-speeds last 2-yrs. 2015 & up dodge pickups now have a BMW 8-speed transmission!! These engines and transmissions can not be overhauled by the traditional shops-if at all at anything considered a reasonable price. Much less at the dealer.

Those transmissions are ZF.

The only ZF transmission’s that get regularly overhauled are the Power-shift’s Etc in Heavy equipment. Normally by owner operators. Or dealers of motor-scrapers Etc, ZF transmission failure, being a common fault, in trade in machinery.

ZF replacement parts are deliberately priced, to make their transmissions cost prohibitive to overhaul.

Pavel,

Even more insidious than repair issues, you can pay $50K for a vehicle, and not own the software…only lease it on license. Your vehicle without proper software is…worthless. Anybody guess where the next revenue stream will come from?

Years ago, I took an Oldsmobile to the dealer for a recall issue to be fixed no charge. They were very aggressive about doing other things, and it was time to check the timing belt, so I agreed to that. Maybe they put a rookie on it, or maybe something more sinister, because within a couple of days, the belt slipped, engine crash disaster, and over 2000 dollars to fix it.

Since then,

Rule #1 never buy a car with a timing belt – they have to be replaced often at high cost and are less reliable. Rule #2, never go in for a no-charge recall fix, unless it’s giving me a problem or is so critical it can’t be dismissed.

There are safety recalls you’re better off getting done. Car catching on fire while you drive, that kind of thing…

“or maybe something more sinister, because within a couple of days, the belt slipped, engine crash disaster, and over 2000 dollars to fix it.”

No 1 it was a gm product.

No 2 unless it was overdue for replacement, or had a non genuine or fake belt in it. “Something” occurred. As most genuine or reputable belts, last way beyond their official replacement date.

How many broken timing chains have you had to deal with, or stripped timing gears, particularly on GM vehicle’s??

Or V8 ford’s with cheap (Mostly aftermarket) Nylon tooth timing gears in them.

folks may want to consider shorting stocks like Ally Financial and Santander Consumer USA, mainly subprime auto financing outfits.

Thanks for the tip

Wolf is bang on re flood of lease returns over the next 4-5 yrs back in 2012 ish leasing picked up popularity and has been gaining strength after a pull back in 08/09/10/11 / I’m in the lease business here in Canada and I can tell you for free that starting now ucp are softening and the trend will only continue. I spy with my little eye the end of 2018 there’s gonna be some deals to be had if you have cash as finance rates will be much higher then

So those planning to sell their TDI vehicles back to VW should expect a price shock?

I keep reading about how expensive houses are to buy or to rent (we ourselves haven’t paid rent or repaid a mortgage in 35 years) and how the bubble expands day by day almost.

So I was intrigued to see a “Breakdown of average total household expenditure” in the UK (see https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/expenditure/bulletins/familyspendingintheuk/financialyearendingmarch2016 ) which shows that in the UK people spend more on transport (i.e. theri beloved chariot) than on housing.

If this is similar in the US, and the auto industry bubble is about to burst, the consequences could be disastrous for the whole economy.

Where I am you can regularly see expensive pickup trucks parked in front of mobile homes, where the truck is worth more than the home. Sometimes more they have more than one new vehicle.

I see that here in WV, too!

If I recall, UK have the most expensive petrol in Europe, and driving with the steering wheel on the wrong side must also cost some extra.

dealerships in houston.

stocked to the gills with inventory.

channel stuffing may bankrupt them all.

some algorithym says that i have already said this. haven’t

It couldn’t be a massive oversupply of vehicles .. could it ?

In their stupidity .. only.

The auto makers aimed their production quoters at the predicted 9.000.000.000 population blow out.

What ever happened to doing a bit of research ?

The Population Institute website has a meter running at the top right of the page.

CURRENT WORLD POPULATION = 7.484.398.850 & counting

and underneath

NET GROWTH DURING YOUR VISIT = 710

Propaganda at it’s best.

The auto industry should have scrapped the petrol guzzlers & begun manufacturing electric cars 20 years ago.

How long did they think they were going to string out the lie that oil was going to come gushing out from the earth forever ?

And, are we at the 11th hour yet ?

I can see corporate hotshots pushing their luxury vehicles to work & back home .. soon.

History of the auto industry is replete with visionaries who produced and attempted to sell their ideal vehicles – and promptly went broke.

DeLorean was one of the later ones. Earlier ones were the Stanley Steamer (could run on firewood and water) and, re electrics, Thomas Parker built one in 1895.

Point is Demand determines what sells and will therefore survive in the marketplace. Your vision or mine of what “ought to be” doesn’t count.

It’s true that the market can be warped by fashionable elites in cahoots with the corporatocracy. But, independently of the degree of warpage responsible, electrics may be coming onto a real market, primarily because of battery technology advances. We’ll see.

Change is a function of economics as well as abundance. When it’s ready to happen, it will happen, whether it’s better batteries – not the huge resource heavy 7000 dollar monsters of today with limited life – or some new technology. You’ll still be driving.

According to the media and alarmists, we were running out of oil several times in history, most recently 1987. I mean, right out, no oil, gone.

In the 1850s, we were running out of whale oil for lamps – crisis – no more lighting! It was true that the whale population was seriously declining, but the refining of oil solved that little problem, at less cost.

With a globe full of oil and collapsing oil demand, there’s room for a whole lot more cars.

A scenario coupling a flood of lease turn-ins with incorrect residual values calculations by car companies at lease commencement (due to used car values declining more than expected years later) will hurt the captive finance companies big time! Someone’s gonna need another bailout I think.

One more damn car on the road in Miami and it will be easier to drive around the dealer lot than drive on the road.

Wall to wall 6AM to 7PM inching along to the next exit or traffic light. Five years ago a trip that took 1/2 hour now takes 2 hours.

Just an anecdote (from someone who never owned a car):

My father had a Volvo for 10 years but never got around to buying a new car. My mother has had Subarus for almost as long but bought new ones every 3 years or so (to hand down the old one to a child or grandchild). The Subarus are good cars & good value so I went with my dad to the dealer last month and assumed we’d get one of those for about $30K. (Note: the money was not an issue; my dad could easily afford a BMW or Mercedes but doesn’t want to have a “snob” car.)

The Sub dealer’s lot was absolutely full of new and used cars, including used BMWs and Mercedes. He even had a used Ferrari on sale! We looked at the sedans but then when we asked for the trade-in price on the Volvo he went away and came back with… $1000! I felt insulted — christ, I’d buy it for $1000 though I have no use for it!) so we walked away.

My father then went without me to the Volvo dealer. To my delight he called up and said he walked out with a used one (S60 I think it’s called) for $19K! He is absolutely thrilled and I think it’s brilliant that a man who could have spent $60K or $80K without batting an eyelid walked out with a used car (which of course is the best value deal). I’m amazed the dealer let him do that. Perhaps there is an extra pressure to get rid of the used cars on the lot?

Family tale aside, all those lots full of cars plus the future defaults by owners of subprime auto loans… not a pretty picture.

Thanks Wolf as always for the great site. Nice to see you on Max Keiser the other day.

I was hoping he bought the Ferrari :-)

I hope the lenders get buried again. I’d rather have reasonable transportation prices. This whole attempt to decouple income and consumption is going to lead to trouble.

“Cash For Clunkers-2.0” Might just be crazy enough to work!

I really enjoy reading about the auto market and current retail implosion. It is some what tangible in that it is part of our physical world. The high finance articles are interesting but less real in some ways. It seem why auto and retail industry didn’t get the memo, we are sisiated with stuff. We are also dangerously over leveraged, and that is making the next down turn in the business cycle a potential depression. The sooner we get on with the next correction the better. It will be painful but we need to let bad business die. Sadly TPTB will do everything they can to delay the inevitable and then follow up with rediculous bailouts to their donners.

AAR weekly railtraffic report published today a 13.8% decrease in car transport. This indicates a steep fall of car sales coming in March.

Check out at https://www.aar.org/newsandevents/Freight-Rail-Traffic/Documents/2017-03-22-railtraffic.pdf

Actually, a fall in wholesale car sales to dealers.

Since dealer inventories are bloated, the decline will last awhile and auto production will have to be cut.

If you like car history read up on the Red Flag Act of the 1800’s and how horse and buggy interests held the automobile back for 30 years.