People buying homes to live in – rather than as investments to be rented out – form the bedrock of a healthy housing market. It was once called the American Dream. Then came the bubble, its collapse, and the new boom that is already a bigger bubble than the prior one in many cities. And in some metro areas, investors are now the majority of buyers!

In the first quarter, the proportion of owner-occupant buyers fell to 63.2% of all residential sales, down from 65.8% in the fourth quarter last year, and down from 68.6% a year ago, RealtyTrac reported today. It was the lowest quarterly level in the data series going back to 2011.

Who were the other buyers? Investors. The report defined them as buyers who purchased a property but then had their property tax bill mailed to a different address. And these investors accounted for a record of 36.8% of all home sales.

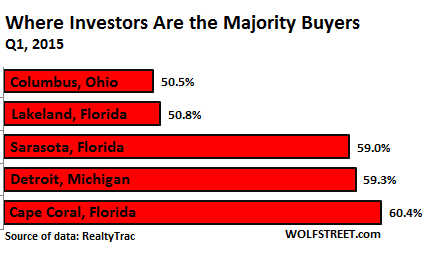

In some metro areas, investors went hog-wild, elbowing owner-occupants into minority status. Here are the metro areas with a population of at least 500,000 where this miracle of our “healed” housing market has occurred in Q1, the miracle being that investors make up the majority of all homebuyers:

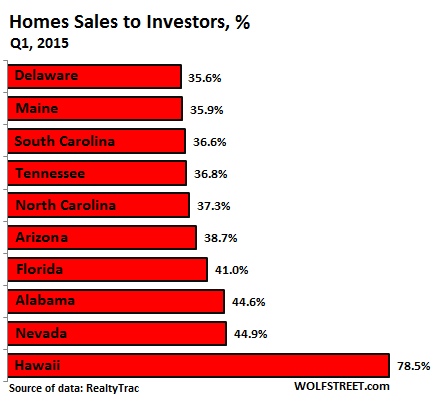

In some states, a similar picture is developing. Of course, there’s tourist-paradise Hawaii which is fully loaded with vacation-rental condos, to where 78.5% of all home sales in Q1 were to investors. But note the next three states in line. So here are the 10 states where investors play the largest role:

This is what happens when the Fed “heals” the housing market with its six-year money-printing and interest-rate-repression campaign. It doused the land with nearly free money so that investors could take this money and buy assets and drive their prices into absurdity, and thereby raise the costs for people who want to live in those assets.

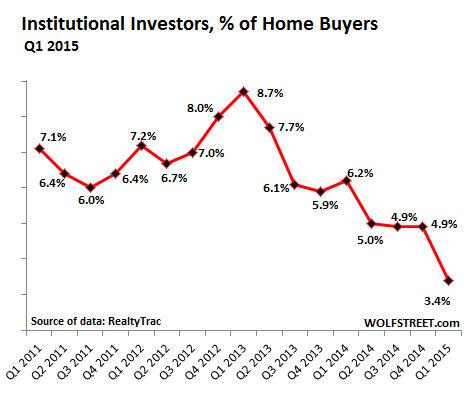

But “institutional investors,” entities that buy 10 or more units a year, accounted for only 3.4% of total sales in Q1, the lowest level in the data series, down from 6.2% in Q1 2014, and from 8.7% during the heyday in Q1 2013. These big investors, including large PE firms that used to buy tens of thousands of units – the “smart money” – have been losing interest for two years. But in the last quarter, they just about pulled up their stakes:

The investors that are now piling into the market like never before are “smaller, mid-tier, and mom-and-pop investors,” explained RealtyTrac VP Daren Blomquist.

Of all investors, 44.7% were all-cash buyers, down from 61% a year ago. Cheap debt is just too tempting. A large variety of easy-money financing options have become available for small investors as “a new crop of nationwide companies has emerged offering financing specifically for investment properties,” Blomquist said. I can attest to that; I get their spam in my inbox.

So small investors are piling into the market in record numbers, even as institutional investors are backing out, to where overall investor purchases hit a new record. And what happens? Prices soar. According to the report, the median price in March jumped 8% from a year ago.

Institutional investors may smell a rat in these prices. For them, the math of buying high and then renting the place to struggling consumers may no longer work. But for the intrepid small investors, including those that have learned the art of real estate investing from once again hot radio shows, it’s a debt-fueled, high-leverage paradise where only the sky is the limit.

However this is going to work out for them, it has undermined the foundation of a healthy housing market: owner-occupied homes.

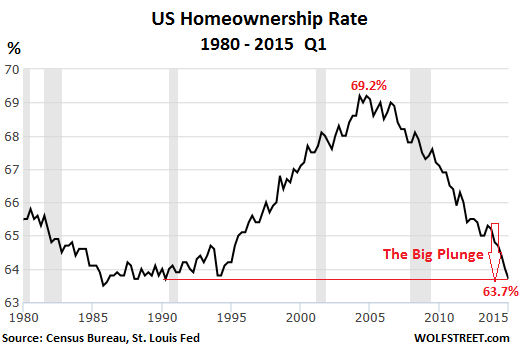

Homeownership rates have been skidding since 2004, when they peaked at 69.2%. It was the middle of a phenomenal housing bubble, when speculative buying whipped prices in to a frenzy. With the Fed nodding approvingly, the industry conspired to stuff people into homes and mortgages they couldn’t afford and would never be able to pay for.

But as prices rose further, even those methods were insufficient to keep the boom in homeownership going. So homeownership started to decline in 2005, accelerated during the housing bust, and continued to drift lower afterwards. But since late 2013, two years after investors had started to send prices soaring once again, homeownership rates fell off a cliff:

The homeownership rate in 2014, not seasonally adjusted, plunged by 1.2 percentage points to 64%, the largest annual drop in the history of the data series going back to 1965. And in the first quarter of 2015, it dropped to 63.7%, according to the Commerce Department, the lowest since Q2 of 1990, unwinding 25 years of the American Dream.

The highest ownership rates were in the Midwest at 68.6%. The lowest were in the West at 58.5%, which includes California where homes have become immensely expensive, and the American Dream a phrase tarnished with cynicism.

Potential buyers face this wall of soaring prices, and they come to their own conclusions. Read… Americans Suddenly Sour on Buying a Home, Worst Drop since 2008, Optimism Plunges in the West

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I wonder how many of the homes are bought with laundered and drug money.

Wolf,

I know that I, like many in my demographic have either been burned by housing or are simply too debt loaded to play ball. As you are well aware, the former is a broad swath of potential buyers as is the last. Couple that with the aging boomers who will have to unload properties at some point (or become landlords?) and sometimes I feel like I am in a MC Escher painting and I can’t quite tell which way is up.

I would be really interested in some thinking on how things might look if home ownership *continues to nosedive* from here. One one hand, if inventory is increasingly locked up by investors, they will set prices as high as possible, potentially diverting cash flows in local recoveries into their own coffers. But they won’t have total pricing power, as workers may opt to bail or the local economy may go under. There may also be issues with muni’s looking for food as well, which is an upward price pressure.

I understand that no one can predict the future, but you tend to have fairly informed and level headed views on the subjects you cover and I suspect I would learn a few things from your assessment of the road ahead if you are willing to go there.

Regards,

Cooter

Cooter, I’ll give it a good thought. My gut feeling is that higher homeownership rates and home prices set by the market rather than inflated by the Fed would be a good thing for the economy.

Landlords generally are supposed to run into a real limit (in that sense, homes are supposed to be different than stocks): the ability of people to spend money on rent. But in San Francisco, where rents have gone crazy, that limit has NOT kicked it. Now four people shack up in a one-bedroom apartment to be able to pay rent, which might be $4K a month. So there is elasticity. I don’t know how far you can stretch it. It has already been stretched a lot further than I thought possible.

We are in an environment (QE, ZIRP, NIRP) where a lot of things are upside down and are really hard to wrap your brains around. There will be surprises along the way. If the cost of capital is zero or below zero after inflation, the normal equations no longer apply, and everything I ever learned is out the door.

Anyway, I’ll keep my eyes on it and share any thoughts as I go.

“(People) who will have to unload properties at some point (or become landlords?)” – Cooper.

Happened to my wife and I. We married late in life and needed to sell her house.

Sales Contract after contract fell through – Financing denied. FMHA “couldn’t” lend. No “comparable” properties for the beancounters to compare ours to.

The things that happen when governments warp their economy!

A Tlingit in Alaska bought my cabin with the cash he had gotten from a Federal Judge’s award to his tribe for past treaty violations and we were able to use it to carry the wife’s place until we could work out a long-term lease purchase.

The buyer will use the 203K Federal Lending program to finance the house and improvements required by Federal nannies.

“Couple that with the aging boomers who will have to unload properties at some point”

not going to happen, the kids still live there and will just take over the property taxes payments of $800 a year (i have a good friend who’s grandparents made sure that happened for her) ….i was just visiting a friend in LA and stopped by one of his buddies and this guy looked like a homeless person, the front yard of the house was a mess but it’s up in the hills and worth millions.. It’s dad’s house and this almost 50 year old dude ain’t ever leaving………this is EVERYWHERE in socal,

I rent from a large investor, they own hundreds of homes. They bought the house in foreclosure and fixed only what was absolutely necessary. It still has multiple code violations outstanding. They are not investing much in keeping up the houses, they spend more money on staff to give renters the run around. Their valuation for the house is probable 150K over what it is really worth. I wouldn’t buy it if I could.

I also wouldn’t be investing in the paper issued by this particular company. The houses are overvalued and the company has a bad reputation for maintenance and management. I don’t think their objective is to sell the individual houses but rather to sell an entire portfolio, as they have already monetized the rental income. This would allow them to sell the houses without accounting for the condition of any of them. They could also then sell the income stream instead of the “houses”. More financial engineering.

I feel your pain Cooter. I would be in the market for new digs if I found something that made sense. With all the hype and disinformation put out for mass consumption, I sometimes wonder if the inmates are now running the asylum. Or, maybe that my perception of reality is slipping. But what I read here is grounding in a world that seems to have slipped it’s tether.

Thanks to Wolf.

I think the new equation goes something like:

negative interest x negative growth = doubleplusgood

Interesting stratification of wealth concentration. “Poor” non-institutional buyers are now participating in the confiscation of housing ownership away from those who must occupy the housing into the hands of the wealthy. Wealth aggregation opportunity is “trickling down”.

That Seattle wasn’t mentioned is nuts – the place is awash in digital cocaine money and housing (including rents) are high and moving Northward at record paces. For now the hyper-inflated bits and bytes jobs are allowing the youngsters to pay $2,000USD/month for a slapped together dead-tech trendy condo with no parking but it can’t last. The sheer number of 20/30somethings I know making $100k + a year yet living paycheck to paycheck is staggering. I’m ready for the music to stop so I can have my pick of the empty chairs once I step over their corpses.

“Cooter” here is how it’s playing out; the transformation of America and it’s society has been completed.

Most of the coming new generations will not afford a home.

They will live in condos. Most the retires will leave their homes to their kids. Builders no longer build homes for the middle class since they cant afford one. The new norm is condo developments with stores, gyms and restaurants around them.

If you need proof just look at Europe.

THE NEW ERA HAS BEGUN.

Wolf,

There may be something else going on here that is not too obvious. Something I have personal and anecdotal evidence for.

Namely, fairly well off boomers buying their retirement home but before they are ready to move. My friend from college did this recently (lives in Ohio and bought in Jax, Fl.). We’re in process of doing and buying in another location in NC. In these cases, the tax bill will indeed be sent to another address until the move is made.

Note that most of the states listed are desirable retirement locations. Exceptions being Detroit and perhaps Maine, not sure.

May not explain all of the purchases but certainly some .

I sort of understand Maine; it is sparsely populated north of the Portland area, the north has similarities to Idaho (and potatoes are a big crop).

But Detroit? That’s got to be pure speculation. They can buy property very cheap, and my wife watches some fix and flip show based there. But the place is like some third world country. For an idea of what it’s like, Google “Detroit’s Incredible Hulk.” about the abandoned Packard plant. It’s so bad that neither the fire department or the cops will respond to a call from there. Very much reminds me of Gary IN, but much bigger.

Here in Bay Area, I have noticed a few things.

a. Many homes sold are not listed on Zillow though the sale is recorded after the fact. You see a board hanging outside the house and that’s pretty much it. Last year, the homes would be listed on Zillow and the updates were regular.

b. The homes stay in Sale Pending state for a while, sometimes a couple of months. A year ago, the homes would go from Sale Pending to Sold in a couple of days or at most a week.

c. Then the homes stay empty.

This leads me to believe that there is money being laundered and there are off-shore folks involved. The time lag between Sale Pending and Sold is probably the time it takes to convert various sources of laundered money into $. Since Uncle Sam is looking out for big amounts moved around (probably over 10K) and for number of transactions done per day, these people are probably moving in chunks of less than 10K and through various channels to avoid detection.

Unlike certain cities (for example, Columbus OH), looking up the owner’s name in San Mateo/Santa Clara counties is very difficult. Works well for the county since the county gets the property taxes, keeps out nosy people, and there is no problem to be solved since nobody can report it.

Seems like the US ownership rates were always 65% +/-, so nothing new actually (if it will remain in that range). In addition: building a new house is more expensive than buying an existing one!, which usually represent low appreciation. So, I believe that new house price will continue to climb in the near future.

“Ronen” They’re not building any new houses for the middle class anymore. They can not afford it. How ever you can buy a condo of your dream.

I have three billionaire real-estate developer clients. They’re building condos these days.

Thus no home prices will not go up anymore because theres no demand for overpriced 50 year old shacks.

Wolf,

Very well written article that summarizes the reason my wife and I “got the feeling something was upside down in the home buying process.” We have owned 3 houses over our lifetime and are of a moderate conservative nature financially. After relocating and researching and educating ourselves as best we could on the Tallahassee market, we attempted to begin the process of purchasing a home. After a few months, what we observed was a a disturbing picture of what we used the movie title to describe: “When Fools Rush In.” This market is interest rate driven and all the “blue sky” has evaporated from our perspective. Buyers in general are approaching the market with a “what is the monthly payment and cash flow perspective” (whether they be an investor or one of the average home buyers, and the majority seem to be the former) with no eye as to what happens if they want or have to sell this home in 2-5 years. Our best guess is that the price appreciation will soon approach levels where not even artificially low interest rates will keep the bubble blowing. Or, if the Fed ever bumps the rates even moderately, the monthly payment increase will begin the reversal of this insanity (again just our perspective). Your article confirms for us that we were not just hallucinating as to what appeared to be going on. Aside from the last housing bubble, we have seen this show twice before in our lifetime before when the market was interest rate driven (exceedingly high as well as low) and neither performance ended with anyone wishing for an encore. As they say on Shark Tank…”I’m Out.” Sadly, my wife and I have chosen to continue to rent for now, although we are able financially, credit wise, and other wise to buy. Thanks for the insight…Mike

You are not alone. My husband and I tried to buy in Denver last year. Our choices were very limited from the beginning, even though we have great credit and a substantial amount of cash.

In order to compete, we felt that we either had to offer more cash, bid higher, or buy a newly built home for nearly 2x what we really want to spend on our first house.

Like you, our hope is that price appreciation will begin to slow a bit and work in our favor in a couple of years, when we can try again. In the meantime, we’re renting…but I still think this is better than overpaying for a home. Just my two cents.

Hi Natalie,

Actually where we relocated to Tallahassee from was Colorado. We lived in a smaller town but our son lives in Denver. They opted out like you and decided to rent there also. One wonders when/if it will “iron out” and it is hard to know. If we find out we should not have waited we will have plenty of company, I think. At a recent Dr. appointment my doctor told me she and her husband had done likewise and decided to rent and save more money. Good luck down the road…

…she meant rent and save more money for cash at the time they eventually buy…just wanted to clarify…renting is no bargain here either, but leaves one more flexible in the short run…

I would really hate to leave CO because my family is here, and we’d like to be close to family when we have little ones. But even the rents are crazy here and it makes me wonder if it will ever slow down. We’d like to eventually buy down the road, but only if it is a sound financial decision that truly benefits us — not a decision made because we “feel like we should do it.”

We will probably start a family before we buy a home. I thought perhaps we’d buy a home before having kids, but I’m tired of planning my life around what I do or do not buy…that’s one habit I’m trying to break.