“It’s an election about who will protect our economy in a period of ongoing global instability,” Stephen Harper, Prime Minister of Canada, announced on Sunday as he officially kicked off the campaign for the federal elections on October 19. He’d just asked Governor General David Johnston to dissolve Parliament.

“Now is not the time for the kind of risky economic schemes that are doing so much damage elsewhere in the world,” he said. “It is time to stay the course and stick to our plan.”

Stay what course, exactly? Because Canada is likely in the middle of at least a “technical recession.”

At first, there was hope that only the oil patch would be headed that way. Now the oil patch is already there. In the city of Calgary, Alberta, the epicenter of the oil bust, home sales plunged 14% in July year-over-year, according to the Calgary Real Estate Board (CREB). Year-to-date, homes sales are down 25%.

Despite months of assurances that the oil bust and the broader commodities rout won’t spread into the rest of the Canadian economy, they’re now beautifully spreading into it.

The Business Barometer Index of small business confidence dropped in July to 58.2, the worst level since mid-2009, a level that corresponds with a shrinking economy. “One normally sees an index level of between 65 and 70 when the economy is growing at its potential,” the report said.

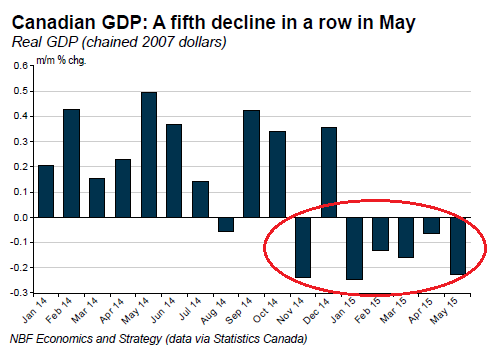

That’s what Statistics Canada has been confirming for months: on Friday, it reported that GDP in May fell for a 5th month in a row.

“Much worse than the flat print expected by consensus,” is how Matthieu Arseneau, a Senior Ecoomist at National Bank Financial explained the phenomenon:

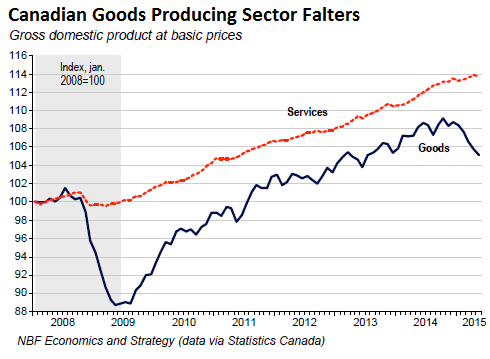

Goods producing industries saw a 0.6% drop in output, as declines for mining and oil & gas (-0.7%), manufacturing (-1.7%) and utilities (-1.4%) dwarfed increases for construction (+1.0%) and agriculture (+0.2%). Industrial production fell 1.2% as a result. The services sector’s output also fell 0.1 % as declines in wholesaling (-1.0%), health (-0.4%), transportation & warehousing (-0.3%), finance/insurance (-0.3%) and information/culture (-0.3%) more than offset gains in retailing (+0.5%), accommodation/food services (+0.9%) and real estate (+0.4%).

The Canadian economy contracted roughly 1.8% annualized over the March-May period.

This chart by National Bank Financial shows the increasingly ugly economic scenario. Note how the economy shrank in six of the last seven months:

The report goes on:

While there were the expected declines from manufacturing, energy, and wholesale, the weakness of other sectors came a bit as a surprise. It will now take more than 1% growth in June to prevent Q2 GDP from printing negative. So, odds are that Canada’s economy contracted for the second straight quarter in Q2 (i.e. technical recession).

The goods producing industries took the biggest hit. Output in May fell 0.6%, down for the fifth month in a row. But the service sector, the beacon of hope in the Canadian economy, has now stalled too – it actually fell 0.1% in May:

But the all-important output of real estate agents and brokers rose 2.1%, up for a fourth month in a row. And construction grew 1.0%, “as engineering and repair construction as well as residential and non-residential building construction advanced,” Statistics Canada reported.

This is part of Canada’s magnificent housing bubble, which is still red-hot in Toronto and Vancouver, and must be maintained at all costs, for the benefit of all sectors involved, from construction to brokers. And so the Bank of Canada has cut interest rates in July to 0.5%, the second desperate cut this year [read… Bank of Canada Sees Global Economy, Freaks Out, Cuts Rate, Warns of Financial Stability Risks, Loonie Plunges].

But that magnificent housing bubble, which is already hissing hot air in the oil patch, is at risk even in Vancouver and Toronto, as Toronto-Dominion Bank warned on Friday:

When we put it all together, key housing indicators on balance continue to highlight the vulnerability of the Toronto and Vancouver housing markets to a significant correction in activity and prices.

In light of its hotter price performance over the past three to five years and greater supply risk, this vulnerability appears to be comparatively high in the Toronto market.

To soothe our already ragged nerves, TD Bank said that it sees for Toronto a “‘medium’ rather than ‘high’ risk to the kind of painful and disorderly price adjustment that was endured in the United States a half-decade ago.”

The most worrying metric in TD Bank’s color-coded indicator is the existing home price-to-income ratio. It’s dark red.

For years, prices have soared far faster than incomes. But even with ultra-low interest rates and aggressive lending, the pool of potential buyers is shrinking. And the market can’t rely forever on the influx of wealthy Chinese and other foreign buyers, while a growing portion of the local population is shoved aside.

As Canada is wobbling into at least a technical recession, the government has been adamant that it’s not heading into any kind of real recession. And that story must be kept alive until the election in October. So Canada-based cartoonist David Parkins puts the dilemma of Prime Minister Stephen Harper and Finance Minister Joe Oliver into hilarious perspective:

Technical or not, it’s ain’t pretty: Parkins on Harper and Oliver in grip of something ugly #cdnpoli #cdnecon pic.twitter.com/KJ0Ra1w800

— Stephen Wicary (@wicary) July 31, 2015

For a long time, conservative mortgage standards have been touted as one of the reasons why Canada’s magnificent housing bubble, when it implodes, will not take down the financial system, unlike the US housing bubble, which terminated in the Financial Crisis. But now Canada’s largest non-bank mortgage lender threw a monkey wrench into this theory. Just the tip of the iceberg? Read… Liar Loans Pop up in Canada’s Magnificent Housing Bubble

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I’ve been expecting this for awhile and when that thing blows, it will be u-g-l-y. We watch some of those home improvement shows as well as the flipping shows that have made their triumphant return after a brief recess as house prices here fell. Anyway, several of them are filmed in Canada and many of them involve homes with ridiculous valuations, even if they’re priced in Canadian dollars. You’re talking California level valuations.

I’ve been almost amazed our neighbors to the north saw what happened here and allowed it to go on there. I’m not terribly familiar with Canada’s media but I wouldn’t be surprised if there’s been a bunch of oh no, it’s different here or this time.

If you are a Canadian who likes beer, and if you don’t brew it yourself, it has been “Ugly in Canada” for quite some time. Just to the south here in Minnesota (and the U. S.) we’ve done the same with cigarettes: tax the hell out them to encourage people to stop smoking. But you Canadian politicians should lighten up on the beer tax, eh?

As a Canadian beer drinker, I actually did resort to making my own beer which was often as good or better than the overtaxed stuff at the provincial monopoly liquor store. Unfortunately, my beer sometimes came out like prison hooch. Regardless, we are so heavily taxed on booze and smokes that the government is driving people to contraband and smuggled goods and loses more revenue by raising taxes.

re statement: “Despite months of assurances that the oil bust and the broader commodities rout won’t spread into the rest of the Canadian economy, they’re now beautifully spreading into it.”

As a Canadian I can only say, “duh”. Commodities are our economy, at least the foundation of it. The rest, including financialization casinos (stocks and housing) are either supportive structures or the pasistitic disease inflicting all areas of the world now chasing wealth for no work. It is the old, “something for nothing” meme, with hot cars and overpriced housing, (all financed, of course), expected and assumed by people who think a hard days work is sitting in a commute line in Vancouver or Toronto.

Having said that, it is my redneck belief that this is an urban bubble of foolishness. The rest of us will do just fine. The Newfie who lost his job in Alberta will go home to family and get by; maybe poach a moose. My son, who quit the patch about a year ago has been contracting and is doing just fine. His friends are doing okay, too. Of course these are all people with skills and a work ethic. When they work they make things people need. They are not flipping houses and selling cell phone plans.

My wife and I plan to pick up a neighbouring property when it comes available. We did the same thing in 2008. We paid cash, saved up by having no debt.

Those stupid home improvement shows from Toronto will soon be ‘home forclosure’ shows as we saw take place in California. There will be some very unhappy people with granite countertops and stainless steel appliances who can no longer make their underwater mortgage payment. Unrealistic inputs and expectations = an “oh oh” moment.

Hopefully, Harper gets his ass kicked big time in the next election.

“…it is my redneck belief that this is an urban bubble of foolishness. The rest of us will do just fine.”

Seconded. I am not Canadian but live in one of the rural areas of the US. Let all the bubbles burst, those of us who have actual skills that are worth something to other people won’t shed a tear.

Just a note on TD Bank. For the past year they have been expanding in South Florida. They are building new branches, stand alone and in new strip malls, all over the place here.

Canadian Banking System Exposed

http://www.economicreason.com/economiccrisisexplained/canadian-banking-system-exposed/

snip: Key Arguments about the Canadian Banking System’s unsound economics:

Canadian banks received a bailout in 2009 from the Fed, BoC, and CMHC;

The key reason underlying this bailout was that Canadian banks are actually under-capitized;

Canadian banks operate under a fractional reserve system, with 0% reserve requirement;

The Canadian Deposit Insurance Corporation does not hold enough cash on hand;

Canadian banks hold the majority of their balance sheets on non-productive assets;

The Bank of Canada has virtually no gold left to back their monetary system

Canadian and especially Australian economies depend heavily on commodities exports which are collapsing. Both loony and aussies currencies have been on the tear but been brought back to earth and recent commodities rout put more pressure on the currency and economy. China took them to the heights and looks like Chinese will bring them down to earth and usher in Great Recession II.

Here in NZ we have the same pressures. Our dairy industry is our major exporter and is in trouble, In the last year the world price of milk powder has slumped 63% from over US$5000 to US1800 per metric ton. Our Reserve Bank cut rates gain and cited ‘russian issues’ and China overstocking as the cause of the plunge in prices. Our coal industry has collapsed and this week the Prime Minister described the state controlled Solid Energy company’s position as ‘precarious’. Pushed to clarify, he said that its future is in the hands of creditor banks who have the choice of asset sales or outright liquidation. Not ugly yet but definitely not pretty. So, that’s three of the ‘five eyes’ in trouble.

I’m a Canuck living in CA, but have family in southern Ontario. There is little or no real estate bubble outside the Toronto sprawl. We do have people from Tononto buying up newly built mega-houses here, but they will get burned when such real estate tanks. Canada will be in a recession or anemic growth for some time, but because of the country’s safety net, it won’t be felt as badly as people in the US felt it in 09.

The people that will really get burned in an economic downtown as we are seeing now are the people who bought high in Toronto and Vancouver. As is the case here in CA, I do not have a problem with that. You play with fire you will get burned. The Albertan’s are another group of people I have very little sympathy for because of their arrogance over the last few year when oil prices were high.

The RoC (Rest of Canada), will do just fine.

It’s all quite simple: we are wonderful, everyone else is horrible, house prices have reached a permanently high plateau unless we’re going to have a soft landing, and if bad things do happen it’s the fault of everyone else. It’s the Canadian way.

By the way, on BOTH charts you presented the last year is upside down.

The party will end ugly for “must have folks”.