Fitch Gets Nervous.

There may be a day when we look back at the current craze of “leveraged share buybacks” – as Fitch Ratings calls these creatures of financial engineering – the way we now look back at the craze of leveraged buyouts (LBO) just before it all came apart during the Financial Crisis.

If a company with a torrent of free cash flow uses some of this cash to invest and expand, and then uses some of the remaining cash to pay dividends and repurchase its own shares, few people would quibble with it.

The problem for bondholders, and stockholders ultimately, arises when a company doesn’t generate enough cash to pay for its investments, dividends, and share buybacks, and ends up borrowing to fund share buybacks, thus increasing its debt burden while hollowing out its equity capital.

Instead of investing this borrowed money to expand and create more business whose cash flow would help service that debt in the future, companies blow this money on reducing the number of shares outstanding, or at least watering down the impact of executive stock compensation plans. Nothing good ever comes of these “leveraged share buybacks,” other than making per-share metrics look better.

And that’s exactly what has been happening, encouraged by the Fed-inspired ultra-low interest rate environment, which makes debt cheap and creditors desperate.

According to the report, share buybacks have exceeded free cash flow after dividends (FCF) since 2014 among Fitch-rated companies, “with most companies using debt to cover the shortfall, underscoring a more aggressive stance across the sector.”

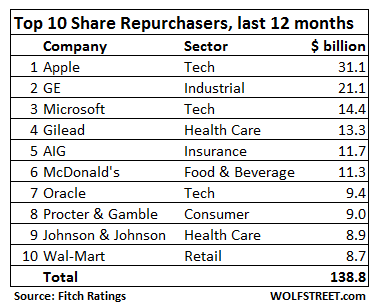

The numbers are huge. This table lists the ten companies that bought back the most shares, blowing $138.8 billion over the last 12 months:

GE is the exception in this group: it has been selling the assets of GE Capital and has used some of the proceeds for share repurchases. This lowers the number of shares outstanding, which makes sense, given that GE is shrinking via these divestitures.

Repurchases pose risks for bondholders: credit down grades, higher risks of defaults, lower recoveries in case of a default, and thus higher funding costs – in theory.

But in the current interest rate environment, funding costs are ultra-low for higher-rated companies, and “many” of them “have been willing to see their rating drift lower, but few have been willing to sacrifice an investment grade rating.” They draw the line at junk territory.

The risk of a downgrade due to share repurchases is concentrated among higher-rated companies — typically those rated ‘A’ and higher — as management teams may conclude that the benefit of reducing share count exceeds the cost of moving down the rating scale.

When companies hobble toward a junk rating (below BBB-), share repurchases become a balancing act. Brinker International’s aggressive buybacks are “noteworthy” in that they pushed its credit rating down to BB+. So junk.

McDonald’s, Number 6 on the list above, was downgraded three times over the past 18 months, from A to BBB, due in part to “concerns about its operating performance” and due in part to “a conscious decision by management to employ higher financial leverage by borrowing to repurchase shares.” Two more downgrades would put McDonald’s into junk territory.

During the Financial Crisis, when shares were dirt cheap, share repurchases came to a halt. But as share prices rose, buybacks started picking up again, and since 2014, have exceeded these companies’ free cash flow. The shortfall was typically filled with borrowed money.

Companies are the relentless bid. The purpose of buybacks is not to buy low, but to drive up the price of their shares, and to do that, they try to buy high.

Companies that do a lot of their business outside the US and keep their cash registered in foreign jurisdictions to avoid US taxes cannot buy back their shares with that foreign-generated cash. So they borrow in the US to buy back their shares, and this too increases their leverage “in some cases, causing negative rating actions.”

Among the reasons for the craze in share repurchases, according to Fitch:

- Low interest rates

- Lack of growth projects that meet return hurdles

- Management compensation incentives

- External pressure from shareholder activists.

The universe of Fitch-rated companies spent about 3% of revenues on share buybacks and about 6% on capital expenditures over the past 12 months. But those are averages; they cover up big variations.

At the high end, the retail/consumer sector and the pharma/healthcare sector spent more on buybacks than on capital expenditures: “This assertive posture can be explained by their low capital intensity, relative stability through cycles and, in the case of pharma companies, healthy cash flow generation.”

In terms of pharma companies, what this elegant phrasing means is that rampant price increases generate a lot of extra cash.

At the low end, the oil & gas sector, ravaged by the oil bust, got busy struggling with their capital holes, and share buybacks have disappeared from the menu. Instead, over the past 12 months, “the vast majority” of oil & gas companies issued more stock to raise capital than they repurchased.

Fitch expects share buybacks to remain “elevated” until expectations for economic growth in the US improve, which might prompt “corporate America to allocate more capital to growth projects,” rather than blow it on share buybacks.

But here’s what typically causes a decline or even a plunge in leveraged share buybacks: rising interest rates that make that strategy too costly; a sharp selloff in the stock market that knocks the wind out of executives; and tightening credit conditions where borrowing becomes difficult and where creditors gain the upper hand, inserting stiff demands into debt covenants, and refusing to lend if a company is going to blow this money on share buybacks.

The energy sector just went through this scenario. For the remaining buyback heroes, the credit bubble is intact, creditors are cowed, and credit market discipline has been surgically removed by the Fed’s policies. But the longer the leveraged share buyback craze continues, the more bondholders and shareholders are at risk – see the craze before the Financial Crisis.

So what would Yellen do? Read… Treasuries Got a Break. Now Beatings Resume until the Mood Improves

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How many of these buy back’s are actually revolving door’s. Ah La HP.

Companies simply purchasing shares, to issue them to executives as compensation. Executive’s then sell said from their trust’s/children Etc, back to the company, at a higher price, and get given them again.

Given HP’s long and ‘illustrious’ acquisition record then it is bound to end badly. Who or what will make HP ‘great again’? Surely not anyone from the C-suite and given as Donald Trump will find, turning the clock back is not an option then HP is best left to their ‘money printing’ business.

HP is merely a proven example of what frequently happens in buyback’s over time. HP stock volume was still basically the same after all teh buyback’s as it was when they started them.

IMO, it slows down when we either –

Get some regulators with ethics who decide to look at “fiduciary duty” and conflict of interest issues, not holding my breath for that.

Or the market prices the corproate debt too low for these guys to make the payments on additional leverage. There’s a tipping point that accelerates because (all else being equal) the Debt to Equity ratio rises geometrically per fixed dollar transfer from one side to the other. Extreme example – at 60 billion debt / 40 billion equity, a transfer of 10 billion into debt is not great but not a disaster, but at 80 billion debt / 20 billion equity, that same 10 billion literally doubles the debt to equity ratio, which certainly causes ratings downgrades and quant models to seriously reprice the equity itself – so you reach a point of negative returns from the transaction. And you have added risk the company blows up on a moderate upward move in interest rates. But, oh well, “nobody saw it coming” :)

So despite ultralow interest rates there is no real economic growth and no need for capital investments ?

The economic growth is just paper growth created through inflated asset prices with debt ?

i think you answered your own questions Yoshua.

this recovery ( a balance sheet recession) did not

create any top line organic corporate growth. Companies , in the search of revenues/earnings, have used cheap money to either merge or acquire other businesses. Reducing the number of shares outstanding also reduces a companies dividend payout since these buybacks shares do not qualify for a dividend. this recovery created asset inflation without wage inflation . below is link to balance sheet recession explanation.

http://im-an-economist.blogspot.com/2013/04/richard-koos-balance-sheet-recession.html

So when shit hits the fan in this bubble economy, will it be Trump’s fault or Obama?

Depends on who you ask :-)

If we assume there are a couple dozen elite execs at each firm, that’s just under $500 million each in debt issued, which is then passed through via stock options. This is very nice because it’s taxed at the capital gains rate — not the normal income rate (assuming it’s kept as cash and not rolled into another asset class right away). How else do you expect them to become multi billionaires?

Matt, thank you for helping support the case for a ‘Modified Flat Tax’.

We got these extra shares we bought back for no reason and wish to gift them to your office Senator!

Do you like vacations?

Here’s what will SURELY stop this. Muppets need to STOP buying products belonging to these guys. Want to stop the drug wars, muppets just need to stop buying. Same with these. I am not advocating to stop buying necessities because by definition those are required.

Stop buying for one month. I guarantee the buyback will stop and just maybe the future will be brighter.

Nah. Muppets == most dangerous group on earth.

Muppets can’t get there act together because they all have a dream they are somehow are going to make it up there and bugger everyone else until they are backed into a corner and realise they and there children don’t have a chance as they see the Davis club skeam how they can keep the game of screwing the muppet taxpayers for longer

If after 35 years of borrowing other peoples money while interest rates dropped from 20% to minus 5% and you haven’t become satisfied with your wealth

Game over!

Stock buy-backs and dividends paid by borrowing are two side of the same clipped coin.

The problem is not that nothing can be done, but rather that no one wants to do it.

For example:

* Revise the IRS code such that any “profits” generated by the sale of stock back to the issuing company is not taxed at capital gains rate, or even ordinary income rates, but at 150% of the ordinary income rate [which can be raised to 200%, 300% etc. of the earned income tax until the practice stops]. Same thing for dividends paid with borrowed money.

* Revise the IRS code to make interest paid for debt to repurchase stock or issue dividends a non-deductible business expense. This is a commonly used ruse by VC, PE, and “turn-around” specialists to loot a company, including the pension funds, before the husk is run through bankruptcy, where the creditors, employees and taxpayers get the shaft, while the VE/PE/hedge funds get the goldmine.

* Enact legislation/regulation, backed with draconian civil/criminal penalties, which prohibits any corporation subject to SEC jurisdiction from using borrowed money to buy-back stock or pay dividends. This could be worded to require that all funds used for stock-buybacks or dividends can only come from income on which U. S. taxes were paid.

Right on, George. All good suggestions. There may be some devils in the details, but overall this is what needs to be enacted.

My thinking has always been “you should not be able to pay a dividend or buy your own shares except by using the profits from the previous year”.

By the way, does anyone know whether the balance sheet accounting line item of “retained earnings” gets adjusted down when a company buys its own stock? I’m pretty sure dividends are subtracted from retained earnings but not sure about stock repurchases.

Yes. The purchased stock gets classified as treasury stock and is a big reduction of total equity.

The problem is this practice jacks up the EPS number even though actual earnings are flat to down from prior periods.

SEC should require additional disclosures that eliminate this impact on EPS to show the true, non-manipulated, EPS. Then watch the stock price drop like it should.

And “Non GAAP” should be illegal. Funny to watch companies report a beat, stock shoots up, then find out later they just played funny business with an interest rate.

The main damage happened in 1999 when the rich got bill Clinton to repeal the glass stegal act witch was enacted in 1933 to prevent this from happening again. We haven’t learnt much from history are are very likely to repeat it

A company buying it’s own shares back used to be called “stock market manipulation” by the SEC and was illegal until it was changed under St. Ronnie and his band of merry corrupters! Change it back.

I’m still surprised it’s legal to borrow to pay a ‘dividend’, which every first year text defines as part of the profit returned to shareholders.

Apart from the fact that it is legal – it’s just a twist on a Ponzi scheme.

The shareholder is being rewarded with his own money- equivalent to the diminished value of the company from the liability of the loan.

I suppose one key to the mystery lies in the much smaller price insiders often pay for their shares- even though they receive the same dividend.

If you can receive several times your investment in the form of dividends, salaries and bonuses. it is not a huge concern that the company eventually goes bust.

Your missing a key point. Most of the companies listed above have enormous sums of cash overseas and have dominate market share in the marketplace (giving them a fairly high probability of continued earnings). So they have 2 choices:

1) They can repatriate at 39% tax rates and then pay dividends or

2) Borrow at 2-4% and pay dividends.

Given these options, they are acting very rationally. Whether you agree or not.

3) Invest in productivity and new markets would make too much sense and therefore, not a viable choice.

The solution requires us to understand a bit of history and some basic corporate tax facts.

1) Why is it that the US is the ONLY industrialized country with a corporate unitary tax structure. This is one of the root causes for this practice. Change the damn tax code.

2) The FRB is another root cause by keeping rates artificially low thereby making it cost advantages. Dump the fed. We’ll be better off.

3) And let’s not forget the Tax Reform Act of 1986 that limited deductible exec payroll costs to $1M, but added the deductability of stock based comp if tied to ‘performance’. Of course we know what a joke this has become. Not sure how to stop this given the incestuous nature of wall street and BOD. Nobody holds anyone truly accountable for ‘REAL’ performance. (Fake news doesn’t hold a candle to fake performance reviews of exec’s).

Don’t get me wrong, I abhor this practice as its short sided and does not put the long-term interests of the organization in play.

But I can’t completely blame the Government, though with their idiotic bailouts that encourage the moral hazard problem they certainly hold a key spot, rather I put most of the blame squarely on the BOD and wall street analysts; the former for agreeing to these schemes and later for being too stupid to see through the earnings report charade.

And let’s not forget the mutual funds, pension funds and insurance trusts that continue to buy these manipulated stocks thereby driving the price up. Nobody is holding anyone accountable for the bad behavior or everyone is part of the same twisted game.

Apologies for the rant.

The behavior of the government and regulators isn’t so idiotic when you consider how many of them roll out of regulatory agencies, the military and congress only to become incredibly well paid “consultants”. Campaign finance reform and harsh censure of quid-pro-quo corruption must be a component of any financial reform that hopes to bring these behaviors to heel

Good point, Tom Skowronski. It used to be illegal in the U.K for a company to buy back its own shares.

Way back in the early sixties I well remember my mean old millionaire of a boss sternly explaining that a company was not allowed to buy its own shares.

Now anything goes as the rape continues.

At that time they were allowed to buy their own shares. If they announced how many they would by, at what price.

However they were then required to cancel all the shares they brought.

This was rigorously checked by the regulators.

These days HP Etc, are effectively trading their own shares.

As when they buy them back they are giving them as compensation. Then the receivers are on selling them. Almost immediately, frequently straight back to HP at a higher price.

The same shares are going round and round inside HP and its executives. Milking the company, and its real shareholders.

Buffet.

Buffet buys Berkshire if the, price is wright, instead of paying dividend’s.

I am not sure. I believe he cancels what he buy’s, unless he need’s to hoard them for an acquisition. Then they are shown as such on the book’s.

If companies want to SELL their own shares (raise money), they have to file the proper paperwork with the SEC and jump through myriad hoops because that would be a follow-on offering.

However, they can PAY people and other companies with shares (stock-based compensation, M&A, etc.). So they’re issuing new shares but don’t get cash for them. Which is what they all do, as you pointed out.

Are they not effectively side stepping that regulation by giving them to the Executive in lieu of remuneration, then the executive selling them at a higher price??

Yes. Paying anyone by issuing shares is like raising money by issuing shares and paying people/companies with the cash thus raised.

America where corporate fraud, is a legal art-form.

P45 wont reign it in, he will give it more free reign.

The buyback craze is happening because corporate profit margins are near all-time highs. The system is protecting multinationals by allowing so much industry consolidation. I work for a company that buys companies simply to take away the competitive threat. Take down the barriers that destroy competition, and the positive forces of capitalism will come back to life.

When companies are allowed to get too big, all sorts of problems develop such as unemployment, wealth concentration, monopolies, lack of competition, etc. Concentration of capital in too few hands is the heart of all our problems today, just like it was before the Great Depression.

Want to hear about some private equity funds making paper profits without improving US economy. In Texas, TXU, a large utility co. in Dallas/Ft. Worth area went bankrupt in Apr. 2014 from its original huge junk bond acquisition that accumulated $33 billion in unpaid debt (then natural gas prices dropped). It just came out of bankruptcy and is owned by some new private equity players. They decided in Dec. 2016 to borrow $1 billion and give themselves a dividend. Now the new entity has 3.8 billion in borrowings. With ready supply of residential & non-residential customers available I assume that borrowing poses no problem for payback.

I see no problem if a company buys back shares when the market cap is deemed too low? Preferably, using cash on hand but there are other ways to obtain financing such as by issuing debt denominated in a currency that’s bound to depreciate?

Mergers provide pricing power, consider the impact if for instance there were fewer automotive manufacturers?

The time spent on this conversation would be better utilized analyzing balance sheet details, IMO.

Maybe I’m the fool in this, but I look at buy-backs as shrinking the business, rather than just shrinking the equity footprint.

I look at the equity as the permanent capital of the business, that which is funded to set up the business for operations. I know most financial engineers look at equity as the highest-cost capital, and this is where we go astray. If the business is funded correctly, it should never need capital infusions from the stockholders just for operations. The capital base should be more permanent.

The last 30 years have seen increased financialization of the economy, where we seem to make more by trading currencies, bonds, and stocks, than we do from making tangible things. There has been too much effort placed upon keeping on good terms with the investment bankers than on knowing what you’re in business for. There are very few beneficiaries of increased financialization. There are more beneficiaries from making what the customers want.

The business of business is running the business. The business of financial empires is turning business profits into business debts, for the benefit of the banker.

If you want to see the dire ramifications of stock buybacks and dividend payments fueled by debt, then look at this report on Exxon-Mobile by SRSRocco:

https://srsroccoreport.com/end-of-the-u-s-major-oil-industry-era-big-trouble-at-exxonmobil/