Consequence of turning “home” into a financialized “asset class.”

Something happened on the way when the concept of “home” transmogrified to a financialized “asset class” whose price the government, the Fed, and the industry conspire to inflate into the blue sky, no matter what the consequences. And here are the consequences.

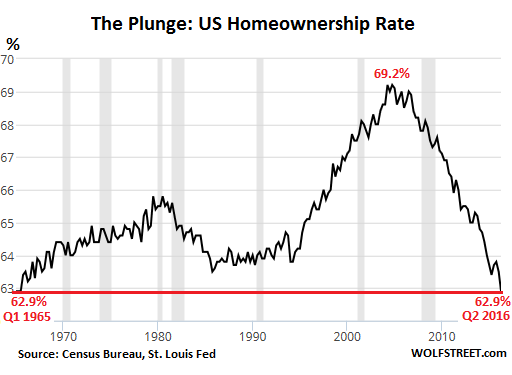

The Census Bureau, which has been tracking homeownership rates in its data series going back to 1965 on a non-seasonally adjusted basis, just reported that in the second quarter 2016, the homeownership rate dropped to 62.9%, the lowest point on record.

It matches the low point in Q1 and Q2 of 1965 when the data series began. At no time in between did it ever fall this low. And it was down half a percentage point from 63.4% a year ago.

The relentless slide has lasted for 12 years, from its peak of 69.2% in Q4 2004, which was when the Greenspan Fed’s low interest rates were boosting speculation in the housing sector, and prices were going haywire. At the time, the concept of “home” had already become an asset class that can never lose money, financialized and later shorted by Wall Street, subsidized by government agencies, and backstopped by the Fed.

And this is what happened to homeownership rates afterwards:

The 1.9 percentage point drop from Q3 2014 (65.3%) to Q2 2015 (63.4%) was the largest two-year drop in the history of the data series. It also coincided with steep increase in home prices.

On a seasonally adjusted basis, the homeownership rate dropped to 63.1% in Q2, the lowest in the non-seasonally-adjusted data series going back to 1985.

There are numerous reasons for this, some known and others still to be guessed at, including:

- Rising home prices in an economy of stagnant wages (for the lower 80%) have pushed entry-level homes out of reach for many people.

- Lower priced homes in many urban areas entail a huge and costly ($ and time) commute every day. And even then, these homes may be too much of stretch for big parts of the population in expensive urban areas.

- First time buyers are having trouble saving for a down payment since they spend their last available dime to meet soaring rents.

- Millennials have been blamed. They always get blamed for everything. They saw their parents deal with the American Dream as it turned into the American Nightmare, and they learned their lesson early in life.

- The super-low interest rate environment hasn’t made homes more affordable because home prices, in response to super-low interest rates, have soared, and in the end, mortgage payments are higher than they were before.

- Higher home prices entail other costs that are higher, including taxes, brokerage fees, and insurance.

The fact that Housing Bubble 2 in most urban areas is now even more magnificent than the prior housing bubble that blew up with such fanfare, even while real incomes have stagnated for all but the top earners, is a sign that the Fed has succeeded elegantly in pumping up nearly all asset prices to achieve its “wealth effect,” come heck or high water. In this ingenious manner, it has “healed” the housing market.

It’s two-year bout of flip-flopping about raising rates just puts some lipstick on these policies that include the purchase of agency mortgage-backed securities, which the Fed continues to buy to replace those that mature and roll off its balance sheet.

Just today, as part of its routine, it acquired $2.6 billion in agency mortgage-backed securities. On July 26, it acquired $2.0 billion. On July 25, $1.9 billion; on July 22, $1.3 billion, on July 21, $2.5 billion; on July 20, $1.9 billion…. and so on.

As MBS mature and are redeemed, the Fed takes this money and goes to its primary dealers (list) and buys more of them, which puts downward pressure on mortgage rates and prevents the free market from playing any kind of role, all in the religious believe that inflating home prices beyond all recognition is somehow good for the economy and Wall Street, despite the consequences, such as plunging homeownership rates, as America turns from a country of homeowners into a country of renters, often dwelling in a corporate-owned financialized asset class.

At the luxury end, something new is hitting the housing market: Manhattan and Miami are already getting mauled. Now it’s expanding to San Francisco, Silicon Valley, Los Angeles, San Diego, even Texas! Read… US Government Mucks up Money-Laundering in Real Estate, Puts Luxury Housing Bubbles at Risk

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The new American Dream is clicking on Facebook’s ads. This is why FB had a massive quarter.

Actually, this is all Fed pumped money into start ups that is showing up as ads for silly stuff. That may explain why Google had a blowout quarter.

I think the clicks they all claim are bogus and some college student in a third world country clicks on them to make an extra buck. Ever notice how the system is now wired so that we get to see ‘self-reported’ clicks? Back in the days when desktop internet browsing existed, entities such as Alexa used to report on the statistics. Now, we have a system where the ad system is managed by the big 3 (Google, FB, and Yahoo?) and the first two have a vested interest in reporting bloated numbers.

Did you say SEC will fix this? I have heard that unicorns have been sighted more often (pardon the pun) than SEC.

Google had a great quarter because they know how to rip people off with adwords. If you don’t pay close attention to what you are doing they make it extremely easy to blow through money amazingly quickly. Recently they suggested to me a way to segment my ads. I tried it and found my cost per click doubled, with no impact on click through (I reversed it). Had another friend whose company was getting charged as much as $10 a click because their marketing consultant wasn’t careful about the keywords (especially negative keywords) or maximum cost per click. Worked with another friend and got his cost per click cut more than in half, just by cleaning up his bids. Multiplied across thousands of users, that’s a lot of “extra” profits for them. That said, the big elephant in the room is what happens when consumers realize that they can send bills to the companies they hate, just by clicking on their ads? Next time you see an ad by a hated company, click away – they pay, you get a laugh for free.

As for housing, its property taxes that will long term doom the market. As long as house prices are moving up, people don’t really protest the rates. Once prices stabilize or drop … and property taxes keep climbing it will get ugly. this is especially true for folks on fixed incomes, who own their houses, but face rising rates.

Jim,

You can save a lot of money if you cut out the middlemen (Google, ad agencies, etc.) and work directly with the publisher. I don’t know what you’re trying to advertise, but if you think it works on WOLF STREET, contact me via the “Contact us” tab in the navigation bar.

My tax valuation went up 9K, on a previous tax valuation of 60K. Pretty big % increase, wouldn’t ya say? And I thought it was cheaper to live in the country! Neighbor across the street, the valuation went up 22K! Gee, I’m glad revaluations only get done every 5 years.

An interesting extension of the homeownership graph would be to look at the impacts of population growth and household formation and at rents. A casual survey of many markets shows skyrocketing rents, so how are prices of apartment REITS and other investments holding up? Are those likely to fall any time in the near future without some crash?

I think REITS in certain areas will crash, especially Florida. The rents there do not correlate to the incomes of the renters. Rentals there need multiple incomes to comply with the rising rents and that alone squeezes the demand for more housing.

I left because most of my income was already going to rent and they raise it, while our income had dropped. I was hardly unique. I think Sam Zell saw this last year and bailed out. I think the rents are even higher now then when I left six months ago.

I can see rent control coming a mile away. It is not just the rising rents but all the other abuses the renters suffer at the hands of the big corporate landlords. As an investor I wouldn’t want to be in any REITS.

The rental market in Manhattan is soft with landlords offering one month free and offering broker incentives that escalate with the number of leases signed

I sold my real estate at the height of the last bubble. Right now, I’m staying in Airbnb rentals on a nightly/weekly rate, moving wherever I want (currently in Montana). It’s actually cheaper than renting, when you factor in the utilities and taxes and time spent doing maintenance.

A lot of homeowners are doing the Airbnb/VRBO thing to make ends meet and one can find some pretty good deals out there, esp. if you go weekly or monthly. Interestingly enough, I’m meeting others who are doing the same – some work on the internet and some are retired. All are telling me it’s cheaper than renting and signing a lease with a deposit. I also have dogs and have trouble finding rentals, but not so with the Airbnb crowd. And staying in some very nice places.

I love your logic, why not double down and just go camping… Bridge Under passes are also lovely this time of year

I get the impression that’s what it’s coming back too, for growing numbers. Be assured they still wear walmart sneakers made not by their homeless pals but imported from their creditors factory somewhere in another country.

Someday perhaps, millenials will look up from the smart phones they used to design and wonder where their opportunities disappeared?

I actually do a lot of camping and love it. Bridge underpasses aren’t on my agenda. I have enough cash in the bank to buy several houses, but don’t intend to ever buy another one.

RVs (some quite luxurious) are home for many folks, these days.

I have in-laws that sold their home on the Hudson, bought an RV and spend their summers travelling the states and their winters parked at Slab City.

They say it’s great and nothing to tie them down. I suppose they’ll settle into kids or elderly housing when the time dictates.

“The reason they call it the American Dream is because you have to be asleep to believe it.”… George Carlin

Mobility in the job market is a big driver of the rental housing market. We will never buy again because of it and I have advised my son to stay mobile. The Florida tags on our car had our new neighbors interested in us because they are transplants as well. Some have been permanently transferred, others only for a year or more. This is the state of the employed, some of these people are even govt workers.

Mobility and owning are NOT mutually exclusive, IF YOU START WITH A GOOD PLAN AND HAVE A THRIFTY MIND-SET. You must be patient for the right deal and for appreciation, inflation, and mortgage pay-down to work.

I did it in the 80s and my 3 boys are doing it now. You MUST leave your ego and “wants” behind. Buy a house that will make a good rental in the future. NOT YOUR “DREAM HOME”, but functional shelter at a great price.

I taught all 3 of my boys how to buy, rehab, finance, and rent a house. All 3 did the purchase and rehab as 17-18 year olds (with my help of course). They oldest 2 used their monthly net profit for books/college expenses, and now those profits pay their student loans AND their basic-used-car payments AND their car insurance.

All 3 knocked a year off of college by going to community college in the summers before and after their freshman year. My youngest will be an incoming 2nd-Semester freshman this fall. When he gets out in 3 years his rental house will also pay his student loan and much more. He already has a paid-off car from his work, savings, and willingness to wait 6 months to get a good price on the car he wanted.

The next step for my older boys is saving the down payment to buy a 3-4 bedroom house to share with room-mates. They will get low or free rent, and their room-mates will get lower-than market rent. Later they can take over the entire house (e.g. if they get married/start a family), or move and continue to rent it.

My boys can move anywhere in the world and these assets will continue to deliver passive income for the rest of their lives as long as they don’t kill the goose for a one-time gain.

If you time it correctly, you don’t even need to be local. But you must have savings and courage to buy when the economy turns down.

BTW, I agree with you getting out of Florida. I grew up in S.E. Florida and still have family there. It is a boom and bust economy with relatively low pay (10% below the national median) and well above-average housing prices pumped up by tourists and suckers from the North.

Sir, you are a great father.

Observing from abroad, the declining standard of living for majority of Americans is so obvious.

Roads, public transport, public health, airports, the large parts of cities that are dangerous.

Great sport on TVs though.

And cheap junk food.

Another ‘benefit’ of the Obama “Hope and Change” regime. Ready for four more years of the same ole stuff if the person from the demonrat party wins the lection?

It probably won’t be the same ‘ol stuff. Worse, Hillaboo has both the Brezinski Strategy and the Wolfowitz Doctrine in her tent.

Congress is Republican – they have the money. No one else. So have another drink and learn how your gov actually works.

Trump will force Corps to bring back how many jobs?? All exported by Corps that have zero interest in the so called American Dream. He is not the answer either and has about as much power as a flea. The Trump myth is just that LOL. A myth built on broken promises, laid off employees and suppliers not paid as he filed bankruptcy after bankruptcy.

“He is not the answer either and has about as much power as a flea.”

Actually, he could have all kinds of power. He could revoke or modify any executive orders he chose to, fix the US code the prez is specifically responsible for (one is the hiring of aliens which has a simple and obvious loophole you could drive a 20 ton truck full of illegals through, intentionally I’m sure; no need to build a stupid wall, just make a minor change to that code and the prez is specifically designated within it to be the ONE person to demand that), veto anything he didn’t like which would then take a 2/3 Congressional majority to override and he could use his bully pulpit to explain his reasons for opposing a bill to the American people in order to fight that.

In reality, THE ONLY person who COULD have any chance at all to fix things at this point IS the President. Go to the 1:55 point in this video:

Dylan Ratigan’s Famous on-Air Rant

https://www.youtube.com/watch?v=gIcqb9hHQ3E

BTW, I’m not saying that Trump WILL, I’m just saying that he or any President COULD.

So how does the purchases of MBSs by the fed keep mortgage rates down?

“As to how the Federal Reserve, or anyone for that matter, buying MBS benefits the economy, here goes:

Just like a bond, the higher the price, the lower the yield. Think of it as a teeter-totter, if one side is high, the other side must be low. Now think of typical supply and demand. If demand is high, prices rise. If many people want what you have, you can sell it for a higher amount. So, as the Fed buys MBS, prices rise. Now go back to the teeter-totter reference, if prices rise, yields (interest rates) fall.”

http://qna.mortgagenewsdaily.com/questions/how-does-the-fed-buying-mortgage-backed-securities-help-the-economy#4e8b84021d41c8094e008892

More details here:

https://www.yahoo.com/news/news/governments-mbs-purchases-keep-lid-mortgage-rates-000000263.html

Shawn

I’m out of my depth here, but if an MBS was offered at an unacceptable market rate and was bought by the Fed (i.e. all taxpayers), the costs (mortgage rates) are somewhat artificially depressed.

This same silly logic works with student loans: the closer to “free” college we get, the more expensive college (as paid by students & taxpayers) becomes.

At some point with housing prices and student loans, it’s the PRINCIPLE amount that kills you, not necessarily the 0.000001% interest rate.

Bottom line:if you can’t afford a $100,000 car, getting it at 0.000001% interest isn’t going to help.

The low interest rate helps a lot if people assume they are never going to pay back the ‘loan’ out of their own pocket.

In my country this applies to student loans (rate: 0.12%, forgiven if you can’t pay it back with 5-10 years) and to many mortgages (rate below 1% for a 10-year mortgage; all mortgages below 275K euro include a free put option from the government). With homes, most buyers assume prices will keep rising indefinitely and if not, government will bail them out.

Incidentally, many first time buyers who have huge student loans don’t mention them when getting a mortgage; no problem even though the mortgages themselves are usually 103% …

I think the notion or the paradigm that the housing prices goes up no matter what (even with the dips every few years after blow-off like 2007 and perhaps 2016) may be questioned few years from now.

My reasoning is the dearth of 1st time buyers who are getting outgunned by investors small and big and the millenials saddled with student loans, some cannot afford to move out of parent’s house, low paying service jobs, etc. with some couples even pushing off getting married, etc. The slow demise of 1st time and the move-up buyers combined with the baby boomers retiring may slowly undermine the housing market. As for the wealthy overseas buyers and investors here and abroad – there is limit to how many rentals they can mop up.

Vespa P200E

I think the paradigm has always been questionable.

Historically real estate blows up somewhere in the USA about once every 20 years (once per generation?). This is usually a regional, not nation-wide event.

The current “housing paradigm” that prices only go up really occurs in a select few areas (eg: San Francisco, Silicon Valley, NYC) corresponding to geographies generating extraordinary wealth. Other areas of the country have experienced this phenomena (Detroit = cars), areas like Miami have external factors like looted South American money.

Other places certainly have irrational RE exuberance, but they’re usually not spectacularly high, and they usually have corresponding run-downs (Miami).

Politicians love the home ownership meme (supposed to increase wealth, provide financial security, and cause people to vote for them) but as people who really can’t afford homes (low income, poor work history, working in obsolet industry) get mortgages, a 1% increase in homeownership represents 1,350,000 new mortgages; 6,500 defaulted mortgages causes $1B of bank real estate bad debt (some recaptured in foreclosure).

As I get older (and I’m pretty old) I see this time and time again.

“Consequence of turning “home” into a financialized “asset class.””

This is yet another in a long list of mechanisms for criminal enterprise to swindle mom and pop out of their life savings, courtesy of and sanctioned by, central bankers on the take.

Why do our “elected” politicians allow this?

The selected political parasites allow the swindle because they are bribed to do so.

What Gregg said – politicians are paid (bribed, campaign contribution, whatever) to do so.

Politicians have a vested interest in keeping housing prices up and making folks think they are living well using their homes as piggy banks. Local pols have the ability to increase tax revenues and empty homes are bad for business prospects. But then everyone who owns a house has a vested interest in higher and higher prices. Real estate folks, folks on TV, bankers, the market hypers, really, anyone who owns, or whose income is dependent on housing. So really, there exists a sizable segment of our population who are prepared to not see the “Big Con”.

exactly … in most countries in the West there is a voter majority that wants home prices to keep going up and who will ignore all danger signs because they only care for their own pockets. It isn’t just the politicians :-(

financially responsible (and independent) people are only a tiny fraction of the voters.

You have to ask ???

OK….. I’ll take a wack at it………

Politician : “Gimme the Vig !…..I wanna be rich and all powerful !!

how’s that ?

What boggles my mind is how people have been deluded into believing that housing represents “wealth.”

A house is not an investment – it is a wasting asset. If you stop paying for maintenance and repairs for a couple of years you’ll see the value decline substantially. Better still, stop paying your property taxes and see how long it takes the government to sell the house out from under you and put you out into the street. So much for your “investment.”

The system works only because everybody believes the con job.

As long as the total cost of ‘ownership’ of a house is equal to or less than the equivalent rental then it is not a ‘wasting asset’.

That is why some housing markets are so interesting. A couple of examples:

Public schools in Australia, in general, are not very good. However, there are some places that are very good. As a result people are willing to pay a premium for houses in those areas. An equivalent private school would cost between A$25,000 to A$30,000 a year per student.

Chinese have piled into these areas causing the value of houses in these areas to soar.

Now what is happening in those areas is that prices have reached a level that no longer make any sense. Rich Chinese are moving to areas that have very good private schools, but lower houses prices. A million bucks will get you a much better place and you’ll have more than enough money to pay the tuition.

We are seeing more Chinese buyers in our little suburb: we have two very good private schools, a number of average ones, a new ‘public’ science’ high school, a university, hospitals (public and private), a train station, and close access to the highway along with one of the bigger shopping centres in Melbourne..

All factors which are/have created a huge demand for houses here.

Also let’s look at Japan. The economy isn’t doing much. Real estate in many places is in a world of hurt with a declining population.

So which would be better: renting or buying one of those ‘wasting assets’?

To rent a house in a decent area would cost you between Y60,000 to 100,000 a month or more.

Do you rent or buy? Under your ‘wasting asset’ scenario you wouldn’t buy.

However, you could buy a house for say 25,000,000 yen and get a 1% loan. Your interest costs would be much less than the cost of rent: anywhere between 2.5 to 4 months rent equivalent.

The problem for Australia is that the high prices are a function of available debt. And that debt comes from offshore. The higher the prices, the more debt is borrowed from offshore. The Landlord is just a collecting agent of the rent for the foreign debt holder.

In Theory, your average house could be worth $10m, if rates were 0.1% and foreigners were will to keep lending.

The vendor would feel rich as some mug has just paid $10m for a house he bought for $1mm 15yrs earlier.

However, the newly rich vendor then ( often a retiree downsizing ) buys a Mercedes, travels Biz class on emirates to Europe, up grades ipads, etc all foreign made goods.

Whats left after the toys are all worn out is, some poor joker with a house, $10mm of debt, a retiree that needs aged care, and a foreigner looking for he next interest payment.

in my country it’s also about available debt even though there are hardly foreign buyers involved. Homes are way overpriced but thanks to sub-1% mortgage rates, endless homeowner subsidies and punishing policies for the small free rental market, renting can be 2-4x more expensive than buying.

I owned an expensive home over a decade ago but I’m currently renting because I want to be flexible and don’t want to bear the risk of the potentially huge correction in valuations when our 30 year old housing bubble burst (which to be honest, I was expecting to happen over 10 years ago already because of the huge runup in prices). But for the average buyer the choice is extremely simple: they can transfer all the risk to others and only enjoy the low monthly cost. Of course in the long run this can never work, because they are (or will become) net taxpayers too.

Instead of money transfer between domestic and foreign buyers, over here there is a massive forced money transfer from savers to debtors :-(

Many of the foreign buyers pay cash for their RE.

Banks here have cut back or eliminated finance for foreign buyers.

The market here is still doing fine, thank you:

“The Domain Group reported a clearance rate of 76 per cent from 534 reported auctions. The results of a further 121 scheduled auctions were unreported.

Period houses with modern extensions led the market action.

In Malvern, Marshall White auctioneer Andrew Hayne saw five $4 million-plus bidders compete for the keys to an extended five-bedroom Edwardian house at 17 McKinley Avenue. On the market at $4.4 million, the property was knocked down for a hefty $4.98 million.

Over in the west, two young couples duked it out for a renovated four-bedroom double-fronted home at 5 Jessie Street in Sunshine. It sold for $1,001,000, well ahead of the $800,000 reserve.”

One doesn’t hear the word “mercantile” much anymore, but it was the policy of England, which got it a foreign empire with a minimum of violence (warfare).

It’s the policy of China today. Why send in the soldiers when you can buy out the target real estate with the local “consumers” money?

Well, and they need a place to live.

Just because something is a waisting asset does not mean it is meaningless. It simply means it goes from $X to $Y, where $Y is less than $X – ignoring inflation (whole different issue).

Example: food is an interesting waisting asset is food; leave the stuff sit in the sun for a couple days and YUCK. Doesn’t mean food isn’t a useful, valuable and necessary commodity.

Up to 50% of all food is also wasted (rots during transport, or thrown out). Tremendous business potential to exploit and promote efficiency.

That’s what having chickens are for ;’)

For those protecting their savings from inflation erosion, or depending entirely on built up home equity, by owning physical gold:

Average weekly price close by month;

Jan. $1102.30

Feb. $1214.80

Mar. $1242.32

Apr. $1249.28

May $1256.30

Jun. $1302.08

The trend is obvious.

RENT HOUSES ARE GOLD BRICKS WITH CASH FLOW.

As far as them continuing to appreciate, here in Dallas there is a HUGE MOAT around basic rental houses since the cost to replace them is double to triple the current price of basic housing.

This is due to:

1) inflation in building materials and labor,

2) cities making the MINIMUM house size 2000sqft to 2500sqft to squeeze out poor people and their social costs

3) good business sense of builders since it takes pretty much the same amount of management to earn 15% on a $300k-$400k house vs. 15% on a $100-$150k house,

4) low interest rates that distort everything

5) but mostly this increase in the average house size is due to the greed and envy of the buyers.

Yes, these higher-priced and/or way-outside-the-city houses will likely go down by 50%+ in the next downturn. But not the basic housing that was more than good enough for families for 30 years from the 50s-70s until everyone got greedy. By basic I mean 1200-1500sqft 3/2 and 4/2 houses with 1 or 2-car garages.

Contrast that with a story I heard today about a couple whose built a 4600sqft house, in an outlying city, and by the time the house was done and they had lived in it for just 1 year their 2 children had gone off to college and there they are, all alone in this mini-mansion, an hour’s drive from the city.

When the bubble bursts, the construction costs could crater and people might want the cheapest/smallest home they can get (because your downside risk is smaller) instead of the biggest/most expensive they can get (because they want maximum exposure to the expected price gains, not because they need the space).

Funny things happen in a bubble like in my area of the Netherlands were 5-10 years ago many homes were build by builders from Belgium (1-2 hour drive) because the Dutch builders charged nearly twice the price for the same home. Currently the northern part of Belgium has bubble trouble as well so I hear less about it, but it clearly shows that building costs can be a bubble just like home valuations (and land valuations).

But it was $2,000 or so a few years ago….

:-]

…the trend is obvious …or not:

July 2011 gold $1837

July 2016 Gold $1336.

This is just silly.

Yes, pointless without looking at the relevant reasons for Gold being where it is, I think the point he wished to make is that he believes Gold will once again continue to appreciate as the US deteriorates .

Brett

I understand the concept.

I also inherited a couple hundred pounds of gold & silver (mostly silver) from my recently deceased father. I’ve learned 4 new things:

1) there are high fees (5-10%) to buy the stuff

2) there are high fees (5-10%) to sell the stuff

3) a troy ounce is about 1.1 regular ounce

4) You really don’t want much of this in your house unless you have a forklift

For the record: 400 pounds (roughly 5800 troy ounces & 3 cubic feet) of silver is worth about $120k @ $20.50/troy ounce (less $6-12K sales fee).

Since 1992:

Gold has appreciated from $370->1820 (492%)

My BRK/A appreciated from $22K->216K (982%)

An appropriate word from the Havamal, the book of ancient Viking wisdom…….

“Fields and flocks had the sons of Thorvinn, who now walk with begging bowls. Wealth can disappear in the blink of an eye, gold is the falsest of friends.”

I found it rather amusing to hear the speakers at the DNC convention including Obama talk so positively about the economy, the hurrahs and alive & well American dreams. The speakers constantly mocked Trump’s glass is half empty POV. Wonder what drugs they are on.

The mantra of America is great, the economy is doing great, no mention of the word ISIS let alone Muslim terrorism, etc. may alienate voters on the sideline and actually motivate the angry voters to vote in droves. Like Brexit – don’t discount the angst of the voters again establishments and exposed DNC corruptions not to mention the baggages Clintons bring.

BTW – someone noted that there was NO American flag displayed on the 1st day of the convention.

“Wonder what drugs they are on.”

The reality as perceived by those who read NYT is different from those who read Drudge. The liberals make fun of conservatives for not reaching out of their comfort zone. Liberals believe they are superior because they read the textbooks they were assigned in colleges and got good grades by working with in the framework set up for them. Never mind that most will question their material as much as a reader of Bible does.

That is why you have a poll saying Trump leads while NYT claims at the same time (based on this very data that was used for polling) that Clinton has a 75% probability of winning.

I think people throng to the websites that present a simple picture and remind them they are still in control. An example is the ABC reporting of the DNC convention where George S. whines about Trump. Fox News reciprocates.

The fact of the matter is that most people cannot think critically and won’t question what has been ingrained in them. To see why this is difficult, you need to watch The Big Short where the guys doubting the ethics of Wall Street banks still believe they will act ethically.

In short, liberals are on drugs just like the conservatives. What we hear in media is Kabuki.

They were so preoccupied by the booming economy that manufactures next to nothing along with their fabulous costumes and decorations, they forgot all about including Old Glory.

IT IS WORSE THAN JUST NO U.S. FLAGS===>>>

DNC Convention 2016: Soviet Flags, Palestinian Flag – BUT NO US FLAGS

Jim Hoft Jul 26th, 2016 8:28 am 1239 Comments

The Democrat Convention kicked off Monday in Philadelphia.

The far left Bernie supporters marched with Soviet flags down the street.

Democrats waved the Palestinian flag from inside the Wells Fargo Convention Center.

…and the DNC had to borrow a few flags from Philadelphia government, to cover their embarrassed asses.

And I’ll bet ALL those flags were manufactured in …….. CHINA !

The REAL tell of where most people stand in the eyes of the Beltway crowd was revealed in VP Biden’s speech.

When he first arrived in DC he was ridiculed as “Middle Class Joe” he said. He claimed it was said in a derogatory fashion and meant that he wasn’t sophisticated enough to be around the Washington crowd.

I doubt he realizes that he just confirmed our ideas of how we’re looked at in Washington.

No American flags at the DNC? Other flags instead. If you are on Wolf’s site, you are too smart to fall for such obvious propaganda. See Snopes, http://www.snopes.com/flags-banned-at-dnc/

I stand corrected. Should know to fact check.

Thank you,

The reason for the financialization of housing were two-fold:

1. To transfer real asset ownership to the rentier class; and

2. To increase national, state and local governments revenues through capital gains, ordinary gains and transfer taxes and after transfer to tax the properties at their most recent and higher valuations proved through sales which also increases everyone else’s assessed valuations.

The result have been windfall profits to the rentier class and greatly increased streams of revenues to the government. Everyone else are net losers but they aren’t rich and can’t bribe the political parasites so they don’t count for anything.

Gregg, what do you mean by rentier class? it seems that the definition has changed from people who buy bonds for income to the wall street financialization sharks–a huge difference. This reeks of psyop to meM

This is my first comment (after reading the site for a year or so) –

I’m in my mid-20s and pulling down ~70k/yr with no student debt (worked hard to get my B.S in 3 years and worked while in school, had a head start because my parents made me put my birthday money / chirstmas money in the bank since I was a child), no car debt (I drive a 15 year old Toyota and DIY maintenance) and my only hobby is restoring motorcycles (which is cashflow neutral).

I have about 30k saved up outside of my retirement accounts (in theory I could use all of this and my IRA towards the down payment but my historic returns have been well above the interest rate on the mortgage so I got pre-approved for 5% down) and I just can’t find a house that seems appropriately valued that’s willing to entertain my offer. I looked at 10 houses over 2 months, made 8 offers (6 of which were above asking), and 7 times I was beat by an above-asking cash offer (probably an investor – either a landlord or property improver), and one time I was simply out-bid.

There are plenty of houses available but the prices only make sense if you expect to find a bigger fool. 900 sq. ft, 1 bathroom homes in not-great-neighborhoods command 180k (and this is in a second tier midwest city). And it seems people are rushing in to avoid finding out that they waited too long and prices soared. That’s too many signs of a bubble and if the economy were to crash again / I were to lose my job, it could become a nightmare much quicker than an apartment.

If a guy like me has trouble getting a home – what chance do people who aren’t as blessed have?

The experience was so unfortunate that I simply signed the lease for an apartment and had to say goodbye to all my motorcycles. That’s the real cost of this crazy equilibrium where some people have so much money they don’t know where to put it, and other people have so little they have to spend it all to service their basal needs.

Wow, Yamahog–you are, indeed, blessed, and I’m glad you acknowledge it. I am a woman in my late fifties, living in San Francsicso, who has exactly the same income, “asset,” and even car profile as you do, and I, too, cannot (and have never been able to) achieve home ownership. I am impressed that you have attained such “security” in your twenties!

Despite how much I economize and save, the housing market here keeps jumping exponentially, and my salary cannot keep pace. So, yes: welcome to the negative American Dream. I hope that, given your age, things will change for you over time. I have lost hope that change will happen (and that my thrift will make any difference) during my lifetime.

Arcadia, please do not lose hope.

There is always a solution, it just may not be what we “think” we want. If the problem seems unsolvable then change the parameters and/or your “ideal” outcome.

For example, is there any way you can move to a much lower cost place? Having lived in Toronto, SE Florida, Atlanta, NY, and now Dallas I can clearly say that expensive places like Toronto, NY and SanFran are EXTREMELY DIFFICULT places for most people to get ahead in.

The best key to successful housing is find an affordable area and buy on the dips. As someone stated above, rent when that is cheaper per month than buying, and buy when that is cheaper per month than renting.

But long-term, for MOST Americans, their #1 asset is their home. Without it you are tremendously exposed to inflation. And whether the government admits it or not, I think everyone on WS agrees that there is significant inflation out there on the things that ordinary people need.

In reasonable areas I think you could afford a house by using the same ROOM-MATE ECONOMICS that I advise my 20-something sons to use to afford their houses. Plus, it adds a community spirit and connectedness that most apartments just don’t provide.

Lastly, please don’t assume that because you are in your “late 50s” that it is game over. Try this website and enter your specifics:

https://www.johnhancockinsurance.com/life/life-expectancy-tool.aspx

It says a non-smoking woman in her late 50s has a BASELINE life expectancy of 88, AND A BEST-CASE LIFE EXPECTANCY OF 99.

So keep trying. Then try something different. Then try again.

Thanks for your encouragement, Chris. Unfortunately, I can’t leave the Bay Area because I am a tenured full professor (and could not even afford to leave my rent-controlled apt in SF because rents everywhere in the area are so high that even moving to another one bedroom place would eat up most of my take-home pay). So yes, I’m waiting for retirement, when I can move to another state, and I am saving so that I can have money for a down-payment when I move.

arcadia

Moving from SF to any of the remaining 99.9% of the USA (ok, 99.8% if you exclude Hollywood & Manhattan) will do wonders for your housing aspirations.

RE is all about location location location. Buy the cheapest house in the best neighborhood, you will never go wrong. Just keep looking, do your research, put in smart bids. Remember, you make your money when you BUY. The right fish will bite eventually.

…and don’t have bought in 1960’s Detroit.

Lesson learned: “never” appears to be less than 65 years.

“buy the cheapest house in the best neighbourhood and you will never go wrong.

That was recently disproven statistically. Can’t remember where I saw it. it’s just something people say, but was never tested before. When someone finally tested it statistically, they could find no validation for the strategy at all. I’ll see if I can dig that up.

There is a hell of a lot of bad statistics out there, Anybody who says that their particular study “proved anything is dubious anyway. A single study can give indications something is going on but cannot prove anything. You better look over the methodology carefully.

To paraphrase somebody infamous (K.M.), the point is not to just analyze conditions, the point is to change them.

Being in the housing industry since 1974 I have been through a number of cycles. One thing I have not seen built in the last twenty years is “Entry Level” housing at least in any quantity. Entry level housing, 800 to 1500 sq ft 3 bdrm bath and a half. Government interference @ local, state and federal levels combined with childlike buyer expectations added into the notion that your residence is some kind of bank are not the original dream of home ownership. Good luck to those that think the increasing debt cycle is the answer.

There are 2 other important parts of the historical housing stock that have been outlawed:

1) Single-Rental-Occupancy with or without kitchens and shared bathrooms

2) Rooming houses with multiple people sharing kitchens and bathrooms

But I think these will come back as housing gets more and more unaffordable.

Check this out for an early-adopter (and over-priced) example: https://www.welive.com

Behold the dawn of micro-apartments, coming to a city near you.

I have an example of this from the Netherlands.

Currently ‘starter homes’ over here cost something like 200-250K, which is available to many starters thanks to government subsidies/guarantees, sub-1% mortgage rates and 103% mortgages (no downpayment if you have fixed income). Of course, affordable to most people on a monthly basis means you won’t get much value for money because government has been restricting the building of new homes for years (both purchase and rental properties) in order to drive up prices and the amount of money they can skim on the sidelines.

So for 200-250K you get an older, small home needing significant ‘TLC’ or maybe a relatively small new home with small garden in the outer areas of the country, with lack of nearby jobs and facilities. Builders and government say it is impossible to build cheaper. But it IS possible: even with the extremely high land prices in the most populated areas, one can build starter homes for just 75K euros including land price. There is nothing wrong with these homes, they just use some clever tricks to get the costs down (e.g. homes are build in rows in a back-to-back organisations which saves on construction costs, and homes are just big enough unlike most of the current ‘starter homes’).

After years of government and builders saying lower prices are ‘impossible’ one project finally got approval, charging 99K for the homes. They build 20 of these homes and there were over 1200 people who applied. The 20 who got lucky are very happy with what they got, and politicians vowed to never allow this again because what if people are satisfied with 75K homes…

BTW, 25 years ago in my city less than 0.1% of the homes were valued at MORE than 200K euros. Currently less than 1% of the homes are valued at LESS than 200K euros … isn’t it just magical what politicians can accomplish?

P.S.: the ‘starter homes’ I’m talking about are usually targeting young couples (double earners) who are likely going to start a family in some years, so with at least two bedrooms and some outside space.

For singles the situation is far more difficult unless they have lots of capital (or rich parents).

I just checked my little suburb here in Oz and the cheapest established house (not unit/townhouse/condo) on the market is A$380,000 (needs work on 1/7th of an acre).

The next cheapest is $A450,000.

The most expensive one with a price listed is A$2.6 million with a number of others more costly, but no price in the listings.

The number of A$1.5 to $2 million houses in the area for sale has dried up as most have been sold in the past few months.

That condo listed for sale for A$1 million still hasn’t sold. IMO too much for that kind of property in our area given the location and characteristics – the first two in that development went for A$1.25 and A$1.32 a couple of years ago, but were much better properties (I wouldn’t have paid that much for those either!!!)

Wonder how long until prices/plans are announced for the big 34 unit development down the road……….

Wolf, What is the home ownership rate? Is it the percentage of U.S. households that own versus rent or is it the percentage of U.S. residential property that is owner-occupied? For anyone laughing at this question; there are lies, damn lies, and then there are statistics. If the measurement is the percentage of owner-occupied properties – who cares? If there are 1,000 people and 65 own and 35 rent and then a builder builds 10 more units and those units are scooped up as vacation properties – even VRBO.com properties – by foreign cash buyers, ownership becomes 65 of 110; 05 59.1%. All while the U.S. households still maintain a 65% ownership rate. Hence, what is the definition of that rate that is reported to be dropping?

Percent of households who own the home they live in, as defined by the Census Bureau.

FROM: http://www.census.gov/prod/2006pubs/tp-66.pdf

David, you are over-thinking this. The people in our government aren’t that smart.

It is done by statistically valid random sampling, then phone contact then in-person contact if needed for the selected samples:

Housing unit information. Upon first contact with a

housing unit, interviewers collect information on the housing

unit’s physical address, its mailing address, the year it

was constructed, the type of structure (single or multiple

family), whether it is renter- or owner-occupied, whether

the housing unit has a telephone and, if so, the telephone

number.

Yes the fed and wall street have distorted the housing market. But not all markets saw the huge runup you did in Fla and Cali. Locally here prices have largely reverted to the mean. The home I bought 20 years ago has increased in value an average of about 2.8% per year based on current pricing. Fairly close to the real nominal rate of inflation. The real problem for many is the lack of good paying jobs that support middle class life. Housing here is not a bad investment either. A 150k home rents for 1200 month.Minus taxes and insurance you can net 7% barring any large expenses which you can write off. Hard to make that with any safe investment today and you are not caught up in the casino called wall street.

“you can net 7%…”

Annual real inflation rate at 6.7% = net/net of 0.30%

Constant erosion of the purchasing power, of the fiat dollar will give you a negative return in the mid-term.

Better to cash out. Take the proceeds and buy physical gold coins/bullion.

I know, I know; “Gold has no return”. Wrong. It preserves your wealth from being eroded away by inflation, while having an actual “return” when compared to the negative yields now on most bonds.

Raw (undeveloped), cheap real estate in low population density states with few or no large cities can be a better strategy than numismatics, IMO.

Downside risk is minimal.

Smart big money (e.g. Ted Turner in Montana and Jim Justice in WV) have been doing it, for years.

So has smart(?) little money, e.g. me.

You seem to be assuming that (1) you will have 100% occupancy of the house with (2) tenants that actually pay the rent.

I’m not so sure those are good assumptions…

the area that I own rental property is in high bemand due to the fairly good public school system. Keeping units rented has not been an issue. Yes gold is an excellent store of wealth. But a retired fellow needs income. Rental property has provided a steady stream of income. It slso has provided some peace of mind. I don’t have to worry about the next market crash wiping out 50% of my net worth.

After helping me build our house 29 years ago as a teenager, my son started buying distressed houses in a nearby college town.

“Sweat equity” was built into them and he now rents the units to college students.

I can find nothing undesirable in his career: He built his wealth with his own hands and now provides a useful community service with his capital.

In this case the money was probably earned by honest work (who am I to judge …) but obviously the average homeflipper, even if they do some home improvement, simply profits from the massive amount of money that is pushed into the housing market by central banks. A rising tide lifts all boats. Many flippers consider themselves clever business persons, just like many people who see their home valuation rise consider themselves very clever because they decided to buy with the maximum mortgage.

however, for the average person flipping is a risky strategy because in the West housing is severely overvalued almost everywhere. You are basically betting on passing the risk to a bigger fool before the whole house of cards comes tumbling down. And this often applies for people who do a really good job on improving homes too, the crash in value can be far bigger than the potential profit from improving a home.

The last housing crash in my country was in 1981, and much of it was due to ‘flipping’ although on a minuscule scale compared to what happened in the last 15 years. Rates were high and when the bottom suddenly fell out with no obvious reason (except that it was ripe for a crash after a 100% runup and too much speculative fever), many of the flippers lost everything. Prices had increased by 100% in five years, the whole runup was vaporized within 1.5 years and the next ten years home prices went nowhere (with inflation around 8% housing was a lousy investment).

The current bubble has been building for almost 30 years, price increase is over 1000% in many areas. Debt load is magnitudes bigger than in 1981 thanks to ECB ZIRP/NIRP policy. If for some unforeseen reason the bottom falls out of the market again the whole system will implode and will take everything with it. I have very little faith in the wisdom and foresight of central banksters ;-(

Interesting perspective. Anything “financialized” can be inflated via lax money (QE, ZIRP, etc.) policies. Basically more of the same from the bankers and bureaucrats who control the money levers. The answer, as far as “taking back control” is obvious: deflation – which would allow the productivity improvements which ARE occurring to flow to the middle and lower classes, instead of being raked off by TPTB.

We bought a fairly new house in northeast PA in 1992 for 108K, sold it ten years later for 128K, after putting in at least 30K of improvements. Last month the house was on zillow for $74K. I don’t think that is unusual these days in the area, or in the economy.

By the way that was Hillary country, her family is from Scranton, PA.

It would be interesting to look at the number of houses total, and the houses per capita. I mean, the houses are mostly still there, more have been built, and most are owned. It’s really a question in a way of who owns them. Now we kind of know that much of it was bought up during the great looting of 2009-2011, and slumlords like Blackwhatever bought up many. So, I think in a way we need to understand who the owners are, not just who they arent.

I say the ones willing to live and lucky enough to have a job outside the main metro areas where housing has not gone up (see black box’s in article), can get a cheap house, low property tax’s and low interest mortgage to boot.

They probably also have the luxury of taking there time finding the right house?

https://www.washingtonpost.com/graphics/business/wonk/housing/overview/

https://www.washingtonpost.com/graphics/business/wonk/housing/stockton/

Completely agree with Petunia that “Mobility in the job market is a big driver of the rental housing market.”

Yes, the economic factors that Wolf mentions are real for those who really want to buy, but I also think that the Millennials and others want flexibility.

I agree that flipping is an extremely risky strategy. The profits are nothing like those shown on TV and when the tide rolls out most flippers are all shown to be swimming naked and almost all go bust.

However, without investors and flippers you would have EVEN LESS housing affordability. There is a large portion of the U.S. housing stock built in the 50s-70s that are now 35-65 years old and need significant rehab. Without substantial investment they decay faster and faster until they are uninhabitable and blight entire neighborhoods.

Most buyers are unwilling and unable to do the extensive repairs that are needed. Furthermore, FHA, Fannie Mae and most conventional lenders (ie. money-center banks) WILL NOT LEND ON THESE HOUSES.

OF COURSE, all we need is to do to appease our envy is to stop the free-market flippers and investors and replace them with centralized planning, rent controls and significantly more government regulations.

BTW, here in Dallas the Local Gubmint decided to follow the Denver policy that it is less expensive for the city to give free housing to the worst of the chronically homeless to reduce their expensive use of emergency rooms, police, social workers, etc.

So they created a community of 50 tiny 400sqft houses for $6,800,000 ==> A COST OF $136,000 PER HOUSE = $340 PER SQUARE FOOT !!!

http://www.dallasnews.com/news/metro/20150817-cottages-for-the-chronically-homeless-take-shape-in-south-dallas.ece

Of course, because of zoning, nobody else in the entire area can compete and show the city how the same (or better) homes can be built for $20k each (or to put it more personally, how to build houses for 340 homeless people for the same $6.8m).

http://www.fastcoexist.com/3056129/this-house-costs-just-20000-but-its-nicer-than-yours

“So they created a community of 50 tiny 400sqft houses for $6,800,000 ==> A COST OF $136,000 PER HOUSE = $340 PER SQUARE FOOT !!!”

that’s really expensive indeed; the Dutch starter homes that I mentioned elsewhere are around 800 sqft and they cost 75K euro including land (where land cost is about 25K). I don’t doubt you could build a basic very small home for $20K if the land is cheap.

In fact, it seems that you can make a very nice 800-1000 sqft home for $20K if they are series produced in factories; what is driving up the cost is the required land, government permits, mandatory plumbing etc. etc. (much of which modern homes don’t need) and installation cost from the builder (which you could probably do yourself with these factor produced homes).

But at least that’s better than the proposals from our Labor (PvdA) politicians to house migrants (for free, of course) in new villa’s costing 400.000 euro each. “we should not discriminate and offer these people the exact same opportunities as everyone else”. Except that not ‘everyone’ from the domestic population can afford a 400.000 euro home …

And BTW, in the city where my brother lives homeless people get temporary housing in a monumental building valued at something like 3 million euro with huge upkeep cost. This has facilities for 10-20 people so even more expensive than the Dallas community ;-(

———

regarding flipping: I don’t know what is common in the US, but in Europe what flippers do is usually just a paint job, some new boards on the walls, make break out a wall, nice looking floors, new kitchen etc. without improving anything on the basic structure, plumbing etc. Underneath the home could still be a disaster, but because it looks new/trendy the public will line up to buy … I think this kind of flipping is a disaster for the community because it only drives up prices without offering any real increase in (longterm) value.

Unfortunately everybody is trying to deal with symptoms rather then causes of the real estate orgy. The problem is not the supply of housing but artificial demand created by tsunami of liquidity forced in to real estate insanity. Limit flow of credit to mortgage market and see what happens to the housing mania. The solutions are simple, go back to the sane mortgage lending we had in 1980’s. Namely 20% downpayment, no mortgage insurance of any kind, forbid FED buying MBS’s, shut down FANNIE and FREDIE, get all levels of government out of any kind of housing subsidies, force banks to keep mortgages on their books for the term of the mortgage and enforce rules that DTI [total debt, (including mortgage, credit cards, line of credit etc,) to income of the borrower] can’t exceed 35%. Lets see how many people would qualify. This would show us the real demand and ability to buy. The house prices, with these rules in place, would collapse by at least 50% nationwide overnight. Problem solved! Of course this will never happen because it is in majority’s interest to keep the real estate Ponzi/Illusion going for as long as possible so everybody can feel “wealthy”. The alternative……. collapse of the financial system as we know it.

In California, over 50% of the purchases are “all cash”, no mortgage, no down payment, all cash. As Wolf noted weeks ago, there is some crackdown on Chinese money being fire-hosed into the real estate market, but there is so much inherent corruption in the PRC, and Hong Kong nearby to Guangzhou…. has it really been shut off? The population pressures are now immense in California and the real estate market reflects it. Businesses are reportedly thinking of buying buildings, just to retain workers by giving them cheaper rents close to work.

The Chinese like other Asians have little faith in governments and written laws and rules and regulations. They view government the same way they view floods and droughts and fires and plagues and barbarian invasions. It is just one of those things you can’t avoid and have to endure as best you can.

PS.

Unfortunately despite of all the printing by the FED and constant manipulation by everybody this credit pyramid will collapse under its own weight. What is mathematically impossible to go on will not. Sadly, because of 30 years of insanity, the damage will be that much greater.

Kris

No it won’t. “(M)athematically impossible”….where’s the math? Where are the statistics to support this idea of a “credit pyramid”? The USA had tremendous debt as a percent of GNP at the end of World War II, and people got laid off from good jobs making totally useless stuff for the domestic market (e.g., P-47s, B-17s, Liberty Ships) and defense spending as a percent of government spending was much greater than now.

The big difference is the population (321 million, versus 152 million in 1950.) More than twice as many people in the same physical space.