Some of the same characters that played leading roles last time.

The value of the US housing market has ballooned to $26 trillion. In many markets, prices exceed even the peak of the prior house price bubble that blew up so spectacularly. This construct is weighed down by $14 trillion in mortgage debt, or about 76% of US GDP. Of that, $10 trillion is owed on one- to four-family residences. The numbers are big – and they matter.

But who’s doing the lending? More and more: nonbanks, evocatively called “shadow banks.” They have now overtaken commercial banks “to grab a record slice” of government-guaranteed mortgages, Attom Data Solutions reported in its housing report.

And these shadow banks are different:

[T]hey typically borrow from Wall Street hedge funds, private investors, or banks to make loans, then quickly sell these mortgages to Fannie Mae and Freddie Mac and other buyers, so they can repay their loans and start the process over again.

Nonbank lenders dominate the origination of mortgages insured by the Federal Housing Administration (FHA) and by the Veterans Administration (VA), the riskier corner of housing lending due to no down payment or low down payment loans and poor-credit buyers.

So subprime mortgages with low or no down payments.

These government entities don’t actually make loans; they buy loans from lenders, package them into mortgage-backed securities, and guarantee them to make investors whole if the mortgages default.

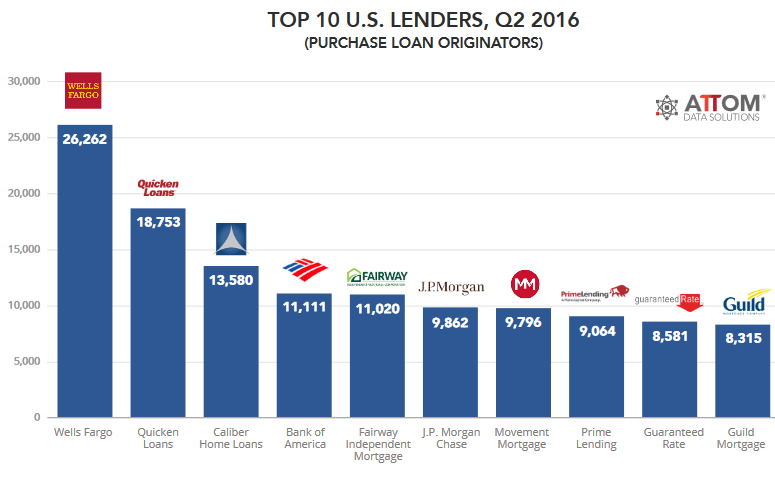

Wells Fargo is still the largest mortgage lender by far, with 26,262 purchase mortgage originations in the second quarter, according to ATTOM. But number two is nonbank Quicken Loans with 18,753 originations, followed by Caliber Home Loans with 13,580 originations, followed by Bank of America, Fairway Independent Mortgage, JP Morgan Chase, Movement Mortgage, Prime lending, Guaranteed Rate, and Guild Mortgage.

Of these top ten originators, shadow banks originated 63% of the mortgages!

These shadow banks are barreling into the market by going after riskier borrowers and government guaranteed no-down payment or low down payment mortgages, with impeccable timing, now that the Fed’s monetary gyrations have inflated home prices nationally past the prior bubble peak, and in many markets far beyond the prior bubble peak.

And some of the same characters that played leading roles in the last housing boom and bust have reappeared. Remember Countrywide? The report:

In California, some of the largest nonbank lenders include PennyMac, AmeriHome Mortgage, and Stearns. All three are headquartered in Southern California, the epicenter of last decade’s subprime mortgage lending industry. And all three companies are run by executives who formerly worked at the once- giant Countrywide Financial, the now defunct subprime lender founded by Angelo Mozilo (Bank of America bought Countrywide for $4 billion in July 2008).

PennyMac, a fast-growing nonbank lender, is run by Stanford Kurland, a former Countrywide Home Loans executive and IndyMac director. Stearns, a Santa Ana, California-based nonbank lender, is run by Brian Hale, a former Countrywide division president. And Joshua Adler, who is AmeriHome’s managing director of secondary marketing, held similar roles at Countrywide and Bank of America.

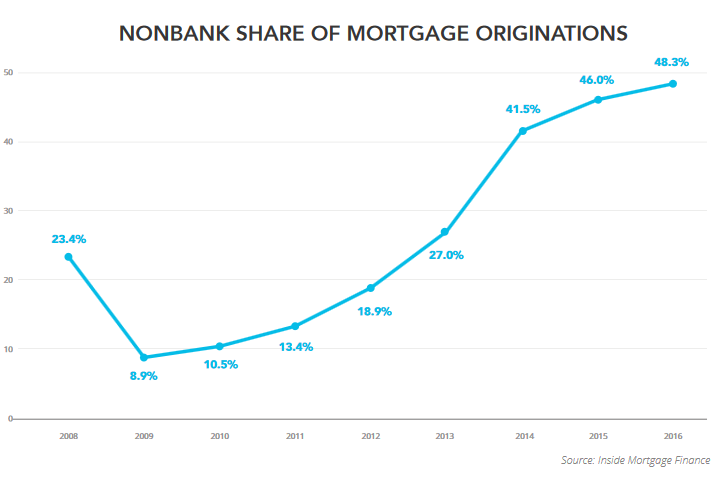

Banks still originate the majority of mortgages overall, but barely! Their share has dropped from 91% of originations in 2009 – after many of the shadow banks had collapsed in the housing bust – to 51.7% so far in 2016. The share of shadow banks (blue line) has soared to 48.3% (chart by ATTOM):

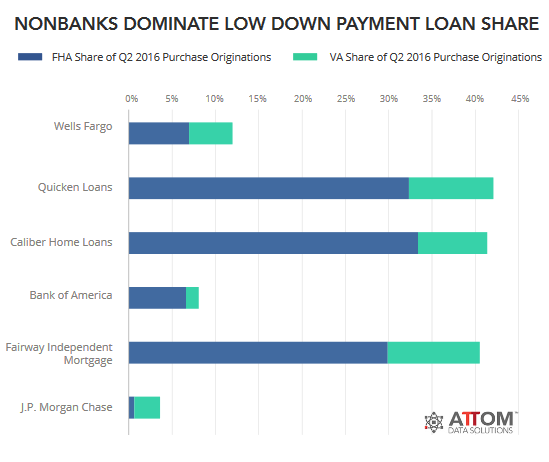

These shadow banks dominate in mortgages that are insured by the FHA and the VA, including no-down-payment and low-down-payment mortgages for buyers with subprime credit ratings, the riskiest mortgages out there. Thus, FHA and VA backed loans have jumped from 6% of all purchase originations in 2006 to 30% in Q3 2016.

“The big banks have restricted their mortgage business,” Guy Cecala, publisher and CEO of Inside Mortgage Finance, told ATTOM. “Instead, banks like Chase and Bank of America are making jumbo loans to more affluent borrowers. More than 50% of their business is jumbo loans.”

Jumbo loans are not insured by the government. Nonbanks and the government are picking up the rest.

Increasingly, the federal government – FHA, VA, Fannie Mae, Freddie Mac, and Ginnie Mae – has played a larger role in the mortgage financing industry as the large depository banks retreat from the home loan market. In all, these five entities own or have guaranteed more than $5 trillion in mortgage risk….

That’s about half of the outstanding mortgage risk.

The role of the government entities that insure high-risk subprime mortgages has soared: The FHA insured 3.4% of all mortgage originations in Q1 2006; by Q2 2016, its share had jumped to 17.5%. Over the same period, the VA’s share soared from 0.7% to 8.7%.

This chart shows the share of FHA and VA insured mortgages as a percent of total mortgage originations by lender. For example, of the mortgages Wells Fargo originated in Q2, 12% were FHA (blue) and VA (green) loans, compared to about 42% for Quicken Loans:

It is largely via this conduit of the shadow banks that the nationalization of the riskiest end of the mortgage industry is proceeding. It has now become completely dependent on government guarantees.

“The government is buying and insuring 60% to 70% of all mortgages,” said Richard X. Bove, vice president of equity research at Rafferty Capital Markets. “The government owns the mortgage market. It’s a nationalized market.”

This artificially pushes down mortgage rates as the risk is born by taxpayers. Low mortgage rates and no-down-payment and low-down-payment subprime mortgages are precisely what is required to inflate already inflated home prices further and drive Housing Bubble 2 to its peak. It creates the foundation for the next housing bust, where taxpayers and/or the Fed, will once again bail out investors in mortgage-backed securities. Why? Because politicians, always eager to buy votes, refuse to get the government out of the mortgage industry.

But there is no risk, we hear constantly. Defaults are at a record low. Same as just before the last housing bust. When home prices soar, no one defaults. You can just sell the home and payoff the mortgage. The problem arises when prices head south. Alas, there’s just no letup in dismal tidbits piling up about the condo markets. Read… Is Chicago’s Housing Market Next?

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Finally, the real bankers doing God’s work are appearing. At this point, the only reasonable thing anyone can do is accelerate the collapse of the system. The bigger the collapse the better. These guys are helping to make it happen. YES!!!

It is maddening to see the taxpayer on the hook to be fleeced again by the “guarantees” provided by FHA and VA. When the SHTF a bailout of some sort will be needed. Also, the subprime buyers are paying increasingly inflated prices for their homes. Which also means higher property taxes and insurance costs over what a more rational market would demand.

Dodd Frank sure did wonders!

Everything is fixed now. They banks don’t have to worry any more.

Let me get this straight. (Seriously, I do not necessarily understand this stuff unless it’s carefully explained to me.)

Various government entities guarantee these shakey loans, but that doesn’t help the home buyers, right. They will still face foreclosure. It’s those INVESTING in the loans that have been packaged as financial products who benefit from that guarantee?

Am I understanding the situation correctly?

When I read these kinds of articles, with grifting and malfeasance at the fore, I liken we, as in society, to Major Kong riding that nuclear broncing buck , yipping and hooting, sub-prime closing papers in clenched fist …. wearing an I-watch with the alarm set to midnight … whilst plunging to a disastrous end !!

Heyzeus help us …… !

Yes, you understand it just fine. The mortgage insurance buyers are forced to pay for when they put down less than 20% protects the lender from the default. They get made whole and then they take your house too. Once the whole thing is over they will make more money taking your house, which is why they like to foreclose.

BTW, Senator Warren could have done something to protect consumers from this, but didn’t.

“BTW, Senator Warren could have done something to protect consumers from this, but didn’t.”

Really? Like what? The FIC™ dictates federal policy, and nobody has her back.

Something as simple as allowing homeowners to catch up with payments and forcing the lenders to comply with a catch up plan. Or protecting renters by allowing them to have longer than one year leases, to protect them against onerous yearly rent increases. Or capping the credit card rates at 5% over prime.

She could have proposed any of these small provisions to protect consumers with her consumer protection bureau. But she didn’t.

“She could have proposed any of these small provisions to protect consumers with her consumer protection bureau. ”

You’ve been posting on this blog forever and still haven’t caught on. How disappointing.

Walter,

I don’t mind the parasites being parasites. I only mind when they can’t own up to it, regardless of which side they claim to be on. Warren claims to be on the side of consumers and the little people, but she is a willing captive of the party apparatchik.

“I don’t mind the parasites being parasites.”

Ah, such willing victims. Perhaps Warren isn’t really the problem after all.

Walter,

The reason I don’t mind parasites being parasites is not because I enjoy being a victim. It is because I am not confused when I finally interact with them.

Walter, P. has what’s called willful ignorance.

In many states the homeowner is still legally responsible to pay off the foreclosure deficiency, i.e., the difference between the large mortgage balance and the much smaller price received for the house.

You got it.

Is this growing little American Fiasco, why The US state dosent wish to sell Freddie and Fanny????????

Its much easier to prop them up with more taxpayer funding, when the state already controls them.

The hard part isn’t selling them. They used to be entirely publicly traded entities before the bailout. The hard part back then was disavowing the then “implicit” government guarantees on the mortgage bonds it issued. China, a large holder of agency debt before the Financial Crisis, relied on that guarantee – and was bailed out via the bailout of these agencies.

Now that implicit guarantee has turned into an explicit guarantee. So the government would have to disavow publicly and forever the guarantees on new debt, though it will have to maintain the guarantees on the existing debt. It’s politically a tough thing to do because mortgage rates would likely jump.

Also, Congress is now in control. Congress doesn’t like to give up control of anything – especially if it can squeeze money and lobbying juice out of it.

Yes, picture it this way. You, personally, lend money to someone to buy a house. The mortgagee, you, then insure the loan (usually at the lender’s expense) to protect yourself. The borrower then defaults. You foreclose, and claim the mortgage insurance and receive the balance owing on your loan, less the value of the property which you put up for auction.

The mortgagor, who has defaulted, gets nothing. Seems fair.

If the mortgagor had paid his loan, he would still be in possession of the house.

In Canada, there is an instrument called Power of Sale, which is preferred to foreclosure because it’s quicker. In that case, any surplus funds from the sale of the property and the settlement of the mortgage and expenses related to the action go to the ‘owner’, i.e. the mortgagor.

This can happen of course if the market has gone much higher since the owner bought, but he can’t or won’t make payments on the mortgage. This wouldn’t make much sense, because the owner could just sell, but it may happen if the holder of the mortgage just doesn’t want to wait any longer, especially if many promises to pay have been broken.

The FHA and VA will only buy conforming loans, though. There may be a low down payment, little equity, but the terms of the loan can’t be abusive like many subprime loans. They’re not setting the borrower up for failure.

It has gotten easier to get a mortgage over the last 2 years, but it’s still pretty onerous. With the rate of home ownership in the 62% to 63% range, it’s as low as it’s been in decades. Demographic behavior indicates that the rate may fall to 60% in 10 more years. So, any housing price correction will be focused on a smaller and smaller percentage of the population.

Ah, but have the robo-signers returned?

They wouldn’t do that. Why, that would be wrong.

Never mind.

Just more examples of debt-stuffing.

Basically, since 1981 when Reagan came into office with the promise of giving Americans something for nothing, (guns and butter AND tax breaks) and he pushed out Stockman to do his asterisk accounting, we, and everyone else, from the biggest multinational, to the smallest bond-making local entity, have monetized the future by turning everything into a debt instrument.

Over and over and over again.

Same guys, blowing the same ever increasing debt-bubbles. No area is immune to this artificial price inflation.

Now we have the greatest bond bubble in the history of humankind.

Worse than that is the derivatives market, another debt toy. That’s how we got DB carrying a notional market value of $75 trillion with only something like $10 billion in assets to back it.

The world wide market for these debt-instruments is north of a quadrillion dollars.

How this will all be unwound will turn out to be the largest DEFLATIONARY crash in history as all the players scramble to find CASH to repay these debt-inflated instruments. Its already happening on the dollar peripheries in the third world.

It will come home SOON.

It should be obvious to anybody that the pirates are still running the show and are still indulging their taste for recreational psychotropics. There’s a few things I’d like to know:

1) Is there an effective strategy to profitably hedge a terminally-corrupt situation like this?

2) Is there an effective strategy for preserving one’s assets when the Financial Industrial Complex (FIC™) once again blows up the global economy?

The evidence keeps piling up that human civilization is destined to die an ignominious death from the sheer weight of its own iniquities. The global survival risk models are grim any way you look at them, and those get worse all the time.

I would say no. It will be one of those situations where the living envy the dead.

If we lose regimental discipline as a society, the bleak, fire-ridden, fallout-strewn environment will be unlivable in a matter of months.

Read or watch The Battle for Chernobyl. The sacrifice made just to control one nuclear plant and the eight day fire destroyed the Soviet Union.

We have more than four hundred around the world. If the local workers somehow can’t make it to tend these plants (say, in place like the Donbass in the Ukraine) they become unquenchable nuclear volcanoes in about 48hrs.

And Fukushima was FIFTY times worse than Chernobyl, by the amount of nuclear waste ejected. And its on-going, virtually guaranteeing the collapse of the Northern Pacific ecosystem.

I learned a new term after 2011 – ELE

Extinction Level Event.

That is absolutely the first time I’ve heard anyone attribute the fall of the Soviet Union to Chernobyl.

BTW: I don’t know if it’s still running but an identical plant was running for years after the fall of the USSR, I think in Ukraine.

The fall of the USSR is a complicated story (!) and at its root is simply Marxism, embodied in the command economy.

The final unwinding began in Poland, not a member of the USSR but a vassal state that introduced martial law at the insistence of Moscow.

The resistance to this was lead by Solidarity, a trade union headed by Lech Walensa and the Catholic Church headed by the new Polish Pope.

Moscow was not amused when the Polish Cardinal Wroclaw was made Pope, but at least they said, the trouble maker is now out of Poland. They were also not pleased that the ritual congratulations required of the Polish Communist Party seemed suspiciously genuine.

But Brezhnev really hit the roof when the Pope announced a visit to Poland, the first ever to a Communist country by a Pope.

He got on the phone to General Z, and suggested he retract permission to visit- “the Pope is a statesman, suggest he plead a diplomatic illness’

The General said this was very unlikely to happen

“So- and- so (The General’s predecessor) was a better Communist than you!” yelled Brezhnev and hung up.

The footage of the Pope’s arrival is epic: he in his white robes, hands clasped at his waist, sternly looking at the uniformed General, who is wearing aviator sun glasses and whose knees are wobbling back and forth…

But it was the arrival of Gorbachev that signaled the end. The Warsaw Pact, the supposed mirror- image of NATO had spent its lifetime enforcing Communism, often with ‘fraternal’ invasions of East Germany, Hungary, Czechoslovakia, etc.

Gorbachev told the GDR- East Germany, that they could not count on Soviet troops to enforce the regime.

Shortly after that border control collapsed then the Wall came down.

BTW: the Poles, Lech Walensa and the Pope deserve at least as much credit as Reagan.

Contrary to popular US belief, the USSR did not go financially bankrupt, its credit was good, but it lost the moral authority to govern. Even the Euro-Communists could no longer accept it- except at the point of a gun.

Thanks Nick for a better understanding of Russia’s ruling collapse. The Russian regime depended on the satellite country’s, Poland being one of them to supply food and new ships. Walesa and the soladerity movement stopped the production of shipping vessels in the Iron Block, the Russian empire at the time. Russia also depended on the fertile soil of Poland to produce food for the Iron Block. Polish farmers still privatly owned their land unlike much of the other Block country’s where the State owned the land. Rationing of gas to power the farm equipment was controlled by the Russian State as was what was planted. A catastrophe waiting to happen, as the black market price of petrol (gas) was far more then the price the farmers recieved for producing wheat. About the time of Reagan, the U.S. began selling wheat in huge amounts to Russia, little do we in the States realise that the farmers selling their rationed gas on the black market in Poland and the Iron Block led to the downfall of the Russian dominance in Eastern Europe. This info was related to me from a Polsh farmers son who immigrated to the U S.. The story was quite comical as told, when the Trotsky farm agent would come out to inspect the fields and see few if any crops growing, the farmer would say, ” Beats me, and I have been doing this for many years”.

Monoline insurance company (AIG ) wants more upfront and the shadow banker goes to the New York attorney general and gets a ruling against the monoline insurance company and its re- insurance provider pulls their guarantee and the shiat show hits the nightly news……like last time!

Just like the AOL Time Warner deal marked the end of the tech bubble last time, the new ATT AOL Time Warner deal is marking the end of the current tech bubble. This one will take the whole ship down.

Keys are scratching the insides of brand new mailboxes!

Absolutely . For first hand proof on the ground come spend a little time here investigating Denver’s Bubble on the verge of bursting market fueled by overly optimistic deluded investors and financed by Shadow Banks and Dark Money [ Dark Money = When pawn brokers and loan sharks etc are used to acquire down payments and/or to make up the disparity between the appraised value and sales price of the property ] Dig just a little deeper and you’ll find a whole other subset of buyers mortgaging their homes and businesses to the hilt in order to purchase one or more ‘ investment ‘ properties . Any way you look at it .. things aint looking too good right now . Or to paraphrase/take a riff on the Bard ; ‘ Bubble Bubble Toil and Trouble all about to turn to Rubble – Scale of subprime – Tooth of Shadow – Investors money all soon to go ‘

Hmmm .. its looking like remaining an OWMNB [ out with money not buying ] since pre-2008 was the wisest choice after all

Unregulated market as an added bonus!

Besides its Colorado – it will come back faster than the regulations ” to never let what is about to happen, happen again” find support in Denver.

Unregulated State and eastern envy – golden country your face is still red!

Holy moly. Time to cash out! Haha wow. Speechless.

Wolf, the first sentence says it all! “The value of the US housing market has ballooned to $26 trillion.”

On your 18 October ‘The Economy is Cracking under Too Much Debt’ with Chris Martenson, you mentioned the housing bubble in 2005, and the fact that nobody saw what was coming.

But as I have posted before, there was one (that stands out to me) foreshadow of what was coming published by The Economist in early August 2006. On 1 January 2001 the housing market in the US was, on aggregate, $14 trillion. On 1 January 2006, it had reached $23 trillion; a stupendous jump for five years that in no way reflected realistic appreciation and new construction. Sure enough, in the next three years we were at about $15 trillion.

Now, in just under seven years we’re $9 trillion back up? In other words, from a realistic value of $14T almost 16 years ago: we went up $9T in 5 years, down $8T in 3 and back up $9T in under 7 years!

Well thank you very much to the Fed and Wall Street!

This time around the housing bubble looks like it will pop much faster than before. Not only is a larger portion of mortgages in US & CA cash only foreign investment but ’08 is still fresh in the minds of everyone. Not only that but defaulting on an underwater mortgage has since become much more socially acceptable.

Need some evidence of an impending disorderly housing crash? It’s now commonplace for 100 pt daily moves in the DOW, as investors are on a hair trigger these days (this behavior likely extends to those same investors’ willingness to dump their real-estate holdings at the first sign of trouble). Also, remember when gold didn’t take off for several months after markets started to free fall back in ’07? This time around the mental link was formed and gold took off on Jan 2nd, the same day markets took a nose dive. Like gold, the association between housing and stock market sell-offs has been burned into memories.

After reading this in total disbelief, I had to go to a MSM site to calm down. I have to do it more frequently these days. There is a soothing calm over there, and I am beginning to envy the sheep.

Lol. First time I’ve laughed all day. Stuck in Glendale, CA – nuff said

Thx

At what point does VA, FHA, Fannie Mae, et al become too big too save¿

And if those creaking bastards pull down a Deutsche Bank-size bank in the early stages then it probably begins too big too save right then and there.

I knew, based on the aftermath of the last bubble, that we would see another crash because it was so lucrative to the jackals in power. No one went to jail, in fact they got rich many times over! Given those facts, you knew they would go to the well again as soon as they could. They “never let a crisis go to waste”, and once you grasp that you see everything they get involved with gets destroyed – by design. It could be housing, or the stock market, or education, or health care – doesnt matter. By destroying things they can rebuild them in such a way to exert and consolidate their control like the fascists they are.

Disaster Capitalsm, Naomi Klein calls it.

It’s just another more insidious form of disaster capitalism. The destruction is very much by design

If you haven’t read The Shock Doctrine I encourage you to do so.

https://www.amazon.com/Shock-Doctrine-Rise-Disaster-Capitalism/dp/0312427999

Anyone up for another “Big Short”?

Tech is the next big short.

I wish the public understood that Andrea Mitchell and Alan Greenspan are married. It’s amazing these people are so much in the spotlight and still in the shadow.

I’ve read that when Greenspan proposed, she initially had no idea what he was talking about.

That’s funny!!! I always refer to him as “Mumbles” Greenspan, like the gangster character in the old Dick Tracy comic strip.

Lost in all of this: The small, genuinely community-based banks, that used to lend local saver’s money to local citizens known by the bank’s board of directors to be worth lending to, are being squeezed out of existence by bank “regulators”

Board members at our local bank are telling me about it, chapter and verse, new regulation after regulation.

Many impose some politically correct, non-discrimination policies which actually operate to restrict ECONOMICALLY sound lending criteria.

Unfortunately, the astute middle-class survivor has no choice but to understand the game and play it.

When I remarried and my wife sold her house, the local banks couldn’t finance it (see my previous comment, supra).

A private “venture capitalist” picked up the load, insured by Fannie Mae.

I can’t help noticing a pattern behind the obvious greed. When the Bolsheviks siezed power they eventually nationalized all private property. I look at the incremental nationalization starting with the BLM in the West (to preserve wild spaces for future generations; Midwest states buying up arable farmland and turning it into Wetlands, public parks, a bike trail from Cedar Rapids to Iowa City that I never see anyone using, and now this huge percentage of mortgages everywhere else, I can’t help but wonder if this isn’t a stealth version of what the Bolsheviks did by main force.

Julian you are 100% correct. Too bad most people don’t have a clue as to how the government is controlling EVERYTHING and we no longer live in a truly free country anymore.

So have you figured out what happens to the land once the Serfs can no longer afford to buy any of it fso ther is nobody to fueld the bubbles..??

How about the state takes it all, dosent pay the bank’s who have financed it. Then starts the whole process again. Thats what Stalin and co, did.

For a short version of the cycle, check Vietnam’s process under Communism. Most blatant crony National land grab, in modern history.

Have you ever noticed, how all the people who control these Communist/Socialist country’s, are all members of the global 1%.

Julian, I’m confused. Could you elaborate as to how you believe a 35 mile bike trail connecting two river valley cities is part of a larger, sinister master plan of the global elites to steal your property? I’m having a difficult time following that one.

Thx

I don’t understand why people are required to buy mortgage insurance. The whole point of mortgage insurance is to protect the lender against default. If mortgage insurance protects the lender against default, then why did we have a housing collapse and why did the taxpayers have to bail out the banks? What an f’ing scam!

Here’s a good one: When we recently applied for a mortgage, we were told that if we put a lot of money down, we would not get as good a rate as if we were to put less money down. Are you freaking kidding me? We would actually be penalized for putting MORE money down! The world is upside down and on fire! I don’t see an end to the current housing bubble until the Fed pops the bubble by raising interest rates and the government gets the hell out of the mortgage industry.

I want to compliment this site and every blogger I’ve read here. My role in the economy is very minor–I teach some “business” math to students who take it as a requirement in their majors.

Will return for more instruction on the mortgage industry and its history. This is to encourage participants to continue sharing their analyses and wisdom. Thanks!