By David Stockman, David Stockman’s Contra Corner:

When stock market guru Laszlo Birinyi told bubblevision today that S&P 3200 would be reached by 2017, his argument was essentially to keep on keeping on:

“What we’re really trying to tell people is stay with it, don’t let the bad news shake you out…There’s no reason we can’t keep on going,” he said.

That got me to thinking about when I first ran into Birinyi at Salomon Brothers way back in 1986. He was then a relatively underpaid numbers cruncher in the equity research department who was adept at making the bull case. Nigh onto 30 years later he has become a rich man crunching the numbers and still making the bull case.

Indeed, I don’t ever recall when he wasn’t making the case to be long equities, and as the chart below shows, you didn’t actually have to crunch the numbers to get there. Just riding the bull from 200 in January 1986 to today’s approximate 2100 on the S&P 500 index computes to a 8.4% CAGR and a 10% annual gain with dividends.

Even when you take the inflation out of it, this 30-year run is something close to awesome. But, alas, that’s my point. It’s too awesome.

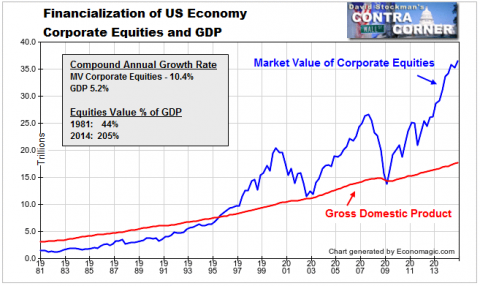

In inflation-adjusted terms, the S&P 500 index rose by 6.2% per annum over the last three decades. That compares to just a 2.2% annual advance for real GDP, meaning that the market has risen nearly 3X faster than national output in real terms.

You don’t have to be a math genius to realize that a few more decades of that kind of huge annual spread, and the stock market capitalization would be several hundred times larger than GDP.

Likewise, you don’t have to be a PhD in quantitative historical research to recognize that the last three decades are utterly unique. If you run the clock backwards by 30 years from the January 1986 starting point, for instance, you get a totally different picture.

Between the relative sunny Eisenhower times of 1956 through the eve of Greenspan’s ascension to the Fed, the S&P index rose by only 4.4X, not 10X. Even more significantly, when you strip out the inflation, the real index rose by 1% per year, not 6.2%.

Moreover, those dramatically less awesome stock market trends occurred during an era when the US economy was riding at its post-war high and clocked GDP growth of 3.5% per annum. That’s 60% more than the most recent equivalent period.

And while we are at it, let’s throw in the ultimate litmus test by comparing the real median family income growth between the two periods. During the 1956-1986 interval this basic measure of the main street standard of living rose from $36,000 to about $60,000 or 1.7% annually.

Since then, not so much. Between the days when Birinyi was peddling stock charts at Salomon Brothers and the present, the real median family income has risen by less than $4k or by 0.2% per year. You could call that flat-out stagnation for 30 years—-unless you like to quibble about rounding errors.

So the question recurs. If real GDP growth has decelerated so sharply and if family incomes have stagnated so unfortunately during the last 30 years why has the stock market been so relentlessly hyper-bullish?

Enter Alan Greenspan at the Fed in August 1987. At length, something else started growing like gangbusters.

To wit, the Fed balance sheet exploded by 22X during the last three decades. That amounts to 11.5% per annum in nominal terms; 9.2% in real terms; and four times the growth rate of real output.

The linkage between the Fed’s erupting balance sheet and the stock market’s 30-year bull run is not at all hard to fathom. Well, not unless you are a Keynesian economist and resolutely insist that balance sheets don’t matter; that it’s all about flow and “aggregate demand”.

But that’s a ridiculous self-serving rationalization that Greenspan era central bankers blather about and Wall Street finds stupendously convenient. In fact, what happened was that the Fed’s relentless money printing caused a sweeping financialization of the US economy driven by a supernova of credit market debt.

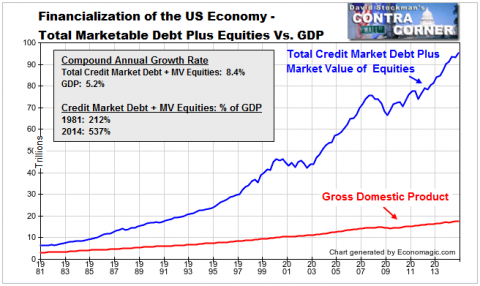

During the approximate span of the modern bull run, credit market debt outstanding in the US—–household, business, financial and government—-has soared by $50 trillion. That compares to just a $13 trillion gain in GDP. Self-evidently, it doesn’t take a spread sheet to recognize that the nation’s leverage ratio soared in lock-step with the upward bounding stock market.

In fact, the 2.0X leverage ratio of 1986 was already significantly elevated from the historic 1.5X leverage ratio that had prevailed for a century prior to Nixon’s 1971 folly of destroying Bretton Woods at Camp David. But by the time of the financial crisis it had soared to 3.5X, and since then has retraced hardly at all.

In short, the last three decades have essentially witnessed a national LBO in which the productive capacity of the main street economy was hocked to a massive accretion of fiat credit. That is, the staggering growth of debt and leverage shown above did not result from some kind of rollicking outbreak of thrift and honest savings out of current income.

Indeed, the household savings rate has been plunging ever since 1971. So today’s mountain of debt was not funded from honest savings; it was conjured from thin air by the nation’s central bank and the banking and financial system into which its massive emissions of fiat credit were deposited.

This collapse of domestic savings, of course, raises the question of the economic dog which didn’t bark. That is to say, in a closed economy this kind of massive outbreak of fiat credit should have caused a nasty surge of consumer inflation.

But it didn’t because just as Greenspan was cranking up the printing presses, China’s Mr. Deng proclaimed that it was glorious to be rich, and that communist party power under the new regime of red capitalism would no longer issue from the barrel of a gun, as Mao had insisted. Now it would come from the end of a printing press.

Accordingly, Greenspan exported the massive dollar liabilities that accumulated on the Fed’s balance sheet, while China, the oil exporters and the Asian mercantilists including Japan mopped them up by printing staggering amounts of their own money.

So doing, they inflated their own currencies, thereby suppressing their exchange rates and showering America and much of the DM world with artificially cheap goods. At the same time, a tidal wave of wage compression otherwise known as the “China price” flattened labor costs in the DM tradable goods industries and spilled over onto their suppliers, vendors and adjacent sectors.

Needless to say, it was this mutually linked monetary and credit tsunami that enabled the massive financialization of the US economy and the 30-year bull run which it fostered. With labor priced at close to zero and capital massively subsidized by the people printing press of China, exports from the Mr. Deng’s gleaming new export factors virtually swamped the planet.

In a world of honest money and credit funded from real savers, not central bank printing presses, of course, there is not a remote chance that China’s exports could have risen by 40X in less than three decades. That was 17% annually and is a rate of gain that cannot be sustained without systemic falsification of exchange rates and financial prices by the central banks.

In a true free market, the China export machine would have run out of capital to build cheap factories and would have suffered soaring exchange rate increases long before the historical aberration depicted in the chart below reached its current towering height.

In the short run, of course, these vast deformations of credit, trade and capital flows all amounted to a giant economic swap. The vast rice paddies of Asia were awakened and brought into the global trading system and monetary economy. So doing, they absorbed the Fed’s monetary inflation and permitted main street American to goose its living standard with debt financed consumption, while not inflating the cost of goods and labor.

At the same time, America’s $50 trillion uptake of new debt provided the financial fuel that funded a massive increase in stock market speculation and corporate financial engineering in the form of LBOs, stock buybacks and incessant M&A deals. In a round about but unmistakable manner, the East Asian central bank printing presses recycled the Fed’s monetary inflation back into domestic financial asset inflation.

That is the true reason for the stock market’s 30 year bull run. There has been a huge increased in the capitalization rate of national income or the implied PE ratio of the stock market. But that did not reflect a permanent improvement after 1986 in the productive efficiency or profitability of the US economy.

In fact, measured productivity growth has been cut in half. And were real GDP not overstated owing to ridiculously low price deflators, the true rate of productivity gain since the late 1980s would have registered at a mere fraction of its pre-1986 trends.

No, the fact that the US stock market capitalization rose from 60% of GDP upon Greenspan’s ascension to 200% today is purely a monetary effect. In practical terms, it reflects a giant ratchet upwards of leveraged speculation in the financial system.

At the end of the day, that’s what ZIRP, QE and the implicit Greenspan/Bernanke/Yellen “put” do. They fuel a cycle of debt funded speculation that drives asset prices ever higher, which, in turn, become the collateral for an even bigger credit-funded bid for financial assets.

In sum, at the time that Birinyi was peddling his Salomon stock research reports back in 1986, the financial sector—defined here as the market value of equities plus credit market debt outstanding—was about $12 billion. Today it is $93 trillion.

You might call the above the mother of all bubbles. And you might also ask why that bubble can be expected to “keep on keeping on” when at last something epochal has changed. Namely, the world’s convoy of central banks have run up against the limits of money printing.

In the US, the Keynesian apparatchiks who run the Fed have decided to quit on the basis of doctrine and their thoroughly misguided belief that the US economy is “fixed”. But once they embark upon “normalization” later this fall, there will be no turning back. A reversal into a new round of massive balance sheet expansion would amount to a repudiation of the last 20-years of Fed policy, thereby triggering a collapse of confidence in the casino and a selling panic of epic scale.

Likewise, China’s printing press is being forced into neutral as well. Having turned a few hundred billion of domestic credit at the time of Mr. Deng’s early 1990s proclamations into $28 trillion today, the overlords of red capitalism sit atop the most lunatic pyramid of credit and speculation in human history. Capital is now fleeing the swaying towers of the Chinese Ponzi—upwards of $800 billion in the last year alone.

Accordingly, China’s central bank is being forced into an about-face. After nearly three decades buying dollar liabilities with newly printed RMB to keep its exchange rate from rising, it is now in the position of selling dollar liabilities and shrinking the RMB supply in order to keep the exchange rate from plunging into an abyss.

This means that the principle central banks of the world do not have the firepower to keep inflating the global financial bubble. Indeed, they are helpless in the face of a worldwide deflationary wave that is the product of their own falsification of asset markets and systematic financial repression.

In a word, Birinyi’s 3200 call is bull because the central bank enabled 30-year bull run is over. At last. By David Stockman, David Stockman’s Contra Corner

China is not a sideshow; it’s the radioactive core of the entire global bubble. Read… Wall Street Still Didn’t Get The Memo – China’s Done!

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Where is the money to push the market higher coming from? Unless the govt sends everybody a check and unleashes a spending spree the size of the Wall St. bailout, I don’t see how this happens.

Venezuelans who invested in the stock market have done pretty well so far. Perhaps when the US is close to that moment, money would escape the bond market to the stock market?

The future is as before quite unknowable.

Petunia, to answer your question, the speculation I have heard is that it will be flight capital leaving Europe. The expectation is that the euro zone will not do well in the years ahead and the hot money will flee to the US. With the bond market on the ropes and little opportunity for investment, the money will gravitate into the stock market driving it up. In short, the expected rise in the Dow will not be a good thing at all.

Mind you, I don’t know if this is likely or not, but I suppose that this logic is what is driving Mr. Birinyi’s comments.

I am sure they will desperately try something. However they will a best delay the inevitable.

Did I really read this correctly? “The Fed balance sheet exploded by 22X (times, that is) during the last three decades.”

Greenspan and company, who were brought in by Reagan toward the end of his second term, have executed the Banking Gods’ plan expertly! What a great scheme … or scam: 1) Create money at the Fed to buy Treasury Notes – you know, to pay for the cash Uncle Sam spends every year that it doesn’t have. 2) Create a ‘reserve status’ for Wall Street’s big boys keep cash on stand-by for the Fed after it is loaned to the banks at essentially zero interest. 3) Wall Street guys like Jamie Dimon and Lloyd Blankfein use these reserves given to them for pennies on the dollar to hold, and sell them as loans ten or more times over to people, corporations and all forms of governments on planet earth. 4) The banks package up and peddle these loans they’ve sold and hold, into bonds by waving the post Glass-Steagall wand (granted by Bill Clinton),and insure, bet and lie on what are now assets which are really of unknown value and cannot be truly accounting for. 5) Then what the heck, why not just transfer wealth to the Uber- elite as the Fed’s puppet master du jour pulls the strings.

Please tell tell me, did I read this correctly?

P.S. to Wolf and readers: At a field day in Casselton ND today, one of my contacts in the seed business in Park River ND told me he reckons that 50% of the wheat farmers in his area did/do spray RoundUp on wheat a few days before harvest – which is full swing now!

Dan for the non-farmer like me – do you mean that farmers are not harvesting but destroying the wheat with Roundup ‘cos wheat price is too low?

Re: Preharvest Roundup application.

Not for destroying the wheat, It’s, nominally, for the weeds in the field.

http://roundup.ca/_uploads/documents/MON-Preharvest%20Staging%20Guide.pdf

[If this link doesn’t work, just google: wheat roundup spraying pre-harvest and look for the Monsanto guide pdf.]

Applying pre-harvest RoundUp is putting poison into the grain. Some farmers do it because they want to help get rid of weeds and make for an easier harvest by having the wheat plants’ straw drier – which makes it easier to cut. Plus, they can use the RoundUp to accelerate the depletion of moisture in the grain.

Yesterday at the field day, one farmer nearby made a sample cut with his combine and the wheat was at 23% moisture – which is too high. 13% is ideal, and a few more percentage points of moisture is OK, but too much is trouble.

The bull to the stratosphere schmucks of Louis Rukeyser PBS stock show – Acampora and Laszlo Birinyi. What can go wrong?

Wait, when the fed began their QE program they assured us the assets they were monetizing would be sold back into the markets for a tidy profit and they would “normalize” their balance sheets.

I think my old mortgage is in that graveyard somewhere.

Hahaha

gee whillikers! My, my, my! Can we say, “creating fictitious capital” kiddies? This sort of thing was predicted a long time ago and it was also predicted that the end result would not be pretty.

Oh well, What goes up must come down…… sooner or later, and I suspect more likely sooner than later. ^,..,^

WANTED: Debt slaves. Inquire within your nearest bank.

When I was lad/teen living in NJ back in the 70s, I had an odd fixation with the Dow. We would hear where it closed on the news every night and it always flirted with 1,000, which to me at the time, represented a break into a new level, a landmark. One time it made it briefly before dropping back down. Then, one day in the early 80s, it broke one thousand and never fell below that mark again.

After watching it for flirt with 1,000 for over ten years I saw it break above 2,000 only a few years later afterward. Then a few years later, it broke 3,000. I thought it was odd that it took decades to break above 1,000 but then a relatively short time to breach 2,000 3, 000. I was working with a wife and stepkids and not paying much mind though.

Then it broke through 4,000 only a few years later and I was like, “What the…?”

Then, the Dot Com Bubble launched. I started hearing about all these companies that basically consisted of an idea and some computer code filing IPOs and being outrageously overvalued. I thought it was strange to see these young companies that barely produce anything tangible being valued so highly.

Fast forward to the summer of 2009. The shit has hit the fan, jobs are flying out the window and have been for over a year. Banks are dropping left and right, yet the markets started rallying. Now, I am not, nor have I ever been, involved a trader or investor but I am familiar with market fundamentals and this recovery in the markets defied logic and fundamentals. That was the launching point for my delving into the economy as well as fiscal and monetary policy. While trying to figure out what was going on, I found an opinion piece by a blogger that stated that only a few stocks were the basis for most of the recovery and I believe they were all banks, banks that had been bailed out.

I started thinking and researching, trying to further figure out what was going on. My conclusion was that the game changed after The Nixon Shock. It was the era that truly introduced a centrally managed economy, not just here but almost everywhere. It led to the USD and eventually all other currencies becoming fiat currencies.

All the signs point to the early 80s as the launch point of the debt based, service economy. The onset of easy credit. Previously you would only qualify for a line of credit if you had some sort of collateral and stable employment. Then along comes this card that you could apply for at Sears that promised to pay back a pittance of your “money”. The more you spend, the more you received in return, even if it was a pittance by comparison. Now, I was raised to believe that credit was only for emergencies but here is this company seemingly encouraging people to borrow. It defied the lessons I was raised on.

Anyway.

The whole damn thing is a house of cards. When it falls the next time, it will make “The Great Recession” look like a Sunday picnic. Why? Because The Fed has no wiggle room when it comes to interest rates these days.

I could go on but my bed is calling me.

What you are describing came about as a result of the rise of derivatives in the market. The mortgage backed security was invented in 1977 by Lewis Ranieri at Salomon Brothers. Please bear in mind that options are also derivatives. The more popular derivatives became in the market the further away from fundamentals the market got.

Dan and Dave, your stories are my own, I had a leg up by reading Atlas Shrugged, wrestling with the conundrum for a couple of years, and unable to disprove her ideas, became a capitalist philosophically. But like you I had no history as an investor except through work and the 401k thing. Like you I started seeing contradictions everywhere. It was Mike Maloney’s 5 part Hidden Secrets of Money videos that woke me up. I think the first 3 were out and I had to wait for the last two. In Reagan’s defense, Greenspan had the rep for being a sound money guy and had been part of Ayn Rand’s inner circle. But like many who go to Washington, he seems to have been turned.

There is a unique cultural atmosphere in Washington that absolutely despises the American people, has no hesitation about lying to and deceiving them and is only interested in increasing the profits of the very rich and very powerful. All domestic and foreign policy ultimately is directed towards end, regardless of the will of the American people. It is this atmosphere that corrupts all the people we elect, including Obama. Hillary joined up with this power clique a long time ago.

Ayn Rand often gets blamed for corrupting America but I hardly see her as in any way approving of the current situation, in fact far from it. I am quite sure also that she would condemn Greenspan as an unmitigated knucklehead who learned absolutely nothing from his time with her.

I have heard the real corrupter is Leo Strauss. It was he who told the rich they were a vastly superior ruling class (a “golden” class) who should lie to and exploit the common people (tell “golden” lies) and that they should undermine democracy and rule behind the scenes. The well being of the people was irrelevant and they deserved the harsh lives they were condemned to by their own inferiority. All wealth and power hould flow to the deserving top. I am not sure if Leo Strauss actually said all this, carefully veiled in obscure and esoteric language but some of his followers certainly interpret his ideas like this. It is disturbing how many people in the corridors of power in Washington were educated by hid disciples.