Despite what you may think, it’s not due to protectionism.

World Trade has been on our worry-list for a while, most recently in December [World Trade Falls to 2014 Level, just in Time for a “Trade War”]. Why has world trade refused to boom recently? And it wasn’t just last year. But last year was particularly crummy. Lackluster global demand gets blamed. But that’s using a broad brush to sketch a troublesome development.

Now the alarmed World Bank, in its report, Trade Developments in 2016 (PDF), barely blames the usual suspects for this lackluster global demand, but identifies a new and dominant one: “policy uncertainty.”

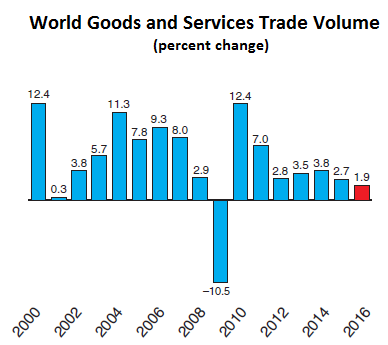

It points out that 2016 was the fifth year in a row of “sluggish trade growth.” 2015 had already been the weakest year since 2009, when global trade collapsed as a result of the Financial Crisis. But 2016 was even worse than 2015.

World trade is devilishly hard to quantify, and so the estimates for 2016 vary:

- The World Bank’s Global Economic Prospects estimates world trade growth in goods and services at 2.5%.

- The IMF’s World Economic Outlook and the OECD’s Economic Outlook peg growth in goods and services at 1.9%.

- The World Trade Monitor by the CPB, Netherlands, estimates growth of merchandise trade at merely 1.1% (in the first 11 months of 2016 compared to the same period in 2015).

Despite the differences in the data, “there is a consensus across data sources that 2016 will register the lowest growth in trade volumes since the Great Recession of 2008–2009,” the report explains. Based on these sources – the IMF, the CPB, and the World Bank – the report estimates trade growth in 2016 at 1.9%:

And 2016 was different from “other post crisis years”: this time, “trade sluggishness” was spread across both advanced and emerging economies.

So why is this happening?

There are the usual suspects, or as the report calls them, the “enduring structural determinants”:

- Maturing of global value chains (GVCs)

- Rising protectionism

- “Notably slow global growth”

- The decline in commodity prices; but after the lows in early 2016, they’ve been rising, so this wasn’t a large factor in 2016, though it was a larger factor in 2015.

- “Macroeconomic rebalancing” in China toward an economy that is less dependent on exports, property investment, and industrial production

And then there’s the new, now dominant factor: the surge in global “policy uncertainty,” as quantified by Economic Policy Uncertainty Index. The report:

Economic policy uncertainty may influence trade through two main channels.

First, a rise in economic policy uncertainty reduces trade by reducing GDP growth. In a less-certain environment, firms may choose to postpone investment decisions, consumers may cut back spending, and banks may increase the cost of finance.

Second, to the extent that the surge in economic policy uncertainty is due to trade policy uncertainty in particular, this may affect trade directly…. [T]rade policy uncertainty delays firms’ entry into foreign markets.

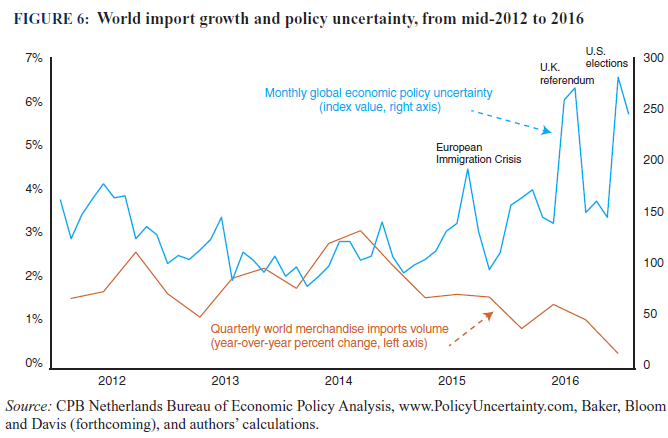

In their analysis, the authors found that trade growth (brown line) from 2012 to 2016 tracks economic policy uncertainty (blue line) with a lag of a few months:

There was plenty of policy uncertainty before 2016, including the European Immigration Crisis. But the UK’s Brexit vote in June 2016 and the US election in November caused it to spike. And that is having an impact. Via a regression analysis, the report found:

A 1% increase in uncertainty is associated with a 0.02-percentage point reduction in goods and services trade volume growth.

This implies that the increase in uncertainty in 2016 may have reduced trade growth by about 0.6 percentage points.

Without this spike in policy uncertainty, global trade growth would have been 2.5% (1.9% + 0.6 points), though it would have still down from 2.7% in 2015. In other words, three-quarters of the year-over-year decline in growth was due to policy uncertainty.

Recently, the meme emerged that the decline in global trade growth in 2016 was due to rising protectionism around the globe. But the report pooh-poohs that assertion:

According to the WTO, the flow of new traderestrictive measures for the first 10 months of 2016 was in line with that of previous years. This evidence suggests that it is not a surge in protection that accounts for the exceedingly weak performance of world trade in 2016 although trade policy may have been a contributing factor….

Instead, “it is likely that trade policy uncertainty” – such as the uncertainty surrounding the new trade pacts, including the now scuttled TPP – “contributed to the surge in overall policy uncertainty.”

How will that work out in 2017? It already started on the wrong foot: In January, the economic uncertainty index surged to a new record high in the data series going back to 1998! More dark clouds over global trade!

Are stocks grounded in some sort of new reality? LOL. Read… S&P 500 Earnings Stuck at 2011 Levels, Stocks up 87% Since

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“trade policy uncertainty”. What utter nonsense. Sounds like someone wants a tax cut and less regulations to me.

It would be cool to see Monthly Global Economic Policy Uncertainty, and the Dow Race each other to the moon !

.

Hey, some rapper is opening a hedge fund. No, I’m not kidding. It’s officially over.

I saw that too. “Pity the poor fool” as Ali used to say.

It is so easy, I don’t know why day-care centers haven’t started investment funds too.

But Petunia it demonstrated the wide division between those who have and those who have not.

You mean Jay Z…Beyonce’s husband? He is heavily investing in a type of Uber for private jets with members of Saudi royal family called JetSmarter. Which actually sounds like a good idea. With core membership costing mere 15K. But better than owning jets and having them just sit around.

global trade in the crapper? globalisation not working? trade depends on people buying stuff . if you steal people`s money then they have no money to buy stuff. greed is not always good. 2008 took $20 Trillion out of the Western Economies. 8.5 years later there is still not enough money , even with Fed and Bank of England and ECB money printing to start another mega scam. the UK economy is being scimmed . Medical and Civil services are being cut to the bone. small businesses are being raped to enrich Supermarket and Online Conglomerates. our Tory / Labour Government is adopting a Victorian Master and Peasant Oligarchy. Elections are becoming meaningless. Obama / Trump promise

eternal happiness; deliver Zero.

as brilliantly stated on a different post recently: “…poverty is trickling up…”. meanwhile the mavens of financialization continue to search desperately for more smoke to pop to obscure the situation…

G`day , I get newsletters from Greenpeace Australia about a Coal Company from India digging the biggest hole in Queensland. They have convinced your Prime Minister to let them cut a shipping channel through the Great Barrier Reef to the South Western Pacific Ocean. It has been stopped once but PM Bullock? wants his Rupees.

Geenpeace Australia is a spin off entity.

Its main “Focus”. Is keeping the Administrators of “Greenpeace Australia” VERY well coddled, on VERY high salaries.

Think about that, every time you see anything from them.

Doesn’t matter, Dow 30K is the only thing that matters. All resources will be diverted to making it happen.

YEEEEEHAAAA ……… not !

I’m gonna keep on growin my veggies, nurturing my hens, caring for my bees, tending my berries & fruit trees ….. and otherwise turn my back on ‘markets’ … cuz at this point they don’t mean shit to me .. or mine ….. !!

Screw this global financial house of mirrors !

You might be the only survivor. Got a spare room?

Actually, I think there will be quite a few self-reliant survivors

Spare rooms not available – your space is up to you.

Irrational markets call for irrational reasoning. I would agree that companies are holding back to see if they can get some special treatment in trade and tax. Another reason would be that household income isn’t rising as fast as hidden inflation is. Their local taxes, housing, healthcare, insurance and tuition are rising faster which eats into their disposable income. Fewer trips to the malls and stores means we aren’t impulse buying anymore. We just buy exactly what we need and want online with no add-ons.

Bingo!

Bingo II

Google retail sales by country and read a few articles. Sales mainly down around the globe. The global elite were betting China would be the new greedy consumer and yet sales of luxury goods sinking like a stone. Hong Kong and Macau down double digits.

Korea worried about it’s domestic situation….economy stalled out.

https://www.focus-economics.com/country-indicator/korea/retail-sales

From https://www.japanmacroadvisors.com/page/category/economic-indicators/gdp-and-business-activity/retail-sales/

“A stagnation seems an apt word to describe the state of retail sales in Japan.

While some pundits may find a puzzle in the stagnation, citing the tight labor market, recovering stock prices and a stable consumer confidence, we actually do not find the consumer behavior in Japan to be puzzling at all. In our view, consumers are only spending according to their means. While they may not be scared about losing their jobs now, they have no reason to feel such stability may last. Wages are not rising and the long-term sustainability of pension and healthcare in Japan remains very much in doubt. Do not blame Japanese consumers for being cautious, because such attitude is exactly how a rational economic agent should behave in the current environment.”

Sound familier?

I get one of the popular fashion magazines and everything in it is junk. I wouldn’t buy most of it, even if I could afford it.

Same with men’s “fashions”.

Seen the latest at L.L. Bean and Eddie Bauer?

Used to be rugged, long-lasting outdoor clothing – now wimpy, singles-bar type stuff.

RD, they are going after the “coveted” Millennial market. So basically they are say screw you to those of us who have been loyal for decades.

How did this cater the the Millennial market meme get started? Talking about cognitive dissonance.

I bought some LL Bean golf shirts for Xmas gifts because they claimed they were some kind of premium cotton. No, they weren’t, they are a cotton polyester blend that feel mostly like polyester. Not shopping them anymore.

Petunia, I agree. However when the status symbol purchases start sinking for the more wealthy, then you know things are bad. I remember visiting Hawaii and Las Vegas in the 90s and the Japanese looked like walking status logos. Gucci sun hat, Channel sunglasses, Hermes handbags, LV fanny packs….lol..you catch my drift. It was so sad and funny; not stylish at all. Reminded me of Minnie Pearl with the price tag hanging off of her hat. And that comparison my friends just gave away my age. :-)

Yep, I was there in ’92.

Japan hit peak retail in ’97 and it is down 10% from that number even 20 years later. Makes me wonder when we hit peak retail (2005 or so?) and when China will. India has a long way to go because they still need indoor plumbing for the most part.

If you look back over the last 50 years, the USA follows Japan at about a ten year lag. Perhaps the clocks are running faster now.

The consumer in just about every country is this world is on their knees trying to keep food on the table and the kids warm. The media doesn’t want to talk about these things, when they have fantasies to sell.

The powers…meaning governments, central banks, elite businessmen/women, and their overpaid advisors are all wrong, have been wrong for decades, and can’t admit it and won’t correct their course. Rocks ahead has no meaning to them, they have wings. They are absolutely sure their way will work until their last breath is taken

The Western economic models are dead in the water. You can not have manipulated, propped up and controlled markets, and that is what we and most of the world have.

Central banks are, buy buying up companies stock, nationalizing these companies, making it appear as if they sales viable and strong. Look at IBM, Caterpillar, and many more.

You can not have a successful world economy when it is not free, and boys and girls it is not free when winners and losers are chosen.

“They are absolutely sure their way will work until their last breath is taken”

…and, that breath will be taken by others, because:

http://www.infowars.com/panicked-elite-buying-bomb-proof-luxury-survival-bunkers-to-escape-civil-unrest-disasters/

“The Western economic models are dead in the water. You can not have manipulated, propped up and controlled markets, and that is what we and most of the world have.”

Beating on the west is stupid and short sighted.

The problem has moved from West to East, and grown much worse.

The Capitalist model has shifted, to a model based on Consumerism . More consumerism, of low quality, shorter and shorter life span products.

Produced by Globalised Vampire Corporate’s, currently allied with china, owing allegiance to, and having loyalty to, nothing, but their tax free profits.

Consumer “Its broken, its only 6 months old” Supplier “tough, buy a new one” Is where we currently are

This does not work on a planet with finite resources, as among other things, it requires an ever increasing population. Something else that is not tenable, on a finite resource planet.

When Capitalism shifted from Sustainable Capitalism (Long lasting quality products) to unsustainable consumerism, The shifty Occurred mostly in the East.

It started with low quality children’s toys made in Hong Kong ( made in hongkonk was the joke, as it did not take long for them to “Konk Out”(British slang for brake)) in the 50’s. And went on from there.

Today, quality, British, German, and even Japanese products, can not compete with the cheap crap coming from china, as the average Western consumer, foolishly always buys on price. Then they complain, that they no longer have a job.

The chinese set out to destroy, and own, western industry. Without fighting a major war with the west. They have almost succeeded.

Once they have done this, they can do as they wish.

As the west will no longer have the industrial engine’s, to fuel it defensive capability’s, and stop them.

An advantage it has had over them, for over 600 years.

Keep on buy from china and chinese owned company’s, and keep on destroying your own country. 1 purchase at a time.

P 45 wants to do a lot of the wright thing’s, that need to be done. I am against him, as he want’s to do them, the wrong way.

He is the proverbial “Bull in a china shop”.

My wife and I make almost 30k more than the median family income in my town (northern CA) with no kids. Our rent just went up by 1k a month – landlord selling – starter houses are selling at 500k.

We are not spending a dime more than needed. I plan to skip our weekly night eating out now.

T

Move! It may surprise you to know, you could make a lot less in another state with lower taxes and pocket more every month. It’s not going to get better.

But for goodness sake don’t bring liberal values to conservative states.

I think some light just shown on his face and it was not California sunshine.

Amen!

Selection of place is critical.

http://lenpenzo.com/blog/id22017-how-i-live-on-less-than-40000-annually-ralph-from-west-virginia.html

Today AdRoll (major advertising co) banned showing ads for infowars products, I checked on WolfStreet and sure enough all infowars ads are gone. All I see now are ads of stuff I already bought at amazon, att, ameritrade, fidelty, Wolf’s ads, and a lot of empty space. Infowars has game changer supplements, they were banned without even a specific on what they had done wrong. There is a list of things you can’t have an opinion about, and if they ban us from commerce because of our opinions the economy is going to get at lot worse.

“There is a list of things you can’t have an opinion about, and if they ban us from commerce because of our opinions the economy is going to get at lot worse.”

For whom????

Lots of sheeple, effectively do, what the MSM, and the MSM add’s, tell them to. I

And the MSM, feed them, to the hand that feed’s.

IF the sheeple Google something, and it isn’t on page 1 of their search, it dosent get seen. Simple.

Media control, of the Consumer mass, something P 45, understands, uses, and find’s perfectly acceptable.

Expect to see much more of it, under the P 45 administration.

Ann Barnhardt dot com has a posting about Airbnb. It seems you have to agree to be gay friendly and pro anything the left supports to open an account and use their app. She warns this will spread and I agree.

So dont use it LOL. Who cares. I guess the real question is did you see that yourself or just rely on fake news to spread hate. You said it seems….Im pro money. Gay or not. Just pay and Im happy. Beats not having money….grow up honey! LOL

Yes, I did read it myself. Your I got mine, so fuck you attitude, will catch up with you eventually. I can site references for that as well.

“Your ‘I got mine, so fuck you attitude’, will catch up with you eventually.”

Yes, Petunia, I think you’re right. It could happen when they encounter the Orwellian ‘health care system’. And then they’ll be toast.

Being gay, I appreciate gay-friendly people and policies. As opposed to those who claim it is their “right” to make my life as miserable as possible. Substitute the word “Jew” for gay in your comment and see how it sounds.

Mary,

I don’t care if people are gay or not. The part you don’t get is that I don’t want to be forced to be gay friendly, especially as a condition of using an app.

You could point a gun at my head and I still wouldn’t support gay marriage. And if I ever land up in a bathroom with a guy in a dress, one of us is going to jail.

BTW, I was in Key West, FL two years ago and the tourist guides all advertise gay places where only gay people are welcomed. I don’t have a problem with that, I appreciated the advance notice.

Airbnb is their own worst enemy. The conservatives will avoid them for their liberal views and agenda. The libs will go after them when they need the lost revenue from hospitality taxes.

@PrototypeGirl1

Nice comments. Yeah, the control happened a long time ago. But Warren Buffett just dumped almost a billion in Walmart stocks. So Walmart is going down. It’s much worse than they admit. Very few people are shopping like even 2 years ago. My family used to send fruit & chocolate around, but it stopped a year ago. We have to hang on, Alex Jones too. They can’t last much longer.

Thanks Friendly Neighbor, I guess that explains the recent huge leap in prices at Walmart. I was wowed by the dollar rise in coffee a couple of weeks ago, Monday I noticed flavored rice and pasta bags went up by half. I looked at them thinking this must be the bigger size but no its the same just way more expensive. I used to give my clients something nice for christmas, new set of towels, nice rug ect a couple of years ago that went down to a bottle of wine, this year I gave out a silver coin, I guess next will be a bag of rice. A lot of people make fun of preppers but I’m so grateful to have my 2-3 yr supply of food. Interesting times.

“A lot of people make fun of preppers but I’m so grateful to have my 2-3 yr supply of food. Interesting times.”

Me, too.

Guys, anyone has experience shorting 2000/2007 events?

Where/when do we start? FB puts? SQQQ calls?

Thanks!

“Where/when do we start? FB puts? SQQQ calls?

Thanks!”

00 and 07 were both pre QE events.

Today you have a market that is disconnected from fundamentals, due to QE.

Try to apply pre QE rules, to such a market, is asking for PERSONALLY EXPENSIVE trouble.

++

Some twisted logic, that shows what you face, try to plan shorts, without lots of inside information.

Since 08, the Global CB’S have blown various asset bubbles, although not in a synchronized manner.

The ECB is still blowing quiet hard, with out much real effect.

In the event of a serious correction, the plunge protection Team’s, will step up very quickly, so only main-street will feel and real pain.

Being on the opposite side of the trade, to a plunge protection team, will HURT, as their fund’s are limited, only by the number of zeros they can add, on their keyboard’s.

The only way they will let this thing seriously correct, is if the whole system collapses, or there is a major, BIG State on BIG State, war.

A very senior Chinese financier, put something quiet truthful and obvious, but unnoticed by many, to me, the other day, over lunch.

The US GOVT, can go bankrupt, whilst the US FED, and the US $, remain stable. Not may countries are set up like that.

d,

So what you’re saying.. this time is different.. the “money” has no meaning (not major currencies at least).. and the only way is up.

Well, we shall see.

“So what you’re saying.. this time is different.. the “money” has no meaning (not major currencies at least).. and the only way is up.”

Not saying that at all, only that the old rules, and old strategy’s, dont apply, or work well, in the current Qe distorted situation.

Ultimately the only way they can avoid allowing the asset bubbles to deflate, is to inflate everything else around them.

Currently this is not working for them, as they have killed the biggest consumer engine on the planet (the US middle class), without first creating another larger one to replace it.

Chinese and Indians, only want to know about, made in china and india. So they are of no use in the resolution of the global trade problem.

They are in fact a big part of that problem. They are over a third of the worlds population and they both think it it their god given wright to run a continuous huge trade surplus.

china has run a continuous and growing State managed and supported trade surplus for over 40 years, that’s how the world ended up in such a trade mess.

You dont have market competition you have a market, competing with state managed export engines supported by unlimited state money printing and unlimited state support to various overcapacity sectors with the deliberate intetion of destroying sectors of everybody else’s economy.

And you think you can apply pre Qe strategy’s to the US market 2 years plus out ???

d,

I can’t reply to your later comments below.

“I have made more money in shorts than long’s, and still do. On indexes and currency’s.”

How did you go about making it on the short side? Puts, short etfs?

I short the indexes and the $ on FX platforms. Mostly now. You can short the $ as an individual inde index with an account based outside the US.

Metals Silver, Copper, can be good, but not Gold, its to manipulated.

I dont do individual stocks, to much insider trading and insider information required.

You’ll just be throwing money away. There won’t be any 2000/2007 event if the current course stays. There’s just too much money being thrown by Central Bankers around the world at the US market. If there’s a Black Swan, it had better be a YUGE Swan because this market will only tank IFF it’s clear that CBs can’t turn it back.

Well the CBs couldn’t turn it back in 2000/2007, not for few years, even with all the “easing”. Yes they did re-inflate the previous bubbles (and then some) eventually; that is why we may be looking at something much more serious now.

Hussman for example (When Speculators Prosper Through Ignorance, https://www.hussmanfunds.com/wmc/wmc170220.htm) for the first time suggests that shorting maybe the only viable strategy at this point (until valuations are aligned with positive long term returns).

I will agree that shorting is not easy, not without sufficient preparation. We shall find out. I could use all advice I can get..

In 2000/2007 prior to the respective crisis, the CBs weren’t actively intervening, they all thought it’s just a normal market shock. And who said that CBs aren’t turning it back. If that’s the case why are you thinking of shorting the market? That means the CBs were successful in inflating the bubble yet again and you think the market is overvalued.

Now I am not saying it’s not overvalued, in fact it’s EXTREMELY overvalued, but right now the CBs, the hedge funds, etc are all holding hands like kumbaya. I am betting the huge hedge funds all have guarantees from the Fed that all their losses will be compensated if the markets were to fall as long as they continue to buy, buy, buy. No one will be prosecuted anyway no matter how much money is used.

“I am betting the huge hedge funds all have guarantees from the Fed that all their losses will be compensated if the markets were to fall as long as they continue to buy, buy, buy. ”

No the FED could never afford to have that get out.

The probably do have an agreement that the FED will buy their in perpetuity 1 %, stock back bond’s, (or some such) in large quantity’s though. Which is almost the same thing.

“Well the CBs couldn’t turn it back in 2000/2007, not for few years, even with all the “easing”. ”

Your missing the point.

00 and 07 were pre Qe markets.

The rules were tried and tested, and they worked.

I have made more money in shorts than long’s, and still do. On indexes and currency’s.

This is a post Qe but still, Qe effected Market.

The rules for this market, in a correction event, have not yet been written.

It will dip to a “point”, then rebound, savagely, and way earlier than normal. Is my prediction.

The question is “at what point”.

The further they let it go, the more work the have to do and the more Obvious it becomes that it is them. Just like shanghai it became a game of. Follow the plunge team’s in the afternoon, and make a fortune.

So from their point of view. Dont let it go very far at all.

I just glanced at Hussman’s performance track record for his HSGFX growth fund.

For ALL 1,3,5,10 and 15 year periods, he is in the bottom 1%. Now that is failure that would be almost impossible for any fool to replicate. Seriously, that kind of dismal performance is impressive.

I suppose it helps to be a multi millionaire Stanford PHD owning your own fund.

I have experience shorting the worst highfliers in November 1999. I was three months early and lost my shirt :-]

Wolf,

I’m thinking chapter 8 of the “Reminiscences of the stock operator” best describes the “strategy” and mistakes made. That was about 1907 panic. Long story short one has to wait for the event to start unfolding, only then add to the short line on increasing scale. Check it out, great read.

I’m looking at the Silicon Valley darlings trading at price/sales of 10 or greater with multi-billion caps (multi-hundred-billion caps in some cases). Jan 2019 puts are now available; these events take 1-3 years to find bottom, but again one has to see it before starting on the short side. Short term puts will not cut it even if one gets timing right. That’s what I gathered so far, works great on paper :)

Thanks for the reply. Love the website.

PS: I’m on battery now, thinking to move to alameda, the 3K rent is getting to me.

Regarding the last ten posts or so: It’s interesting to see the thought processes and backgrounds of serious players in “the markets” and contrast them with my way of life.

“Macroeconomic rebalancing” in China toward an economy that is less dependent on exports, property investment, and industrial production”

This rebalancing mantra everyone is chanting is unsubstantiated and always quoted with no supporting facts.

Everyone says it, because it’s the communist party line on why their economy is in the crapper (no one really knows, due to the opaque nature of their stats).

If by rebalancing you mean, pumping trillions into failing industries and real estate, I guess that’s a balance of sorts.

The Chinese are getting their Yuan out of China because as the dollar rises, so does the Yuan due to the currency fix.

This makes their Chinese Walmart junk factories less competitive with Vietnam, Indonesia, India. Junk factories and slave labor are still the beating heart of Chinese industry. Of course this means the Yuan is really falling as it rises.

The Chinese have become HUGE consumers. Of everything, from fake medicine to new cars. For example, China has become the largest auto market in the world, by far. That’s in part what that “rebalancing” means.

Hi Wolf,

It also means you can kiss any idea of getting ‘global warming’ under control for the next 50 years. Oh, and don’t forget India….

“It also means you can kiss any idea of getting ‘global warming’ under control for the next 50 years”

Which means you can kiss humanity, good bye

That’s why global warming is a farce, thanks for you’re support .

The leftest knows this too, that’s why from the very beginning they used this real cause for concern for their political gain, because they know even their good intentions can’t solve this problem due to global growth bought by neoliberalism.

I was browsing some electronic and optics sites, and the products comments there are astonishing. Some sample: “We already had two TVs so bought one for the third bedroom”, or “I bought my old TV in 2010 so was due for a new one”, or “Bought three of these binoculars” and so on. And I thought, holy c. this baby will go down like a rock when the credit dries up. The hyper consumer zombies are stuffed to the gills with stuff. The world trade growth was due to the fact that production and consumption were geographically separated. Now, that cannot continue forever.

I watched a few episodes of a tv reality show called Hoarders. What fascinated me the most was the amount of money spent on the stuff they warehouse. One middle class woman had a nice suburban house stuffed to the ceiling with boxes from home/online shopping. They don’t use or enjoy what they buy. It was like watching a horror movie.

Someone took out the engine of the global economy.

When one dollar in every three is spent in the US, the US consumer is the engine of the global economy.

They used to acknowledge this a few decades ago but not any more, although it is still the case.

The US spearheaded neo-liberalism and now has a populist president looking to protectionism.

What went wrong?

Market theory is one thing, but what we see is dysfunctional markets in all the necessities like housing, healthcare and education.

You are free to spend your money as you choose.

But with the necessities rising in price so much, this has led to …

No money, no freedom

The purchasing power of the majority is tending to zero and they can’t fulfil their wants within the market place.

The cost of living is so high in the US, the required minimum wage has priced US labour out of global labour markets requiring protectionist policies.

Let’s have a look at dysfunctional markets in necessities in the US.

Owners of property like rising house prices, their asset rises in value through no effort at all.

This then leads to increasing rents in the rental market and house prices are so high the younger generation cannot buy a property of their own.

These costs will either be covered by wages or the Government when out of work or retired.

The private US healthcare market is one of the most expensive and inefficient in the world, profiteering is the name of the game.

These costs will either be covered by employers/wages or the Government through subsidies or fully, when out of work or retired.

The US education system continues to charge higher and higher prices; the income goes on more bureaucracy and not raising the standard of education.

These costs are covered by loans whose repayments will be covered by wages.

Neo-liberal ideas move taxes off the wealthy and then push the cost onto employers and the Government.

Western labour cannot compete with Eastern labour due to the high cost of living, most of the jobs in the middle are off-shored but they can’t off-shore those low paid service sector jobs and employers moan about the minimum wage necessary to cover these costs.

Inequality rises, the economy hollows out, the Government takes on more and more debt and the young are unable to afford to have families of their own.

Welcome to the banana republic. Everyone who is not already in the upper middle class is pretty much toasted.

to use the prophetic verses from The Cribs – Victims of Mass Production (2009) (Johnny Marr from the Smiths plays lead guitar for the album ‘Ignore the Ignorant’ that contains this song. Great album):

Well he’s a creature without a care

Except for the fact that he’ll only wear

The things he sees in magazines

He is a victim of mass production

I was brought up with my own beliefs

And well, I prided myself on being free

But the powers-that-be invaded me

Looking for some weapons of mass destruction

The first time that I met my mate

Was in a building that houses the things I hate

But she seemed to feel the things I feel

She is the object of my affection

I never thought that you’d care

I can’t believe that you’re still living there

But you’ll always be the last who sees

You are a victim of mass production

Well I’ve seen it all before but that’s not for me to say

We’ll live

We’ll die

We’ll never say goodbye

Cause we’re not supposed to be here anyway

Well he’s a creature without a care

Except for the fact that he’ll only wear out

The things he sees in magazines

He is a victim of mass production

I was brought up with my own beliefs

And well, I prided myself on being free

But the powers-that-be invaded me

Looking for some weapons of mass destruction

Blaming low world growth on policy uncertainty is a bad joke. The US isn’t growing gangbusters because no combination of spending on defense, healthcare, and debt are offset by taxes – not in recent history, and not as far out as the eye can see (unless Donald Trump and his merry band of rich misfits crack the code). And it’s getting worse. Meanwhile, Europe is a mess too – and certainly not growing. Moreover, even if the currency union (German political-will) doesn’t fracture when Italy becomes a crisis to dwarf Greece, then if France stumbles all bets are off. Meanwhile, Japan has been in a funk for decades, and China is like the man balancing spinning plates on a pool cue whilst feeling his way barefoot over shards of glass (complete with economic numbers nobody can believe because even electric consumption is a state secret). As the 4th bloc, lump Brazil (plus the rest of Latin-America) along with Indonesia, Africa, and the sub-Continent where large denomination bills (Rupees) were recently outlawed! And the effects of Brexit has yet to register. Bottom line? Looking back on events since 2008, perhaps the raised middle-finger of the Icelanders to British banks will serve as the sole shining example where government did right by the people. Put another way, is policy uncertainty just another way of saying government malpractice? In the immortal words of Schulz’s creation Charlie Brown . . . ‘Good grief!’

8 Years wasted, it appears.