Traders have a way with words. These folks around the world – whoever they may be, from the stay-at-home dad trying to make a living in front of a bank of high-resolution screens to central banks trying manipulate the markets – actually don’t need to use words. They just buy and sell. But in doing so, they become very vocal.

And this is what they have decided: the plunge in the price of oil and the impact of the sanctions are ransacking the Russian economy and finances.

They have expressed their opinions by selling off the ruble over the last few months and particularly over the last few weeks. As I’m writing this, these traders are willing to exchange 53.5 rubles for a buck, down 37% since June. This also happens to be how much the price of oil has dropped over the same period.

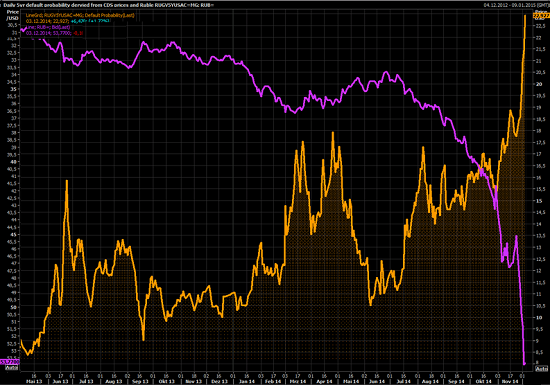

And the folks who trade in credit default swaps have decided that Russian debt now has a 22.9% probability of default.

This is what their collective judgment looks like in one chart, going back to early last year. The orange line spiking so beautifully is the probability of default and the collapsing mauve line is the exchange rate of the ruble against the dollar:

Russia has some issues. That’s what these traders are saying. And Russia will get through them somehow. That’s what they’re also saying, or else the probability of default would be much higher.

Not so for Venezuela. It too has been hit in the gut by the collapsing price of oil. But unlike Russia, which still has large though declining international reserves, Venezuela can schedule its out-of-money date in April, unless it gets bailed out. And there are worries that chaos will “lead to barbarity and people looting.” Read… Oil War Pushes Venezuela Over Brink, Probability of Default Soars to 84%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

No question Russia has pain, but the sensible policy of a country that runs a trade surplus exporting natural resources in a different country’s currency is to embrace a declining currency in order to mitigate the effects of a price decline and continue liquidity. Russia is doing the right thing and Western talking heads are not thinking. In Taleb’s vernacular, Fat Tony (Russia) is in hand to hand combat with Dr. John (the Ivy League West).

This is costing Russia far more than it’s costing the US, yet Russia seems content to sit on its hands. Why? Putin must believe he can win the waiting game, or has a plan. It has to be one or the other, because I’m darn sure he’s not suicidal.

Watch their actions, ignore their words, you’ll still be faked out, but it costs them more to fake actions than words. Therefore, you’ll get just a bit more truth.

Why? Because Russia is not in a trade war with the US. Russia is the target of monetary warfare.

Sandwiched in-between is Europe, and they aren’t looking too good for the marathon trade fight that monetary warfare brings on.

Possibly a good idea to factor in gold purchases where Russia is concerned………

I think Russia will weather the storm. Bailing out the looters in Venezuela would be a major mistake, like the one we made back in the 1920’s ‘helping’ the Bolsheviks. By the way, I believe V.I. Lenin was the first to say he could run the Soviet Union from his desk with a couple of telephones. Deja vu all over again.