Designated losers of monetary policy

Since the financial crisis, the government of the UK and the Bank of England have jumped through hoops and twirled around in extraordinary gyrations to bail out one of the largest financial centers in the world, the uniquely powerful and at once unaccountable speck of land, the City of London, an incorporated area within London known as the Square Mile; or rather bail out its financial institutions, its way of doing business, and its bonuses; and along the way, bail out banks further afield.

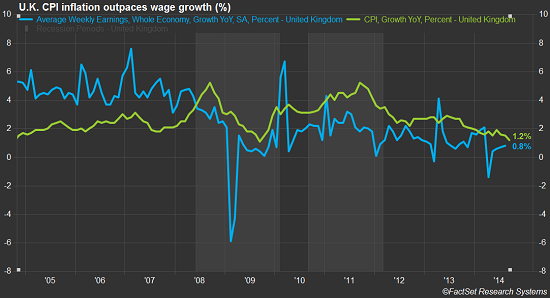

Done in the now classic way. Key ingredient: the Bank of England printed enormous amounts of money, repressed interest rates, and stirred up inflation, which hit 5% in 2011. But somebody had to pay for it: savers and workers. It demolished real wages and purchasing power of the people who make up the rest of the country.

This chart by FactSet shows how average hourly earnings growth (blue line, in percent, seasonally adjusted, year-over-year) has been relentlessly below CPI (yellow line, in percent, year-over-year). It’s the process of pauperization by inflation:

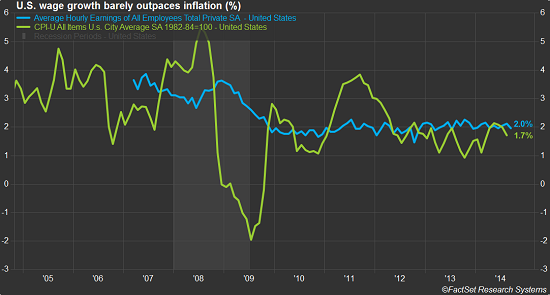

By comparison, here is how American workers fared after the Fed began to bail out the banks, insurance companies, and myriad corporate giants, including Warren Buffett’s financial empire, not only with temporary measures to keep them from toppling, but also with long-term – or perhaps infinite – “solutions,” namely QE and ZIRP.

This chart by FactSet shows the results: growth in average hourly earnings (in percent, year-over-year, seasonally adjusted, blue line) bumped along around 2% since late 2009. Only when CPI (in percent, year-over-year, yellow line) was less than 2% did workers come out ahead. The rest of the time, too bad.

Here is what happened: workers benefited from rising real incomes during the three quarters of deflation in 2009 – which probably was responsible for firing up moribund consumer spending. But it didn’t last long. In 2010 and 2011, a burst of inflation took it all away again.

It’s only during periods of low inflation or actual deflation that modern American workers get real wage increases. Turns out, slight deflation every now and then – to make up for the costs of inflation – is good for workers!

But there is another huge group of people that has been taken to the cleaners: savers. These conservative investors don’t want to lose, in rigged financial markets, 30% or 40% or 50% of what little they have during the last 10 or 20 or 30 years of their lives. Unlike young folks, they have no way of ever earning their hard-earned money a second time, so to speak.

With interest rates on their bank accounts, CDs, and money market accounts reduced to nearly nothing, their income from those assets – $9.5 trillion! – was whittled down to nearly nothing as well, and they had to tighten their belts and curtail their spending.

To these poor souls, the downtrodden conservative investors, Peter Boockvar, Managing Director and Chief Market Analyst at the Lindsey Group, wrote a letter titled, “Dear Saver, May You RIP.” And this is how it concludes:

I wish I had good advice for your savings, but I can’t advise buying stocks that have only been more expensive in 2000 on some key metrics right before you know what, and I can’t recommend buying any long term bond as the yields also stink relative to inflation. With the Fed now saying that the dollars in your pocket are worth too much relative to money in people’s pockets overseas, and thus joining the global FX war, maybe you should buy some gold but I know that yields nothing either. You are the sacrificial lamb in this grand experiment conducted by the unelected officials working at some building named Eccles who seem to have little faith in the ability of the US economy to thrive on its own as it did for most of its 238 years of existence. Borrowers and debt are their only friends. To you responsible saver that worked hard your whole life, may you again rest in peace.

Ironically, the designated losers of central bank policies – wage earners and savers – are the vast majority of the households out there. But it’s hard to get an economy to thrive if the vast majority of its participants are being systematically and relentlessly plundered in tiny insidious increments on a daily basis. Of course, central banks have a solution: get these folks to borrow money and spend it to goose the economy, so that they’ll turn into debt slaves, rather than just impoverished middle-class workers.

But financial assets have now taken a hit, the fretting has started, and new calls for QE infinity are being heard. Read…. ‘This Market is Driven by Psychology and Momentum,’ which ‘Works Really Painfully on the Way Down’

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

And let’s not forget that, in many countries, CPI is already a rigged number, adjusted to exclude volatile items in order to bring the official rate more in line with expectations (the Pollyanna Effect). If it were an honest reflection of people’s everyday expenses, the gap between blue and green/yellow would be much *much* wider.

Here in Australia the CPI includes cassette tapes, answering machines, camera film and DVD rentals. It’s not up for review until 2015…

I am sorry for those people like my dad in their 70s to see their wealth rotten away and can’t do anything. They are too fragile to invest in gold as you need an iron stomach for it.

UK like other countries over relying on service sector and encourage young people to take loan to do a worthless degree. There is nothing worst than wasting 3-4 years to learn a skill and realised it is not needed in the society.

On the street wise, there always be increasing number of close down shops in my local town, too many coffee shops, salon and charity shops. If people still think there is recovery coming, I won’t pity them when the crash comes.

Joe, all of us deserve pity because it will crash. Our system is totally out of balance.

If you try and drive a car with just one wheel out of balance long enough, it will wear spots in the tire until it blows out prematurely. If you are stupid or arrogant enough to have all 4 tires out of balance and getting more out of balance every day. You can only go so fast before losing control. That is where our economy is at. It can’t get better until we fix (replace) the 4 tires and balance them. It is to late to balance the tires that are on the car because they are all about to blow.

Because of the leveraged debts, we owe to much money to to many places (like pension funds, trust funds, SS, corporate debt, personal debt, mortgage debt and on and on) so we can’t even slow down or we crash.. We need to go faster to get there but can’t.

No WE are all in a really bad situation with really NO way out. I pity all of us as we had it made and then quit paying attention.. Fatal mistake! You always have to pay attention.

What is more, usually average weekly earnings are calculated by finding the arithmetic mean, which is not quite the same as median weekly earnings. Where there is a big difference between people on lowest incomes and the people on the highest incomes, the arithmetic mean could be considerably higher than the income that the majority of people actually earn, and the divergence could well be growing larger these last ten years.

I agree with Jan. What disturbs me are the charts I have seen showing that the income of the top 5% has risen dramatically in the last decade while the bottom 95% has fallen. Even so, the average between the two has fallen. This just makes the ability of the 95% to survive much less consume worse.

We have two pyramids. One which appears solid with the majority on the bottom and the elite on the top. Looks good to those on top because they only see their pyramid. Problem is that this pyramid is actually sitting on top of an inverted one of debt where the ability to pay is at the bottom and the inability to pay is at the top. And the entire structure is built on shifting sands. All that is needed to topple the entire structure is a little wind.

Ig-zactly, Jan.

I recently did an analysis of the housing component which makes up about 1/3 of CPI in the US. This is where much of the understatement of inflation happens. It’s very systematic, it’s by design.

If you have a minute and haven’t seen it yet, check it out:

http://wolfstreet.com/2014/09/12/how-the-government-hides-red-hot-housing-inflation/

If we used some form of true inflation measure – say for Boomers with kids in college and medical bills – these charts, as bad as they are, would look atrocious.

Please folks, no more with ‘Central Banks Printing Money’. They don’t because they can’t.

Central banks are all balance sheet (assets = liabilities) they cannot create ‘new money’ or offer unsecured loans. For this reason, central banks do not have a capital structure (equity, goodwill, etc.) Balance sheets expand but what of it? This is only a change of custody: private sector IOUs swapped to the public sector for a worthless ‘credit’ (excess reserves). The reserves cannot be deployed unless all other reserves are exhausted first … as during a bank run. (During runs, the private sector bank balance sheet collapses faster than reserves can be deployed: the banks close before excess reserves are put into circulation. Depositors are deprived of their funds. This is what happened during the banking crisis of the early 1930s and in Argentina during the early 2000s.)

Private sector finance makes unsecured loans that is where the ‘liquidity’ comes from. By making these loans the private sector becomes insolvent: there is no way around it. Just like a carpenter builds himself out of a job, a bank lends itself into bankruptcy.

If the central banks make unsecured loans then all the banks private and public are equally insolvent: there is no lender of last resort, no guarantor for bank deposits (unsecured loans TO the banks). The outcome = Argentina (or Russia): capital flight is a form of bank run. If there are bank runs or capital flight it is because the central bank has attempted to make unsecured loans, attempted to print money. As soon as depositors notice they flee, by doing so they collapse the banking system.

Please pay careful attention: every loan made by a central bank is fully collateralized … by a loan made previously by a private sector bank. The intent of the process is to validate the worth of collateral outside the marketplace (‘reform’ the market and manipulate interest rates).

It only works when there is available collateral for the central bank to ‘buy’. A shortage of good collateral is why the Fed tapered and for no other reason. Good collateral cannot be ‘printed’ any more than can money. Ask the Japanese!

What affects our economies today is not monetary excesses but peak oil and attendant high real price for crude. The shortage strands our consumption infrastructure and the loans taken on to fund it: houses, freeways, cars, airlines, overseas shipping, militaries and giant governments, towers, factories, oil wells-refineries-distribution also finance and insurance. All = underwater at crude price greater than $20/barrel (2008 dollar). Total amount stranded = hundreds of trillion$.

http://www.economic-undertow.com/2014/02/15/debtonomics-currency-crisis-3/

Good points.

This Forbes article does a decent job of explaining and why QE is worst than money printing:

http://www.forbes.com/sites/johntamny/2014/03/09/the-fed-is-not-printing-money-its-doing-something-much-worse/

Considering the Fed’s allocation of $4 trillion of credit borrowed from banks, the horror isn’t “money printing” that not’s occurring, rather it’s the Fed spending $4 trillion to prop up investment errors that, if allowed to reach their natural level, would force a reorientation of capital to higher, more economically enhancing uses. To be blunt, the fact that the Fed is paying interest on reserves means that it is explicitly robbing us of an economic recovery by virtue of it allocating capital to bad, economy-sapping ideas that would otherwise be starved of it were the Fed’s top officials not so tragically infected by the central-planning gene.

So no, the Fed is not printing money. In fact, the Fed is doing much worse than that. In allocating $4 trillion borrowed from banks, it’s supporting the very government spending and housing consumption that got us into trouble to begin with. More to the point, the Fed is financing ongoing economic hardship through its expanded borrowing of bank reserves.

@Steve,

I get the mechanics you describe – indeed have gotten it for a long time. Just one little thought that arises from time to time; When ever anyone talks of collateral we are entering the brave new world of valuations of the said collateral. Getting away from the intricacies of the model based valuations things aren’t worth squat if there is no willing and able counter party. So if the lender of last resort is perpetually stepping in to buy what does this imply qua the valuation of said collateral and normalized markets? The other side of this question is that if the collaterals cannot be instantly or at least quickly realized for full value then the hair cut was inadequate and to that extent the loan was in effect unsecured. So the million dollar question is what all are good CB collateral if the Repo ever needs unwinding – T-Bills perhaps good, Mortgage backed and CDO’s perhaps not so much (depending on hair-cuts applied).

So in effect we are already strained on the size of the G-Securities pools (T-bills, Bond et al ) – hence the mechanics of the situation demand tapering though the markets protest.

Steve, thanks for the explanation, but… “money printing” is a synonym of “QE” – with a pejorative connotation. Nothing more, nothing less.

If we tried to explain the process of QE or “money printing” every time we write about it, we’d never get to finish our story, and we’d lose every reader at the beginning of the explanation because the explanation doesn’t change over time.

It’s like when you write about a car and when you mention it has 300 “horsepower,” you explain what “horsepower” is (and what torque is), and everyone goes to sleep. And then there is always someone who points out that it’s not actually horsepower. I mean, put 300 horses in front of a car and see how fast they can tow the car? Can they get to 150 mph? But this is how language works.

I smell a conspiracy here…

Enslave people via debt traps by the CB arm of the government in cahoot with the TBTF banksters.

CB prints money, gives away money via QE scheme to the banksters who in turn buy the Treasuries and loan money to the people (mortgage, car, student loan, credit card, pay day loans, etc). Basically the 99%ers become debt slaves and whim of the banksters using the courts & cops to as thugs to collect their bloated debts (prinicipal + 20% rate, etc). And the savior is the government who will offer to forgive the some loans to those who support their socialist policies or march in line so to speak. Who would have thought the future role of the government as loan sharks and the people as modern day debt slaves?

Then human nature is a conspiracy… this shit has been going on for an eternity or since we left the garden. Some people have this twisted gene that makes them want to prey upon others. It was Hannibal and Genghis Kan and the Pirates or the Highway Men, the bank robbers and the drug dealers … Now those kinds of people rule Wall Street, the TBTF institutions and our government… In school they were the bullies or they were bullied and now they are taking their revenge upon us. Nothing new.. They still don’t have a clue and they can’t play nice in the sand box. But if you think these people have what it takes to stay in power, you to are delusional. This to will end. It just isn’t pleasant while it is happening… Then when everyone has forgotten about how terrible this was, it will start again. That is just life… Providing we don’t completely destroy the ability of the earth to support humans for some eons.

Let’s take back the language shall we? This is not an economic “crisis” any more than we suffered a great “depression” in the 30’s. Both events were engineered by the money powers, most notably the federal reserve, to the great benefit of its owners, who are now flush with QE cash to mop up after the coming crash. Ben Bernanke has admitted the fed caused the 30’s (just a terrible accident):

“Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton [Friedman] and Anna [Schwartz]: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.” — Ben Bernanke, lying through his teeth.

http://www.federalreserve.gov/BOARDDOCS/SPEECHES/2002/20021108/

I think the proper term is “The Great Ripoff”. As far as the current “crisis”, aside from the implausible handwaving economic hocus-pocus marketed by Greenspan over the past 2 decades, the smoking gun for me was Eliot Spitzers explosive article here:

http://www.washingtonpost.com/wp-dyn/content/article/2008/02/13/AR2008021302783.html

This was a well coordinated “financial attack” by predators within the economic system.

A local tire company, major major brand, is going around the neighborhood knocking on doors, asking if you need tires and leaving brochures. A neighborhood regional stockbroker, very recognizable brand, is also knocking on doors drumming up business. These are things I have never seen before.

Some of the posts are as interesting as the article itself.Economicminor speaks of the psychopaths,sociopaths,& narcissists who have risen to power in the past.This bring to mind a quote from the ancient Greek Aesop,he said that “the petty thieves we hang & the great ones are appointed to high office”.

As far as the grand schemes of the bankers are concerned,I believe that they are completely out of control.I think that the banking sector is in full retreat & running out of tricks to survive.Much has been said of the NWO people & I believe that they are out there.By nature these international bankers are conservative & moved slowly & doing what was needed to keep their plundering from killing the Golden Goose which laid the golden eggs.The major occurrence that transpired in the past 20 years is going to finish off this Central Banking System.The occurrence was the election of Bill Clinton to the White House

1)The Clinton years saw the removal of the financial firewalls which were set in place to keep the system from eating up the whole economy.The financial markets went crazy. Many of these new guys who came into the financial markets were not NWO statist,they were outsiders interested in fast & easy plunder & not international hegemony.They brought leverage to new levels,they flooded the world with derivative bets which can never be paid.Soon the Central Banking System will collapse.It will collapse because of the wildly excessive gaming of an already corrupt system by the Gordon Gekkos of WallStreet & the other financial markets

Totally agree. The thought of Hillary as a proxy for Bill is scary. Bill in the WH unaccountable to anyone…it’s like a scary movie you can’t stop watching.

I also am not a Hillary fan. Partly because of Bill and his game playing.. almost like Monika was a planned distraction while he and Congress dismantled the regulatory system. Some men in power are really bad but I think a bad woman in power can be the worst of all. I just don’t like her.

Petunia,this may sound nutty but every time I think of the players in the financial sector I think of Walt Disney’s classic Fantasia.In Fantasia Mickey Mouse is the Sorcerer’s Apprentice.He thinks that he knows how to get the castle floors mopped by casting a spell to animate the mop & bucket & get the floor cleaned by magic!

He fouls up the spell & ends up with 10,000 mops & buckets dumping water on the floor & flooding the castle.Mickey doesn’t know any spells that will make them stop & is only saved by the arrival of his boss,the sorcerer!

Like Mickey Mouse,the financial gurus in banking & in the markets opened the financial spigots,created a Frankenstein debt monster & don’t know how to shut it down!

Agree completely. I think the stage was set for all the disasters since and including NAFTA were passed during Bill Clintons’ tenure… and ever since then these politicians (president on down) have followed the exact same path simply using wars and such as major distractions from their corrupt economic/monetary agendas. Reminds me of the Jefferson quote regarding ‘thru every change of ministers’. I simply cannot identify a single economic or monetary related piece of legislation passed in the last 20 years that is actually good for the country and its citizenry for the long term.

This tweet in response to my article just nails it:

This pauperization is REALLY Agenda 21, the plan to impoverish all but the elites. The poorer we are the more dependent we are on the elites. This is why they have unleashed a ceaseless barrage of laws and taxes to destroy the economy while, of course, exempting themselves. This is also why they are destroying self sufficiency by going after small farms. To enslave us they need to make us dependent on them. This is also why the surveillance grid is going in. The more they know about us the more they can control us.

On any sunny day I’d call your post paranoid. But lately it’s been raining all the time..

Love your column, it’s part of my economics education.

As to personal and friends’ finance, let me tell you why *some* retailers may be suffering. We live in Marin County and have plenty of money to buy what we need with a stress on the word “need”.

However, we refuse to patronize large box retailers because of their ill treatment of their employees and their proclivity to send the profits out of town. Plus there’s the Chinese crap they sell but that’s a different story.

There’s a place in Fairfax, California that sells recycled building material at a low price. It’s called the Away Station. They have a huge variety of ever changing high quality American made material. People can donate used building material and get a tax write off since it’s a non-profit.

When I or my friends need hardware or building material we check their yard and usually find what we need cheap. If they don’t have it then we’ll buy it new at the hardware store right there. This store is EMPLOYEE OWNED, and along with another EMPLOYEE OWNED store, Jackson’s in San Rafael, it is the only place we will spend our hard earned money.

Being employee owned means you get excellent and expert service and advice and the profits stay in town and get spent locally through the multiplier effect.

We absolutely refuse to spend one penny at Home Depot or Sears because of the financial machinations of the owners of this company i.e. Lambert, as well as their mistreatment of their employees. Profits from these companies leave town and go to paying down junk debt service or enriching people that don’t live around here rather than being recirculated locally.

The attitude I have cataloged here is spreading among people in the know and this may be one reason why the big box retailers are suffering. Every single working man that I talk to understands the consequences of these kind of actions and is encouraged to tell their friends and acquaintances to follow the same behavior.

Like W said in a different context,

“Either you’re with us or you’re against us”.

That’s my attitude toward the economic parasites running corporate America. Friends get my support, non-friends are the enemies of the American people and get boycotted.

It didn’t help things when Bernanke said back in 2009, “It’s not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money than it is to borrowing”.