Leveraged-loan yields go exponential. Offshore drillers worst off.

Yesterday, I discussed how the plunging price of oil is wreaking havoc on leveraged loans in the energy sector. These loans are issued by junk-rated corporations already burdened by a large amount of debt. Banks that originate these loans can retain them on their balance sheets or sell them in various creative ways, including by repackaging them into synthetic structured securities, called Collateralized Loan Obligations.

Earlier today, I discussed how the current generation of leveraged loans in general compares to the leveraged loans issued at the cusp of the Financial Crisis. Spoiler alert: by almost every metric, they’re bigger and crappier now than they were in 2007 [read… Treasury Warns Congress (and Investors): This Financial Creature Could Sink the System].

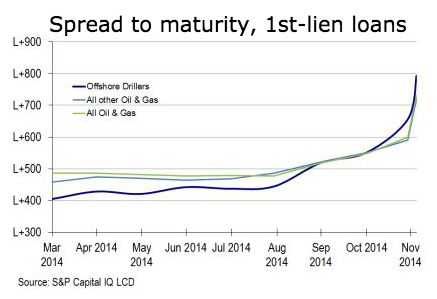

So here’s a chart of S&P Capital IQ’s energy-sector leveraged-loan index for the latest week, and it was such a doozie that it caused leveraged-loan focused LCD News, a unit of S&P Capital IQ, to tweet: “Yes, it Was a Brutal Week for the Oil & Gas Loan Sector.”

The average bid price of first-lien oil & gas Index loans fell to 90.35 cents on the dollar for the week, from 94.90 at the November 28 close and down from 96.77 at the end of October, S&P Capital IQ’s LeveragedLoan.com reported. And yields soared: the spread to maturity implied by the average bid jumped from Libor plus 500 basis points in August to Libor plus 600 basis points at the end of November, to Libor plus 731 basis points at the end of the latest week.

The US dollar Libor rate is about 0.1%, so yields jumped from 5.1% in August to 7.4% in the latest week. An exponential increase:

Note how offshore drillers (blue line) got hammered the most, though they had the lowest yields of the bunch for most of the year. Their spreads nearly doubled from 400 basis points over Libor in March to nearly 800 basis points over Libor last week. That’s a move from about 4% in March to nearly 8% now, and a big part of it within a single month. It’s really brutal out there.

In the oil and gas sector, revenues are already plunging. Earnings will get hit. Earnings estimates are crashing at a rate not seen since crisis year 2009. Liquidity is drying up. And stocks got eviscerated. It’s tough out there. Read… Oil and Gas Bloodbath Spreads to Junk Bonds, Leveraged Loans. Defaults Next

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()