Where has all the optimism gone?

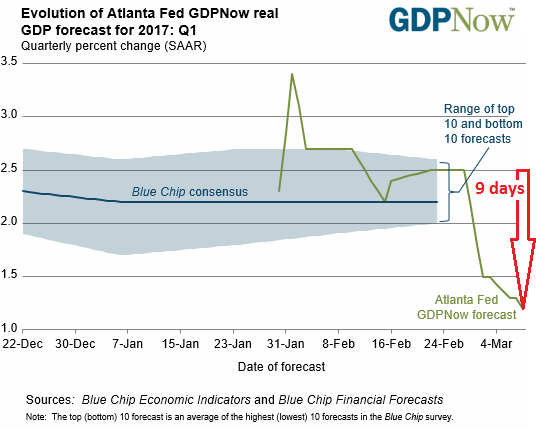

The Atlanta Fed’s GDPNow model, which forecasts GDP growth in the US in the current quarter, picks up data as it is released and changes the forecast in real time. As the quarter advances and as more data is included, it becomes a more accurate predictor, not of actual economic growth, but of GDP as measured in the first estimate for that quarter by the Bureau of Economic Analysis (BEA). So now we’re 67 days into the first quarter, and the GDPNow forecast has been spiraling down in an amazing manner for the past nine days.

The model now forecasts GDP growth in Q1 of 1.2% seasonally adjusted annual rate. This means that if the economy continues to grow at this rate for the rest of the year, annual GDP growth would be 1.2%, which would be the worst since the Financial Crisis.

Today’s down-tick from yesterday’s GDPNow forecast of 1.3% growth was caused by the contribution of “inventory investment” to GDP – when inventories rise or fall – as reported this morning by the Census Bureau in its wholesale trade data release. According to this data, the contribution of inventory investment to Q1 growth fell from -0.72 percentage points to -0.79 percentage points.

Yesterday’s release of the GDPNow forecast had plunged from 1.8%, as reported on March 1, to 1.3% due to three crummy data points on March 2, March 3, and March 6 that lowered growth forecasts:

- Growth in real personal consumption expenditures fell from 2.1% to 1.8%.

- Growth in real nonresidential equipment investment fell from 9.1% to 7.3%.

- Contribution of inventory investment to Q1 growth fell from -0.50 percentage points to -0.72 percentage points.

The Atlanta Fed’s chart shows the 9-day plunge from 2.5% on February 27 to 1.2% today (red marks added):

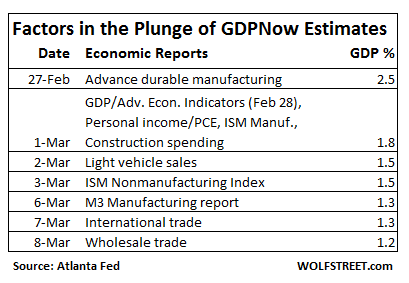

To forecast the BEA’s first estimate of real GDP growth, the GDPNow model aggregates forecasts of 13 sub-components of GDP. These are the data inputs since February 27 that have caused the forecast to spiral down:

So how bad is annualized real GDP growth of 1.2%? We hope it’s just a brief dip in the data. Because if this type of growth becomes reality for the rest of the year, it would be even worse than in 2016, when GDP inched up 1.6%, which matched the GDP growth rate of 2011, both of which were the worst growth rates since crisis-year 2009.

Consumer and business surveys have reported a surge in sentiment since the election, and the stock market has rallied in a further sign of ebullient sentiment by investors, hoping that consumer and business sentiment surveys would somehow translate into something real, or at least into higher stock prices, which is all that matters. While these ebullient levels of sentiments have translated into higher stock prices, they do not appear to have translated into anything real.

So how long before the stock market hits the wall? Read… This is Worse than Before the Last Three Crashes

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This was probably all my fault. On Monday, I purchased a $178 dress for $20, at a better store than BCBG.

Ah yes the “PETUNIA” effect. lol

LOL!

http://www.adpemploymentreport.com/2017/February/NER/NER-February-2017.aspx

Doesn’t seem to be Petunia’s extraordinarily frugal shopping habits? Just look at the ADP Service sector hiring. Everybody is hiring because the economy is so friggin’ awesome. I would question the Fed’s statistics–obviously they are missing some key data that Automatic Data Processing isn’t. Hey, anybody own ADP stock??? WOW, investors are LOVING what they are doing…

It should prove to be interesting in light of the current drop in tourism , foreign business travel , overseas students , visa inquiries etc due to embassies across the globe including countries not on any of Trump’s ‘ lists ‘ such France , UK , Spain , Indonesia etc recommending their citizens not travel to the US as well as advising those with LPR , H1B etc status currently in the US not to venture beyond the US border due to in their words the inherit instability and chaos being created by this administration how that winds up effecting this ‘ virtual ‘ US economy we’re in .

TJ,

Funny you should make this post. I live in Canada but was born in the States. My brother grew up in the States, but last year he and his wife renounced their American citizenship. We were talking last week and both of us admitted we have decided not to visit our sister in WA. Neither of us feel comfortable with the way the country has changed. He is worried about hassles due to his citizenship renunciation, and I am concerned about current investigations and prosecutions by the IRS. I have never worked in the States, ever, but the tax authorities granted themselves the ability to try and seize foreign assets to pay fines for those not having filed US tax statements. The law, while presently not inforced upon people like me, nevertheless exists, and the US has taken upon itself to contact tax departments of other countries in order to seize their assets. My folks moved back to Canada when I was 12, but because my birth was in the US I am vulnerable to this action.

So, we will be spending our vacation funds in Canada for the forseeable future. As an aside, I know dozens of couples who have now decided to abstain from travelling to the States. It is their way to express their displeasure.

Spending or not, talks.

Some on this site will say, “Good riddance, etc…+ stay home, then”. To them I say my Dad was a ww2 veteran, and my sister-in-law was a US army Captain. Her entire family was military. Just saying….. :-) We moved to Canada in ’68 due to the protests and violence of that time. My Dad always said that the US was on its way to becoming a police state.

If this GDP forecast holds true, it will be one more ratchet down as the disenchanted become angry and even more disillusioned.

regards…always

None of what you have mentioned, IRS/Denaturalization process has anything to do with Trump…..The previous admin had 8 years to change any IRS laws, and as I remember it it was the previous admin that gave the IRS pretty much immunity to do anything and then plea the 5th (Louis Lerner). Again, none of what you mentioned has anything to do with what the current admin had done…

Yes, I know this. (I had my lawyer brother-in-law reseaarch it for me).

Trump is just piling on, so to speak. Think how an outsider might feel about the new tone in the country. It is scary and worse. Tonight I was watching CNN after supper for a short while. After just 47 days in office the public commentators are just laughing at him about the tweets. He is now a punchline.

We will just choose to stay away as will many others. Just because.

It’s funny I had this same discussion with relatives today who are indefinitely postponing travel to the U.S. (despite living on the border). I pointed out that a lot of their concerns were longstanding and they replied that the risks still seemed to have gone up with the change in government, and I had to admit that was true.

Even if a lot of the madness and overreach in the U.S. (e.g. FACTA, collecting social media information, etc. etc.) predates Trump, the Trump publicity around tighter borders can be the trigger for people to start taking it seriously, and with the notion that ‘the gloves have been taken off’ spreading through the various enforcement agencies, who can blame them.

I remember when Bush jr became President and I said back then there was no way I ever wanted to set foot in the states. At one stage in the early 90’s my wife and I had big plans to tour the USA. But I’m afraid to say all the Presidents are tarred with the same brush the past 15 something years they have just been puppets.

If President Trump really wants to kick Wall Street and the International Banksters who control the US Federal Reserve in the teeth, he should do, like President Xi of China did last summer to halt the free-fall of the Shanghai Stock Market, make naked short selling illegal !!!

President Xi made short selling in general illegal.

President Trump should begin with making ‘Black Screen infinite-money’ naked short selling illegal. Because, short selling is the Financial Terrorists, as Max Keiser terms them, short selling is their main weapon of Financial Terrorism, and the main way in which they control markets.

Like the gold and silver markets, in which Silver is in a rapid free-fall this very week, in perhaps reaction to the revealing of how the CIA eavesdrops and spies on the unsuspecting citizenry. Is Trump Enterprises long Silver ??

“Where has all the optimism gone”?

The incessant numbers pump continues as can be seen with the latest ADP jobs report. The ADP states in their report describing their methodology, that it “seeks to closely align” the final output, with the final print of the BLS numbers.

The ADP report is just a mirror image of the fraudulent BLS report,

leading Mr. and Mrs. Joe Sixpack to continue to believe the fairy tale.

The most outstanding height of optimism is still amongst the futures traders, with the Daily Sentiment Survey of Futures Traders sitting at a 92% bulls reading!

http://www.investmentresearchdynamics.com/adps-job-creation-report-is-a-fraud/

Small business is optimistic:

http://www.nfib.com/assets/SBET-December-2016.pdf

Is it just because we little peons do OK under the radar, or is there something else going on?

Divergence between “soft” data (e.g. NFIB surveys) and “hard” data.

“Soft” data seems to be propelled by– in MY opinion– unrealistically optimistic projections for the Trump administration. He’s going to cut taxes huge, spend huge, balance the budget (you can ignore that the previous two items will almost certainly blow up the deficit even larger, but I digress), bring back jobs, destroy ISIS (US marines on the ground in Syria now, yay!), face down China, North Korea, Iran, Russia, and any other enemies… make healthcare better AND cheaper (lol)… etc. etc. etc.

Meanwhile, reality is reality.

I will say though, that sometimes optimism itself can actually boost an economy– as long as actions follow sentiment. If people weren’t spending because of a lack of confidence in the economy before Trump, wrong or right, but now are hopeful and begin spending, it can be a beneficial self-fulfilling prophesy. I have yet to see any evidence of that happening, though.

And if the GDPNow forecast is correct, the Fed is getting ready to hike into a tepid economy, and a market that is showing signs of cracking… high yield credit, emerging markets, copper, oil (down about 10% over the last few days).

RE: “Soft” data seems to be propelled by– in MY opinion– unrealistically optimistic projections for the Trump administration.

=====

You appear to be correct, but it would be the same for a Clinton administration, and indeed has been true for a number of past administrations, back to at least FDR.

The Sociological and Psychological phenomena of “Group Think,” “Peer Pressure,” and ruthless individual self promotion within large bureaucratic and heiricial organizations are well known and studied, but can be encapsulated as “always tell the boss what s/he wants to hear.” [Men and Women of the Corporation by Rosebeth Moss Kantor, although dated, is a good introduction. https://www.amazon.com/Women-Corporation-Rosabeth-Moss-Kanter/dp/0465044549/ All her work is helpful]

When combined with the human trait to give much more credence to data that supports our existing beliefs, frequently to the extend of denying/ignoring adverse facts/warnings, it is a toxic and often fatal condition. This frequently leads to [lost] wars and collapsed corporations, e. g. General Motors, when decisions are based on short term expediency, opportunism, and improvisation, rather than principles based on logic and historical utility. [Translation: Things are different this time.]

INSHO the Federal government currently has more than ample resources of personnel, methodology and equipment, e. g. the staffs and supercomputers of NSA and the National Weather Service, to analyze the mountains of real time data such as exchange trading records including the dark pools, SWIFT money transfers, credit card transactions, tax returns, Medicare records, etc. What is lacking is: (1) the will to do so; and (2) an unwillingness to accept and act on the results of such analysis and projections.

For example, short term cost avoidance have been realized by those tasked with managing/rolling over the national debt by shifting to shorter term bonds with lower interest rates.

While this has an immediate cost avoidance, it also makes the debt management process much more vulnerable to changes in interest rates. A return to normal interest rates by the FRB will GREATLY increase the cost of national debt service over a short period of time, and will cause the total debt to skyrocket.

One of the major problems with these type of computerized models is they keep generating projections with problems. The normal management response when the model projections are undesired, is to denigrate the model and its developers, then ignore the model projections, and do what they want anyhow, for example Long-Term Capital Management.

INMSHO the future of these models is adaptive Artificial Intelligence and “Big Data” such as real time exchange transactions [stocks, bonds, commodities, FS, etc.] and SWIFT money transfers, running on NSA grade super computers.

This is not so much for a “planned” economy, as for “weather” forecasting, analogous to the storm warnings and hurricane tracking doe by the weather service. While we are unable to control the weather, we can and do take steps to minimize its bad effects such as flood warnings and tornado alerts. Indeed in many areas building construction in flood plains is no longer allowed due to the high probability of loss.

Unfortunately, like Geithner, Mnuckhin (Trump’s Treasury pick) wants to deregulate and help the banksters gamble with depositors funds until their banks need another taxpayer or indirect government (via the Federal reserve crooks giving them super low interest loans when their banks are insolvent) bailout. Unfortunately, Goldman sachs’s protege H. Clinton would have done the same. Our country is up a creek without a paddle.

with an economy doa for the last 8 plus years means only one thing,massive money printing,massive borrowing on a scale not seen since well…. ever.Just to get through next fiscal year federal gov’t will need to borrow.at least 3.5 and a staggering 5 trillion,beyond insane and this is after 9 years of “recovery”lol

And what is going to happen when the people realize that all this vast flood of money is backed by nothing, represents nothing, and means nothing? All our money is now is the delusional belief that it actually is worth something and not just a bunch of zeros and ones…..

If you look at the birthrates in the developed world, you realize that the 4% everyone wants just won’t fly. 1.2% is probably what we need to get used to.

Using the rule of 72, which defines a double using compound growth, a 4% gain means a double in 18 years. Does anyone really think that the GDP can double in 18 years? At 1.2%, it takes 60 years to double which seems much more realistic to me based on a declining population.

Yet, the national debt has doubled to an amount larger than GDP in the eight years under President Obama. According to the CBO, it is set to increase from the current $20 trillion to $30 T in the next decade.

https://www.nytimes.com/2017/01/24/us/politics/budget-deficit-trump.html?_r=0

Since my source is the New York Times, it must be true, eh? (yes, I’m being sarcastic) Speaking of the NYT, their Op/Ed essayist and Nobel Laureate, Paul Krugman assures us that debt is good, so we should have no worries.

Well if they predict 10 trillion increase I would go with 20 or more.Past predictions suggest they are terrible fortune tellers.

Gains in GDP= population growth+productivity growth.

Demograpphics are largely set in stone.

Probably the main productivity gain in the future is the increasing use of robots .But as robots become more sophisticated ,their use will inevitably eliminate human jobs ,even in sophisticated occupations.

Such a hot economy dictates an aggressive series of rate increases, I hear.

GDP growth of 1% is disastrous. Most companies pay 3-7% on debt. This means profits are shrinking relative to debt service costs, so businesses are becoming more extended and less profitable, all else equal. If wages start rising too, look out below. Profits will crash.

Why am I NOT surprised by any of this?

If wages start rising then I think the economy will start growing more too. Call it the multiplier effect, Part of the reason for low growth is so much wealth has been taken from the people that the circulation of money has become depressed. Then again, consider this: At the dawn of the automotive age back in the 20’s. why did Henry Ford decide to pay his workers good wages who were making the first Model T? Was he a fool?

“Then again, consider this: At the dawn of the automotive age back in the 20’s. why did Henry Ford decide to pay his workers good wages who were making the first Model T? Was he a fool?”

Well, the myth is that he did it so his workers could buy his cars. Pay them enough to make a decent living, so on and so forth.

The reality is his workforce had extremely high turnover due to the low pay and working conditions, to the point where it was detrimental to his business. It was plain economics. The decrease in turnover and training costs outweighed the increase in wage costs.

Even with their increased pay, in reality Ford cars were not a realistic purchase for most factory workers.

don’t forget that GDP growth is real so nominal GDP is a lot higher depending on what variable you believe represents inflation accurately

“Where has all the optimism gone?”

It’s all on Bloomberg radio.

Glowing, effusive, globbering, incestuous, fawning; an almost orgasmic cavalcade of analyst after analyst spewing ‘it’s all clear to buy stocks’ , ‘prosperity forever’, ‘you can’t lose’.

Its Terry Gilliam meets ‘Hunger Games’ style reporters cheer it all on and keep it spinning in a maddening vortex that evokes images of my expensive Japanese toilette swallowing something it shouldn’t have.

Wasn’t it kind of like that in the first half of 1929?

If this forecast came from anyone other than the Fed, I’d worry. When did the Fed ever get anything right?

READ MY LIPS

The stock market is not directly related to the economy

What is good for big companies is bad for the average worker.

Supply side economics is BS

Who the hell cares about how many billionaires the economy is generating !!

Exactly! GDP and per capita GDP mean nothing without the

GINI coefficient that measures equality of income/wealth distribution. This metric could be [simplistically] defined as per capita GPD multiplied by (1 – GINI) or (1 – GINI) squared.

https://en.wikipedia.org/wiki/Gini_coefficient

https://en.wikipedia.org/wiki/List_of_countries_by_income_equality

(Jerry sings:)

“They used to tell me I was building a dream

And so I followed the mob

When there was earth to plow or guns to bear

I was always there right on the job

They used to tell me I was building a dream

With peace and glory ahead

Why should I be standing in line

Just waiting for bread?

Once I built a railroad, I made it run

Made it race against time

Once I built a railroad, now it’s done

Brother, can you spare a dime?

Once I built a tower up to the sun

Brick and rivet and lime

Once I built a tower, now it’s done

Brother, can you spare a dime?

Oh, say, don’t you remember, they called me Al

It was Al all the time

Say, don’t you remember, I’m your pal

Buddy, can you spare a dime?”

Bing Crosby – Brother Can You Spare A Dime Lyrics | MetroLyrics

Friends, please prepare yourself for some potentially very hard times. I fear history is about to repeat itself.