Bloodletting in one of the most conservative investments.

All kinds of things are now happening in the world of bonds that haven’t happened before. For example, authorities in China today halted trading for the first time ever in futures contracts of government bonds, after prices had swooned, with the 10-year yield hitting 3.4%. Trading didn’t resume until after the People’s Bank of China injected $22 billion into the short-term money market.

What does this turmoil have to do with US Treasurys? China has been dumping them to stave off problems in its own house….

The US Treasury Department released its Treasury International Capital data for October, and what it said about the dynamics of Treasury securities is a doozie of historic proportions.

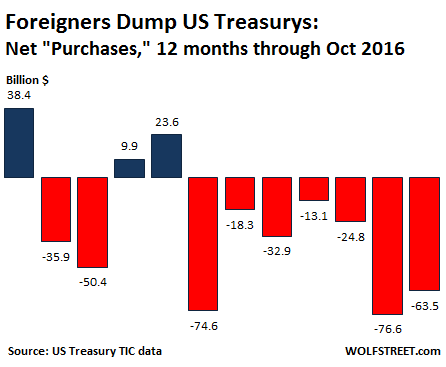

Net “acquisitions” of Treasury bonds & notes by “private” investors amounted to a negative $18.3 billion in October, according to the TIC data. In other words, “private” foreign investors sold $18.3 billion more than they bought. And “official” foreign investors, which include central banks, dumped a net $45.3 billion in Treasury bonds and notes. Combined, they unloaded $63.5 billion in October.

In September, these foreign entities had already dumped a record $76.6 billion. They have now dumped Treasury paper for seven months in a row. Over the past 12 months through October, they unloaded $318.2 billion:

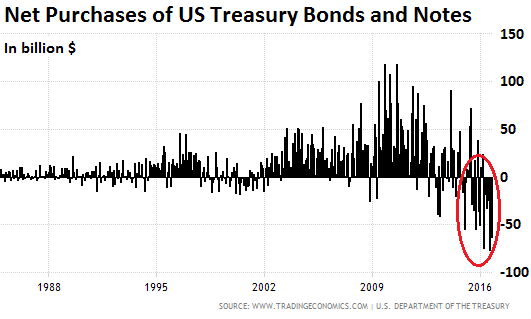

A 12-month selling spree in this magnitude has never occurred before. There have been a few months of timid net selling in 2012, and some in 2013, and a few in 2014, but no big deal because the Fed was buying under its QE programs. But then, with QE tapered out of the way, the selling picked up in 2015, and has sharply accelerated in 2016.

This chart (via Trading Economics), going back to the early 1980s, shows just how historic this wholesale dumping (circled in red) of US Treasury bonds and notes by foreign entities has been:

The chart is particularly telling: It shows in brutal clarity that foreign buyers funded the $1 trillion-and-over annual deficits during and after the Financial Crisis, with net purchases in several months exceeding $100 billion. The other big buyer was the Fed.

But since last year, the world has changed. China, once the largest holder of US Treasurys, has been busy trying to keep a lid on its own financial problems that are threatening to boil over. It’s trying to prop up the yuan. It’s trying furiously to stem rampant capital flight. It’s trying to keep its asset bubbles, particularly in the property sector, from getting bigger and from imploding – all at the same time. And in doing so, it has been selling foreign exchange reserves hand over fist.

According to the TIC data (market price adjusted), China was the largest seller in October, unloading $41 billion. Over the last six months, it unloaded $128 billion. This slashed its holdings of Treasury securities to $1.116 trillion, below the holdings of Japan. Japan, now the largest holder of Treasury securities, reduced its holdings by $4.5 billion in October to $1.132 trillion.

Japan and China are by far the largest two creditors of the US – the US still owes them $2.25 trillion – and they’re cutting back their lending.

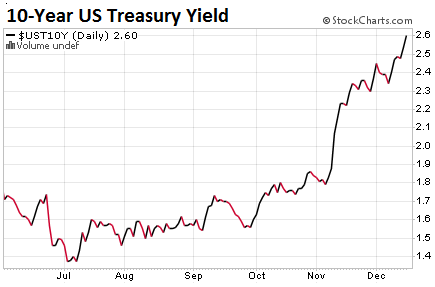

But who’s buying this paper? For every seller, there must be a buyer. But when demand sags, sellers have to offer a better deal. So they have to cut the price – for buyers, it means that the yield rises and becomes more attractive. The yield of the 10-year Treasury has nearly doubled since July this year, settling today at 2.60%:

At this yield, Treasurys found buyers today. But the remaining buyers – now that the biggest holders have turned into sellers – may demand even higher yields in the future. This comes on top of a lot of new supply: Over the last 24 months, the US gross national debt has ballooned by $1.85 trillion, or by about $925 billion per 12-month period (using the two-year average eliminates the distortions of the debt ceiling fight). Soon, the US gross national debt will hit $20 trillion.

And given President Elect Trump’s ambitious deficit-spending and tax-cut programs, a lot more debt may soon wash over the market. But this time, neither China nor Japan, nor the other major foreign entities may be willing and able to bail out the US, as they’ve done during and after the Financial Crisis. The bond market sees this too. Hence, the bloodletting in Treasurys, considered among the most conservative investments in the world.

But the “death of the dollar” will have to be rescheduled. Read… Currency Armageddon? A Word about the Hated Dollar

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

A recent article here exposed private capital flight from China as going into American and European real estate.

Where is this liquidated (“liberated”) bond money going?

Good question. In China’s case: Buy yuan and yuan-denominated instruments, to prop up the yuan?

You use the term “dump” to describe the liquidation of these instruments by their holders???

In they are being “Dumped” why is there no massive yield spike (I mean massive 7-10%) due to an oversupply???

There are obviously willing buyers, or yield would spike.

The Treasury auctions are (Have not to date ) reflected any massive increase in Yield’s.

People who need US $ are being forced to liquidate their blue chip US Treasury holdings.

Unless you have stats to support the allegation/suggestion they are selling at a large loss, how are they being dumped???

They’re “dumped” in a very methodical manner. No one puts $1 trillion of Treasurys on the market in one day. No one benefits – least of all the Chinese – from destroying the value of those securities. So they do it in a methodical manner to avoid disrupting the market.

The 10-year yield has surged from 1.38% to 2.6% in a few months. Proportionately, that’s a HUGE move (a move from 10% to 11.3% is very different).

You may object to the word “dump” for this process, and I can see why. But this is a big event … and the writer in me says “dump” is a good word to describe it :-)

“The 10-year yield has surged from 1.38% to 2.6% in a few months. Proportionately, that’s a HUGE move (a move from 10% to 11.3% is very different).

Yes % wise, 1 is a 100 and the other is 13.

Lets see how quickly it gets over 4%

Dump

Yes you did not use it as “take what you can get for it today, as tomorrow it may only be worth half that”. ( MDP stock)

Which is how we use it, in Financials.

Which is what I wanted to clarify.

I think China government is selling US bonds to China elite, taking payment in Yuan. This is the very definition of capital flight for the top 0.1%.

Tell me how I am wrong about this, if anyone does not agree.

By the way, how else could the USD-per-CNY exchange rate rise, unless the buyers are using Yuan to get the bonds?

“Where is this liquidated (“liberated”) bond money going?”

Isn’t capital flight really just a symptom? China is repatriating its dollar assets to fund it’s internal dollar based debts, which are huge and getting bigger every day. The dollar assets are being used to balance bank books, not to counter “capital flight.” They disappear onto some electronic ledger, never to be seen again.

The selling of U.S. Treasuries is a sign of China’s financial desperation, because there simply aren’t enough dollars to keep up with all the non-productive dollar based debt China has built up. China has burned through one trillion dollars of reserves in the last years. Does anyone really think that one trillion dollars of capital flight would have gone unnoticed?

China foolishly decided years ago to base much of its internal finances on the dollar. Now they can barely control the Yuan. If anyone wants to see how bad it’s getting for China, just watch as the Yuan falls steadily to 7 on the dollar, as it becomes harder and harder for financial and pseudo-financial institutions to obtain dollar based funds. And it won’t stop there.

China and Japan haven’t been “loaning” us money to fund our debt. They’ve been recycling their trade surpluses that they built by currency manipulation. We don’t “owe” them anything. They can buy more American goods if they want to get their money back. Unfortunately for them, they have to use their surpluses to protect their currency, to avoid the financial collapse that they will have brought on themselves by thinking they could get a free ride in international trade.

So their elite who are giving up yuan for Treasuries are buying houses in top US cities with the dollars they receive when selling the Treasuries? And this is their way of buying US goods?

Exactly.

Buying a house is taking title, a piece of paper. China exchanges treasury paper for dollar cash paper, then buys yuan paper from elites with dollar paper, the elites exchange their dollar paper for title paper, that’s it. Just an exchange of one form of net financial assets (NFA) for another.

However, the demand for us houses drives some new construction, creating some jobs… until China either runs out of foreign NSA or crimps the capital flight, at which point unemployment rises… as seems to be happening in SF, Vancouver, Sydney, etc.

>>China is repatriating its dollar assets to fund it’s internal dollar based debts, which are huge and getting bigger every day.

1. where is the evidence that China has “internal dollar-based debt”? I have never heard of that. Reference, please.

2. What do you mean by “repatriating dollar assets”, exactly? What asset? A US Treasury bond certificate?

I still think my own theory is the only one that makes logical sense so far: PBOC is selling USD-denominated assets to thwir own elites who wan to get their Yuan into USD and thereby out of China.

What’s a thwir? And who are these elites who wan to get their Yuan out? Would that apply to Mexicans in China? For example, would Juan also wan to get his Yuan out?

Deflation

IT GOES AWAY!

Like when you pay off a credit card debt and than cut up the cards?

China has decided to use its more than 3 trillion (or 3000 billion or 3000 000 million) in foreign reserves to buy high tech businesses, hotels like the Waldoft Astoria, London cab in UK, and so on. This is where most of the money is going.

It is not CAPITAL flight. It is called “foreign direct investment” by China, at least more than 100 billion US dollars in many countries in one year. It invested more money in one year, in 2015 than any other country.

China has decided to reduce loaning money to the USA because of the low interest rates and US provocation in the S China Sea.

I personally have been watching the 10 year as a bellwether of the economic situation. As the 10 year goes up, so goes up the cost of debt maintenance. At some point, which isn’t very high, maintaining the 20 trillion debt becomes impossible. QE could be reinstituted, but at some point the value of the dollar will go down with QE. I still think that the thing is going to go down in a blaze of hyperinflation.

I agree and cannot understand the attraction to the USD but am dollar heavy at the moment thankfully Im just wondering when to get out and back up the truck Id hate to think that Harry Dent is right about his deflationary spiral theory I still agree with most people that the FED will print like crazy to keep the inflation rate elevated

A clock is right twice a day.

If it is stopped!

Otherwise, If it is a good clock, it might cycle to absolute accuracy every thousand years

Check the dollar chart 1919 -1950.

Then think about all the things that happened and were happening at the respective points on the chart.

Unless

The US completely I mean Completely (like Zimbabwe/Venezuela) debases it’s currency.

Or a new kid shows up, that is not CCP toilet paper.

Where are they (is it) going?

Only so much can flow into CHF, sterling and loonie (both dodgy bets) or AUD if your down there, or do business there. Before there is nowhere left to run to.

This has been my and many other peoples problem since 1996.

Gold buying price is around 400 % + the band it should be in and silver was high (A sell) if you “Hold it” physically on spec.

Land has a high possibility of Government confiscation.

As to Harry he is a Perma Super Doomer.

So one day, he will be wright.

With out a reliable time frame he is just another Meredith Whitney on Munis.

A failed trader who knows exactly what will happen. But cant put an accurate date on that one day. so is no better off for the knowledge.

Even I can tell you one day the US $ will, cease to be the global reserve currency.

Dont ask me when. If I knew and was going to live that long I wouldn’t tell you.

But I can tell you currently I dont know.

Neither does harry.

He makes a lot of money off of people attending his doom protection events though.

BREAKING: Harry Dent, whose articles we feature here from time to time, just flipped from perma-bear on stocks to bull. In his latest article, he apologized for being wrong about his stock-market crash predictions – “mea culpa,” he calls it – and says that the breakout of the Trump Rally is real and will continue.

Is this the contrarian signal everyone has been waiting for? That Harry Dent finally throws in the towel and becomes bullish on stocks? That the last bear standing finally gives up?

He says a lot of other interesting things in his article….

http://economyandmarkets.com/economy/forecasts/harry-dent-trump-rally-looks-real-damn-it/

Bed time now, so I will, after I get up again.

Logically, if dent has gone bull. BEWARE. The trump boom expected by many, may be very short lived.

Yes the Post NOV 8 P45 events are a short term bubble but he dosent know how long. Realistically nobody does.

Especially when people start doing silly things like this, http://uk.reuters.com/article/uk-usa-china-drone-idUKKBN1452HV

Doing this under 44 will not cause a big issue, under 45 who knows what thin-skinned, spoilt boy, in an old mans body, will do.

china wants conflict with the US.

There is no other logical explanation for some of their recent actions.

Including deploying weapons systems to illegal reef recovery sites.

Making them unquestionable military facility’s which when they built hem they claimed they would not be.

“Even I can tell you one day the US $ will, cease to be the global reserve currency.”

When will the global monetary reset occur–ending the reserve status of the $US?– and when will gold be reintegrated into the global monetary system? Not before nations begin steadily reducing the US dollar component of their national monetary reserves–now approximately 60%– well below 60% and not before the proportion of world trade conducted in the US dollar–now approximately 43%– falls significantly below 40% of the total amount of currencies used in trade. When these trends are irreversible, economic confidence in the current fiat system will erode because capital flows to where its owners deem it is safest. Loss of that confidence will trigger the reset.

“Not before nations begin steadily reducing the US dollar component of their national monetary reserves”

Thats how it normally happens, took over America over 40 years and two world wars along with some very underhand tactics to drive England from the premium reserve status.

However America elected P45, the fraudster, who is a professional bankrupt.

Who uses bankruptcy as a profit tool, and does not understand there is no chapter 11 for nation States.

so

“Loss of that confidence will trigger the reset.”

Could occur almost overnight.

I changed the base currency of all my Forex and trading accounts to CHF.

p45 is to unpredictable.

Hyperinflation – As if the FED has no room to raise rates by tremendous amounts, the employment picture is white hot and demand is through the roof?

Sorry but employment is far from “white hot” Take a gander at labor force participation and you will see a far bleaker picture than the BS of the BLS

Who do you think publishes the labor force participation rate? It’s the BLS.

The hype from the news is that employment is white hot BUT in the last jobs report a little noticed statistic, full time jobs declined, the only job increases were in part time jobs! Do you really think that a los of full time jobs and only gains in part time jobs is the mark of a healthy economy? Really?

” At some point, which isn’t very high, maintaining the 20 trillion debt becomes impossible.”

When that happens, “bankruptcy” occurs and a great deal of “wealth” “takes a haircut”.

A perspective I haven’t seen elsewhere: That will mollify those of us who believe the “elites” have taken an unjustified share of the wealth created by leveraging while we have been savers and followed prudent, old-fashioned ideas about savings.

Sure, everybody loses when the excesses get corrected, but we get hurt least. Relative political tranquility will follow.

Also, commenting on Wolf’s citation of Dent, supra:

My wife wants to invest in the U.S common stock market a little of the proceeds from the sale of her house, which she occupied before our marriage.

While that kind of enterprise is anathema to me, I nevertheless told her what I would do if it weren’t: Bet on Trump’s prospective programs.

So, she bought CAT (infrastructure building equipment), NAV (International brand heavy truck manufacturer) and UTX (broad spectrum defense hardware manufacturer).

Since my recommendation had been forthcoming under duress, I extracted a pledge she wouldn’t blame me if the investments went south.

But, like Dent, I’m sure mea culpas would be customary.

Hyperinflation? I really don’t think that we could get from high inflation to hyper because 70% of the US economy is consumer spending and a good part of the US consumers don’t have enough income and no real savings or assets to survive even a short term bout of rising prices. It looks to me that defaults of all kinds would shortly ensue and a general collapse of the economy would follow.

So a short bout of hyperinflation would lead to deflation unless I am missing something about our overly leveraged system and the relationship between debt, consumers and the effects of the inflationary processes.

I think all of us would like to get this right so any reply to my faulty logic would help all of us.

I think you’re right. I haven’t seen many credible arguments for hyperinflation in the US.

Let’s look at the long-term factors affecting inflation:

1) Global jobs crisis. Automation replacing humans: bigly deflationary.

2) Demographics. Aging populations in the developed world. Those who are retired generally live on fixed incomes and reduce spending considerably. Bigly deflationary (except in perhaps healthcare).

3) Pension/retirement crises. A substantial portion of pensions are dramatically underfunded. This will lead to benefits cuts and/or higher contributions. Bigly deflationary.

4) Rising wealth inequality. Giving a billionaire a tax cut does virtually nothing for a consumer driven economy. Stock market highs do virtually nothing for the lower and middle class, who own few investable assets. BIGLY deflationary.

5) Unsustainable public and private debt. This constrains spending. Bigly deflationary.

No person can change 1 or 2. The only way 3 gets resolved is PAIN. And 4 and 5 under President Trump are likely only going to get significantly worse, not better.

The ‘reflation trade’ is a farce, although I’m not advising anyone to bet against it in the short term since the ‘animal spirits’ seem to be strong right now, and as the saying goes: the market can stay irrational longer than you can stay solvent.

and u forgot history. The US has never had an inflationary depression, unless you count what happened under Jimmy Carter in the late 70’s.

New word of the day : “bigly”. I’m going to use it. Hilarious!

You can have hyperinflation in a collapsed economy- in fact the two go together. It all depends how much money the government prints.

E.g. Zimbabwe, Venezuela etc.

BTW: the former abandoned its currency when the denomination on the bills reached billions.

Deflation has got something of a bad rap, at least compared to hyper- inflation.

If prices drop 5 % over a year and your income does likewise, you are even.

But if prices rise 10% and your income rises only 5 %- you have lost.

Deflation has two great disadvantages for government: as the biggest debtor, its debts and fixed obligations get larger in nominal terms.

The deflation of the 30’s probably wouldn’t happen again for this reason. In 1930, compared to today, the government had almost no bills to pay, and virtually no debt.

In a 30’s type deflation today, the government would go broke, not in some figurative sense, but literally. It wouldn’t be able to pay its employees, it vastly larger military, or issue the myriad social security checks.

The second main reason (part from politics) the government hates deflation is that unlike inflation, it can’t be taxed, and reduces taxes.

If prices fall 10% and your income falls 10%, in real terms you are even, but the government’s take falls.

I think the main difference between them and us is the amount of consumer debt in the US vs Venezuela and Zimbabwe. Any sudden increase in costs would cost immediately cause debt defaulting and that would cause deflation rather than inflation.. Fewer buyers and same production. I just can’t see how a system based on consumerism and debt can hyper inflate.

And the government can’t actually go broke. It can always cover its out go by printing..

Under our current system that would mean getting rid of the FED and stop the fiat creation of debt for money. The government would have to just create money with out the corresponding debt.. That with out any restraint would cause prices to rise but the connection would not be immediate. It would take time..

The us is a nett importer, almost a dependent one.

If import prices rise along with a negative national economic cycle, you get import price hyper inflation, wage and assets stagnation or deflation. Nationally produced goods price hyper inflation driven by import price content.

All this is Negativly compounded if the dollar looses value due to p45 stupidity.

P45 is an experienced professional Bankrupt/Fraudster.

The US electorate has now put him in the Oval office.

Many now see the US as a military and financial juggernaut.

Run by a Professional Fraudster, who uses bankruptcy regularly, as a profit making method.

p45 still does not seem to understand, there is no chapter 11 for a nation.

Watch, but keep your finger firmly on the dump the US button.

Its just Business, the p45 way.

Another factor, this uncertainty caused by p45 has to have a negative effect on foreign investment (not money laundering or speculation) in the US.

And it doesn’t matter what the government hates, when consumers are way over their heads in debt and so are many corporations it is just timing. At some point all this just comes tumbling down and the demand for products and houses and apartments and autos just disappears. Once this happens, what can the government do besides helicopter money and that would mean they actually understood the problem and got their own personal greed and beliefs out of the way. I will believe that when I see it.

I am waiting for someone to put up a convincing argument that consumer and corporate debt default isn’t going to happen. Raise the prices and or Raise the interest rate and it looks to me that this stretched out debt cycle will end in a deflationary spiral.

Inflation is first caused by a shortage of real goods, virtually never by money printing, which happens when countries have debts in foreign currencies or, e.g. Weimar, gold.

Fed buying treasuries (qe) reduces interest earnings to private sector and, even though pushing up prices of certain assets such as equities, is overall deflationary.

Its called helicopter money and wolf has been in the zone all week.

Qe4 to pump up world asset prices.

Chinese debt service and it ends up in the fed by way of reserve system and relieves the system of assets needing supported? (Softening deflations bite)

China is forcing a dollar devalue?

-In the US, there is no inflation, no demand.

-Export from China is down, for two years.

-From Europe, the same.

-That despite a falling Chinese currency,

that make everything from China, cheaper

and it should encourage more export.

-US Industrial Production is down for

a long time.

-The only sector that was really hot, was the

car industry and it’s cooling down, after

the election.

-When debt is unbearable, you dump the

most liquid assets, first.

-Gold.

-US bonds & notes.

-Chinese banks & crony, large corp. had to

do it. Brazil and other EM countries, too.

-But, I suspect, that, all of the sudden, unexpectedly,

the USD, our $, will hit a major avalanche, too.

-It will be shocking.

-That will make US bonds & notes even less attractive

and interest will pop up, further, in order

to encourage buying,

Thats exactly whats going to happen Michael

I’m an expat in Egypt….they are desperate here. The local currency has depreciated around 55% in the past 12 months. Local currency accounts are giving 19% interest, USD accounts are hitting 6% interest, the local stock market is doing pretty good, but not great. Lets just say….it’s good to be heavy USD in times likes these.

Nicko Im in SW Turkey(Marmaris) and they only pay 2percent on dollar accts here so youre in great shape for sure If I got that Id be very happy too

>>> “In the US, there is no inflation….”

So the cost of healthcare, college, housing, cars, cable TV, etc. hasn’t gone up in recent years? It’s all been just in our imagination? :-)

Dont forget homeowners insurance Before I sold in 2014 my carrier wanted to double my premium Thats crazy

Inflation is a sort of ever-shifting bogey that’s always tough to define.

Or, in other words, not all inflation is created equal. It all has the same end result– things cost more– but I don’t think that really fits with the economic definition of inflation, which would in my opinion be the result of concurrent price rises resulting from a singular cause, e.g. the devaluation of a currency.

For example, one of the reasons health insurance is costing more is a result of an aging and increasingly unhealthy population, increasing costs for everyone. Nothing to do with why cars cost more. On the other hand, you could look at the stock market and housing markets and surmise that low rates are the inflationary factor there (simplistic but no doubt a significant cause), but again, has nothing to do with cable TV, or college.

And of course, inflation statistics themselves are averaged, because everyone’s personal basket of goods are different. So I see anecdotes all the time about how people are paying so much more for food and everything else, but I’m not seeing it much personally. Beef has gone up a little bit, but milk is as cheap as it was 7 or 8 years ago. I can buy a 60 inch 4K HD TV for the same price as I got my current 40 inch 780P TV a few years ago.

So yeah, in the sense that the prices of things are going up, inflation is alive and well. But in the meaningful sense that central banks and economists care about, not really. Deflation is still the much larger worry in the long-run, there.

The Fed can stop panic selling anytime it wants by purchasing treasuries at any price it wants. And it has infinite capacity. Coupled with the fact that folks hate losing money, an equilibrium will be reached. If rates get too high the Fed will quietly step in and buy at the price it wants and keep it there. There are lots of concerning issues in the world, this is not one of them.

Exactly and well stated. The only issue here is the hype associated with this topic. A majority of the debt is owed to US itself. The options for better investment are where? China LOL???

>>> “A majority of the debt is owed to US itself.”

That’s a common misconception.

1. the “majority” is actually a “minority”: $14.4 trillion is held by the public. $5.5 trillion is held by the government.

2. The $5.5 trillion “held by the government” are in pension funds, the Social Security “Trust Fund,” and the like. The securities in these funds are only “held” by the government but have been promised to, and are owed to the beneficiaries of those funds, who’ve often paid for them (SS) via payroll deductions.

The only reason why the amounts “held by the government” are separated out is NOT to claim that the government does not somehow owe this debt. It does! But to show that this debt is not subject to bond vigilantes and market forces. But it is still debt and is still owed the public!!

I believe the phrase “A majority of the debt is owed to US itself” means treasuries owned by Americans and not foreign interests. The thought being that since it’s not owed to Germans in Euros, there is no need to adjust to lower the overall income of Americans in order to pay the “debt”. One American’s loss is another’s gain. Doesn’t help to be on the loss side though.

>>But it is still debt and is still owned the public!!

Possibly an interesting typo. OWNED (by ) the public, or OWED (to) the public (namely, those entitled to SSA payments).

Yes, one of my infamous instances of typo sarcasm.

But I fixed it. So unfortunately, future readers cannot enjoy it as much as you could :-)

not only public as in SS but pension funds and insurance companies.. even some normal corporations have their excesses in treasuries from what I understand. Lots of entities by law have to keep their immediately or eminently needed capital in US Treasuries.

The raising of interest rates is going to hurt in lots of ways not easily discernible I would think

Is this before or after a few of the great US banking houses collapse?

They didn’t collapse in 2008. The Fed can repo treasuries from the “great banking houses” at par.

The US will not be the problem. The problem is going to be 3rd world companies with dollar denominated debts, a rising dollar, rising interest rates and a potential recession.

The FED had unlimited “credit” and can save ANY banking house, especially those who own stock in the Federal Reserve Corporation.

You, sir, understand how our monetary system is constructed.

The Fed can buy Treasurys, but it doesn’t now – so rates/yields rise.

Think about that: the Fed is allowing these yields to rise, and in fact has just raised its own target rate. The Fed is not anywhere near QE4. It’s tightening.

Rising yields is ALL we’re talking about here, not the “bankruptcy” or whatever of the US – which I agree is nonsense because the Fed WILL buy government debt long before it gets anywhere near that.

Wolf, could you imagine any circumstances in which the Fed would lose control and the Fed’s buying government debt wouldn’t be enough to forestall a collapse?

I’m not Wolf, but the issue would be where the general level of prices is going up at say 10% while the Fed Res Board buys debt securities to peg the rate at say 2%. Then the general populace wont want to hold fed notes in any way other than very short term for everyday expenses. That situation would be problematic, but I don’t doubt the fed res would come up with a solution to the problem, and that Congress would pass whatever laws necessary.

@Anonymous:

history has shown over and over again that these money printers are confident that they can nip (hyper)inflation in the bud when it starts to show.

Reality is completely different: by the time inflation becomes impossible to ignore it usually is too late to stop it and the currency will hyperinflate. It has happened hundreds of times in history, and even now it is going on in several countries an nobody is able to do something about it. The exceptions to the rule (like Volcker around 1980) are very few.

No. The Fed can lose control over all kinds of things, including the dollar and inflation, but not the government bond market.

Look at Japan. That country is a fiscal nightmare. But the BOJ has the market for JGBs under total control. It might end up owning 70% or 80% of all JGBs in a couple of years. Theoretically, it could own 100%. There really is no more market for JGBs. So there will not be a debt crisis, neither in Japan, nor in the US – though there may be a currency crisis or lots of inflation.

“The Public Be Damned”

William Van der Bilt

(which, by the way, was taken out of context)

OK

So what happens if the FED buy the mountains of debt { boomers’ S.S. payments — boomers’ medicare — Trump infrastructure — etc } what can or will the FED do to sterilize the money used to buy the debt ?

Failure to sterilize is the problem, not buying the debt.

http://www.businessinsider.com/this-is-what-it-means-when-people-talk-about-sterilized-qe-2012-3

Or am I wrong ?

Thanks

SnowieGeorgie

The article is wrong (to a degree). It conflates QE with “injecting money into the economy”. In reality, the Fed creates money to purchase treasuries from banks. The money goes into the banks reserve account at the Fed. And the Fed pays interest on it, and the bank is getting free profits, so the bank is happy to leave it there. It never goes into the real economy.

The bank could create loans against the reserves. This would be “injecting new money into the economy”, but it is bank created money, not Fed created money. This is what really causes inflation. However, if the economy is doing well enough that banks want to monetize lots of new credit, the federal reserve would just force the banks to buy back their treasuries and drain the reserves. The Fed would certainly lose money, but it has an infinite amount so it doesn’t really care.

Where the article is correct is that the Fed is “sterilizing” the new money by paying interest on it so it doesn’t enter the real economy (banks don’t do this anyway). But it in no way effects the Fed’s balance sheet.

@Kent:

of course much of those free profits for the banks end up in the real economy! What do you think is happening with those billions in loot that Goldman Sachs and its employees have collected over the last years? They sure don’t invest all of it in US treasuries or stocks.

Initially it may show up mostly as inflation for the 0.1% (like prices for Hamptons mansions, NYC RE, super-cars and super-yachts) but it will certainly trickle down into inflation for the rest of the population – without any of the benefits that the first receivers enjoyed.

Several current ‘theories’ pop up here a lot. One- that you can’t go broke if you print a currency- many African countries have their own currencies and are so broke you can only phone collect from them. The international phone system won’t extend them credit for its part of the cost.

The other one ( there are a few) is that the Fed is omnipotent.

I wonder how old some of these posters are: in the early 80’s the Fed did lose control of inflation- Paul Volcker eventually reined it back but only at the brutal cost of a double digit Fed rate and mortgages over 20%- this is not supposed to happen.

The related problem was that the dollar was in danger of being dethroned as the world’s lead reserve currency- the Swiss franc and the German D-mark were being frantically sought after. along with gold, silver, real estate- anything but US$.

The other conviction is that the Fed can always prevent deflation.

Well, if theoretically it could resort to ‘helicopter money’ although as I pointed out months ago, and some MSM have more recently, you would not actually scatter money- the Fed could deposit it into everyone’s bank account.

Maybe 1000 per personal account, one only per person and only in accounts with less than 10,000?

But this can’t overcome fundamental problems- if it did Zimbabwe would be doing fine.

The Fed has been trying to get 2 percent inflation since 2008 and has spent 3.5 trillion.

In any normal healthy economy such unprecedented stimulus should cause double digit inflation. If you are taking a large dose of medicine to increase your blood pressure- and your blood pressure is low/ normal, you have a serious health issue. Can the Fed taper back to normal?

David Rosenberg has opined that the inflation scare ( bonus?) following Trump’s election is not going to last.

A fundamental factor is demographics- 10, 000 US workers a day are hitting retirement age.

Financial engineering by the Fed can’t alter this drag on the economy, anymore than the much larger stimulus by the BOJ could alter the deflationary effect on Japan’s economy.

A symptom of deflation is the destruction of money via bad debt.

I read in one of WR’s posts that 6 million Americans are 90 days overdue on their car payments- which right away raises the question- why haven’t they been re- possessed? Why would you leave your valuable car in the possession of someone who is unlikely to change the oil?

Sounds like extend and pretend?

The next question: what is the real value of the trillion dollar auto loan book?

And the commercial real estate book?

Student loans- don’t even ask.

You have gone round in the circle again.

The economy is flat /or in deflation depending on your perception as the global system has extended to much credit and bad debt out side of the State sector. Yet china and Europe are still piling it on.

If you stimulate the economy outside the states sector and reduce unemployment the gdp to debt ration automatically improves. then a slong as you can service the state debt the size of it is almost irrelevant, you can service it with playing field leveling tariffs.

Europe will not clean out is bad bank’s and NPL’S. Look at the can kick situation with MDP.

The debt is the growth we are looking for and it is now over a normal generation’s spending for its entire life.

SO we get no more real growth until the NPL’S are resolved and debt is paid down as the expanding population base does not have any REAL income.

It dosent matter how much paper and digits you create in the markets, and Corporate accounts all it does it make the long term situation worse.

The stimulation is required at the bottom.

America must stop importing unskilled labour and put it’s own unskilled and unemployed to work. At a good rate. And it must ensure that new wealth stays in America.

If you have to invent new tarrifs to do that to force American companies to make in America so be it. those new tariff should be based on environmental standards (Total national pollution not just CO2 on a per capita basis) and labour conditions not simply anti trade punitive aimed a 1 nation.

These playing field leveling tariffs can not be replied to in kind, without starting a trade war as they are not punitive. They must be environmental and labour condition and safety standard related. Including tariffs based on taxation in production nations.

Then any tarrifs raised by producer nations that export to the US can be replied to in kind by the US.

In fact what p45 has always threatened “Playing field leveling tarriff’s”

Then American / European / British growth will stay there, and not be siphoned off to tax havens and china or any other cheap dirty producer nation.

This dosent only apply to America, it applies to any clean, developed, consumer nation.

These new Enviromental and Production/Labour standard’s tariffs will start to force globalization to do what it was meant to, raise standards and rates at the bottom. GLOBALLY.

Not enrich just china and a few Globalised Vampire Corpoprates allied with china, at the expense of everybody else, which is currently what Globalisation does.

+++

And America seems to be developing Production standard problems as well.

https://www.bloomberg.com/news/photo-essays/2016-12-16/the-plastic-military-industrial-complex

look at the workers, no ear muffs, dust masks, overalls/ coats , gloves, protective foot wear. There are also no filling platforms for the hoppers, those bags of material a 25 Kg each they will inflict back injury’s on the workers filling the hoppers with out suitable filling platforms.

I worked with molders over thirty years ago, we had all those things (Provided by the employer by law) then, they are dirty, very noisy, hot and the materials are toxic, both through skin and airborne contact.

Very impressive d! You have a real grasp of the situation.

It occurs to me that all of us on here have a “past”. I certainly do. ^,..,^

Something tells me that your personal history is unusually rich and original….

Re: “The other conviction is that the Fed can always prevent deflation.”

“Deflation in the casino: central banks play their last chips to no avail”

http://breskin.com/Inquiramus/2016/06/15/deflation-in-the-casino-central-banks-play-their-last-chips-to-no-avail/

Thanks- Good read

We have seen 8 years of out-of-control spending pushing the debt to levels never comprehended before. The disinformation coming from Washington and New York that all is peachy was ‘entertaining’ for as long as bond buyers snickered at the joke. It is no longer a joke. We have on our hands as a nation the possibility of a coup, does that make you want to own bonds…at any interest rate, no matter if you are an individual or nation?

An old friend at city, in the bond department, says they are chewing their fingernails off with the BS from this government over the Russians ( and now we are sending 4,000 troops to the Polish boarder with Russia as of yesterday plus the hacking crap). Still want to own bonds?

Not even gold and silver are safe at this moment in time, but bonds are just another promise from a country in turmoil. If there is any safe haven right now, it is cash only because you can move it fast.

I will take a combination of cash in variousi denominations and ten percent precious metals as insurance I was at the border of Russia in Poland a month ago and didnt see any military activity I was in Warsaw on business and took a couple days out in the country Went to Terespol to see the New Silk Road rail infrastructure on the Belorussian border

If Putin takes another nibble it won’t be Poland. Too big, decent military, not a bunch of ethnic Russians for a ‘Sudetenland’ scam.

And NATO member.

Inflation is going to be induced, or manufactured, on many fronts. Minimum wage laws, natural resource shortages, supply chain disruptions, etc. Harry Dent’s deflationary forecasts are warnings that are valid yet not guaranteed. Even in the ‘hot’ real estate market of the U.S. are wide regions of falling home prices in rural areas of the Northeast and suburbs of Chicago, for example.

The root of the issue is capital flight from emerging markets, with China being the most seriously affected. With that hot money leaving it’s only a matter of time before their economies collapse, if they haven’t already. The end of globalization can be a fairly messy, though necessary business.

The rise in US interest rates I think can be pretty much attributed to Trump’s victory and serious uncertainty about what he may or may not do. One of his campaign themes was to get interest rates back up ( to get the vote of those with no earnings on savings) and the other main one was criticizing the Fed and Yellen.

I seriously doubt our fragile economy can handle this jump in rates over a period of months. You will start to see some major slowdown in housing and commercial real estate building; particularly since that boom is getting long in the tooth anyway.

And signficantly, if the projected rise in oil actually takes hold (I have my doubts), then all bets are off and we’ll be a quickly developing recession.

As far as inflation is concerned; yes the Fed desparately wants it and is getting it in fits and starts; however, it is crushing 3/4’s of the citizens of the US. Only the top earners aren’t really feeling the pain. That is of course, why Trump’s win was so unexpected. The top 1/4 of the country are pretty much in a bubble of their own making and couldn’t imagine someone like Trump appealing to the masses. Now they know; at least on a thinking level. They still aren’t feeling the pain yet though.

The top 25 percent I believe its more like the top 5 percent who dont feel the pain of inflation Maybe the top 25 on the coasts If rates rise substantially and energy dies as well there is going to be a world of pain out there

With the dollar so high you would expect to see the stores jammed packed with imported goods, but that is not what I’m seeing. My travels thru the Xmas shopping maze show a very curated inventory everywhere. There is a limited supply of everything at all price points. I do see long lines at the cash registers, but the stores are not jammed packed. I hesitated to write “cash registers” because in many large stores there is only one. The shoppers do have to lineup to pay.

Which leads me to an observation about my occasional trips to the local thrift store. Several weeks ago the store was packed with clothing and the cash register line was busy with buyers buying shopping carts full of items. Yesterday, the store looked much less stocked and the buyers were still buying shopping carts full of items. It is now a real shopping destination.

good observations; in our community the Goodwill store is always the busiest. any time of year. anyone else see this?

The analogue here: Dollar General is eating Kroger’s linch.

For some years now.

Many of the customers are far from destitute they are simply maximizing their purchasing power.

I brought a new electric kettle the other week, is bright orange and very ugly, also still in its box, and almost brand new.

New price over $70.00, is German, very good quality.

I paid $1.00 for it, nobody wanted it, because it was ugly orange.

Except me. I just wanted an as new Kettle, for next to nothing..

Yes. I have shopped thrift stores for at least 15 years in areas that are doing well economically and the clientele are like me…looking for a great deal. Not broke.

I wonder if there are thrift stores in poor areas? I’ve not seen them, but I have seen Dollar General and Family Dollar in poor areas.

One of my best friends is an electrical engineer with a healthy six figure income working for a defense contractor. He does his shopping at the Salvation Army. He was bragging to me last weekend about how he got an $80 Tommy Bahama shirt for $2.

I’m guessing it was worn at least a couple of times by somebody. Kinda gives me the heebie-jeebies, but to each his own.

Dont buy clothes from there, as its to difficult to sterilize them with out using chemicals, and not damage them.

Also you dont know what chemicls are on or in them that may take time to get out.

Methamphetamine production, Formalin, Etc. Most new Chinese clothes, Linen, are drenched in Formalin. Which is very bad fro you.

the trhift stores in my area are the busiest except for maybe walmart Home depot s been pretty busy too. On Wed the thrift stores here have sales and the checkout lines are huge; never seen anything like it except when a hurricane was coming.

Ditto here too David. I shop at thrift stores regularly and buy (only food, non-taxable) only at the bargain, dollar-store-type discount ‘supermarket’.

I just got a beautiful hand-made pottery pair of salt & pepper shakers for $1. Someone put a LOT of work into those, which raises the larger question of WHY anyone would be willing to do such hard, honest workmanship in future since the rest of us cannot afford to pay more…

there you are, PETUNIA! i was looking for you on my way to the gym to thank you for writing back about the florida rental experience you had, in detail. it’s so far back i wanted to thank you here.

the man i thought was the secret love of my life died this past weekend of a heart attack in his sleep at age 45, but he wasn’t the love of my life – i do this love thing like an epic art project, as you as a woman may be able to secretly tell.

so i’ll be MIA for a little while. i cried hard hard hard and mad for about 36 good hours, but now i’m oddly relieved that it’s over because many people mess with my intensity, get in my head, and won’t let me go. but i have my head/energy back and have to get a lot done as i’m having a huge creative/energy surge for the freed up energy.

people are complicated, yeah? (smile) i just wanted to say thank you.

x

Pray for him, you might be the only one.

Merry Christmas, anyway.

“because many people mess with my intensity, get in my head, and won’t let me go.”

Many men find goofy, artsy chicks to be the hottest. In my younger days I was always wildly attracted to them, found them intensely sexy, and had an uncontrollable masculine need to make sure they were going to be okay. Of course, that’s completely impossible because what represented “okay” to them usually made me want to scream in frustration.

Kitten Lopez: “the man i thought was the secret love of my life died this past weekend of a heart attack in his sleep at age 45”

Off subject, but I have to ask: Was this James who was reading passages from UNSPEAKABLE to you last week?

I do not understand the time lag. The TIC data shows that China has been selling Treasuries for 18 months or more. But, the rates only went up after the election. Can there really be that much fear in the markets that the Trump administration will/may significantly increase the debt? I cannot believe the Congress, which is well in control of the conservative Republicans will give Trump a blank check.

The size of the deficit is irrelevant, when republicans hold the Oval office, and only when republicans hold the Oval office.

As long as the office spends, on what the house and congress want it to spend on.

Iraq was OK, as they, and all their crony’s were getting big rake-off’s.

Trump stated during the campaign that he would fire Yellen. As a good democrat, she is probably just getting even with him.

Democrats would crash the economy again to make Trump look bad, because they really only care about their power, and not the country. At least the republicans admit they only care about the rich donors.

I’m not sure the motivations of either party are that simply cynical.

Here in WV. Republicans took control of both houses of the legislature for the first time in more than a generation.

The first legislation they enacted undid several “liberal” state court decisions making farmers liable for the misfortunes befalling trespassers when they hurt themselves by e.g. falling into sinkholes on the farmer’s land.

(Wow!) O.K. pardna’s, let’s mosey on over to the Long Branch and see if we can get Sam to stop servin’ that Kool-Aid to Miss Petunia! And tell Sam to change the durned channel on that blasted TV set! The overdoses are peakin’ agin’!

“Trump stated during the campaign that he would fire Yellen. As a good democrat, she is probably just getting even with him. ”

Trump stated a lot of things during the campaign.

He said Goldman Sachs was the head of the corrupt, multinational elite. He criticized Hillary Clinton for giving paid speeches to Goldman Sachs. He criticized Ted Cruz for being “owned” by Goldman Sachs because he was married to a GS banker. He said he was going to drain the swamp, rid their influence.

And yet, his top advisor, Steve Bannon, is a Goldman Sachs alum. His top economic advisor, Gary Cohn, is a Goldman Sachs alum. His Treasury Secretary, Steve Mnuchin, is a Goldman Sachs alum.

He said he’d fire Yellen. Except after he was elected, he said he wouldn’t.

He said he’d prosecute Hillary. Except after he was elected, he said that was just rhetoric to rile his base.

“Democrats would crash the economy again to make Trump look bad, because they really only care about their power, and not the country.”

Sort of like how they fought Obama’s stimulus plans tooth and nail because of ‘deficits’ but are now giddy over the idea of PE Trump spending trillions?

For the record, both parties care about their rich donors. Don’t get confused. But one party at least pays SOME lip service to helping the poor and needy– and it’s not the “Christian” one.

The vast majority of economists had a late 2016 rate hike penciled in when nearly all of them thought Clinton would win.

There had only been one other one since 2006.

After 20 + years of cutting rates, to the point where there was no more to cut, the Fed had to begin crawling back to normal sometime.

Many thought it would come in Sept. That was the last chance to do it before in the final weeks of the campaign, when the Fed is not supposed to do anything.

December 2016 was simply the last chance to do it 2016.

Not every act requires an ulterior motive- Yellen did the least amount of hiking she could possibly do, even as a pretty dovish Fed

dove.

PS- after all the abuse she and the Fed have taken for low rates, including from Trump, and given the extremely loose Fed policy so far during her tenure ( and her predecessor’s) you can make the case that she should have fired two barrels, and hiked 50%.

As for all the nonsense about firing Yellen- watch the swearing in:

Trump will swear to respect the independence of the Federal Reserve.

The yields started rising in July, as the bottom chart shows. But you’re right, there is still a time lag. And it’s never just one thing. There are many reasons why yields have been rising. And this is one of them. We’ve pointed at others before, including the rise of inflation, which can impact long-duration bonds in a big way, and increasing government deficits under the Trump administration.

Is it possible that US treasury bonds can still be considered a “most conservative investment” after experiencing a rigged 35 year bull market to previously unthinkable levels? Followed by a 2 month price decline in the 10 year bond equal to 6 years of interest? ( 11 years of interest for the 30 year bond) and in the process losing for the first time in history its AAA rating?

Hmmmm… Curious definition of “conservative.”

Credit risk. What are the chances of a US default? Zero.

Why? The Fed can buy this debt and supply the government with unlimited amounts of money. If that were to happen, the dollar would get crushed but the debt would be redeemed at face value, no problem. Hence, there is no “credit risk.” But there are other risks, including inflation.

I think the guy’s point is not about getting the face value back, assuming someone actually wanted to hold either to maturity- unlikely in the case of the thirty year, but about the beating these very low interest bonds have taken and will likely take in a rising rate environment.

They look risky from that point of view- although of course if deflation happens they’ll look great.

Patrick Grimes

Dec 16, 2016 at 9:33 am

” I cannot believe the Congress, which is well in control of the conservative Republicans will give Trump a blank check.”

Perceptions change. I believe there were lots of people who thought he would never win, no matter what they all thought of mrs. clinton. Trump demonstrated already that for good or bad, in reality of internet dis-information he is going to effect us jobs leaving the country. He has a few american businesses rethinking leaving.

This brings him support, and he knows how to rally his troops, and they will whip those worthless congressman, and equally worthless senators into giving him what he commands his troops to get out of their representatives.

Trump IS the Perfect Storm.

In the end, a country gets the kind of government it deserves….

Yes, awful as Trump is, people underestimate him at their peril.

I think it’s almost impossible to underestimate his knowledge of geo-politics.

For the 10 yr US Treasury, the all time low yield of 1.36% occurred in July 2016. Over the next 4 months the yield rose about 50 basis points to the mid 1.8% range until the US election of Donald Trump.

Since the election in a little more than 5 weeks (1.3 months) post election the yield has jumped approximately 80 basis points to around 2.6%.

Per the “Foreigners Dump US Treasuries” chart the dumping occurred almost all this year even when the low yield mark was reached.

That still leaves unanswered the underlying question why the yield jumped and the price declined so much and so quickly after Trump was elected. Your chart does not report sales after October and I assume that there must have been a very substantial increase in selling in the 5 week period since the election.

One thought is that the “full faith and credit” of the US may be regarded as less secure now because a man whose business expertise is in the use of bankruptcy to avoid repaying debt is President.

“…One thought is that the “full faith and credit” of the US may be regarded as less secure now because a man whose business expertise is in the use of bankruptcy to avoid repaying debt is President.”

Exactly.

IMHO the main cause of rising rates since the election is increased uncertainty. With Hillary it would have been ‘business as usual’.

Maybe this will reverse soon after he takes office, but due to the current chaotic political conditions in the US it might still be unclear then what the policy in many areas is going to be.

I think the most important point in the article has been lost in the conversation about demand for US debt and interest rates. The futures market in China failed. No demand, no liquidity. If that doesn’t signal a busted bubble, I don’t know what will. Nobody was willing to price the futures higher because they didn’t believe it. And nobody was willing to price the futures as low as they could go, because they didn’t dare to.

I think the Chinese are dumping their treasuries because they need all the dollars they can get to pump into Vancouver RE, for Vancouver bubble v2.0 ;-)

Judging from todays ZH story, the BC government has borrowed from the Dutch housing bubble playbook to pump up their bubble to even more epic dimensions. Officially this time the small Canadian fish can profit and not the rich Chinese, but I don’t doubt they will find some way around the limitations.

And rest assured, there are plenty more chapters in the Dutch playbook to make this bubble even more epic, you ain’t see nothing yet – many of these tricks are very modest compared to what the Dutch government has been doing for years.

The Fed afraid of loosing control ? Look to Japan. The US has a long way to go yet. The USD is the game in town. Timing is everything. Others must die before the US gets its turn.

The EU is on deck to get crushed in the near term. Crazy ECB behavior and decention in the ranks is pointing to this.

When you ‘look to Japan’ – don’t forget that in terms of law and order, mutual respect, civility, etc. etc. the US is by comparison on the verge of civil war.

I was just watching Fox ‘News’ – (we just switched our cable outfit and I don’t know the channel settings yet- but I noticed I always tell when its Fox just by the content. It’s the only one like that. Sure, when Rachel Maddow is on MSNBC you know what you’re going to get- but that’s her show not MSNBC news. There is almost editorial floating around on Fox)

They had some Trumpet hothead yacking with Martina Barto, saying that the mayors of these sanctuary cities were in for it.

Later on another channel the mayor of LA said, politely- bring it.

But most disgusting of all of is Trump’s pick for ambassador to Israel- who shocked Israelis are describing as to the right of Binyamin, which ain’t easy. He wants to expand illegal settlements in the Occupied West Bank and apparently annex part of it. He rejects the two-state solution a corner stone of US policy from both parties since the 1967.

This after Trump was driveling away a few weeks ago about a deal in the ME.

The only ‘good’ thing about this is that it makes the theft of Palestinian land US policy and does it blatantly. This is something of a relief from US whining about settlements, when it is the only one that could do anything about them.

But the other super power, The Rest of the World may not be able to stomach this- nor will many Americans, or Israelis.

There is big trouble ahead with this joker.

There is big trouble ahead with this joker.

Yes there is, and there is just as much trouble with you and your attitude as well you like him are part of the problem just the other side of it.

There will be not peace in the Levant until muslims concede Israel is there to stay and they have to share.

This is a financial site just like Germanys leader 1932 1945, the Levant issue ist Verboten Heir.

You are all reacting like this is Pre-1913. You are all reacting as if there are Trillions of ounces of GOLD involved.

Relax. It is only paper. None of this is real. The Central Bankers, since 1650 in Holland, have been issuing and dealing with “notes” and “bank notes” and “Gold Certificates” for over 400 hundred years.

They know what they are doing. The most BRILLIANT people work for the Central Banks.

Relax. It is only paper.

It’s not even paper. It’s digital.

Even corruptions “going green” . Counterfeit digital money. Every time I read someone calling the central bankers “stupid” and “clueless” , I have to laugh.

Right, they’re not stupid or clueless, they’re bought and paid for.

@Me, somebody gets control of real assets using all that paper, front-running YOU in the process. That is the reason why paper also matters.

Perhaps it’s easy to appear brilliant when you’re an insider. An insider who’s forecasts are always incorrect. If you’ve been trading CBO forecasts you’d be living in a cardboard box and the debt would have gone parabolic.

Of course they can paper over anything given they have infinite pulp, b/c they’re insiders.

I trust you are being sarcastic.

IMHO there are primary factors at play in the past 6 months on the 10 year yield. The first one being the serious jabbering about oil production between OPEC et. al. This probably accounts for the mild rise starting in July.

I really don’t think many in financial power thought Trump would win. I mean the news cabal did Hillary in by making it look like she was always ahead. Anyhow, the steeper rise in rates clearly took off after the election.

It’s not rocket science, this Trump effect. He has alot of people all over the world worried about rates, inflation, the future value of the dollar, etc. It will be very interesting to see whether a continued rise in bond yields will ‘temper’ Mr. Trumps rhetoric or whether he’ll succeed in crashing the fragile system we live in.

” It will be very interesting to see whether a continued rise in bond yields will ‘temper’ Mr. Trumps rhetoric or whether he’ll succeed in crashing the fragile system we live in.”

I doubt either of these two, there will be another based on something you’ve overlooked. Although the latter one is preferable to the more of the same falsehoods we’ve been struggling to comprehend waiting for the failure.

I’d say though, a sigh of relief seems to have washed over Wall Street up until now, good or bad it’s unclear.

So with China selling fast, and Trump promising the run up a bigger deficit than the current guy, who is going to buy? Logically, yields should keep going up next year. What does it mean for mortgage rates?

I’ve been thinking about this since last summer…I decided to sell all my houses. I’m half way through. The more unfolds, the more it seems mortgage rates should rise until there’s a recession. But rates move rather slowly. When the world tanked in 2008, it took a 3 or 4 years to get to historically low mortgage rates. Assuming the USD remains the reserve currency, which is very likely….this scenario could be repeated, but with even lower rates as we’ll be in much worse economic shape.

The status of currencies ebb and flow. After 2008, you could not sell dollars in Europe. At the time, they had no idea what a rag the Euro would become. The most precious thing is the benefit of the hindsight.

“So with China selling fast, and Trump promising the run up a bigger deficit than the current guy, who is going to buy?”

I suspect you’re in for a surprise, I know I was over the last 8 years so now it’s your turn.

-The yield rise started in Japan. A rebellion, counter to the BOJ

move and it’s spreading since then, globally.

– A rise from 1.40% to 2.80% affect bond prices the same way as a rise from 3.00$ to 6.00%,

or, 8.00% to 16.00%, that happened in the early 80’s.

-A drop from 16.00% to 8.00% is similar to a move

from 3.00% to1.50%, or, from

1/2% to 1/4%.

-If the US will be embroiled in a major crisis,

smart money will not seek a refuge in the USA.

–

HYD has taken a substantial dump, Chinese CB selling this too? How’s that state pension liabilities thing going lately, is the mess all taken care of?

OK,

Completely different opinion than what has generally been stated here.

There may be several months of higher rates and noise. These are going to be great opportunities to buy long dated treasuries and zeros. Just need to get yer timing right.

There likely could be a recession if rates go too high, there could also be a continued stock rally if they level out or move lower soon.

I made the same arguement three years ago when everyone expected rates to go up, and initial conditions are probably worse now.

Our government continues to prop up. Print more money to continue to pump up the market. We keep putting more of the stock market on credit cards. When will or will they wake up.