But all games have an endgame.

By Larry Kummer, Editor of Fabius Maximus, a multi-author website with a focus on geopolitics:

Nothing shows how America’s reins are held than our out-of-control corporations, enriching their executives at the cost of the future of their businesses — and ours. Here’s another status report on this sad but fixable story.

The Q2 Buybacks Report by FactSet is, as usual, sobering reading. During the 12 months ending in June, companies in the S&P 500 spent $555.5 billion repurchasing their shares. For the first time since October 2009, buybacks exceeded free cash flow (cash flow after capex); they’re borrowing to buy back shares.

For the past two years buybacks have run at the fantastic rate of about $120 billion per quarter — the same rate as in 2006-2007, with tech companies the leaders. In 2014 they spent 95% of their profits on buybacks and dividends (building the future is somebody else’s problem in corporate America).

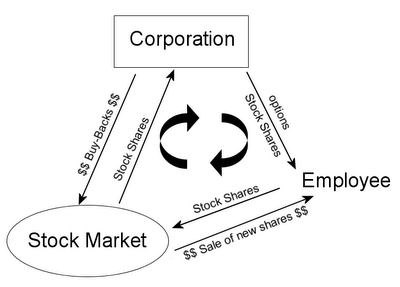

Investors applaud this as a boost to share prices. Surprising to the naive, a decade of buybacks has reduced the S&P 500’s share count by only 2%. Share buybacks are one part of the triangle trade that transfers vast fortunes from shareholders to senior executives using stock options:

- executives exercise their options when shares rise (i.e., the company sells shares to executives at a discount to current prices),

- the executive sells those shares to the public,

- the company buys back those shares from the public.

Net result: the company has less money, their executives have more, the share count is unchanged.

This is an example of how America’s senior executives have learned to treat running companies — even running them into the ground, as Carly Fiorina did at HP — as a sideshow to their real job of financial engineering (for their personal profit). During their boom, the Japanese called these financial games zaitech (cursing it after their crash in 1989). Stock options, tax avoidance, earnings manipulation, mergers and acquisitions (almost all of which fail; see articles at CBS and HBR) — these are the paths to success for execs in New America.

Today’s example: Monsanto

Monsanto is famous for introducing large quantities of glyphosate-based herbicides (e.g., Roundup) to the biosphere, despite controversy over its toxicity. Why rely on research in the lab when you can use the world as your test tube? (Also see the MIT website about Roundup Ready Crops.)

Like other high-tech companies, Monsanto’s executives decided zaitech offered a better-risk reward ratio than biotechnology. So they massively borrowed to fund dividends and buybacks, as shown by this slide from their October 2015 quarterly presentation…

The fanboy investment community applauded this bold application of “The World’s Dumbest Idea,” as aptly described by James Montier at GMO.

- “Monsanto Loads Up on “Fertilizer” to Grow Its Stock Price” at the Motley Fool (July 2014).

“Monsanto is levering up to return cash to investors”. - “Monsanto’s Buyback Has Become Quite Substantial” by Tim McAleenan Jr. at Seeking Alpha (Dec 2014): “historically cheap and is a fair starting valuation for a company with double-digit growth.”

- “Analyst Favorites With Strong Buyback Activity: Monsanto Ranks As a Top Pick” at the Online Investor (Feb 2015).

- “Barclays: Stocks With High Buybacks Make Better Investments” (April 2015) — So they do, in a euphoric bull market.

- “Monsanto Buyback Sets Stage for Higher Stock Price” at Barron’s (June 2015).

Monsanto’s executives delivered, reducing the share count by 12% during the past 2 years. But all games have an endgame, which Monsanto learned after the failure of their “hail Mary” offer to merge with their large competitor Syngenta. During the past five years they’ve bought their stock with an average price of $116; it closed at $88.06 yesterday (graph from StockCharts).

Expect no refunds from management, just more executive bonuses as they announced plans to “separate” 2,600 employees and spend $3 billion on “accelerated buybacks.” By Larry Kummer, Editor of Fabius Maximus

And what might spark a crisis? Read… US Economy Flies into “Coffin Corner,” But We Don’t Mind!

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

All games have an end…. the question is how long and how much pain will be endured until this one is over. I am growing tired of the nonsense.

CEOs and his cronies under BOD’s nod of approval resorting to Financial Engineering to goose up the #s and their bonuses…

So they go out on gorge on cheap credit thanks to Helicopter Benny and his protege Janet’s ZIRP policy and buy back shares to goose up the #s….

Welcome to American corporate world bowing down to stockholders as who cares about increasing EBITA and GAAP accounting and focus on revenue and profit when they can be manipulated if not #s made out of thin air (like FIAT currency) by non-GAAP and mark to market accounting?

That said – there are consequances to financial engineering and ZIRP inspired stock market…

“This is an example of how America’s senior executives have learned to treat running companies — even running them into the ground, as Carly Fiorina did at HP — as a sideshow to their real job of financial engineering …”

This is the way most big companies are run today. It is standard operating procedure. Indeed, any executive who doesn’t do this would quickly be ousted.

Read Robert Cringley’s book about IBM. That company is being cannibalized for profit.

Three large companies I worked for during the first decade of my career are gone.

Going after Monsanto, a company everybody loves to hate, hits and easy target, but what about blowing the whistle on a much beloved company with a cult following, Apple? Here’s a quick down and dirty:

“During the 12 months ending in June, companies in the S&P 500 spent $555.5 billion repurchasing their shares.”

And Apple, alone, has borrowed $55 billion to pay for its stock buybacks and dividends.

Apple relies on slave labor for materials:

“As this mini-documentary from the Pulitzer Center shows, children as young as 13 are forced to work in the mines for as little as 2 dollars a day. They wear no safety protection, carry a store-bought, battery-powered flashlight, and often die from brutal working conditions that result in suffocation, cave-ins, and death from sheer exhaustion. Multinational corporations like Apple, Samsung, Dell, and HP all depend on the Congolese mining operations for their raw materials, as 80 percent of the world’s coltan supply comes from the region. The children have no other option but to work in the mines, because school is beyond the financial means of ordinary Congolese families.”

And how does Apple treat its Chinese workers?

“Workers in Chinese factories making Apple products continue to be poorly treated, with exhausted employees falling asleep on their 12-hour shifts, the BBC has said after an undercover investigation.

Reporters who took jobs at the Pegatron factories found workers regularly exceeded 60 hours a week – contravening the company’s guidance – and that standards on ID cards, dormitories, work meetings and juvenile workers were also breached.

Promises made by Apple to protect workers in the wake of a spate of suicides at supplier Foxconn in 2010 were “routinely broken”.

And Apple pays almost no taxes on the $190 billion it claims to have stashed in offshore tax havens.

Apple CEO Tim Cook’s 2014 pay was over $100,000,000.

Enjoy your I-phones.

Rich,

I’ve gone after Apple plenty of times. But I don’t want to sound like a broken record. Here are some of my better examples:

===> make sure you read the third one: “Revealed: Apple’s Offshore Cash Isn’t even Offshore.” Because this is one of the biggest tax scams in America….

http://wolfstreet.com/2015/03/09/does-apple-get-enough-free-publicity-from-the-fawning-media/

http://wolfstreet.com/2013/10/04/apple-after-2-year-fight-fails-to-squash-cafe-in-germany-2/

http://wolfstreet.com/2013/05/22/revealed-apples-offshore-cash-isnt-even-offshore/

http://wolfstreet.com/2013/04/30/wall-street-engineering-hones-in-on-apples-offshore-cash/

You idiot…Apple now produces all their goods at their South Carolina-Super Headquarters. However, Windows, HP, Samsung etc are still made by slave labor at FOXCONN—-quit spreading crap that you know to be false, TROLL

Enjoy your stupidity! lol

also, Microsoft hires temps, who they abuse, then fire after so many hours, and refuses to give them Medical benefits. I used to work there-plenty of cult like worshippers of Bill Gates

I used to be FTE blue badge at MSFT.

I recall the big hoopla back in 2000 when the orange badge contractors got together on class-action lawsuit which only enriched the lawyers and ridiculous since they came thru agency knowing no benefits but usually at higher hourly rate. Outcome was that people got few thousand $s and worst part was they can work only 10 months on followed by 2 month off – forced furlough – unless they work on another gig which hurt a lot of people who preferred to work as orange badge. Some started their own 1099 companies but that was only for those who were really “consultant”.

And what was uncool was that many blue badges looked down upon the orange badges often doing same work.

I think this is a joke, a form of irony, where you say one thing and mean the opposite. It better be. I’m laughing … “Apple now produces all their goods at their South Carolina-Super Headquarters” Just HILARIOUS. So in the that light, I find the rest of it hilarious too.

(But if you were serious, the comment would be headed for the trash bin.)

I have 1st hand account of Foxconn…

Visited Foxlink the Foxconn subsidiary who makes cable assy in Baoan district of ShenZhen in 2002. Foxlink was 2nd tier cable supplier to Flextronics the 1st tier EMS. It was the most DESPICABLE plant I’ve visited outside India. There was latrine at end of each floor and it smelled really BAD like open cesspool. It was unbearable and the plant managed seeing our facing expressions said new and trouble maker workers are placed near the bathrooms. 1 of my engineer noticed that the cable harness machine was winding cable wrong way and plant manager called the shift supervisor and chewed him out in Chinese. He later told us the poor operator and supervisor got fired and thanked us for pointing out quality control issue.

No wonder local Chinese workers avoid working for Taiwanese factories…

go to any big companies website and it is filled with “diversity is our strength” propaganda.

meanwhile, they are paying slave labor wages overseas on all the jobs they shipped there from the USA.

its a nice racket, the diversity scam. distract, divide and conquer.

I think the whole sad story is the government is very happy to regulate the everyday person while letting corporates run riat at the expense of our economy. We are left to pick up the pieces when I all goes wrong. The fed had there chance to fix it 3 yrs ago but they sat on there ass ( caved in to the big corps ) with easy credit for far to long . ( that was supposed to free up liquidity ) No wonder we don’t trust governments. The sad thing is the emphasis isn’t about people and good jobs. It’s about the big corps getting fatter at the expense of the working person who end up paying the price. The more things change the more they stay the same. We are meant to be smarter but are we history has a habit of repeating itself and it’s no different this time. This government should be charged with negligence. For all our education what is smartness. For those that hurt us the most we end up bailing them out .what a travesty of justice