Time to be taking some chips off the table?

By Christine Hughes, Chief Investment Strategist, OtterWood Capital:

This is bear market 2.5 of my career. The half-bear is for the quick one in 1998 during the Asian crisis. It wasn’t the end of the US business cycle but if the Fed hadn’t dropped rates in a hurry back then, it would have been.

Today, we’re still in a “bounce” within an ongoing bear market, and as one market pundit put it, “It’s the bounce that never ends.”

In reality though, bounces can have some serious staying power and produce excitable rallies that convince most the worst is over when it’s just about to get worse.

Below you can see the first big bear I lived through as a money manager – the tech crash of 2000-2002. Smallest bounce was 8%, biggest was 21%:

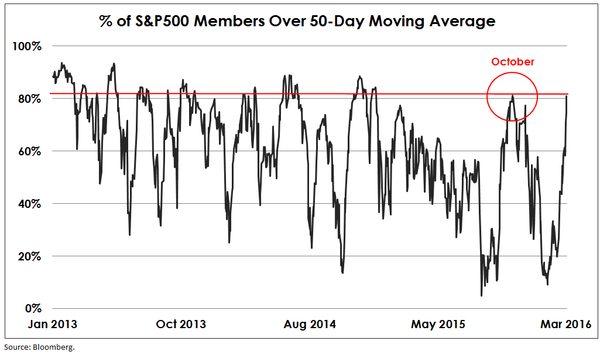

The S&P500 is up 9.3% from the February 11th lows and is now as overbought as last October when the market topped. The chart below shows how the internals of the market are now stretched, the percentage of stocks within the S&P 500 that are above their 50 day moving average is as high as last October.

I don’t think this bounce is going to be a +21%’er, although I think we’ll see those during this bear market. The big bounces come after the markets see very washed-out action which we have yet to see on the S&P500. The current rally is reaching overbought conditions (as noted above), and it’s possible that overbought conditions could get more extreme.

However, this is the time you want to be taking some chips off the table. Credit has barely budged and overall yields have hardly risen throughout the entire bounce – not what happens when we’re off and running for real.

North American oil production is finally coming down, which is good for energy prices and likely sends energy shares higher short-term. However, I also believe that sector is only experiencing a bounce. Please read our blog post for our thoughts on energy here.

Could natural gas soon be free? This falls into the “can’t make this stuff up” category. The WSJ is out with an article about how natural gas storage facilities are almost full, and enough wells are ready to come back online as soon as prices stabilize. That leaves natural-gas prices with nowhere to go but down and, in some areas, way down—perhaps near zero if producers get desperate….

Gold had a pretty good week and broke out to new highs as German 2yr yields hit all-time low negative yields. The lower rates sink into negative territory in Europe and Japan, the more attractive gold looks as a currency. It now costs more money to store cash at a bank in Germany for two years than it costs to store physical gold. BlackRock announced that “Issuance of gold trust shares ‘IAU’ was suspended due to demand for gold.” It means they can’t get their hands on the physical fast enough. Wow.

The next couple weeks are big for macro news as the European Central Bank, Bank of Japan, Federal Reserve, and Bank of Canada all hold their meetings. Expectations for further easing from the ECB and the Bank of Japan are very high, and we’ll find out if they are going to disappoint markets again or beat expectations for further easing. The ECB has promised to cut rates further into negative territory, and we’ll see how that goes over if they indeed follow through. Markets will likely stay buoyant until these meetings.

My issue with further easing measures is that it works to weaken the Euro and the Yen which effectively makes the US dollar go higher. A strong US dollar is how we got into this market stress in the first place. Next week should have some fireworks. I still remain cautious. By Christine Hughes, OtterWood Capital

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’ve read natural gas production is rising, but I’ve also read it’s dropping. I’ve also read the winter following el nino’s tend to be bad. If this is correct enjoy the low natural gas prices while you can.

So don’t buy, don’t sell, and, if you keep your money in the bank, someday you’ll be punished with negative interest. The Germans have a word for this, zugswang (any way you move, you lose).

I love Germans, I got close I married an Austrian, lovely people.

http://dict.leo.org/ende/index_de.html#/search=zugzwang&searchLoc=0&resultOrder=basic&multiwordShowSingle=on

What should Aunt Janet do? Can she do it? Dare she do it?

Just wondering ? If the Fed were to raise interest rates, wouldn’t it attract a lot of foreign money to US banks ? And if so wouldn’t they FINALLY have to lend it out as regular retail loans?? Instead of all this credit card, on-line, pawn-shop type loans we have seen for last 6yrs?? I’m a small business owner with a good #’s for 25yrs. But I’m trapped in a 50yr old building. Ready to expand & hire. But the loan enviroment is dominated by sharks !! What happened to regular business loans and mortgages ? Dod-Frank?? I don’t know. I only took out one SBA loan in my life back in 2004. Paid it off, it was a smaller reasonable loan…But now those don’t seem to be available anymore. And I am currently debt free ! Everything is paid off, tools equipment, vehicles, home, buildings….but everything is old and falling apart. Just like the roads. My dad in his business back in the 70’s never had trouble accessing capital investment-like now.

“The next couple weeks are big for macro news as the European Central Bank, Bank of Japan, Federal Reserve, and Bank of Canada all hold their meetings…..Markets will likely stay buoyant until these meetings.”

and then:

“Next week should have some fireworks.”

There’s seems to be a contradiction here?

NIRP, Brexit, Syrian immigration, rogue US politics, etc… This is shaping up to be one helluva ride. I’ve nev been so entertained.

All these monetary, debt driven problems and cycles are so counter productive to having a stable, happy society. Sometimes i just imagine how the world would look like if we had no money at all. Its a liberating thought to consider that what we do and have is ultimately built and made by society for its own benefit. It’s especially fun to reason out what would happen if money couldn’t be brought back: we would probably realize that the world will keep turning. Even factories would keep working, though they would have to express their finances in a web of contracts and obligations.

And no one should forget what made the great depression so vexing to everyone: in effect, people had no boots but were forced to look at bankrupt boot factories all around them. Workers itched to do something, but for lack of money in the system, couldn’t. The failure of our monetary system created this situation where so much economic collateral damage was done.

Keynesian thinking is a step in the right direction ( keep access to credit open), but it is still missing a major element of a truly stable, 2.0 monetary system.

I think such a system will require another Awakening for our whole society, another Enlightenment so to speak. We have to finally decouple some of our vital economic activities, such as social programs, upkeep of infrastructure etc from the common currency. It’s foolish that the same dollar can pay for ice cream sandwich, a barrel crude or be represented with trillions of others in derivatives. This endangers the basic functions were don’t want perturbed.

Biological systems work the same way, in that they compartmentalize vital functions. In practice, that might mean paying someone in multiple currencies: one for discretionary spending, one that can only be used in economic fields related to retirement etc. Perhaps we could have capital to vote with too: during elections, everyone gets to allocate money to projects they like (so someone could vote extra for one department but not another, etc).

My ideas aren’t fleshed out yet in their entirety, but one thing I’m sure of 100% is that our current system isn’t very stable or advanced. It deals poorly with technological changes and has no chance of coping with structural unemployment, should that ever be caused by robotics. People a few generations from now will laugh about our simple ways, about how we made life so unnecessarily difficult for ourselves.

Very interesting. You are an advanced thinker with insightful comments.

This is a cut and paste from Bloomberg on China’s transition from an export economy to a internal service one:

‘Cheap labor, vast factories and a building spree without parallel powered China’s economic miracle. Times are changing. Services today make up more than half of the nation’s economy as baristas, barbers and baby sitters become the new growth drivers.’

Now isn’t that funnee? Hey, how about an Uber for babysitters? (if someone actually runs with this successfully, I will shoot myself)

Reality check: during the recent Chinese holiday- millions of young people headed home to their villages and towns.

On motorcycles. Mostly 125 cc Yumbos etc. that we would call a kid’s motor bike.

Often there’d be a passenger on the back, with parcels. even a kid sometimes. This was no joyride- it’s freezing cold and traffic jams can be 20 miles long.

Good for them- but sorry, this economy’s consumers are a long, long way from catching up even to the Walmart consumer.

However the reference to barbers may not be entirely misplaced: there are undoubtedly going to be more haircuts.

Islander

As I see it, the main problem with our ‘system’ is simply the rampant corruption that controls it. A world with no money? Money, in whatever form it takes, is simply a store of ones labor & productivity. It really doesn’t matter whether it’s a coin, piece of paper, seashells, rocks, feathers, or anything else in the long list of items that have served as money throughout history. As long as all parties involved agree the item being used as money has X value, it doesn’t really matter what it is.

I’m all for barter whenever that can happen. The main problem with barter is that it relies on a coincidence of wants & it would take a huge barter network to overcome this. Do you partake in any local barter networks?

I understand your dreams for a better world & a different system of money. Our current monetary system/unit & most others around the world is predicated on debt & those that issue the units have the control & keep their populations in perpetual servitude. They expand or contract the economy at will. Greed, corruption, & the lust for control have been with us throughout recorded history & I doubt that will ever change. Our planet has finite resources & there will be a tipping point somewhere down the line. We are wrecking the hell out of this beautiful planet, that’s for sure! There are technologies either unknown, unexplored, or under explored that will likely impact the future ‘tipping’ point so all we can do is throw out our best guess at future sustainability. That said, I believe our current system has spawned way to many useless eaters & unproductive people that are a drain on the system & natural resources.This may sound cruel to some, but there is a large segment of society that could not cut it in my version of a natural world. I have great compassion for those that for “reasons outside their control” cannot sustain themselves. Able bodied unproductive men & women, not so much.

I don’t think an exotic system of monies is needed. End the debt based units. End fractional reserve banking & you would have a system that for the most part reflects real growth, which is fairly low. End all the financial engineering games & products, just outlaw them. The only loans made are backed 100% by deposits & you get paid a real return on your savings because you agree/contract to leave your funds in the bank for X period of time in exchange for a real return on your funds. These changes would take away the mechanisms that the greedy use to game the system & enslave the masses. In my vision, the economy only grows at a natural rate correlated to population growth, productivity, & savings rates. I don’t have a solid answer for bonds, whether municipal or private, still pondering that one.

I can’t begin to envision how your world of labor would work with the web of contracts & obligations you eluded to. I don’t get the 4th paragraph in your post at all, care to expound on it?

In the end, whatever ideas are laid out & however logical they seem on paper, is there any system (political or financial) that can work with millions or billions of people? I’ve concluded that there isn’t due to the corrupt nature of mankind in general. Undoubtedly, there are great numbers of well intentioned good people, but they get overtaken by the smaller majority of corrupt scum that inhabits the earth. Ever try to work with a small group on a project, say 10 people. It’s often hard to do. Everyone has their views on what is right & will work & will not work. Now try it with 100 people, then 10,000, then millions.

What we have had throughout history is a situation of fraud/control that is enforced through violence. The strongest army of the day imposes it’s will on the people, simple as that. Comply or die! Our current implied freedoms are a ridiculous illusion IMO.

Try this sometime. Search for a time lapse map of a given region of the earth that spans hundreds of years & watch as the borders/names change & see the varied amount of peoples that have ‘ruled’ any given piece of ground over a long period of time. Invade, conquer, comply or die. Same old song & dance throughout history. I try to mitigate the realities as best I can, mostly through knowledge & attitude as well as trying to remain connected to the earth in my own way. Stay positive but realize that a few generations from now, the “system” will still most likely be controlled by the strongest army of the day & enforced through violence.

Can we invent a new market? “Dog chasing its own tail”?

As Christine rightly said, a strenghtening dollar is what kicked off the present “bear” market. The present rally/bounce was kicked off by a weakening dollar, vis-a-vis with the euro and yen.

In the next couple weeks both the ECB and the BOJ are bound to do something about it. They just have to because they cannot reverse course.

The problem is what form this will take: the “stimulus and easing” crowd has pretty high expectations as always, but there isn’t a whole lot left to cut, if anything. More QE is bound to cause more havoc on bank and insurance companies balance sheets. It’s very likely any enthusiasm will be very short lived.

This leaves the US Federal Reserve which, however, has painted itself in the tiniest of corners. It cannot cut rates because that would mean the data it uses are worthless. It cannot raise rates because that would mean sending the dollar skyrocketing and markets falling. All it has are words, and the hope they will have the usual soothing effects on markets.

Now, over the past two months I noticed two very peculiar phenomena.

The first is “panic buying”, a new version of the old saying “bad news are good news because… stimulus!”. To do so in face of increasingly unwilling and ineffective central banks is a recipe for trouble. What if that stimulus materializes and “disappoints”? What if that stimulus fails to materialize altogether? It’s one thing to buy because you feel the price had dropped enough to allow you to turn a profit over a certain timeframe and quite another to simply buy assets you somehow hope will be at the receiving end of some stimulus program that doesn’t exist and probably will never exist.

The second is the odd behavior of energy. The short squeeze (or forced rally) in oil is an abomination engineered by creditors to allow distressed oil outfits to sell equities and to repay secured loans. We haven’t seen the end of it yet (oil may test $45 or even $50/bbl shortly) but it’s bound to cause a bust of epic proportions because fundamentals are unchanged if not worsening.

And then we have natural gas. American consumers are lucky to be feeling market forces at work. The European benchmark (Russian natgas at the entry points in Germany) is down 43% year on year but retail price is actually going up. Deflation for me but not for thee but better profits for me (and my government buddies skimming VAT off reatil prices).

How long can this downright manipulation of energy continue before yet another correction hits and hits hard?

i’m optimistic. i have to be.

in my opinion, it’s a long-term bull market.

just try not to think you can’t be made into hamburger.

Ha ha….yikes!….Ground Round 2.0

According to Stockhouse, issuance of new IAU sharec could come as early as 6 business days after the announcement by Blackrock. That is Monday March 14 if I calculated correctly. Shall we see DUST go up Tuesday????Just Asking.